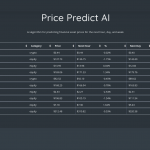

(VIANEWS) – Clearfield (CLFD), First Bancorp (FBNC), Sun Communities (SUI) are the highest sales growth and return on equity stocks on this list.

Here is a list of stocks with an above 5% expected next quarter sales growth, and a 3% or higher return on equity. May these stocks be a good medium-term investment option?

1. Clearfield (CLFD)

38.9% sales growth and 26.07% return on equity

Clearfield, Inc. manufactures, markets, and sells standard and custom passive connectivity products to the fiber-to-the-premises, enterprises, and original equipment manufacturers markets in the United States and internationally. The company offers FieldSmart, a series of panels, cabinets, wall boxes, and other enclosures. It also provides WaveSmart, which are optical components integrated for signal coupling, splitting, termination, multiplexing, demultiplexing, and attenuation for integration within its fiber management platform; and outdoor cabinet and fiber active cabinet products. The company offers StreetSmart, a portfolio of fiber management products; FieldShield, a fiber pathway and protection method for reducing the cost of broadband deployment; and YOURx platform that consists of hardened terminals, test access points, and various drop cable options for portions of the access network across various fiber drop cable media. It also provides CraftSmart, a line of optical protection field enclosures, including CraftSmart Fiber Protection Pedestals and CraftSmart Fiber Protection Vaults integrated solutions optimized to house FieldSmart products at the last mile access point of the network in above-grade or below-grade installations. The company offers fiber and copper assemblies with an industry-standard or customer-specified configuration; and designs and manufactures custom solutions for in-the-box and network connectivity assemblies specific to that customer's product line. It provides its fiber to anywhere platform for various incumbent local exchange carriers, competitive local exchange carriers, wireless operators, and multiple systems operators and cable TV companies, as well as the utility/municipality, enterprise, and data center markets. The company was formerly known as APA Enterprises, Inc. and changed its name to Clearfield, Inc. in January 2008. Clearfield, Inc. was founded in 1979 and is headquartered in Minneapolis, Minnesota.

Earnings Per Share

As for profitability, Clearfield has a trailing twelve months EPS of $3.88.

PE Ratio

Clearfield has a trailing twelve months price to earnings ratio of 15.87. Meaning, the purchaser of the share is investing $15.87 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 26.07%.

Moving Average

Clearfield’s worth is way below its 50-day moving average of $79.24 and way under its 200-day moving average of $88.43.

Yearly Top and Bottom Value

Clearfield’s stock is valued at $61.56 at 15:22 EST, way under its 52-week high of $134.90 and way higher than its 52-week low of $48.91.

2. First Bancorp (FBNC)

23.6% sales growth and 12.99% return on equity

First Bancorp operates as the bank holding company for First Bank that provides banking products and services for individuals and small to medium-sized businesses primarily in North Carolina and northeastern South Carolina. It accepts deposit products, such as checking, savings, and money market accounts, as well as time deposits, including certificate of deposits and individual retirement accounts. The company also offers loans for a range of consumer and commercial purposes comprising loans for business, real estate, personal, home improvement, and automobiles, as well as residential mortgages and small business administration loans; and accounts receivable financing and factoring, inventory financing, and purchase order financing services. In addition, it provides credit and debit cards, letter of credits, and safe deposit box rental services, as well as electronic funds transfer services consisting of wire transfers; and internet and mobile banking, cash management, bank-by-phone services, and remote deposit capture services. Further, the company offers investment and insurance products, such as mutual funds, annuities, long-term care insurance, life insurance, and company retirement plans, as well as property and casualty insurance products; and financial planning services. First Bancorp was founded in 1934 and is headquartered in Southern Pines, North Carolina.

Earnings Per Share

As for profitability, First Bancorp has a trailing twelve months EPS of $3.18.

PE Ratio

First Bancorp has a trailing twelve months price to earnings ratio of 13.05. Meaning, the purchaser of the share is investing $13.05 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 12.99%.

3. Sun Communities (SUI)

17.6% sales growth and 3.73% return on equity

Sun Communities, Inc. is a REIT that, as of March 31, 2022, owned, operated, or had an interest in a portfolio of 603 developed MH, RV and marina properties comprising nearly 159,300 developed sites and over 45,700 wet slips and dry storage spaces in 39 states, Canada, Puerto Rico and the UK.

Earnings Per Share

As for profitability, Sun Communities has a trailing twelve months EPS of $1.69.

PE Ratio

Sun Communities has a trailing twelve months price to earnings ratio of 85.6. Meaning, the purchaser of the share is investing $85.6 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 3.73%.

Growth Estimates Quarters

The company’s growth estimates for the ongoing quarter is a negative 9.1% and positive 2100% for the next.

4. Sterling Construction Company (STRL)

12.6% sales growth and 22.41% return on equity

Sterling Construction Company, Inc., a construction company, engages in the heavy civil, specialty services, and residential construction activities primarily in the southern United States, the Rocky Mountain states, California, and Hawaii. The company undertakes various heavy civil construction projects, including highways, roads, bridges, airfields, ports, light rail, water, wastewater and storm drainage systems for the departments of transportation in various states, regional transit authorities, airport authorities, port authorities, water authorities, and railroads. It offers specialty services such as foundations for multi-family homes, parking structures, and other commercial concrete projects for blue-chip end users in the e-commerce, data center, distribution center and warehousing, energy, mixed use, and multi-family sectors. The company also undertakes concrete foundations for single-family homes. In addition, it provides surveying, clearing and grubbing, erosion control, grading, grassing, site excavation, storm drainage, sanitary sewer and water main installation, drilling and blasting, curb and gutter, paving, concrete work, and landfill services. The company was formerly known as Oakhurst Company, Inc. and changed its name to Sterling Construction Company, Inc. in November 2001. Sterling Construction Company, Inc. was founded in 1955 and is headquartered in The Woodlands, Texas.

Earnings Per Share

As for profitability, Sterling Construction Company has a trailing twelve months EPS of $1.76.

PE Ratio

Sterling Construction Company has a trailing twelve months price to earnings ratio of 21.13. Meaning, the purchaser of the share is investing $21.13 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 22.41%.

Yearly Top and Bottom Value

Sterling Construction Company’s stock is valued at $37.10 at 15:22 EST, below its 52-week high of $37.56 and way higher than its 52-week low of $20.46.

Revenue Growth

Year-on-year quarterly revenue growth grew by 27.1%, now sitting on 1.79B for the twelve trailing months.

Moving Average

Sterling Construction Company’s worth is way higher than its 50-day moving average of $33.03 and way higher than its 200-day moving average of $26.87.

Sales Growth

Sterling Construction Company’s sales growth is 9.9% for the ongoing quarter and 12.6% for the next.