(VIANEWS) – Today, the Innrs artificial intelligence algorithm suggests a high probability of discovering the approximate price for tomorrow of Cigna CI, Twitter TWTR and others.

Via News will regularly fact-check this AI algorithm that aims to consistently predict the next session price and next week’s trend of financial assets.

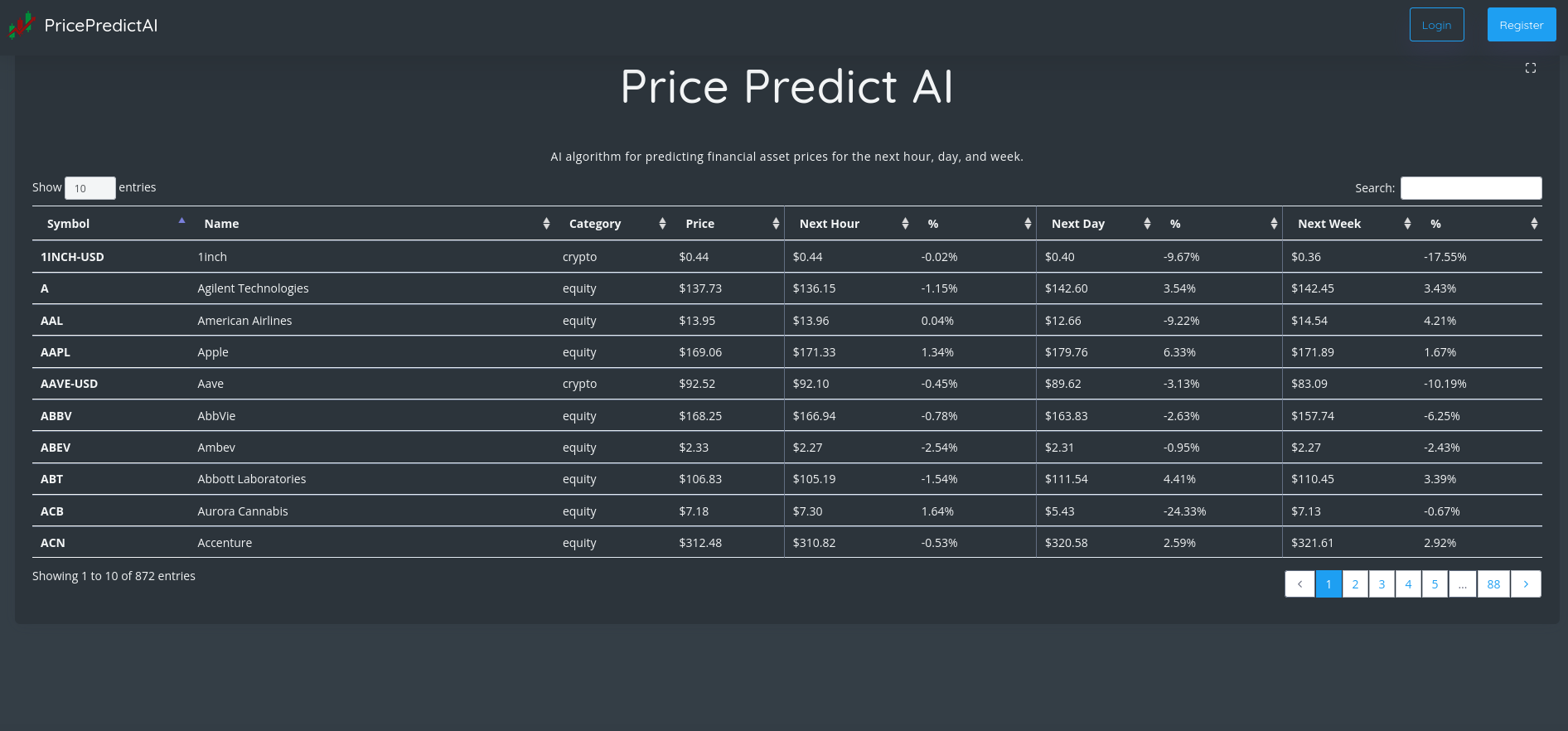

Innrs provides A.I.-based statistical tools to help investors make decisions. The table below shows the financial assets predicting price, ordered by the highest expected accuracy.

Innrs officials say this tool helps investors make better-informed decisions, supposedly used alongside other relevant financial information and the specific trader strategy.

In the next session, Via News will report the finding on the algorithm precision.

| Financial Asset | Accuracy | Close Price | Prediction |

|---|---|---|---|

| Cigna (CI) | 87.75% | $331.72 | ⇧ $338.86 |

| Twitter (TWTR) | 84.13% | $53.7 | ⇧ $54.1 |

| VALE (VALE) | 83.62% | $16.25 | ⇧ $16.53 |

| Zoom (ZM) | 82.84% | $69.99 | ⇧ $71.48 |

| Interactive Brokers Group (IBKR) | 79.25% | $76.35 | ⇧ $77.72 |

| Air Products and Chemicals (APD) | 78.97% | $315.64 | ⇧ $317.59 |

| Orix Corp (IX) | 78.92% | $79.99 | ⇧ $80.49 |

| Colgate-Palmolive (CL) | 78.44% | $77.39 | ⇧ $79.13 |

| Consolidated Edison (ED) | 78.16% | $96.5 | ⇧ $98.83 |

| Vertex Pharmaceuticals (VRTX) | 77.91% | $185.4 | ⇧ $191.85 |

| Medtronic (MDT) | 77.81% | $76.8 | ⇧ $79.5 |

| 3D Systems (DDD) | 77.2% | $9.2 | ⇩ $9.19 |

| Zai Lab (ZLAB) | 77.17% | $32.98 | ⇧ $33.33 |

| Boston Scientific (BSX) | 74.11% | $45.53 | ⇧ $45.94 |

| TJX Companies (TJX) | 74% | $79.17 | ⇧ $81.31 |

| Gap (GPS) | 73.66% | $14.47 | ⇧ $14.6 |

| The Travelers Companies (TRV) | 73.4% | $187.88 | ⇧ $192.82 |

| Celsius Holdings (CELH) | 73.21% | $111.74 | ⇧ $115.06 |

| HCA Holdings (HCA) | 72.97% | $237.98 | ⇧ $243.68 |

| Atlassian (TEAM) | 69.45% | $125.52 | ⇩ $120.32 |

| Entergy Corporation (ETR) | 68.89% | $116.18 | ⇧ $118.97 |

1. Cigna (CI)

Shares of Cigna jumped 0.92% in from $328.7 to $331.72 at 18:21 EST on Wednesday, after five successive sessions in a row of gains. NYSE is sliding 0% to $0.00, after two successive sessions in a row of losses.

Cigna Corporation provides insurance and related products and services in the United States. Its Evernorth segment provides a range of coordinated and point solution health services, including pharmacy, benefits management, care delivery and management, and intelligence solutions to health plans, employers, government organizations, and health care providers. The company's Cigna Healthcare segment offers medical, pharmacy, behavioral health, dental, vision, health advocacy programs, and other products and services for insured and self-insured customers; Medicare Advantage, Medicare Supplement, and Medicare Part D plans for seniors, as well as individual health insurance plans to on and off the public exchanges; and health care coverage in its international markets, as well as health care benefits for mobile individuals and employees of multinational organizations. The company also offers permanent insurance contracts sold to corporations to provide coverage on the lives of certain employees for financing employer-paid future benefit obligations. It distributes its products and services through insurance brokers and consultants; directly to employers, unions and other groups, or individuals; and private and public exchanges. The company was founded in 1792 and is headquartered in Bloomfield, Connecticut.

Sales Growth

Cigna saw a 3.6% increase in sales for its current quarter, compared to 3% during the previous quarter.

More news about Cigna.

2. Twitter (TWTR)

Shares of Twitter fell 0% in from $53.7 to $53.70 at 18:21 EST on Wednesday, following the last session’s downward trend. NYSE is falling 0% to $0.00, after two successive sessions in a row of losses.

Exclusive: s.f. Exclusive: A city attorney investigates the loss of jobs for twitter janitors

Olga Miranda (president of the local union), said that the contractor who employed them will be replaced. Twitter wouldn’t disclose this information to the union. Although I don’t find it surprising that this has happened, I am sorry for the workers and all contractors at Twitter who were laid off.

Elon Musk fires twitter lawyer allegedly involved in censoring hunter biden laptop storyIn light of concerns about Baker’s possible role in suppression of information important to the public dialogue, he was exited from Twitter today, On Tuesday, Twitter Deputy General Counsel (and former FBI General Counsel) Jim Baker was fired.

Twitter, Inc. operates as a platform for public self-expression and conversation in real-time. The company's primary product is Twitter, a platform that allows users to consume, create, distribute, and discover content. It also provides promoted products that enable advertisers to promote brands, products, and services, as well as enable advertisers to target an audience based on various factors, including who an account follows and actions taken on its platform, such as Tweets created and engagement with Tweets. Its promoted products consist of promoted ads and Twitter Amplify, Follower Ads, and Twitter takeover. In addition, the company offers monetization products for creators, including Tips to directly send small one-time payments on Twitter using various payment methods, including bitcoin; Super Follows, a paid monthly subscription, which includes bonus content, exclusive previews, and perks as a way to support and connect with creators on Twitter; and Ticketed Spaces to support creators on Twitter for their time and effort in hosting, speaking, and moderating the public conversation on Twitter Spaces. Further, it offers products for developers and data partners comprising Twitter Developer Platform, a platform that enables developers to build tools for people and businesses using its public application programming interface; and paid access to Twitter data for partners with commercial use cases. Twitter, Inc. was founded in 2006 and is based in San Francisco, California.

Yearly Top and Bottom Value

Twitter’s stock is valued at $53.70 at 18:21 EST, way under its 52-week high of $68.41 and way above its 52-week low of $31.30.

Revenue Growth

Year-on-year quarterly revenue growth declined by 1.2%, now sitting on 5.23B for the twelve trailing months.

Sales Growth

Twitter is forecast to grow its sales by 0.6% in the next quarter.

Previous days news about Twitter

- Dogecoin co-founder says twitter suspending meme accounts spreading 'positivity:' Elon Musk responds. According to Benzinga on Monday, 5 December, "See Also: No, It’s Not A Bug: If Your Twitter Feed Is Filled With Tweets From People You Don’t Even Follow, It’s Because…", "Read Next: Elon Musk Says Kanye West Suspended Again From Twitter For Inciting Violence: ‘I Tried My Best’"

More news about Twitter.

3. VALE (VALE)

Shares of VALE jumped by a staggering 12.53% in from $14.44 to $16.25 at 18:21 EST on Wednesday, after two sequential sessions in a row of gains. NYSE is dropping 0% to $0.00, after two sequential sessions in a row of losses.

Vale S.A., together with its subsidiaries, produces and sells iron ore and iron ore pellets for use as raw materials in steelmaking in Brazil and internationally. The company operates through Ferrous Minerals and Base Metals segments. The Ferrous Minerals segment produces and extracts iron ore and pellets, manganese, ferroalloys, and other ferrous products; and provides related logistic services. The Base Metals segment produces and extracts nickel and its by-products, such as gold, silver, cobalt, precious metals, and others, as well as copper. The company was formerly known as Companhia Vale do Rio Doce and changed its name to Vale S.A. in May 2009. Vale S.A. was founded in 1942 and is headquartered in Rio de Janeiro, Brazil.

More news about VALE.

4. Zoom (ZM)

Shares of Zoom fell by a staggering 12% in from $79.53 to $69.99 at 18:21 EST on Wednesday, after five sequential sessions in a row of losses. NASDAQ is dropping 0% to $0.00, after three consecutive sessions in a row of losses.

Zoom Video Communications, Inc. offers unified communication platform throughout the Americas, Asia Pacific, Europe, Middle East, Africa, and Europe. Zoom Meetings offers HD video and voice chat as well as content sharing via mobile devices, computers, phones, conference rooms, and telephones. Zoom Phone is an enterprise cloud-based phone system. Zoom Chat allows users to send messages, photos, audio files and other content from desktops, tablets, smartphones, mobiles and laptops. It also provides Zoom Rooms, a software-based conference room system; Zoom Hardware-as-a-Service allows users to access video communication technology from third party equipment; Zoom Conference Room Connector, a gateway for SIP/H.323 endpoints to join Zoom meetings; Zoom Events, which enables users to manage and host internal and external virtual events; OnZoom, a prosumer-focused virtual event platform and marketplace for Zoom users to create, host, and monetize online events; and Zoom Webinars to provide video presentations to large audiences from many devices. The company also offers Zoom Developer Platform, which allows platform integrators and service providers to create apps and integrate Zoom’s technology in their products or services. Zoom App Marketplace is a portal for SIP/H.323 endpoints to join Zoom meetings. Zoom Contact Center, an Omnichannel Contact Center solution, helps users to contact customers and publish apps. The company serves people in education and entertainment/media as well as finance, health, healthcare and manufacturing. Zoom Communications, Inc. was the company’s former name. In May 2012, Zoom Video Communications, Inc. became Zoom Video Communications, Inc. It was founded in 2011, and its headquarters are in San Jose, California.

Yearly Top and Bottom Value

Zoom’s stock is valued at $69.99 at 18:21 EST, under its 52-week low of $70.43.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Zoom stock considered overbought (>=80).

Moving Average

Zoom’s worth is way below its 50-day moving average of $78.50 and way under its 200-day moving average of $104.13.

More news about Zoom.

5. Interactive Brokers Group (IBKR)

Shares of Interactive Brokers Group fell 5.02% in from $80.39 to $76.35 at 18:21 EST on Wednesday, following the last session’s upward trend. NASDAQ is dropping 0% to $0.00, after three consecutive sessions in a row of losses.

Interactive Brokers Group, Inc. operates as an automated electronic broker worldwide. The company specializes in executing, clearing, and settling trades in stocks, options, futures, foreign exchange instruments, bonds, mutual funds, exchange traded funds (ETFs), metals, and cryptocurrencies. It also custodies and services accounts for hedge and mutual funds, ETFs, registered investment advisors, proprietary trading groups, introducing brokers, and individual investors. In addition, it offers custody, prime brokerage, securities, and margin lending services. The company serves institutional and individual customers through approximately 150 electronic exchanges and market centers. Interactive Brokers Group, Inc. was founded in 1977 and is headquartered in Greenwich, Connecticut.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Interactive Brokers Group’s stock is considered to be oversold (<=20).

Volatility

Interactive Brokers Group’s last week, last month’s, and last quarter’s current intraday variation average was a positive 0.06%, a negative 0.20%, and a positive 1.70%.

Interactive Brokers Group’s highest amplitude of average volatility was 1.11% (last week), 1.52% (last month), and 1.70% (last quarter).

More news about Interactive Brokers Group.

6. Air Products and Chemicals (APD)

Shares of Air Products and Chemicals jumped by a staggering 11.25% in from $283.72 to $315.64 at 18:21 EST on Wednesday, after two sequential sessions in a row of losses. NYSE is sliding 0% to $0.00, after two consecutive sessions in a row of losses.

Air Products and Chemicals, Inc. supplies atmospheric, specialty, and process gases, as well as equipment and services around the world. It produces atmospheric gases such as oxygen, nitrogen and argon, process gases like hydrogen, carbon dioxide and carbon monoxide, syngas, and equipment to produce or process gasses. This includes non-cryogenic generators and air separation units for various industries including manufacturing, refining chemical, gasification and metals. The company also produces equipment for natural gas liquefaction and air separation. Baker Hughes Company has formed a strategic partnership with Air Products and Chemicals, Inc. to create hydrogen compression systems. This company was established in 1940, and its headquarters are in Allentown in Pennsylvania.

Growth Estimates Quarters

For the current quarter, the company expects to grow by 10% and 7.5% respectively.

Revenue growth

The year-over-year revenue growth was 22.4%. It now stands at 11.97B in the 12 trailing months.

More news about Air Products and Chemicals.

7. Orix Corp (IX)

Shares of Orix Corp rose by a staggering 11.16% in from $71.96 to $79.99 at 18:21 EST on Wednesday, after two consecutive sessions in a row of gains. NYSE is falling 0% to $0.00, after two sequential sessions in a row of losses.

ORIX Corporation offers a variety of financial services throughout Japan, Asia, Europe and Australasia. Corporate Financial Services and Maintenance Leasing are the company’s segments. They deal with leasing and renting automobiles and electronic measuring devices, as well as providing life and environmental insurance and products and services. The company’s Real Estate segment manages, develops, leases and rents real estate. It also manages office buildings and residential condos. Concession and PE Investment segment of the company engages in private equity (PEI) investments and concessions businesses. The company’s Environment and Energy segment offers renewable energy, ESCO and sells electricity. It also provides recycling and waste management and storage system sales. Its Insurance segment offers life insurance products via agents, banks and other financial institutions. These are available online, face-to-face, and online. The company’s Banking and Credit segment offers banking and consumer finance services. Aircraft and Ships is the company’s aircraft and ships segment. It also engages in ship-related finance and investments. The company’s ORIX USA section offers investment and finance services as well as asset management. The company’s ORIX Europe section offers equity and fixed-income asset management services. The company’s Asia-Australia segment provides finance and investment services. ORIX Corporation was formerly known under the name Orient Leasing Co., Ltd. ORIX Corporation was founded in Tokyo in 1950.

Annual Top and Bottom Value

Orix Corp stock was valued at $79.99 as of 18:21 EST. This is way lower than the 52-week high $112.91, and much higher than the 52-week low $69.03.

More news about Orix Corp.

8. Colgate-Palmolive (CL)

Shares of Colgate-Palmolive jumped 4.68% in from $73.93 to $77.39 at 18:21 EST on Wednesday, after two consecutive sessions in a row of gains. NYSE is dropping 0% to $0.00, after two sequential sessions in a row of losses.

Colgate-Palmolive Company, together with its subsidiaries, manufactures and sells consumer products worldwide. The company operates through two segments, Oral, Personal and Home Care; and Pet Nutrition. The Oral, Personal and Home Care segment offers toothpaste, toothbrushes, mouthwash, bar and liquid hand soaps, shower gels, shampoos, conditioners, deodorants and antiperspirants, skin health products, dishwashing detergents, fabric conditioners, household cleaners, and other related items. This segment markets and sells its products under various brands, which include Colgate, Darlie, elmex, hello, meridol, Sorriso, Tom's of Maine, Irish Spring, Palmolive, Protex, Sanex, Softsoap, Lady Speed Stick, Speed Stick, EltaMD, Filorga, PCA SKIN, Ajax, Axion, Fabuloso, Murphy, Suavitel, Soupline, and Cuddly to a range of traditional and eCommerce retailers, wholesalers, and distributors. It also includes pharmaceutical products for dentists and other oral health professionals. The Pet Nutrition segment offers pet nutrition products for everyday nutritional needs under the Hill's Science Diet brand; and a range of therapeutic products to manage disease conditions in dogs and cats under the Hill's Prescription Diet brand. This segment markets and sells its products through pet supply retailers, veterinarians, and eCommerce retailers. Colgate-Palmolive Company was founded in 1806 and is headquartered in New York, New York.

Volatility

Colgate-Palmolive last week’s and last month’s intraday variations averages were 0.59%, 0.344% and 1.01%, respectively.

Colgate-Palmolive had the highest average volatility amplitudes at 0.86%, 0.78% and 1.01% respectively (last week, last month and last quarter).

Sales Growth

Colgate-Palmolive’s sales growth is 3.1% for the present quarter and 3.4% for the next.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Colgate-Palmolive stock considered overbought (>=80).

More news about Colgate-Palmolive.

9. Consolidated Edison (ED)

Shares of Consolidated Edison rose 8.98% in from $88.55 to $96.50 at 18:21 EST on Wednesday, after four successive sessions in a row of gains. NYSE is falling 0% to $0.00, after two sequential sessions in a row of losses.

Consolidated Edison, Inc., via its subsidiaries, is involved in the regulation of electric, gas, steam delivery business in the United States. The company offers electric service to approximately 3 million people in New York City, Westchester County, and parts of Queens. It also provides gas services to about 1.1 million Manhattan and Westchester County customers. Steam is available to around 1,555 Manhattan customers. It also provides electricity to about 0.3 million customers in New York’s southeastern New York, and parts of New Jersey. The company also offers gas to approximately 0.01 million customers in the southeastern New York. It also operates 533 miles of transmission line; 15 substations, 64 distribution substations, 87.564 in-service transformers, 3,924 poles of overhead distribution lines and 2,291 mile of underground lines. There are also 4,350 miles and 377.971 lines that serve natural gas distribution. The company also owns and operates energy infrastructure projects and offers energy-related products to retail and wholesale customers. It also invests in gas and electric transmission projects. The company sells electricity to residential, industrial, commercial and government customers. It was established in New York in 1823.

Sales Growth

Consolidated Edison’s sales growth is 4.8% for the present quarter and 3% for the next.

More news about Consolidated Edison.

10. Vertex Pharmaceuticals (VRTX)

Shares of Vertex Pharmaceuticals fell 0% in from $0 to $0.00 at 18:21 EST on Wednesday, after two sequential sessions in a row of losses. NASDAQ is falling 0% to $0.00, after three sequential sessions in a row of losses.

Vertex Pharmaceuticals Incorporated is a biotechnology firm that develops and markets therapies to treat cystic fibrosis. SYMDEKO/SYMKEVI and ORKAMBI are available to patients suffering from cystic fibrosis. TRIKAFTA is for patients 6 and older with CF who possess at least one F508del mutation. VX-864 is being developed for AAT deficiency treatment and is currently in Phase 2. Clinical trial. VX147 is for treatment of APOL1 mediated focal segmental glomerulosclerosis (or FSGS) and other severe kidney disease. VX-880 is for treatment of Type 1 Diabetes and is in Phase 1/2 clinical trials. VX-548 is a NaV1.8 inhibitor that treats acute, neuropathic and musculoskeletal pain and is currently in Phase 3. Clinical trial. CTX001 is for treatment of severe SCD/T and TDT treatment. It sells products to specialty pharmacies, specialty distributors, retail chains and hospitals around the world. Affinia Therapeutics, Inc., Arbor Biotechnologies, Inc., and CRISPR Therapeutics AG are some of its collaborations. ; Kymera Therapeutics, Inc., Mammoth Biosciences, Inc., Moderna, Inc., Obsidian Therapeutics, Inc., Skyhawk Therapeutics, Inc., Ribometrix, Inc., Genomics plc, Merck KGaA, Darmstadt, Germany, as well as X-Chem, Inc. Vertex Pharmacs Incorporated was established in Boston, Massachusetts in 1989.

Annual Top and Bottom Value

Vertex Pharmaceuticals’ stock price is $0.00 as of 18:22 EST. This value falls below its 52-week low $203.04.

Sales Growth

Vertex Pharmaceuticals has experienced a 11% quarter-over-quarter sales increase and 9.7% in the following.

Moving Average

Vertex Pharmaceuticals’s worth is under its 50-day moving average of $303.66 and under its 200-day moving average of $278.70.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Vertex Pharmaceuticals’s stock is considered to be overbought (>=80).

More news about Vertex Pharmaceuticals.

11. Medtronic (MDT)

Shares of Medtronic slid 4.73% in from $80.61 to $76.80 at 18:21 EST on Wednesday, after four successive sessions in a row of losses. NYSE is sliding 0% to $0.00, after two consecutive sessions in a row of losses.

Medtronic plc designs, produces, and markets device-based medical treatments to hospitals, doctors, clinicians and patients around the world. The Cardiovascular Portfolio segment includes implantable cardioverter and heart rate monitors, cardiac resynchronization therapies devices, cardiac ablation products, insertable cardiac monitor systems, TYRX products, remote monitoring, patient-centered software, and cardioverter defibrillators. The company also offers aortic valves as well as surgical valve repair and replacement products. It also sells transcatheter and intravascular stents. Percutaneous coronary intervention products and balloons are available. Medical Surgical Portfolio segments include surgical stapling, vessel sealing, wound closure and electrosurgery. They also offer surgical stapling, medical artificial intelligence, robotic-assisted surgical products, surgical mesh, gynecology, lung products and other therapies. The company’s Neuroscience Portfolio section offers products for spine surgeons, neurosurgeons, neurologists, pain management specialists, anesthesiologists, orthopedic surgeons, urologists, urogynecologists, interventional radiologists, ear, nose and throat specialists, as well as systems that integrate energy surgical instruments. Image-guided and intra-operative imaging, as well as robotic guidance systems for robot-assisted spine procedures are all offered by the company. There is also treatment of vasculature within and around the brain. Diabetes Operating Unit offers consumables and insulin pumps, as well as continuous glucose monitoring systems and smart insulin pen systems. It also supplies consumables. It was established in 1949 in Dublin, Ireland.

Volatility

Medtronic’s last week, last month’s, and last quarter’s current intraday variation average was a positive 1.14%, a negative 0.40%, and a positive 1.55%.

Medtronic’s highest amplitude of average volatility was 1.14% (last week), 1.96% (last month), and 1.55% (last quarter).

More news about Medtronic.

12. 3D Systems (DDD)

Shares of 3D Systems rose by a staggering 19.64% in from $7.69 to $9.20 at 18:21 EST on Wednesday, after two consecutive sessions in a row of losses. NYSE is dropping 0% to $0.00, after two successive sessions in a row of losses.

3D Systems Corporation provides 3D printing services through its subsidiaries in Asia Pacific, Europe, Africa, Middle East and Africa. 3D printing services offered by the company include stereolithography and selective laser sintering. Multi-jet printing and color jet printing are also available. Extrusion and SLA-based bioprinting transforms digital data from 3D software or computer aided designing (CAD) software into printed parts. The company also creates, blends and markets a variety of print materials such as nylon, plastic, metal, composite and elastomeric. The company also offers digital design tools such as software, scanners and haptic device, along with solutions for product design and simulation. It also offers 3D Sprint, 3DXpert and Bioprint Pro software solutions that allow researchers to create repeatable bioprint experiments and to optimize CAD data. The company also offers maintenance, training and manufacturing services. It also provides software and precision health services. The company serves small and medium-sized businesses, including those in the medical, dental and aerospace industries. 3D Systems Corporation was established in 1986. It is located in Rock Hill in South Carolina.

Volatility

3D Systems’s last week, last month’s, and last quarter’s current intraday variation average was 2.84%, 1.33%, and 3.25%.

3D Systems’s highest amplitude of average volatility was 2.89% (last week), 3.73% (last month), and 3.25% (last quarter).

Revenue growth

The year-over-year revenue growth for quarters fell by 13.8%. We now have 580.01M in the 12 trailing months.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

3D Systems’s stock is considered to be overbought (>=80).

More news about 3D Systems.

13. Zai Lab (ZLAB)

Shares of Zai Lab rose by a staggering 10.82% in from $29.76 to $32.98 at 18:21 EST on Wednesday, following the last session’s upward trend. NASDAQ is sliding 0% to $0.00, after three consecutive sessions in a row of losses.

Zai Lab Limited develops and commercializes therapies to treat oncology, autoimmune disorders, infectious diseases, and neuroscience primarily in Mainland China and Hong Kong. The company's commercial products include Zejula, a once-daily small-molecule poly polymerase 1/2 inhibitor; Optune, a device that delivers tumor treating fields; NUZYRA for acute bacterial skin and skin structure infections, and community acquired bacterial pneumonia; and Qinlock to treat gastrointestinal stromal tumors. It also develops Odronextamab to treat follicular lymphoma, diffuse large B-cell lymphoma, and other B-celllymphomas; Repotrectinib, a tyrosine kinase inhibitor (TKI) to target ROS1 and TRK A/B/C in TKI-naïve- or -pretreated cancer patients; Margetuximab for the treatment of breast and gastroesophageal cancers; Adagrasib for treating KRAS-G12C-mutated NSCLC, colorectal cancer, pancreatic cancer, and other solid tumors; and Bemarituzumab to treat gastric and gastroesophageal junction cancer. In addition, the company develops CLN-081 for the treatment of patients with EGFR exon 20 insertion NSCLC; Elzovantinib, an orally bioavailable multi-targeted kinase inhibitor; Tebotelimab, a tetravalent IgG4 monoclonal antibody; Retifanlimab that inhibits interactions between PD-1 and its ligands; ZL-2309, an orally active, selective, and ATP-competitive cell division cycle 7 (CDC7) kinase inhibitor; ZL-1201, a humanized IgG4 monoclonal antibody; Efgartigimod to reduce disease-causing immunoglobulin G antibodies; ZL-1102, a human nanobody targeting interleukin- 17A; KarXT for the treatment of psychiatric and neurological conditions; ZL-2313, an investigational inhibitor of triple-mutant EGFR harboring; ZL-2314, an investigational inhibitor of double-mutant EGFR harboring; and Sulbactam/durlobactam for the treatment of serious infections caused by Acinetobacter. Zai Lab Limited was incorporated in 2013 and is headquartered in Shanghai, China.

Moving Average

Zai Lab’s value is higher than its 50-day moving average of $31.85 and way below its 200-day moving average of $38.04.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Zai Lab’s stock is considered to be overbought (>=80).

Yearly Top and Bottom Value

Zai Lab’s stock is valued at $32.98 at 18:22 EST, way under its 52-week high of $73.85 and way above its 52-week low of $20.98.

Revenue growth

The year-on-year revenue growth was 30.4%. We now have 182.17M in the 12 trailing months.

More news about Zai Lab.

14. Boston Scientific (BSX)

Shares of Boston Scientific jumped 8.38% in from $42.01 to $45.53 at 18:21 EST on Wednesday, after two successive sessions in a row of losses. NYSE is dropping 0% to $0.00, after two successive sessions in a row of losses.

Boston Scientific Corporation develops, manufactures, and markets medical devices for use in various interventional medical specialties worldwide. It operates through three segments: MedSurg, Rhythm and Neuro, and Cardiovascular. The company offers devices to diagnose and treat gastrointestinal and pulmonary conditions; devices to treat various urological and pelvic conditions; implantable cardioverter and implantable cardiac resynchronization therapy defibrillators; pacemakers and implantable cardiac resynchronization therapy pacemakers; and remote patient management systems. It also provides medical technologies to diagnose and treat rate and rhythm disorders of the heart comprising 3-D cardiac mapping and navigation solutions, ablation catheters, diagnostic catheters, mapping catheters, intracardiac ultrasound catheters, delivery sheaths, and other accessories; spinal cord stimulator systems for the management of chronic pain; indirect decompression systems; and deep brain stimulation systems. In addition, the company offers interventional cardiology products, including drug-eluting coronary stent systems used in the treatment of coronary artery disease; percutaneous coronary interventions products to treat atherosclerosis; intravascular catheter-directed ultrasound imaging catheters, fractional flow reserve devices, and systems for use in coronary arteries and heart chambers, as well as various peripheral vessels; and structural heart therapies. Further, it provides stents, balloon catheters, wires, and atherectomy systems to treat arterial diseases; thrombectomy and acoustic pulse thrombolysis systems, wires, and stents to treat venous diseases; and peripheral embolization devices, radioactive microspheres, ablation systems, cryotherapy ablation systems, and micro and drainage catheters to treat cancer. The company was incorporated in 1979 and is headquartered in Marlborough, Massachusetts.

Moving Average

Boston Scientific’s value is above its 50-day moving average of $41.67 and way above its 200-day moving average of $41.22.

Sales Growth

Boston Scientific saw a 3.7% increase in sales for its current quarter, and 4.9% the following.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Boston Scientific stock is overbought (>=80).

Revenue Growth

Year-on-year quarterly revenue growth grew by 8.1%, now sitting on 12.57B for the twelve trailing months.

More news about Boston Scientific.

15. TJX Companies (TJX)

Shares of TJX Companies jumped by a staggering 10.56% in from $71.61 to $79.17 at 18:21 EST on Wednesday, after four successive sessions in a row of losses. NYSE is falling 0% to $0.00, after two consecutive sessions in a row of losses.

The TJX Companies, Inc., together with its subsidiaries, operates as an off-price apparel and home fashions retailer. It operates through four segments: Marmaxx, HomeGoods, TJX Canada, and TJX International. The company sells family apparel, including footwear and accessories; home fashions, such as home basics, furniture, rugs, lighting products, giftware, soft home products, decorative accessories, tabletop, and cookware, as well as expanded pet, kids, and gourmet food departments; jewelry and accessories; and other merchandise. As of February 23, 2022, it operated 1,284 T.J. Maxx, 1,148 Marshalls, 850 HomeGoods, 59 Sierra, and 39 Homesense stores, as well as tjmaxx.com, marshalls.com, and sierra.com in the United States; 293 Winners, 147 HomeSense, and 106 Marshalls stores in Canada; 618 T.K. Maxx and 77 Homesense stores, as well as tkmaxx.com in Europe; and 68 T.K. Maxx stores in Australia. The company was incorporated in 1962 and is headquartered in Framingham, Massachusetts.

Revenue growth

The year-on-year revenue growth was 13.1%. It now stands at 49.87B in the 12 trailing months.

Growth Estimates Quarters

The company’s growth estimates for the ongoing quarter is a negative 12.7% and positive 2.4% for the next.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

TJX Companies’s stock is considered to be overbought (>=80).

More news about TJX Companies.

16. Gap (GPS)

Shares of Gap rose by a staggering 26.38% in from $11.45 to $14.47 at 18:21 EST on Wednesday, following the last session’s downward trend. NYSE is sliding 0% to $0.00, after two sequential sessions in a row of losses.

The Gap, Inc. operates as an apparel retail company. The company offers apparel, accessories, and personal care products for men, women, and children under the Old Navy, Gap, Banana Republic, and Athleta brands. Its products include denim, tees, fleece, and khakis; eyewear, jewelry, shoes, handbags, and fragrances; and fitness and lifestyle products for use in yoga, training, sports, travel, and everyday activities for women and girls. The company offers its products through company-operated stores, franchise stores, Websites, third-party arrangements, and catalogs. It has franchise agreements with unaffiliated franchisees to operate Old Navy, Gap, Athleta, and Banana Republic stores and websites in Asia, Europe, Latin America, the Middle East, and Africa. As of December 31, 2021, the company had 2,835 company-operated stores and 564 franchise stores. It also provides its products through e-commerce sites. The Gap, Inc. was incorporated in 1969 and is headquartered in San Francisco, California.

More news about Gap.

17. The Travelers Companies (TRV)

Shares of The Travelers Companies rose 1.36% in from $185.36 to $187.88 at 18:21 EST on Wednesday, after two sequential sessions in a row of gains. NYSE is sliding 0% to $0.00, after two sequential sessions in a row of losses.

The Travelers Companies, Inc., through its subsidiaries, provides a range of commercial and personal property, and casualty insurance products and services to businesses, government units, associations, and individuals in the United states and internationally. The company operates through three segments: Business Insurance, Bond & Specialty Insurance, and Personal Insurance. The Business Insurance segment offers workers' compensation, commercial automobile and property, general liability, commercial multi-peril, employers' liability, public and product liability, professional indemnity, marine, aviation, onshore and offshore energy, construction, terrorism, personal accident, and kidnap and ransom insurance products. This segment operates through select accounts, which serve small businesses; commercial accounts that serve mid-sized businesses; national accounts, which serve large companies; and national property and other that serve large and mid-sized customers, commercial trucking industry, and agricultural businesses, as well as markets and distributes its products through brokers, wholesale agents, and program managers. The Bond & Specialty Insurance segment provides surety, fidelity, management and professional liability, and other property and casualty coverages and related risk management services through independent agencies and brokers. The Personal Insurance segment offers property and casualty insurance covering personal risks, primarily automobile and homeowners insurance to individuals through independent agencies and brokers. The Travelers Companies, Inc. was founded in 1853 and is based in New York, New York.

Sales Growth

Travelers Companies saw a 8.4% increase in sales for the current quarter, and 7.7% the following.

Revenue Growth

Year-on-year quarterly revenue growth grew by 5.7%, now sitting on 36.26B for the twelve trailing months.

Moving Average

Travelers Companies is worth more than its $50-day average moving price of $167.35, and much higher than its $200-day average moving price of $170.22.

Yearly Top and Bottom Value

The Travelers Companies’s stock is valued at $187.88 at 18:22 EST, under its 52-week high of $187.98 and way above its 52-week low of $145.40.

More news about The Travelers Companies.

18. Celsius Holdings (CELH)

Shares of Celsius Holdings jumped by a staggering 36% in from $82.16 to $111.74 at 18:21 EST on Wednesday, following the last session’s upward trend. NASDAQ is sliding 0% to $0.00, after three successive sessions in a row of losses.

Celsius Holdings, Inc. develops, processes, markets, distributes, and sells functional drinks and liquid supplements in North America, Europe, Asia, and internationally. It offers various carbonated and non-carbonated functional energy drinks under the CELSIUS Originals name; dietary supplement in carbonated flavors, including apple jack'd, orangesicle, inferno punch, cherry lime, blueberry pomegranate, strawberry dragon fruit, tangerine grapefruit, and jackfruit under the CELSIUS HEAT name; and branched-chain amino acids functional energy drink that fuels muscle recovery under the CELSIUS BCCA+ENERGY name. The company also provides CELSIUS On-the-Go, a powdered form of the active ingredients in functional energy drinks in individual On-The-Go packets and canisters; and sparkling grapefruit, cucumber lime, and orange pomegranate, as well as pineapple coconut, watermelon berry, and strawberries and cream non-carbonated functional energy drinks under the CELSIUS Sweetened. It distributes its products through direct-to-store delivery distributors and direct to retailers, including supermarkets, convenience stores, drug stores, nutritional stores, and mass merchants, as well as health clubs, spas, gyms, the military, and e-commerce websites. The company was formerly known as Vector Ventures, Inc. and changed its name to Celsius Holdings, Inc. in January 2007. Celsius Holdings, Inc. was founded in 2004 and is headquartered in Boca Raton, Florida.

Revenue Growth

Year-on-year quarterly revenue growth grew by 136.7%, now sitting on 486.57M for the twelve trailing months.

Moving Average

Celsius Holdings’s value is way higher than its 50-day moving average of $92.45 and way higher than its 200-day moving average of $76.71.

More news about Celsius Holdings.

19. HCA Holdings (HCA)

Shares of HCA Holdings jumped by a staggering 12.34% in from $211.84 to $237.98 at 18:21 EST on Wednesday, following the last session’s upward trend. NYSE is dropping 0% to $0.00, after two successive sessions in a row of losses.

HCA Healthcare, Inc., via its subsidiaries, offers health care company services in the United States. HCA Healthcare, Inc. operates hospitals for general and acute care. It offers medical and surgical services including cardiac care, inpatient care and intensive care. Outpatient services include outpatient surgery and laboratory radiology. The company also has outpatient facilities that include freestanding ambulatory surgical centers, emergency care centers, walk-in facilities, radiology and oncology treatment centers, rehabilitation and physical therapy centres, as well as radiation and chemotherapy therapy centers. The company also operates psychiatric hospital, providing therapeutic programs that include child, adolescent, and adult psychiatric, as well as adolescent, adult, and drug abuse treatment. It operated 182 hospitals as of December 31, 2020, which included 175 acute and general care hospitals, 5 psychiatric hospital, 2 rehabilitation hospitals and 2 rehab hospitals. There were also 125 freestanding surgical centers and 21 endoscopy centres in the United States and England. HCA Holdings, Inc. is the former name of this company. HCA Healthcare, Inc. was established in Nashville, Tennessee in 1968.

More news about HCA Holdings.

20. Atlassian (TEAM)

Shares of Atlassian jumped 1.96% in from $123.11 to $125.52 at 18:21 EST on Wednesday, after two consecutive sessions in a row of losses. NASDAQ is dropping 0% to $0.00, after three sequential sessions in a row of losses.

Atlassian Corporation and its subsidiaries design, develop, license, maintain, and support various software products around the world. Jira Software, Jira Work Management and Jira Software are its products. These software tools allow teams to track, organize, collaborate and manage their work and projects. Jira Service Management is a service desk product that allows service providers to create and manage service experiences. Jira Align, which allows enterprise organizations to develop and manage a masterplan that links strategic projects with the work streams that will deliver them. Opsgenie is an incident management tool to help IT teams plan and react to any service interruptions. It also offers Confluence which is a flexible social content collaboration platform that allows users to share, organize and discuss projects. Trello can be used for collaboration and organizational purposes to capture and structure fluid and fast-form work. Bitbucket is a collaboration and code management product that allows teams to use distributed version control system. Atlassian Access provides enterprise-wide security and central administration. It works with all Atlassian products including Jira Service Management and Jira Jira. Atlassian Corporation was established in Sydney in 2002. It is located in Australia.

Revenue Growth

Year-on-year quarterly revenue growth grew by 35.8%, now sitting on 2.8B for the twelve trailing months.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Atlassian stock is overbought (>=80).

More news about Atlassian.

21. Entergy Corporation (ETR)

Shares of Entergy Corporation rose 7.11% in from $108.47 to $116.18 at 18:21 EST on Wednesday, after two successive sessions in a row of gains. NYSE is falling 0% to $0.00, after two consecutive sessions in a row of losses.

Entergy Corporation, together with its subsidiaries, engages in the production and retail distribution of electricity in the United States. The company operates in two segments, Utility and Entergy Wholesale Commodities. The Utility segment generates, transmits, distributes, and sells electric power in portions of Arkansas, Louisiana, Mississippi, and Texas, including the City of New Orleans; and distributes natural gas. The Entergy Wholesale Commodities segment engages in the ownership, operation, and decommissioning of nuclear power plants; and ownership of interests in non-nuclear power plants that sell electric power to wholesale customers, as well as provides services to other nuclear power plant owners. It generates electricity through gas, nuclear, coal, hydro, and solar power sources. The company sells energy to retail power providers, utilities, electric power co-operatives, power trading organizations, and other power generation companies. The company's power plants have approximately 24,000 megawatts (MW) of electric generating capacity, which include 5,000 MW of nuclear power. It delivers electricity to 3 million utility customers in Arkansas, Louisiana, Mississippi, and Texas. The company was founded in 1913 and is headquartered in New Orleans, Louisiana.

Growth Estimates Quarters

The company’s growth estimates for the present quarter and the next is 4.5% and 10.2%, respectively.

Yearly Top and Bottom Value

Entergy Corporation’s stock is valued at $116.18 at 18:23 EST, under its 52-week high of $126.82 and way above its 52-week low of $94.94.

Moving Average

Entergy Corporation’s worth is above its 50-day moving average of $109.16 and higher than its 200-day moving average of $112.92.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Entergy Corporation’s stock is considered to be overbought (>=80).

More news about Entergy Corporation.