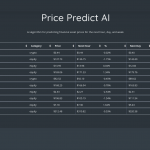

(VIANEWS) – Afya (AFYA), FleetCor Technologies (FLT), RCI Hospitality Holdings (RICK) are the highest sales growth and return on equity stocks on this list.

Here is a list of stocks with an above 5% expected next quarter sales growth, and a 3% or higher return on equity. May these stocks be a good medium-term investment option?

1. Afya (AFYA)

22.7% sales growth and 12.57% return on equity

Afya (afya) lags Q1 earnings estimatesWhile Afya has underperformed the market so far this year, the question that comes to investors’ minds is: what’s next for the stock?

Afya Limited, through its subsidiaries, operates as a medical education group in Brazil. The company operates through three segments: Undergrad, Continuing Education, and Digital Services. It offers educational products and services, including medical schools, medical residency preparatory courses, graduate courses, and other programs to lifelong medical learners enrolled across its distribution network, as well as to third-party medical schools. The company also provides digital health services, such as subscription-based mobile app and website portal that focuses on assisting health professionals and students with clinical decision-making through tools, such as medical calculators, charts, and updated content, as well as prescriptions, clinical scores, medical procedures and laboratory exams, and others. It offers health sciences courses, which comprise medicine, dentistry, nursing, radiology, psychology, pharmacy, physical education, physiotherapy, nutrition, and biomedicine; and degree programs and courses in other subjects and disciplines, including undergraduate and post graduate courses in business administration, accounting, law, civil engineering, industrial engineering, and pedagogy. In addition, the company provides medical postgraduate specialization programs; printed and digital content; and an online medical education platform and practical medical training services. The company was founded in 1999 and is headquartered in Nova Lima, Brazil.

Earnings Per Share

As for profitability, Afya has a trailing twelve months EPS of $0.85.

PE Ratio

Afya has a trailing twelve months price to earnings ratio of 15.27. Meaning, the purchaser of the share is investing $15.27 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 12.57%.

2. FleetCor Technologies (FLT)

13% sales growth and 32.88% return on equity

FLEETCOR Technologies, Inc., a business payments company that helps businesses spend less by enabling them to manage their expense-related purchasing and vendor payments processes. It offers corporate payments solutions, such as accounts payable automation; Virtual Card, which provides a single-use card number for a specific amount usable within a defined timeframe; Cross-Border that is used by its customers to pay international vendors, foreign office and personnel expenses, capital expenditures, and profit repatriation and dividends; and purchasing cards and travel and entertainment cards for its customers to analyze and manage their corporate spending. The company also provides vehicle and mobility solutions, including fuel solutions to businesses and government entities that operate vehicle fleets, as well as to oil and leasing companies, and fuel marketers; lodging solutions to businesses that have employees who travel overnight for work purposes, as well as to airlines and cruise lines to accommodate traveling crews and stranded passengers; and electronic toll payments solutions to businesses and consumers in the form of radio frequency identification tags affixed to vehicles' windshields. In addition, it offers gift card program management and processing services in plastic and digital forms that include card design, production and packaging, delivery and fulfillment, card and account management, transaction processing, promotion development and management, website design and hosting, program analytics, and card distribution channel management. Further, the company provides other products consisting of payroll cards, vehicle maintenance service solution, long-haul transportation solution, prepaid food vouchers or cards, and prepaid transportation cards and vouchers. It serves business, merchant, consumer, and payment network customers in North America, Brazil, and Internationally. The company was founded in 1986 and is headquartered in Atlanta, Georgia.

Earnings Per Share

As for profitability, FleetCor Technologies has a trailing twelve months EPS of $12.69.

PE Ratio

FleetCor Technologies has a trailing twelve months price to earnings ratio of 18.25. Meaning, the purchaser of the share is investing $18.25 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 32.88%.

Sales Growth

FleetCor Technologies’s sales growth is 9.8% for the ongoing quarter and 13% for the next.

Earnings Before Interest, Taxes, Depreciation, and Amortization

FleetCor Technologies’s EBITDA is 6.23.

Volume

Today’s last reported volume for FleetCor Technologies is 104490 which is 83.39% below its average volume of 629325.

Yearly Top and Bottom Value

FleetCor Technologies’s stock is valued at $231.61 at 11:22 EST, below its 52-week high of $251.61 and way higher than its 52-week low of $161.69.

3. RCI Hospitality Holdings (RICK)

12.6% sales growth and 19.41% return on equity

RCI Hospitality Holdings, Inc., through its subsidiaries, engages in the hospitality and related businesses in the United States. The company operates through Nightclubs, Bombshells, and Other segments. It owns and/or operates upscale adult nightclubs serving primarily businessmen and professionals under the Rick's Cabaret, Jaguars Club, Tootsie's Cabaret, XTC Cabaret, Club Onyx, Hoops Cabaret and Sports Bar, Scarlett's Cabaret, Temptations Adult Cabaret, Foxy's Cabaret, Vivid Cabaret, Downtown Cabaret, Cabaret East, The Seville, Silver City Cabaret, and Kappa Men's Club. The company also operates restaurants and sports bars under the Bombshells Restaurant & Bar brand, as well as a dance club under the Studio 80 brand. In addition, it owns two national industry trade publications serving the adult nightclubs industry and the adult retail products industry; a national industry convention and tradeshow; and two national industry award shows, as well as approximately a dozen industry and social media Websites. Further, RCI Hospitality Holdings, Inc. holds license to sell Robust Energy Drink in the United States. The company was formerly known as Rick's Cabaret International, Inc. and changed its name to RCI Hospitality Holdings, Inc. in August 2014. RCI Hospitality Holdings, Inc. was founded in 1983 and is based in Houston, Texas.

Earnings Per Share

As for profitability, RCI Hospitality Holdings has a trailing twelve months EPS of $4.9.

PE Ratio

RCI Hospitality Holdings has a trailing twelve months price to earnings ratio of 15.6. Meaning, the purchaser of the share is investing $15.6 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 19.41%.

Earnings Before Interest, Taxes, Depreciation, and Amortization

RCI Hospitality Holdings’s EBITDA is 52.5.

Sales Growth

RCI Hospitality Holdings’s sales growth is 12.2% for the present quarter and 12.6% for the next.

4. Cadence Design Systems (CDNS)

12.4% sales growth and 30.01% return on equity

Cadence Design Systems, Inc. provides software, hardware, services, and reusable integrated circuit (IC) design blocks worldwide. The company offers functional verification services, including emulation and prototyping hardware. Its functional verification offering consists of JasperGold, a formal verification platform; Xcelium, a parallel logic simulation platform; Palladium, an enterprise emulation platform; and Protium, a prototyping platform for chip verification. The company also provides digital IC design and sign off products, including Genus logic synthesis and Joules RTL power solutions, as well as Modus software solution to reduce systems-on-chip design-for-test time; physical implementation tools, such as place and route, optimization, and multiple patterning preparation; and Innovus implementation system, a physical implementation system. In addition, it offers custom IC design and simulation products to create schematic and physical representations of circuits down to the transistor level for analog, mixed-signal, custom digital, memory, and radio frequency designs; and system design and analysis products to develop printed circuit boards and IC packages, as well as to analyze electromagnetic, electro-thermal, and other multi-physics effects. Further, the company provides intellectual property (IP) products comprising pre-verified and customizable functional blocks to integrate into customer's ICs; and verification IP with memory models to emulate and model the expected behavior and interaction of standard industry system interface protocols. Additionally, it offers services related to methodology, education, and hosted design solutions, as well as technical support and maintenance services. The company serves 5G communications, aerospace and defense, automotive, industrial and healthcare, mobile, consumer, and hyperscale computing markets. Cadence Design Systems, Inc. was incorporated in 1987 and is headquartered in San Jose, California.

Earnings Per Share

As for profitability, Cadence Design Systems has a trailing twelve months EPS of $3.05.

PE Ratio

Cadence Design Systems has a trailing twelve months price to earnings ratio of 66.74. Meaning, the purchaser of the share is investing $66.74 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 30.01%.

5. RPC (RES)

10.6% sales growth and 34.67% return on equity

RPC, Inc., through its subsidiaries, provides a range of oilfield services and equipment for the oil and gas companies involved in the exploration, production, and development of oil and gas properties. The company operates through Technical Services and Support Services segments. The Technical Services segment offers pressure pumping, fracturing, acidizing, cementing, downhole tools, coiled tubing, snubbing, nitrogen, well control, wireline, pump down, and fishing services that are used in the completion, production, and maintenance of oil and gas wells. The Support Services segment provides a range of rental tools for onshore and offshore oil and gas well drilling, completion, and workover activities. This segment also offers oilfield pipe inspection, and pipe management and storage services, as well as well control training and consulting services. The company operates in the United States, Africa, Canada, Argentina, China, Mexico, Eastern Europe, Latin America, the Middle East, and internationally. RPC, Inc. was founded in 1984 and is headquartered in Atlanta, Georgia.

Earnings Per Share

As for profitability, RPC has a trailing twelve months EPS of $1.27.

PE Ratio

RPC has a trailing twelve months price to earnings ratio of 5.76. Meaning, the purchaser of the share is investing $5.76 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 34.67%.

Volume

Today’s last reported volume for RPC is 798801 which is 42.32% below its average volume of 1385050.

6. Sealed Air Corporation (SEE)

7% sales growth and 150.72% return on equity

Sealed Air Corporation provides packaging solutions in the Americas, Europe, the Middle East, Africa, Asia, Australia, and NewZealand. It operates through two segments, Food and Protective. The Food segment offers integrated packaging materials and automation equipment solutions to provide food safety and shelf life extension, reduce food waste, automate processes, and optimize total cost for food processors in the fresh red meat, smoked and processed meats, poultry, seafood, plant-based, and dairy markets under the CRYOVAC, CRYOVAC Grip & Tear, CRYOVAC Darfresh, Simple Steps, and Optidure brands. This segment sells its solutions directly to customers through its sales, marketing, and customer service personnel. The Protective segment provides foam, inflatable, suspension and retention, temperature assurance packaging solutions to protect goods to e-commerce, consumer goods, pharmaceutical and medical devices, and industrial manufacturing markets under the SEALED AIR, BUBBLE WRAP, AUTOBAG, SEALED AIR, AUTOBAG, Instapak, Korrvu, Kevothermal, and TempGuard brands. This segment sells its solutions through supply distributors, as well as directly to fabricators, original equipment manufacturers, contract manufacturers, logistics partners, and e-commerce/fulfillment operations. Sealed Air Corporation was incorporated in 1960 and is headquartered in Charlotte, North Carolina.

Earnings Per Share

As for profitability, Sealed Air Corporation has a trailing twelve months EPS of $2.77.

PE Ratio

Sealed Air Corporation has a trailing twelve months price to earnings ratio of 15.26. Meaning, the purchaser of the share is investing $15.26 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 150.72%.

Earnings Before Interest, Taxes, Depreciation, and Amortization

Sealed Air Corporation’s EBITDA is 1.7.

Revenue Growth

Year-on-year quarterly revenue growth declined by 4.9%, now sitting on 5.57B for the twelve trailing months.

Yearly Top and Bottom Value

Sealed Air Corporation’s stock is valued at $42.26 at 11:22 EST, way below its 52-week high of $64.07 and higher than its 52-week low of $41.15.