Gold has once again taken center stage in global financial markets. Since late 2023, the precious metal has been on an upward trajectory, reaching unprecedented heights.

What’s behind this new gold rush? Historically, It’s no secret that gold tends to perform well in uncertainty and economic recession periods. With wars raging, political upheavals, and countries’ debt crisis, investors seem to turn to gold as a possible safe haven. Yet, there’s more at play here than just the usual market volatility and geopolitical risk.

Central Banks and the Quiet Power Shift

One of the fascinating developments in this gold rush is the surge in demand from central banks, particularly those of BRICS+ nations and countries aiming to reduce their dependence on the U.S. dollar. China, Turkey, India, and Russia have been aggressively stockpiling gold recently, with purchases driving prices higher.

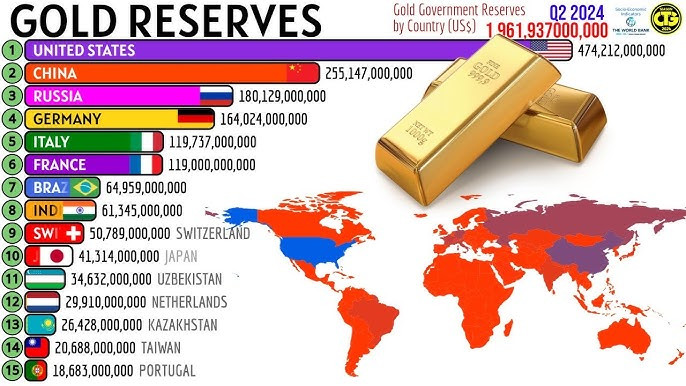

Gold Reserves Surge in 2024: US and China Lead the Pack

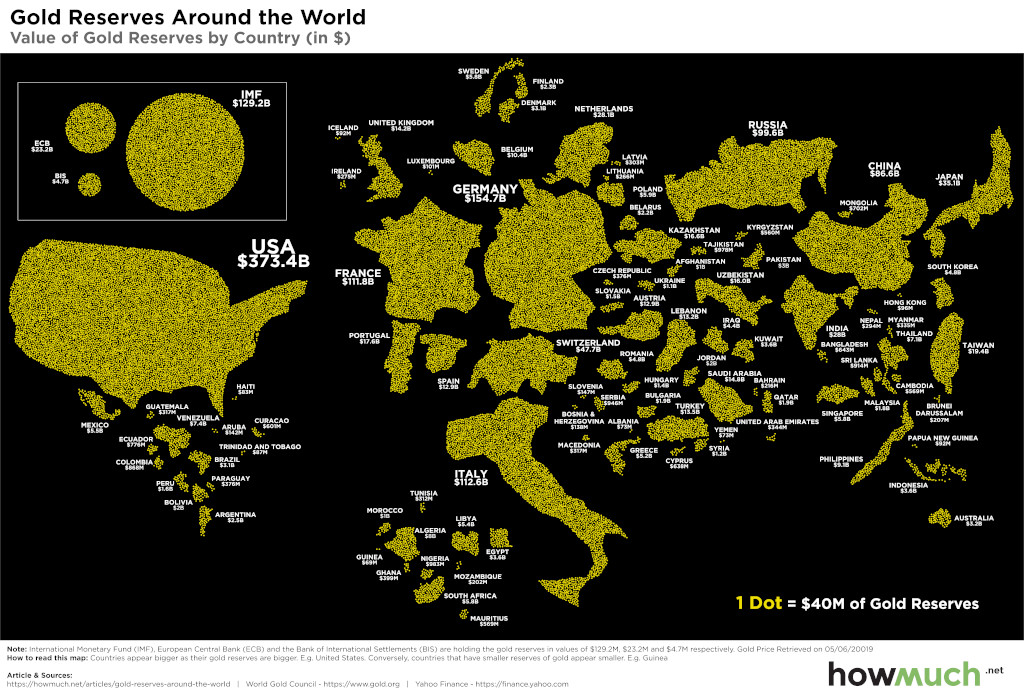

Over the past five years, the gold reserves of major economies have skyrocketed, with the United States and China leading the surge. As of 2024, the U.S. holds an impressive $474.2 billion in reserves, while China’s reserves reached $255.1 billion, reflecting a growing desire to diversify away from traditional foreign exchange reserves. In Europe, Germany, and France maintain significant holdings, with reserves of $164 billion and $119 billion, respectively. This increase underscores the importance of gold as a global safe haven during times of geopolitical uncertainty and economic transition. The sharp rise in reserves, particularly for the U.S. and China, highlights the critical role that gold continues to play in the world’s shifting financial landscape.

Gold Reserves Surge in 2024: US and China Lead a Global Gold Rush

Over the past five years, gold has reasserted itself as a pivotal asset in the global financial system, with nations bolstering their reserves in response to economic instability, geopolitical tensions, and the decline in confidence in fiat currencies. The gold reserves of major economies have seen remarkable growth, particularly in 2024, with the United States and China emerging as the dominant players in this modern-day gold rush.

As of 2024, the United States holds an unprecedented $474.2 billion in gold reserves, further cementing its status as the largest holder of the precious metal. This represents a notable increase from previous years and highlights gold’s importance to the U.S. financial strategy, particularly in a world where the dollar faces competition from emerging powers.

On the other hand, China has made significant strides in accumulating gold, with reserves reaching $255.1 billion by mid-2024. This dramatic growth reflects China’s long-term strategy of reducing its reliance on the U.S. dollar and diversifying its foreign exchange holdings. The increase in gold reserves also speaks to the country’s desire to bolster economic security as it faces potential economic headwinds and geopolitical uncertainties.

In Europe, countries like Germany and France maintain their traditional stronghold in gold, with Germany holding $164 billion and France $119 billion in reserves. While their growth in reserves has been steady, it hasn’t matched the explosive accumulation seen in the U.S. and China. Nonetheless, Europe’s significant gold holdings underscore the continent’s cautious approach to safeguarding its financial stability, particularly as inflationary pressures and energy crises loom.

A New Era of Strategic Gold Accumulation

This global surge in gold reserves is driven by several critical factors. For one, gold provides a hedge against inflation, which has seen persistent upticks in many major economies over the past few years. As central banks, particularly in the Eurozone, continue to battle inflation while keeping monetary policy relatively loose, gold offers a stable store of value.

Moreover, geopolitical tensions—ranging from the war in Ukraine to rising hostilities in the Middle East—have renewed interest in gold as a safe-haven asset. With the U.S. dollar increasingly seen as a political tool, countries like China and Russia have accelerated their gold purchases to reduce their vulnerability to potential sanctions or economic disruptions. For instance, Russia now holds $180.1 billion in gold, further securing its reserves against Western economic pressure.

The Role of Gold in a Multipolar World

Gold’s surge in global reserves also aligns with the growing shift towards a multipolar world. With BRICS+ nations, including China, Russia, and others, pushing for a global financial system less reliant on the U.S. dollar, gold has become a critical asset in these countries’ diversification efforts. These nations are laying the groundwork for a more resilient global economy, where gold-backed currencies may play a more prominent role in trade and international finance.

As we look ahead, it’s clear that the strategic accumulation of gold will continue to be a cornerstone of financial policies across the globe. In the face of global uncertainties—whether economic, geopolitical, or financial—gold’s role as a timeless asset is not only reaffirmed but growing in importance, shaping the next chapter of the global economic order.

Gold as a Hedge Against Inflation and Uncertainty

At the same time, the global economy remains precarious. Inflation, while no longer at the dizzying heights of the past few years, continues to burden households and businesses. Central banks around the world have been cautious in tightening monetary policy, and many governments are grappling with how to manage mounting fiscal deficits.

In Europe, the conversation around gold has evolved. While European countries such as Germany and France have historically held significant gold reserves, they are now observing how other regions use gold to assert their independence economic, fiscal, and geopolitical pressures.

A Shift in Global Power

What we are witnessing is not just a market trend, but a potential shift in the global balance of power. BRICS+ nations now account for one third of the world’s GDP, and they’re actively positioning themselves as alternatives to the Western-dominated financial system. These nations have even floated the idea of creating a gold-backed currency, a move that could challenge the dominance of the U.S. dollar on the global stage.

While such a drastic shift may seem far off, it’s clear that the ongoing accumulation of gold by BRICS+ countries is a significant step in that direction. As the West contends with its own internal divisions and economic challenges, the rest of the world is quietly preparing for a future where gold, not the U.S. dollar, may play a central role in global finance.

What Lies Ahead?

Looking forward, it seems likely that the gold rush will continue, driven by both geopolitical tensions and economic factors. As more nations seek to reduce their exposure to the U.S. dollar, we can expect to see even greater demand for gold.

But does this mean the end of the dollar’s reign? Probably not in the near future. However, what’s clear is that gold’s appeal is stronger than ever, and the world’s economic powers are taking notice.

Are we at the top of the gold market or is there more space for growth?