(VIANEWS) – Today, the Innrs artificial intelligence algorithm suggests a high probability of discovering the approximate price for tomorrow of Fox Corporation FOX, ICICI Bank IBN and others.

Via News will regularly fact-check this AI algorithm that aims to consistently predict the next session price and next week’s trend of financial assets.

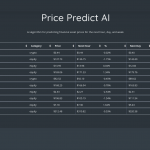

Innrs provides A.I.-based statistical tools to help investors make decisions. The table below shows the financial assets predicting price, ordered by the highest expected accuracy.

Innrs officials say this tool helps investors make better-informed decisions, supposedly used alongside other relevant financial information and the specific trader strategy.

In the next session, Via News will report the finding on the algorithm precision.

| Financial Asset | Accuracy | Close Price | Prediction |

|---|---|---|---|

| Fox Corporation (FOX) | 93.97% | $29.26 | ⇧ $29.52 |

| ICICI Bank (IBN) | 93.68% | $22.9 | ⇧ $23.48 |

| Dominion Resources (D) | 93.13% | $56.7 | ⇧ $57.98 |

| Starbucks (SBUX) | 92.74% | $106.72 | ⇧ $110.61 |

| Insulet (PODD) | 89.05% | $319.98 | ⇧ $322.08 |

| Kinder Morgan (KMI) | 89.03% | $16.94 | ⇩ $16.85 |

| NetApp (NTAP) | 88.88% | $63.95 | ⇧ $64.96 |

| SPS Commerce (SPSC) | 88.68% | $154.83 | ⇧ $156.68 |

| Tractor Supply Company (TSCO) | 88.57% | $241.38 | ⇧ $246.85 |

| Logitech (LOGI) | 88.46% | $63.9 | ⇧ $65.39 |

| Merck (MRK) | 88.31% | $117.77 | ⇧ $121.42 |

| MercadoLibre (MELI) | 88.27% | $1260 | ⇧ $1288.85 |

| Marvell Technology Group (MRVL) | 88.24% | $40.35 | ⇧ $41.3 |

| General Mills (GIS) | 88.21% | $89.92 | ⇧ $91.08 |

| AMD (AMD) | 87.87% | $95.58 | ⇧ $97.72 |

| Catalent (CTLT) | 84.45% | $35.17 | ⇧ $38.83 |

| Rogers Communication (RCI) | 84.14% | $49.4 | ⇧ $50.03 |

| Franco (FNV) | 84.11% | $159.63 | ⇧ $160.94 |

| Biogen (BIIB) | 83.93% | $315.05 | ⇧ $321.31 |

| Verizon (VZ) | 83.76% | $37.65 | ⇧ $38.38 |

| Toll Brothers (TOL) | 83.72% | $65.08 | ⇧ $66.22 |

| Kellogg Company (K) | 83.72% | $70.85 | ⇧ $72.09 |

| NVIDIA (NVDA) | 83.69% | $287.18 | ⇧ $293.14 |

| Netflix (NFLX) | 83.68% | $332.56 | ⇧ $338.35 |

| Colgate-Palmolive (CL) | 83.56% | $80.64 | ⇧ $81.89 |

| Astrazeneca (AZN) | 83.54% | $75.29 | ⇧ $76.16 |

| CME Group (CME) | 83.53% | $185.96 | ⇧ $187.86 |

| Teleflex (TFX) | 83.52% | $251.59 | ⇧ $257.88 |

| Exact Sciences (EXAS) | 83.46% | $70.16 | ⇧ $71.31 |

| Sempra Energy (SRE) | 83.4% | $156.01 | ⇧ $158.59 |

1. Fox Corporation (FOX)

Shares of Fox Corporation slid 6.39% in from $31.26 to $29.26 at 19:21 EST on Tuesday, after two successive sessions in a row of gains. NASDAQ is sliding 0.63% to $12,179.55, after two consecutive sessions in a row of gains.

Fox Corporation operates as a news, sports, and entertainment company in the United States (U.S.). The company operates through Cable Network Programming; Television; and Other, Corporate and Eliminations segments. The Cable Network Programming segment produces and licenses news, business news, and sports content for distribution through traditional and virtual multi-channel video programming distributors (MVPDs) and other digital platforms, primarily in the U.S. It operates FOX News, a national cable news channel; FOX Business, a business news national cable channel; FS1 and FS2 multi-sport national networks; FOX Sports Racing, a video programming service that comprises motor sports programming; FOX Soccer Plus, a video programming network for live soccer and rugby competitions; FOX Deportes, a Spanish-language sports programming service; and Big Ten Network, a national video programming service. The Television segment acquires, produces, markets, and distributes programming. It operates The FOX Network, a national television broadcast network that broadcasts sports programming and entertainment; Tubi, an advertising-supported video-on-demand service; Fox Alternative Entertainment, a full-service production studio that develops and produces unscripted and alternative programming; MyNetworkTV, a programming distribution service; and Blockchain Creative Labs, which is focuses on the creation, distribution and monetization of Web3 content. This segment owns and operates 29 broadcast television stations. The Other, Corporate and Eliminations segment owns the FOX Studios Lot that provides production and post-production services, including 15 sound stages, two broadcast studios, theaters and screening rooms, editing rooms, and other television and film production facilities in Los Angeles, California. The company was incorporated in 2018 and is based in New York, New York.

Sales Growth

Fox Corporation’s sales growth is 5.7% for the present quarter and 5.5% for the next.

Revenue Growth

Year-on-year quarterly revenue growth grew by 3.7%, now sitting on 14.28B for the twelve trailing months.

More news about Fox Corporation.

2. ICICI Bank (IBN)

Shares of ICICI Bank jumped 7.31% in from $21.34 to $22.90 at 19:21 EST on Tuesday, after two successive sessions in a row of gains. NYSE is dropping 0.25% to $15,352.81, after two consecutive sessions in a row of gains.

ICICI Bank Limited provides various banking products and services in India and internationally. It operates through Retail Banking, Wholesale Banking, Treasury, Other Banking, Life Insurance, General Insurance, and Others segments. The company offers savings, salary, pension, current, and other accounts; and time, fixed, recurring, and security deposits. It also provides home, car, two-wheeler, personal, gold, and commercial business loans, as well as loans against securities and other loans; business loans, including working capital finance, term loans, collateral free loans, loans without financials, finance for importers and exporters, and overdraft facilities, as well as loans for new entities, card swipes, and schools and colleges; and credit, debit, prepaid, travel, and corporate cards. In addition, the company offers insurance products; pockets wallet; fixed income products; investment products, such as mutual funds, gold monetization schemes, initial public offerings, and other online investment services; and agri and rural business, farmer finance, tractor loans, and micro banking services, as well as other services to agri corporates. Further, it provides portfolio management, trade, foreign exchange, locker, private and NRI banking, and cash management services; family wealth and demat accounts; commercial and investment banking, capital market, custodial, project and technology finance, and institutional banking services, as well as Internet, mobile, and phone banking services. Additionally, the company offers securities investment, broking, trading, and underwriting services; and merchant banking, trusteeship, housing finance, pension fund management, asset management, investment advisory, points of presence, and private equity/venture capital fund management services. ICICI Bank Limited was founded in 1955 and is headquartered in Mumbai, India.

Volatility

ICICI Bank’s last week, last month’s, and last quarter’s current intraday variation average was 0.67%, 0.26%, and 0.88%.

ICICI Bank’s highest amplitude of average volatility was 0.87% (last week), 0.75% (last month), and 0.88% (last quarter).

Revenue Growth

Year-on-year quarterly revenue growth grew by 66.6%, now sitting on 1.29T for the twelve trailing months.

More news about ICICI Bank.

3. Dominion Resources (D)

Shares of Dominion Resources slid 2.15% in from $57.95 to $56.70 at 19:21 EST on Tuesday, following the last session’s upward trend. NYSE is falling 0.25% to $15,352.81, after two sequential sessions in a row of gains.

Dominion Energy, Inc. produces and distributes energy in the United States. It operates through four segments: Dominion Energy Virginia, Gas Distribution, Dominion Energy South Carolina, and Contracted Assets. The Dominion Energy Virginia segment generates, transmits, and distributes regulated electricity to approximately 2.7 million residential, commercial, industrial, and governmental customers in Virginia and North Carolina. The Gas Distribution segment is involved in the regulated natural gas sales, transportation, gathering, storage, and distribution operations in Ohio, North Carolina, Utah, southwestern Wyoming, and southeastern Idaho that serve approximately 3.0 million residential, commercial and industrial customers. It also has nonregulated renewable natural gas facilities in operation. The Dominion Energy South Carolina segment generates, transmits, and distributes electricity to approximately 782,000 customers in the central, southern, and southwestern portions of South Carolina; and distributes natural gas to approximately 435,000 residential, commercial, and industrial customers in South Carolina. The Contracted Assets segment is involved in the nonregulated long-term contracted renewable electric generation and solar generation facility development operations; and gas transportation, LNG import, and storage operations, as well as in the liquefaction facility. As of December 31, 2022, the company's portfolio of assets included approximately 31.0 gigawatt of electric generating capacity; 10,600 miles of electric transmission lines; 78,500 miles of electric distribution lines; and 93,500 miles of gas distribution mains and related service facilities. The company was formerly known as Dominion Resources, Inc. Dominion Energy, Inc. was incorporated in 1983 and is headquartered in Richmond, Virginia.

Sales Growth

Dominion Resources’s sales growth is 4.2% for the present quarter and 11.8% for the next.

Growth Estimates Quarters

The company’s growth estimates for the ongoing quarter is a negative 17.8% and positive 2.6% for the next.

More news about Dominion Resources.

4. Starbucks (SBUX)

Shares of Starbucks rose 1.96% in from $104.67 to $106.72 at 19:21 EST on Tuesday, following the last session’s downward trend. NASDAQ is falling 0.63% to $12,179.55, after two consecutive sessions in a row of gains.

Starbucks Corporation, together with its subsidiaries, operates as a roaster, marketer, and retailer of specialty coffee worldwide. The company operates through three segments: North America, International, and Channel Development. Its stores offer coffee and tea beverages, roasted whole beans and ground coffees, single serve products, and ready-to-drink beverages; and various food products, such as pastries, breakfast sandwiches, and lunch items. The company also licenses its trademarks through licensed stores, and grocery and foodservice accounts. The company offers its products under the Starbucks, Teavana, Seattle's Best Coffee, Evolution Fresh, Ethos, Starbucks Reserve, and Princi brands. Starbucks Corporation has company-operated and licensed stores in North America and internationally. The company was founded in 1971 and is based in Seattle, Washington.

Volatility

Starbucks’s last week, last month’s, and last quarter’s current intraday variation average was a negative 2.33%, a positive 0.10%, and a positive 1.10%.

Starbucks’s highest amplitude of average volatility was 4.40% (last week), 1.25% (last month), and 1.10% (last quarter).

More news about Starbucks.

5. Insulet (PODD)

Shares of Insulet rose 1.6% in from $314.94 to $319.98 at 19:21 EST on Tuesday, following the last session’s downward trend. NASDAQ is falling 0.63% to $12,179.55, after two sequential sessions in a row of gains.

Insulet Corporation develops, manufactures, and sells insulin delivery systems for people with insulin-dependent diabetes. It offers Omnipod System, a self-adhesive disposable tubeless Omnipod device that is worn on the body for up to three days at a time, as well as its wireless companion, the handheld personal diabetes manager. The company sells its products primarily through independent distributors and pharmacy channels, as well as directly in the United States, Canada, Europe, the Middle East, and Australia. Insulet Corporation was incorporated in 2000 and is headquartered in Acton, Massachusetts.

Growth Estimates Quarters

The company’s growth estimates for the present quarter and the next is 146% and 587.5%, respectively.

Yearly Top and Bottom Value

Insulet’s stock is valued at $319.98 at 19:21 EST, under its 52-week high of $335.91 and way above its 52-week low of $181.00.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions, Insulet’s stock is considered to be oversold (<=20).

Sales Growth

Insulet’s sales growth is 21.1% for the current quarter and 27.4% for the next.

More news about Insulet.

6. Kinder Morgan (KMI)

Shares of Kinder Morgan fell 4.72% in from $17.78 to $16.94 at 19:21 EST on Tuesday, following the last session’s downward trend. NYSE is falling 0.25% to $15,352.81, after two successive sessions in a row of gains.

Kinder Morgan, Inc. operates as an energy infrastructure company in North America. The company operates through four segments: Natural Gas Pipelines, Products Pipelines, Terminals, and CO2. The Natural Gas Pipelines segment owns and operates interstate and intrastate natural gas pipeline, and underground storage systems; natural gas gathering systems and natural gas processing and treating facilities; natural gas liquids fractionation facilities and transportation systems; and liquefied natural gas gasification, liquefaction, and storage facilities. The Products Pipelines segment owns and operates refined petroleum products, and crude oil and condensate pipelines; and associated product terminals and petroleum pipeline transmix facilities. The Terminals segment owns and/or operates liquids and bulk terminals that stores and handles various commodities, including gasoline, diesel fuel, renewable fuel stock, chemicals, ethanol, metals, and petroleum coke; and owns tankers. The CO2 segment produces, transports, and markets CO2 to recovery and production crude oil from mature oil fields; owns interests in/or operates oil fields and gasoline processing plants; and operates a crude oil pipeline system in West Texas, as well as owns and operates RNG and LNG facilities. It owns and operates approximately 83,000 miles of pipelines and 140 terminals. The company was formerly known as Kinder Morgan Holdco LLC and changed its name to Kinder Morgan, Inc. in February 2011. Kinder Morgan, Inc. was founded in 1936 and is headquartered in Houston, Texas.

Volatility

Kinder Morgan’s last week, last month’s, and last quarter’s current intraday variation average was a positive 0.33%, a negative 0.23%, and a positive 0.96%.

Kinder Morgan’s highest amplitude of average volatility was 1.11% (last week), 0.76% (last month), and 0.96% (last quarter).

More news about Kinder Morgan.

7. NetApp (NTAP)

Shares of NetApp dropped 1.67% in from $65.04 to $63.95 at 19:21 EST on Tuesday, after four successive sessions in a row of gains. NASDAQ is sliding 0.63% to $12,179.55, after two consecutive sessions in a row of gains.

NetApp, Inc. provides cloud-led and data-centric services to manage and share data on-premises, and private and public clouds worldwide. It operates in two segments, Hybrid Cloud and Public Could. The company offers intelligent data management software, such as NetApp ONTAP, NetApp Snapshot, NetApp SnapCenter Backup Management, NetApp SnapMirror Data Replication, NetApp SnapLock Data Compliance, NetApp ElementOS software, and NetApp SANtricity software; and storage infrastructure solutions, including NetApp All-Flash FAS series, NetApp Fabric Attached Storage, NetApp FlexPod, NetApp E/EF series, NetApp StorageGRID, and NetApp SolidFire. It also provides cloud storage and data services comprising NetApp Cloud Volumes ONTAP, Azure NetApp Files, Amazon FSx for NetApp ONTAP, NetApp Cloud Volumes Service for Google Cloud, NetApp Cloud Sync, NetApp Cloud Tiering, NetApp Cloud Backup, NetApp Cloud Data Sense, and NetApp Cloud Volumes Edge Cache; and cloud operations services, such as NetApp Cloud Insights, Spot Ocean Kubernetes Suite, Spot Security, Spot Eco, and Spot CloudCheckr. In addition, the company offers application-aware data management service under the NetApp Astra name; and professional and support services, such as strategic consulting, professional, managed, and support services. Further, it provides assessment, design, implementation, and migration services. The company serves the energy, financial service, government, technology, internet, life science, healthcare service, manufacturing, media, entertainment, animation, video postproduction, and telecommunication markets through a direct sales force and an ecosystem of partners. NetApp, Inc. was incorporated in 1992 and is headquartered in San Jose, California.

More news about NetApp.

8. SPS Commerce (SPSC)

Shares of SPS Commerce rose 2.72% in from $150.73 to $154.83 at 19:21 EST on Tuesday, after two consecutive sessions in a row of gains. NASDAQ is falling 0.63% to $12,179.55, after two sequential sessions in a row of gains.

SPS Commerce, Inc. provides cloud-based supply chain management solutions worldwide. It offers solutions through the SPS Commerce, a cloud-based platform that enhances the way retailers, suppliers, grocers, distributors, and logistics firms manage and fulfill omnichannel orders, optimize sell-through performance, and automate new trading relationships. The company also provides Fulfillment solution, an electronic data interchange solution that scales as a business grows, where companies use a single system to manage orders and logistics from various sales channels, including wholesale, eCommerce, and marketplaces; and Analytics product that enables organizations to enhance visibility into how products are selling through a single connection across various sales channels, including wholesale, eCommerce, and marketplaces, as well as enhances access and usage of sales and inventory data through a combination of analytics applications, network of connections, and industry-leading expertise. In addition, it offers various complimentary products, such as assortment product, which simplifies the communication of robust, accurate item data by automatically translating item attributes, and hierarchies; and community product that allows organizations to accelerate digitization of their supply chain and improve collaboration with suppliers through change management and onboarding programs. The company was formerly known as St. Paul Software, Inc. and changed its name to SPS Commerce, Inc. in May 2001. SPS Commerce, Inc. was incorporated in 1987 and is headquartered in Minneapolis, Minnesota.

Volatility

SPS Commerce’s last week, last month’s, and last quarter’s current intraday variation average was a negative 0.30%, a positive 0.08%, and a positive 1.56%.

SPS Commerce’s highest amplitude of average volatility was 1.26% (last week), 1.40% (last month), and 1.56% (last quarter).

More news about SPS Commerce.

9. Tractor Supply Company (TSCO)

Shares of Tractor Supply Company rose 1.17% in from $238.59 to $241.38 at 19:21 EST on Tuesday, after two consecutive sessions in a row of gains. NASDAQ is falling 0.63% to $12,179.55, after two consecutive sessions in a row of gains.

Tractor Supply Company operates as a rural lifestyle retailer in the United States. The company offers a selection of merchandise, including equine, livestock, pet, and small animal products necessary for their health, care, growth, and containment; hardware, truck, towing, and tool products; seasonal products, such as heating products, lawn and garden items, power equipment, gifts, and toys; work/recreational clothing and footwear; and maintenance products for agricultural and rural use. It provides its products under the 4health, Producer's Pride, American Farmworks, Red Shed, Bit & Bridle, Redstone, Blue Mountain, Retriever, C.E. Schmidt, Ridgecut, Countyline, Royal Wing, Dumor, Strive, Groundwork, Traveller, Huskee, Treeline, JobSmart, TSC Tractor Supply Co, Paws & Claws, and Untamed brands. The company operates its retail stores under the Tractor Supply Company, Orscheln Farm and Home, and Petsense names; and operates websites under the TractorSupply.com and Petsense.com names. It sells its products to recreational farmers, ranchers, and others. The company was founded in 1938 and is based in Brentwood, Tennessee.

Moving Average

Tractor Supply Company’s worth is above its 50-day moving average of $235.37 and way higher than its 200-day moving average of $215.60.

Revenue Growth

Year-on-year quarterly revenue growth grew by 9.1%, now sitting on 14.48B for the twelve trailing months.

Yearly Top and Bottom Value

Tractor Supply Company’s stock is valued at $241.38 at 19:21 EST, under its 52-week high of $251.17 and way higher than its 52-week low of $166.49.

Growth Estimates Quarters

The company’s growth estimates for the ongoing quarter and the next is 12.7% and 12.9%, respectively.

More news about Tractor Supply Company.

10. Logitech (LOGI)

Shares of Logitech rose by a staggering 11.99% in from $57.06 to $63.90 at 19:21 EST on Tuesday, after three consecutive sessions in a row of gains. NASDAQ is sliding 0.63% to $12,179.55, after two successive sessions in a row of gains.

Logitech International S.A., through its subsidiaries, designs, manufactures, and markets products that connect people to digital and cloud experiences worldwide. The company offers pointing devices, such as wireless mouse; corded and cordless keyboards, living room keyboards, and keyboard-and-mouse combinations; PC webcams; and keyboards for tablets and smartphones, as well as other accessories for mobile devices. It also provides keyboards, mice, headsets, and simulation products, such as steering wheels and flight sticks for gamers; video conferencing products, such as ConferenceCams, which combine enterprise-quality audio and high-definition video to bring video conferencing to businesses of any size; webcams and headsets that turn desktop into collaboration space; and controller for video conferencing room solutions. In addition, the company offers portable wireless Bluetooth and Wi-Fi connected speakers, mobile speakers, PC speakers, PC headsets, microphones, in-ear headphones, and wireless audio wearables; home entertainment controllers, and home security cameras. Its channel network includes consumer electronics distributors, retailers, e-tailers, mass merchandisers, specialty stores, computer and telecommunications stores, value-added resellers, and online merchants. The company sells its products under the Logitech, Logitech G, ASTRO Gaming, Streamlabs, Blue Microphones, Ultimate Ears, and Jaybird brands. Logitech International S.A. was incorporated in 1981 and is headquartered in Lausanne, Switzerland.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions, Logitech’s stock is considered to be oversold (<=20).

Revenue Growth

Year-on-year quarterly revenue growth declined by 22.2%, now sitting on 4.81B for the twelve trailing months.

Moving Average

Logitech’s value is way higher than its 50-day moving average of $55.40 and way higher than its 200-day moving average of $55.04.

More news about Logitech.

11. Merck (MRK)

Shares of Merck rose 4.83% in from $112.34 to $117.77 at 19:21 EST on Tuesday, after two successive sessions in a row of gains. NYSE is dropping 0.25% to $15,352.81, after two consecutive sessions in a row of gains.

Merck & Co., Inc. operates as a healthcare company worldwide. It operates through two segments, Pharmaceutical and Animal Health. The Pharmaceutical segment offers human health pharmaceutical products in the areas of oncology, hospital acute care, immunology, neuroscience, virology, cardiovascular, and diabetes, as well as vaccine products, such as preventive pediatric, adolescent, and adult vaccines. The Animal Health segment discovers, develops, manufactures, and markets veterinary pharmaceuticals, vaccines, and health management solutions and services, as well as digitally connected identification, traceability, and monitoring products. The company serves drug wholesalers and retailers, hospitals, and government agencies; managed health care providers, such as health maintenance organizations, pharmacy benefit managers, and other institutions; and physicians and physician distributors, veterinarians, and animal producers. It has collaborations with AstraZeneca PLC; Bayer AG; Eisai Co., Ltd.; Ridgeback Biotherapeutics LP; and Gilead Sciences, Inc. to jointly develop and commercialize long-acting treatments in HIV. Merck & Co., Inc. was founded in 1891 and is headquartered in Rahway, New Jersey.

Moving Average

Merck’s worth is above its 50-day moving average of $110.55 and way above its 200-day moving average of $101.94.

Volatility

Merck’s last week, last month’s, and last quarter’s current intraday variation average was a negative 0.06%, a positive 0.34%, and a positive 0.98%.

Merck’s highest amplitude of average volatility was 0.42% (last week), 0.74% (last month), and 0.98% (last quarter).

More news about Merck.

12. MercadoLibre (MELI)

Shares of MercadoLibre jumped 0.95% in from $1248.14 to $1,260.00 at 19:21 EST on Tuesday, after two successive sessions in a row of gains. NASDAQ is dropping 0.63% to $12,179.55, after two sequential sessions in a row of gains.

MercadoLibre, Inc. operates online commerce platforms in Latin America. It operates Mercado Libre Marketplace, an automated online commerce platform that enables businesses, merchants, and individuals to list merchandise and conduct sales and purchases online; and Mercado Pago FinTech platform, a financial technology solution platform, which facilitates transactions on and off its marketplaces by providing a mechanism that allows its users to send and receive payments online, as well as allows users to transfer money through their websites or on the apps. The company also offers Mercado Fondo that allows users to invest funds deposited in their Mercado Pago accounts; Mercado Credito, which extends loans to certain merchants and consumers; and Mercado Envios logistics solution that enables sellers on its platform to utilize third-party carriers and other logistics service providers, as well as fulfillment and warehousing services for sellers. In addition, it provides Mercado Libre Classifieds, an online classified listing service, where users can list and purchase motor vehicles, real estate, and services; Mercado Libre Ads, an advertising platform, which enables large retailers and brands to promote their products and services on the web; and Mercado Shops, an online storefronts solution that enables users to set-up, manage, and promote their own digital stores. The company was incorporated in 1999 and is headquartered in Montevideo, Uruguay.

Moving Average

MercadoLibre’s value is above its 50-day moving average of $1,241.47 and way above its 200-day moving average of $1,015.85.

Growth Estimates Quarters

The company’s growth estimates for the present quarter and the next is 72% and 78.9%, respectively.

Volatility

MercadoLibre’s last week, last month’s, and last quarter’s current intraday variation average was a negative 0.36%, a negative 0.01%, and a positive 1.84%.

MercadoLibre’s highest amplitude of average volatility was 3.30% (last week), 1.78% (last month), and 1.84% (last quarter).

Yearly Top and Bottom Value

MercadoLibre’s stock is valued at $1,260.00 at 19:21 EST, below its 52-week high of $1,337.75 and way higher than its 52-week low of $600.68.

More news about MercadoLibre.

13. Marvell Technology Group (MRVL)

Shares of Marvell Technology Group rose 0.22% in from $40.26 to $40.35 at 19:21 EST on Tuesday, after two consecutive sessions in a row of gains. NASDAQ is sliding 0.63% to $12,179.55, after two successive sessions in a row of gains.

Marvell Technology, Inc., together with its subsidiaries, provides data infrastructure semiconductor solutions and spanning the data center core to network edge. The company develops, scales complex System-on-a-Chip architectures, integrating analog, mixed-signal, and digital signal processing functionality. It offers a portfolio of Ethernet solutions, including controllers, network adapters, physical transceivers, and switches; single or multiple core processors; custom application specific integrated circuits; and System-on-a-Chip solutions. The company also provides electro-optical products, including pulse amplitude modulations, coherent digital signal processors, laser drivers, trans-impedance amplifiers, silicon photonics, and data center interconnect solutions; fibre channel products comprising host bus adapters and controllers; single or multiple core processors; storage controllers for hard disk drives and solid-state-drives; and host system interfaces, including serial attached SCSI, serial advanced technology attachment, peripheral component interconnect express, non-volatile memory express (NVMe), and NVMe over fabrics. It has operations in the United States, Argentina, China, India, Israel, Japan, Singapore, South Korea, Taiwan, and Vietnam. Marvell Technology, Inc. was incorporated in 1995 and is headquartered in Wilmington, Delaware.

Growth Estimates Quarters

The company’s growth estimates for the current quarter and the next is a negative 44.2% and a negative 43.9%, respectively.

Revenue Growth

Year-on-year quarterly revenue growth grew by 5.6%, now sitting on 5.92B for the twelve trailing months.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions, Marvell Technology Group’s stock is considered to be oversold (<=20).

More news about Marvell Technology Group.

14. General Mills (GIS)

Shares of General Mills rose 4.18% in from $86.31 to $89.92 at 19:21 EST on Tuesday, after five sequential sessions in a row of gains. NYSE is falling 0.25% to $15,352.81, after two sequential sessions in a row of gains.

General Mills, Inc. manufactures and markets branded consumer foods worldwide. The company operates in five segments: North America Retail; Convenience Stores & Foodservice; Europe & Australia; Asia & Latin America; and Pet. It offers ready-to-eat cereals, refrigerated yogurt, soup, meal kits, refrigerated and frozen dough products, dessert and baking mixes, bakery flour, frozen pizza and pizza snacks, snack bars, fruit and salty snacks, ice cream, nutrition bars, wellness beverages, and savory and grain snacks, as well as various organic products, including frozen and shelf-stable vegetables. It also supplies branded and unbranded food products to the North American foodservice and commercial baking industries; and manufactures and markets pet food products, including dog and cat food. The company markets its products under the Annie's, Betty Crocker, Bisquick, Blue Buffalo, Blue Basics, Blue Freedom, Bugles, Cascadian Farm, Cheerios, Chex, Cinnamon Toast Crunch, Cocoa Puffs, Cookie Crisp, EPIC, Fiber One, Food Should Taste Good, Fruit by the Foot, Fruit Gushers, Fruit Roll-Ups, Gardetto's, Go-Gurt, Gold Medal, Golden Grahams, Häagen-Dazs, Helpers, Jus-Rol, Kitano, Kix, Lärabar, Latina, Liberté, Lucky Charms, Muir Glen, Nature Valley, Oatmeal Crisp, Old El Paso, Oui, Pillsbury, Progresso, Raisin Nut Bran, Total, Totino's, Trix, Wanchai Ferry, Wheaties, Wilderness, Yoki, and Yoplait trademarks. It sells its products directly, as well as through broker and distribution arrangements to grocery stores, mass merchandisers, membership stores, natural food chains, e-commerce retailers, commercial and noncommercial foodservice distributors and operators, restaurants, convenience stores, and pet specialty stores, as well as drug, dollar, and discount chains. The company operates 466 leased and 392 franchise ice cream parlors. General Mills, Inc. was founded in 1866 and is headquartered in Minneapolis, Minnesota.

Yearly Top and Bottom Value

General Mills’s stock is valued at $89.92 at 19:21 EST, above its 52-week high of $88.34.

More news about General Mills.

15. AMD (AMD)

Shares of AMD rose 0.42% in from $95.18 to $95.58 at 19:21 EST on Tuesday, after three successive sessions in a row of gains. NASDAQ is falling 0.63% to $12,179.55, after two sequential sessions in a row of gains.

Advanced Micro Devices, Inc. operates as a semiconductor company worldwide. It operates in four segments: Data Center, Client, Gaming, and Embedded segments. The company offers x86 microprocessors and graphics processing units (GPUs) as an accelerated processing unit, chipsets, data center, and professional GPUs; and embedded processors, and semi-custom system-on-chip (SoC) products, microprocessor and SoC development services and technology, data processing unites, field programmable gate arrays (FPGA), and adaptive SoC products. It also provides processors under the AMD Ryzen, AMD Ryzen PRO, Ryzen Threadripper, Ryzen Threadripper PRO, AMD Athlon, AMD Athlon PRO, and AMD PRO A-Series brand names; graphics under the AMD Radeon graphics and AMD Embedded Radeon graphics; and professional graphics under the AMD Radeon Pro graphics brand name. In addition, the company offers data center graphics under the Radeon Instinct and Radeon PRO V-series brands, as well as servers under the AMD Instinct accelerators brand; server microprocessors under the AMD EPYC brands; embedded processor solutions under the AMD Athlon, AMD Geode, AMD Ryzen, AMD EPYC, AMD R-Series, and G-Series brands; FPGA products under the Virtex-6, Virtex-7, Virtex UltraScale+, Kintex-7, Kintex UltraScale, Kintex UltraScale+, Artix-7, Artix UltraScale+, Spartan-6, and Spartan-7 brands; adaptive SOCs under the Zynq-7000, Zynq UltraScale+ MPSoC, Zynq UltraScale+ RFSoCs, Versal HBM, Versal Premium, Versal Prime, Versal AI Core, Versal AI Edge, Vitis, and Vivado brands; and compute and network acceleration board products under the Alveo brand. It serves original equipment and design manufacturers, public cloud service providers, system integrators, independent distributors, online and brick and mortar retailers, and add-in-board manufacturers through its direct sales force, independent distributors, and sales representatives. The company was incorporated in 1969 and is headquartered in Santa Clara, California.

Moving Average

AMD’s value is above its 50-day moving average of $89.59 and way higher than its 200-day moving average of $78.93.

Growth Estimates Quarters

The company’s growth estimates for the present quarter is a negative 45.7% and positive 9% for the next.

Volatility

AMD’s last week, last month’s, and last quarter’s current intraday variation average was a negative 0.11%, a negative 0.16%, and a positive 2.19%.

AMD’s highest amplitude of average volatility was 6.67% (last week), 2.22% (last month), and 2.19% (last quarter).

More news about AMD.

16. Catalent (CTLT)

Shares of Catalent slid by a staggering 91.1% in from $395.17 to $35.17 at 19:21 EST on Tuesday, after three successive sessions in a row of losses. NYSE is sliding 0.25% to $15,352.81, after two consecutive sessions in a row of gains.

Catalent, Inc., together with its subsidiaries, develops and manufactures solutions for drugs, protein-based biologics, cell and gene therapies, and consumer health products worldwide. The Softgel and Oral Technologies segment provides formulation, development, and manufacturing services for soft capsules for use in a range of customer products, such as prescription drugs, over-the-counter medications, dietary supplements, unit-dose cosmetics, and animal health medicinal preparations. The Biologics segment provides biologic cell-line; develops and manufactures cell therapy and viral based gene therapy; formulation, development, and manufacturing for parenteral dose forms, including vials, prefilled syringes, vials, and cartridges; and analytical development and testing services. The Oral and Specialty Delivery segment offers formulation, development, and manufacturing across a range of technologies along with integrated downstream clinical development and commercial supply solutions. This segment also offers oral delivery solutions platform comprising pre-clinical screening, formulation, analytical development, and current good manufacturing practices services. The Clinical Supply Services segment offers manufacturing, packaging, storage, distribution, and inventory management for drugs and biologics, and cell and gene therapies in clinical trials. The company also offers FlexDirect direct-to-patient and FastChain demand-led clinical supply services. It serves pharmaceutical, biotechnology, and consumer health companies; and companies in other healthcare market segments, such as animal health and medical devices, as well as in cosmetics industries. The company was incorporated in 2007 and is headquartered in Somerset, New Jersey.

Revenue Growth

Year-on-year quarterly revenue growth declined by 5.6%, now sitting on 4.76B for the twelve trailing months.

Sales Growth

Catalent’s sales growth is negative 11.1% for the ongoing quarter and 6.6% for the next.

Growth Estimates Quarters

The company’s growth estimates for the present quarter is a negative 38.5% and positive 22.7% for the next.

Volatility

Catalent’s last week, last month’s, and last quarter’s current intraday variation average was a negative 1.29%, a negative 1.08%, and a positive 2.88%.

Catalent’s highest amplitude of average volatility was 1.81% (last week), 4.32% (last month), and 2.88% (last quarter).

More news about Catalent.

17. Rogers Communication (RCI)

Shares of Rogers Communication jumped 1.35% in from $48.74 to $49.40 at 19:21 EST on Tuesday, after four sequential sessions in a row of gains. NYSE is falling 0.25% to $15,352.81, after two successive sessions in a row of gains.

Rogers Communications Inc. operates as a communications and media company in North America. It operates through three segments: Wireless, Cable, and Media. The company offers mobile Internet access, wireless voice and enhanced voice, device financing, device protection, global voice and data roaming, wireless home phone, bridging landline, machine-to-machine and Internet of Things solutions, and advanced wireless solutions for businesses, as well as device shipping services; and postpaid and prepaid services under the Rogers, Fido, and chatr brands. It also provides internet and WiFi services; and smart home monitoring services, such as monitoring, security, automation, energy efficiency, and smart control through a smartphone app. In addition, the company offers local and network TV; on-demand television; cloud-based digital video recorders; voice-activated remote controls, and integrated apps; personal video recorders; linear and time-shifted programming; digital specialty channels; 4K television programming; and seasonal games through television, smartphones, tablets, personal computers, and other streaming devices, as well as operates Ignite TV and Ignite TV app. Further, it provides residential and small business local telephony services; calling features, such as voicemail, call waiting, and long distance; voice, data networking, Internet protocol, and Ethernet services; private networking, Internet, IP voice, and cloud solutions; optical wave and multi-protocol label switching services; information technology (IT) and network technologies; cable access network services; and telecommunications technical consulting services. Additionally, the company owns Toronto Blue Jays and the Rogers Centre event venue; and operates Sportsnet ONE, Sportsnet 360, Sportsnet World, Citytv, OMNI, FX (Canada), FXX (Canada), and OLN television networks, as well as 54 AM and FM radio stations. Rogers Communications Inc. was founded in 1960 and is headquartered in Toronto, Canada.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions, Rogers Communication’s stock is considered to be oversold (<=20).

Yearly Top and Bottom Value

Rogers Communication’s stock is valued at $49.40 at 19:21 EST, way under its 52-week high of $64.55 and way above its 52-week low of $36.23.

More news about Rogers Communication.

18. Franco (FNV)

Shares of Franco rose 4.4% in from $152.9 to $159.63 at 19:21 EST on Tuesday, after five sequential sessions in a row of gains. NYSE is sliding 0.25% to $15,352.81, after two consecutive sessions in a row of gains.

Franco-Nevada Corporation operates as a gold-focused royalty and streaming company in Latin America, the United States, Canada, and internationally. It operates through Mining and Energy segments. The company manages its portfolio with a focus on precious metals, such as gold, silver, and platinum group metals; and engages in the sale of crude oil, natural gas, and natural gas liquids. The company was founded in 1986 and is headquartered in Toronto, Canada.

Yearly Top and Bottom Value

Franco’s stock is valued at $159.63 at 19:21 EST, under its 52-week high of $168.59 and way higher than its 52-week low of $109.70.

Moving Average

Franco’s value is way above its 50-day moving average of $139.77 and way above its 200-day moving average of $133.33.

More news about Franco.

19. Biogen (BIIB)

Shares of Biogen jumped by a staggering 11.36% in from $282.91 to $315.05 at 19:21 EST on Tuesday, following the last session’s downward trend. NASDAQ is dropping 0.63% to $12,179.55, after two consecutive sessions in a row of gains.

Biogen Inc. discovers, develops, manufactures, and delivers therapies for treating neurological and neurodegenerative diseases in the United States, Europe, Germany, Asia, and internationally. The company offers TECFIDERA, VUMERITY, AVONEX, PLEGRIDY, TYSABRI, and FAMPYRA for multiple sclerosis (MS); SPINRAZA for spinal muscular atrophy; ADUHELM to treat Alzheimer's disease; FUMADERM to treat plaque psoriasis; BENEPALI, an etanercept biosimilar referencing ENBREL; IMRALDI, an adalimumab biosimilar referencing HUMIRA; FLIXABI, an infliximab biosimilar referencing REMICADE; and BYOOVIZ, a ranibizumab biosimilar referencing LUCENTIS. It also provides RITUXAN for treating non-Hodgkin's lymphoma, chronic lymphocytic leukemia (CLL), rheumatoid arthritis, two forms of ANCA-associated vasculitis, and pemphigus vulgaris; RITUXAN HYCELA for non-Hodgkin's lymphoma and CLL; GAZYVA to treat CLL and follicular lymphoma; OCREVUS for relapsing MS and primary progressive MS; LUNSUMIO to treat relapsed or refractory follicular lymphoma; glofitamab for non-Hodgkin's lymphoma; and other anti-CD20 therapies. In addition, the company is developing various products for the treatment of MS, Alzheimer's disease and dementia, neuromuscular disorders, Parkinson's disease and movement disorders, neuropsychiatry, immunology related diseases, neurovascular disorders, genetic neurodevelopmental disorders, and biosimilars, which are under various stages of development. Biogen Inc. has collaboration and license agreements with Acorda Therapeutics, Inc.; Alkermes Pharma Ireland Limited; Denali Therapeutics Inc.; Eisai Co., Ltd.; Genentech, Inc.; Neurimmune SubOne AG; Ionis Pharmaceuticals, Inc.; Samsung Bioepis Co., Ltd.; Sangamo Therapeutics, Inc.; and Sage Therapeutics, Inc. The company was founded in 1978 and is headquartered in Cambridge, Massachusetts.

Moving Average

Biogen’s worth is way higher than its 50-day moving average of $279.68 and way higher than its 200-day moving average of $263.93.

More news about Biogen.

20. Verizon (VZ)

Shares of Verizon slid 4.17% in from $39.29 to $37.65 at 19:21 EST on Tuesday, after two consecutive sessions in a row of losses. NYSE is sliding 0.25% to $15,352.81, after two successive sessions in a row of gains.

Verizon Communications Inc., through its subsidiaries, provides communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide. It operates in two segments, Verizon Consumer Group (Consumer) and Verizon Business Group (Business). The Consumer segment provides wireless services across the wireless networks in the United States under the Verizon and TracFone brands and through wholesale and other arrangements; and fixed wireless access (FWA) broadband through its wireless networks. It also offers wireline services in the Mid-Atlantic and Northeastern United States, as well as Washington D.C. through its fiber-optic network, Verizon Fios product portfolio, and a copper-based network. The Business segment provides wireless and wireline communications services and products, including data, video, conferencing, corporate networking, security and managed network, local and long-distance voice, network access, and various IoT services and products, as well as FWA broadband through its wireless networks. The company was formerly known as Bell Atlantic Corporation and changed its name to Verizon Communications Inc. in June 2000. Verizon Communications Inc. was incorporated in 1983 and is headquartered in New York, New York.

Revenue Growth

Year-on-year quarterly revenue growth declined by 1.9%, now sitting on 136.19B for the twelve trailing months.

Moving Average

Verizon’s worth is under its 50-day moving average of $38.13 and under its 200-day moving average of $39.68.

More news about Verizon.

21. Toll Brothers (TOL)

Shares of Toll Brothers rose by a staggering 12.13% in from $58.04 to $65.08 at 19:21 EST on Tuesday, after four successive sessions in a row of gains. NYSE is sliding 0.25% to $15,352.81, after two sequential sessions in a row of gains.

Toll Brothers, Inc., together with its subsidiaries, designs, builds, markets, sells, and arranges finance for a range of detached and attached homes in luxury residential communities in the United States. It also designs, builds, markets, and sells condominiums through Toll Brothers City Living. In addition, the company develops a range of single-story living and first-floor primary bedroom suite home designs, as well as communities with recreational amenities, such as golf courses, marinas, pool complexes, country clubs, and fitness and recreation centers; develops and sells land; and develops, operates, and rents apartments, as well as provides various interior fit-out options, such as flooring, wall tile, plumbing, cabinets, fixtures, appliances, lighting, and home-automation and security technologies. Further, it owns and operates architectural, engineering, mortgage, title, insurance, smart home technology, landscaping, lumber distribution, house component assembly, and manufacturing operations. The company serves first-time, move-up, empty-nester, active-adult, and second-home buyers. It has a strategic partnership with Equity Residential to develop new rental apartment communities in the United States markets. The company was founded in 1967 and is headquartered in Fort Washington, Pennsylvania.

Moving Average

Toll Brothers’s worth is higher than its 50-day moving average of $59.89 and way higher than its 200-day moving average of $51.44.

More news about Toll Brothers.

22. Kellogg Company (K)

Shares of Kellogg Company rose 4.67% in from $67.69 to $70.85 at 19:21 EST on Tuesday, after two successive sessions in a row of gains. NYSE is sliding 0.25% to $15,352.81, after two sequential sessions in a row of gains.

Kellogg Company, together with its subsidiaries, manufactures and markets snacks and convenience foods. The company operates through four segments: North America, Europe, Latin America, and Asia Middle East Africa. Its principal products include crackers, crisps, savory snacks, toaster pastries, cereal bars, granola bars and bites, ready-to-eat cereals, frozen waffles, veggie foods, and noodles. The company offers its products under the Kellogg's, Cheez-It, Pringles, Austin, Parati, RXBAR, Kashi, Bear Naked, Eggo, Morningstar Farms, Choco Krispies, Crunchy Nut, Nutri-Grain, Special K, Squares, Zucaritas, Sucrilhos, Pop-Tarts, K-Time, Sunibrite, Split Stix, Be Natural, LCMs, Coco Pops, Frosties, Krave, Rice Krispies Treats, Kashi Go, Crunchy Nut, Rice Krispies Squares, Incogmeato, Veggitizers, and Gardenburger brand names. It sells its products to retailers through direct sales forces, as well as brokers and distributors. Kellogg Company was founded in 1906 and is headquartered in Battle Creek, Michigan.

Revenue Growth

Year-on-year quarterly revenue growth grew by 12.1%, now sitting on 15.32B for the twelve trailing months.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions, Kellogg Company’s stock is considered to be overbought (>=80).

Sales Growth

Kellogg Company’s sales growth is 7.6% for the ongoing quarter and 5% for the next.

More news about Kellogg Company.

23. NVIDIA (NVDA)

Shares of NVIDIA jumped 4.31% in from $275.31 to $287.18 at 19:21 EST on Tuesday, after two sequential sessions in a row of gains. NASDAQ is dropping 0.63% to $12,179.55, after two consecutive sessions in a row of gains.

NVIDIA Corporation provides graphics, and compute and networking solutions in the United States, Taiwan, China, and internationally. The company's Graphics segment offers GeForce GPUs for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, and solutions for gaming platforms; Quadro/NVIDIA RTX GPUs for enterprise workstation graphics; vGPU software for cloud-based visual and virtual computing; automotive platforms for infotainment systems; and Omniverse software for building 3D designs and virtual worlds. Its Compute & Networking segment provides Data Center platforms and systems for AI, HPC, and accelerated computing; Mellanox networking and interconnect solutions; automotive AI Cockpit, autonomous driving development agreements, and autonomous vehicle solutions; cryptocurrency mining processors; Jetson for robotics and other embedded platforms; and NVIDIA AI Enterprise and other software. The company's products are used in gaming, professional visualization, datacenter, and automotive markets. NVIDIA Corporation sells its products to original equipment manufacturers, original device manufacturers, system builders, add-in board manufacturers, retailers/distributors, independent software vendors, Internet and cloud service providers, automotive manufacturers and tier-1 automotive suppliers, mapping companies, start-ups, and other ecosystem participants. It has a strategic collaboration with Kroger Co. NVIDIA Corporation was incorporated in 1993 and is headquartered in Santa Clara, California.

Moving Average

NVIDIA’s worth is way above its 50-day moving average of $260.89 and way higher than its 200-day moving average of $186.54.

Sales Growth

NVIDIA’s sales growth is negative 21.5% for the ongoing quarter and 5.9% for the next.

More news about NVIDIA.

24. Netflix (NFLX)

Shares of Netflix dropped 1.83% in from $338.76 to $332.56 at 19:21 EST on Tuesday, after four successive sessions in a row of gains. NASDAQ is falling 0.63% to $12,179.55, after two consecutive sessions in a row of gains.

Netflix, Inc. provides entertainment services. It offers TV series, documentaries, feature films, and mobile games across various genres and languages. The company provides members the ability to receive streaming content through a host of internet-connected devices, including TVs, digital video players, television set-top boxes, and mobile devices. The company has approximately 231 million paid members in 190 countries. Netflix, Inc. was incorporated in 1997 and is headquartered in Los Gatos, California.

Yearly Top and Bottom Value

Netflix’s stock is valued at $332.56 at 19:21 EST, way below its 52-week high of $379.43 and way higher than its 52-week low of $162.71.

Moving Average

Netflix’s worth is above its 50-day moving average of $321.96 and way above its 200-day moving average of $289.62.

Revenue Growth

Year-on-year quarterly revenue growth grew by 3.7%, now sitting on 31.91B for the twelve trailing months.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions, Netflix’s stock is considered to be oversold (<=20).

More news about Netflix.

25. Colgate-Palmolive (CL)

Shares of Colgate-Palmolive jumped 7.32% in from $75.14 to $80.64 at 19:21 EST on Tuesday, after two successive sessions in a row of gains. NYSE is sliding 0.25% to $15,352.81, after two sequential sessions in a row of gains.

Colgate-Palmolive Company, together with its subsidiaries, manufactures and sells consumer products worldwide. The company operates through two segments, Oral, Personal and Home Care; and Pet Nutrition. The Oral, Personal and Home Care segment offers toothpaste, toothbrushes, mouthwash, bar and liquid hand soaps, shower gels, shampoos, conditioners, deodorants and antiperspirants, skin health products, dishwashing detergents, fabric conditioners, household cleaners, and other related items. This segment markets and sells its products under various brands, which include Colgate, Darlie, elmex, hello, meridol, Sorriso, Tom's of Maine, Irish Spring, Palmolive, Protex, Sanex, Softsoap, Lady Speed Stick, Speed Stick, EltaMD, Filorga, PCA SKIN, Ajax, Axion, Fabuloso, Murphy, Suavitel, Soupline, and Cuddly to a range of traditional and eCommerce retailers, wholesalers, and distributors. It also includes pharmaceutical products for dentists and other oral health professionals. The Pet Nutrition segment offers pet nutrition products for everyday nutritional needs under the Hill's Science Diet brand; and a range of therapeutic products to manage disease conditions in dogs and cats under the Hill's Prescription Diet brand. This segment markets and sells its products through pet supply retailers, veterinarians, and eCommerce retailers. Colgate-Palmolive Company was founded in 1806 and is headquartered in New York, New York.

Yearly Top and Bottom Value

Colgate-Palmolive’s stock is valued at $80.64 at 19:21 EST, below its 52-week high of $83.81 and way above its 52-week low of $67.84.

More news about Colgate-Palmolive.

26. Astrazeneca (AZN)

Shares of Astrazeneca rose 4.47% in from $72.07 to $75.29 at 19:21 EST on Tuesday, after two successive sessions in a row of gains. NYSE is dropping 0.25% to $15,352.81, after two consecutive sessions in a row of gains.

AstraZeneca PLC, a biopharmaceutical company, focuses on the discovery, development, manufacture, and commercialization of prescription medicines. The company's marketed products include Calquence, Enhertu, Faslodex, Imfinzi, Iressa, Koselugo, Lumoxiti, Lynparza, Orpathys, Tagrisso, and Zoladex for oncology; Andexxa/Ondexxya, Atacand, Atacand HCT, Atacand Plus, Brilinta/Brilique, Bydureon/Byetta, BCise, Byetta, Crestor, Evrenzo, Farxiga/Forxiga, Komboglyze/Kombiglyze XR, Lokelma, Onglyza, Qtern, Xigduo/Xigduo, and Zestril XR for cardiovascular, renal, and metabolism diseases; Accolate, Accoleit, Vanticon, Bevespi Aerosphere, Breztri Aerosphere, Bricanyl Respules and Turbuhaler, Daliresp/Daxas, Duaklir Genuair, Fasenra, Pulmicort, Rhinocort, Saphnelo, Symbicort, and Tezspire for respiratory and immunology; and Kanuma, Soliris, Strensiq, and Ultomiris for rare diseases. Its marketed products also comprise Synagis for respiratory syncytial virus; Fluenz Tetra/FluMist Quadrivalent for Influenza; and Vaxzevria and Evusheld for covid-19. The company serves primary care and specialty care physicians through distributors and local representative offices in the United Kingdom, rest of Europe, the Americas, Asia, Africa, and Australasia. It has a collaboration agreement with Neurimmune AG to develop and commercialize NI006; and Personalis, Inc. The company was formerly known as Zeneca Group PLC and changed its name to AstraZeneca PLC in April 1999. AstraZeneca PLC was incorporated in 1992 and is headquartered in Cambridge, the United Kingdom.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions, Astrazeneca’s stock is considered to be oversold (<=20).

More news about Astrazeneca.

27. CME Group (CME)

Shares of CME Group dropped 3.72% in from $193.14 to $185.96 at 19:21 EST on Tuesday, after three consecutive sessions in a row of gains. NASDAQ is dropping 0.63% to $12,179.55, after two successive sessions in a row of gains.

CME Group Inc., together with its subsidiaries, operates contract markets for the trading of futures and options on futures contracts worldwide. It offers futures and options products based on interest rates, equity indexes, foreign exchange, agricultural commodities, energy, and metals, as well as fixed income and foreign currency trading services. The company also provides clearing house services, including clearing, settling, and guaranteeing futures and options contracts, and cleared swaps products traded through its exchanges; and trade processing and risk mitigation services. In addition, the company offers a range of market data services, including real-time and historical data services. It serves professional traders, financial institutions, institutional and individual investors, corporations, manufacturers, producers, governments, and central banks. The company was formerly known as Chicago Mercantile Exchange Holdings Inc. and changed its name to CME Group Inc. in July 2007. CME Group Inc. was founded in 1898 and is headquartered in Chicago, Illinois.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions, CME Group’s stock is considered to be oversold (<=20).

More news about CME Group.

28. Teleflex (TFX)

Shares of Teleflex dropped 3.89% in from $261.77 to $251.59 at 19:21 EST on Tuesday, after three successive sessions in a row of gains. NYSE is sliding 0.25% to $15,352.81, after two successive sessions in a row of gains.

Teleflex Incorporated designs, develops, manufactures, and supplies single-use medical devices for common diagnostic and therapeutic procedures in critical care and surgical applications worldwide. It provides vascular access products that comprise Arrow branded catheters, catheter navigation and tip positioning systems, and intraosseous access systems for the administration of intravenous therapies, the measurement of blood pressure, and the withdrawal of blood samples through a single puncture site. The company also offers interventional products, which consists of various coronary catheters, structural heart therapies, and peripheral intervention and cardiac assist products that are used by interventional cardiologists and radiologists, and vascular surgeons; and Arrow branded catheters, Guideline, Turnpike, and Trapliner catheters, the Manta Vascular Closure, and Arrow Oncontrol devices. It provides anesthesia products, such as airway and pain management products to support hospital, emergency medicine, and military channels; and surgical products, including metal and polymer ligation clips, and fascial closure surgical systems that are used in laparoscopic surgical procedures, percutaneous surgical systems, and other surgical instruments. The company also offers interventional urology products comprising the UroLift System, an invasive technology for treating lower urinary tract symptoms due to benign prostatic hyperplasia; and respiratory products, including oxygen and aerosol therapies, spirometry, and ventilation management products for use in various care settings. It provides urology products, such as catheters, urine collectors, and catheterization accessories and products for operative endourology; and bladder management services. The company serves hospitals and healthcare providers, medical device manufacturers, and home care markets. The company was incorporated in 1943 and is headquartered in Wayne, Pennsylvania.

More news about Teleflex.

29. Exact Sciences (EXAS)

Shares of Exact Sciences jumped 6.55% in from $65.85 to $70.16 at 19:21 EST on Tuesday, after four sequential sessions in a row of gains. NASDAQ is falling 0.63% to $12,179.55, after two successive sessions in a row of gains.

Exact Sciences Corporation provides cancer screening and diagnostic test products in the United States and internationally. The company offers Cologuard, a non-invasive stool-based DNA screening test to detect DNA and hemoglobin biomarkers associated with colorectal cancer and pre-cancer. It also provides Oncotype DX Breast Recurrence Score Test; Oncotype DX Breast DCIS Score Test; Oncotype DX Colon Recurrence Score Test; OncoExTra Test for tumor profiling for patients with advanced, metastatic, refractory, relapsed, or recurrent cancer; and Covid-19 testing services. The company's pipeline products focus on enhancing the Cologuard test's performance characteristics and developing blood and other fluid-based tests. It has license agreements with MAYO Foundation for Medical Education and Research; and Hologic, Inc. Exact Sciences Corporation was incorporated in 1995 and is headquartered in Madison, Wisconsin.

Sales Growth

Exact Sciences’s sales growth is 11.7% for the present quarter and 8.5% for the next.

Growth Estimates Quarters

The company’s growth estimates for the current quarter and the next is 26.9% and 26.6%, respectively.

Yearly Top and Bottom Value

Exact Sciences’s stock is valued at $70.16 at 19:21 EST, under its 52-week high of $72.19 and way higher than its 52-week low of $29.27.

Revenue Growth

Year-on-year quarterly revenue growth grew by 16.7%, now sitting on 2.08B for the twelve trailing months.

More news about Exact Sciences.

30. Sempra Energy (SRE)

Shares of Sempra Energy jumped 0.42% in from $155.36 to $156.01 at 19:21 EST on Tuesday, after three successive sessions in a row of gains. NYSE is falling 0.25% to $15,352.81, after two consecutive sessions in a row of gains.

Sempra Energy operates as an energy infrastructure company in the United States and internationally. It operates through four segments: San Diego Gas & Electric Company, Southern California Gas Company, Sempra Texas Utilities, and Sempra Infrastructure. The San Diego Gas & Electric Company segment provides to San Diego and southern Orange counties; and natural gas service to San Diego County. It generates electricity through wind, solar, and other resources. As of December 31, 2022, it offered electric services to approximately 3.6 million population and natural gas services to approximately 3.3 million population that covers 4,100 square miles. The Southern California Gas Company segment owns and operates a natural gas distribution, transmission, and storage system that supplies natural gas. As of December 31, 2022, it serves a population of 21.1 million covering an area of 24,000 square miles. The Sempra Texas Utilities segment engages in the regulated electricity transmission and distribution. As of December 31, 2022, its transmission system included 18,268 circuit miles of transmission lines; 1,207 transmission and distribution substations; interconnection to 146 third-party generation facilities totaling 48,430 MW; and distribution system included approximately 3.9 million points of delivery and consisted of 123,500 miles of overhead and underground lines. The Sempra Infrastructure segment develops, builds, operates, and invests in energy infrastructure to help enable the energy transition in North American markets and worldwide. The company was formerly known as Mineral Energy company and changed its name to Sempra Energy in 1998. Sempra Energy was founded in 1998 and is based in San Diego, California.

Yearly Top and Bottom Value

Sempra Energy’s stock is valued at $156.01 at 19:21 EST, way under its 52-week high of $176.47 and way above its 52-week low of $136.54.

Volatility

Sempra Energy’s last week, last month’s, and last quarter’s current intraday variation average was 0.37%, 0.02%, and 1.08%.

Sempra Energy’s highest amplitude of average volatility was 0.63% (last week), 0.72% (last month), and 1.08% (last quarter).

More news about Sempra Energy.