We’re all usually told that If we want to get the most out of our investments, we should consider diversification. We’ve also been told that a typical portfolio might be split between 50/50 stocks and bonds. But this type of portfolio doesn’t represent a diversified portfolio and may be completely outdated.

No one knows what will happen in the future but periods of rising inflation usually make investors choose commodities, stocks, as well as real estate, to help increase money faster than, or at least as fast as, inflation.

The Federal Reserve recently announced a change in its policy regarding inflation. Instead of targeting two percent annual inflation, they adopted a target rate of between six to ten percent. This shift indicates that the debt cycle has entered the printing phase, known as the debasement phase. Inflation is a sign of an ongoing inflationary cycle. If you aren’t taking advantage of this, it’s time to diversify your portfolio.

Ray Dalio, a billionaire investor, recommends investing in stocks and bonds in a global portfolio that’s not tied to one country. According to Dalio, this makes sense because inflation is likely to be prolonged. For instance, he says the US is facing monetary and cyclical inflation, both of which threaten the economy’s long-term health. He recommends reducing cash balances in dollars, euros, and yen.

Commodities, on the other hand, are not cash flows. They sit in vaults and do not produce any cash. They are great at holding value against inflation but don’t generate much value on their own. Even if you have enough money to buy commodities and store them, you’ll likely end up losing money to inflation. Commodities can also be extremely expensive to buy and maintain, and they’ve historically had negative real returns. Buying commodities futures are also an option, especially to take advantage of commodities price volatility.

Another investment option that holds up during periods of inflation is consumer staples companies such as Procter & Gamble Co., The Coca-Cola Co., General Mills Inc., and Walmart Inc. People still buy toilet paper and bread, even when prices are sky-high. Beverages are also in this category. For example, Coca-Cola, a Warren Buffett’s favorite, raised its prices despite higher input costs in 2021. Bridgewater recently doubled its Alibaba holdings in the second half of 2021. It’s also worth noting that the price of consumer staples is rising with inflation.

Other good investment opportunities seem to be in the energy industry. When energy prices go up, energy companies can reap the benefits.

Also interesting may be high dividend stocks but one must pay attention if a company’s possible devaluation dilutes dividends.

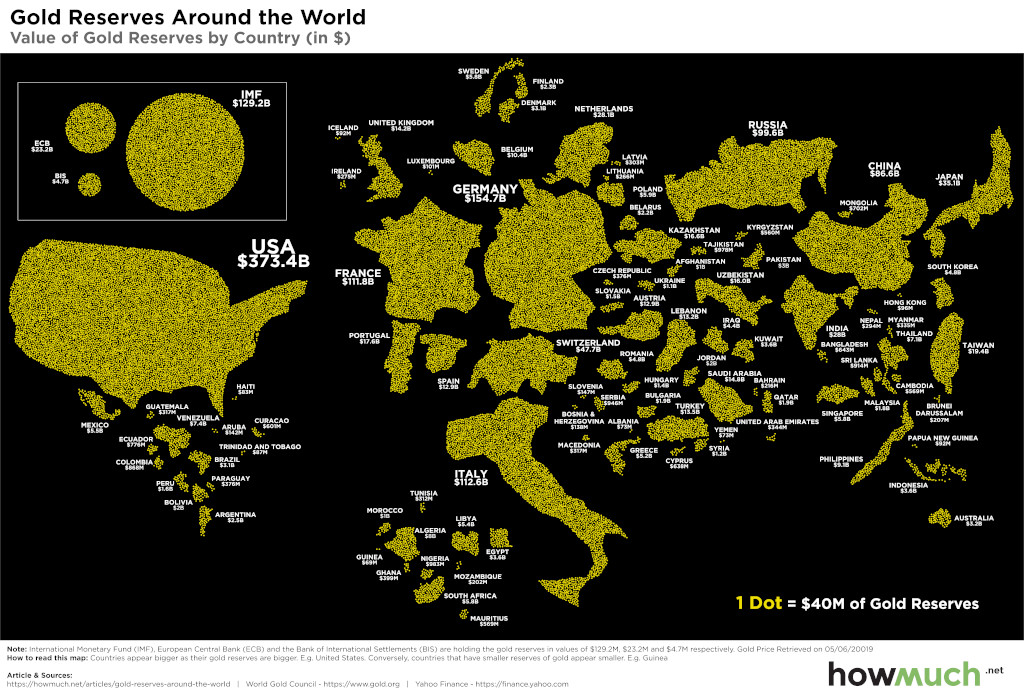

If you don’t want to lose your purchasing power and rely on the Federal Reserve, consider investing in gold. This ancient form of money has historically been worth 10 to 20 times its current price. Though temporary anomalies occasionally occur, this ratio always returns to its original value over time. Gold and silver usually have a fifteen-to-one price ratio. This ratio has risen and fallen several times since then, and it has held up quite well in the inflation of fiat currencies.

Real estate is a well-known traditional hedge against inflation. At least, it has been like that historically. According to Redfin, a residential real estate brokerage U.S company, “on average, the number of homes sold was down 23.1% year over year and there were 497,265 homes sold in September this year, down 646,437 homes sold in September last year.”