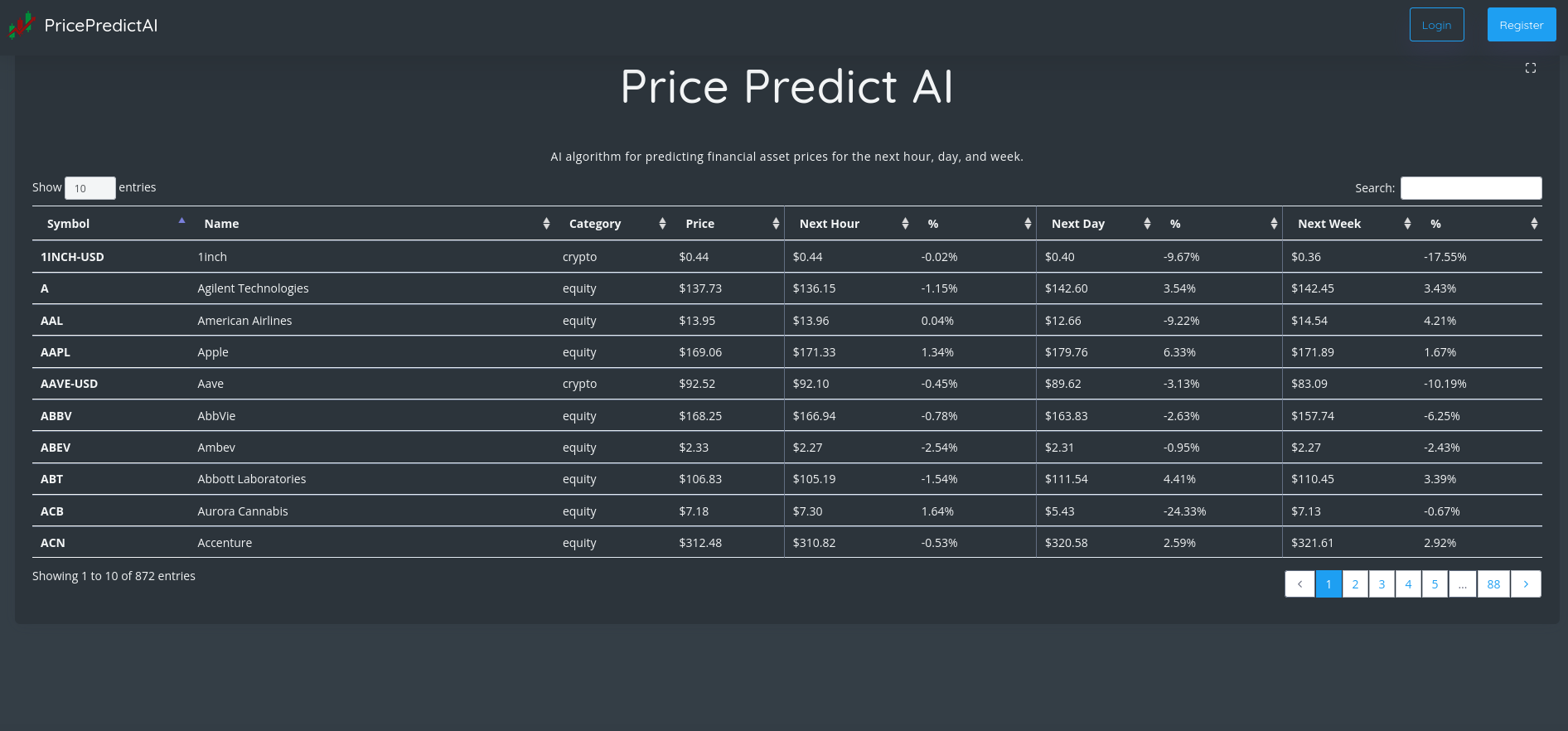

It gives out price predictions for tomorrow and the trend for next week not only for stocks but also for other asset classes. We have been watching how INNRS predicts prices, when it gets it right, and when it doesn’t.

INNRS is an artificial intelligence-based algorithm that predicts the intraday prices and weekly trends of financial assets. The goal isn’t to guess financial assets’ prices like clockwork. That is, of course, not at all possible. What’s possible, is using machine learning algorithms that, within normal market conditions, are statistically relevant in finding the price for tomorrow or a weekly trend.

By taking this approach with AI, investors have more information to review for their buying and selling decisions. The algorithm accounts for past and projected data while maintaining an automated system with minimal human interference.

In a 2020 study funded by JPMorgan, over 60% of trades over $10 million were executed using algorithms. The trading market for this sector alone is expected to grow to $19 billion by 2024, an increase of approximately $4 billion from 2020 figures.

“Artificial Intelligence is numbers-based and financial assets price action follows people’s decisions,” said Miguel Salvado, the founder of INNRS. “We can’t forget this distinction when using INNRS, that’s why our algorithm only does well during normal market conditions.”

The stock market has always had a reputation for being nonlinear, dynamic, and volatile. Multiple factors influence pricing, including global economics, politics, and individual corporate decisions. Data is the raw material that serves at the heart of INNRS’ AI algorithm. It incorporates machine learning technology, giving computers the ability to learn without being explicitly programmed for that activity.

By finding the patterns within the data, AI delivers insights into probable trends and pricing data. This process reduces research time while improving the potential quality of each trade.

AI Is on an Epic Growth Curve for Investors

According to OECD reporting on artificial intelligence, machine learning, and big data in the finance sector, global spending is expected to grow to more than $110 billion annually by 2024 in these efforts. AI results in greater efficiencies, reduced costs, and new consumer offerings while augmenting human intelligence and decision-making opportunities.

The issue that causes pause for some investors is the black swan event. When the markets reacted to the COVID-19 emergency in 2020, the information available for machine learning changed. AI was unable to predict the choices investors would make or the enhanced volatility of the economic environment with significant accuracy. An algorithm works better when it evaluates trends to create pricing models while keeping a human in the loop to monitor unexpected trends.

Firms use artificial intelligence to automate the tracking process for companies of interest while following the daily financial news feeds. INNRS algorithm can take the unstructured data, evaluate the key performance indicators in each section or group, and synthesize information for review. It facilitates idea generation, enhances the research phase of each investment opportunity, and improves pitch development opportunities.

Investment decisions for early investors are often based on instinct or emotional reactions. When AI insights are involved, a person’s feelings get taken out of the equation during the crucial evaluation period. Health issues, poor moods, and stressful days can lead to human error, but the algorithm is based on logic with artificial intelligence.

Although some investors may look at the INNRS algorithm and see too much risk with its verified accuracy percentages, its results trend with what AI technologies produce across multiple industries.

AI Accuracy Is Not as Crucial a Metric as Some May Believe

AI programs cannot determine the accuracy of the data being analyzed. That means the average success rate for an algorithm in 2022 is approximately 80%, according to information published by IGI Global. Accuracy is a difficult metric to track because four factors directly influence the model.

- Inclusion of all relevant inputs that influence eventual outcomes.

- The quality of the collected historical data.

- Relationships between the inputs and outcomes as based on the algorithm or model.

- Differences in future scenarios from the original baseline.

Accuracy finds itself at the end of imperfect connections, which is why striving for insights as INNRS does can deliver more results for anyone seeking more information. It fuses the benefits of human idealism with the improved information analysis that AI brings to the table. That makes it usable with other technologies because the process is highly adaptive.

In return, the investing process creates opportunities for advisers and investors to have a better holistic understanding of corporate and public movements to create insights. Those observations can lead to improved outcomes at all levels.

Banking and finance continue to push toward an AI-first approach instead of placing these technologies on the periphery of expectations. When implemented correctly, tools like INNRS improve the decision-making process while keeping risks low, unlocking potentially trillions of dollars in opportunities for the global economy.

Artificial intelligence technology adoption is increasing every day. The range and speed at which is evolving may well be a groundbreaking opportunity for businesses and consumers if they adopt it in due time.