(VIANEWS) – North European Oil Royality Trust (NRT), MFS Special Value Trust (MFV), Voya Global Equity Dividend and Premium Opportunity Fund (IGD) have the highest dividend yield stocks on this list.

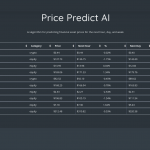

| Financial Asset | Forward Dividend Yield | Updated (EST) |

|---|---|---|

| North European Oil Royality Trust (NRT) | 18.07% | 2023-04-16 15:46:08 |

| MFS Special Value Trust (MFV) | 10.19% | 2023-04-16 03:23:08 |

| Voya Global Equity Dividend and Premium Opportunity Fund (IGD) | 9.28% | 2023-04-15 13:42:08 |

| Liberty All (ASG) | 8.73% | 2023-05-01 03:10:07 |

| Holly Energy Partners, L.P. (HEP) | 8.06% | 2023-04-15 07:55:14 |

| Kennedy (KW) | 5.94% | 2023-04-15 21:12:07 |

| Northern Trust (NTRS) | 3.92% | 2023-04-30 03:11:50 |

| Exelon (EXC) | 3.3% | 2023-05-01 14:37:52 |

| Hurco Companies (HURC) | 2.64% | 2023-04-21 10:43:07 |

Close to 2K companies listed in the Nasdaq and NYSE pay out dividends to its shareholders. The dividend yield is a dividend to price ratio showing how much a company pays out in dividends each year.

1. North European Oil Royality Trust (NRT) – Dividend Yield: 18.07%

North European Oil Royality Trust’s last close was $14.28, 31.08% under its 52-week high of $20.72. Intraday change was 3.7%.

North European Oil Royalty Trust, a grantor trust, holds overriding royalty rights covering gas and oil production in various concessions or leases in the Federal Republic of Germany. It has rights under contracts with German exploration and development subsidiaries of ExxonMobil Corp. and the Royal Dutch/Shell Group of Companies. The company holds royalties for the sale of well gas, oil well gas, crude oil, condensate, and sulfur. North European Oil Royalty Trust is based in Keene, New Hampshire.

Earnings Per Share

As for profitability, North European Oil Royality Trust has a trailing twelve months EPS of $2.64.

PE Ratio

North European Oil Royality Trust has a trailing twelve months price to earnings ratio of 5.41. Meaning, the purchaser of the share is investing $5.41 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 5306.82%.

Revenue Growth

Year-on-year quarterly revenue growth grew by 284.4%, now sitting on 25.04M for the twelve trailing months.

Yearly Top and Bottom Value

North European Oil Royality Trust’s stock is valued at $14.28 at 03:15 EST, way under its 52-week high of $20.72 and way higher than its 52-week low of $10.03.

Earnings Before Interest, Taxes, Depreciation, and Amortization

North European Oil Royality Trust’s EBITDA is 4.58.

More news about North European Oil Royality Trust.

2. MFS Special Value Trust (MFV) – Dividend Yield: 10.19%

MFS Special Value Trust’s last close was $4.31, 35.29% under its 52-week high of $6.66. Intraday change was 0.23%.

MFS Special Value Trust is a closed-ended balanced mutual fund launched and managed by Massachusetts Financial Services Company The fund invests in the public equity and fixed income markets of the United States. It primarily invests in value stocks of companies operating across diversified sectors. The fund employs fundamental analysis and a bottom-up stock picking approach to create its portfolio. For the fixed income component of its portfolio, it seeks to invest in U.S. government securities, foreign government securities, mortgage backed and other asset-backed securities of U.S. and foreign issuers, corporate bonds of U.S. and foreign issuers, and debt instruments of issuers located in emerging market countries. The fund benchmarks the performance of its equity portfolio against Russell 1000 Value Index and fixed income against Barclays U.S. High-Yield Corporate Bond 2% Issuer Capped, MFS Special Value Trust Blended Index, and JPMorgan Emerging Markets Bond Index Global Index. MFS Special Value Trust was formed on November 30, 1989 and is domiciled in United States.

Earnings Per Share

As for profitability, MFS Special Value Trust has a trailing twelve months EPS of $-0.57.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is negative -11.48%.

Volume

Today’s last reported volume for MFS Special Value Trust is 15904 which is 6.5% below its average volume of 17011.

Dividend Yield

As claimed by Morningstar, Inc., the next dividend payment is on Apr 17, 2023, the estimated forward annual dividend rate is 0.44 and the estimated forward annual dividend yield is 10.19%.

Yearly Top and Bottom Value

MFS Special Value Trust’s stock is valued at $4.31 at 03:15 EST, way below its 52-week high of $6.66 and above its 52-week low of $3.95.

Moving Average

MFS Special Value Trust’s value is under its 50-day moving average of $4.33 and below its 200-day moving average of $4.44.

More news about MFS Special Value Trust.

3. Voya Global Equity Dividend and Premium Opportunity Fund (IGD) – Dividend Yield: 9.28%

Voya Global Equity Dividend and Premium Opportunity Fund’s last close was $5.13, 13.78% under its 52-week high of $5.95. Intraday change was -0.77%.

Voya Global Equity Dividend and Premium Opportunity Fund is a closed-ended equity mutual fund launched by Voya Investment Management LLC. The fund is co-managed by Voya Investments, LLC and NNIP Advisors B.V. It invests in public equity markets across the globe. The fund seeks to invest in stocks of companies operating across diversified sectors. It primarily invests in dividend paying stocks of companies having a market capitalization of $1 billion or more. The fund also invests through call options on selected indices, individual securities, and/or exchange traded funds. It employs fundamental analysis to create its portfolio. The fund benchmarks the performance of its portfolio against the MSCI World Index and the Chicago Board Options Exchange BuyWrite Monthly Index. It was formerly known as ING Global Equity Dividend and Premium Opportunity Fund. Voya Global Equity Dividend and Premium Opportunity Fund was formed on March 28, 2005 and is domiciled in the United States.

Earnings Per Share

As for profitability, Voya Global Equity Dividend and Premium Opportunity Fund has a trailing twelve months EPS of $-0.11.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is negative -1.92%.

More news about Voya Global Equity Dividend and Premium Opportunity Fund.

4. Liberty All (ASG) – Dividend Yield: 8.73%

Liberty All’s last close was $5.09, 26.23% below its 52-week high of $6.90. Intraday change was 0.99%.

Liberty All-Star Growth Fund, Inc. is a closed-ended equity mutual fund launched and managed by ALPS Advisers, Inc. It is co-managed by Weatherbie Capital, LLC, Congress Asset Management Company, and Sustainable Growth Advisers, LP. The fund invests in the public equity markets of the United States. It seeks to invest in stocks of companies operating across diversified sectors. The fund primarily invests in growth stocks of companies across all market capitalizations. It employs fundamental analysis with a bottom-up stock picking approach to create its portfolio. The fund benchmarks the performance of its portfolio against the NASDAQ Composite Index, Russell 3000 Growth Index, and the S&P 500 Index. It conducts in-house research to make its investments. The fund was previously known as Charles Allmon Trust, Inc. Liberty All-Star Growth Fund, Inc. was formed on March 14, 1986 and is domiciled in the United States.

Earnings Per Share

As for profitability, Liberty All has a trailing twelve months EPS of $-2.52.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is negative -37.15%.

Yearly Top and Bottom Value

Liberty All’s stock is valued at $5.09 at 03:15 EST, way under its 52-week high of $6.90 and above its 52-week low of $4.82.

Volume

Today’s last reported volume for Liberty All is 92007 which is 42.64% below its average volume of 160430.

More news about Liberty All.

5. Holly Energy Partners, L.P. (HEP) – Dividend Yield: 8.06%

Holly Energy Partners, L.P.’s last close was $17.39, 13.05% under its 52-week high of $20.00. Intraday change was 0.17%.

Holly Energy Partners, L.P. provides petroleum product and crude oil transportation, terminalling, storage, and throughput services to the petroleum industry in the United States. It operates through two segments, Pipelines and Terminals, and Refinery Processing Unit. The company operates refined product pipelines that transport conventional gasolines, reformulated gasolines, and low-octane gasolines for oxygenate blending, as well as sulfur diesel and jet fuels, and liquefied petroleum gases; intermediate product pipelines that transport intermediate feedstocks and crude oils; and oil trunk, gathering, and connection pipelines that delivers crude oil. It operates 26 main pipelines; crude gathering networks; 10 refined product terminals; 1 crude terminal; 1 lube terminal; 31,800 track feet of rail storage; 7 locations with truck and/or rail racks; and tankages at 6 refining facility locations, as well as five refinery processing units. The company was incorporated in 2004 and is based in Dallas, Texas.

Earnings Per Share

As for profitability, Holly Energy Partners, L.P. has a trailing twelve months EPS of $1.77.

PE Ratio

Holly Energy Partners, L.P. has a trailing twelve months price to earnings ratio of 9.82. Meaning, the purchaser of the share is investing $9.82 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 28.13%.

Volume

Today’s last reported volume for Holly Energy Partners, L.P. is 40641 which is 64.5% below its average volume of 114485.

More news about Holly Energy Partners, L.P..

6. Kennedy (KW) – Dividend Yield: 5.94%

Kennedy’s last close was $16.17, 34.03% below its 52-week high of $24.51. Intraday change was -1.22%.

Kennedy-Wilson Holdings, Inc. operates as a real estate investment company. The company owns, operates, and invests in real estate both on its own and through its investment management platform. It focuses on multifamily and commercial properties located in the Western United States, the United Kingdom, Ireland, Spain, Italy, and Japan. The company owns interest in approximately 49 million square feet of property, including 29,705 multifamily rental units; and 22.0 million square feet of commercial property. It also provides real estate services primarily to financial services clients. In addition, the company is involved in the development, redevelopment, and entitlement of real estate properties; and management of real estate properties for third parties. Kennedy-Wilson Holdings, Inc. was founded in 1977 and is headquartered in Beverly Hills, California.

Earnings Per Share

As for profitability, Kennedy has a trailing twelve months EPS of $0.47.

PE Ratio

Kennedy has a trailing twelve months price to earnings ratio of 34.4. Meaning, the purchaser of the share is investing $34.4 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 5.34%.

Moving Average

Kennedy’s value is under its 50-day moving average of $17.03 and below its 200-day moving average of $17.24.

Revenue Growth

Year-on-year quarterly revenue growth declined by 34.7%, now sitting on 599.1M for the twelve trailing months.

More news about Kennedy.

7. Northern Trust (NTRS) – Dividend Yield: 3.92%

Northern Trust’s last close was $77.03, 31.93% under its 52-week high of $113.16. Intraday change was 0.74%.

Northern Trust Corporation, a financial holding company, provides wealth management, asset servicing, asset management, and banking solutions for corporations, institutions, families, and individuals worldwide. It operates in two segments, Asset Servicing and Wealth Management. The Asset Servicing segment offers asset servicing and related services, including custody, fund administration, investment operations outsourcing, investment management, investment risk and analytical services, employee benefit services, securities lending, foreign exchange, treasury management, brokerage services, transition management services, banking, and cash management services. This segment serves corporate and public retirement funds, foundations, endowments, fund managers, insurance companies, sovereign wealth funds, and other institutional investors. The Wealth Management segment offers trust, investment management, custody, and philanthropic; financial consulting; guardianship and estate administration; family business consulting; family financial education; brokerage services; and private and business banking services. This segment serves high-net-worth individuals and families, business owners, executives, professionals, retirees, and established privately held businesses. The company also provides asset management services, such as active and passive equity; active and passive fixed income; cash management; alternative asset classes comprising private equity and hedge funds of funds; and multi-manager advisory services and products through separately managed accounts, bank common and collective funds, registered investment companies, exchange traded funds, non-U.S. collective investment funds, and unregistered private investment funds. In addition, it offers overlay and other risk management services. Northern Trust Corporation was founded in 1889 and is headquartered in Chicago, Illinois.

Earnings Per Share

As for profitability, Northern Trust has a trailing twelve months EPS of $5.88.

PE Ratio

Northern Trust has a trailing twelve months price to earnings ratio of 13.2. Meaning, the purchaser of the share is investing $13.2 for every dollar of annual earnings.

Yearly Top and Bottom Value

Northern Trust’s stock is valued at $77.60 at 03:15 EST, way below its 52-week high of $113.16 and higher than its 52-week low of $75.97.

More news about Northern Trust.

8. Exelon (EXC) – Dividend Yield: 3.3%

Exelon’s last close was $43.18, 13.4% under its 52-week high of $49.86. Intraday change was 1.56%.

Exelon Corporation, a utility services holding company, engages in the energy distribution and transmission businesses in the United States and Canada. The company is involved in the purchase and regulated retail sale of electricity and natural gas, transmission and distribution of electricity, and distribution of natural gas to retail customers. It also offers support services, including legal, human resources, information technology, supply management, financial, engineering, customer operations, distribution and transmission planning, asset management, system operations, and power procurement services. It serves distribution utilities, municipalities, cooperatives, and financial institutions, as well as commercial, industrial, governmental, and residential customers. Exelon Corporation was incorporated in 1999 and is headquartered in Chicago, Illinois.

Earnings Per Share

As for profitability, Exelon has a trailing twelve months EPS of $2.08.

PE Ratio

Exelon has a trailing twelve months price to earnings ratio of 20.72. Meaning, the purchaser of the share is investing $20.72 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 6.9%.

Volume

Today’s last reported volume for Exelon is 3988150 which is 47.48% below its average volume of 7593790.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions, Exelon’s stock is considered to be oversold (<=20).

More news about Exelon.

9. Hurco Companies (HURC) – Dividend Yield: 2.64%

Hurco Companies’s last close was $23.25, 23.54% under its 52-week high of $30.41. Intraday change was 0%.

Hurco Companies, Inc., an industrial technology company, designs, manufactures, and sells computerized machine tools to companies in the metal cutting industry worldwide. The company's principal products include general-purpose computerized machine tools, including vertical machining centers and turning centers. It also provides computer control systems and related software for press brake applications. In addition, the company offers machine tool components, automation integration equipment, and solutions for job shops; and software options, control upgrades, and accessories and replacement parts for its products, as well as customer service, training, and applications support services. It serves independent job shops and specialized short-run production applications within large manufacturing operations, as well as precision tool, die, and mold manufacturers in aerospace, defense, medical equipment, energy, automotive/transportation, electronics, and computer industries. The company sells its products under the Hurco, Milltronics, and Takumi brands through independent agents and distributors, as well as through its direct sales and service organizations. Hurco Companies, Inc. was founded in 1968 and is headquartered in Indianapolis, Indiana.

Earnings Per Share

As for profitability, Hurco Companies has a trailing twelve months EPS of $0.9.

PE Ratio

Hurco Companies has a trailing twelve months price to earnings ratio of 25.83. Meaning, the purchaser of the share is investing $25.83 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 2.55%.

Dividend Yield

As stated by Morningstar, Inc., the next dividend payment is on Mar 23, 2023, the estimated forward annual dividend rate is 0.64 and the estimated forward annual dividend yield is 2.64%.

Moving Average

Hurco Companies’s value is way below its 50-day moving average of $27.18 and under its 200-day moving average of $25.64.

Earnings Before Interest, Taxes, Depreciation, and Amortization

Hurco Companies’s EBITDA is 0.53.

More news about Hurco Companies.