(VIANEWS) – Another day of trading has ended and here’s today’s list of stocks that have had significant trading activity in the US session.

The three biggest winners today are Greencity Acquisition Corporation, iClick Interactive Asia Group Limited, and Hasbro.

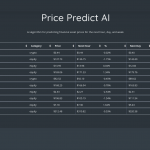

| Rank | Financial Asset | Price | Change | Updated (EST) |

|---|---|---|---|---|

| 1 | Greencity Acquisition Corporation (GRCYW) | 0.03 | 38.21% | 2023-04-27 07:06:07 |

| 2 | iClick Interactive Asia Group Limited (ICLK) | 3.09 | 18.85% | 2023-04-27 14:07:16 |

| 3 | Hasbro (HAS) | 59.00 | 14.76% | 2023-04-27 14:56:02 |

| 4 | Meta Platforms (META) | 238.37 | 13.83% | 2023-04-27 14:52:38 |

| 5 | Flux Power Holdings (FLUX) | 3.43 | 13.2% | 2023-04-26 20:23:07 |

| 6 | Comcast Corporation (CMCSA) | 40.26 | 10.25% | 2023-04-27 14:54:04 |

| 7 | Greenpro Capital Corp. (GRNQ) | 1.71 | 9.62% | 2023-04-27 07:08:08 |

| 8 | NewMarket (NEU) | 395.98 | 9.33% | 2023-04-27 13:43:20 |

| 9 | Tilray (TLRY) | 2.38 | 9.17% | 2023-04-27 14:46:59 |

| 10 | Riot Blockchain (RIOT) | 11.89 | 8.98% | 2023-04-27 14:46:30 |

The three biggest losers today are Esports Entertainment Group, GoHealth, and Aspen Group.

| Rank | Financial Asset | Price | Change | Updated (EST) |

|---|---|---|---|---|

| 1 | Esports Entertainment Group (GMBLW) | 0.04 | -37.7% | 2023-04-27 04:17:07 |

| 2 | GoHealth (GOCO) | 7.68 | -17.95% | 2023-04-27 05:11:07 |

| 3 | Aspen Group (ASPU) | 0.09 | -11.01% | 2023-04-27 14:15:56 |

| 4 | FlexShopper (FPAY) | 0.75 | -10.7% | 2023-04-26 21:15:08 |

| 5 | Align Technology (ALGN) | 319.00 | -10.03% | 2023-04-27 14:53:03 |

| 6 | Harbor Custom Development (HCDI) | 3.24 | -10% | 2023-04-27 08:07:13 |

| 7 | Histogen (HSTO) | 0.83 | -8.9% | 2023-04-27 11:10:07 |

| 8 | STMicroelectronics (STM) | 42.92 | -7.27% | 2023-04-27 14:53:08 |

| 9 | AbbVie (ABBV) | 150.38 | -7.06% | 2023-04-27 13:37:31 |

| 10 | Ideanomics (IDEX) | 0.03 | -5.11% | 2023-04-27 15:06:09 |

Winners today

1. Greencity Acquisition Corporation (GRCYW) – 38.21%

NASDAQ ended the session with Greencity Acquisition Corporation jumping 38.21% to $0.03 on Thursday while NASDAQ rose 2.43% to $12,142.24.

Yearly Top and Bottom Value

Greencity Acquisition Corporation’s stock is valued at $0.03 at 17:32 EST, way under its 52-week high of $0.04 and above its 52-week low of $0.03.

More news about Greencity Acquisition Corporation.

2. iClick Interactive Asia Group Limited (ICLK) – 18.85%

iClick Interactive Asia Group Limited, together with its subsidiaries, provides online marketing services in the People's Republic of China and internationally. It offers iAudience, an audience identification solution that allows marketers to search, identify, and customize their targeted audience to generate or enhance brand awareness; iAccess and iActivation, an audience engagement and activation solution tailored for brand awareness-driven and performance-driven campaigns; iExpress, the lite version of iAccess solution for small and medium-sized enterprises; iNsights, an online campaign results monitoring and measurement solution; and iExperience, a content creation solution. The company also provides mobile marketing solutions, which are non-search engine marketing solutions to identify, engage, and activate audience on mobile apps, as well as monitor and measure the results of online marketing activities on such channels; and other solutions that focuses on identifying, engaging, and activating audience on non-mobile app content distribution channels comprising PC banner displays, PC video advertisements, and search engine marketing. In addition, it offers enterprise solutions that help clients collate information from various consumer touchpoints and integrate them into a single data management platform to drive sales and marketing decisions to new retail, online education, real estate, and other sectors. The company sells its solutions by entering into sales contracts with entities or marketing agencies, including marketing campaign contracts. It has a strategic collaboration with Tencent International Business Group to co-develop Smart Retail and Smart Travel SaaS solutions. The company was formerly known as Optimix Media Asia Limited and changed its name to iClick Interactive Asia Group Limited in March 2017. iClick Interactive Asia Group Limited was founded in 2009 and is headquartered in Quarry Bay, Hong Kong.

NASDAQ ended the session with iClick Interactive Asia Group Limited jumping 18.85% to $3.09 on Thursday while NASDAQ jumped 2.43% to $12,142.24.

Earnings Per Share

As for profitability, iClick Interactive Asia Group Limited has a trailing twelve months EPS of $-4.11.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is negative -32.21%.

Yearly Top and Bottom Value

iClick Interactive Asia Group Limited’s stock is valued at $3.09 at 17:32 EST, way under its 52-week high of $10.90 and way higher than its 52-week low of $2.10.

More news about iClick Interactive Asia Group Limited.

3. Hasbro (HAS) – 14.76%

Hasbro, Inc., together with its subsidiaries, operates as a play and entertainment company in the United States and internationally. The company operates through Consumer Products, Wizards of the Coast and Digital Gaming, and Entertainment segments. The Consumer Products segment engages in the sourcing, marketing, and sale of toy and game products. This segment also promotes its brands through the out-licensing of trademarks, characters, and other brand and intellectual property rights to third parties through the sale of branded consumer products, such as toys and apparels. Its toys and games include action figures, arts and crafts and creative play products, fashion and other dolls, play sets, preschool toys, plush products, sports action blasters and accessories, vehicles and toy-related specialty products, games, and other consumer products; and licensed products, such as apparels, publishing products, home goods and electronics, and toy products. The Wizards of the Coast and Digital Gaming segment engages in the promotion of its brands through the development of trading card, role-playing, and digital game experiences based on Hasbro and Wizards of the Coast games. The Entertainment segment engages in the development, acquisition, production, distribution, and sale of world-class entertainment content, including film, scripted and unscripted television, family programming, digital content, and live entertainment. The company sells its products to retailers, distributors, wholesalers, discount stores, drug stores, mail order houses, catalog stores, department stores, and other traditional retailers, as well as ecommerce retailers; and directly to customer through Hasbro PULSE e-commerce website. The company was founded in 1923 and is headquartered in Pawtucket, Rhode Island.

NASDAQ ended the session with Hasbro rising 14.76% to $59.00 on Thursday while NASDAQ jumped 2.43% to $12,142.24.

: hasbro revenue declines but tops expectationsToymaker Hasbro Inc. HAS posted a surprise adjusted profit for its latest quarter Thursday while seeing revenue exceed expectations. , On an adjusted basis, Hasbro earned 1 cent a share, compared with 57 cents a share a year before.

Earnings Per Share

As for profitability, Hasbro has a trailing twelve months EPS of $1.47.

PE Ratio

Hasbro has a trailing twelve months price to earnings ratio of 40.14. Meaning, the purchaser of the share is investing $40.14 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 6.83%.

More news about Hasbro.

4. Meta Platforms (META) – 13.83%

Meta Platforms, Inc. engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality headsets, and wearables worldwide. It operates in two segments, Family of Apps and Reality Labs. The Family of Apps segment offers Facebook, which enables people to share, discuss, discover, and connect with interests; Instagram, a community for sharing photos, videos, and private messages, as well as feed, stories, reels, video, live, and shops; Messenger, a messaging application for people to connect with friends, family, communities, and businesses across platforms and devices through text, audio, and video calls; and WhatsApp, a messaging application that is used by people and businesses to communicate and transact privately. The Reality Labs segment provides augmented and virtual reality related products comprising consumer hardware, software, and content that help people feel connected, anytime, and anywhere. The company was formerly known as Facebook, Inc. and changed its name to Meta Platforms, Inc. in October 2021. Meta Platforms, Inc. was incorporated in 2004 and is headquartered in Menlo Park, California.

NASDAQ ended the session with Meta Platforms jumping 13.83% to $238.37 on Thursday while NASDAQ jumped 2.43% to $12,142.24.

Meta platforms stock earnings and forecast: zuckerberg's META jumps nearly 12% on Q1 slam dunkSeeing as how the Relative Strength Index (RSI) is now near overbought territory, Meta Platforms stock has little in the way of support until $200.

Earnings Per Share

As for profitability, Meta Platforms has a trailing twelve months EPS of $8.46.

PE Ratio

Meta Platforms has a trailing twelve months price to earnings ratio of 28.18. Meaning, the purchaser of the share is investing $28.18 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 18.52%.

Growth Estimates Quarters

The company’s growth estimates for the current quarter and the next is a negative 25.4% and a negative 2%, respectively.

Volume

Today’s last reported volume for Meta Platforms is 65970100 which is 116.92% above its average volume of 30411400.

Volatility

Meta Platforms’s last week, last month’s, and last quarter’s current intraday variation average was a positive 1.72%, a negative 0.50%, and a positive 2.43%.

Meta Platforms’s highest amplitude of average volatility was 3.57% (last week), 2.24% (last month), and 2.43% (last quarter).

Previous days news about Meta Platforms

- Time to buy meta platforms stock with Q1 earnings approaching?. According to Zacks on Tuesday, 25 April, "Off to a stellar start in 2023, Meta Platforms (META Quick QuoteMETA – Free Report) ) first-quarter earnings are much anticipated with the social media titan set to report on Wednesday, April 26."

- Zacks investment ideas feature highlights: meta platforms and snap. According to Zacks on Wednesday, 26 April, "Chicago, IL - April 26, 2023 - Today, Zacks Investment Ideas feature highlights Meta Platforms (META Quick QuoteMETA – Free Report) and Snap (SNAP Quick QuoteSNAP – Free Report) .", "Off to a stellar start in 2023, Meta Platforms first-quarter earnings are much anticipated with the social media titan set to report on Wednesday, April 26."

- Meta platforms (meta) surpasses Q1 earnings and revenue estimates. According to Zacks on Wednesday, 26 April, "While Meta Platforms has outperformed the market so far this year, the question that comes to investors’ minds is: what’s next for the stock?"

More news about Meta Platforms.

5. Flux Power Holdings (FLUX) – 13.2%

Flux Power Holdings, Inc., through its subsidiary Flux Power, Inc., designs, develops, manufactures, and sells lithium-ion energy storage solutions for lift trucks, airport ground support equipment, and other industrial and commercial applications in the United States. It offers battery management system (BMS) that provides cell balancing, charging, discharging, monitoring, and communication between the pack and the forklift. The company also provides 24-volt onboard chargers for its Class 3 Walkie LiFT packs; and smart wall mounted chargers to interface with its BMS. The company sells its products directly to small companies and end-users, as well as through original equipment manufacturers, lift equipment dealers, and battery distributors. Flux Power Holdings, Inc. was incorporated in 1998 and is based in Vista, California.

NASDAQ ended the session with Flux Power Holdings jumping 13.2% to $3.43 on Thursday while NASDAQ rose 2.43% to $12,142.24.

Earnings Per Share

As for profitability, Flux Power Holdings has a trailing twelve months EPS of $-0.59.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is negative -67.61%.

Sales Growth

Flux Power Holdings’s sales growth is 24% for the ongoing quarter and 20.8% for the next.

More news about Flux Power Holdings.

6. Comcast Corporation (CMCSA) – 10.25%

Comcast Corporation operates as a media and technology company worldwide. It operates through Cable Communications, Media, Studios, Theme Parks, and Sky segments. The Cable Communications segment provides broadband, video, voice, wireless, and other services to residential and business customers under the Xfinity brand; and advertising services. The Media segment operates NBCUniversal's television and streaming platforms, including national, regional, and international cable networks; the NBC and Telemundo broadcast networks; and Peacock, a direct-to-consumer streaming service. The Studios segment operates NBCUniversal's film and television studio production and distribution operations. The Theme Parks segment consists of Universal theme parks in Orlando, Florida; Hollywood, California; Osaka, Japan; and Beijing, China. The Sky segment offers direct-to-consumer services, such as video, broadband, voice and wireless phone services, and content business operates entertainment networks, the Sky News broadcast network, and Sky Sports networks. The company also owns the Philadelphia Flyers, as well as the Wells Fargo Center arena in Philadelphia, Pennsylvania; and provides streaming service, such as Peacock. Comcast Corporation was founded in 1963 and is headquartered in Philadelphia, Pennsylvania.

NASDAQ ended the session with Comcast Corporation jumping 10.25% to $40.26 on Thursday while NASDAQ rose 2.43% to $12,142.24.

Earnings Per Share

As for profitability, Comcast Corporation has a trailing twelve months EPS of $1.21.

PE Ratio

Comcast Corporation has a trailing twelve months price to earnings ratio of 33.28. Meaning, the purchaser of the share is investing $33.28 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 5.47%.

Dividend Yield

As maintained by Morningstar, Inc., the next dividend payment is on Apr 3, 2023, the estimated forward annual dividend rate is 1.16 and the estimated forward annual dividend yield is 3.06%.

Volume

Today’s last reported volume for Comcast Corporation is 23786600 which is 29.63% above its average volume of 18348900.

More news about Comcast Corporation.

7. Greenpro Capital Corp. (GRNQ) – 9.62%

Greenpro Capital Corp. provides financial consulting and corporate services to small and medium-size businesses primarily in Hong Kong, Malaysia, and China. It operates in two segments, Service Business and Real Estate Business. The company offers business consulting and corporate advisory services, including cross-border listing advisory, tax planning, bookkeeping, advisory and transaction, record management, and accounting outsourcing services; and venture capital related education and support services. It is also involved in the acquisition and rental of real estate properties held for investment and sale; and provision of company formation advisory, company secretarial, and financial services. In addition, the company provides corporate advisory services, such as company review, bank loan advisory, and bank products analysis, as well as loan and credit, and insurance brokerage services; and wealth planning, administration, charity, tax and legal, trusteeship and risk management, investment planning and management, and business support services, as well as asset protection and management, consolidation, and performance monitoring services. The company was formerly known as Greenpro, Inc. and changed its name to Greenpro Capital Corp. in May 2015. Greenpro Capital Corp. was founded in 2013 and is headquartered in Hung Hom, Hong Kong.

NASDAQ ended the session with Greenpro Capital Corp. rising 9.62% to $1.71 on Thursday, after four sequential sessions in a row of gains. NASDAQ rose 2.43% to $12,142.24, following the last session’s upward trend on what was an all-around bullish trend trading session today.

Earnings Per Share

As for profitability, Greenpro Capital Corp. has a trailing twelve months EPS of $-0.9.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is negative -39.61%.

More news about Greenpro Capital Corp..

8. NewMarket (NEU) – 9.33%

NewMarket Corporation, through its subsidiaries, primarily engages in the manufacture and sale of petroleum additives. The company offers lubricant additives for use in various vehicle and industrial applications, including engine oils, transmission fluids, off-road powertrain and hydraulic systems, gear oils, hydraulic oils, turbine oils, and other applications where metal-to-metal moving parts are utilized; engine oil additives designed for passenger cars, motorcycles, on and off-road heavy duty commercial equipment, locomotives, and engines in ocean-going vessels; driveline additives designed for products, such as transmission fluids, axle fluids, and off-road powertrain fluids; and industrial additives designed for products for industrial applications consisting of hydraulic fluids, grease, industrial gear fluids, and industrial specialty applications, such as turbine oils. It also provides fuel additives that are used to enhance the oil refining process and the performance of gasoline, diesel, biofuels, and other fuels to industry, government, original equipment manufacturers, and individual customers. In addition, the company engages in the marketing of antiknock compounds, as well as contracted manufacturing and services activities; and owns and manages a real property in Virginia. It operates in North America, Latin America, the Asia Pacific, Europe, the Middle East, Africa, and India. NewMarket Corporation was founded in 1887 and is headquartered in Richmond, Virginia.

NYSE ended the session with NewMarket jumping 9.33% to $395.98 on Thursday while NYSE jumped 1.33% to $15,431.64.

Earnings Per Share

As for profitability, NewMarket has a trailing twelve months EPS of $27.53.

PE Ratio

NewMarket has a trailing twelve months price to earnings ratio of 14.38. Meaning, the purchaser of the share is investing $14.38 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 36.67%.

Dividend Yield

As maintained by Morningstar, Inc., the next dividend payment is on Mar 13, 2023, the estimated forward annual dividend rate is 8.4 and the estimated forward annual dividend yield is 2.27%.

Volatility

NewMarket’s last week, last month’s, and last quarter’s current intraday variation average was a negative 0.40%, a positive 0.13%, and a positive 0.90%.

NewMarket’s highest amplitude of average volatility was 0.69% (last week), 0.52% (last month), and 0.90% (last quarter).

More news about NewMarket.

9. Tilray (TLRY) – 9.17%

Tilray Brands, Inc. engages in the research, cultivation, production, marketing, and distribution of medical cannabis products in Canada, the United States, Europe, Australia, New Zealand, Latin America, and internationally. The company operates through four segments: Cannabis Business, Distribution Business, Beverage Alcohol Business, and Wellness Business. It offers medical and adult-use cannabis products, including GMP-certified flowers, oils, vapes, edibles, and topicals; purchases and resells pharmaceutical and wellness products; and produces, markets, sells, and distributes beverage alcohol products, and hemp-based food and other wellness products. The company offers its products under the Tilray, Aphria, Broken Coast, Symbios, B!NGO, The Batch, P'tite Pof, Dubon, Good Supply, Solei, Chowie Wowie, Canaca, RIFF, SweetWater, Breckenridge Distillery, Alpine Beer Company, and Green Flash brands. It sells its products to retailers, wholesalers, patients, physicians, hospitals, pharmacies, researchers, and governments, as well as direct to consumers. The company was formerly known as Tilray, Inc. Tilray Brands, Inc. is headquartered in Leamington, Canada.

NASDAQ ended the session with Tilray rising 9.17% to $2.38 on Thursday while NASDAQ rose 2.43% to $12,142.24.

Earnings Per Share

As for profitability, Tilray has a trailing twelve months EPS of $-3.1.

Volatility

Tilray’s last week, last month’s, and last quarter’s current intraday variation average was a negative 1.92%, a negative 0.67%, and a positive 2.86%.

Tilray’s highest amplitude of average volatility was 3.00% (last week), 3.02% (last month), and 2.86% (last quarter).

Moving Average

Tilray’s worth is way under its 50-day moving average of $2.71 and way below its 200-day moving average of $3.26.

More news about Tilray.

10. Riot Blockchain (RIOT) – 8.98%

Riot Platforms, Inc., together with its subsidiaries, operates as a bitcoin mining company in North America. It operates through Bitcoin Mining, Data Center Hosting, and Engineering segments. The company also provides co-location services for institutional-scale bitcoin mining companies; and critical infrastructure and workforce for institutional-scale miners to deploy and operate their miners. In addition, it engages in the design and manufacturing of power distribution equipment and custom engineered electrical products; electricity distribution product design, manufacture, and installation services primarily focused on large-scale commercial and governmental customers, as well as a range of markets, including data center, power generation, utility, water, industrial, and alternative energy; operation of data centers; and maintenance/management of computing capacity. The company was formerly known as Riot Blockchain, Inc. Riot Platforms, Inc. was incorporated in 1998 and is based in Castle Rock, Colorado.

NASDAQ ended the session with Riot Blockchain jumping 8.98% to $11.89 on Thursday while NASDAQ rose 2.43% to $12,142.24.

Earnings Per Share

As for profitability, Riot Blockchain has a trailing twelve months EPS of $-3.72.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is negative -40.77%.

Yearly Top and Bottom Value

Riot Blockchain’s stock is valued at $11.89 at 17:32 EST, way under its 52-week high of $15.21 and way higher than its 52-week low of $3.25.

Sales Growth

Riot Blockchain’s sales growth is negative 5.3% for the current quarter and 20.3% for the next.

More news about Riot Blockchain.

Losers Today

1. Esports Entertainment Group (GMBLW) – -37.7%

NASDAQ ended the session with Esports Entertainment Group falling 37.7% to $0.04 on Thursday, after five consecutive sessions in a row of losses. NASDAQ rose 2.43% to $12,142.24, following the last session’s upward trend on what was an all-around positive trend trading session today.

Yearly Top and Bottom Value

Esports Entertainment Group’s stock is valued at $0.04 at 17:32 EST, under its 52-week high of $0.04 and way above its 52-week low of $0.04.

More news about Esports Entertainment Group.

2. GoHealth (GOCO) – -17.95%

GoHealth, Inc. operates as a health insurance marketplace and Medicare focused digital health company in the United States. It operates through four segments: Medicare—Internal; Medicare—External; Individual and Family Plans (IFP) and Other—Internal; and Individual and Family Plans and Other—External. The company operates a technology platform that leverages machine-learning algorithms of insurance behavioral data to optimize the process for helping individuals find the health insurance plan for their specific needs. Its products include Medicare Advantage, Medicare Supplement, Medicare prescription drug plans, and Medicare Special Needs Plans; and IFP, dental plans, vision plans, and other ancillary plans to individuals. The company sells its products through carrier and online platform, as well as independent and external agencies. GoHealth, Inc. was founded in 2001 and is headquartered in Chicago, Illinois.

NASDAQ ended the session with GoHealth dropping 17.95% to $7.68 on Thursday while NASDAQ rose 2.43% to $12,142.24.

Earnings Per Share

As for profitability, GoHealth has a trailing twelve months EPS of $-11.77.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is negative -50.72%.

Earnings Before Interest, Taxes, Depreciation, and Amortization

GoHealth’s EBITDA is -5.84.

Moving Average

GoHealth’s worth is way below its 50-day moving average of $15.20 and way under its 200-day moving average of $10.83.

Volume

Today’s last reported volume for GoHealth is 226303 which is 361.58% above its average volume of 49027.

More news about GoHealth.

3. Aspen Group (ASPU) – -11.01%

Aspen Group, Inc., an education technology company, provides online higher education services in the United States. The company offers baccalaureate, master's, and doctoral degree programs in nursing and health sciences, business and technology, arts and sciences, and education fields through Aspen University and United States University. As of April 30, 2022, it had 13,334 degree-seeking students enrolled. Aspen Group, Inc. was founded in 1987 and is based in New York, New York.

NASDAQ ended the session with Aspen Group sliding 11.01% to $0.09 on Thursday, after two consecutive sessions in a row of losses. NASDAQ rose 2.43% to $12,142.24, following the last session’s upward trend on what was an all-around up trend exchanging session today.

Earnings Per Share

As for profitability, Aspen Group has a trailing twelve months EPS of $-0.47.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is negative -28.28%.

Volatility

Aspen Group’s last week, last month’s, and last quarter’s current intraday variation average was 0.99%, 3.86%, and 9.14%.

Aspen Group’s highest amplitude of average volatility was 5.97% (last week), 11.73% (last month), and 9.14% (last quarter).

Sales Growth

Aspen Group’s sales growth is negative 24% for the present quarter and negative 29.3% for the next.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions, Aspen Group’s stock is considered to be overbought (>=80).

Yearly Top and Bottom Value

Aspen Group’s stock is valued at $0.09 at 17:32 EST, way under its 52-week high of $1.34 and way above its 52-week low of $0.03.

More news about Aspen Group.

4. FlexShopper (FPAY) – -10.7%

FlexShopper, Inc., a financial and technology company, operates an e-commerce marketplace to shop electronics, home furnishings, and other durable goods on a lease-to-own (LTO) basis. It offers durable products, such as consumer electronics; home appliances; computers, including tablets and wearables; smartphones; tires; and jewelry and furniture, such accessories. The company was formerly known as Anchor Funding Services, Inc. and changed its name to FlexShopper, Inc. in October 2013. FlexShopper, Inc. was founded in 2003 and is based in Boca Raton, Florida.

NASDAQ ended the session with FlexShopper dropping 10.7% to $0.75 on Thursday while NASDAQ rose 2.43% to $12,142.24.

Earnings Per Share

As for profitability, FlexShopper has a trailing twelve months EPS of $0.2.

PE Ratio

FlexShopper has a trailing twelve months price to earnings ratio of 3.75. Meaning, the purchaser of the share is investing $3.75 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 57.79%.

Sales Growth

FlexShopper’s sales growth is 14.7% for the ongoing quarter and negative 0.5% for the next.

Moving Average

FlexShopper’s value is way under its 50-day moving average of $0.90 and way below its 200-day moving average of $1.31.

Growth Estimates Quarters

The company’s growth estimates for the present quarter is 71.4% and a drop 103.9% for the next.

Earnings Before Interest, Taxes, Depreciation, and Amortization

FlexShopper’s EBITDA is 4.78.

More news about FlexShopper.

5. Align Technology (ALGN) – -10.03%

Align Technology, Inc. designs, manufactures, and markets Invisalign clear aligners, and iTero intraoral scanners and services for orthodontists and general practitioner dentists in the United States, Switzerland, China, and internationally. It operates in two segments, Clear Aligner; and Imaging Systems and CAD/CAM Services (Systems and Services). The Clear Aligner segment offers comprehensive products, including Invisalign comprehensive package that addresses the orthodontic needs of teenage patients, such as mandibular advancement, compliance indicators, and compensation for tooth eruption; and Invisalign First Phase I and Invisalign First Comprehensive Phase 2 package for younger patients generally between the ages of seven and ten years, which is a mixture of primary/baby and permanent teeth. This segment's non-comprehensive products comprise Invisalign moderate, lite and express packages, and Invisalign go and Invisalign Go Plus; and non-case products that include retention products, Invisalign training, and adjusting tools used by dental professionals during the course of treatment. The Systems and Services segment offers iTero intraoral scanning system, a single hardware platform with software options for restorative or orthodontic procedures; restorative software for general practitioner dentists, prosthodontists, periodontists, and oral surgeons; and software for orthodontists for digital records storage, orthodontic diagnosis, and for the fabrication of printed models and retainers. This segment also provides Invisalign outcome simulator, a chair-side and cloud-based application for the iTero scanner; Invisalign progress assessment tool; and TimeLapse technology, which allows doctors or practitioners to compare a patient's historic 3D scans to the present-day scan, as well as subscription software, disposables, rentals, leases, and pay per scan services Align Technology, Inc. was incorporated in 1997 and is headquartered in Tempe, Arizona.

NASDAQ ended the session with Align Technology sliding 10.03% to $319.00 on Thursday while NASDAQ rose 2.43% to $12,142.24.

Earnings Per Share

As for profitability, Align Technology has a trailing twelve months EPS of $4.64.

PE Ratio

Align Technology has a trailing twelve months price to earnings ratio of 68.75. Meaning, the purchaser of the share is investing $68.75 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 10.01%.

Earnings Before Interest, Taxes, Depreciation, and Amortization

Align Technology’s EBITDA is 124.92.

Sales Growth

Align Technology’s sales growth is negative 7.2% for the ongoing quarter and negative 2% for the next.

Volatility

Align Technology’s last week, last month’s, and last quarter’s current intraday variation average was 0.15%, 0.72%, and 2.41%.

Align Technology’s highest amplitude of average volatility was 1.79% (last week), 1.86% (last month), and 2.41% (last quarter).

Volume

Today’s last reported volume for Align Technology is 2094930 which is 113.24% above its average volume of 982421.

Previous days news about Align Technology

- Align technology (algn) Q1 earnings and revenues top estimates. According to Zacks on Wednesday, 26 April, "While Align Technology has outperformed the market so far this year, the question that comes to investors’ minds is: what’s next for the stock?"

More news about Align Technology.

6. Harbor Custom Development (HCDI) – -10%

Harbor Custom Development, Inc. engages in the real estate development business in Western Washington's Puget Sound region. The company undertakes projects, such as residential lots, home communities, and single family and multi-family properties. It is involved in the land development cycle activities, including land acquisition, entitlements, construction of project infrastructure, home building, marketing, sales, and management of various residential projects. The company was formerly known as Harbor Custom Homes, Inc. and changed its name to Harbor Custom Development, Inc. in August 2019. Harbor Custom Development, Inc. was founded in 2014 and is headquartered in Gig Harbor, Washington.

NASDAQ ended the session with Harbor Custom Development sliding 10% to $3.24 on Thursday while NASDAQ jumped 2.43% to $12,142.24.

Earnings Per Share

As for profitability, Harbor Custom Development has a trailing twelve months EPS of $-32.37.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is negative -19.31%.

More news about Harbor Custom Development.

7. Histogen (HSTO) – -8.9%

Histogen Inc., a clinical-stage therapeutics company, focuses on developing therapeutics based upon the products of fibroblast cells grown under simulated embryonic conditions. It offers HST-001, a hair stimulating complex that is in Phase 1b/2a clinical trial for the treatment of androgenic alopecia (hair loss); HST-003, a human extracellular matrix, which is in Phase 1/2 clinical trial to treat articular cartilage defects in the knee; and Emricasan, an orally active pan-caspase inhibitor that is in Phase 1 clinical trial for the treatment of COVID-19. The company's pre-clinical programs include HST-004, a cell conditioned media (CCM) solution to treat spinal disc repair; and HST-002, a human-derived collagen and extracellular matrix dermal filler for the treatment of facial folds and wrinkles. Histogen Inc. was founded in 2007 and is headquartered in San Diego, California.

NASDAQ ended the session with Histogen sliding 8.9% to $0.83 on Thursday, after five consecutive sessions in a row of losses. NASDAQ jumped 2.43% to $12,142.24, following the last session’s upward trend on what was an all-around up trend trading session today.

Earnings Per Share

As for profitability, Histogen has a trailing twelve months EPS of $-3.36.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is negative -63.43%.

Revenue Growth

Year-on-year quarterly revenue growth declined by 20%, now sitting on 3.77M for the twelve trailing months.

Yearly Top and Bottom Value

Histogen’s stock is valued at $0.83 at 17:32 EST, way below its 52-week high of $4.76 and way higher than its 52-week low of $0.69.

Moving Average

Histogen’s worth is way below its 50-day moving average of $1.07 and way below its 200-day moving average of $1.42.

Earnings Before Interest, Taxes, Depreciation, and Amortization

Histogen’s EBITDA is 2.16.

More news about Histogen.

8. STMicroelectronics (STM) – -7.27%

STMicroelectronics N.V., together with its subsidiaries, designs, develops, manufactures, and sells semiconductor products in Europe, the Middle East, Africa, the Americas, and the Asia Pacific. The company operates through Automotive and Discrete Group; Analog, MEMS and Sensors Group; and Microcontrollers and Digital ICs Group segments. The Automotive and Discrete Group segment offers automotive integrated circuits (ICs), and discrete and power transistor products. The Analog, MEMS and Sensors Group segment provides industrial application-specific integrated circuits (ASICs) and application-specific standard products (ASSPs); general purpose analog products; custom analog ICs; wireless charging solutions; galvanic isolated gate drivers; low and high voltage amplifiers, comparators, and current-sense amplifiers; MasterGaN, a solution that integrates a silicon driver and GaN power transistors in a single package; wireline and wireless connectivity ICs; touch screen controllers; micro-electro-mechanical systems (MEMS) products, including sensors or actuators; and optical sensing solutions. The Microcontrollers and Digital ICs Group segment offers general purpose and secure microcontrollers; radio frequency (RF) and electrically erasable programmable read-only memories; and RF, digital, and mixed-signal ASICs. It also provides assembly and other services. The company sells its products through distributors and retailers, as well as through sales representatives. It serves automotive, industrial, personal electronics and communications equipment, and computers and peripherals markets. STMicroelectronics N.V. was incorporated in 1987 and is headquartered in Geneva, Switzerland.

NYSE ended the session with STMicroelectronics sliding 7.27% to $42.92 on Thursday while NYSE rose 1.33% to $15,431.64.

Earnings Per Share

As for profitability, STMicroelectronics has a trailing twelve months EPS of $4.19.

PE Ratio

STMicroelectronics has a trailing twelve months price to earnings ratio of 10.24. Meaning, the purchaser of the share is investing $10.24 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 37.51%.

Moving Average

STMicroelectronics’s worth is way under its 50-day moving average of $49.36 and higher than its 200-day moving average of $39.41.

Previous days news about STMicroelectronics

- What's in store for stmicroelectronics (stm) in Q1 earnings?. According to Zacks on Tuesday, 25 April, "Our proven model predicts an earnings beat for STMicroelectronics this time around. "

More news about STMicroelectronics.

9. AbbVie (ABBV) – -7.06%

AbbVie Inc. discovers, develops, manufactures, and sells pharmaceuticals worldwide. The company offers Humira, a therapy administered as an injection for autoimmune, intestinal Behçet's diseases, and pyoderma gangrenosum; Skyrizi to treat moderate to severe plaque psoriasis, psoriatic disease, and Crohn's disease; Rinvoq, a JAK inhibitor to treat rheumatoid and psoriatic arthritis, ankylosing spondylitis, atopic dermatitis, axial spondyloarthropathy, and ulcerative colitis; Imbruvica for the treatment of adult patients with blood cancers; and Venclexta/Venclyxto to treat hematological malignancies. It also provides facial injectables, plastics and regenerative medicine, body contouring, and skincare products; Vraylar for depressive disorder; Duopa and Duodopa to treat advanced Parkinson's disease; and Ubrelvy for the acute treatment of migraine with or without aura in adults; Qulipta for episodic migraine. In addition, the company offers Lumigan/Ganfort and Alphagan/Combigan for the reduction of elevated intraocular pressure(IOP) in patients with open angle glaucoma (OAG) or ocular hypertension; Restasis, a calcineurin inhibitor immunosuppressant indicated to increase tear production; and eye care products. Further, it provides Mavyret/Maviret to treat chronic hepatitis C virus (HCV) genotype 1-6 infection and HCV genotype 1 infection; Creon, a pancreatic enzyme therapy; Lupron to treat advanced prostate cancer, endometriosis and central precocious puberty, and patients with anemia caused by uterine fibroids; Linzess/Constella to treat irritable bowel syndrome with constipation and chronic idiopathic constipation; and Synthroid for hypothyroidism. It has collaborations with Calico Life Sciences LLC; REGENXBIO Inc.; I-Mab Biopharma; Genmab A/S; Janssen Biotech, Inc.; and Genentech, Inc. The company was incorporated in 2012 and is headquartered in North Chicago, Illinois.

NYSE ended the session with AbbVie sliding 7.06% to $150.38 on Thursday while NYSE jumped 1.33% to $15,431.64.

: AbbVie stock falls toward a 6-week low after adjusted profit fell short of expectations, but the full-year outlook was raisedShares of AbbVie Inc. ABBV dove 6.2% toward a six-week low in premarket trading Thursday, after the biopharmaceutical company missed first-quarter profit expectations but lifted its full-year outlook.

AbbVie (abbv) Q1 earnings and revenues top estimatesWhile AbbVie has underperformed the market so far this year, the question that comes to investors’ minds is: what’s next for the stock?

Earnings Per Share

As for profitability, AbbVie has a trailing twelve months EPS of $6.63.

PE Ratio

AbbVie has a trailing twelve months price to earnings ratio of 22.68. Meaning, the purchaser of the share is investing $22.68 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 72.39%.

More news about AbbVie.

10. Ideanomics (IDEX) – -5.11%

Ideanomics, Inc. focuses on driving the adoption of commercial electric vehicles, associated energy consumption, and developing financial services and fintech products. Its Ideanomics Mobility division facilitates the adoption of electric vehicles by commercial fleet operators. This division also offers solutions for the procurement, financing, charging, and energy management needs for fleet operators of commercial electric vehicles. The company's Ideanomics Capital division provides fintech services, which focuses on the enhancement of efficiency, transparency, and profitability for the financial services industry. Ideanomics, Inc. was incorporated in 2004 and is headquartered in New York, New York.

NASDAQ ended the session with Ideanomics dropping 5.11% to $0.03 on Thursday while NASDAQ jumped 2.43% to $12,142.24.

Earnings Per Share

As for profitability, Ideanomics has a trailing twelve months EPS of $-0.33.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is negative -109.94%.

Volume

Today’s last reported volume for Ideanomics is 161016000 which is 420.47% above its average volume of 30936300.

Sales Growth

Ideanomics’s sales growth is 232.8% for the present quarter and 755.4% for the next.

Earnings Before Interest, Taxes, Depreciation, and Amortization

Ideanomics’s EBITDA is -0.63.

Yearly Top and Bottom Value

Ideanomics’s stock is valued at $0.03 at 17:32 EST, way under its 52-week high of $0.89 and way above its 52-week low of $0.02.

More news about Ideanomics.

Stay up to date with our winners and losers daily report