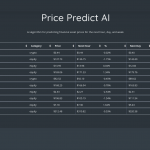

(VIANEWS) – Solar Capital Ltd. (SLRC), First Trust Enhanced Equity Income Fund (FFA), DNP Select Income Fund (DNP) have the highest dividend yield stocks on this list.

| Financial Asset | Forward Dividend Yield | Updated (EST) |

|---|---|---|

| Solar Capital Ltd. (SLRC) | 11.32% | 2023-04-23 16:41:08 |

| First Trust Enhanced Equity Income Fund (FFA) | 7.5% | 2023-04-14 22:41:08 |

| DNP Select Income Fund (DNP) | 7.26% | 2023-04-14 11:11:07 |

| Bank of Hawaii Corporation (BOH) | 5.53% | 2023-04-13 17:12:07 |

| Suncor Energy (SU) | 4.98% | 2023-04-26 13:45:25 |

| Adecoagro S.A. (AGRO) | 3.95% | 2023-04-13 05:13:07 |

| American Electric Power Company (AEP) | 3.59% | 2023-04-26 13:37:39 |

| Unilever (UL) | 3.24% | 2023-04-26 13:46:19 |

Close to 2K companies listed in the Nasdaq and NYSE pay out dividends to its shareholders. The dividend yield is a dividend to price ratio showing how much a company pays out in dividends each year.

1. Solar Capital Ltd. (SLRC) – Dividend Yield: 11.32%

Solar Capital Ltd.’s last close was $14.49, 16.58% below its 52-week high of $17.37. Intraday change was -1.29%.

Solar Capital Ltd. is a business development company specializing in secured debt (first lien unitranche and second lien), subordinated (unsecured) debt, minority equity, and strategic income-oriented control equity investments in leveraged middle market companies. The fund invests in aerospace and defense; air freight & logistics; asset management; automotive; banking; beverage, food and tobacco; building products; buildings and real estate; broadcasting and entertainment; cargo transport; commercial services and supplies; communications equipment; chemicals, plastics and rubber; containers, packaging and glass; construction & engineering; diversified/conglomerate manufacturing; consumer Finance; distributors; diversified/conglomerate services; diversified financial services; diversified real estate sctivities; food products; Footwear; Education Services; diversified telecommunications services; electronics; farming and agriculture; finance; grocery; health care equipment and supplies; health care facilities; education and childcare; home and office furnishing, durable consumer products; hotels, motels, inns and gaming; insurance; restaurants, leisure, amusement, and entertainment; leisure equipment tolls and services, media, multiline retail, multi sector holdings; paper and forest products; personal products; professional services, research and consulting services, software; specialty retail; textiles apparel and luxury goods, thrifts and mortgage finance, trading companies and distributors, utilities, and wireless telecommunication services; industrial conglomerates; internet software and services, IT services, machinery; mining, steel, iron, and non precious metals; oil and gas; personal, food and miscellaneous services; printing and publishing; retail stores; telecommunications; textiles and leather; and utilities. It also invests in life sciences with focus on specialty pharmaceuticals, medical devices, biotech, health Care Providers and services; health Care technology, enabling technologies and tools. The fund primarily invests in United States. The fund's investments generally range between $5 million and $100 million. The fund invests in companies with revenues between $50 million and $1 billion and EBITDA between $15 million and $100 million. It invests in the form of senior secured loans, mezzanine loans, and equity securities. It may also seek investments in thinly traded public companies and also make secondary investments. The fund makes non-control equity investments. It primarily exits within three years of the initial capital commitment.

Earnings Per Share

As for profitability, Solar Capital Ltd. has a trailing twelve months EPS of $0.35.

PE Ratio

Solar Capital Ltd. has a trailing twelve months price to earnings ratio of 41.4. Meaning, the purchaser of the share is investing $41.4 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 1.99%.

More news about Solar Capital Ltd..

2. First Trust Enhanced Equity Income Fund (FFA) – Dividend Yield: 7.5%

First Trust Enhanced Equity Income Fund’s last close was $16.80, 15.87% under its 52-week high of $19.97. Intraday change was -0.06%.

First Trust Enhanced Equity Income Fund is a closed-ended equity mutual fund launched and managed by First Trust Advisors L.P. The fund is co-managed by Chartwell Investment Partners, L.P. It invests in public equity markets of the United States. The fund seeks to invest in stocks of companies operating across the diversified sectors. It invests in stocks of companies across diversified market capitalizations. The fund also writes covered call options. It benchmarks the performance of its portfolio against the S&P 500 Index. The fund was formerly known as First Trust/Fiduciary Asset Management Covered Call Fund. First Trust Enhanced Equity Income Fund was formed on August 26, 2004 and is domiciled in the United States.

Earnings Per Share

As for profitability, First Trust Enhanced Equity Income Fund has a trailing twelve months EPS of $-3.45.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is negative -18.04%.

Volume

Today’s last reported volume for First Trust Enhanced Equity Income Fund is 14923 which is 64.31% below its average volume of 41816.

Moving Average

First Trust Enhanced Equity Income Fund’s value is above its 50-day moving average of $16.59 and higher than its 200-day moving average of $16.36.

Revenue Growth

Year-on-year quarterly revenue growth grew by 10.5%, now sitting on 7.05M for the twelve trailing months.

Yearly Top and Bottom Value

First Trust Enhanced Equity Income Fund’s stock is valued at $16.80 at 17:15 EST, way below its 52-week high of $19.97 and way above its 52-week low of $14.36.

More news about First Trust Enhanced Equity Income Fund.

3. DNP Select Income Fund (DNP) – Dividend Yield: 7.26%

DNP Select Income Fund’s last close was $10.73, 10.58% under its 52-week high of $12.00. Intraday change was -0.16%.

DNP Select Income Fund Inc. is a closed ended balanced mutual fund launched by Virtus Investment Partners, Inc. The fund is managed by Duff & Phelps Investment Management Co. It invests in the public equity and fixed income markets of the United States. For the fixed income portion, the fund invests in bonds. It seeks to invest in stocks of companies operating in the Utility sector. The fund invests in stocks of companies across all market capitalizations. It benchmarks the performance of its portfolio against the S&P 500 Utilities Index and Barclays Capital U.S. Utility Bond Index. DNP Select Income Fund Inc. was formed on November 26, 1986 and is domiciled in the United States.

Earnings Per Share

As for profitability, DNP Select Income Fund has a trailing twelve months EPS of $-0.01.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is negative -0.69%.

Revenue Growth

Year-on-year quarterly revenue growth declined by 0.6%, now sitting on 133.43M for the twelve trailing months.

Dividend Yield

As maintained by Morningstar, Inc., the next dividend payment is on Apr 26, 2023, the estimated forward annual dividend rate is 0.78 and the estimated forward annual dividend yield is 7.26%.

Volume

Today’s last reported volume for DNP Select Income Fund is 145240 which is 69.08% below its average volume of 469834.

More news about DNP Select Income Fund.

4. Bank of Hawaii Corporation (BOH) – Dividend Yield: 5.53%

Bank of Hawaii Corporation’s last close was $50.63, 40.75% under its 52-week high of $85.45. Intraday change was -0.12%.

Bank of Hawaii Corporation operates as the bank holding company for Bank of Hawaii that provides various financial products and services in Hawaii, Guam, and other Pacific Islands. It operates in three segments: Consumer Banking, Commercial Banking, and Treasury and Other. The Consumer Banking segment offers checking, savings, and time deposit accounts; residential mortgage loans, home equity lines of credit, automobile loans and leases, personal lines of credit, installment loans, small business loans and leases, and credit cards; private and international client banking, and trust services to individuals and families, and high-net-worth individuals; investment management and institutional investment advisory services to corporations, government entities, and foundations; and brokerage offering equities, mutual funds, life insurance, and annuity products. This segment operates 65 branch locations and 357 ATMs throughout Hawaii and the Pacific Islands, as well as through a customer service center, and online and mobile banking. The Commercial Banking segment provides corporate banking, commercial real estate loans, commercial lease financing, auto dealer financing, and deposit products. It offers commercial lending and deposit products to middle-market and large companies, and government entities; commercial real estate mortgages to investors, developers, and builders; and international banking and merchant services. The Treasury and Other segment offers corporate asset and liability management services, including interest rate risk management and foreign exchange services. Bank of Hawaii Corporation was founded in 1897 and is headquartered in Honolulu, Hawaii.

Earnings Per Share

As for profitability, Bank of Hawaii Corporation has a trailing twelve months EPS of $5.48.

PE Ratio

Bank of Hawaii Corporation has a trailing twelve months price to earnings ratio of 9.23. Meaning, the purchaser of the share is investing $9.23 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 15.42%.

Sales Growth

Bank of Hawaii Corporation’s sales growth is 6.3% for the present quarter and 2.8% for the next.

Yearly Top and Bottom Value

Bank of Hawaii Corporation’s stock is valued at $50.57 at 17:15 EST, way under its 52-week high of $85.45 and way above its 52-week low of $34.71.

Revenue Growth

Year-on-year quarterly revenue growth grew by 2.4%, now sitting on 702.88M for the twelve trailing months.

Volume

Today’s last reported volume for Bank of Hawaii Corporation is 443988 which is 13.18% below its average volume of 511411.

More news about Bank of Hawaii Corporation.

5. Suncor Energy (SU) – Dividend Yield: 4.98%

Suncor Energy ‘s last close was $29.87, 30.08% below its 52-week high of $42.72. Intraday change was -2.11%.

Suncor Energy Inc. operates as an integrated energy company in Canada and internationally. It operates through Oil Sands; Exploration and Production; and Refining and Marketing segments. The Oil Sands segment explores, develops, and produces bitumen, synthetic crude oil, and related products. This segment also engages in syncrude oil sands mining and upgrading operations; and marketing, supply, transportation, and risk management of crude oil, natural gas, power, and byproducts. The Exploration and Production segment is involved in offshore operations in the East Coast of Canada. The Refining and Marketing segment refines crude oil and petrochemical products; and markets, transports, and manages refined and petrochemical products, and other purchased products through the retail and wholesale networks. This segment also involved in trading of crude oil, natural gas, and power. The company was formerly known as Suncor Inc. and changed its name to Suncor Energy Inc. in April 1997. Suncor Energy Inc. was founded in 1917 and is headquartered in Calgary, Canada.

Earnings Per Share

As for profitability, Suncor Energy has a trailing twelve months EPS of $4.82.

PE Ratio

Suncor Energy has a trailing twelve months price to earnings ratio of 6.07. Meaning, the purchaser of the share is investing $6.07 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 23.89%.

Moving Average

Suncor Energy ‘s worth is below its 50-day moving average of $32.27 and below its 200-day moving average of $32.27.

Earnings Before Interest, Taxes, Depreciation, and Amortization

Suncor Energy ‘s EBITDA is 10.11.

Growth Estimates Quarters

The company’s growth estimates for the current quarter and the next is a negative 30.8% and a negative 52.5%, respectively.

More news about Suncor Energy .

6. Adecoagro S.A. (AGRO) – Dividend Yield: 3.95%

Adecoagro S.A.’s last close was $8.94, 34.02% under its 52-week high of $13.55. Intraday change was 4.2%.

Adecoagro S.A., an agro-industrial company, engages in farming crops and other agricultural products, dairy operations, sugar, ethanol and energy production, and land transformation activities in South America. The company is involved in the planting, harvesting, and sale of grains and oilseeds, as well as fibers, including wheat, corn, soybeans, cotton, sunflowers, and other; provision of grain warehousing/conditioning, handling, and drying services to third parties; and purchase and sale of crops produced by third parties. It also plants, harvests, processes, and markets rice; and produces and sells milk and other dairy products. In addition, the company engages in the cultivation and processing of sugar and ethanol, as well as cogeneration of electricity from sugarcane bagasse; and identification and acquisition of underdeveloped and undermanaged farmland, and realization of value through the strategic disposition of assets. Further, it is involved in leasing of approximately 18,005 hectares of pasture land to cattle farmers in Argentina; and coffee plantation. As of December 31, 2019, the company owned a total of 225,630 hectares, including 19 farms in Argentina, 8 farms in Brazil, and 1 farm in Uruguay; 3 rice processing facilities in Argentina; and 3 dairy facilities with approximately 9,066 milking cows in Argentina. It also had 11 grain and rice conditioning and storage plants in Argentina; and 3 sugar and ethanol mills in Brazil with a sugarcane crushing capacity of 14.2 million tons, as well as had a total of 232 megawatts of installed cogeneration capacity. Adecoagro S.A. was founded in 2002 and is based in Luxembourg.

Earnings Per Share

As for profitability, Adecoagro S.A. has a trailing twelve months EPS of $0.98.

PE Ratio

Adecoagro S.A. has a trailing twelve months price to earnings ratio of 9.12. Meaning, the purchaser of the share is investing $9.12 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 9.82%.

Yearly Top and Bottom Value

Adecoagro S.A.’s stock is valued at $8.94 at 17:15 EST, way below its 52-week high of $13.55 and way above its 52-week low of $6.95.

Volume

Today’s last reported volume for Adecoagro S.A. is 932522 which is 71.19% above its average volume of 544703.

More news about Adecoagro S.A..

7. American Electric Power Company (AEP) – Dividend Yield: 3.59%

American Electric Power Company’s last close was $94.38, 10.63% below its 52-week high of $105.60. Intraday change was -2.2%.

American Electric Power Company, Inc., an electric public utility holding company, engages in the generation, transmission, and distribution of electricity for sale to retail and wholesale customers in the United States. It operates through Vertically Integrated Utilities, Transmission and Distribution Utilities, AEP Transmission Holdco, and Generation & Marketing segments. The company generates electricity using coal and lignite, natural gas, renewable, nuclear, hydro, solar, wind, and other energy sources. It also supplies and markets electric power at wholesale to other electric utility companies, rural electric cooperatives, municipalities, and other market participants. The company was incorporated in 1906 and is headquartered in Columbus, Ohio.

Earnings Per Share

As for profitability, American Electric Power Company has a trailing twelve months EPS of $4.49.

PE Ratio

American Electric Power Company has a trailing twelve months price to earnings ratio of 20.56. Meaning, the purchaser of the share is investing $20.56 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 9.85%.

Sales Growth

American Electric Power Company’s sales growth is 1.4% for the present quarter and 0.6% for the next.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions, American Electric Power Company’s stock is considered to be oversold (<=20).

Growth Estimates Quarters

The company’s growth estimates for the ongoing quarter and the next is 6.6% and 3.3%, respectively.

Moving Average

American Electric Power Company’s value is above its 50-day moving average of $90.63 and under its 200-day moving average of $93.83.

More news about American Electric Power Company.

8. Unilever (UL) – Dividend Yield: 3.24%

Unilever’s last close was $54.70, 0.09% below its 52-week high of $54.75. Intraday change was -0.67%.

Unilever PLC operates as a fast-moving consumer goods company. It operates through Beauty & Wellbeing, Personal Care, Home Care, Nutrition, and Ice Cream segments. The Beauty & Wellbeing segment engages in the sale of hair care products, such as shampoo, conditioner, and styling; skin care products including face, hand, and body moisturizer; and prestige beauty and health & wellbeing products, which includes the vitamins, minerals, and supplements. Personal Care segment offers skin cleansing products comprising soap and shower, deodorant and oral care products, such as toothpaste, toothbrush, and mouthwash products. Home Care segment engages in the sale of fabric care including washing powders and liquids, and rinse conditioners; and home and hygiene, fabric enhancers, water and air wellness products. Nutrition segment provides the sale of scratch cooking aids, which includes soups, bouillons, and seasonings; dressings products, such as mayonnaise and ketchup; and beverages and functional nutrition products including Horlicks and Boost, as well as tea products. Ice Cream segment offers ice cream products including in-home and out-of-home ice creams. It offers its products under the AXE, Bango, Ben & Jerry's, Cif, Comfort, Domestos, Dove, Equilibra, Hellmann's, Knorr, LUX, Lifebuoy, Liquid I.V., Love Beauty & Planet, Magnum, OLLY, OMO, Onnit, Rexona, Seventh Generation, SmartPants, Sunsilk, The Vegetarian Butcher, Vaseline, and Wall's brands. The company was founded in 1860 and is headquartered in London, the United Kingdom.

Earnings Per Share

As for profitability, Unilever has a trailing twelve months EPS of $3.29.

PE Ratio

Unilever has a trailing twelve months price to earnings ratio of 16.52. Meaning, the purchaser of the share is investing $16.52 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 39.9%.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions, Unilever’s stock is considered to be oversold (<=20).

Yearly Top and Bottom Value

Unilever’s stock is valued at $54.33 at 17:15 EST, under its 52-week high of $54.75 and way higher than its 52-week low of $42.44.

More news about Unilever.