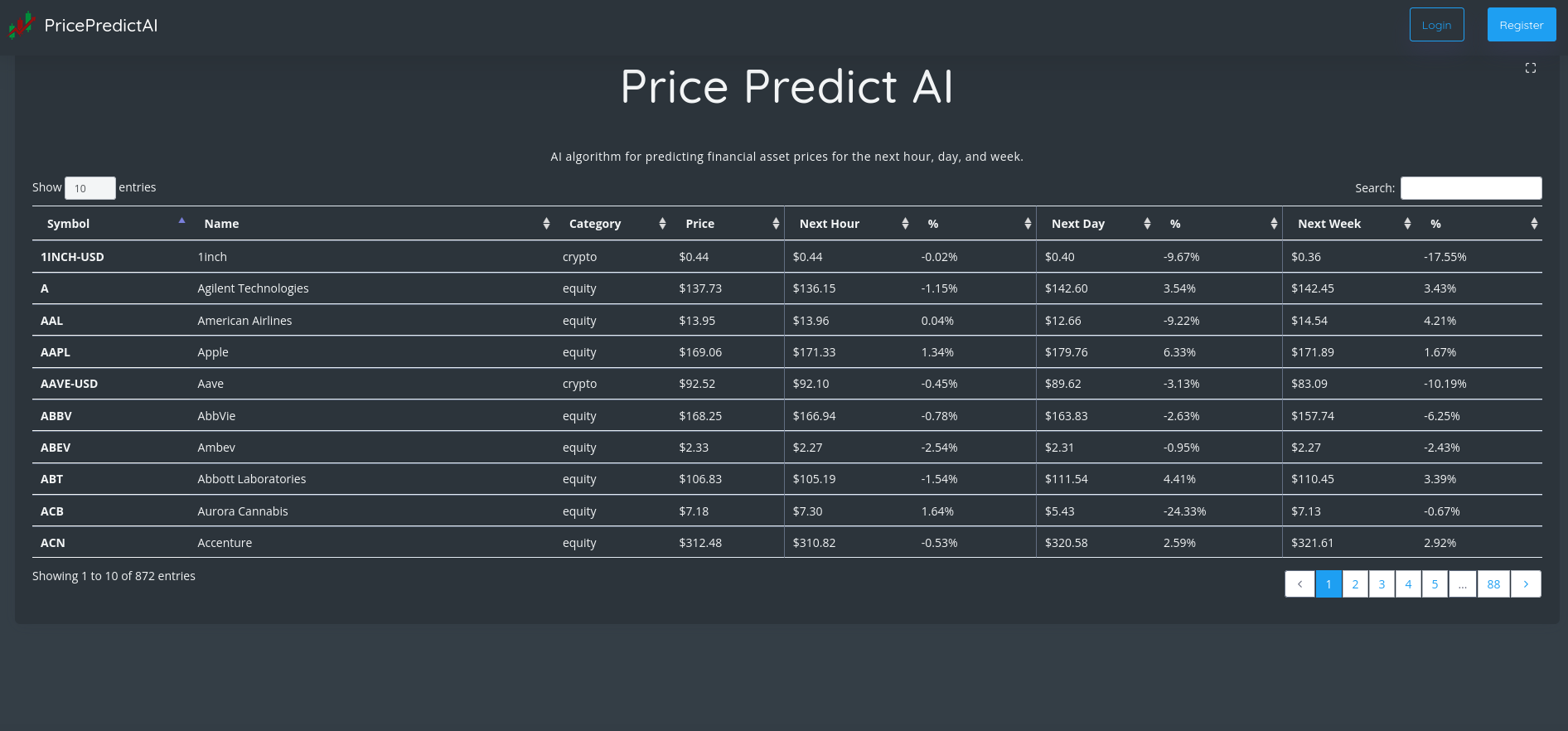

(VIANEWS) – Today, the Innrs artificial intelligence algorithm suggests a high probability of discovering the approximate price for tomorrow of America Movil AMX, UBS Group UBS and others.

Via News will regularly fact-check this AI algorithm that aims to consistently predict the next session price and next week’s trend of financial assets.

Innrs provides A.I.-based statistical tools to help investors make decisions. The table below shows the financial assets predicting price, ordered by the highest expected accuracy.

Innrs officials say this tool helps investors make better-informed decisions, supposedly used alongside other relevant financial information and the specific trader strategy.

In the next session, Via News will report the finding on the algorithm precision.

| Financial Asset | Accuracy | Close Price | Prediction |

|---|---|---|---|

| America Movil (AMX) | 99.56% | $20.74 | ⇧ $20.96 |

| UBS Group (UBS) | 99.54% | $21.32 | ⇧ $21.55 |

| Pembina Pipeline (PBA) | 99.34% | $35.9 | ⇧ $36.59 |

| Wausau Pape (WPP) | 99.14% | $56.23 | ⇧ $56.79 |

| Fox Corporation (FOXA) | 99.1% | $31.5 | ⇧ $32.05 |

| Booking Holdings (BKNG) | 99.07% | $2295.63 | ⇧ $2310.66 |

| Chipotle Mexican Grill (CMG) | 98.94% | $1514.22 | ⇧ $1554.16 |

| Valero Energy (VLO) | 98.79% | $135.56 | ⇧ $138.02 |

| Match Group (MTCH) | 98.77% | $47.37 | ⇧ $49.15 |

| EPAM Systems (EPAM) | 98.66% | $352.97 | ⇧ $357.82 |

| ABB Ltd (ABB) | 98.63% | $34 | ⇧ $35.01 |

| Schlumberger (SLB) | 98.56% | $57.22 | ⇧ $58.39 |

| Raymond James Financial (RJF) | 98.54% | $114.33 | ⇧ $116.33 |

| The Carlyle Group (CG) | 98.19% | $33.52 | ⇧ $34.33 |

| America Movil (AMOV) | 94.39% | $20.61 | ⇧ $21.02 |

| Brookfield Infrastructure Partners (BIP) | 94.35% | $34.8 | ⇧ $35.31 |

| CDW Corporation (CDW) | 94.26% | $198.76 | ⇧ $201.77 |

| Bank Nova Scotia Halifax (BNS) | 94.25% | $51.29 | ⇧ $52.05 |

| Liberty Broadband (LBRDA) | 94.19% | $87.02 | ⇧ $87.18 |

| SS&C Technologies Holdings (SSNC) | 94.08% | $55.89 | ⇧ $56.18 |

| Banco Bilbao Vizcaya Argentaria (BBVA) | 94.06% | $6.88 | ⇧ $6.99 |

| Capital One Financial (COF) | 94.01% | $102 | ⇧ $103.46 |

| Fomento Economico Mexicano S.A.B. de C.V. (FMX) | 93.98% | $85.12 | ⇧ $87.03 |

| Full House Resorts (FLL) | 93.95% | $8.52 | ⇧ $8.6 |

| General Motors (GM) | 93.93% | $36.44 | ⇧ $36.68 |

| Taiwan Semiconductor (TSM) | 93.91% | $89.59 | ⇧ $91.9 |

| TransCanada (TRP) | 93.89% | $42.76 | ⇧ $43.84 |

| Trimble (TRMB) | 93.82% | $54.56 | ⇧ $56.15 |

| Canadian Pacific Railway (CP) | 93.82% | $78.4 | ⇧ $80.43 |

| Marvell Technology Group (MRVL) | 93.81% | $40.51 | ⇧ $40.92 |

| Walt Disney (DIS) | 93.76% | $98.94 | ⇧ $102.39 |

| Advanced Semiconductor Engineering (ASX) | 93.74% | $7.12 | ⇧ $7.26 |

| Akamai Technologies (AKAM) | 93.73% | $87.84 | ⇧ $89.61 |

| PennyMac (PFSI) | 93.7% | $63.68 | ⇧ $65.36 |

| Skyworks Solutions (SWKS) | 93.68% | $102.19 | ⇧ $105.19 |

| NICE Ltd (NICE) | 93.66% | $206.96 | ⇧ $212.43 |

| STMicroelectronics (STM) | 93.64% | $42.28 | ⇧ $43.03 |

| Pool Corporation (POOL) | 93.57% | $359.38 | ⇧ $367.84 |

| SPS Commerce (SPSC) | 93.54% | $132.38 | ⇧ $134.49 |

| Toll Brothers (TOL) | 93.51% | $56.19 | ⇧ $57.2 |

| Illumina (ILMN) | 93.5% | $205.83 | ⇧ $208.79 |

| NetApp (NTAP) | 93.49% | $65.17 | ⇧ $66.47 |

| Bank Of Montreal (BMO) | 93.45% | $97.39 | ⇧ $100.08 |

| Royal Caribbean Cruises (RCL) | 93.45% | $62.24 | ⇧ $63.96 |

1. America Movil (AMX)

Shares of America Movil jumped by a staggering 13.71% in from $18.24 to $20.74 at 18:21 EST on Wednesday, after five consecutive sessions in a row of gains. NYSE is dropping 1.48% to $15,649.12, following the last session’s downward trend.

América Móvil, S.A.B. de C.V. provides telecommunications services in Latin America and internationally. The company offers wireless and fixed voice services, including local, domestic, and international long-distance services; and network interconnection services. It also provides data services, such as data centers, data administration, and hosting services to residential and corporate clients; value-added services, including Internet access, messaging, and other wireless entertainment and corporate services; data transmission, email services, instant messaging, content streaming, and interactive applications; and wireless security services, mobile payment solutions, machine-to-machine services, mobile banking, virtual private network services, and video calls and personal communications services. In addition, the company offers residential broadband services; IT solutions for small businesses and large corporations; and cable and satellite pay television subscriptions. Further, it sells equipment, accessories, and computers; and offers telephone directories, wireless security, call center, advertising, media, and software development services. Additionally, the company provides video, audio, and other media content through the Internet directly from the content provider to the end user. It sells its products and services under the Telcel, Telmex Infinitum, and A1 brands through a network of retailers and service centers to retail customers; and through sales force to corporate customers. As of December 31, 2021, the company had approximately 286.5 million wireless voice and data subscribers. América Móvil, S.A.B. de C.V. was incorporated in 2000 and is based in Mexico City, Mexico.

Moving Average

America Movil’s value is above its 50-day moving average of $19.23 and above its 200-day moving average of $19.14.

More news about America Movil.

2. UBS Group (UBS)

Shares of UBS Group rose by a staggering 18.12% in from $18.05 to $21.32 at 18:21 EST on Wednesday, after five consecutive sessions in a row of gains. NYSE is dropping 1.48% to $15,649.12, following the last session’s downward trend.

UBS Group AG provides financial advice and solutions to private, institutional, and corporate clients worldwide. It operates through four divisions: Global Wealth Management, Personal & Corporate Banking, Asset Management, and Investment Bank. The Global Wealth Management division offers investment advice and solutions, and lending solutions to ultra high net worth and high net worth clients. This segment also provides estate and wealth planning, investing, philanthropy, corporate and banking, and family advisory services, as well as mortgage, securities-based, and structured lending solutions. The Personal & Corporate Banking division provides personal banking products and services, such as deposits, cards, and online and mobile banking, as well as lending, investments, and retirement services; and corporate and institutional solutions, including equity and debt capital markets, syndicated and structured credit, private placements, leasing, traditional financing, trade and export finance, and global custody solutions, as well as transaction banking solutions for payment and cash management. The Asset Management division offers equities, fixed income, hedge funds, real estate and private markets, indexed and alternative beta strategies, asset allocation and currency investment strategies, customized multi-asset solutions, advisory and fiduciary services, and multi-manager hedge fund solutions and advisory services. The Investment Bank division advises clients on strategic business opportunities and helps them raise capital to fund their activities; enables its clients to buy, sell, and finance securities on capital markets and to manage their risks and liquidity; and offers clients differentiated content on major financial markets and securities. The company was formerly known as UBS AG and changed its name to UBS Group AG in December 2014. UBS Group AG was founded in 1862 and is based in Zurich, Switzerland.

Volatility

UBS Group’s last week, last month’s, and last quarter’s current intraday variation average was 1.12%, 0.92%, and 1.37%.

UBS Group’s highest amplitude of average volatility was 1.12% (last week), 1.20% (last month), and 1.37% (last quarter).

More news about UBS Group.

3. Pembina Pipeline (PBA)

Shares of Pembina Pipeline rose 8.26% in from $33.16 to $35.90 at 18:21 EST on Wednesday, after five successive sessions in a row of gains. NYSE is sliding 1.48% to $15,649.12, following the last session’s downward trend.

Pembina Pipeline Corporation provides transportation and midstream services for the energy industry. It operates through three segments: Pipelines, Facilities, and Marketing & New Ventures. The Pipelines segment operates conventional, oil sands and heavy oil, and transmission assets with a transportation capacity of 3.1 millions of barrels of oil equivalent per day, ground storage of 11 millions of barrels, and rail terminalling capacity of approximately 105 thousands of barrels of oil equivalent per day serving markets and basins across North America. The Facilities segment offers infrastructure that provides customers with natural gas, condensate, and natural gas liquids (NGLs), including ethane, propane, butane, and condensate; and includes 354 thousands of barrels per day of NGL fractionation capacity, 21 millions of barrels of cavern storage capacity, and associated pipeline and rail terminalling facilities. The Marketing & New Ventures segment buys and sells hydrocarbon liquids and natural gas originating in the Western Canadian sedimentary basin and other basins. Pembina Pipeline Corporation was incorporated in 1954 and is headquartered in Calgary, Canada.

More news about Pembina Pipeline.

4. Wausau Pape (WPP)

Shares of Wausau Pape rose by a staggering 15.56% in from $48.66 to $56.23 at 18:21 EST on Wednesday, after five consecutive sessions in a row of gains. NYSE is falling 1.48% to $15,649.12, following the last session’s downward trend.

WPP plc is a company that specializes in creative transformation. It provides communication, experience, commerce and technology services throughout North America, North America and the United Kingdom. It operates in three distinct segments, Global Integrated Agencies (Public Relations), and Specialist Agencies. The company plans, creates, and designs marketing campaigns and advertisements. It also provides media buying services such as business development, content, technology and data, strategy, investment in media, and media and media. It also provides public relations consulting services for clients looking to communicate with various stakeholders, including consumers and governments as well as the financial and business communities. WPP plc was established in London in 1985.

More news about Wausau Pape.

5. Fox Corporation (FOXA)

Shares of Fox Corporation jumped 5% in from $30 to $31.50 at 18:21 EST on Wednesday, following the last session’s downward trend. NASDAQ is sliding 1.24% to $10,957.01, after five consecutive sessions in a row of gains.

Fox Corporation operates as a news, sports, and entertainment company in the United States (U.S.). The company operates through Cable Network Programming; Television; and Other, Corporate and Eliminations segments. The Cable Network Programming segment produces and licenses news, business news, and sports content for distribution through traditional and virtual multi-channel video programming distributors (MVPDs) and other digital platforms, primarily in the U.S. It operates FOX News, a national cable news channel; FOX Business, a business news national cable channel; FS1 and FS2 multi-sport national networks; FOX Sports Racing, a video programming service that comprises motor sports programming; FOX Soccer Plus, a video programming network for live soccer and rugby competitions; FOX Deportes, a Spanish-language sports programming service; and Big Ten Network, a national video programming service. The Television segment acquires, produces, markets, and distributes programming. It operates The FOX Network, a national television broadcast network that broadcasts sports programming and entertainment; Tubi, an advertising-supported video-on-demand service; Fox Alternative Entertainment, a full-service production studio that develops and produces unscripted and alternative programming; MyNetworkTV, a programming distribution service; and Blockchain Creative Labs, which is focuses on the creation, distribution and monetization of Web3 content. This segment owns and operates 29 broadcast television stations. The Other, Corporate and Eliminations segment owns the FOX Studios Lot that provides production and post-production services, including 15 sound stages, two broadcast studios, theaters and screening rooms, editing rooms, and other television and film production facilities in Los Angeles, California. The company was incorporated in 2018 and is based in New York, New York.

Growth Estimates Quarters

For the current quarter, the company expects to grow by 2.7% and 30% respectively.

Annual Top and Bottom Value

Fox Corporation stock was valued at $31.50 as of 18:21 EST. This is way lower than its 52 week high of $44.95, and much higher than its 52-week lowest of $28.01.

More news about Fox Corporation.

6. Booking Holdings (BKNG)

Shares of Booking Holdings rose by a staggering 17.23% in from $1958.23 to $2,295.63 at 18:21 EST on Wednesday, after five successive sessions in a row of gains. NASDAQ is falling 1.24% to $10,957.01, after five successive sessions in a row of gains.

Booking Holdings Inc. offers online reservations for travel and restaurants worldwide. Booking.com offers accommodation bookings online; Rentalcars.com provides rental car services online; Priceline which allows customers to make travel reservations online for hotel, flight and rental cars. Agoda, which offers online accommodations reservation, flight, ground transport, and activity reservation services, is also available. KAYAK is an online price comparison site that lets consumers search for and compare prices on travel itineraries. This includes information about rental cars, airline tickets, hotel reservations, and accommodation. OpenTable allows customers to book online restaurants. It also offers insurance and management services for consumers and travel service providers. The original name of the company was The Priceline Group Inc., but it changed its name in February 2018 to Booking Holdings Inc. It was established in 1997. The headquarters are located in Norwalk in Connecticut.

More news about Booking Holdings.

7. Chipotle Mexican Grill (CMG)

Shares of Chipotle Mexican Grill rose 5.89% in from $1429.99 to $1,514.22 at 18:21 EST on Wednesday, after five sequential sessions in a row of gains. NYSE is sliding 1.48% to $15,649.12, following the last session’s downward trend.

Chipotle Mexican Grill, Inc., along with its subsidiaries, is the owner and operator of Chipotle Mexican Grill restaurants. It owned or operated around 3,000 restaurants across the United States, Canada and the United Kingdom as well as France, Germany and the rest of Europe, according to its February 15th 2022 report. It was established in 1993 in Newport Beach, California.

Volatility

Chipotle Mexican Grill’s last week, last month’s, and last quarter’s current intraday variation average was 1.61%, 0.32%, and 1.52%.

Chipotle Mexican Grill’s highest amplitude of average volatility was 1.61% (last week), 1.43% (last month), and 1.52% (last quarter).

Revenue growth

The year-over-year revenue growth was 13.7%. We now have 8.41B in the 12 trailing months.

More news about Chipotle Mexican Grill.

8. Valero Energy (VLO)

Shares of Valero Energy rose by a staggering 11.36% in from $121.73 to $135.56 at 18:21 EST on Wednesday, after five successive sessions in a row of gains. NYSE is falling 1.48% to $15,649.12, following the last session’s downward trend.

Valero Energy Corporation manufactures, markets, and sells transportation fuels and petrochemical products in the United States, Canada, the United Kingdom, Ireland, and internationally. The company operates through three segments: Refining, Renewable Diesel, and Ethanol. It produces conventional, premium, and reformulated gasolines; gasoline meeting the specifications of the California Air Resources Board (CARB); diesel fuels, and low-sulfur and ultra-low-sulfur diesel fuels; CARB diesel; other distillates; jet fuels; blendstocks; and asphalts, petrochemicals, lubricants, and other refined petroleum products, as well as sells lube oils and natural gas liquids. As of December 31, 2021, the company owned 15 petroleum refineries with a combined throughput capacity of approximately 3.2 million barrels per day; and 12 ethanol plants with a combined ethanol production capacity of approximately 1.6 billion gallons per year. It sells its refined products through wholesale rack and bulk markets; and through approximately 7,000 outlets under the Valero, Beacon, Diamond Shamrock, Shamrock, Ultramar, and Texaco brands. The company also produces and sells ethanol, dry distiller grains, syrup, and inedible corn oil primarily to animal feed customers. In addition, it owns and operates crude oil and refined petroleum products pipelines, terminals, tanks, marine docks, truck rack bays, and other logistics assets; and owns and operates a plant that processes animal fats, used cooking oils, and inedible distillers corn oils into renewable diesel. The company was formerly known as Valero Refining and Marketing Company and changed its name to Valero Energy Corporation in August 1997. Valero Energy Corporation was founded in 1980 and is headquartered in San Antonio, Texas.

Revenue Growth

Year-on-year quarterly revenue growth grew by 86.1%, now sitting on 149.96B for the twelve trailing months.

Sales Growth

The next quarter’s Valero Energy sales growth is 9.7%.

More news about Valero Energy.

9. Match Group (MTCH)

Shares of Match Group rose by a staggering 17.69% in from $40.25 to $47.37 at 18:21 EST on Wednesday, after five sequential sessions in a row of gains. NASDAQ is falling 1.24% to $10,957.01, after five successive sessions in a row of gains.

Match Group, Inc. provides dating products worldwide. The company's portfolio of brands includes Tinder, Match, Meetic, OkCupid, Hinge, Pairs, PlentyOfFish, and OurTime, as well as a various other brands. The company was incorporated in 1986 and is based in Dallas, Texas.

More news about Match Group.

10. EPAM Systems (EPAM)

Shares of EPAM Systems rose 6.27% in from $332.14 to $352.97 at 18:21 EST on Wednesday, after five consecutive sessions in a row of gains. NYSE is falling 1.48% to $15,649.12, following the last session’s downward trend.

EPAM Systems, Inc. offers software development and digital platform engineering services around the world. The company provides engineering services such as platform selection and customization, cross-platform migrating, integration, and implementation; infrastructure management services like software development and testing with private and public infrastructures. These include maintenance of application, database and server storage systems, monitoring and notification services. The company also offers operation solutions, which include integrated engineering and smart automation. It provides consulting and services for customers to improve their software testing practices and to ensure that information is not lost. The company also offers technical and advisory services in business experience and technology. It also provides digital and service design services that include strategy, design and creative services as well as product development such as virtual reality, artificial intelligence and robotics. The company serves various industries, including travel, consumer, software, hi-tech and business information, healthcare and life sciences, as well as financial and retail services. Newtown, Pennsylvania is the headquarters of this company.

More news about EPAM Systems.

11. ABB Ltd (ABB)

Shares of ABB Ltd rose by a staggering 12.66% in from $30.18 to $34.00 at 18:21 EST on Wednesday, after five sequential sessions in a row of gains. NYSE is falling 1.48% to $15,649.12, following the last session’s downward trend.

ABB Ltd engages in manufacture and sale of electrification, automation, robotics, and motion products for customers in utilities, industry and transport, and infrastructure in Switzerland and internationally. Its Electrification segment provides electric vehicle charging infrastructure, renewable power solutions, modular substation packages, distribution automation products, switchboard and panelboards, switchgear, UPS solutions, circuit breakers, measuring and sensing devices, control products, wiring accessories, enclosures and cabling systems, and intelligent home and building solutions. The company's Robotics & Discrete Automation segment offers industrial robots, software, robotic solutions and systems, field services, spare parts, and digital services. This segment also offers solutions based on its programmable logic controllers, industrial PCs, servo motion, transport system, and machine vision. Its Motion segment manufactures and sells drives, motors, generators, traction converters, and mechanical power transmission products that are driving the low-carbon future for industries, cities, infrastructure, and transportation. The company's Process Automation segment provides process and discrete control technologies, advanced process control software and manufacturing execution systems, sensing, measurement and analytical instrumentation, marine propulsion systems, and large turbochargers. In addition, this segment offers remote monitoring, preventive maintenance, asset performance management, emission monitoring, and cybersecurity services. It serves aluminum, automotive, buildings and infrastructure, cement, channel partners, chemical, data centers, food and beverage, process automation, life sciences, marine and ports, metals, mining, oil and gas, ports, power generation, printing, pulp and paper, railway, smart cities, water, and wind power industries. The company was founded in 1883 and is headquartered in Zurich, Switzerland.

Sales Growth

ABB Ltd’s sales growth is negative 2.8% for the ongoing quarter and negative 95.1% for the next.

Revenue growth

The year-on-year revenue growth was 5.4%. It now stands at 29.19B in the 12 trailing months.

More news about ABB Ltd.

12. Schlumberger (SLB)

Shares of Schlumberger rose by a staggering 10.1% in from $51.97 to $57.22 at 18:21 EST on Wednesday, after five consecutive sessions in a row of gains. NYSE is dropping 1.48% to $15,649.12, following the last session’s downward trend.

Schlumberger Limited is a global provider of technology to the energy sector. It operates in four segments: Digital & Integration; Reservoir Performance; Well Construction and Production Systems. The company offers IT infrastructure, software and information management services. It also provides consulting services to reservoir characterization and field development planning. It also offers mud logging and engineering support services; drilling machinery and equipment for energy companies and shipyards; and land drilling rigs. It also offers well completion and equipment, artificial lift production equipment, optimization services, valves, process systems, and integrated subsea systems consisting of wellheads subsea tree, flowline connectors control systems, connectors and services. The firm was formerly called Societe’de Prospection Electro’lectrique. Schlumberger Limited was established in Houston, Texas in 1926.

Volatility

Schlumberger’s intraday variation average for the week and quarter ended last week at 1.45%, 0.911% and 2.15 respectively.

Schlumberger had the highest average volatility amplitudes of 1.45%, 1.91% and 2.15 (last week), respectively.

Revenue Growth

Year-on-year quarterly revenue growth grew by 27.9%, now sitting on 26.44B for the twelve trailing months.

More news about Schlumberger.

13. Raymond James Financial (RJF)

Shares of Raymond James Financial jumped 7.62% in from $106.23 to $114.33 at 18:21 EST on Wednesday, after five successive sessions in a row of gains. NYSE is falling 1.48% to $15,649.12, following the last session’s downward trend.

Raymond James Financial, Inc., a diversified financial services company, provides private client group, capital markets, asset management, banking, and other services to individuals, corporations, and municipalities in the United States, Canada, and Europe. The Private Client Group segment offers investment services, portfolio management services, insurance and annuity products, and mutual funds; support to third-party product partners, including sales and marketing support, as well as distribution and accounting, and administrative services; margin loans; and securities borrowing and lending services. The Capital Markets segment provides investment banking services, including equity underwriting, debt underwriting, and merger and acquisition advisory services; and fixed income and equity brokerage services. The Asset Management segment offers asset management, portfolio management, and related administrative services to retail and institutional clients; and administrative support services, such as record-keeping. The Raymond James Bank segment provides insured deposit accounts; commercial and industrial, commercial real estate (CRE) and CRE construction, tax-exempt, residential, securities-based, and other loans; and loan syndication services. The Other segment engages in the private equity investments, including various direct and third-party private equity investments; and legacy private equity funds. The company was founded in 1962 and is headquartered in St. Petersburg, Florida.

Volatility

Raymond James Financial’s last week, last month’s, and last quarter’s current intraday variation average was 1.53%, 0.49%, and 1.42%.

Raymond James Financial’s highest amplitude of average volatility was 1.53% (last week), 1.06% (last month), and 1.42% (last quarter).

More news about Raymond James Financial.

14. The Carlyle Group (CG)

Shares of The Carlyle Group rose by a staggering 16.96% in from $28.66 to $33.52 at 18:21 EST on Wednesday, after five consecutive sessions in a row of gains. NASDAQ is dropping 1.24% to $10,957.01, after five successive sessions in a row of gains.

The Carlyle Group Inc. is an investment firm specializing in direct and fund of fund investments. Within direct investments, it specializes in management-led/ Leveraged buyouts, privatizations, divestitures, strategic minority equity investments, structured credit, global distressed and corporate opportunities, small and middle market, equity private placements, consolidations and buildups, senior debt, mezzanine and leveraged finance, and venture and growth capital financings, seed/startup, early venture, emerging growth, turnaround, mid venture, late venture, PIPES. The firm invests across four segments which include Corporate Private Equity, Real Assets, Global Market Strategies, and Solutions. The firm typically invests in industrial, agribusiness, ecological sector, fintech, airports, parking, Plastics, Rubber, diversified natural resources, minerals, farming, aerospace, defense, automotive, consumer, retail, industrial, infrastructure, energy, power, healthcare, software, software enabled services, semiconductors, communications infrastructure, financial technology, utilities, gaming, systems and related supply chain, electronic systems, systems, oil and gas, processing facilities, power generation assets, technology, systems, real estate, financial services, transportation, business services, telecommunications, media, and logistics sectors. Within the industrial sector, the firm invests in manufacturing, building products, packaging, chemicals, metals and mining, forestry and paper products, and industrial consumables and services. In consumer and retail sectors, it invests in food and beverage, retail, restaurants, consumer products, domestic consumption, consumer services, personal care products, direct marketing, and education. Within aerospace, defense, business services, and government services sectors, it seeks to invest in defense electronics, manufacturing and services, government contracting and services, information technology, distribution companies. In telecommunication and media sectors, it invests in cable TV, directories, publishing, entertainment and content delivery services, wireless infrastructure/services, fixed line networks, satellite services, broadband and Internet, and infrastructure. Within real estate, the firm invests in office, hotel, industrial, retail, for sale residential, student housing, hospitality, multifamily residential, homebuilding and building products, and senior living sectors. The firm seeks to make investments in growing business including those with overleveraged balance sheets. The firm seeks to hold its investments for four to six years. In the healthcare sector, it invests in healthcare services, outsourcing services, companies running clinical trials for pharmaceutical companies, managed care, pharmaceuticals, pharmaceutical related services, healthcare IT, medical, products, and devices. It seeks to invest in companies based in Sub-Saharan focusing on Ghana, Kenya, Mozambique, Botswana, Nigeria, Uganda, West Africa, North Africa and South Africa focusing on Tanzania and Zambia; Asia focusing on Pakistan, India, South East Asia, Indonesia, Philippines, Vietnam, Korea, and Japan; Australia; New Zealand; Europe focusing on France, Italy, Denmark, United Kingdom, Germany, Austria, Belgium, Finland, Iceland, Ireland, Netherlands, Norway, Portugal, Spain, Benelux , Sweden, Switzerland, Hungary, Poland, and Russia; Middle East focusing on Bahrain, Jordan, Kuwait, Lebanon, Oman, Qatar, Saudi Arabia, Turkey, and UAE; North America focusing on United States which further invest in Southeastern United States, Texas, Boston, San Francisco Bay Area and Pacific Northwest; Asia Pacific; Soviet Union, Central-Eastern Europe, and Israel; Nordic region; and South America focusing on Mexico, Argentina, Brazil, Chile, and Peru. The firm seeks to invest in food, financial, and healthcare industries in Western China. In the real estate sector, the firm seeks to invest in various locations across Europe focusing on France and Central Europe, United States, Asia focusing on China, and Latin America. It typically invests between $1 million and $50 million for venture investments and between $50 million and $2 billion for buyouts in companies with enterprise value of between $31.57 million and $1000 million and sales value of $10 million and $500 million. It seeks to invest in companies with market capitalization greater than $50 million and EBITDA between $5 million to $25 million. It prefers to take a majority or a minority stake. While investing in Japan, it does not invest in companies with more than 1,000 employees and prefers companies' worth between $100 million and $150 million. The firm originates, structures, and acts as lead equity investor in the transactions. The Carlyle Group Inc. was founded in 1987 and is based in Washington, District of Columbia with additional offices in 21 countries across 5 continents (North America, South America, Asia, Australia and Europe).

More news about The Carlyle Group.

15. America Movil (AMOV)

Shares of America Movil rose by a staggering 13.99% in from $18.08 to $20.61 at 18:21 EST on Wednesday, following the last session’s upward trend. NASDAQ is sliding 1.24% to $10,957.01, after five consecutive sessions in a row of gains.

America Movil, S.A.B. de C.V. offers telecommunications services throughout Latin America as well as internationally. It offers fixed and wireless voice services as well as network interconnection. These services include local, national, and international long distance services. The company also offers data services such as hosting, data administration and data centers to residential and business clients. It also offers value-added services including Internet access and messaging; data transmission, email, instant messaging and content streaming; wireless security services and machine-to-machine, machine-to man-machine, mobile banking and virtual private network service. Video calls and personal communication services are all offered by the company. The company also offers broadband services for residential customers, IT solutions to large businesses and small corporations and subscriptions to satellite and cable pay TV. It also sells accessories and computers, as well as equipment directories and wireless security. The company offers call center services, software development, and advertising. The company also provides audio and video content via the Internet, directly from content providers to end users. The company sells products and services under Telcel, Telmex Infinitum and A1 brand names through a network that includes retailers, service centers, corporate clients, as well as through sales representatives. The company has approximately 286.5 millions wireless voice and data customers as of December 31, 2021. America Movil, S.A.B. de C.V. was established in 2000. It is located in Mexico City.

Moving Average

America Movil’s value is above its 50-day moving average of $19.02 and above its 200-day moving average of $19.01.

Volatility

America Movil’s last week, last month’s, and last quarter’s current intraday variation average was 1.30%, 0.85%, and 1.42%.

America Movil’s highest amplitude of average volatility was 1.43% (last week), 1.34% (last month), and 1.42% (last quarter).

Revenue Growth

Year-on-year quarterly revenue growth grew by 1.8%, now sitting on 871.29B for the twelve trailing months.

More news about America Movil.

16. Brookfield Infrastructure Partners (BIP)

Shares of Brookfield Infrastructure Partners jumped by a staggering 12.33% in from $30.98 to $34.80 at 18:21 EST on Wednesday, after four consecutive sessions in a row of gains. NYSE is falling 1.48% to $15,649.12, following the last session’s downward trend.

Brookfield Infrastructure Partners L.P. operates utility, transport, middlestream and data companies in North, South, Europe and Asia Pacific. Utilities is the company segment that operates 61,000 km (km) in operational electricity transmission and distribution lines, 5,300 km of transmission lines and 4,200 km natural gas pipelines. There are 7.3 million connections and 736,000 long-term contracts for submetering. The segment offers cooling and heating solutions, gas distribution, water heaters, heating, ventilation and rental air conditioners, along with other home services. The company’s Transport segment provides transportation, storage and handling services for goods and commodities. It has a track network that spans approximately 22,000km, 5,500 km, 4,800 km, rail, 3,800 km motorways, 13 ports terminals, and 5,500 km. Natural gas transportation, gathering, processing and storage are provided by the company’s Midstream segment. It has approximately 15,000km of natural oil transmission pipelines. There is 600 billion cubic feet natural gas storage. 17 natural gas processing facilities. 3,900 km of gas gathering pipes. One petrochemical processing plant. The company’s Data segment has approximately 148,000 telecom towers, 8,000 multipurpose towers, active rooftop locations and 10,000km of fiber backbone. There are 1,600 cell sites with approximately 12,000 km fiber optic cable and 2,100 active towers. It also operates 50 data centers and 200 megawatts critical load capacity. Hamilton, Bermuda is the home of the company. Brookfield Asset Management Inc. has a subsidiary called Brookfield Infrastructure Partners L.P.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Brookfield Infrastructure Partners stock is oversold (=20).

More news about Brookfield Infrastructure Partners.

17. CDW Corporation (CDW)

Shares of CDW Corporation jumped by a staggering 11.19% in from $178.76 to $198.76 at 18:21 EST on Wednesday, after five successive sessions in a row of gains. NASDAQ is dropping 1.24% to $10,957.01, after five consecutive sessions in a row of gains.

CDW Corporation provides information technology (IT) solutions in the United States, the United Kingdom, and Canada. It operates through three segments: Corporate, Small Business, and Public. The company offers discrete hardware and software products and services, as well as integrated IT solutions, including on-premise, hybrid, and cloud capabilities across data center and networking, digital workspace, and security. Its hardware products comprise notebooks/mobile devices, network communications, desktop computers, video monitors, enterprise and data storage, and others; and software products consists of application suites, security, virtualization, operating systems, and network management. The company also provides advisory and design, software development, implementation, managed, professional, configuration, and telecom services, as well as warranties; mission critical software, systems, and network solutions; and implementation and installation, and repair services to its customers through various third-party service providers. It serves government, education, and healthcare customers; and small, medium, and large business customers. The company was founded in 1984 and is headquartered in Vernon Hills, Illinois.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

CDW Corporation’s stock is considered to be oversold (<=20).

Annual Top and Bottom Value

CDW Corporation stock was valued at $198.76 as of 18:22 EST. This is lower than the 52-week peak of $199.77, and much higher than its 52 week low of $147.91.

More news about CDW Corporation.

18. Bank Nova Scotia Halifax (BNS)

Shares of Bank Nova Scotia Halifax rose 6.79% in from $48.03 to $51.29 at 18:21 EST on Wednesday, after five consecutive sessions in a row of gains. NYSE is falling 1.48% to $15,649.12, following the last session’s downward trend.

The Bank of Nova Scotia provides various banking products and services in Canada, the United States, Mexico, Peru, Chile, Colombia, the Caribbean and Central America, and internationally. It operates in four segments: Canadian Banking, International Banking, Global Wealth Management, and Global Banking and Markets. The company offers financial advice and solutions, and day-to-day banking products, including debit and credit cards, chequing and saving accounts, investments, mortgages, loans, and insurance to individuals; and business banking solutions comprising lending, deposit, cash management, and trade finance solutions to small, medium, and large businesses, including automotive financing solutions to dealers and their customers. It also provides wealth management advice and solutions, including online brokerage, mobile investment, full-service brokerage, trust, private banking, and private investment counsel services; and retail mutual funds, exchange traded funds, liquid alternative funds, and institutional funds. In addition, the company offers international banking services for retail, corporate, and commercial customers; and lending and transaction, investment banking advisory, and capital markets access services to corporate customers. Further, it provides online, mobile, and telephone banking services. The company operates a network of 954 branches and approximately 3,766 automated banking machines in Canada; and approximately 1,300 branches and a network of contact and support center internationally. The Bank of Nova Scotia was founded in 1832 and is headquartered in Halifax, Canada.

More news about Bank Nova Scotia Halifax.

19. Liberty Broadband (LBRDA)

Shares of Liberty Broadband jumped by a staggering 25.43% in from $69.38 to $87.02 at 18:21 EST on Wednesday, after five successive sessions in a row of gains. NASDAQ is sliding 1.24% to $10,957.01, after five successive sessions in a row of gains.

Liberty Broadband Corporation is involved in communications business. GCI Holdings, Charter and Charter are its segments. GCI Holdings provides wireless, data and voice services for residential customers and businesses. It also offers managed services to educational and medical institutions, as well as businesses and governmental entities. Subscription-based video services are offered by the Charter segment. These services include video on demand and high-definition TV, digital video recorder, local and long distance calling, voicemail and call waiting. Spectrum TV also offers voice services. The company also offers internet services. This includes an in-home WiFi product, which provides customers high-performance Wi-Fi routers and managed WiFi services. Advanced community Wi-Fi and mobile internet are just a few of the many options. It also has a security suite to protect against spyware and computer viruses. This segment also offers data networking and internet access to cellular towers, office buildings and video entertainment; business telephone services; digital outlet advertising; regional sports networks; and provides internet connectivity. Liberty Broadband Corporation, which was founded in 2014 is located in Englewood in Colorado.

Growth Estimates Quarters

The company’s growth estimates for the ongoing quarter and the next is 19.4% and 54%, respectively.

Yearly Top and Bottom Value

Liberty Broadband’s stock is valued at $87.02 at 18:22 EST, way under its 52-week high of $151.90 and way higher than its 52-week low of $68.15.

Sales Growth

Liberty Broadband has a negative 1.8% quarter-over-quarter sales growth and a negative 0.9% next quarter.

More news about Liberty Broadband.

20. SS&C Technologies Holdings (SSNC)

Shares of SS&C Technologies Holdings jumped by a staggering 10.48% in from $50.59 to $55.89 at 18:21 EST on Wednesday, after four sequential sessions in a row of gains. NASDAQ is sliding 1.24% to $10,957.01, after five sequential sessions in a row of gains.

SS&C Technologies Holdings, Inc., along with its subsidiaries, offers software products and services that are software-enabled to the financial and healthcare sectors. It owns and manages technology across the following areas: securities accounting; front office functions such as modeling and trading; middle-office operations such as portfolio management and reporting; back offices such as accounting, performance, reconciliation, reporting and processing, tax reporting and compliance; healthcare solutions such as care management, benefits management, claims adjudication and management. The company’s services enable professionals working in healthcare and financial services to simplify complex business processes. They also help clients manage their information processing needs. Software-enabled services offered by the company include SS&C GlobeOp and Global Investor and Distribution Solutions. SS&C Retirement Solutions. Bluedoor. Advent Outsourcing Services. Advent Data Solutions. ALPS Advisors. Virtual Data Rooms. Also, pharmacy and healthcare administration. Software products include portfolio/investment and analytic software, portfolio management and trading software, and digital process automation product suite. They also offer banking and lending solutions as well as research and analysis, risk and training solutions. It also offers professional services such as consulting, implementation and support services for clients. The company operates across the United States, Canada, Japan, Europe, Middle East and Africa, as well as the United Kingdom, Europe, Middle East and Africa, Asia Pacific, Japan, Canada, and the Americas. It was established in 1986. The headquarters are located in Windsor, Connecticut.

Growth Estimates Quarters

The company’s growth estimates for the ongoing quarter and the next is a negative 9.4% and a negative 4.8%, respectively.

Sales Growth

SS&C Technologies Holdings’s sales growth is 2.6% for the present quarter and 2.8% for the next.

More news about SS&C Technologies Holdings.

21. Banco Bilbao Vizcaya Argentaria (BBVA)

Shares of Banco Bilbao Vizcaya Argentaria rose by a staggering 16.61% in from $5.9 to $6.88 at 18:21 EST on Wednesday, after five consecutive sessions in a row of gains. NYSE is dropping 1.48% to $15,649.12, following the last session’s downward trend.

Banco Bilbao Vizcaya Argentaria, S.A., together with its subsidiaries, provides retail banking, wholesale banking, and asset management services. It offers current accounts; and demand, savings, overnight, time, term, and subordinated deposits. The company also provides loan products; deals in securities; and manages pension and investment funds. In addition, it offers credit cards; corporate and investment banking services; insurance products and services; and real estate services. The company provides its products through online and mobile channels. As of December 31, 2021, it operated through a network of 6,083 branches and 29,148 ATMs. It operates in Spain, Mexico, South America, the United States, Turkey, Asia, and rest of Europe. Banco Bilbao Vizcaya Argentaria, S.A. was founded in 1857 and is headquartered in Bilbao, Spain.

Annual Top and Bottom Value

Banco Bilbao Vizcaya Argentaria stock was valued at $6.88 as of 18:22 EST. This is lower than the 52-week high at $6.97, and much higher than the 52-week low at $3.93.

More news about Banco Bilbao Vizcaya Argentaria.

22. Capital One Financial (COF)

Shares of Capital One Financial rose by a staggering 15.37% in from $88.41 to $102.00 at 18:21 EST on Wednesday, after two consecutive sessions in a row of gains. NYSE is sliding 1.48% to $15,649.12, following the last session’s downward trend.

Capital One Financial Corporation operates as the financial services holding company for the Capital One Bank (USA), National Association; and Capital One, National Association, which provides various financial products and services in the United States, Canada, and the United Kingdom. It operates through three segments: Credit Card, Consumer Banking, and Commercial Banking. The company accepts checking accounts, money market deposits, negotiable order of withdrawals, savings deposits, and time deposits. Its loan products include credit card loans; auto and retail banking loans; and commercial and multifamily real estate, and commercial and industrial loans. The company also offers credit and debit card products; online direct banking services; and treasury management and depository services. It serves consumers, small businesses, and commercial clients through digital channels, branches, cafés, and other distribution channels located in New York, Louisiana, Texas, Maryland, Virginia, New Jersey, and California. Capital One Financial Corporation was founded in 1988 and is headquartered in McLean, Virginia.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Capital One Financial’s stock is considered to be oversold (<=20).

Annual Top and Bottom Value

Capital One Financial stock was valued at $102.00 as of 18:22 EST. This is way below its 52 week high of $162.40, and far above its 52 week low of $86.98.

More news about Capital One Financial.

23. Fomento Economico Mexicano S.A.B. de C.V. (FMX)

Shares of Fomento Economico Mexicano S.A.B. de C.V. rose by a staggering 10.79% in from $76.83 to $85.12 at 18:21 EST on Wednesday, after five consecutive sessions in a row of gains. NYSE is dropping 1.48% to $15,649.12, following the last session’s downward trend.

Fomento Económico Mexicano, S.A.B. de C.V., through its subsidiaries, operates as a bottler of Coca-Cola trademark beverages. The company produces, markets, and distributes Coca-Cola trademark beverages in Mexico, Guatemala, Nicaragua, Costa Rica, Panama, Colombia, Venezuela, Brazil, Argentina, and Uruguay. It also operates small-box retail chain stores in Mexico, Colombia, Peru, Chile, and Brazil under the OXXO name; retail service stations for fuels, motor oils, lubricants, and car care products under the OXXO GAS name in Mexico; and drugstores in Chile, Colombia, Ecuador, and Mexico under the Cruz Verde, Fybeca, SanaSana, YZA, La Moderna, and Farmacon names. In addition, the company is involved in the production and distribution of chillers, commercial refrigeration equipment, plastic boxes, food processing, and preservation and weighing equipment; and provision of logistic transportation, distribution and maintenance, point-of-sale refrigeration, and plastics solutions, as well as distribution platform for cleaning products and consumables. As of December 31, 2021, it operated 20,431 OXXO stores; 3,652 drugstores; and 567 OXXO GAS service stations. Fomento Económico Mexicano, S.A.B. de C.V. was founded in 1890 and is based in Monterrey, Mexico.

Moving Average

Fomento Economico Mexicano S.A.B. de C.V. is worth more than its moving average for 50 days of $78.21, and much higher than the moving average for 200 days of $70.73.

Growth Estimates Quarters

For the current quarter, the company expects to grow by 180% and 38.5% respectively.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Fomento Economico Mexicano S.A.B. de C.V.’s stock is considered to be oversold (<=20).

Volatility

Fomento Economico Mexicano S.A.B. de C.V.’s intraday variations averages for the last week, month, and quarter were 0.77%, 0.666% and 1.19%, respectively.

Fomento Economico Mexicano S.A.B. de C.V. had the highest average volatility amplitude at 0.77%, 1.08% and 1.19% respectively.

More news about Fomento Economico Mexicano S.A.B. de C.V..

24. Full House Resorts (FLL)

Shares of Full House Resorts jumped by a staggering 13.45% in from $7.51 to $8.52 at 18:21 EST on Wednesday, after five sequential sessions in a row of gains. NASDAQ is falling 1.24% to $10,957.01, after five sequential sessions in a row of gains.

Full House Resorts, Inc. develops, invests, manages, leases, and operates casinos and other entertainment and hospitality facilities throughout the United States. Silver Slipper Casino & Hotel is located in Hancock County Mississippi. It has 757 slots and 24 table game options, a surface lot and 129 hotel rooms. There’s also an on-site casino, a buffet restaurant and a restaurant that serves fine dining, fast-service, oyster bars, a bar and beachfront, and an RV park with 37 spaces. Bronco Billy’s Casino and Hotel is also owned and operated in Cripple Creek. It has 14 rooms and gaming space, as well as a steakhouse, casual dining, and a bar. The Rising Star Casino Resort is located in Rising Sun, Indiana. It has 642 slots machines and 16 tables games. There’s also a land-based pavilion that can hold approximately 31500 square feet. A contiguous hotel with 190 rooms and a leased hotel with 104 bedrooms; 56 spaces for RV parking and surface parking. It also owns the Stockman’s Casino, located in Fallon in Nevada. This casino has 186 slots, a bar and fine-dining restaurants, as well as a coffee shop. The Grand Lodge Casino, with 269 slot machines plus 9 table games is part of the Hyatt Regency lake Tahoe Resort, Spa, Casino and Casino, Incline Village. Full House Resorts, Inc. is located in Las Vegas, Nevada.

More news about Full House Resorts.

25. General Motors (GM)

Shares of General Motors jumped 3.49% in from $35.21 to $36.44 at 18:21 EST on Wednesday, following the last session’s upward trend. NYSE is dropping 1.48% to $15,649.12, following the last session’s downward trend.

General Motors Company designs, builds, and sells trucks, crossovers, cars, and automobile parts and accessories in North America, the Asia Pacific, the Middle East, Africa, South America, the United States, and China. The company operates through GM North America, GM International, Cruise, and GM Financial segments. It markets its vehicles primarily under the Buick, Cadillac, Chevrolet, GMC, Holden, Baojun, and Wuling brand names. The company also sells trucks, crossovers, cars, and purpose-built vehicles to dealers for consumer retail sales, as well as to fleet customers, including daily rental car companies, commercial fleet customers, leasing companies, and governments. In addition, it offers safety and security services for retail and fleet customers, including automatic crash response, emergency services, roadside assistance, crisis assist, stolen vehicle assistance, and turn-by-turn navigation; and connected services comprising mobile applications for owners to remotely control their vehicles and electric vehicle owners to locate charging stations, on-demand vehicle diagnostics, smart driver, marketplace in-vehicle commerce, in-vehicle voice, voice assistant, navigation and app ecosystem, connected navigation, SiriusXM with 360L, and 4G LTE wireless connectivity, as well as develops and commercializes autonomous vehicle technology. Further, the company provides automotive financing and insurance services; and software-enabled services and subscriptions. General Motors Company was founded in 1908 and is headquartered in Detroit, Michigan.

Growth Estimates Quarters

The company’s growth estimates for the current quarter is 25.2% and a drop 26.3% for the next.

Yearly Top and Bottom Value

General Motors’s stock is valued at $36.44 at 18:23 EST, way below its 52-week high of $60.35 and way higher than its 52-week low of $30.33.

More news about General Motors.

26. Taiwan Semiconductor (TSM)

Shares of Taiwan Semiconductor rose by a staggering 18.04% in from $75.9 to $89.59 at 18:21 EST on Wednesday, after two successive sessions in a row of gains. NYSE is falling 1.48% to $15,649.12, following the last session’s downward trend.

Taiwan Semiconductor Manufacturing Company Limited produces, packages, tests and sells integrated circuits. It also exports to the United States and international markets. The company offers complementary metal oxide silicon wafer manufacturing processes for logic, mixed signal, radio frequency and embedded memory semiconductors. It also provides customer service, account management and engineering services. The company’s products can be found in high-performance computing devices, mobile phones, automobile electronics and the internet of Things markets. It was founded in 1987 in Hsinchu City in Taiwan.

Revenue growth

Quarterly revenue growth was 47.9% year-over-year, and now stands at 2.08T in the 12 trailing months.

More news about Taiwan Semiconductor.

27. TransCanada (TRP)

Shares of TransCanada rose 7.49% in from $39.78 to $42.76 at 18:21 EST on Wednesday, after five successive sessions in a row of gains. NYSE is falling 1.48% to $15,649.12, following the last session’s downward trend.

TC Energy Corporation operates as an energy infrastructure company in North America. It operates through five segments: Canadian Natural Gas Pipelines; U.S. Natural Gas Pipelines; Mexico Natural Gas Pipelines; Liquids Pipelines; and Power and Storage. The company builds and operates 93,300 km network of natural gas pipelines, which transports natural gas from supply basins to local distribution companies, power generation plants, industrial facilities, interconnecting pipelines, LNG export terminals, and other businesses. It also has regulated natural gas storage facilities with a total working gas capacity of 535 billion cubic feet. In addition, it has approximately 4,900 km liquids pipeline system that connects Alberta crude oil supplies to refining markets in Illinois, Oklahoma, Texas, and the U.S. Gulf Coast. Further, the company owns or has interests in seven power generation facilities with a combined capacity of approximately 4,300 megawatts that are powered by natural gas and nuclear fuel sources located in Alberta, Ontario, Québec, and New Brunswick; and owns and operates approximately 118 billion cubic feet of non-regulated natural gas storage capacity in Alberta. The company was formerly known as TransCanada Corporation and changed its name to TC Energy Corporation in May 2019. TC Energy Corporation was incorporated in 1951 and is headquartered in Calgary, Canada.

Yearly Top and Bottom Value

TransCanada’s stock is valued at $42.76 at 18:23 EST, way below its 52-week high of $59.38 and above its 52-week low of $39.11.

More news about TransCanada.

28. Trimble (TRMB)

Shares of Trimble jumped by a staggering 10.96% in from $49.17 to $54.56 at 18:21 EST on Wednesday, after five sequential sessions in a row of gains. NASDAQ is sliding 1.24% to $10,957.01, after five sequential sessions in a row of gains.

Trimble Inc. provides technology solutions that enable professionals and field mobile workers to enhance or transform their work processes worldwide. The company's Buildings and Infrastructure segment offers field and office software for route selection and design; systems to guide and control construction equipment; software for 3D design and data sharing; systems to monitor, track, and manage assets, equipment, and workers; software to share and communicate data; program management solutions for construction owners; 3D conceptual design and modeling software; building information modeling software; enterprise resource planning, project management, and project collaboration solutions; integrated site layout and measurement systems; cost estimating, scheduling, and project controls solutions; and applications for sub-contractors and trades. Its Geospatial segment provides surveying and geospatial products, and geographic information systems. The company's Resources and Utilities segment offers precision agriculture products and services, such as guidance and positioning systems, including autonomous steering systems, automated and variable-rate application and technology systems, and information management solutions; manual and automated navigation guidance for tractors and other farm equipment; solutions to automate application of pesticide and seeding; water solutions; and agricultural software. Its Transportation segment offers solutions for long haul trucking and freight shipper markets; mobility solutions comprising route management, safety and compliance, end-to-end vehicle management, video intelligence, and supply chain communications; and fleet and transportation management systems, analytics, routing, mapping, reporting, and predictive modeling solutions. The company was formerly known as Trimble Navigation Limited and changed its name to Trimble Inc. in October 2016. Trimble Inc. was founded in 1978 and is headquartered in Westminster, Colorado.

Annual Top and Bottom Value

Trimble stock was valued at $54.56 as of 18:23 EST. This is way lower than the 52-week high at $76.49, and much higher than the 52-week low at $47.52.

Sales Growth

Trimble has experienced a 1% increase in sales for the current quarter, and 2.3% growth for the following.

More news about Trimble.

29. Canadian Pacific Railway (CP)

Shares of Canadian Pacific Railway rose 4.78% in from $74.82 to $78.40 at 18:21 EST on Wednesday, after four successive sessions in a row of gains. NYSE is sliding 1.48% to $15,649.12, following the last session’s downward trend.

Canadian Pacific Railway Limited, together with its subsidiaries, owns and operates a transcontinental freight railway in Canada and the United States. The company transports bulk commodities, including grain, coal, potash, fertilizers, and sulphur; and merchandise freight, such as energy, chemicals and plastics, metals, minerals and consumer, automotive, and forest products. It also transports intermodal traffic comprising retail goods in overseas containers. The company offers rail and intermodal transportation services through a network of approximately 13,000 miles serving business centers in Quebec and British Columbia, Canada; and the United States Northeast and Midwest regions. Canadian Pacific Railway Limited was incorporated in 1881 and is headquartered in Calgary, Canada.

Annual Top and Bottom Value

Canadian Pacific Railway stock was valued at $78.40 as of 18:23 EST. This is below its 52 week high of $84.22 but well above its low 52-week of $65.17.

Volatility

Canadian Pacific Railway’s intraday variation average for the week and quarter ended December 31, 2013, 0.33% and 1.25%, respectively.

Canadian Pacific Railway had the highest average volatility amplitudes of 1.22%, 1.39% and 1.25% respectively in last week, quarter and month.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Canadian Pacific Railway stock considered oversold (=20).

Moving Average

Canadian Pacific Railway is worth more than its moving average for 50 days of $77.15 (and its moving average for 200 days of $74.71)

More news about Canadian Pacific Railway.

30. Marvell Technology Group (MRVL)

Shares of Marvell Technology Group jumped 7.03% in from $37.85 to $40.51 at 18:21 EST on Wednesday, after five sequential sessions in a row of gains. NASDAQ is falling 1.24% to $10,957.01, after five sequential sessions in a row of gains.

Marvell Technology, Inc., together with its subsidiaries, designs, develops, and sells analog, mixed-signal, digital signal processing, and embedded and standalone integrated circuits. It offers a portfolio of Ethernet solutions, including controllers, network adapters, physical transceivers, and switches; single or multiple core processors; ASIC; and printer System-on-a-Chip products and application processors. The company also provides a range of storage products comprising storage controllers for hard disk drives (HDD) and solid-state drives that support various host system interfaces consisting of serial attached SCSI (SAS), serial advanced technology attachment (SATA), peripheral component interconnect express, non-volatile memory express (NVMe), and NVMe over fabrics; and fiber channel products, including host bus adapters, and controllers for server and storage system connectivity. It has operations in the United States, China, Malaysia, the Philippines, Thailand, Singapore, India, Israel, Japan, South Korea, Taiwan, and Vietnam. Marvell Technology, Inc. was incorporated in 1995 and is headquartered in Wilmington, Delaware.

Revenue Growth

Year-on-year quarterly revenue growth grew by 41%, now sitting on 5.52B for the twelve trailing months.

More news about Marvell Technology Group.

31. Walt Disney (DIS)

Shares of Walt Disney rose by a staggering 13.71% in from $87.01 to $98.94 at 18:21 EST on Wednesday, following the last session’s upward trend. NYSE is dropping 1.48% to $15,649.12, following the last session’s downward trend.

The Walt Disney Company, together with its subsidiaries, operates as an entertainment company worldwide. It operates through two segments, Disney Media and Entertainment Distribution; and Disney Parks, Experiences and Products. The company engages in the film and episodic television content production and distribution activities, as well as operates television broadcast networks under the ABC, Disney, ESPN, Freeform, FX, Fox, National Geographic, and Star brands; and studios that produces motion pictures under the Walt Disney Pictures, Twentieth Century Studios, Marvel, Lucasfilm, Pixar, and Searchlight Pictures banners. It also offers direct-to-consumer streaming services through Disney+, Disney+ Hotstar, ESPN+, Hulu, and Star+; sale/licensing of film and television content to third-party television and subscription video-on-demand services; theatrical, home entertainment, and music distribution services; staging and licensing of live entertainment events; and post-production services by Industrial Light & Magic and Skywalker Sound. In addition, the company operates theme parks and resorts, such as Walt Disney World Resort in Florida; Disneyland Resort in California; Disneyland Paris; Hong Kong Disneyland Resort; and Shanghai Disney Resort; Disney Cruise Line, Disney Vacation Club, National Geographic Expeditions, and Adventures by Disney as well as Aulani, a Disney resort and spa in Hawaii; licenses its intellectual property to a third party for the operations of the Tokyo Disney Resort; and provides consumer products, which include licensing of trade names, characters, visual, literary, and other IP for use on merchandise, published materials, and games. Further, it sells branded merchandise through retail, online, and wholesale businesses; and develops and publishes books, comic books, and magazines. The Walt Disney Company was founded in 1923 and is based in Burbank, California.

Revenue Growth

Year-on-year quarterly revenue growth grew by 26.3%, now sitting on 81.11B for the twelve trailing months.

Volatility

Walt Disney’s intraday variation average for the week and quarter ended last week at 1.24%, 0.555% and 1.90%, respectively.

The highest levels of volatility at Walt Disney were 1.51% (last week), 1.68 (last month) and 1.90%(last quarter).

Annual Top and Bottom Value

Walt Disney stock was valued at $98.94 as of 18:23 EST. This is way lower than its 52 week high of $157.50, and much higher than its 52-week low $84.07.

More news about Walt Disney.

32. Advanced Semiconductor Engineering (ASX)

Shares of Advanced Semiconductor Engineering rose by a staggering 12.66% in from $6.32 to $7.12 at 18:21 EST on Wednesday, following the last session’s upward trend. NYSE is dropping 1.48% to $15,649.12, following the last session’s downward trend.

ASE Technology Holding Co. Ltd. offers a variety of electronic manufacturing services, including testing and packaging of semiconductors. The company offers packaging services including chip scale package (CSP) and flip-chip ball grid arrays (BGA), as well as advanced and low-profile quad flat packages. It also provides bump chip carrier, QFN (Quick Flat No Lead) packages and plastic BGAs. 3D chip packages are available, along with stackable die solutions in different packages. There is also copper and silver wire bonding. Advanced packages include flip chip BGA, heat-spreader FCCBGA; flipchip CSP and hybrid FCCSP; package with flip chip (POP); flip chip package in package or package on package; advanced single-sided substrate; high bandwidth POP; fan out wafer-level packaging SESUB and 2.5D Silicon interposer. It also offers IC wire bonding packaging, system-in-package (SiP), and module packages, and interconnect materials. Further, the company provides a range of semiconductor testing services, including front-end engineering testing, wafer probing, logic/mixed-signal/RF module and SiP/MEMS/discrete final testing, and other test-related services, as well as drop shipment services. It also develops and constructs, rents, leases and manages real property properties. Kaohsiung is the headquarters of this company, which was founded in 1984.

Volatility

Advanced Semiconductor Engineering’s last week, last month’s, and last quarter’s current intraday variation average was 0.43%, 0.57%, and 1.84%.

Advanced Semiconductor Engineering’s highest amplitude of average volatility was 0.52% (last week), 1.51% (last month), and 1.84% (last quarter).

Annual Top and Bottom Value

Advanced Semiconductor Engineering stock was valued at $7.12 as of 18:23 EST. This is below its 52 week high of $7.88, and well above its 52 week low of $4.45.

More news about Advanced Semiconductor Engineering.

33. Akamai Technologies (AKAM)

Shares of Akamai Technologies jumped 3.82% in from $84.61 to $87.84 at 18:21 EST on Wednesday, after two consecutive sessions in a row of gains. NASDAQ is sliding 1.24% to $10,957.01, after five consecutive sessions in a row of gains.

Akamai Technologies, Inc. provides cloud services for securing, delivering, and optimizing content and business applications over the internet in the United States and internationally. The company offers cloud solutions to keep infrastructure, websites, applications, application programming interfaces, and users safe from various cyberattacks and online threats while enhancing performance. It also provides web and mobile performance solutions to enable dynamic websites and applications; media delivery solutions, including video streaming and video player services, game and software delivery, broadcast operations, authoritative domain name system, resolution, and data and analytics; and edge compute solutions to enable developers to deploy and distribute code at the edge. In addition, the company offers carrier offerings, including cybersecurity protection, parental controls, DNS infrastructure and content delivery solutions; and an array of service and support to assist customers with integrating, configuring, optimizing, and managing its offerings. It sells its solutions through direct sales and service organizations, as well as through various channel partners. Akamai Technologies, Inc. was incorporated in 1998 and is headquartered in Cambridge, Massachusetts.

More news about Akamai Technologies.

34. PennyMac (PFSI)

Shares of PennyMac rose by a staggering 14.43% in from $55.65 to $63.68 at 18:21 EST on Wednesday, after two consecutive sessions in a row of gains. NYSE is dropping 1.48% to $15,649.12, following the last session’s downward trend.

PennyMac Financial Services, Inc., via its subsidiaries, is involved in mortgage banking and investment management in the United States. The company operates in three main segments, Production, Servicing and Investment Management. It is responsible for the acquisition and sale, as well as origination of, loans. The segment sources residential first-lien conventional, government-insured and guaranteed mortgage loans. It services newly issued loans and executes and manages early buyout transactions. The Servicing segment handles loan administration and collection activities. This includes responding to customers’ inquiries and accounting for principal, interest and other costs. It also holds custodial money for payment of insurance premiums and property taxes. Investment Management is responsible for sourcing, conducting diligence, bidding and closing investments asset acquisitions. It also manages PennyMac Mortgage Investment Trust correspondent production activities and management of acquired assets. PennyMac Financial Services, Inc., was established in 2008. It is located in Westlake Village, California.

Growth Estimates Quarters

According to the company, the growth estimate for this quarter and next quarter is negative 55.6% and negative 52.4% respectively.

Moving Average

PennyMac’s value is way higher than its 50-day moving average of $55.87 and way above its 200-day moving average of $51.12.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

PennyMac’s stock is considered to be overbought (>=80).

Yearly Top and Bottom Value

PennyMac’s stock is valued at $63.68 at 18:23 EST, under its 52-week high of $70.44 and way higher than its 52-week low of $38.53.

More news about PennyMac.

35. Skyworks Solutions (SWKS)

Shares of Skyworks Solutions jumped by a staggering 13.58% in from $89.97 to $102.19 at 18:21 EST on Wednesday, after five successive sessions in a row of gains. NASDAQ is falling 1.24% to $10,957.01, after five successive sessions in a row of gains.

Skyworks Solutions, Inc., together with its subsidiaries, designs, develops, manufactures, and markets proprietary semiconductor products, including intellectual property in the United States, China, South Korea, Taiwan, Europe, the Middle East, Africa, and rest of Asia-Pacific. Its product portfolio includes amplifiers, antenna tuners, attenuators, automotive tuners and digital radios, circulators/isolators, DC/DC converters, demodulators, detectors, diodes, wireless analog system on chip products, directional couplers, diversity receive modules, filters, front-end modules, hybrids, light emitting diode drivers, low noise amplifiers, mixers, modulators, optocouplers/optoisolators, phase locked loops, phase shifters, power dividers/combiners, receivers, switches, synthesizers, timing devices, technical ceramics, voltage controlled oscillators/synthesizers, and voltage regulators. The company provides its products for use in the aerospace, automotive, broadband, cellular infrastructure, connected home, entertainment and gaming, industrial, medical, military, smartphone, tablet, and wearable markets. It sells its products through direct sales force, electronic component distributors, and independent sales representatives. The company was incorporated in 1962 and is headquartered in Irvine, California.

More news about Skyworks Solutions.

36. NICE Ltd (NICE)

Shares of NICE Ltd jumped 6.39% in from $194.53 to $206.96 at 18:21 EST on Wednesday, after five consecutive sessions in a row of gains. NASDAQ is sliding 1.24% to $10,957.01, after five sequential sessions in a row of gains.

NICE Ltd. and its subsidiaries provide cloud platforms worldwide for AI-driven digital businesses solutions. CXone is a cloud-native open platform for contact centers that can support small, remote, or enterprise-level agents; Enlighten an AI engine that finds automation opportunities for self service; digital-entry point solutions that allow organizations to respond to consumers’ needs; journey orchestration that allows organizations to route and connect customers, making it possible to handle the customer’s request using AI-based routing. Smart self-service solutions enable organizations to create intelligent, automated conversations using data. The prepared agent tools and solutions allow contact center agents in real time to direct and alert customers and provide solutions. NICE Evidencentral is a digital evidence management platform that records structured and unstructured customer interactions. It also offers XSight, an AI-cloud platform that allows financial crime detection and prevention; Xceed which is a platform that provides comprehensive AML prevention and fraud prevention services for small and medium-sized businesses; AI and data analytics solutions to enable organisations to transform raw data into actionable intelligence that can prevent or detect financial crimes. NICE-Systems Ltd. was the company’s previous name. NICE Ltd. changed its name in June 2016. NICE Ltd. was established in 1986. It is located in Ra’anana in Israel.

Moving Average

NICE Ltd is worth more than its moving average for 50 days of $193.18, and greater than its moving average for 200 days of $201.09.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

NICE Ltd’s stock is considered to be oversold (<=20).

Sales Growth

NICE Ltd has a 10.5% and 9.2% sales growth for the quarters currently underway.

More news about NICE Ltd.

37. STMicroelectronics (STM)

Shares of STMicroelectronics jumped by a staggering 14.61% in from $36.89 to $42.28 at 18:21 EST on Wednesday, after five sequential sessions in a row of gains. NYSE is falling 1.48% to $15,649.12, following the last session’s downward trend.

STMicroelectronics N.V. and its subsidiaries design, develop, manufacture, and market semiconductor products throughout Europe, Africa, Asia Pacific, Africa, Americas and the Middle East. It operates in three segments: Automotive and Discrete Group, Analog MEMS and Sensors Group and Microcontrollers and Digital ICs Group. Automotive and Discrete Group offers integrated circuits for automobiles, as well as discrete and power transistors. The Analog, MEMS and Sensors Group segment provides industrial application-specific integrated circuits (ASICs) and application-specific standard products (ASSPs); general purpose analog products; custom analog ICs; wireless charging solutions; galvanic isolated gate drivers; low and high voltage amplifiers, comparators, and current-sense amplifiers; MasterGaN, a solution that integrates a silicon driver and GaN power transistors in a single package; wireline and wireless connectivity ICs; touch screen controllers; micro-electro-mechanical systems (MEMS) products, including sensors or actuators; and optical sensing solutions. Microcontrollers and Digital ICs Group offers general-purpose and secure microcontrollers, radio frequency (RF), and electrically erasable programmable memory read-only memories, as well as RF, mixed-signal and digital ASICs. The company also offers assembly services. It sells products via distributors, retailers and sales reps. The company serves the automotive, computer and peripherals, as well as industrial and personal electronic and communication equipment markets. STMicroelectronics N.V. is an international corporation that was founded in 1987. Its headquarters are in Geneva, Switzerland.

Sales Growth

STMicroelectronics’s sales growth is 24.2% for the current quarter and 15% for the next.

Growth Estimates Quarters

The company’s growth estimates for the ongoing quarter and the next is 68.6% and 8.5%, respectively.

Moving Average

STMicroelectronics’s value is way above its 50-day moving average of $33.52 and way higher than its 200-day moving average of $37.36.

Volatility

STMicroelectronics was at 0.98% in the last week. The last month and quarter were at 0.63% and 2.09% respectively.

STMicroelectronics had the highest average volatility amplitudes at 0.98%, 1.80% and 2.09% respectively.

More news about STMicroelectronics.

38. Pool Corporation (POOL)

Shares of Pool Corporation rose by a staggering 18.32% in from $303.74 to $359.38 at 18:21 EST on Wednesday, after five sequential sessions in a row of gains. NASDAQ is falling 1.24% to $10,957.01, after five consecutive sessions in a row of gains.