Forest products are always on demand. This is true today as it will be in the future. Indeed, the growth of the global forestry industry depends on the demand for wood products. According to the Food and Agriculture Organization (FAO), the unceasing demand for wood and its products drives the investment in the forestry industry.

The global forestry industry has four major categories; the timber markets, pulp markets, lumber markets, and biomass markets. In the global timber markets, the supply of softwood logs increased in the period between Q4 2018 and Q1 2019, hence affecting global prices. Indeed, the Global Sawlog Price Index (GSPI), which tracks the global prices of softwood logs, declined by 1.8% in Q1 2019. In like manner, the European Sawlog Price Index (ESPI) declined but with a bigger margin of 3.1%. Interestingly, the decline of the two indexes extended into Q2 2019.

On the contrary, the performance of the price of softwood fiber (pulpwood) was positive globally. In the first quarter of 2019, the Softwood Fiber Price Index (SFPI) climbed by half of a percent. The global pulpwood market is performing well because this increase is the third one consecutively since Q3 2018.

The performance of the global lumber market was uneven across different countries. Further, the biomass market continues to perform well on a global scale. However, Canada and the US (North America) dominated the industry as the largest exporters of pellets. On the other hand, the UK remains the largest importer of pellets. In 2018, the UK imported 36% of all the global supply of pellets.

Which countries lead in forest management and the trade of forestry products?

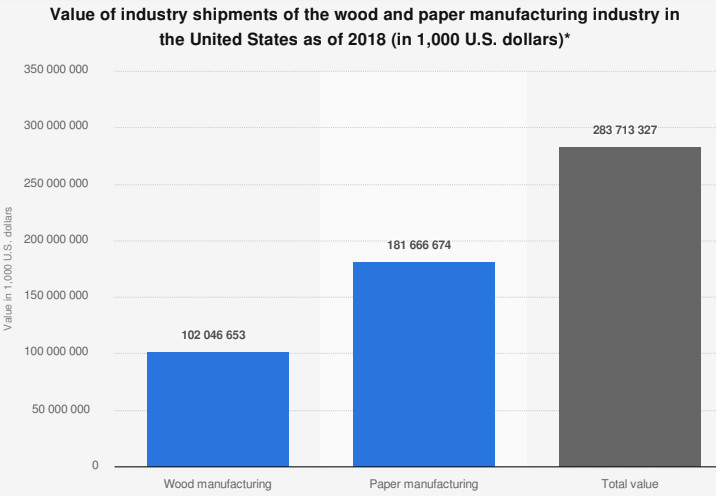

The Americas region has the largest percentage of forest cover in the world. According to Statista data, 42.6% of North and Central America consisted of primary forest. No wonder, the US and Canada are among the biggest players in the forestry industry. In the US, the paper manufacturing sector performed better than the wood manufacturing sector in 2018. Notably, the value of US paper manufacturing shipments in 2018 was over $181 billion. In comparison, the shipments for wood manufacturing were worth a little over $102 billion.

Canada is the other country where the forestry industry is a major contributor to the GDP. In 2016, Canada was the world’s largest exporter of forest products earning a total of USD $17.2 billion. Notably, most of the products went to the UK, which was the world’s largest importer. Mainly, Canada produces sawnwood, roundwood, paper and paperboard, wood pulp, and wood-based panels.

Major sectors of the forestry industry

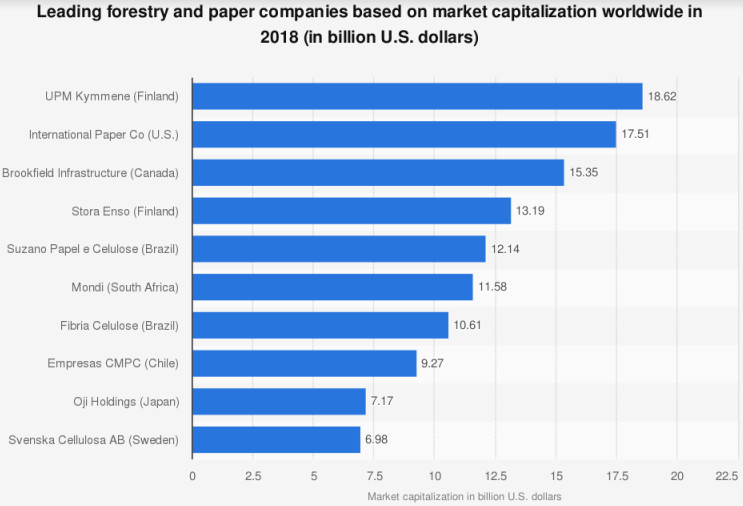

The paper sector is the largest in the global forestry industry. The largest companies worldwide in the global forestry industry focus on paper production. Finland-based UPM Kymmene, is the largest forestry and paper company in the world, according to Statista. Indeed, the company was worth $18.62 billion in market capitalization as of 2018. Other major companies in this sector include International Paper Company of the US, Canada-based Brookfield Infrastructure, and Finland-based Stora Enso.

Other sectors of the forestry industry include wood and pulp. In the US, wood is the second most important sector after paper. Major players in the US wood sector include Boise Cascade, North Pacific Group, and Newark Group.

Industry outlook

The future performance of the global forestry industry will continue to be uneven. This is because of varied demand among the sectors. For instance, the demand for wood will increase on the back of a larger population. By 2030, the global population could hit 8.2 billion, which implies that more wood will go into servicing different needs for these people. Besides, the continued expansion of the global economy implies that demand for forest products like wood-based panels will increase.