(VIANEWS) – Another day of trading has ended and here’s today’s list of stocks that have had significant trading activity in the US session.

The three biggest winners today are Glori Energy, Genetic Technologies Ltd, and Catalent.

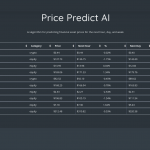

| Rank | Financial Asset | Price | Change | Updated (EST) |

|---|---|---|---|---|

| 1 | Glori Energy (GLRI) | 0.00 | 9900% | 2023-02-06 07:48:17 |

| 2 | Genetic Technologies Ltd (GENE) | 1.82 | 82% | 2023-02-06 07:09:07 |

| 3 | Catalent (CTLT) | 66.94 | 19.43% | 2023-02-06 15:52:29 |

| 4 | Heron Therapeutics (HRTX) | 3.29 | 15.67% | 2023-02-06 15:07:09 |

| 5 | AMC (AMC) | 6.86 | 12.8% | 2023-02-06 15:50:50 |

| 6 | Galectin Therapeutics (GALT) | 1.32 | 10.42% | 2023-02-06 05:14:12 |

| 7 | Snap (SNAP) | 12.06 | 9.59% | 2023-02-06 15:53:52 |

| 8 | Celsius Holdings (CELH) | 99.42 | 7.91% | 2023-02-06 15:47:09 |

| 9 | GameStop (GME) | 23.91 | 7.46% | 2023-02-06 15:59:51 |

| 10 | Good Times Restaurants (GTIM) | 2.91 | 5.72% | 2023-02-06 10:43:18 |

The three biggest losers today are Xenetic Biosciences, 1-800-FLOWERS.COM, and Tattooed Chef.

| Rank | Financial Asset | Price | Change | Updated (EST) |

|---|---|---|---|---|

| 1 | Xenetic Biosciences (XBIO) | 0.58 | -17.69% | 2023-02-06 15:50:02 |

| 2 | 1-800-FLOWERS.COM (FLWS) | 11.23 | -14.37% | 2023-02-06 01:13:08 |

| 3 | Tattooed Chef (TTCF) | 1.51 | -8.79% | 2023-02-06 15:54:05 |

| 4 | Identiv (INVE) | 8.73 | -7.57% | 2023-02-06 15:58:31 |

| 5 | Beyond Meat (BYND) | 17.99 | -7.36% | 2023-02-06 15:47:02 |

| 6 | Groupon (GRPN) | 8.14 | -7.35% | 2023-02-06 15:57:39 |

| 7 | SmileDirectClub (SDC) | 0.65 | -7.09% | 2023-02-06 15:49:09 |

| 8 | Canaan (CAN) | 3.35 | -6.94% | 2023-02-06 15:47:06 |

| 9 | Restoration Hardware Holdings (RH) | 319.97 | -6.88% | 2023-02-06 15:49:01 |

| 10 | V.F. Corporation (VFC) | 28.59 | -6.61% | 2023-02-06 15:58:19 |

Winners today

1. Glori Energy (GLRI) – 9900%

Glori Energy Inc., an energy technology and oil production company, provides services to third party exploration and production companies in North America and Brazil. It operates through Oil and Gas, and AERO Services segments. The Oil and Gas segment produces and develops oil and natural gas interests. The AERO Services segment offers biotechnology solutions of enhanced oil recovery through a two-step process, including analysis phase, reservoir screening process that obtains field samples and evaluates potential of AERO system; and field deployment phase that deploys skid mounted injection equipment. Glori Energy Inc. was founded in 2005 and is headquartered in Houston, Texas.

NASDAQ ended the session with Glori Energy jumping 9900% to $0.00 on Monday while NASDAQ fell 1% to $11,887.45.

Earnings Per Share

As for profitability, Glori Energy has a trailing twelve months EPS of $-1.13.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is negative -233.02%.

Volume

Today’s last reported volume for Glori Energy is 20000 which is 429.1% above its average volume of 3780.

Revenue Growth

Year-on-year quarterly revenue growth declined by 44.9%, now sitting on 5.11M for the twelve trailing months.

Yearly Top and Bottom Value

Glori Energy’s stock is valued at $0.00 at 16:32 EST, below its 52-week low of $0.00.

More news about Glori Energy.

2. Genetic Technologies Ltd (GENE) – 82%

Genetic Technologies Limited, a molecular diagnostics company, provides predictive genetic testing and risk assessment tools to help physicians manage people's health in the United States, Canada, Europe, the Middle East, Africa, Latin America, and the Asia Pacific. It operates in two segments, EasyDNA and GeneType/Corporate. The company offers BREVAGenplus, a clinically validated risk assessment test for non-hereditary breast cancer. It also markets BREVAGenplus to healthcare professionals in breast health care and imaging centers, as well as to obstetricians/gynecologists and breast cancer risk assessment specialists, such as breast surgeons. In addition, the company offers various cancer risk assessment tests under the GeneType for Colorectal Cancer and GeneType for Breast Cancer brand names; and develops other risk assessment tests across a range of diseases, which include colorectal cancer, ovarian cancer, prostate cancer, coronary artery, and type 2 diabetes. Further, it offers genetic testing services, including medical, animal, forensic, and plant testing. The company has research and collaboration agreements with the University of Melbourne, Translational Genomics Research Institute, Memorial Sloan Kettering New York Cambridge University, the Ohio State University, and Shivom. Genetic Technologies Limited was incorporated in 1987 and is headquartered in Fitzroy, Australia.

NASDAQ ended the session with Genetic Technologies Ltd rising 82% to $1.82 on Monday while NASDAQ dropped 1% to $11,887.45.

Earnings Per Share

As for profitability, Genetic Technologies Ltd has a trailing twelve months EPS of $-0.6.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is negative -37.57%.

Volume

Today’s last reported volume for Genetic Technologies Ltd is 90615400 which is 5289.58% above its average volume of 1681310.

Moving Average

Genetic Technologies Ltd’s worth is way above its 50-day moving average of $1.05 and way above its 200-day moving average of $1.27.

More news about Genetic Technologies Ltd.

3. Catalent (CTLT) – 19.43%

Catalent, Inc., together with its subsidiaries, develops and manufactures solutions for drugs, protein-based biologics, cell and gene therapies, and consumer health products worldwide. The Softgel and Oral Technologies segment provides formulation, development, and manufacturing services for soft capsules for use in a range of customer products, such as prescription drugs, over-the-counter medications, dietary supplements, unit-dose cosmetics, and animal health medicinal preparations. The Biologics segment provides biologic cell-line; develops and manufactures cell therapy and viral based gene therapy; formulation, development, and manufacturing for parenteral dose forms, including vials, prefilled syringes, vials, and cartridges; and analytical development and testing services. The Oral and Specialty Delivery segment offers formulation, development, and manufacturing across a range of technologies along with integrated downstream clinical development and commercial supply solutions. This segment also offers oral delivery solutions platform comprising pre-clinical screening, formulation, analytical development, and current good manufacturing practices services. The Clinical Supply Services segment offers manufacturing, packaging, storage, distribution, and inventory management for drugs and biologics, and cell and gene therapies in clinical trials. The company also offers FlexDirect direct-to-patient and FastChain demand-led clinical supply services. It serves pharmaceutical, biotechnology, and consumer health companies; and companies in other healthcare market segments, such as animal health and medical devices, as well as in cosmetics industries. The company was incorporated in 2007 and is headquartered in Somerset, New Jersey.

NYSE ended the session with Catalent rising 19.43% to $66.94 on Monday, after two sequential sessions in a row of losses. NYSE dropped 0.63% to $15,898.10, following the last session’s downward trend on what was a somewhat bearish trend exchanging session today.

: catalent stock rockets 21% premarket on report of takeover interest from danaherLife Sciences Company Danaher Corp. is interested in taking over contract manufacturer Catalent Inc. and is willing to pay a significant premium for the company, Bloomberg reported Monday, citing people familiar with the matter. , It’s unclear whether Catalent is receptive, the people said, adding that a deal is not imminent.

Catalent shares jump on report danaher wants to buy itLife Sciences Company Danaher Corp. is interested in taking over contract manufacturer Catalent Inc. and is willing to pay a significant premium for the company, Bloomberg reported Monday, citing people familiar with the matter. , It’s unclear whether Catalent is receptive, the people said, adding that a deal is not imminent.

Earnings Per Share

As for profitability, Catalent has a trailing twelve months EPS of $1.8.

PE Ratio

Catalent has a trailing twelve months price to earnings ratio of 37.09. Meaning,

the purchaser of the share is investing $37.09 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 11.45%.

More news about Catalent.

4. Heron Therapeutics (HRTX) – 15.67%

Heron Therapeutics, Inc., a biotechnology company, engages in developing treatments to address unmet medical needs. The company's product candidates utilize its proprietary Biochronomer, a drug delivery technology, which delivers therapeutic levels of a range of short-acting pharmacological agents over a period from days to weeks with a single administration. It offers SUSTOL (granisetron), an extended-release injection for the prevention of acute and delayed nausea and vomiting associated with moderately emetogenic chemotherapy, or anthracycline and cyclophosphamide combination chemotherapy regimens; and CINVANTI, an intravenous formulation of aprepitant, a substance P/neurokinin-1 receptor antagonist for the prevention of acute and delayed nausea and vomiting associated with highly emetogenic cancer chemotherapy, as well as nausea and vomiting associated with moderately emetogenic cancer chemotherapy. The company is also developing HTX-011, an investigational, dual-acting, and fixed-dose combination of the local anesthetic bupivacaine with a low dose of the nonsteroidal anti-inflammatory drug meloxicam, which is in Phase III clinical trials for pain management; and HTX-034, which is in Phase Ib/II clinical trials for postoperative pain management. The company was formerly known as A.P. Pharma, Inc. and changed its name to Heron Therapeutics, Inc. in January 2014. Heron Therapeutics, Inc. was founded in 1983 and is headquartered in San Diego, California.

NASDAQ ended the session with Heron Therapeutics jumping 15.67% to $3.29 on Monday, following the last session’s downward trend. NASDAQ fell 1% to $11,887.45, following the last session’s downward trend on what was a somewhat bearish trend trading session today.

Earnings Per Share

As for profitability, Heron Therapeutics has a trailing twelve months EPS of $-2.293.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is negative -306.88%.

Moving Average

Heron Therapeutics ‘s value is way higher than its 50-day moving average of $2.69 and under its 200-day moving average of $3.48.

Revenue Growth

Year-on-year quarterly revenue growth grew by 14.3%, now sitting on 98.3M for the twelve trailing months.

Sales Growth

Heron Therapeutics ‘s sales growth is 30.2% for the present quarter and 31.4% for the next.

Volume

Today’s last reported volume for Heron Therapeutics is 2690040 which is 4.92% above its average volume of 2563660.

More news about Heron Therapeutics .

5. AMC (AMC) – 12.8%

AMC Entertainment Holdings, Inc., through its subsidiaries, engages in the theatrical exhibition business. The company owns, operates, or has interests in theatres in the United States and Europe. As of March 1, 2022, it operated approximately 950 theatres and 10,600 screens. The company was founded in 1920 and is headquartered in Leawood, Kansas.

NYSE ended the session with AMC jumping 12.8% to $6.86 on Monday, after two sequential sessions in a row of losses. NYSE fell 0.63% to $15,898.10, following the last session’s downward trend on what was a somewhat negative trend exchanging session today.

: AMC stock rises 14% amid meme-stock rallyA meme-stock rally heated up in afternoon trading Monday, leading to a brief volatility-related halt in shares of AMC Entertainment Holdings Inc. AMC shares were halted at 3:28 p.m.

Earnings Per Share

As for profitability, AMC has a trailing twelve months EPS of $-39.15.

Moving Average

AMC’s worth is way higher than its 50-day moving average of $5.77 and way below its 200-day moving average of $10.59.

More news about AMC.

6. Galectin Therapeutics (GALT) – 10.42%

Galectin Therapeutics Inc., a clinical stage biopharmaceutical company, engages in the research and development of therapies for fibrotic, cancer, and other diseases. The company's lead product candidate is belapectin (GR-MD-02) galectin-3 inhibitor, a galactoarabino-rhamnogalacturonan polysaccharide polymer that is in Phase III clinical trial for the treatment of liver fibrosis associated with fatty liver disease and non-alcoholic steatohepatitis cirrhosis, as well as for the treatment of cancer. It also engages in developing GM-CT-01, which is in pre-clinical development stage for the treatment of cardiac and vascular fibrosis, as well as focuses on developing belapectin for the treatment of psoriasis, and lung and kidney fibrosis. The company, through its Galectin Sciences, LLC, which is a collaborative joint venture co-owned by SBH Sciences, Inc., to research and development of small organic molecule inhibitors of galectin-3 for oral administration. The company was formerly known as Pro-Pharmaceuticals, Inc. and changed its name to Galectin Therapeutics, Inc. in May 2011. Galectin Therapeutics Inc. was founded in 2000 and is based in Norcross, Georgia.

NASDAQ ended the session with Galectin Therapeutics rising 10.42% to $1.32 on Monday while NASDAQ fell 1% to $11,887.45.

Earnings Per Share

As for profitability, Galectin Therapeutics has a trailing twelve months EPS of $-0.58.

Yearly Top and Bottom Value

Galectin Therapeutics’s stock is valued at $1.32 at 16:32 EST, way under its 52-week high of $2.57 and way higher than its 52-week low of $1.02.

Earnings Before Interest, Taxes, Depreciation, and Amortization

Galectin Therapeutics’s EBITDA is -12.56.

Volume

Today’s last reported volume for Galectin Therapeutics is 211888 which is 149.45% above its average volume of 84940.

More news about Galectin Therapeutics.

7. Snap (SNAP) – 9.59%

Snap Inc. operates as a camera company in North America, Europe, and internationally. The company offers Snapchat, a camera application with various functionalities, such as Camera, Communication, Snap Map, Stories, and Spotlight that enable people to communicate visually through short videos and images. It also provides Spectacles, an eyewear product that connects with Snapchat and captures photos and video from a human perspective; and advertising products, including AR ads and Snap ads comprises a single image or video ads, story ads, collection ads, dynamic ads, and commercials. The company was formerly known as Snapchat, Inc. and changed its name to Snap Inc. in September 2016. Snap Inc. was founded in 2010 and is headquartered in Santa Monica, California.

NYSE ended the session with Snap rising 9.59% to $12.06 on Monday while NYSE fell 0.63% to $15,898.10.

Earnings Per Share

As for profitability, Snap has a trailing twelve months EPS of $-0.63.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is negative -21.28%.

Yearly Top and Bottom Value

Snap’s stock is valued at $12.06 at 16:32 EST, below its 52-week low of $12.55.

More news about Snap.

8. Celsius Holdings (CELH) – 7.91%

Celsius Holdings, Inc. develops, processes, markets, distributes, and sells functional drinks and liquid supplements in North America, Europe, Asia, and internationally. It offers various carbonated and non-carbonated functional energy drinks under the CELSIUS Originals name; dietary supplement in carbonated flavors, including apple jack'd, orangesicle, inferno punch, cherry lime, blueberry pomegranate, strawberry dragon fruit, tangerine grapefruit, and jackfruit under the CELSIUS HEAT name; and branched-chain amino acids functional energy drink that fuels muscle recovery under the CELSIUS BCCA+ENERGY name. The company also provides CELSIUS On-the-Go, a powdered form of the active ingredients in functional energy drinks in individual On-The-Go packets and canisters; and sparkling grapefruit, cucumber lime, and orange pomegranate, as well as pineapple coconut, watermelon berry, and strawberries and cream non-carbonated functional energy drinks under the CELSIUS Sweetened. It distributes its products through direct-to-store delivery distributors and direct to retailers, including supermarkets, convenience stores, drug stores, nutritional stores, and mass merchants, as well as health clubs, spas, gyms, the military, and e-commerce websites. The company was formerly known as Vector Ventures, Inc. and changed its name to Celsius Holdings, Inc. in January 2007. Celsius Holdings, Inc. was founded in 2004 and is headquartered in Boca Raton, Florida.

NASDAQ ended the session with Celsius Holdings jumping 7.91% to $99.42 on Monday while NASDAQ dropped 1% to $11,887.45.

Earnings Per Share

As for profitability, Celsius Holdings has a trailing twelve months EPS of $0.11.

PE Ratio

Celsius Holdings has a trailing twelve months price to earnings ratio of 903.82. Meaning,

the purchaser of the share is investing $903.82 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 8.63%.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Celsius Holdings’s stock is considered to be overbought (>=80).

Sales Growth

Celsius Holdings’s sales growth is 70.6% for the current quarter and 61.2% for the next.

Revenue Growth

Year-on-year quarterly revenue growth grew by 136.7%, now sitting on 486.57M for the twelve trailing months.

More news about Celsius Holdings.

9. GameStop (GME) – 7.46%

GameStop Corp., a specialty retailer, provides games and entertainment products through its e-commerce properties and various stores in the United States, Canada, Australia, and Europe. The company sells new and pre-owned gaming platforms; accessories, such as controllers, gaming headsets, virtual reality products, and memory cards; new and pre-owned gaming software; and in-game digital currency, digital downloadable content, and full-game downloads. It also sells collectibles comprising licensed merchandise primarily related to the gaming, television, and movie industries, as well as pop culture themes. As of January 29, 2022, the company operated 4,573 stores and ecommerce sites under the GameStop, EB Games, and Micromania brands; and 50 pop culture themed stores that sell collectibles, apparel, gadgets, electronics, toys, and other retail products under the Zing Pop Culture brand, as well as offers Game Informer, a print and digital video game publication featuring reviews of new releases, previews of the big titles on the horizon, and coverage of the latest developments in the gaming industry. The company was formerly known as GSC Holdings Corp. GameStop Corp. was founded in 1996 and is headquartered in Grapevine, Texas.

NYSE ended the session with GameStop rising 7.46% to $23.91 on Monday while NYSE dropped 0.63% to $15,898.10.

Earnings Per Share

As for profitability, GameStop has a trailing twelve months EPS of $-3.31.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is negative -32.51%.

More news about GameStop.

10. Good Times Restaurants (GTIM) – 5.72%

Good Times Restaurants Inc., through its subsidiaries, engages in the restaurant business in the United States. The company operates and franchises Good Times Burgers & Frozen Custard, an upscale quick-service drive-through dining restaurant; and owns, operates, franchises, and licenses Bad Daddy's Burger Bar, a full-service upscale casual dining restaurant. As of December 15, 2021, it operated, franchised, or licensed 42 Bad Daddy's Burger Bar restaurants; and 32 Good Times Burgers & Frozen Custard restaurants. The company was incorporated in 1987 and is based in Golden, Colorado.

NASDAQ ended the session with Good Times Restaurants jumping 5.72% to $2.91 on Monday while NASDAQ dropped 1% to $11,887.45.

Earnings Per Share

As for profitability, Good Times Restaurants has a trailing twelve months EPS of $-0.984.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 5.59%.

Moving Average

Good Times Restaurants’s value is way higher than its 50-day moving average of $2.56 and above its 200-day moving average of $2.73.

Volume

Today’s last reported volume for Good Times Restaurants is 2355 which is 88.3% below its average volume of 20134.

More news about Good Times Restaurants.

Losers Today

1. Xenetic Biosciences (XBIO) – -17.69%

Xenetic Biosciences, Inc., a biopharmaceutical company, focuses on advancing XCART, a personalized chimeric antigen receptor T cell (CAR T) platform technology engineered to target patient-specific tumor neoantigens. The company engages in the discovery, research, and development of biologic drugs and oncology therapeutics. It advances cell-based therapeutics targeting the B-cell receptor on the surface of an individual patient's malignant tumor cells for the treatment of B-cell lymphomas. It is also leveraging PolyXen, its proprietary drug delivery platform, by partnering with biotechnology and pharmaceutical companies. It has collaboration agreements with Takeda Pharmaceutical Co. Ltd., Serum Institute of India Limited, PJSC Pharmsynthez, and SynBio LLC. Xenetic Biosciences, Inc. is headquartered in Framingham, Massachusetts.

NASDAQ ended the session with Xenetic Biosciences dropping 17.69% to $0.58 on Monday, after two sequential sessions in a row of losses. NASDAQ fell 1% to $11,887.45, following the last session’s downward trend on what was a somewhat down trend trading session today.

Earnings Per Share

As for profitability, Xenetic Biosciences has a trailing twelve months EPS of $-1.704.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is negative -59.34%.

Moving Average

Xenetic Biosciences’s worth is way higher than its 50-day moving average of $0.40 and below its 200-day moving average of $0.64.

Volatility

Xenetic Biosciences’s last week, last month’s, and last quarter’s current intraday variation average was 6.27%, 4.68%, and 5.15%.

Xenetic Biosciences’s highest amplitude of average volatility was 6.62% (last week), 5.92% (last month), and 5.15% (last quarter).

Yearly Top and Bottom Value

Xenetic Biosciences’s stock is valued at $0.58 at 16:32 EST, way under its 52-week high of $1.25 and way above its 52-week low of $0.24.

More news about Xenetic Biosciences.

2. 1-800-FLOWERS.COM (FLWS) – -14.37%

1-800-FLOWERS.COM, Inc., together with its subsidiaries, provides gifts for various occasions in the United States and internationally. It operates through three segments: Consumer Floral & Gifts, Gourmet Foods & Gift Baskets, and BloomNet. The company offers a range of products, including fresh-cut flowers, floral and fruit arrangements, plants, personalized products, dipped berries, popcorns, gourmet foods and gift baskets, cookies, chocolates, candies, wines, and gift-quality fruits. It offers its products and services through online platform under the 1-800-Flowers.com, 1-800-Baskets.com, Cheryl's Cookies, FruitBouquets.com, Harry & David, Moose Munch, The Popcorn Factory, Wolferman's Bakery, PersonalizationMall.com, Simply Chocolate, DesignPac, Stock Yards, Shari's Berries, BloomNet, Napco, and Flowerama brand names. 1-800-FLOWERS.COM, Inc. was founded in 1976 and is headquartered in Jericho, New York.

NASDAQ ended the session with 1-800-FLOWERS.COM falling 14.37% to $11.23 on Monday, following the last session’s downward trend. NASDAQ fell 1% to $11,887.45, following the last session’s downward trend on what was a somewhat bearish trend trading session today.

Earnings Per Share

As for profitability, 1-800-FLOWERS.COM has a trailing twelve months EPS of $0.13.

PE Ratio

1-800-FLOWERS.COM has a trailing twelve months price to earnings ratio of 86.42. Meaning,

the purchaser of the share is investing $86.42 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 1.88%.

Yearly Top and Bottom Value

1-800-FLOWERS.COM’s stock is valued at $11.23 at 16:32 EST, way under its 52-week high of $16.65 and way above its 52-week low of $5.82.

Earnings Before Interest, Taxes, Depreciation, and Amortization

1-800-FLOWERS.COM’s EBITDA is -23.2.

More news about 1-800-FLOWERS.COM.

3. Tattooed Chef (TTCF) – -8.79%

Tattooed Chef, Inc., a plant-based food company, produces and sells a portfolio of frozen foods. It supplies plant-based products to retailers in the United States. The company offers ready-to-cook bowls, zucchini spirals, riced cauliflower, acai and smoothie bowls, cauliflower crust pizza, and plant-based burgers. Its products are available in private label and Tattooed Chef brand name in the frozen food section of retail food stores. As of December 31, 2021, it operated approximately 14,000 retail outlets. Tattooed Chef, Inc. is headquartered in Paramount, California.

NASDAQ ended the session with Tattooed Chef dropping 8.79% to $1.51 on Monday while NASDAQ slid 1% to $11,887.45.

Earnings Per Share

As for profitability, Tattooed Chef has a trailing twelve months EPS of $-0.069.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is negative -38.9%.

Volatility

Tattooed Chef’s last week, last month’s, and last quarter’s current intraday variation average was 2.21%, 1.08%, and 6.17%.

Tattooed Chef’s highest amplitude of average volatility was 4.17% (last week), 5.33% (last month), and 6.17% (last quarter).

Yearly Top and Bottom Value

Tattooed Chef’s stock is valued at $1.51 at 16:32 EST, way below its 52-week low of $5.84.

Volume

Today’s last reported volume for Tattooed Chef is 1017320 which is 33.96% below its average volume of 1540480.

Sales Growth

Tattooed Chef’s sales growth is 26.4% for the ongoing quarter and 15.4% for the next.

More news about Tattooed Chef.

4. Identiv (INVE) – -7.57%

Identiv, Inc. operates as a security technology company that secures things, data, and physical places in the Americas, Europe, the Middle East, and the Asia-Pacific. The company operates in two segments, Identity and Premises. The Identity segment offers products and solutions that enables secure access to information serving the logical access and cyber security markets, as well as protecting connected objects and information using radio-frequency identification embedded security. The Premises segment provides solutions for premises security market, such as access control, video surveillance, analytics, audio, access readers, and identities to government facilities, schools, utilities, hospitals, stores, apartment buildings, and shops. The company sells its products through dealers, systems integrators, value added resellers, and resellers. The company was formerly known as Identive Group, Inc. and changed its name to Identiv, Inc. in May 2014. Identiv, Inc. was founded in 1990 and is headquartered in Fremont, California.

NASDAQ ended the session with Identiv dropping 7.57% to $8.73 on Monday while NASDAQ dropped 1% to $11,887.45.

Earnings Per Share

As for profitability, Identiv has a trailing twelve months EPS of $-0.34.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is negative -0.86%.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Identiv’s stock is considered to be oversold (<=20).

Moving Average

Identiv’s value is way higher than its 50-day moving average of $7.86 and way below its 200-day moving average of $11.39.

More news about Identiv.

5. Beyond Meat (BYND) – -7.36%

Beyond Meat, Inc. manufactures, markets, and sells plant-based meat products in the United States and internationally. The company sells a range of plant-based meat products across the platforms of beef, pork, and poultry. It sells its products through grocery, mass merchandiser, club store, convenience store and natural retailer channels, and direct-to-consumer, as well as various food-away-from-home channels, including restaurants, foodservice outlets, and schools. The company was formerly known as Savage River, Inc. and changed its name to Beyond Meat, Inc. in September 2018. Beyond Meat, Inc. was founded in 2009 and is headquartered in El Segundo, California.

NASDAQ ended the session with Beyond Meat sliding 7.36% to $17.99 on Monday while NASDAQ slid 1% to $11,887.45.

Earnings Per Share

As for profitability, Beyond Meat has a trailing twelve months EPS of $-0.85.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is negative -320.69%.

More news about Beyond Meat.

6. Groupon (GRPN) – -7.35%

Groupon, Inc., together with its subsidiaries, operates a marketplace that connects consumers to merchants. It operates in two segments, North America and International. The company sells goods or services on behalf of third-party merchants; and first-party goods inventory. It serves customers through its mobile applications and websites. The company was formerly known as ThePoint.com, Inc. and changed its name to Groupon, Inc. in October 2008. Groupon, Inc. was incorporated in 2008 and is headquartered in Chicago, Illinois.

NASDAQ ended the session with Groupon dropping 7.35% to $8.14 on Monday, following the last session’s downward trend. NASDAQ slid 1% to $11,887.45, following the last session’s downward trend on what was a somewhat bearish trend exchanging session today.

Earnings Per Share

As for profitability, Groupon has a trailing twelve months EPS of $-10.07.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is negative -17.51%.

Yearly Top and Bottom Value

Groupon’s stock is valued at $8.14 at 16:32 EST, way under its 52-week high of $27.38 and way above its 52-week low of $6.22.

More news about Groupon.

7. SmileDirectClub (SDC) – -7.09%

SmileDirectClub, Inc., an oral care company, offers clear aligner therapy treatment. The company manages the end-to-end process, which include marketing, aligner manufacturing, fulfillment, treatment by a doctor, and monitoring through completion of their treatment with a network of approximately 250 licensed orthodontists and general dentists through its teledentistry platform, SmileCheck in the United States, Puerto Rico, Canada, Australia, the United Kingdom, New Zealand, Ireland, Hong Kong, Germany, Singapore, France, Spain, and Austria. It also offers aligners, impression and whitening kits, whitening gels, and retainers; and toothbrushes, toothpastes, water flossers, SmileSpa, and various ancillary oral care products. The company was founded in 2014 and is headquartered in Nashville, Tennessee.

NASDAQ ended the session with SmileDirectClub falling 7.09% to $0.65 on Monday, after two successive sessions in a row of losses. NASDAQ dropped 1% to $11,887.45, following the last session’s downward trend on what was a somewhat negative trend exchanging session today.

Earnings Per Share

As for profitability, SmileDirectClub has a trailing twelve months EPS of $-2.334.

Volatility

SmileDirectClub’s last week, last month’s, and last quarter’s current intraday variation average was 6.46%, 3.70%, and 7.48%.

SmileDirectClub’s highest amplitude of average volatility was 7.93% (last week), 9.53% (last month), and 7.48% (last quarter).

More news about SmileDirectClub.

8. Canaan (CAN) – -6.94%

Canaan Inc. engages in the research, design, and sale of integrated circuit (IC) final mining equipment products by integrating IC products for bitcoin mining and related components primarily in the People's Republic of China. It is also involved in the assembly and distribution of mining equipment and spare parts. The company has a strategic cooperation with Northern Data AG in the areas of artificial intelligence development, blockchain technology, and datacenter operations. Canaan Inc. was founded in 2013 and is based in Beijing, the People's Republic of China.

NASDAQ ended the session with Canaan sliding 6.94% to $3.35 on Monday, following the last session’s downward trend. NASDAQ slid 1% to $11,887.45, following the last session’s downward trend on what was a somewhat negative trend exchanging session today.

Earnings Per Share

As for profitability, Canaan has a trailing twelve months EPS of $-0.212.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 85.52%.

Revenue Growth

Year-on-year quarterly revenue growth grew by 52.8%, now sitting on 6.51B for the twelve trailing months.

More news about Canaan.

9. Restoration Hardware Holdings (RH) – -6.88%

RH, together with its subsidiaries, operates as a retailer in the home furnishings. It offers products in various categories, including furniture, lighting, textiles, bathware, décor, outdoor and garden, and child and teen furnishings. The company provides its products through its retail galleries; and Source Books, a series of catalogs, as well as online through rh.com, rhbabyandchild.com, rhteen.com, and rhmodern.com, as well as waterworks.com. As of January 29, 2022, it operated a total of 67 RH Galleries and 38 RH outlet stores in 30 states in the District of Columbia and Canada, as well as 14 Waterworks showrooms throughout the United States and the United Kingdom. The company was formerly known as Restoration Hardware Holdings, Inc. and changed its name to RH in January 2017. RH was incorporated in 2011 and is headquartered in Corte Madera, California.

NYSE ended the session with Restoration Hardware Holdings falling 6.88% to $319.97 on Monday while NYSE fell 0.63% to $15,898.10.

Earnings Per Share

As for profitability, Restoration Hardware Holdings has a trailing twelve months EPS of $9.96.

PE Ratio

Restoration Hardware Holdings has a trailing twelve months price to earnings ratio of 32.13. Meaning,

the purchaser of the share is investing $32.13 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 64.56%.

Growth Estimates Quarters

The company’s growth estimates for the ongoing quarter and the next is a negative 32.9% and a negative 32.9%, respectively.

Volume

Today’s last reported volume for Restoration Hardware Holdings is 1455010 which is 85.68% above its average volume of 783572.

More news about Restoration Hardware Holdings.

10. V.F. Corporation (VFC) – -6.61%

V.F. Corporation, together with its subsidiaries, engages in the design, procurement, marketing, and distribution of branded lifestyle apparel, footwear, and related products for men, women, and children in the Americas, Europe, and the Asia-Pacific. It operates through three segments: Outdoor, Active, and Work. The company offers outdoor, merino wool and other natural fibers-based, lifestyle, and casual apparel; footwear; equipment; accessories; outdoor-inspired, performance-based, youth culture/action sports-inspired, streetwear, and protective work footwear; handbags, luggage, backpacks, and totes; and work and work-inspired lifestyle apparel and footwear. It provides its products under the North Face, Timberland, Smartwool, Icebreaker, Altra, Vans, Supreme, Kipling, Napapijri, Eastpak, JanSport, Dickies, and Timberland PRO brand names. The company sells its products primarily to specialty stores, department stores, national chains, and mass merchants, as well as sells through direct-to-consumer operations, including retail stores, concession retail stores, and e-commerce sites, and other digital platforms. V.F. Corporation was founded in 1899 and is headquartered in Denver, Colorado.

NYSE ended the session with V.F. Corporation sliding 6.61% to $28.59 on Monday while NYSE dropped 0.63% to $15,898.10.

Earnings Per Share

As for profitability, V.F. Corporation has a trailing twelve months EPS of $-0.43.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 12.68%.

Moving Average

V.F. Corporation’s worth is below its 50-day moving average of $29.76 and way below its 200-day moving average of $39.98.

Growth Estimates Quarters

The company’s growth estimates for the present quarter and the next is a negative 11.8% and a negative 13.3%, respectively.

More news about V.F. Corporation.

Stay up to date with our winners and losers daily report