Waste Connections And 4 Other Stocks Have Very High Payout Ratio

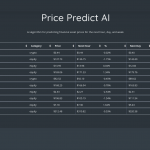

(VIANEWS) – Radius Health (RDUS), Artisan Partners Asset Management (APAM), Axis Capital Holdings Limited (AXS) are the highest payout ratio stocks on this list. Here’s the data we’ve collected of stocks with a high payout ratio up until now. The payout ratio in itself isn’t a promise of a future good investment but it’s an…