(VIANEWS) – MetLife (MET), Mesa Royalty Trust (MTR), SK Telecom (SKM) are the highest payout ratio stocks on this list.

We have collected information about stocks with the highest payout ratio as yet. The payout ratio in itself isn’t a guarantee of good investment but it’s an indicator of whether dividends are being paid and how the company chooses to distribute them.

When researching a potential investment, the dividend payout ratio is a good statistic to know so here are a few stocks with an above 30% percent payout ratio.

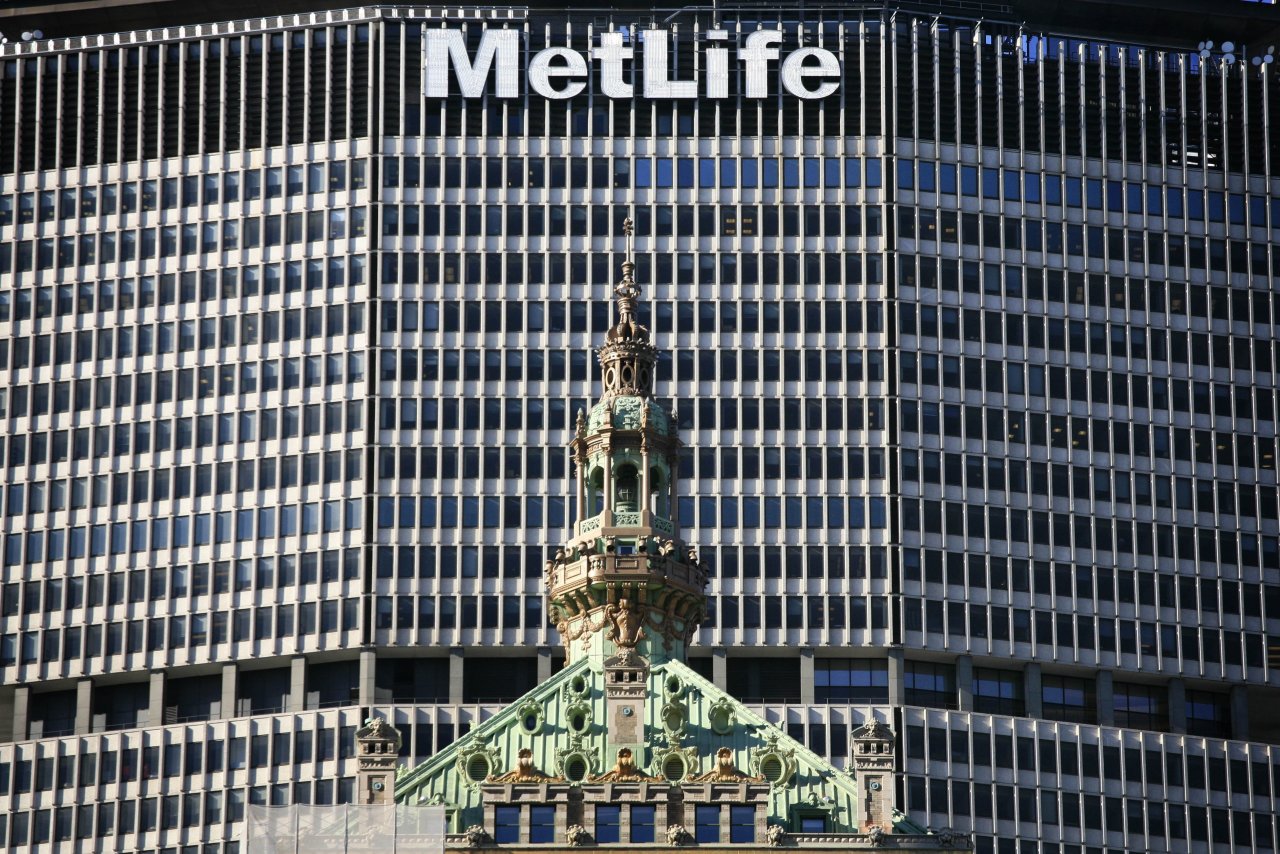

1. MetLife (MET)

192.31% Payout Ratio

MetLife, Inc., a financial services company, provides insurance, annuities, employee benefits, and asset management services worldwide. It operates through five segments: U.S.; Asia; Latin America; Europe, the Middle East and Africa; and MetLife Holdings. The company offers life, dental, group short-and long-term disability, individual disability, pet insurance, accidental death and dismemberment, vision, and accident and health coverages, as well as prepaid legal plans; administrative services-only arrangements to employers; and general and separate account, and synthetic guaranteed interest contracts, as well as private floating rate funding agreements. It also provides pension risk transfers, institutional income annuities, structured settlements, and capital markets investment products; and other products and services, such as life insurance products and funding agreements for funding postretirement benefits, as well as company, bank, or trust-owned life insurance used to finance nonqualified benefit programs for executives. In addition, it provides fixed, indexed-linked, and variable annuities; pension products; regular savings products; whole and term life, endowments, universal and variable life, and group life products; longevity reinsurance solutions; credit insurance products; and protection against long-term health care services. MetLife, Inc. was founded in 1863 and is headquartered in New York, New York.

Earnings Per Share

As for profitability, MetLife has a trailing twelve months EPS of $1.04.

PE Ratio

MetLife has a trailing twelve months price to earnings ratio of 52.08. Meaning, the purchaser of the share is investing $52.08 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 2.32%.

Dividend Yield

According to Morningstar, Inc., the next dividend payment is on May 7, 2023, the estimated forward annual dividend rate is 2.08 and the estimated forward annual dividend yield is 3.9%.

Moving Average

MetLife’s value is under its 50-day moving average of $55.02 and way below its 200-day moving average of $65.10.

Sales Growth

MetLife’s sales growth is negative 6.9% for the present quarter and negative 26.3% for the next.

2. Mesa Royalty Trust (MTR)

95.68% Payout Ratio

Mesa Royalty Trust owns net overriding royalty interests in various oil and gas producing properties in the United States. It has interests in properties located in the Hugoton field of Kansas; and the San Juan Basin field of New Mexico and Colorado. The company was founded in 1979 and is based in Houston, Texas.

Earnings Per Share

As for profitability, Mesa Royalty Trust has a trailing twelve months EPS of $2.14.

PE Ratio

Mesa Royalty Trust has a trailing twelve months price to earnings ratio of 11.31. Meaning, the purchaser of the share is investing $11.31 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 142.63%.

3. SK Telecom (SKM)

74.04% Payout Ratio

SK Telecom Co., Ltd. provides wireless telecommunication services in South Korea. The company operates through three segments: Cellular Services, Fixed-Line Telecommunications Services, and Other Businesses. The Cellular Services segment offers wireless voice and data transmission, Internet of Things solutions, platform, cloud, smart factory solutions, subscription, advertising and curated shopping under T Deal brand name, and metaverse platform-based services, as well as sells wireless devices. The Fixed-Line Telecommunications Services segment provides fixed-line telephone services; broadband Internet services; media platform services, such as Internet protocol TV and cable TV; and business communications services. The Other Businesses segment offers T-commerce services, as well as portal services under Nate brand name. In addition, it provides call center management, base station maintenance, information gathering and consulting, database and internet website, cable broadcasting, broadcasting programs, and digital contents sourcing services; manufactures non-memory and other electronic integrated circuits; and operates information and communications facilities, and mobile virtual network, as well as engages in communications and other telecommunication device retail business. The company was incorporated in 1984 and is headquartered in Seoul, South Korea.

Earnings Per Share

As for profitability, SK Telecom has a trailing twelve months EPS of $1.93.

PE Ratio

SK Telecom has a trailing twelve months price to earnings ratio of 10.49. Meaning, the purchaser of the share is investing $10.49 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 8.38%.

Volume

Today’s last reported volume for SK Telecom is 640838 which is 26.97% above its average volume of 504693.

4. RPM International (RPM)

40.29% Payout Ratio

RPM International Inc. manufactures, markets, and sells specialty chemicals for the industrial, specialty, and consumer markets worldwide. It offers waterproofing, coating, and institutional roofing systems; sealants, air barriers, tapes, and foams; residential home weatherization systems; roofing and building maintenance services; sealing and bonding, subfloor preparation, flooring, and glazing solutions; resin flooring systems, polyurethane, MMA waterproof, epoxy floor paint and coatings, concrete repair, and protection products; solutions for fire stopping and intumescent steel coating, and manufacturing industry; rolled asphalt roofing materials and chemical admixtures; concrete and masonry admixtures, concrete fibers, curing and sealing compounds, structural grouts and mortars, epoxy adhesives, injection resins, polyurethane foams, floor hardeners and toppings, joint fillers, industrial and architectural coatings, decorative color/stains/stamps, and restoration materials; insulated building cladding materials; and concrete form wall systems. It also provides polymer flooring systems; fiberglass reinforced plastic gratings and shapes; corrosion-control coating, containment and railcar lining, fire and sound proofing, and heat and cryogenic insulation products; specialty construction products; amine curing agents, reactive diluents, and epoxy resins; fluorescent colorants and pigments; shellac-based-specialty and marine coatings; fire and water damage restoration, carpet cleaning, and disinfecting products; fuel additives; wood treatments, and touch-up products; and nail enamels, polishes, and coating components. In addition, it offers paint contractors and the DIYers solutions, concrete restoration and flooring, metallic and faux finish coatings, cleaners, and hobby paints and cements; and caulk, sealant, adhesive, insulating foam, spackling, glazing, patch, and repair products. The company was incorporated in 1947 and is headquartered in Medina, Ohio.

Earnings Per Share

As for profitability, RPM International has a trailing twelve months EPS of $4.07.

PE Ratio

RPM International has a trailing twelve months price to earnings ratio of 20.36. Meaning, the purchaser of the share is investing $20.36 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 27.1%.

5. Huntington Bancshares (HBAN)

40% Payout Ratio

Huntington Bancshares Incorporated operates as the bank holding company for The Huntington National Bank that provides commercial, consumer, and mortgage banking services in the United States. The company operates through four segments: Consumer and Business Banking; Commercial Banking; Vehicle Finance; and Regional Banking and The Huntington Private Client Group (RBHPCG). The Consumer and Business Banking segment offers financial products and services, such as checking accounts, savings accounts, money market accounts, certificates of deposit, credit cards, and consumer and small business loans, as well as investment products. This segment also provides mortgages, insurance, interest rate risk protection, foreign exchange, automated teller machine, and treasury management services, as well as online, mobile, and telephone banking services. It serves consumer and small business customers. The Commercial Banking segment offers regional commercial banking solutions for middle market businesses, government and public sector entities, and commercial real estate developers/REITs; and specialty banking solutions for healthcare, technology and telecommunications, franchise finance, sponsor finance, and global services industries. It also provides asset finance services; capital raising solutions, sales and trading, and corporate risk management products; institutional banking services; and treasury management services. The Vehicle Finance segment provides financing to consumers for the purchase of automobiles, light-duty trucks, recreational vehicles, and marine craft at franchised and other select dealerships, as well as to franchised dealerships for the acquisition of new and used inventory. The RBHPCG segment offers private banking, wealth and investment management, and retirement plan services. Huntington Bancshares Incorporated was founded in 1866 and is headquartered in Columbus, Ohio.

Earnings Per Share

As for profitability, Huntington Bancshares has a trailing twelve months EPS of $1.55.

PE Ratio

Huntington Bancshares has a trailing twelve months price to earnings ratio of 6.69. Meaning, the purchaser of the share is investing $6.69 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 12.83%.

Sales Growth

Huntington Bancshares’s sales growth is 5.8% for the present quarter and 1.4% for the next.

Volume

Today’s last reported volume for Huntington Bancshares is 6720520 which is 58.22% below its average volume of 16085800.

Yearly Top and Bottom Value

Huntington Bancshares’s stock is valued at $10.36 at 08:23 EST, way below its 52-week high of $15.74 and way higher than its 52-week low of $9.13.