The International Monetary Fund’s Global Financial Stability report makes the case of how crucial the European Union is to the Uk's finance industry.

The GFSR (Global Financial Stability Report) is a report by the IMF that's published twice a year and which draws out the financial ramifications of economic issues highlighted in the IMF’s World Economic Outlook (WEO).

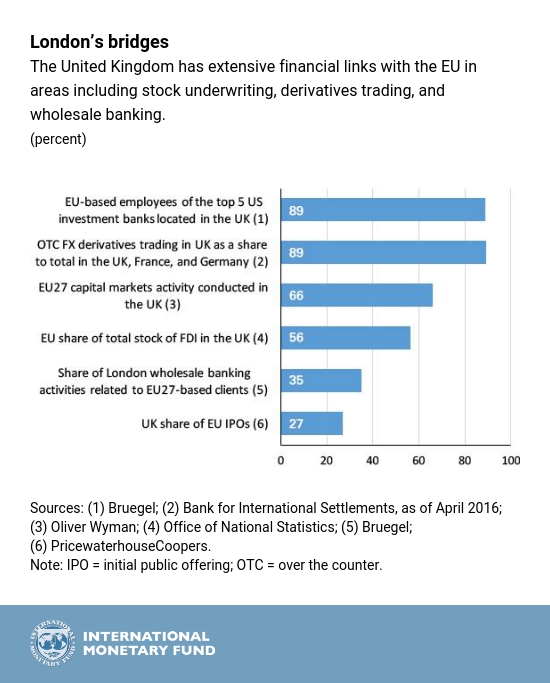

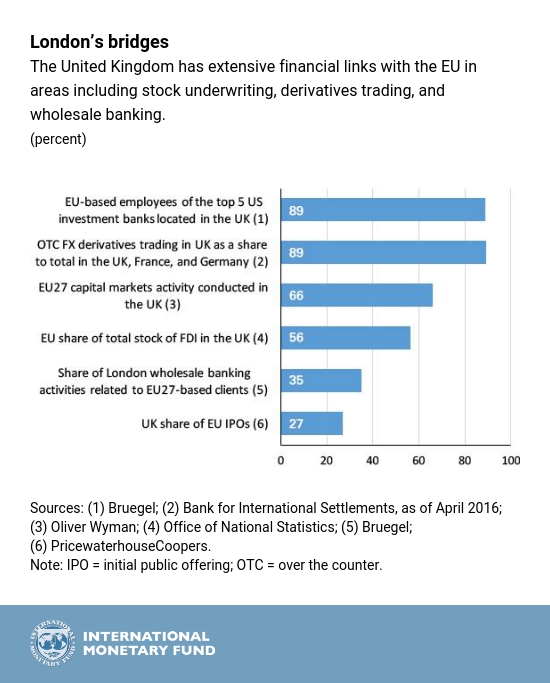

On page 45 of the GFSR April 2017, the graphic "Figure 1.3.1." shows measures of financial linkages between the United Kingdom and the European Union that might be affected by the BREXIT scenario.

[caption id="attachment_1590" align="aligncenter" width="550"]

BREXIT - IMF - Global Financial Stability Report April 2017[/caption]

According to the IMF, here are some of the examples of what could be at stake for the United Kingdom’s financial services industry:

- 69% of EU-based employees of the top five U.S. investment banks located in the UK.

- Of the over-the-counter trading in foreign exchange derivatives in the United Kingdom, Germany, and France, the UK share comes to 89%.

- EU27 capital markets activity conducted in the UK - 66%

- EU share of total stock of FDI in the UK - 56%

- Share of London wholesale banking activities related to EU27-based clients - 35%

- UK share of EU IPOs 27%

The United Kingdom plays a key role in the global financial network which stems from a "combination of factors, including concentration of capital and risk management, as well as the availability of ancillary financial services and expertise", says the IMF.

"The implications for EU-U.K. euro cross-border payments systems could be substantial. The United Kingdom may cease to be part of the Single Euro Payments Area unless membership is retained. The cost of making international payments could increase notably, affecting international activity."

IMF's Global Financial Stability Report - April 2017

In case no agreement is reached, banks have started preparing for a worst-case scenario. According to the IMF, Brexit-related costs might also increase the burden on banks due to:

- "Duplication of some activities and business structures in different locations"

- "Operating in different regulatory regimes"

The EU-U.K. euro cross-border payments systems could also change in the case that the United Kingdom ceases to be part of the Single Euro Payments Area. According to the IMF, "the cost of making international payments could increase notably, affecting international activity."

The uncertainty levels are high regarding the outcomes of the BREXIT negotiations and any conjectures of financial stability or instability are difficult to estimate. There is even the suggestion the EU would benefit from a BREXIT scenario where "financial stability benefits could arise from a less concentrated banking system throughout Europe", says the

IMF.

BREXIT - IMF - Global Financial Stability Report April 2017[/caption]

According to the IMF, here are some of the examples of what could be at stake for the United Kingdom’s financial services industry:

BREXIT - IMF - Global Financial Stability Report April 2017[/caption]

According to the IMF, here are some of the examples of what could be at stake for the United Kingdom’s financial services industry: