(VIANEWS) – Shares of EPAM Systems (NYSE: EPAM) fell by a staggering 15.74% in 5 sessions from $366.53 to $308.84 at 14:22 EST on Thursday, after four successive sessions in a row of losses. NYSE is falling 0.13% to $15,510.50, after five sequential sessions in a row of losses.

EPAM Systems’s last close was $311.08, 32.81% under its 52-week high of $462.99.

About EPAM Systems

EPAM Systems, Inc. provides digital platform engineering and software development services worldwide. The company offers engineering services, including requirements analysis and platform selection, customization, cross-platform migration, implementation, and integration; infrastructure management services, such as software development, testing, and maintenance with private, public, and mobile infrastructures for application, database, network, server, storage, and systems operations management, as well as monitoring, incident notification, and resolution services; and maintenance and support services. It also provides operation solutions comprising integrated engineering practices and smart automation; and optimization solutions that include software application testing, test management, automation, and consulting services to enable customers enhance their existing software testing and quality assurance practices, as well as other testing services that identify threats and close loopholes to protect its customers' business systems from information loss. In addition, the company offers business, experience, technology, data, and technical advisory consulting services; and digital and service design solutions, which comprise strategy, design, creative, and program management services, as well as physical product development, such as artificial intelligence, robotics, and virtual reality. It serves the financial services, travel and consumer, software and hi-tech, business information and media, life sciences and healthcare, and other industries. The company was founded in 1993 and is headquartered in Newtown, Pennsylvania.

Earnings Per Share

As for profitability, EPAM Systems has a trailing twelve months EPS of $5.6.

PE Ratio

EPAM Systems has a trailing twelve months price to earnings ratio of 55.15. Meaning, the purchaser of the share is investing $55.15 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 15.95%.

Volatility

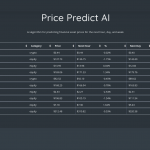

EPAM Systems’s last week, last month’s, and last quarter’s current intraday variation average was a negative 1.50%, a negative 0.09%, and a positive 2.31%.

EPAM Systems’s highest amplitude of average volatility was 2.62% (last week), 2.50% (last month), and 2.31% (last quarter).

Yearly Top and Bottom Value

EPAM Systems’s stock is valued at $308.84 at 14:22 EST, way under its 52-week high of $462.99 and way higher than its 52-week low of $168.59.

More news about EPAM Systems (EPAM).