Executives in North America and developing markets have become less hopeful about their countries’ economies, while Leaders in China and India are growing more upbeat, according to McKinsey & Company.

A July survey of more than 2,000 global executives by the global consulting firm highlights the magnitude of the challenges triggered by the coronavirus pandemic, especially in some geographies.

The study shows that executives in North America and developing markets have become more cautious than others in their views about potential scenarios for COVID-19 recovery.

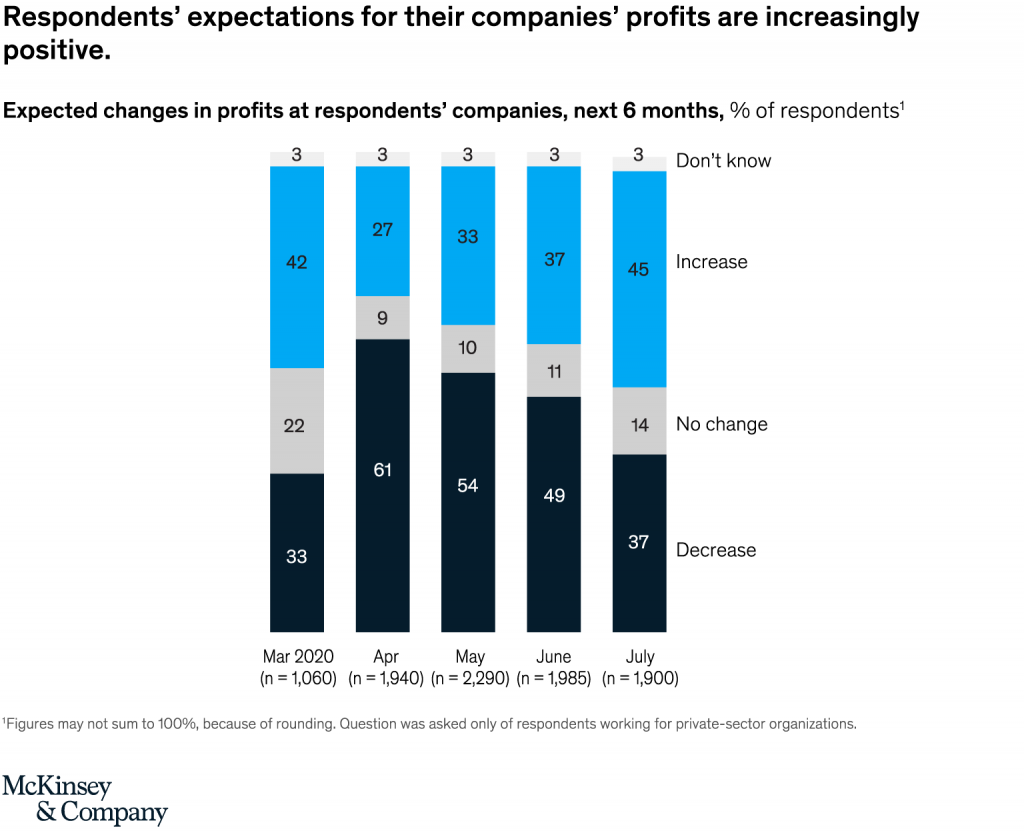

“Overall expectations on these scenarios also suggest growing caution and uncertainty. Even so, respondents’ outlook for their own companies continues to brighten. For the first time in 2020, respondents are more likely to expect their companies’ profits to increase than decrease in the months ahead,” reads the report.

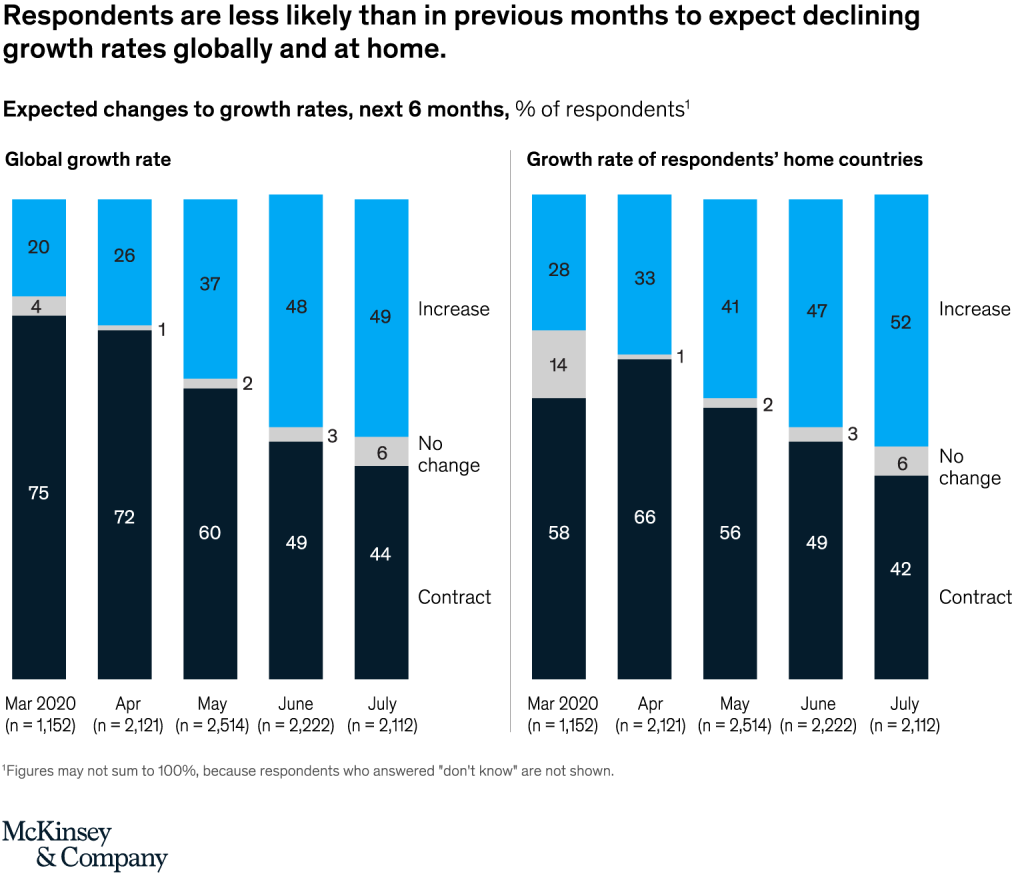

McKinsey says executives, on the whole,maintain the more positive than negative outlook they reported in June for both the global economy and their home countries. “And they are less likely than in previous months to expect declining growth rates globally and at home.”

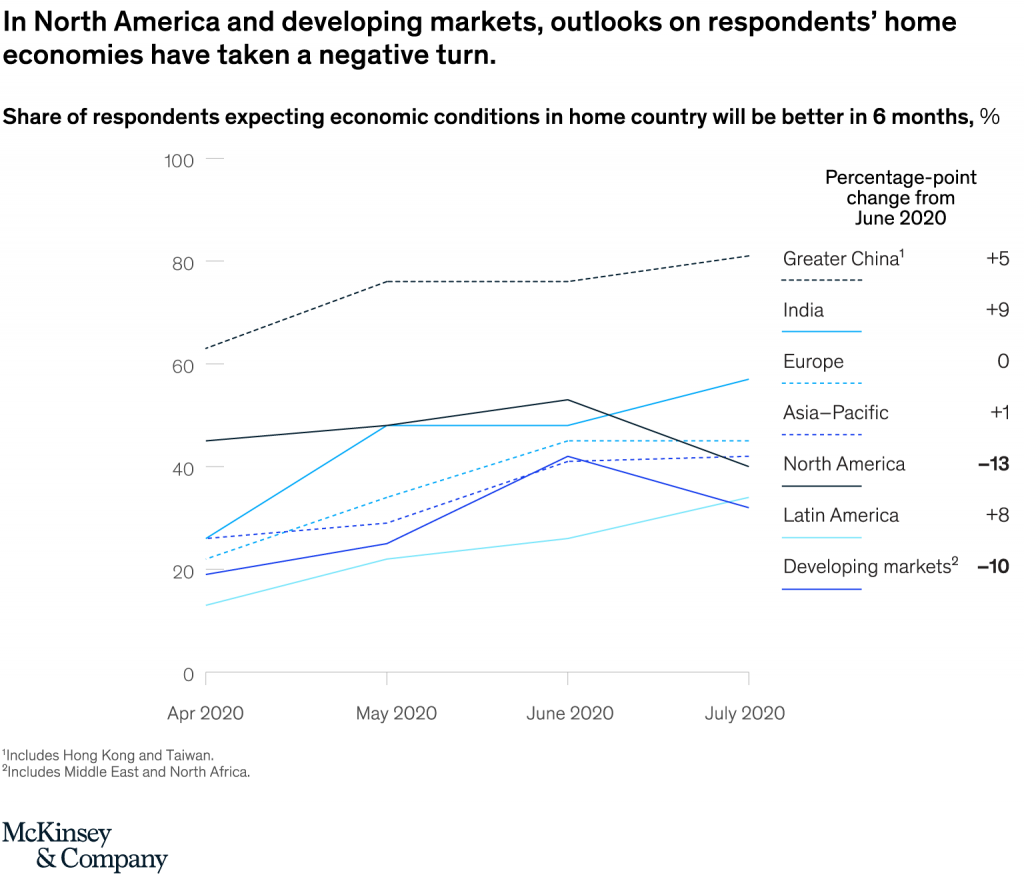

Respondents’ outlooks about their countries’ economies have improved in most regions over the past four surveys. However, responses in North America and developing markets have taken a negative turn since last month.

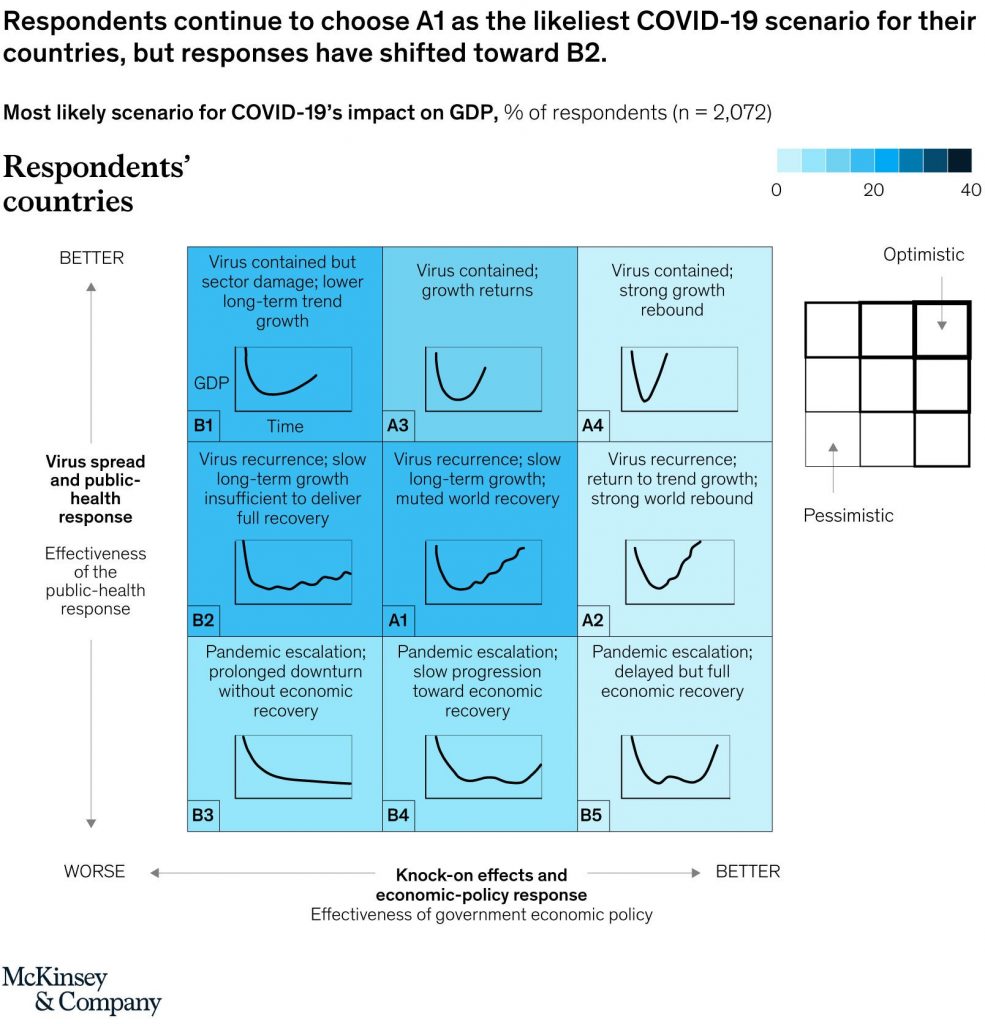

When asked about the pandemic’s effects on domestic GDP, those surveyed in North America and developing markets said they are much less likely than June to choose one of the more optimistic options out of the nine scenarios seen in the image below.

“Across all geographies, views on the COVID-19 recovery have also become less favorable,” McKinsey said.

In June, the two following scenarios were selected most often as outcomes for respondents’ home economies:

– The virus is contained and growth returns slowly to pre-crisis levels.

– Public health and economic-policy interventions are partially effective, and the return to pre-crisis levels of GDP, income, and corporate earnings will take time.

Now, the largest share of respondents rank the latter as the likeliest outcome for their own countries in the next year, followed by a scenario in which public health interventions are effective but do not prevent virus reoccurrences, and economic-policy interventions are insufficient to deliver a full recovery to pre-crisis levels.

According to the consulting firm, respondents are now more upbeat when considering their companies’ prospects over the next six months.

“For the first time in 2020, respondents are now more likely to predict an increase than a decrease. Furthermore, the share of respondents who say they expect customer demand for their companies’ products or services to weaken in the months ahead has continually decreased since April.”

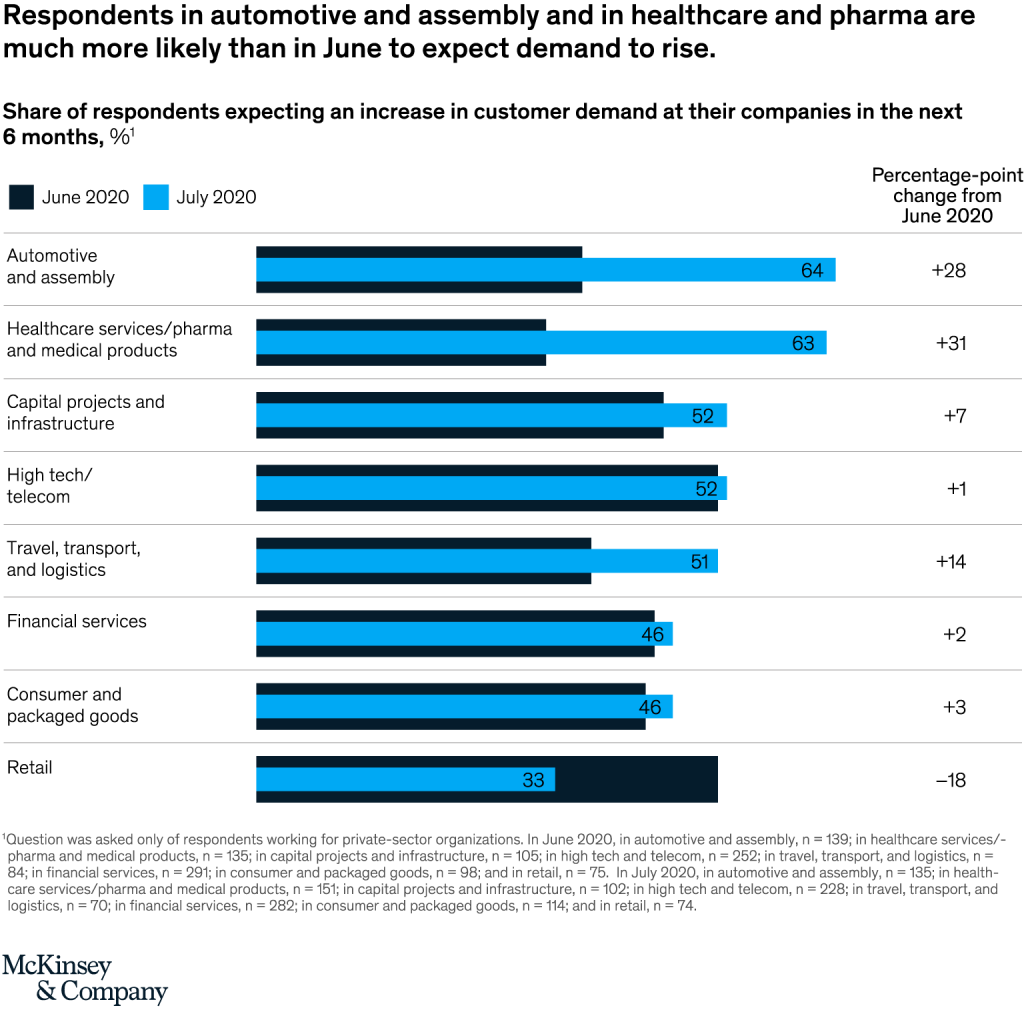

“By industry, respondents in automotive and assembly; healthcare services, pharma, and medical products; and travel, transport, and logistics—all sectors hit especially hard by the pandemic’s knock-on effects—are much more likely now than in June to expect demand for their companies’ products or services to increase in the months ahead,” the report added.

In contrast, respondents in retail, which was one of the most optimistic segments in the June survey, have become much more pessimistic.