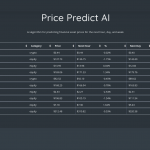

(VIANEWS) – Nustar Energy L.P. (NS), Unilever (UL), Colgate-Palmolive (CL) are the highest payout ratio stocks on this list.

We have congregated information about stocks with the highest payout ratio at the moment. The payout ratio in itself isn’t a guarantee of good investment but it’s an indicator of whether dividends are being paid and how the company chooses to issue them.

When researching a potential investment, the dividend payout ratio is a good statistic to know so here are a few stocks with an above 30% percent payout ratio.

1. Nustar Energy L.P. (NS)

432.43% Payout Ratio

NuStar Energy L.P. engages in the terminalling, storage, and marketing of petroleum products in the United States and internationally. The company also engages in the transportation of petroleum products and anhydrous ammonia. It operates through three segments: Pipeline, Storage, and Fuels Marketing. The Pipeline segment transports refined petroleum products, crude oil, and anhydrous ammonia. The Storage segment owns terminal and storage facilities, which offer storage, handling, and other services for petroleum products, crude oil, specialty chemicals, and other liquids. This segment also provides pilotage, tug assistance, line handling, launch, emergency response, and other ship services. The Fuels Marketing segment is involved in bunkering operations in the Gulf Coast; blending operations; and purchase of petroleum products for resale. As of December 31, 2019, the company had 3,205 miles of refined product pipelines and 2,155 miles of crude oil pipelines in Texas, Oklahoma, Kansas, Colorado, and New Mexico; a 2,150-mile refined product pipeline originating in southern Kansas and terminating at Jamestown, North Dakota; a 450-mile refined product pipeline originating at Marathon Petroleum Corporation's Mandan, North Dakota refinery and terminating in Minneapolis, Minnesota; 2,000 miles of anhydrous ammonia pipelines; and 40 terminal and storage facilities, which offer approximately 61.3 million barrels of storage capacity. NuStar Energy L.P. was founded in 1999 and is headquartered in San Antonio, Texas.

Earnings Per Share

As for profitability, Nustar Energy L.P. has a trailing twelve months EPS of $0.37.

PE Ratio

Nustar Energy L.P. has a trailing twelve months price to earnings ratio of 42.92. Meaning, the purchaser of the share is investing $42.92 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 14.12%.

Moving Average

Nustar Energy L.P. ‘s worth is under its 50-day moving average of $16.33 and above its 200-day moving average of $15.45.

Growth Estimates Quarters

The company’s growth estimates for the current quarter and the next is 240.9% and 75%, respectively.

Yearly Top and Bottom Value

Nustar Energy L.P. ‘s stock is valued at $15.88 at 19:23 EST, way below its 52-week high of $17.75 and way higher than its 52-week low of $12.80.

2. Unilever (UL)

75.82% Payout Ratio

Unilever PLC operates as a fast-moving consumer goods company. It operates through Beauty & Personal Care, Foods & Refreshment, and Home Care segments. The Beauty & Personal Care segment provides skin care and hair care products, deodorants, and skin cleansing products. The Foods & Refreshment segment offers ice cream, soups, bouillons, seasonings, mayonnaise, ketchups, and tea categories. The Home Care segment provides fabric solutions and various cleaning products. The company offers its products under the Domestos, OMO, Seventh Generation, Ben & Jerry's, Knorr, Magnum, Wall's, Bango, the Vegetarian Butcher, Axe, Cif, Comfort, Dove, Lifebuoy, Lux, Rexona, Sunsilk, Equilibra, OLLY, Liquid I.V., SmartyPants, Onnit, Hellmann's, and Vaseline brands. Unilever PLC was incorporated in 1894 and is headquartered in London, the United Kingdom.

Earnings Per Share

As for profitability, Unilever has a trailing twelve months EPS of $2.55.

PE Ratio

Unilever has a trailing twelve months price to earnings ratio of 19.54. Meaning, the purchaser of the share is investing $19.54 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 30.43%.

Revenue Growth

Year-on-year quarterly revenue growth grew by 14.9%, now sitting on 56.28B for the twelve trailing months.

Dividend Yield

As stated by Morningstar, Inc., the next dividend payment is on Nov 16, 2022, the estimated forward annual dividend rate is 1.8 and the estimated forward annual dividend yield is 3.62%.

3. Colgate-Palmolive (CL)

74.69% Payout Ratio

Colgate-Palmolive Company, together with its subsidiaries, manufactures and sells consumer products worldwide. The company operates through two segments, Oral, Personal and Home Care; and Pet Nutrition. The Oral, Personal and Home Care segment offers toothpaste, toothbrushes, mouthwash, bar and liquid hand soaps, shower gels, shampoos, conditioners, deodorants and antiperspirants, skin health products, dishwashing detergents, fabric conditioners, household cleaners, and other related items. This segment markets and sells its products under various brands, which include Colgate, Darlie, elmex, hello, meridol, Sorriso, Tom's of Maine, Irish Spring, Palmolive, Protex, Sanex, Softsoap, Lady Speed Stick, Speed Stick, EltaMD, Filorga, PCA SKIN, Ajax, Axion, Fabuloso, Murphy, Suavitel, Soupline, and Cuddly to a range of traditional and eCommerce retailers, wholesalers, and distributors. It also includes pharmaceutical products for dentists and other oral health professionals. The Pet Nutrition segment offers pet nutrition products for everyday nutritional needs under the Hill's Science Diet brand; and a range of therapeutic products to manage disease conditions in dogs and cats under the Hill's Prescription Diet brand. This segment markets and sells its products through pet supply retailers, veterinarians, and eCommerce retailers. Colgate-Palmolive Company was founded in 1806 and is headquartered in New York, New York.

Earnings Per Share

As for profitability, Colgate-Palmolive has a trailing twelve months EPS of $3.11.

PE Ratio

Colgate-Palmolive has a trailing twelve months price to earnings ratio of 23.76. Meaning, the purchaser of the share is investing $23.76 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 318.19%.

Dividend Yield

As stated by Morningstar, Inc., the next dividend payment is on Apr 19, 2022, the estimated forward annual dividend rate is 1.88 and the estimated forward annual dividend yield is 2.4%.

4. UPS (UPS)

40.8% Payout Ratio

United Parcel Service, Inc. provides letter and package delivery, transportation, logistics, and related services. It operates through two segments, U.S. Domestic Package and International Package. The U.S. Domestic Package segment offers time-definite delivery of letters, documents, small packages, and palletized freight through air and ground services in the United States. The International Package segment provides guaranteed day and time-definite international shipping services in Europe, the Asia Pacific, Canada and Latin America, the Indian sub-continent, the Middle East, and Africa. This segment offers guaranteed time-definite express options. The company also provides international air and ocean freight forwarding, customs brokerage, distribution and post-sales, and mail and consulting services in approximately 200 countries and territories. In addition, it offers truckload brokerage services; supply chain solutions to the healthcare and life sciences industry; shipping, visibility, and billing technologies; and financial and insurance services. The company operates a fleet of approximately 121,000 package cars, vans, tractors, and motorcycles; and owns 59,000 containers that are used to transport cargo in its aircraft. United Parcel Service, Inc. was founded in 1907 and is headquartered in Atlanta, Georgia.

Earnings Per Share

As for profitability, UPS has a trailing twelve months EPS of $5.92.

PE Ratio

UPS has a trailing twelve months price to earnings ratio of 31.37. Meaning, the purchaser of the share is investing $31.37 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 80.59%.

Yearly Top and Bottom Value

UPS’s stock is valued at $185.77 at 19:23 EST, way below its 52-week high of $233.72 and way higher than its 52-week low of $161.90.

Moving Average

UPS’s worth is under its 50-day moving average of $193.02 and below its 200-day moving average of $196.67.

Volume

Today’s last reported volume for UPS is 1760900 which is 40.02% below its average volume of 2936060.

Growth Estimates Quarters

The company’s growth estimates for the current quarter is 11.4% and a drop 1.1% for the next.