Since the first quarter of 2015, the global House Price Index has been on the rise, according to figures by Deloitte. Particularly, Knight Frank noted that the year-on-year increase in the price of housing happened in more countries in Q2 2019 than at any other time in the last decade. However, Knight Frank went ahead to qualify that the average rate at which prices are rising is slowing as global economic uncertainty entrenches itself.

Often, the rising house price index implies a higher uptake of mortgages. It is because as the prices rise, people have to rely on mortgages even more to finance the acquisition of houses. As a result, mortgage brokers and mortgage lenders benefit a lot from such developments.

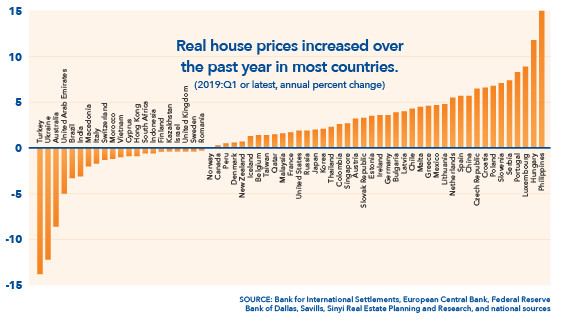

The housing market is currently in a boom cycle, but this is not synchronized across all countries globally. For instance, in 2019, the real house prices in the Philippines and Hungary increased by over 10%.In comparison, the real house prices in Turkey and Ukraine fell by more than 10%, according to data by the IMF.

In which countries is the mortgage brokers industry more active?

For starters, the mortgage brokers industry is most active in countries with three characteristics when it comes to the housing market. First, the house price-to-income ratio is very high such that the majority of house owners rely on mortgages to acquire houses. Second, there is a vast supply of houses for uptake coupled with elaborate schemes by developers to push the houses into the market. Third, housing is equated to a status symbol where one is not fully independent without owning a house.

The United States is the largest market for mortgage brokers. In 2019, the industry registered $676 million in total revenues, according to figures by IBIS Word.Interestingly, growth in the US mortgage brokers industry was not unique to 2019. In the past five years (from 2014 to 2019), the sector experienced incredible annual growth of 22.6%.

Further, IBIS World noted that mortgage brokers categorize their products in five categories. They include Home Loans, Residential Mortgages (single-family residences), Refinancing, Residential Mortgages (multi-family residences), and Others. As of October 2019, the US Census Bureau noted that close to 63% of US citizens had mortgages.

The United Kingdom is another market that the mortgage brokers thrive. In Q3 2019, mortgage brokers lent £1,486 billion ($1.944 billion) in residential mortgage loans, according to statistics compiled by the Financial Conduct Authority (FCA). During the same quarter, gross mortgage advances remained constant at £73.3 billion compared to the same quarter the previous year.

In which sectors are the mortgage brokers more active?

Typically, people take mortgages to facilitate the acquisition of new houses. However, mortgage lenders split the industry into small operational units (sectors) to streamline their activities. In the US, for instance, most mortgage brokers operate in the Home Loans sector. It is where the brokers extend loans (or connect consumers to lenders) to consumers. Consumers use the loans to buy new homes or to refinance mortgages.

In the US, LendingTree and Zillow are the most successful mortgage brokers. Between 2008 and 2019, LendingTree recorded quarterly revenue growth on a year-on-year basis of at least 10% and at most 118%. In comparison, Zillow recorded revenue of $454.1 million in Q1 2019, a 51% y-over-y expansion.

Outlook

The outlook of the global mortgage brokers industry is mixed. On the one hand, the industry is expected to grow on the back of a rising trend of construction of new housing units on a global level, according to a study by The Freedonia Group. Other factors that will catapult the global mortgage brokers industry to new higher levels include increasing population in towns and cities, higher family incomes, and rose and easier access to credit and financing.

On the other hand, growing uncertainty in the health of the global economy is something that should worry everyone. Notably, the rising tensions in the Middle East and the constant push and pull between the US and China will have a significant impact on the direction of the global housing market.