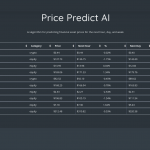

(VIANEWS) – EUR/CHF (EURCHF) has been up by 1.54% for the last 21 sessions. At 07:06 EST on Wednesday, 8 February, EUR/CHF (EURCHF) is $0.99.

EUR/CHF’s yearly highs and lows, it’s 4.698% up from its 52-week low and 6.964% down from its 52-week high.

Volatility

EUR/CHF’s last week, last month’s, and last quarter’s current intraday variation average was a negative 0.45%, a positive 0.02%, and a positive 0.29%, respectively.

EUR/CHF’s highest amplitude of average volatility was 0.45% (last week), 0.34% (last month), and 0.29% (last quarter), respectively.

Forex Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions, EUR/CHF’s Forex is considered to be overbought (>=80).

News about

- Usd/jpy skids below 132.50 as boj confirms stealth intervention. According to FXStreet on Tuesday, 7 February, "The USD/JPY pair has slipped below the immediate cushion of 132.50 in the Asian session. ", "On the Japanese Yen front, the stealth intervention by the BoJ might have been conducted amid fresh concerns that further interest rate hikes by the Fed will weaken the USD/JPY broadly."

- Usd/jpy: the ingredients are in place for a renewed move lower – HSBC. According to FXStreet on Monday, 6 February, "A move lower in USD/JPY over the coming few weeks will mostly rely on the outlook for BoJ policy change, but other more medium-term forces (such as improving current account balance) should also be helping in the background."

- Usd/jpy price analysis: renews three-week high but 50-dma probes bulls. According to FXStreet on Monday, 6 February, "However, the 50-DMA hurdle surrounding 132.70 presently challenges the USD/JPY bulls. ", "If at all the USD/JPY bears manage to conquer the 128.20 support bottom surrounding 127.20 and May 2022 low near 126.35 could probe them before highlighting the 120.00 round figure."

- Breaking: boj intervention sinking usd/jpy. According to FXStreet on Tuesday, 7 February, "At the time, USD/JPY was soaring and made life uncomfortable for the Japanese central bank."

More news about EUR/CHF (EURCHF).