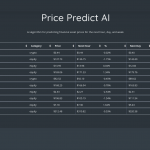

(VIANEWS) – Gap (GPS), Universal Health Realty Income Trust (UHT), Ardmore Shipping Corporation (ASC) have the highest dividend yield stocks on this list.

| Financial Asset | Forward Dividend Yield | Updated (EST) |

|---|---|---|

| Gap (GPS) | 7.19% | 2023-05-28 03:18:05 |

| Universal Health Realty Income Trust (UHT) | 6.49% | 2023-05-23 15:06:08 |

| Ardmore Shipping Corporation (ASC) | 6.23% | 2023-05-18 23:07:08 |

| Luxfer Holdings PLC (LXFR) | 3.62% | 2023-05-21 11:23:07 |

| MiX Telematics Limited (MIXT) | 2.95% | 2023-05-21 16:42:09 |

A little less 2K companies listed in the Nasdaq and NYSE pay out dividends to its shareholders. The dividend yield is a dividend to price ratio showing how much a company pays out in dividends each year.

1. Gap (GPS) – Dividend Yield: 7.19%

Gap’s last close was $8.34, 46.16% below its 52-week high of $15.49. Intraday change was 13.68%.

The Gap, Inc. operates as an apparel retail company. The company offers apparel, accessories, and personal care products for men, women, and children under the Old Navy, Gap, Banana Republic, and Athleta brands. Its products include denim and khakis; eyewear, jewelry, shoes, handbags, and fragrances; and fitness and lifestyle products for use in yoga, training, sports, travel, and everyday activities for women and girls. The company offers its products through company-operated stores, franchise stores, websites, and third-party arrangements. It has franchise agreements to operate Old Navy, Gap, Banana Republic, and Athleta stores and websites in Asia, Europe, Latin America, the Middle East, and Africa. The company also provides its products through e-commerce sites. The Gap, Inc. was incorporated in 1969 and is headquartered in San Francisco, California.

Earnings Per Share

As for profitability, Gap has a trailing twelve months EPS of $-0.55.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is negative -2.5%.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions, Gap’s stock is considered to be oversold (<=20).

More news about Gap.

2. Universal Health Realty Income Trust (UHT) – Dividend Yield: 6.49%

Universal Health Realty Income Trust’s last close was $44.04, 23.44% below its 52-week high of $57.52. Intraday change was 1.45%.

Universal Health Realty Income Trust, a real estate investment trust, invests in healthcare and human service related facilities including acute care hospitals, rehabilitation hospitals, sub-acute care facilities, medical/office buildings, free-standing emergency departments and childcare centers. We have investments in seventy-one properties located in twenty states, including two that are currently under construction.

Earnings Per Share

As for profitability, Universal Health Realty Income Trust has a trailing twelve months EPS of $1.46.

PE Ratio

Universal Health Realty Income Trust has a trailing twelve months price to earnings ratio of 30.6. Meaning, the purchaser of the share is investing $30.6 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 8.78%.

Revenue Growth

Year-on-year quarterly revenue growth grew by 5.2%, now sitting on 92.99M for the twelve trailing months.

Moving Average

Universal Health Realty Income Trust’s worth is below its 50-day moving average of $46.26 and below its 200-day moving average of $49.16.

Dividend Yield

According to Morningstar, Inc., the next dividend payment is on Mar 16, 2023, the estimated forward annual dividend rate is 2.86 and the estimated forward annual dividend yield is 6.49%.

More news about Universal Health Realty Income Trust.

3. Ardmore Shipping Corporation (ASC) – Dividend Yield: 6.23%

Ardmore Shipping Corporation’s last close was $12.44, 35.91% under its 52-week high of $19.41. Intraday change was 0.16%.

Ardmore Shipping Corporation engages in the seaborne transportation of petroleum products and chemicals worldwide. As of February 15, 2021, the company operated a fleet of 25 double-hulled product and chemical tankers. It serves oil majors, oil companies, oil and chemical traders, chemical companies, and pooling service providers. The company was founded in 2010 and is based in Pembroke, Bermuda.

Earnings Per Share

As for profitability, Ardmore Shipping Corporation has a trailing twelve months EPS of $4.64.

PE Ratio

Ardmore Shipping Corporation has a trailing twelve months price to earnings ratio of 2.68. Meaning, the purchaser of the share is investing $2.68 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 44.28%.

Yearly Top and Bottom Value

Ardmore Shipping Corporation’s stock is valued at $12.44 at 20:15 EST, way under its 52-week high of $19.41 and way higher than its 52-week low of $6.32.

Earnings Before Interest, Taxes, Depreciation, and Amortization

Ardmore Shipping Corporation’s EBITDA is 1.33.

More news about Ardmore Shipping Corporation.

4. Luxfer Holdings PLC (LXFR) – Dividend Yield: 3.62%

Luxfer Holdings PLC’s last close was $14.76, 17.22% below its 52-week high of $17.83. Intraday change was 0.2%.

Luxfer Holdings PLC, a materials technology company, designs, manufactures, and supplies high-performance materials, components, and high-pressure gas cylinders for transportation, defense and emergency response, healthcare, and general industrial end-market applications. It operates in two segments, Gas Cylinders and Elektron. The Gas Cylinders segment manufactures and markets aluminum, titanium, and carbon composite cylinders, which are used for self-contained breathing apparatus that are used by firefighters and other emergency-responders, as well as scuba divers and personnel in potentially hazardous environments, such as mines; and aluminum and composite cylinders for use in the containment of oxygen and other medical gases that are used by patients, healthcare facilities, and laboratories. This segment also offers carbon composite cylinders for compressed natural gas and hydrogen containment in alternative fuel vehicles; lightweight aluminum cylinders for a variety of industrial applications, such as fire extinguishers and containment of high-purity specialty gases; and lightweight aluminum and titanium panels primarily for use in the aerospace and luxury-auto industries. The Elektron segment focuses on specialty materials based on magnesium, zircon sand, and rare earths. It develops and manufactures magnesium alloys; magnesium powders; and magnesium, copper, and zinc photoengraving plates for graphic arts and luxury packaging. This segment also develops and manufactures zirconium-based materials and oxides used as catalysts and in the manufacture of advanced ceramics, fiber-optic fuel cells, and other performance products. Luxfer Holdings PLC has operations in the United States, the United Kingdom, Germany, Italy, France, rest of Europe, the Asia Pacific, Canada, South America, Latin America, and Africa. The company was founded in 1898 and is headquartered in Manchester, the United Kingdom.

Earnings Per Share

As for profitability, Luxfer Holdings PLC has a trailing twelve months EPS of $0.9.

PE Ratio

Luxfer Holdings PLC has a trailing twelve months price to earnings ratio of 16.4. Meaning, the purchaser of the share is investing $16.4 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 11.79%.

Volume

Today’s last reported volume for Luxfer Holdings PLC is 66848 which is 45.44% below its average volume of 122541.

Earnings Before Interest, Taxes, Depreciation, and Amortization

Luxfer Holdings PLC’s EBITDA is 1.22.

Yearly Top and Bottom Value

Luxfer Holdings PLC’s stock is valued at $14.76 at 20:15 EST, way below its 52-week high of $17.83 and way above its 52-week low of $12.71.

Sales Growth

Luxfer Holdings PLC’s sales growth is 0.5% for the ongoing quarter and 4.9% for the next.

More news about Luxfer Holdings PLC.

5. MiX Telematics Limited (MIXT) – Dividend Yield: 2.95%

MiX Telematics Limited’s last close was $7.23, 32.24% below its 52-week high of $10.67. Intraday change was -2.56%.

MiX Telematics Limited provides fleet and mobile asset management solutions through software-as-a-service (Saas) delivery model. The company offers fleet solutions, including MiX Fleet Manager Premium that provides access to secure information about drivers and vehicles; MiX Fleet Manager Essential for monitoring drivers and vehicles; and MiX Asset Manager used to track hardware products and other assets. It also provides consumer solutions, including Matrix that provides vehicle tracking, telematics, and personal safety services; and Beame, a wireless device, which offers vehicle recovery services. In addition, the company provides value added services comprising driver communication, collision prevention and reduction, satellite communication, track and react bureau, driver performance management, driving monitoring, field services management, driver engagement, fuel management and security solutions, and driver identification solutions, as well as voice kits and keypads, and in-vehicle cameras. It delivers fleet and mobile asset management solutions as SaaS to 818,487 subscribers in South Africa, the Americas, the Middle East, Australia, Europe, and Brazil. The company was founded in 1996 and is based in Boca Raton, Florida.

Earnings Per Share

As for profitability, MiX Telematics Limited has a trailing twelve months EPS of $0.35.

PE Ratio

MiX Telematics Limited has a trailing twelve months price to earnings ratio of 20.66. Meaning, the purchaser of the share is investing $20.66 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 4.97%.

Earnings Before Interest, Taxes, Depreciation, and Amortization

MiX Telematics Limited’s EBITDA is 45.79.

Moving Average

MiX Telematics Limited’s worth is under its 50-day moving average of $7.88 and below its 200-day moving average of $7.88.

Dividend Yield

As maintained by Morningstar, Inc., the next dividend payment is on Feb 15, 2023, the estimated forward annual dividend rate is 0.22 and the estimated forward annual dividend yield is 2.95%.

More news about MiX Telematics Limited.