With the economy expected to remain on rocky footing potentially beyond 2020 and COVID-19 quarantines and lockdowns ebbing and flowing on a rolling basis, new trends in consumer sentiment and behaviors are emerging globally.

According to a new Future Consumer Index published by Ernst & Young, 42% of surveyed consumers believe that their shopping habits will fundamentally change as a result of the coronavirus.

While there are certainly differences by country and region, these are the major trends that hold almost globally:

1- Spending is down across all industries. Consumers are spending on essentials.

It would be stating the obvious to say that a large number of consumers are reining in their spending.

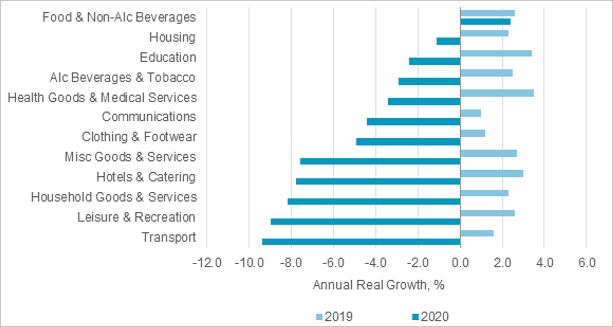

A report by Euromonitor International—a leading independent provider of strategic market research—says global consumer expenditure growth is forecast to decrease by 4.3% in real terms year-on-year in 2020 (down from 2.4% real growth in 2019).

"They [consumers] will practice thriftier and more self-sufficient lifestyles, as they move away from conspicuous consumption and reassess their needs, values, and priorities."

A global survey conducted by McKinsey found that consumers are spending on "essentials and not-discretionary categories" as incomes have declined.

However, the future is not that bleak as multiple surveys point to an anticipated recovery in consumer confidence and spending growth in the long term.

"As each country moves along the COVID-19 curve, we can see a glimmer of increasing optimism levels, which in turn is linked to higher spending," reads a post on the website of the World Economic Forum, citing McKinsey's survey.

2- Consumers are shifting toward buying and doing more things online.

Both online and offline sales for businesses in certain sectors have taken a major hit. However, digital commerce in general has seen a boost as new consumers migrate online for a wide variety of purchasing.

Accenture, a multinational professional services company, calls it a rise that is "likely to be sustained post-outbreak".

Read more: Is Facebook Stock Still a Buy After the Advertising Boycott?

The survey by McKinsey also confirms the trend of shifting to digital and online solutions as well as reduced-contact channels to get services and goods.

"Intent to shop more online across categories is positive in several countries, including the U.S., India, South Korea, and Japan. In Europe and Latin America, the intent to shop more online is lower. This lower penetration likely stems from lower reach given limited infrastructure, which has limited the ability of consumers to shift their spending in a large-scale way."

Euromonitor International believes that those businesses that are prepared for the "new normal" of digital consumer engagement, e-commerce, and cashless payment are more likely to emerge successfully out of the pandemic.

3- Consumers are spending more on home entertainment.

The survey by McKinsey indicates that entertainment has seen a rise amid the coronavirus pandemic and spending on at-home entertainment continues to show positive momentum.

"This trend is reflected in the types of apps that consumers are downloading, related to entertainment," Accenture writes.

4- Consumers are putting greater emphasis on their health.

The coronavirus outbreak has made people more conscious of their physical, emotional, and mental well-being.

According to McKinsey, consumers intend to spend more on personal-care products.

"Consumers will continue to pay more attention to all aspects of their health, recognizing that all aspects of health are interlinked. As such, these consumers will also pay more attention to their mental health as well as physical health," reads an article by Candy Industry, a business-to-business publication that covers the global confectionery industry.

Accenture says brands should make it a priority to support healthy lifestyles as having a "health strategy" will be a strategic differentiator for the foreseeable future.

Similarly, Euromonitor International argues that successful companies will be those who "understand the health and safety concerns that dominate the thinking of their consumers" and "create value by focusing on hygiene, health, and wellbeing".

Brands should make it a priority to support healthy lifestyles as having a "health strategy" will be a strategic differentiator.

Accenture

5- Areas like sustainability and ethically-minded products is seeing renewed interest.

The Future Consumer Index by Ernst & Young concluded that 23% of consumers will pay more for ethical brands as they are paying greater attention to their consumption choices and the impact they have on the world.

"The restriction of movement and reduced levels of business activity has resulted in the improvement of natural resources such as air and water. This is something that will result in more consumers believing that damage done to the environment is reversible," writes Candy Industry.

Read more: AI Replacing Teachers Will Have Dire Consequences

The magazine says this new wave of awareness will encourage consumers to adopt more ethical and sustainable lifestyles and choose brands and products that display similar levels of commitment to the environment.

6- Attitudes toward areas like privacy and purpose are evolving.

The survey by Ernst & Young highlights that people generally adopt more open attitudes to privacy and sharing personal data during a pandemic like the one the world is experiencing right now.

"54% of consumers would make their data more available if it helped to monitor and track an infection cluster," the findings of their survey show.

People generally adopt more open attitudes to privacy and sharing personal data during a pandemic.

Survey by Ernst & Young

7- There is a growing desire to shop locally.

Various surveys suggest that consumers are showing a stronger preference for local products. Ernst & Young says 34% of consumers would pay more for local products. The reason seems to be two-fold.

"Consumers may be conscious about purchasing products from certain countries. They may also want reduced supply chains for greater quality control measures and because they feel it reduces the risk of products being exposed to germs, bacteria, and other forms of contamination," Candy Industry says.

"In addition to this and a recessionary environment, consumers will also want brands to be demonstrating support to local and small-scale suppliers to whom they associate with being healthier, safer, and better quality," it added.

Accenture argues that brands will need to "explore ways to connect locally—be it through highlighting local provenance, customizing for local needs, or engaging in locally relevant ways."