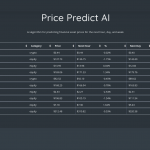

(VIANEWS) – Hallador Energy Company (HNRG), The York Water Company (YORW), BorgWarner (BWA) are the highest sales growth and return on equity stocks on this list.

Here is a list of stocks with an above 5% expected next quarter sales growth, and a 3% or higher return on equity. May these stocks be a good medium-term investment option?

1. Hallador Energy Company (HNRG)

139.7% sales growth and 9.02% return on equity

Hallador Energy Company, through its subsidiaries, engages in the production of steam coal in the Illinois basin for the electric power generation industry. The company owns the Oaktown 1 and Oaktown 2 underground mines in Oaktown, Indiana; and Ace in the Hole mine located near Clay City, Indiana. It is also involved in gas exploration activities in Indiana. The company was founded in 1949 and is headquartered in Terre Haute, Indiana.

Earnings Per Share

As for profitability, Hallador Energy Company has a trailing twelve months EPS of $0.55.

PE Ratio

Hallador Energy Company has a trailing twelve months price to earnings ratio of 14.22. Meaning, the purchaser of the share is investing $14.22 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 9.02%.

Yearly Top and Bottom Value

Hallador Energy Company’s stock is valued at $7.82 at 20:22 EST, way under its 52-week high of $11.57 and way higher than its 52-week low of $3.97.

Revenue Growth

Year-on-year quarterly revenue growth grew by 132.1%, now sitting on 361.99M for the twelve trailing months.

Moving Average

Hallador Energy Company’s value is under its 50-day moving average of $8.32 and under its 200-day moving average of $7.89.

Earnings Before Interest, Taxes, Depreciation, and Amortization

Hallador Energy Company’s EBITDA is 9.34.

2. The York Water Company (YORW)

20.2% sales growth and 10.68% return on equity

The York Water Company impounds, purifies, and distributes drinking water. It owns and operates two wastewater collection systems; five wastewater collection and treatment systems; and two reservoirs, including Lake Williams and Lake Redman, which hold approximately 2.2 billion gallons of water. The company also operates a 15-mile pipeline from the Susquehanna River to Lake Redman; and owns nine groundwater wells that supply water to customers in the Adams County. It serves customers in the fixtures and furniture, electrical machinery, food products, paper, ordnance units, textile products, air conditioning systems, laundry detergents, barbells, and motorcycle industries in 51 municipalities within three counties in south-central Pennsylvania. The York Water Company was incorporated in 1816 and is based in York, Pennsylvania.

Earnings Per Share

As for profitability, The York Water Company has a trailing twelve months EPS of $1.36.

PE Ratio

The York Water Company has a trailing twelve months price to earnings ratio of 32.11. Meaning, the purchaser of the share is investing $32.11 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 10.68%.

Volume

Today’s last reported volume for The York Water Company is 15221 which is 67.65% below its average volume of 47064.

Sales Growth

The York Water Company’s sales growth is 14.1% for the ongoing quarter and 20.2% for the next.

Moving Average

The York Water Company’s worth is below its 50-day moving average of $44.03 and under its 200-day moving average of $43.91.

Yearly Top and Bottom Value

The York Water Company’s stock is valued at $43.67 at 20:22 EST, under its 52-week high of $47.23 and way higher than its 52-week low of $36.85.

3. BorgWarner (BWA)

14.2% sales growth and 13.89% return on equity

BorgWarner Inc. provides solutions for combustion, hybrid, and electric vehicles worldwide. The company's Engine segment offers turbocharger and turbocharger actuators; eBoosters; and timing systems products, including timing chains, variable cam timing, crankshaft and camshaft sprockets, tensioners, guides and snubbers, front-wheel drive transmission chains, four-wheel drive chains, and hybrid power transmission chains. It also provides emissions systems, such as electric air pumps and exhaust gas recirculation (EGR) modules, EGR coolers and valves, glow plugs, and instant starting systems; thermal systems products comprising viscous fan drives, polymer fans, coolant pumps, cabin heaters, battery heaters, and battery charging; and gasoline ignition technologies. The company's Drivetrain segment offers friction and mechanical products that include dual and friction clutch modules, friction and separator plates, transmission bands, torque converter and one-way clutches, and torsional vibration dampers. It also provides electro-hydraulic solenoids, transmission solenoid modules, and dual clutch control modules; rear-wheel drive/all-wheel drive (AWD) transfer case systems, front wheel drive-AWD coupling systems, and cross-axle coupling systems; starters, alternators, and hybrid electric motors; and motor controllers, battery chargers, and uninterrupted power source systems. The company sells its products to original equipment manufacturers of light vehicles, which comprise passenger cars, sport-utility vehicles, vans, and light trucks; commercial vehicles, including medium-duty and heavy-duty trucks, and buses; and off-highway vehicles, such as agricultural and construction machinery, and marine applications, as well as to tier one vehicle systems suppliers and the aftermarket for light, commercial, and off-highway vehicles. The company was formerly known as Borg-Warner Automotive, Inc. BorgWarner Inc. was founded in 1987 and is headquartered in Auburn Hills, Michigan.

Earnings Per Share

As for profitability, BorgWarner has a trailing twelve months EPS of $3.99.

PE Ratio

BorgWarner has a trailing twelve months price to earnings ratio of 12.1. Meaning, the purchaser of the share is investing $12.1 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 13.89%.

Revenue Growth

Year-on-year quarterly revenue growth grew by 12.4%, now sitting on 15.8B for the twelve trailing months.

Dividend Yield

As claimed by Morningstar, Inc., the next dividend payment is on May 30, 2023, the estimated forward annual dividend rate is 0.68 and the estimated forward annual dividend yield is 1.41%.

4. H&E Equipment Services (HEES)

14% sales growth and 39.31% return on equity

H&E Equipment Services, Inc. operates as an integrated equipment services company. The company operates in five segments: Equipment Rentals, Used Equipment Sales, New Equipment Sales, Parts Sales, and Repair and Maintenance Services. The Equipment Rentals segment provides construction and industrial equipment for rent on a daily, weekly, and monthly basis through a fleet of approximately 42,725 pieces of equipment. The Used Equipment Sales segment sells used equipment through retail sales force primarily from its rental fleet, as well as inventoried equipment that are acquired through trade-ins from equipment customers. The New Equipment Sales segment sells new construction equipment through a professional in-house retail sales force. The Parts Sales segment sells parts for the equipment customers, as well as offers for its rental fleet. The Repair and Maintenance Services segment serves its rental fleet and equipment owned customers, as well as offers ongoing preventative maintenance services to industrial customers. It also provides ancillary equipment support activities, including transportation, hauling, parts shipping, and loss damage waivers. The company's rental fleet consists of hi-lift or aerial work platforms, cranes, earthmoving and material handling equipment, and others. It serves industrial and commercial companies, construction contractors, manufacturers, public utilities, municipalities, maintenance contractors, and various other industrial account customers. As of December 31, 2021, the company had a network of 102 service facilities in the Pacific Northwest, West Coast, Intermountain, Southwest, Gulf Coast, Southeast, and Mid-Atlantic regions of the United States. H&E Equipment Services, Inc. was founded in 1961 and is headquartered in Baton Rouge, Louisiana.

Earnings Per Share

As for profitability, H&E Equipment Services has a trailing twelve months EPS of $3.96.

PE Ratio

H&E Equipment Services has a trailing twelve months price to earnings ratio of 8.71. Meaning, the purchaser of the share is investing $8.71 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 39.31%.

Volume

Today’s last reported volume for H&E Equipment Services is 252078 which is 13.59% below its average volume of 291755.

Earnings Before Interest, Taxes, Depreciation, and Amortization

H&E Equipment Services’s EBITDA is 2.05.

Yearly Top and Bottom Value

H&E Equipment Services’s stock is valued at $34.50 at 20:22 EST, way under its 52-week high of $56.47 and way higher than its 52-week low of $26.12.

5. U.S. Silica Holdings (SLCA)

9.8% sales growth and 19.36% return on equity

U.S. Silica Holdings, Inc. produces and sells commercial silica in the United States. It operates through two segments, Oil & Gas Proppants and Industrial & Specialty Products. The company offers whole grain commercial silica products to be used as fracturing sand in connection with oil and natural gas recovery, as well as sells its whole grain silica products in various size distributions, grain shapes, and chemical purity levels for the manufacturing of glass products. It also provides various grades of whole-grain round silica to the foundry industry; ground silica and industrial minerals products for various products; and engineered performance materials made from diatomaceous earth (DE), clay, and perlite. In addition, the company offers transportation, equipment rental, and contract labor services. It serves oilfield services companies, and exploration and production companies that are engaged in hydraulic fracturing, building and construction products, chemicals, fillers and extenders, filtration, glass, sports, recreation, and industrial and specialty products end markets. The company was formerly known as GGC USS Holdings Inc. and changed its name to U.S. Silica Holdings, Inc. in July 2011. U.S. Silica Holdings, Inc. was founded in 1894 and is headquartered in Katy, Texas.

Earnings Per Share

As for profitability, U.S. Silica Holdings has a trailing twelve months EPS of $1.69.

PE Ratio

U.S. Silica Holdings has a trailing twelve months price to earnings ratio of 7.21. Meaning, the purchaser of the share is investing $7.21 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 19.36%.

6. Gartner (IT)

9.7% sales growth and 315.08% return on equity

Gartner, Inc. operates as a research and advisory company in the United States, Canada, Europe, the Middle East, Africa, and internationally. It operates through three segments: Research, Conferences, and Consulting. The Research segment delivers its research primarily through a subscription service that include on-demand access to published research content, data and benchmarks, and direct access to a network of research experts. The Conferences segment offers business professionals in an organization the opportunity to learn, share, and network. The Consulting segment offers market research, custom analysis, and on-the-ground support services. This segment also offers actionable solutions for IT-related priorities, including IT cost optimization, digital transformation, and IT sourcing optimization. Gartner, Inc. was founded in 1979 and is headquartered in Stamford, Connecticut.

Earnings Per Share

As for profitability, Gartner has a trailing twelve months EPS of $11.8.

PE Ratio

Gartner has a trailing twelve months price to earnings ratio of 27.28. Meaning, the purchaser of the share is investing $27.28 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 315.08%.

Earnings Before Interest, Taxes, Depreciation, and Amortization

Gartner’s EBITDA is 4.63.

Growth Estimates Quarters

The company’s growth estimates for the ongoing quarter and the next is a negative 12.3% and a negative 17.8%, respectively.

Previous days news about Gartner(IT)

- According to VentureBeat on Monday, 15 May, "Remediating vulnerabilities by faster patching is costly and can lead astray the most active threats," writes Gartner in its report Tracking the Right Vulnerability Management Metrics (client access required). "