The immediate effects of the coronavirus outbreak and the ensuing lockdowns exacted a heavy toll on the global economy and presented the greatest challenge in a decade for the auto sector.

According to McKinsey & Company, global sales of light vehicles in 2020 are expected to decline 20 to 25 percent from pre-pandemic forecasts. In the hardest-hit countries, the pandemic could force drops of up to 45 percent.

Electric vehicles—which in 2019 accounted for a record 2.5 percent of the global LV market with over two million units sold—have not been spared.

However, despite the current grim scenario, new research by McKinsey indicates that EV sales may come back quickly in the next couple of years, especially in Asia and Europe.

The report analyses the three key markets that represent 94 percent of global EV sales: China, Europe, and the United States.

Its findings show that the EV market is much more likely to see a speedy recovery and robust growth in China and Europe than in the United States.

EV market share is also more likely to increase in China and Europe over the long term, according to the global consulting firm.

Here are the key insights from the study:

China: Quick Recovery

According to McKinsey, 1.2 million EVs were sold in China in 2019, making it the largest EV market in the world.

It says the country’s quick containment of the coronavirus pandemic and its economic rebound as well as its emerging EV startups have contributed positively to the electric mobility industry.

The report adds that China benefits from government policies aimed at supporting EV growth.

"For instance, China had established strong federal-fleet-emission targets and created a system in which OEMs received emission credits for passenger cars, based on various features, such as energy efficiency and vehicle range."

Read more: COVID-19 Redrawing Auto Industry’s World Map

McKinsey says another key growth driver is the fact that Chinese authorities are attempting to stimulate EV sales by extending purchase subsidies of up to 22,500 renminbi—which were about to expire—through 2022. The government has also recently exempted EVs from the purchase tax.

Despite the incentives in place, EV sales in China plunged during the COVID-19 crisis.

"Only 100,000 units were sold in June 2020, compared with 196,000 in June 2019," the report noted.

But the EV market share in China slightly increased to 4.4 percent in June 2020 and could grow further in the second half of 2020, it added.

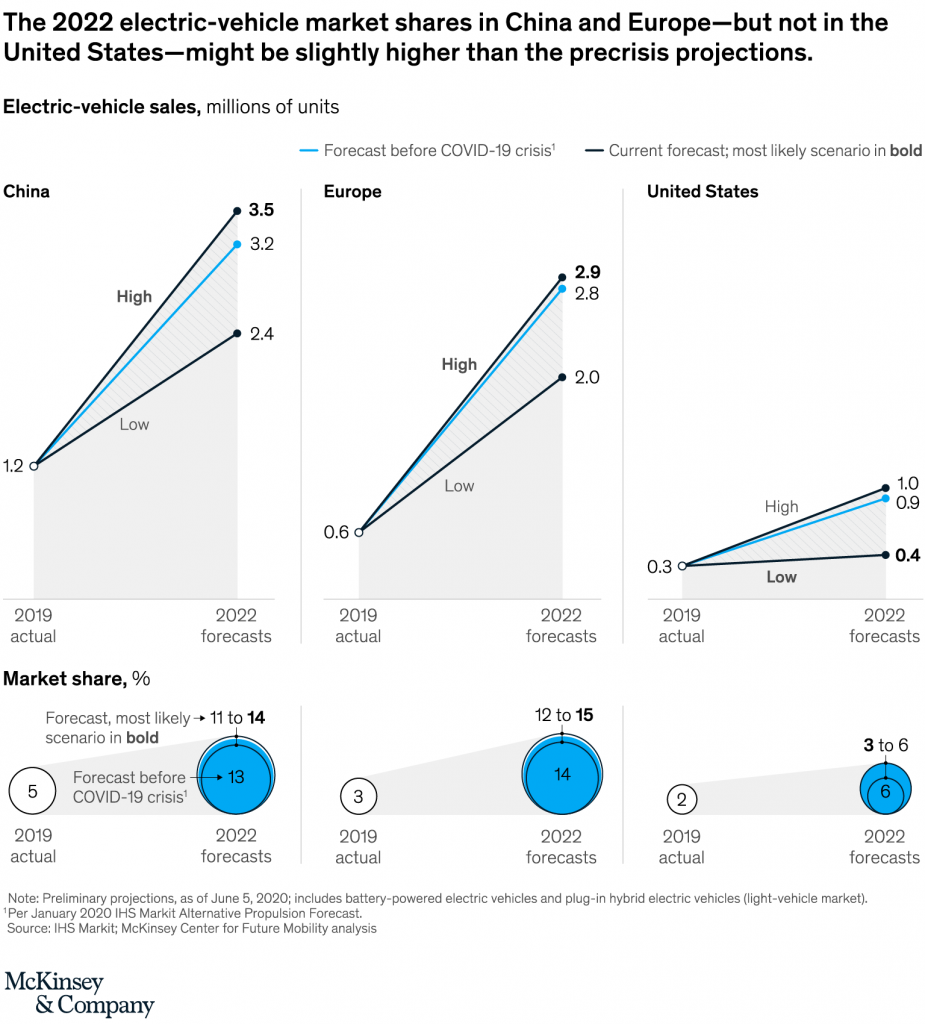

"We expect that the number of EVs sold in China to potentially increase from 1.2 million in 2019 to between 2.4 million and 3.5 million in 2022—about 300,000 more in the most likely scenario than predicted before the COVID-19 crisis. With that shift, the EV market share in China would rise to 11–14 percent, from 5 percent," McKinsey analysts say.

The firm also predicts that the consolidation of Chinese brands will accelerate in 2022 and 2023.

The EV market is much more likely to see a quick recovery and strong growth in China and Europe than in the United States.

McKinsey & Company

Europe: Positive Momentum

The report highlights the fact that European leaders have maintained a strict fleetwide CO2-emission target of 95 grams of CO2 per kilometer by 2021 despite the pandemic.

"Many major European-based OEMs have publicly committed to reaching that target and have rolled out an unprecedented number of battery-powered-EV and plug-in hybrid-EV models."

By McKinsey's count, they introduced 42 models in the first quarter of 2020 alone.

It adds that European governments have introduced new purchase subsidies, tax breaks, and other incentives to promote green mobility.

These initiatives, combined with the increase in EV models, has led to soaring consumer demand despite the ongoing pandemic, the report noted.

"For example, vehicle registrations for plug-in hybrid EVs and battery-powered EVs in Germany in the first half of 2020 increased by 200 percent and 43 percent, respectively, over the first half of 2019."

McKinsey's analysis shows that Europe is likely to make a quick recovery in this sector.

"European EV sales will potentially increase from 600,000 in 2019 to between 2.0 million and 2.9 million in 2022. Europe’s EV market share is also increasing, in line with trends that were occurring before the COVID-19 crisis."

The market share increased from 3 percent in 2019 to 7 percent by June 2020, the firm wrote, adding that EVs may have a 12–15 percent market share in Europe by 2022.

United States: Stagnating Sales

McKinsey's observations show that the U.S. EV market looks vastly different from that in China or Europe.

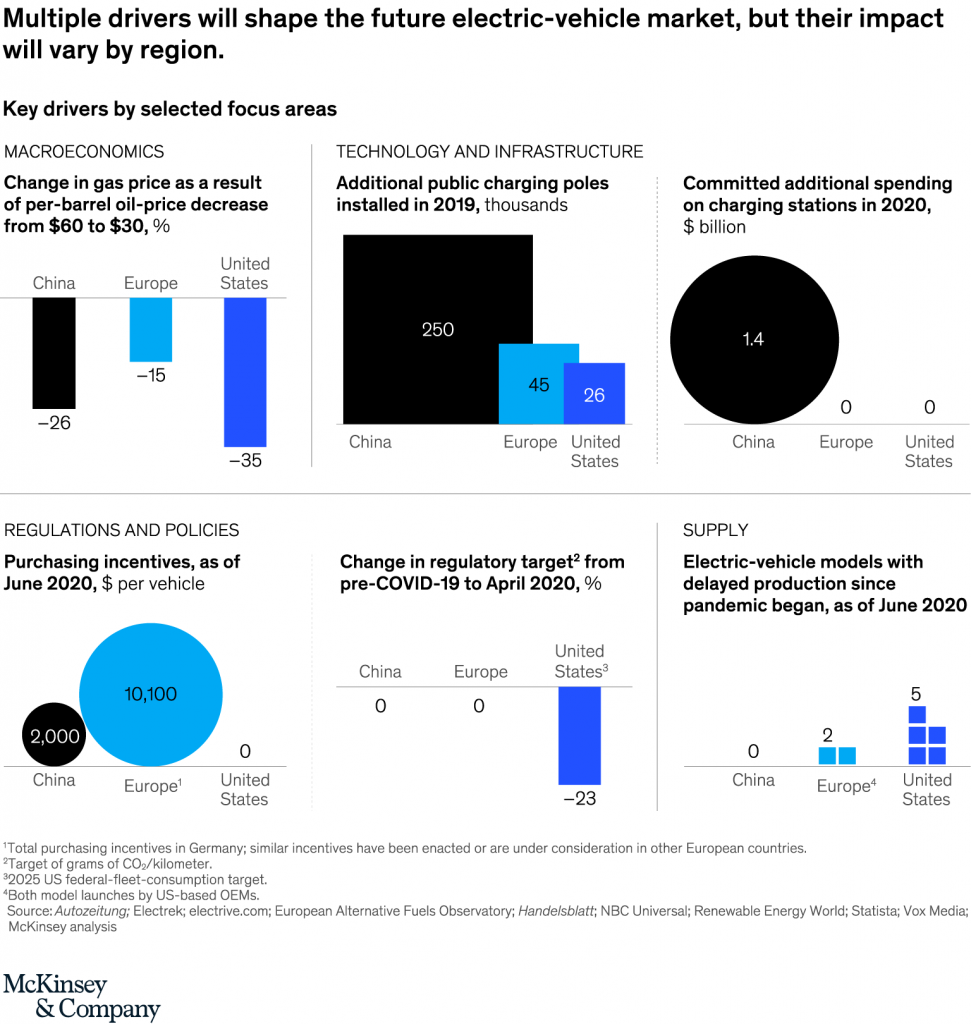

"As in China, EV sales in the United States had been slowing before the COVID-19 crisis, with annual growth decreasing from 80 percent in 2018 to 12 percent in 2019."

According to the report, the country’s slowing economy during the pandemic and the subsequent decrease in consumer spending are to blame for the lackluster EV market.

"Moreover, low demand for oil—and bottomed-out oil prices—make ICE vehicles cheaper than EVs to operate in the United States, since gasoline taxes are relatively low compared with those of most other countries," McKinsey wrote.

It added that the U.S. federal government's decision to decrease the fuel-economy standard to 40.4 miles per gallon by 2026 and relax CO2-emission targets are also hindering the widespread adoption of EVs.

Also, several U.S.-based OEMs have recently delayed the start of production on new EV models, the report said.

"Consequently, we expect that EV sales may only increase slightly, going from 300,000 units sold in 2019 to between 400,000 (in the most likely scenario) up to 1.0 million in 2022."

Read more: Shared Mobility Poised to Make a Comeback After COVID-19

According to McKinsey, growth in EV market share is also slowing noticeably in the United States.

"It fell from 2 percent in the fourth quarter of 2019 to 1.3 percent in April 2020 before reaching 2.4 percent in June 2020. The projected 2022 market share of 3 to 6 percent is below pre-crisis expectations," the research says.

Long-Term Outlook

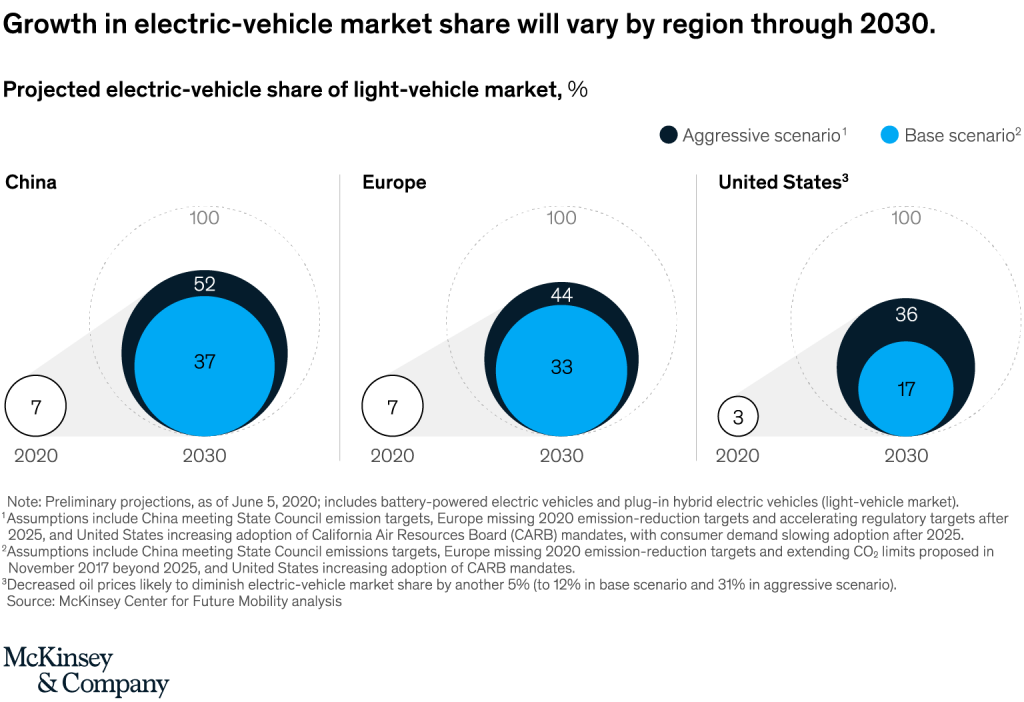

Estimates by the consulting firm illustrate that incentives and regulations will likely propel EV market share in China to roughly 35 to 50 percent and in Europe to 35 to 45 percent by 2030.

It says prospects for the U.S. market is more uncertain due to macroeconomic challenges and regulatory headwinds.

"While the EV market share in the United States will likely increase, the pace of its growth will likely be slower than seen in China or Europe, only reaching around 15 to 35 percent by 2030," it added.

The research also highlights the large-scale implications of COVID-19 on how cars are sold and how profitable they can be.

"For example, with the pandemic preventing or discouraging consumers from going to showrooms, online sales of EVs could soar."

Despite the seeds of trouble and uncertainty sown by the coronavirus pandemic all over the world, McKinsey says the future of global electric mobility is likely to emerge even "brighter than before".