Washington, USA (ViaNews) – At a time when most people have been soundly asleep at home for at least a few hours, 2 a.m. is usually the time the people who are still awake make decisions they will later regret. From loneliness-driven phone calls to an ex-boyfriend to getting a spur-of-the-moment tattoo, some decisions really should be held off until the light of day. Unfortunately, the Senate’s 51-49 nocturnal vote to approve the new tax law is looking like yet another horrendous middle-of-the-night decision to add to the history books.

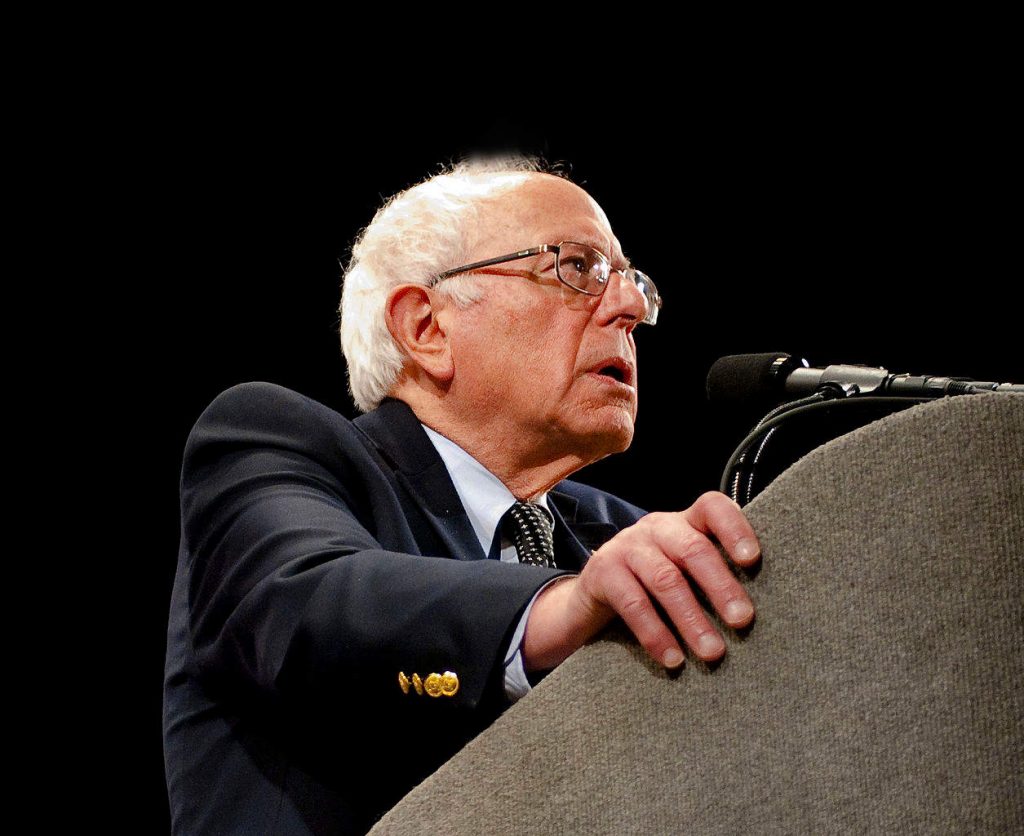

Sen. Bernie Sanders has repeatedly called the bill “a disastrous piece of legislation.”

“Historians will look back on Dec. 1, 2017, and they will conclude that today is a day of one of the great robberies, or criminal activities if you like, in the modern history of this country. Because the federal treasury is being looted tonight,” Sanders said.

With the bill expected to grow the deficit by $1.4 trillion, Sanders is highly concerned about future cuts to social programs to make up the difference. More than likely, dramatic cuts to Social Security, Medicare and Medicaid will be the next items on the GOP’s chopping block after the Republicans finally dismantle Obamacare. The tax bill also takes the wind out of the Affordable Care Act’s sails by repealing the individual mandate, which Democrats state is essential for the Act’s survival.

In a political environment more suited to a fight club than the passage of bipartisan constituent-beneficial legislation, Republicans voted for a bill that they received at 7 pm, was nearly 500 pages long, and most admitted hadn’t read but they were going to vote for anyway. In fact, large typed sections had been crossed out and illegibly handwritten amendments were written in the margins. So even if you could speed read and retain what you read, the chicken scratch handwriting made it impossible to decipher large portions of the bill.

In a desperate race to have Trump’s administration pass something before the end of the year, Republicans were voting to adopt legislation despite their constituents’ vocal objections. According to a Quinnipiac University poll released on December 5, 53% of Americans are opposed to the GOP bill with 18% unsure of what to think. That means a paltry 29% of Americans approve. The same poll concluded 64% of respondents believe this bill will only benefit the wealthy, and they are absolutely right.

The general consensus among everyone who has read this giant paperweight of a bill agrees that the big winners of this tax plan are those that are already in the top 10% and an absolute early Christmas gift for the top 1% of the American wealth pyramid.

The heavily pro-business bill will permanently cut the corporate tax rate from 35% to 20%. Bloomberg reports that asset managers, banks, and pharmaceutical companies are all set to make out well with the new plan.

According to the New York Times, the Joint Committee on Taxation calculated these pro-corporate cuts would decrease federal revenue by $1.5 trillion over the next decade.

Republicans have stated this gift to big business is going to cause the economy to explode with new jobs and will actually improve the economy, which both Democrats and economists have been quick to point out is highly unlikely.

According to an article in New York Magazine, 52% of the 38 economists surveyed stated this bill did not have the potential to “substantially” increase the GDP, and 36% were “uncertain” if it would “substantially increase” GDP. Harvard Economist Oliver Hart said in the same interview, ““Almost everyone is extremely doubtful this is going to come out well. This is wishful thinking.’

Another winner in this bill will be landlords. Although mortgage interest is, at best, capped for the average homeowner and, at worst, could be a deduction that disappears entirely, landlords can continue to deduct 100% of mortgage interest. Taxes will also decrease for landlords, although the amount is yet to be reconciled by the House and Senate bills. In the bill passed by the House, all rental income drops from current tax rate of 39.6% currently to 25%. In the Senate, landlords earning over $700k from rental property income will have to pay 38.5%, still lower than today’s rate and will be even lower if they pay out considerable wages. Where the final number ends up is anyone’s guess at this time. Regardless of where that percentage ends up, Trump’s real estate empire is slated to make a small fortune off of this impending change.

The average American, for whom the tax breaks were supposed to aid, is looking like the biggest loser in this bill. In a country where there are over 40 million Americans living below the poverty threshold and the level of income inequality continues to grow at an alarming rate, this tax bill is only going to widen the chasm between the ultra-rich and the painfully poor.

According to Inequality.org America’s top 10 percent currently average more than nine times as much income as the bottom 90 percent combined. With the passage of a tax bill that is chock-full of cuts for the wealthy and corporations, the wealth divide is only going to widen.

According to a report by the New York Times, under the House bill, the middle class may initially see a modest decrease in taxes based on how much you make. For those making under $30k, the average savings with the new bill would be $180. Families making $100k to $200k, on average, will see a decrease of $2,113. For those making over $500k, the average savings skyrockets to $28,313.

The Senate bill, however, is a different story. The same NYT analysis concluded that somewhere between 10 to 15 million Americans earning under $100k per year are going to pay more taxes than they currently do.

Aside from the average Joe, another big loser in this bill is the public school system, which is commonly known to be perpetually short on funding as well as continually short on educators. The National Education Association released a statement saying that within the next decade, over $370 billion worth of SALT revenue used in part for school funding could be lost and 370,000 jobs are also at risk.

Also, the passage of this act will most likely be a nail in Obamacare’s coffin. By repealing the individual mandate requiring health insurance, many young healthy people are going to save a few dollars by dropping coverage. According to the Congressional Budget Office, repealing the mandate will increase the number of uninsured Americans by around thirteen million. When the young and healthy take themselves out of the insurance pool, those that must maintain coverage because of chronic illness or disability will see their premiums rise by at least 10%.

The uninsured will still flock to hospitals for treatment when they get sick, and most won’t write off services that go unpaid by the uninsured, making everyone’s bills go up to cover the difference. This also tends to overcrowd emergency rooms with people coming for treatment for even minor ailments since they can’t be turned away for their inability to pay.

Now that the players have been selected for the reconciliation between the bills, there is little likelihood this bill isn’t going to get shoved through the system before Christmas. All that is left to be seen is where the final numbers will end up and to watch the drama unfold like a brakeless train entering a station. One thing is for certain – The Senate’s 2 a.m. mistake is going to be a vicious hangover the American people are going to have to endure.