(VIANEWS) – Today, the Innrs artificial intelligence algorithm suggests a high probability of discovering the approximate price for tomorrow of Palo Alto Networks PANW, MicroStrategy MSTR and others.

Via News will regularly fact-check this AI algorithm that aims to consistently predict the next session price and next week’s trend of financial assets.

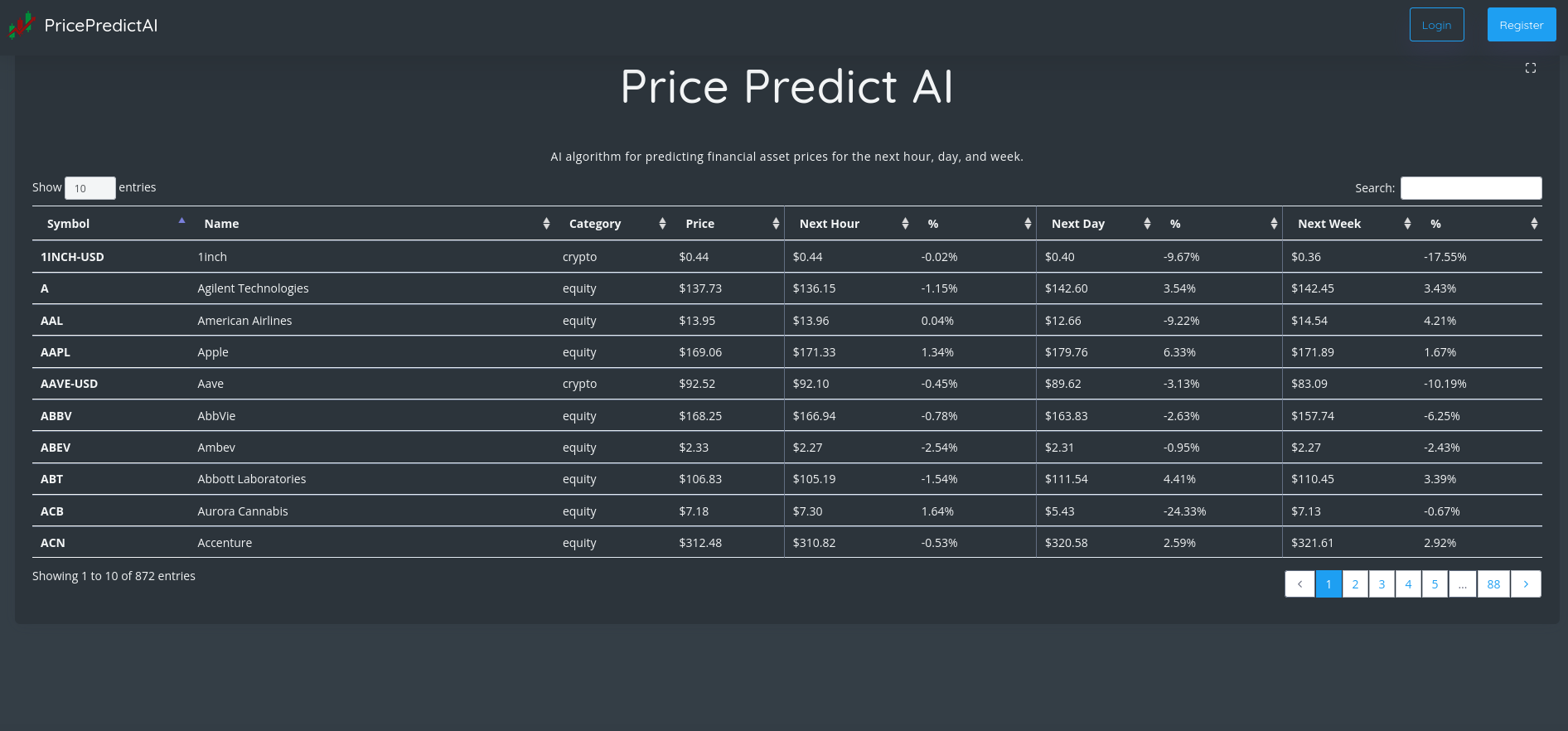

Innrs provides A.I.-based statistical tools to help investors make decisions. The table below shows the financial assets predicting price, ordered by the highest expected accuracy.

Innrs officials say this tool helps investors make better-informed decisions, supposedly used alongside other relevant financial information and the specific trader strategy.

In the next session, Via News will report the finding on the algorithm precision.

| Financial Asset | Accuracy | Close Price | Prediction |

|---|---|---|---|

| Palo Alto Networks (PANW) | 99.54% | $140.18 | ⇩ $138.53 |

| MicroStrategy (MSTR) | 96.59% | $137.26 | ⇩ $135.96 |

| Everbridge (EVBG) | 96.51% | $28.51 | ⇩ $26.19 |

| Chunghwa Telecom Co. (CHT) | 93.75% | $36.75 | ⇧ $37.39 |

| Charles Schwab (SCHW) | 93.39% | $82.61 | ⇧ $85.29 |

| Dominion Resources (D) | 92.81% | $61.63 | ⇧ $63.11 |

| Procter & Gamble (PG) | 92.5% | $152.69 | ⇧ $158.27 |

| Ringcentral (RNG) | 91.57% | $35.55 | ⇩ $32.61 |

| Upwork (UPWK) | 90.01% | $10.48 | ⇩ $9.4 |

| Coupons.com (COUP) | 89.63% | $79.15 | ⇩ $79.1 |

| Kimberly (KMB) | 89.43% | $137.02 | ⇧ $138.55 |

| SK Telecom (SKM) | 89.23% | $20.8 | ⇧ $20.8 |

| Dropbox (DBX) | 89.05% | $22.32 | ⇩ $22.3 |

| Sabre Corporation (SABR) | 88.92% | $5.99 | ⇩ $5.86 |

| Colgate-Palmolive (CL) | 88.89% | $79.36 | ⇧ $81.13 |

| Brandywine Realty Trust (BDN) | 88.8% | $6.2 | ⇩ $6.17 |

| Archer (ADM) | 88.74% | $93.28 | ⇧ $95.87 |

| Exelon (EXC) | 88.69% | $43.15 | ⇧ $44.41 |

| Pinterest (PINS) | 88.4% | $23.75 | ⇧ $24.03 |

1. Palo Alto Networks (PANW)

Shares of Palo Alto Networks dropped by a staggering 20.49% in from $176.3 to $140.18 at 18:21 EST on Thursday, after five consecutive sessions in a row of losses. NYSE is jumping 1.36% to $15,241.21, following the last session’s downward trend.

Palo Alto Networks, Inc. offers cybersecurity solutions around the world. Palo Alto Networks, Inc. offers software and firewall appliances. Panorama is a security management tool that allows customers to control firewall appliances. It can also be used in virtual and private cloud environments. Virtual system upgrades are offered as an extension of the physical system capacity. The company also offers subscription services in the following areas: malware, persistent threat, URL filtering and firewall. It also offers DNS security and Internet of Things security. The company also offers secure access, cloud security and threat intelligence, cyber security consulting, professional services including architecture design, planning, implementation and configuration and firewall migration, education services such as certificates, online training, support, and services. Palo Alto Networks, Inc. offers its services and products through channel partners, medium- to large businesses, service providers, government agencies, and other entities in various sectors, such as education, energy, financial, government entities, healthcare, media, manufacturing, the public sector, and telecoms. Santa Clara is the headquarters of this company, which was founded in 2005.

Volatility

The current intraday variation of Palo Alto Networks was negative 2.29% in the last week, last months, and last quarter. It was positive 0.50% and positive 2.14%, respectively.

Palo Alto Networks had the highest average volatility amplitude at 2.29%, 2.16% and 2.14% respectively in last week.

More news about Palo Alto Networks.

2. MicroStrategy (MSTR)

Shares of MicroStrategy fell by a staggering 44.25% in from $246.21 to $137.26 at 18:21 EST on Thursday, after five consecutive sessions in a row of losses. NASDAQ is rising 2.59% to $10,478.09, after two sequential sessions in a row of losses.

MicroStrategy Incorporated offers enterprise analytics software and other services around the world. MicroStrategy is an enterprise platform that provides insights across multiple devices. It also offers hyperintelligence products and visualization and reporting capabilities. Custom applications are developed on the platform. Analysts and data scientists have seamless access to trusted and governed data right within their tools. There are APIs and gateways as well as multiple deployment options. Enterprise semantic graph, security, scalability and scaling can all be found. MicroStrategy support is available to customers in order to help them achieve system availability, uptime and improve their overall user experience. This includes proactive product support and highly responsive technical troubleshooting. It also offers MicroStrategy Consulting, which provides architecture and implementation services that help customers quickly achieve results and maximize returns on their investment. It provides services via channel partners and enterprise sales. The company serves clients from many industries including technology, retail, consulting and manufacturing. It also provides services through channel partners. It was founded in 1989, and its headquarters are in Tysons Corner in Virginia.

Moving Average

MicroStrategy’s value is way below its 50-day moving average of $205.18 and way below its 200-day moving average of $265.44.

Revenue Growth

Year-on-year quarterly revenue growth declined by 2.6%, now sitting on 503.86M for the twelve trailing months.

Volatility

MicroStrategy’s last week, last month’s, and last quarter’s current intraday variation average was a negative 2.78%, a positive 0.05%, and a positive 4.46%.

MicroStrategy’s highest amplitude of average volatility was 2.78% (last week), 3.35% (last month), and 4.46% (last quarter).

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

MicroStrategy stock considered overbought (>=80).

More news about MicroStrategy.

3. Everbridge (EVBG)

Shares of Everbridge dropped by a staggering 14.1% in from $33.19 to $28.51 at 18:21 EST on Thursday, after five consecutive sessions in a row of losses. NASDAQ is rising 2.59% to $10,478.09, after two consecutive sessions in a row of losses.

Everbridge, Inc. operates as a software company, provides enterprise software applications that automate and accelerate organizations operational response to critical events in the United States and internationally. The company's Critical Event Management, a software as a service based platform with various software applications that address tasks an organization has to perform to manage a critical event, including Mass Notification, Safety Connection, IT Alerting, Visual Command Center, Public Warning, Community Engagement, Risk Center, Crisis Management, CareConverge, Control Center, 911 Connect, Travel Risk Management, SnapComms, and E911; and provides customer support services. It serves enterprises, small businesses, non-profit organizations, educational institutions, and government agencies in technology, energy, financial services, healthcare and life sciences, manufacturing, media and entertainment, retail, higher education, and professional services industries. The company was formerly known as 3n Global, Inc. and changed its name to Everbridge, Inc. in April 2009. The company was founded in 2002 and is headquartered in Burlington, Massachusetts.

More news about Everbridge.

4. Chunghwa Telecom Co. (CHT)

Shares of Chunghwa Telecom Co. jumped 0.77% in from $36.47 to $36.75 at 18:21 EST on Thursday, after two consecutive sessions in a row of losses. NYSE is rising 1.36% to $15,241.21, following the last session’s downward trend.

Together with its subsidiaries, Chunghwa Telecom Co., Ltd. provides telecom services both in Taiwanese and international. The company operates in the following segments: Domestic Fixed Communications Business; Mobile Communications Business; Internet Business; International Fixed Communications Business; and Other. It offers long distance telephone services, including broadband access and local calls, as well as information and technology services and VAS. The company also provides interconnections with fixed-line networks to connect with other fixed and mobile operators. The company also offers mobile, HiNet Internet, cloud, data communication and Internet data center services, as well as international long-distance and data service. The company also distributes and markets mobile phones, data cards and other electronic products. It designs, develops printed circuit boards and semiconductor components. It also offers property development, property management, system, network and communications integration, intelligent buildings, energy network, digital information supply, and advertisement, property and liability insurance agency, family education, computing equipment installation, management consultancy, data processing, telecommunication engineering, Internet identification, and information and solution services. The company also offers software design and Internet content production and play services. It also provides motion picture production, distribution, energy savings solutions, management consultancy, data processing, telecommunication engineering, international circuits and services for electronic parts or machine processed products. Taipei City is the headquarters of this company, which was founded in 1996.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Chunghwa Telecom Co. stock is oversold (=20).

Revenue growth

The year-on-year revenue growth was 5.7%. We now have 214.51B in the 12 trailing months.

More news about Chunghwa Telecom Co..

5. Charles Schwab (SCHW)

Shares of Charles Schwab jumped 0.19% in from $82.45 to $82.61 at 18:21 EST on Thursday, after five sequential sessions in a row of gains. NYSE is jumping 1.36% to $15,241.21, following the last session’s downward trend.

The Charles Schwab Corporation, together with its subsidiaries, provides wealth management, securities brokerage, banking, asset management, custody, and financial advisory services. The company operates in two segments, Investor Services and Advisor Services. The Investor Services segment provides retail brokerage, investment advisory, banking and trust, retirement plan, and other corporate brokerage services; equity compensation plan sponsors full-service recordkeeping for stock plans, stock options, restricted stock, performance shares, and stock appreciation rights; and retail investor and mutual fund clearing services, as well as compliance solutions. The Advisor Services segment offers custodial, trading, banking, and support services; and retirement business and corporate brokerage retirement services. This segment provides brokerage accounts with equity and fixed income, margin lending, options, and futures and forex trading; cash management capabilities comprising third-party certificates of deposit; third-party and proprietary mutual funds; plus mutual fund trading and clearing services; and exchange-traded funds (ETFs), including proprietary and third-party ETFs. It also offers advice solutions, such as managed portfolios of proprietary and third-party mutual funds and ETFs, separately managed accounts, customized personal advice for tailored portfolios, and specialized planning and portfolio management. In addition, this segment provides banking products and services, including checking and savings accounts, first lien residential real estate mortgage loans, home equity lines of credit, and pledged asset lines; and trust services comprising trust custody services, personal trust reporting services, and administrative trustee services. As of December 31, 2021, the Company had approximately 400 domestic branch offices in 48 states and the District of Columbia, as well as locations in Puerto Rico, the United Kingdom, Hong Kong, and Singapore. The Charles Schwab Corporation was incorporated in 1971 and is headquartered in Westlake, Texas.

Growth Estimates Quarters

The company’s growth estimates for the ongoing quarter and the next is 27.9% and 40.3%, respectively.

Yearly Top and Bottom Value

Charles Schwab’s stock is valued at $82.61 at 18:22 EST, way below its 52-week high of $96.24 and way higher than its 52-week low of $59.35.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Charles Schwab stock considered oversold by analysts (=20).

Average Moving

Charles Schwab is worth more than its $50-day moving mean of $77.12, and much higher than its $200-day moving median of $72.96.

More news about Charles Schwab.

6. Dominion Resources (D)

Shares of Dominion Resources rose 0.98% in from $61.03 to $61.63 at 18:21 EST on Thursday, following the last session’s downward trend. NYSE is jumping 1.36% to $15,241.21, following the last session’s downward trend.

Dominion Energy, Inc. distributes and produces energy throughout the United States. There are four main segments of the company: Dominion Energy Virginia; Gas Distribution; Dominion Energy South Carolina; and Contracted Assets. Dominion Energy Virginia generates, transmits and distributes electricity to about 2.7 million residents, businesses, industrial, and government customers in Virginia, North Carolina. Gas Distribution is responsible for the regulation of natural gas sales and transportation. It also gathers, stores, transports, collects, stores, and distributes it in Ohio, West Virginia and North Carolina. This segment serves approximately 3.1 Million residential, commercial, and industrial customers. There are also non-regulated, renewable natural gas plants in operation. Dominion Energy South Carolina generates, transmits and distributes electricity in approximately 772,000 South Carolina customers. It also distributes natural gas in approximately 419,000 South Carolina residential, commercial and industrial customers. Contracted Assets is responsible for long-term, non-regulated contracts in renewable electricity generation, solar generator facility development, gas transportation, LNG import and storage, and the liquefaction plant. The company had approximately 30.2-gigawatts of electrical generating capacity, 10,700 miles worth of electric transmission lines, 78,000 miles of electricity distribution lines, and 95.700 miles of gas distribution mains. The former name of the company was Dominion Resources, Inc. Dominion Energy, Inc. is located in Richmond, Virginia.

More news about Dominion Resources.

7. Procter & Gamble (PG)

Shares of Procter & Gamble rose 2.79% in from $148.55 to $152.69 at 18:21 EST on Thursday, after two successive sessions in a row of losses. NYSE is rising 1.36% to $15,241.21, following the last session’s downward trend.

The Procter & Gamble Company provides branded consumer packaged goods worldwide. It operates through five segments: Beauty; Grooming; Health Care; Fabric & Home Care; and Baby, Feminine & Family Care. The Beauty segment offers conditioners, shampoos, styling aids, and treatments under the Head & Shoulders, Herbal Essences, Pantene, and Rejoice brands; and antiperspirants and deodorants, personal cleansing, and skin care products under the Olay, Old Spice, Safeguard, Secret, and SK-II brands. The Grooming segment provides shave care products and appliances under the Braun, Gillette, and Venus brand names. The Health Care segment offers toothbrushes, toothpastes, and other oral care products under the Crest and Oral-B brand names; and gastrointestinal, rapid diagnostics, respiratory, vitamins/minerals/supplements, pain relief, and other personal health care products under the Metamucil, Neurobion, Pepto-Bismol, and Vicks brands. The Fabric & Home Care segment provides fabric enhancers, laundry additives, and laundry detergents under the Ariel, Downy, Gain, and Tide brands; and air care, dish care, P&G professional, and surface care products under the Cascade, Dawn, Fairy, Febreze, Mr. Clean, and Swiffer brands. The Baby, Feminine & Family Care segment offers baby wipes, taped diapers, and pants under the Luvs and Pampers brands; adult incontinence and feminine care products under the Always, Always Discreet, and Tampax brands; and paper towels, tissues, and toilet papers under the Bounty, Charmin, and Puffs brands. The company sells its products primarily through mass merchandisers, e-commerce, grocery stores, membership club stores, drug stores, department stores, distributors, wholesalers, specialty beauty stores, high-frequency stores, pharmacies, electronics stores, and professional channels, as well as directly to consumers. The Procter & Gamble Company was founded in 1837 and is headquartered in Cincinnati, Ohio.

Revenue Growth

Year-on-year quarterly revenue growth grew by 1.3%, now sitting on 80.46B for the twelve trailing months.

Moving Average

Procter & Gamble’s value is higher than its 50-day moving average of $141.69 and higher than its 200-day moving average of $144.47.

Yearly Top and Bottom Value

Procter & Gamble’s stock is valued at $152.69 at 18:22 EST, below its 52-week high of $165.35 and way above its 52-week low of $122.18.

More news about Procter & Gamble.

8. Ringcentral (RNG)

Shares of Ringcentral slid 3.35% in from $36.78 to $35.55 at 18:21 EST on Thursday, after five consecutive sessions in a row of losses. NYSE is rising 1.36% to $15,241.21, following the last session’s downward trend.

RingCentral, Inc. provides software-as-a-service solutions that enable businesses to communicate, collaborate, and connect in North America. It offers cloud communication and contact centre solutions for businesses based on its messaging video phone? platform. RingCentral Office provides collaboration and communication across multiple modes including video, voice, text, SMS and messaging, collaboration and conferencing. RingCentral Contact Center is a collaboration contact center that offers omnichannel services. RingCentral Engage Digital allows businesses to engage with customers digitally. RingCentral Engage Voice is a cloud-based customer engagement platform that enables midsize companies to communicate with their customers. RingCentral Video offers video and audio conference, file sharing and task management. RingCentral Professional is a virtual phone service which provides professional inbound calling and management. RingCentral Fax provides online faxing capabilities. It serves many industries including finance, law, health, realty, tech, insurance, construction and hospitality. The company sells products via a network that includes direct sales reps as well as resellers and channel partners. RingCentral, Inc. is a strategic partner with AlcatelLucent Enterprise and Vodafone Business. It was founded in 1999, and its headquarters are in Belmont in California.

Moving Average

Ringcentral’s value is higher than its 50-day moving average of $35.48 and way below its 200-day moving average of $58.20.

Annual Top and Bottom Value

Ringcentral stock was valued at $35.55 as of 18:22 EST at 19:22 EST. This is way lower than the 52-week high at $198.79, and much higher than its 52 week low at $28.00.

Sales Growth

Ringcentral’s sales growth is 27.8% for the current quarter and 21.5% for the next.

Volatility

Ringcentral’s last week, last month’s, and last quarter’s current intraday variation average was a negative 2.96%, a positive 1.09%, and a positive 3.84%.

Ringcentral’s highest amplitude of average volatility was 2.96% (last week), 5.43% (last month), and 3.84% (last quarter).

More news about Ringcentral.

9. Upwork (UPWK)

Shares of Upwork fell by a staggering 15.74% in from $12.44 to $10.48 at 18:21 EST on Thursday, after four sequential sessions in a row of losses. NASDAQ is rising 2.59% to $10,478.09, after two sequential sessions in a row of losses.

Upwork Inc. and its affiliates operate a marketplace for independent professionals in America, India and the Philippines. Its work marketplace allows access to talent in a variety of areas, such as sales, marketing, customer service and data science, design, software development, software engineering, web and mobile. The company’s work marketplace allows clients to simplify workflows such as contracting, talent sourcing and outreach. Its work marketplace provides access to many functions for remote collaboration with talent. These include communication and collaboration as well as the ability to receive invoices from their talent marketplace and payment protection. The company’s marketplace services include Upwork Basic and Plus, Upwork Enterprise and Upwork Payroll. It also offers managed and online escrow agent services. It was previously known as ElanceoDesk, Inc., but changed its name in May 2015 to Upwork Inc. Upwork Inc. was founded in 2013. It is located in San Francisco, California.

More news about Upwork.

10. Coupons.com (COUP)

Shares of Coupons.com rose by a staggering 24.51% in from $63.57 to $79.15 at 18:21 EST on Thursday, after two consecutive sessions in a row of gains. NASDAQ is jumping 2.59% to $10,478.09, after two successive sessions in a row of losses.

Coupa Software Incorporated provides cloud-based business spend management platform that connects its customers with suppliers worldwide. The company provides visibility into and control over how companies spend money, optimize supply chains, and manage liquidity, as well as enables businesses to achieve savings that drive profitability. Its platform offers procurement, invoicing, expense management, and payment solutions that form the transactional engine for managing a company's business spend; and specialized solutions, including strategic sourcing, contract management, contingent workforce, supplier risk management, supply chain design and planning, treasury management, and spend analysis. It serves businesses in various industries, including healthcare and pharmaceuticals, retail, financial services, manufacturing, and technology. The company markets its platform primarily through a direct sales force. Coupa Software Incorporated was incorporated in 2006 and is headquartered in San Mateo, California.

Annual Top and Bottom Value

Coupons.com stock was valued at $79.15 as of 18:22 EST at $166.21, which is way lower than its 52 week high of $166.21 but much higher than its low 52-week of $40.29.

More news about Coupons.com.

11. Kimberly (KMB)

Shares of Kimberly rose 1.14% in from $135.48 to $137.02 at 18:21 EST on Thursday, following the last session’s downward trend. NYSE is rising 1.36% to $15,241.21, following the last session’s downward trend.

Kimberly-Clark Corporation, together with its subsidiaries, manufactures and markets personal care and consumer tissue products worldwide. It operates through three segments: Personal Care, Consumer Tissue, and K-C Professional. The Personal Care segment offers disposable diapers, swimpants, training and youth pants, baby wipes, feminine and incontinence care products, and other related products under the Huggies, Pull-Ups, Little Swimmers, GoodNites, DryNites, Sweety, Kotex, U by Kotex, Intimus, Depend, Plenitud, Softex, Poise, and other brand names. The Consumer Tissue segment provides facial and bathroom tissues, paper towels, napkins, and related products under the Kleenex, Scott, Cottonelle, Viva, Andrex, Scottex, Neve, and other brand names. The K-C Professional segment offers wipers, tissues, towels, apparel, soaps, and sanitizers under the Kleenex, Scott, WypAll, Kimtech, and KleenGuard brands. The company sells household use products directly to supermarkets, mass merchandisers, drugstores, warehouse clubs, variety and department stores, and other retail outlets, as well as through other distributors and e-commerce; and away-from-home use products directly to manufacturing, lodging, office building, food service, and public facilities, as well as through distributors and e-commerce. Kimberly-Clark Corporation was founded in 1872 and is headquartered in Dallas, Texas.

Moving Average

Kimberly’s value is higher than its 50-day moving average of $128.82 and above its 200-day moving average of $128.83.

Yearly Top and Bottom Value

Kimberly’s stock is valued at $137.02 at 18:22 EST, under its 52-week high of $145.79 and way above its 52-week low of $108.74.

Volatility

Kimberly’s last week, last month’s, and last quarter’s current intraday variation average was 0.35%, 0.20%, and 1.02%.

Kimberly’s highest amplitude of average volatility was 0.49% (last week), 0.69% (last month), and 1.02% (last quarter).

More news about Kimberly.

12. SK Telecom (SKM)

Shares of SK Telecom dropped 2.98% in from $21.44 to $20.80 at 18:21 EST on Thursday, after two consecutive sessions in a row of losses. NYSE is jumping 1.36% to $15,241.21, following the last session’s downward trend.

SK Telecom Co., Ltd. offers wireless telecommunications services in South Korea. Cellular Services, Fixed-Line Telecommunications Services and Other Businesses are the three main segments of the company. Cellular Services offers voice and data wireless transmissions, Internet of Things solutions platform cloud smart factory solutions subscriptions, metaverse platform-based service and also sells wireless devices. Fixed-Line Telecommunications Services provides fixed-line phone services and broadband Internet services. It also offers media platform services such as cable TV, Internet protocol TV and other communications services. In addition to portal and television shopping, the Other Businesses segment provides services for other businesses under T-commerce. It also provides services such as call center management and base station maintenance, information gathering, consulting, software supply and development, digital contents sourcing, quant information and communications, content and mastering sound albums sales, product manufacturing and sale, and trading in anti-theft devices and surveillance equipment. The company has 3.6 million subscribers to fixed lines and 31.9million wireless subscribers as of December 31, 2021. SK Telecom Company Limited, a South Korean company founded in 1984, is headquartered at Seoul.

Moving Average

SK Telecom’s worth is higher than its 50-day moving average of $20.09 and under its 200-day moving average of $22.88.

Revenue Growth

Year-on-year quarterly revenue growth grew by 4%, now sitting on 17.08T for the twelve trailing months.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

SK Telecom stock considered oversold (=20).

More news about SK Telecom.

13. Dropbox (DBX)

Shares of Dropbox slid 5.33% in from $23.58 to $22.32 at 18:21 EST on Thursday, after two consecutive sessions in a row of losses. NASDAQ is rising 2.59% to $10,478.09, after two consecutive sessions in a row of losses.

Dropbox, Inc. provides a content collaboration platform worldwide. Its platform allows individuals, families, teams, and organizations to collaborate and sign up for free through its website or app, as well as upgrade to a paid subscription plan for premium features. As of December 31, 2021, the company had approximately 700 million registered users. It serves customers in professional services, technology, media, education, industrial, consumer and retail, and financial services industries. The company was formerly known as Evenflow, Inc. and changed its name to Dropbox, Inc. in October 2009. Dropbox, Inc. was incorporated in 2007 and is headquartered in San Francisco, California.

Revenue growth

The year-on-year revenue growth was 7.9%. It now stands at 2.25B in the 12 trailing months.

Moving Average

Dropbox’s value is higher than its $50-day moving mean of $21.95, and greater than its $200-day moving median of $22.02.

More news about Dropbox.

14. Sabre Corporation (SABR)

Shares of Sabre Corporation dropped 1.67% in from $6.09 to $5.99 at 18:21 EST on Thursday, after two consecutive sessions in a row of losses. NASDAQ is rising 2.59% to $10,478.09, after two sequential sessions in a row of losses.

Sabre Corporation provides technology and software solutions to the global travel industry through Sabre Holdings Corporation. The company operates two main segments: Travel Solutions and Hospitality Solutions. It operates in two segments, Travel Solutions and Hospitality Solutions. The Travel Solutions segment is a business to-business marketplace for travel information. This includes inventory, prices and availability of a variety of suppliers including hotels, airlines, cars rental brands, railway companies and cruise lines. There are also travel buyers that include travel managers, corporate travel departments, online travel agencies and travel management firms. This segment also provides a portfolio of software technology products and solutions through software-as-a-service (SaaS) and hosted delivery models to airlines and other travel suppliers. These products include reservations systems for airlines, commercial and operation products, agency solutions and data-driven Intelligence solutions. Hospitality Solutions provides software and services to hotels through hosted delivery and SaaS. Sabre Corporation was founded in 2006, and its headquarters are in Southlake Texas.

Revenue Growth

Year-on-year quarterly revenue growth grew by 56.7%, now sitting on 2.18B for the twelve trailing months.

Growth Estimates Quarters

The company’s growth estimates for the present quarter and the next is 54% and 61.7%, respectively.

Sales Growth

Sabre Corporation’s sales growth is 59.2% for the present quarter and 44.5% for the next.

Moving Average

Sabre Corporation is worth more than its moving average over 50 days of $5.59, and much less than its moving average over 200 days of $7.16.

More news about Sabre Corporation.

15. Colgate-Palmolive (CL)

Shares of Colgate-Palmolive jumped 2.82% in from $77.18 to $79.36 at 18:21 EST on Thursday, after two sequential sessions in a row of losses. NYSE is rising 1.36% to $15,241.21, following the last session’s downward trend.

Colgate-Palmolive Company, together with its subsidiaries, manufactures and sells consumer products worldwide. The company operates through two segments, Oral, Personal and Home Care; and Pet Nutrition. The Oral, Personal and Home Care segment offers toothpaste, toothbrushes, mouthwash, bar and liquid hand soaps, shower gels, shampoos, conditioners, deodorants and antiperspirants, skin health products, dishwashing detergents, fabric conditioners, household cleaners, and other related items. This segment markets and sells its products under various brands, which include Colgate, Darlie, elmex, hello, meridol, Sorriso, Tom's of Maine, Irish Spring, Palmolive, Protex, Sanex, Softsoap, Lady Speed Stick, Speed Stick, EltaMD, Filorga, PCA SKIN, Ajax, Axion, Fabuloso, Murphy, Suavitel, Soupline, and Cuddly to a range of traditional and eCommerce retailers, wholesalers, and distributors. It also includes pharmaceutical products for dentists and other oral health professionals. The Pet Nutrition segment offers pet nutrition products for everyday nutritional needs under the Hill's Science Diet brand; and a range of therapeutic products to manage disease conditions in dogs and cats under the Hill's Prescription Diet brand. This segment markets and sells its products through pet supply retailers, veterinarians, and eCommerce retailers. Colgate-Palmolive Company was founded in 1806 and is headquartered in New York, New York.

More news about Colgate-Palmolive.

16. Brandywine Realty Trust (BDN)

Shares of Brandywine Realty Trust dropped by a staggering 11.45% in from $7 to $6.20 at 18:21 EST on Thursday, following the last session’s downward trend. NYSE is jumping 1.36% to $15,241.21, following the last session’s downward trend.

Brandywine Realty Trust, NYSE: BDN, is one of America’s largest, most publicly traded, fully-service, integrated realty companies. Its core markets are Philadelphia, Austin, and Washington, D.C. As a real-estate investment trust (REIT), our portfolio includes 175 properties, 24.7 million square feet, and is currently being developed, leased, and managed by us. This excludes any assets that may be sold. Through our knowledge, relationships, communities we create, and the stories we share, we aim to influence, connect, and inspire the world.

Yearly Top and Bottom Value

Brandywine Realty Trust’s stock is valued at $6.20 at 18:23 EST, way under its 52-week high of $14.88 and above its 52-week low of $5.95.

More news about Brandywine Realty Trust.

17. Archer (ADM)

Shares of Archer dropped 4.58% in from $97.76 to $93.28 at 18:21 EST on Thursday, after two sequential sessions in a row of losses. NYSE is rising 1.36% to $15,241.21, following the last session’s downward trend.

Archer-Daniels-Midland Company procures, transports, stores, processes, and merchandises agricultural commodities, products, and ingredients in the United States, Switzerland, Cayman Islands, Brazil, Mexico, the United Kingdom, and internationally. The company operates through three segments: Ag Services and Oilseeds, Carbohydrate Solutions, and Nutrition. It procures, stores, cleans, and transports agricultural raw materials, such as oilseeds, corn, wheat, milo, oats, and barley. The company also engages in the agricultural commodity and feed product import, export, and distribution; and structured trade finance activities. In addition, it offers vegetable oils and protein meals; ingredients for the food, feed, energy, and industrial customers; crude vegetable oils, salad oils, margarine, shortening, and other food products; and partially refined oils to produce biodiesel and glycols for use in chemicals, paints, and other industrial products. Further, the company provides peanuts, peanut-derived ingredients, and cotton cellulose pulp; sweeteners, corn and wheat starches, syrup, glucose, wheat flour, and dextrose; alcohol and other food and animal feed ingredients; ethyl alcohol and ethanol; corn gluten feed and meal; distillers' grains; and citric acids. Additionally, the company provides natural flavors, flavor systems, natural colors, proteins, emulsifiers, soluble fiber, polyols, hydrocolloids, and natural health and nutrition products, including probiotics, prebiotics, enzymes, and botanical extracts; and other specialty food and feed ingredients; edible beans; formula feeds, and animal health and nutrition products; and contract and private label pet treats and foods. It also offers futures commission merchant; commodity brokerage services; cash margins and securities pledged to commodity exchange clearinghouses; and cash pledged as security under certain insurance arrangements. The company was founded in 1902 and is headquartered in Chicago, Illinois.

Revenue growth

The year-over-year growth in quarterly revenue was 21.4%. We now have 98.71B to our credit for the 12 trailing months.

Sales Growth

Archer saw a 8.1% increase in sales for this quarter, and 1.6% the following.

More news about Archer.

18. Exelon (EXC)

Shares of Exelon rose 4.94% in from $41.12 to $43.15 at 18:21 EST on Thursday, following the last session’s downward trend. NASDAQ is jumping 2.59% to $10,478.09, after two successive sessions in a row of losses.

Exelon Corporation is a holding company for utility services. It engages in energy generation, distribution, and marketing in both the United States of America and Canada. The company owns a variety of facilities, including solar, nuclear, renewable, energy, biofuel, and hydroelectric. It also offers electricity wholesale to retail customers and natural gas and renewable energy as well as other energy-related products, services, and goods. It is also involved in the regulation and purchase of electricity and natural gases; transmission and distribution, as well distribution of natural gas retail customers. The company also offers support services such as legal, human resource, information technology and accounting. The company serves residential, commercial, industrial and governmental customers as well as distribution utilities and cooperatives. Exelon Corporation, which was founded in 1999, is located in Chicago.

Growth Estimates Quarters

For the current quarter, the company expects a decline of 50% in growth and a rise of 1.6% the following.

Revenue growth

The year-on-year revenue growth was 5.4%. It now stands at 37.26 billion for the 12 trailing months.

More news about Exelon.

19. Pinterest (PINS)

Shares of Pinterest dropped 6.19% in from $25.32 to $23.75 at 18:21 EST on Thursday, after five successive sessions in a row of losses. NYSE is rising 1.36% to $15,241.21, following the last session’s downward trend.

Pinterest, Inc. is a visual search engine that operates in the United States as well internationally. It allows users to discover inspiration and ideas for every aspect of their life, such as style, home, and DIY. The engine displays visual machine learning recommendations that are based on the interests and tastes of pinners. The original name of the company was Cold Brew Labs Inc., but it changed its name in April 2012 to Pinterest, Inc. Pinterest, Inc. was founded in 2008, and has its headquarters in San Francisco, California.

Volatility

Pinterest’s last week, last month’s, and last quarter’s current intraday variation average was a positive 0.38%, a negative 0.07%, and a positive 3.04%.

Pinterest’s highest amplitude of average volatility was 1.61% (last week), 2.75% (last month), and 3.04% (last quarter).

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Pinterest stock considered overbought (>=80).

Sales Growth

Pinterest is experiencing 11.9% sales growth in the current quarter.

More news about Pinterest.