(VIANEWS) – Shares of Monolithic Power Systems (NASDAQ: MPWR) dropped by a staggering 11.7% to $405.25 at 11:49 EST on Friday, after three sequential sessions in a row of losses. NASDAQ is jumping 1.79% to $12,180.87, after four successive sessions in a row of losses. This seems, up until now, an all-around positive trend exchanging session today.

Monolithic Power Systems’s last close was $458.93, 15.23% under its 52-week high of $541.39.

About Monolithic Power Systems

Monolithic Power Systems, Inc. engages in the design, development, marketing, and sale of semiconductor-based power electronics solutions for the computing and storage, automotive, industrial, communications, and consumer markets. The company provides direct current (DC) to DC integrated circuits (ICs) that are used to convert and control voltages of various electronic systems, such as portable electronic devices, wireless LAN access points, computers and notebooks, monitors, infotainment applications, and medical equipment. It also offers lighting control ICs for backlighting that are used in systems, which provide the light source for LCD panels in notebook computers, monitors, car navigation systems, and televisions, as well as for general illumination products. The company sells its products through third-party distributors and value-added resellers, as well as directly to original equipment manufacturers, original design manufacturers, electronic manufacturing service providers, and other end customers in China, Taiwan, Europe, South Korea, Southeast Asia, Japan, the United States, and internationally. Monolithic Power Systems, Inc. was incorporated in 1997 and is based in Kirkland, Washington.

Earnings Per Share

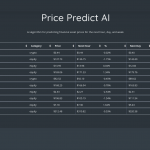

As for profitability, Monolithic Power Systems has a trailing twelve months EPS of $9.04.

PE Ratio

Monolithic Power Systems has a trailing twelve months price to earnings ratio of 44.83. Meaning, the purchaser of the share is investing $44.83 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 30.05%.

Volume

Today’s last reported volume for Monolithic Power Systems is 977102 which is 106.56% above its average volume of 473022.

Growth Estimates Quarters

The company’s growth estimates for the present quarter is 21.6% and a drop 8.3% for the next.

Yearly Top and Bottom Value

Monolithic Power Systems’s stock is valued at $405.25 at 11:49 EST, way below its 52-week high of $541.39 and way higher than its 52-week low of $301.69.

Revenue Growth

Year-on-year quarterly revenue growth grew by 36.7%, now sitting on 1.79B for the twelve trailing months.

More news about Monolithic Power Systems (MPWR).