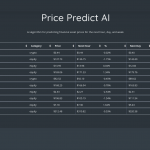

(VIANEWS) – Pimco Corporate & Income Opportunity Fund (PTY), Alliancebernstein Global High Income Fund (AWF), Global Ship Lease (GSL) have the highest dividend yield stocks on this list.

| Financial Asset | Forward Dividend Yield | Updated (EST) |

|---|---|---|

| Pimco Corporate & Income Opportunity Fund (PTY) | 11.2% | 2023-04-17 03:14:07 |

| Alliancebernstein Global High Income Fund (AWF) | 8.06% | 2023-04-13 11:23:07 |

| Global Ship Lease (GSL) | 7.66% | 2023-04-15 07:09:07 |

| Ennis (EBF) | 4.81% | 2023-04-14 13:11:07 |

| Geopark Ltd (GPRK) | 4.47% | 2023-04-15 06:23:08 |

| Standard Register Company (SR) | 4.23% | 2023-04-17 15:09:07 |

| Simmons First National Corporation (SFNC) | 3.4% | 2023-04-06 04:44:13 |

| The Hackett Group (HCKT) | 2.38% | 2023-04-03 17:09:09 |

Almost 2K companies listed in the Nasdaq and NYSE pay out dividends to its shareholders. The dividend yield is a dividend to price ratio showing how much a company pays out in dividends each year.

1. Pimco Corporate & Income Opportunity Fund (PTY) – Dividend Yield: 11.2%

Pimco Corporate & Income Opportunity Fund’s last close was $12.73, 16.36% below its 52-week high of $15.22. Intraday change was -0.31%.

PIMCO Corporate & Income Opportunity Fund is a closed-ended fixed income mutual fund launched and managed by Allianz Global Investors Fund Management LLC. It is co-managed by Pacific Investment Management Company LLC. The fund invests in fixed income markets across the globe. It invests in corporate debt obligations rated in the lowest investment grade category Baa or BBB and in the highest non-investment grade category Ba or BB. The fund focuses on intermediate maturity bonds across multiple industries and sectors. It employs fundamental analysis along with top-down approach to make its fixed income investments. The fund uses in-house research to make its investments. PIMCO Corporate Opportunity Fund was founded on December 27, 2002 and is domiciled in United States.

Earnings Per Share

As for profitability, Pimco Corporate & Income Opportunity Fund has a trailing twelve months EPS of $0.92.

PE Ratio

Pimco Corporate & Income Opportunity Fund has a trailing twelve months price to earnings ratio of 13.84. Meaning, the purchaser of the share is investing $13.84 for every dollar of annual earnings.

Yearly Top and Bottom Value

Pimco Corporate & Income Opportunity Fund’s stock is valued at $12.73 at 03:15 EST, way under its 52-week high of $15.22 and way higher than its 52-week low of $11.38.

Volume

Today’s last reported volume for Pimco Corporate & Income Opportunity Fund is 277480 which is 46.79% below its average volume of 521521.

Dividend Yield

As maintained by Morningstar, Inc., the next dividend payment is on Apr 11, 2023, the estimated forward annual dividend rate is 1.43 and the estimated forward annual dividend yield is 11.2%.

More news about Pimco Corporate & Income Opportunity Fund.

2. Alliancebernstein Global High Income Fund (AWF) – Dividend Yield: 8.06%

Alliancebernstein Global High Income Fund’s last close was $9.92, 7.29% below its 52-week high of $10.70. Intraday change was 0.72%.

AllianceBernstein Global High Income Fund is a close-ended fixed income mutual fund launched and managed by AllianceBernstein L.P. It invests in fixed income markets across the globe. The fund primarily invests in lower-rated corporate debt securities and government bonds. It employs a combination of fundamental and quantitative analysis to create its portfolio. The fund benchmarks the performance of its portfolio against a composite index comprised of JPMorgan Government Bond Index-Emerging Markets, JPMorgan Emerging Markets Bond Index Global, and the Barclays U.S. Corporate High Yield 2% Issuer Capped Index. It was previously known as Alliance World Dollar Government Fund II, Inc. AllianceBernstein Global High Income Fund was formed on May 20, 1993 and is domiciled in the United States.

Earnings Per Share

As for profitability, Alliancebernstein Global High Income Fund has a trailing twelve months EPS of $-2.07.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is negative -18.03%.

Revenue Growth

Year-on-year quarterly revenue growth grew by 3.8%, now sitting on 64.75M for the twelve trailing months.

Yearly Top and Bottom Value

Alliancebernstein Global High Income Fund’s stock is valued at $9.93 at 03:15 EST, under its 52-week high of $10.70 and way above its 52-week low of $8.76.

More news about Alliancebernstein Global High Income Fund.

3. Global Ship Lease (GSL) – Dividend Yield: 7.66%

Global Ship Lease’s last close was $20.43, 23.48% below its 52-week high of $26.70. Intraday change was 1.64%.

Global Ship Lease, Inc. owns and charters containerships of various sizes under fixed-rate charters to container shipping companies. As of March 10, 2022, it owned 65 mid-sized and smaller containerships with an aggregate capacity of 342,348 twenty-foot equivalent units. The company was founded in 2007 and is based in London, the United Kingdom.

Earnings Per Share

As for profitability, Global Ship Lease has a trailing twelve months EPS of $7.62.

PE Ratio

Global Ship Lease has a trailing twelve months price to earnings ratio of 2.68. Meaning, the purchaser of the share is investing $2.68 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 34.89%.

Growth Estimates Quarters

The company’s growth estimates for the present quarter and the next is 7.3% and 19.5%, respectively.

Volatility

Global Ship Lease’s last week, last month’s, and last quarter’s current intraday variation average was 1.64%, 0.70%, and 1.92%.

Global Ship Lease’s highest amplitude of average volatility was 1.64% (last week), 1.58% (last month), and 1.92% (last quarter).

More news about Global Ship Lease.

4. Ennis (EBF) – Dividend Yield: 4.81%

Ennis’s last close was $20.80, 11.41% below its 52-week high of $23.48. Intraday change was -1.02%.

Ennis, Inc. designs, manufactures, and sells business forms and other business products in the United States. The company offers snap sets, continuous forms, laser cut sheets, tags, labels, envelopes, integrated products, jumbo rolls, and pressure sensitive products under the Ennis, Royal Business Forms, Block Graphics, Specialized Printed Forms, 360º Custom Labels, ColorWorx, Enfusion, Uncompromised Check Solutions, VersaSeal, Ad Concepts, FormSource Limited, Star Award Ribbon Company, Witt Printing, B&D Litho, Genforms, PrintGraphics, Calibrated Forms, PrintXcel, Printegra, Falcon Business Forms, Forms Manufacturers, Mutual Graphics, TRI-C Business Forms, Major Business Systems, Independent Printing, Hoosier Data Forms, Hayes Graphics, Wright Business Graphics, Wright 360, Integrated Print & Graphics, the Flesh Company, Impressions Direct, and Ace Forms brands. It also provides point of purchase advertising for large franchise and fast food chains, as well as kitting and fulfillment under the Adams McClure brand; and presentation folders and document folders under the Admore, Folder Express, and Independent Folders brands. In addition, the company offers custom printed, high performance labels, and custom and stock tags under the Ennis Tag & Label brands; custom and stock tags and labels under the Allen-Bailey Tag & Label, Atlas Tag & Label, Kay Toledo Tag, and Special Service Partners brands; custom and imprinted envelopes under the Trade Envelopes, Block Graphics, Wisco, and National Imprint Corporation brands; and financial and security documents under the Northstar and General Financial Supply brands. It distributes business products and forms through independent distributors. The company was formerly known as Ennis Business Forms, Inc. Ennis, Inc. was founded in 1909 and is headquartered in Midlothian, Texas.

Earnings Per Share

As for profitability, Ennis has a trailing twelve months EPS of $1.61.

PE Ratio

Ennis has a trailing twelve months price to earnings ratio of 12.63. Meaning, the purchaser of the share is investing $12.63 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 13.31%.

Sales Growth

Ennis’s sales growth for the current quarter is 3%.

More news about Ennis.

5. Geopark Ltd (GPRK) – Dividend Yield: 4.47%

Geopark Ltd’s last close was $11.89, 35.8% under its 52-week high of $18.52. Intraday change was 2.24%.

GeoPark Limited engages in the exploration, development, and production of oil and gas reserves in Chile, Colombia, Brazil, Argentina, and Ecuador. As of December 31, 2021, the company had working and/or economic interests in 42 hydrocarbons blocks. It had net proved reserves of 87.8 million barrels of oil equivalent. GeoPark Limited has a strategic partnership with ONGC Videsh to jointly acquire, invest in, and create value from upstream oil and gas projects across Latin America. The company was formerly known as GeoPark Holdings Limited and changed its name to GeoPark Limited in July 2013. GeoPark Limited was founded in 2002 and is based in Bogotá, Colombia.

Earnings Per Share

As for profitability, Geopark Ltd has a trailing twelve months EPS of $3.75.

PE Ratio

Geopark Ltd has a trailing twelve months price to earnings ratio of 3.17. Meaning, the purchaser of the share is investing $3.17 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 836.46%.

More news about Geopark Ltd.

6. Standard Register Company (SR) – Dividend Yield: 4.23%

Standard Register Company’s last close was $68.01, 14.17% below its 52-week high of $79.24. Intraday change was 2.47%.

Spire Inc., together with its subsidiaries, engages in the purchase, retail distribution, and sale of natural gas to residential, commercial, industrial, and other end-users of natural gas in the United States. The company operates through two segments, Gas Utility and Gas Marketing. It is also involved in the marketing of natural gas. In addition, the company engages in the transportation of propane through its propane pipeline; risk management; and other activities. Further, it provides physical natural gas storage services. The company was formerly known as The Laclede Group, Inc. and changed its name to Spire Inc. in April 2016. Spire Inc. was founded in 1857 and is based in Saint Louis, Missouri.

Earnings Per Share

As for profitability, Standard Register Company has a trailing twelve months EPS of $4.6.

PE Ratio

Standard Register Company has a trailing twelve months price to earnings ratio of 15.15. Meaning, the purchaser of the share is investing $15.15 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 9.26%.

More news about Standard Register Company.

7. Simmons First National Corporation (SFNC) – Dividend Yield: 3.4%

Simmons First National Corporation’s last close was $16.63, 36.58% under its 52-week high of $26.22. Intraday change was -1.42%.

Simmons First National Corporation operates as the holding company for Simmons Bank that provides banking and other financial products and services to individuals and businesses. It offers checking, savings, and time deposits; consumer, real estate, and commercial loans; agricultural finance, equipment, and small business administration lending; trust and fiduciary services; credit cards; investment management products; insurance products; and securities and investment services. The company also provides ATM services; Internet and mobile banking platforms; overdraft facilities; and safe deposit boxes. As of January 27, 2022, the company operated through 199 financial centers in Arkansas, Missouri, Tennessee, Texas, Oklahoma, and Kansas. Simmons First National Corporation was founded in 1903 and is headquartered in Pine Bluff, Arkansas.

Earnings Per Share

As for profitability, Simmons First National Corporation has a trailing twelve months EPS of $2.25.

PE Ratio

Simmons First National Corporation has a trailing twelve months price to earnings ratio of 7.4. Meaning, the purchaser of the share is investing $7.4 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 7.87%.

Dividend Yield

As claimed by Morningstar, Inc., the next dividend payment is on Mar 13, 2023, the estimated forward annual dividend rate is 0.8 and the estimated forward annual dividend yield is 3.4%.

Revenue Growth

Year-on-year quarterly revenue growth grew by 18.2%, now sitting on 869.63M for the twelve trailing months.

Yearly Top and Bottom Value

Simmons First National Corporation’s stock is valued at $16.63 at 03:15 EST, way below its 52-week high of $26.22 and higher than its 52-week low of $16.43.

Volume

Today’s last reported volume for Simmons First National Corporation is 636498 which is 5.86% above its average volume of 601252.

More news about Simmons First National Corporation.

8. The Hackett Group (HCKT) – Dividend Yield: 2.38%

The Hackett Group’s last close was $18.48, 25.42% under its 52-week high of $24.78. Intraday change was 1.41%.

The Hackett Group, Inc. operates as a strategic advisory and technology consulting firm primarily in North America and internationally. It offers best practice intelligence center, an online searchable repository; best practice accelerators that provide web-based access to best practices, customized software configuration tools, and best practice process flows; advisor inquiry for access to fact-based advice on proven approaches and methods; best practice research that provides insights into the proven approaches; and peer interaction comprising member-led webcasts, annual best practice conferences, annual member forums, membership performance surveys, and client-submitted content, as well as intellectual property as-a-service and Hackett Institute programs. The company's benchmarking services conduct studies for selling, general and administrative, finance, human resources, information technology, procurement, enterprise performance management, and shared services; and business transformation practices to help clients develop coordinated strategy for achieving performance enhancements across the enterprise. It also provides Oracle EEA solutions for core financial close and consolidation, integrated business planning, and reporting/advanced analytics areas. In addition, the company offers SAP solutions, including planning, architecture, and vendor evaluation and selection through implementation, customization, testing, and integration; post-implementation support, change management, exception management, process transparency, system documentation, and end-user training; off-shore application development, and application maintenance and support services; and OneStream practice that helps clients choose and deploy OneStream XF Platform and Market Place solutions. The company was formerly known as Answerthink, Inc. and changed its name to The Hackett Group, Inc. in 2008. The Hackett Group, Inc. was founded in 1991 and is headquartered in Miami, Florida.

Earnings Per Share

As for profitability, The Hackett Group has a trailing twelve months EPS of $1.28.

PE Ratio

The Hackett Group has a trailing twelve months price to earnings ratio of 14.64. Meaning, the purchaser of the share is investing $14.64 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 40.37%.

Growth Estimates Quarters

The company’s growth estimates for the ongoing quarter is a negative 5.3% and positive 2.6% for the next.

Dividend Yield

As stated by Morningstar, Inc., the next dividend payment is on Mar 22, 2023, the estimated forward annual dividend rate is 0.44 and the estimated forward annual dividend yield is 2.38%.

Volume

Today’s last reported volume for The Hackett Group is 131270 which is 26.38% below its average volume of 178316.

More news about The Hackett Group.