Long before the coronavirus unleashed a massive wave of shock across the world, economists had envisioned several scenarios for a possible recession in Europe.

However, few would have thought that some of the largest economies in the world would find themselves at war with a novel virus.

The coronavirus has brought economic activities almost to a halt in Europe, which has now taken over from China as the epicenter of the outbreak.

Countries such as Italy, France, and Spain are in a sweeping nationwide lockdown to slow the spread of COVID-19—a coronavirus-caused illness that originated in the Wuhan region of China in late 2019.

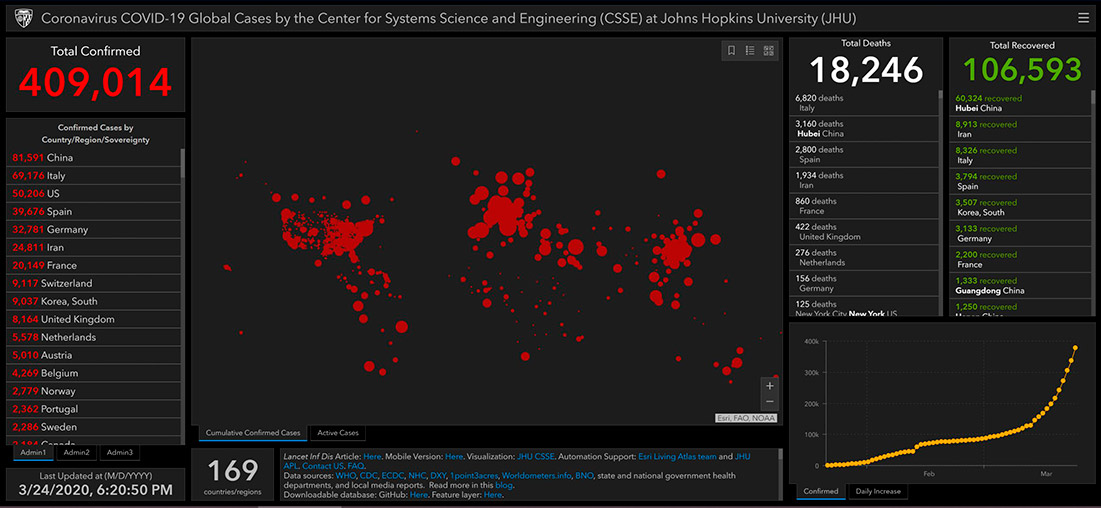

More than 409,000 people worldwide have been confirmed to have the coronavirus, and the death toll has reached 18,246, according to the data published by the Center for Systems Science and Engineering at Johns Hopkins University on March 24.

In Europe, where governments are getting more serious about lockdowns, Italy is the worst-affected by the virus with 69,176 cases and 6,820 deaths. Spain, Germany, France, Switzerland, and the United Kingdom have also been badly hit.

The UK became one of the latest countries to impose a lockdown alongside one-third of the global population after Prime Minister Boris Johnson ordered Britons on Monday to stay at home to halt the spread of the respiratory illness, the Independent reported.

With supply chains frozen, conferences canceled, shops and restaurants shuttered, businesses battered, travel restricted, and aircraft grounded, a profound economic downturn across the continent appears all but unavoidable. The global economy could be headed that way, too.

The UK became one of the latest countries to impose a lockdown alongside one-third of the global population.

IMF's Forecast

The International Monetary Fund expects a global recession this year that will rival the one triggered by the global financial crisis more than a decade ago.

However, the group foresees a rebound soon after, IMF's Managing Director Kristalina Georgieva, said in a Monday statement carried by Fortune.

The IMF's outlook for global growth in 2020 "is negative—a recession at least as bad as during the global financial crisis or worse," Georgieva said.

"But we expect a recovery in 2021. To get there, it is paramount to prioritize containment and strengthen health systems—everywhere. The economic impact is and will be severe, but the faster the virus stops, the quicker and stronger the recovery will be."

United Nations Secretary-General Antonio Guterres has also warned that a global recession in on the horizon, AP reported.

"A global recession—perhaps of record dimensions—is a near certainty," he noted, referring to a report by the International Labor Organization that said workers across the world could lose $3.4 trillion in income by the end of this year.

Economists polled by Reuters say the global economy is already in a recession given the widespread impact of the coronavirus pandemic on economic activities. A recession is generally defined by two consecutive quarters of negative growth.

Prospects for Europe

Luis de Guindos, vice president of the European Central Bank (ECB), said recently that Europe is expected to slip into a recession of a transitory nature.

"I believe that the first semester will be very bad. Europe will enter into a recession, and this will drag the overall European economy into negative growth rates in the year. But in the second semester, I believe we will see positive growth rates for Europe," de Guindos said in an interview with Spanish TV La Sexta channel, Reuters reported.

De Guindos insisted that the ECB will act as much as needed to cushion the devastating impact of the ongoing health crisis and emphasized the importance of staving off a debt crisis in Europe.

Magnitude of Crisis

Fears of an economic slump have been confirmed by Swiss Investment Bank UBS, which says a steep recession in Europe is now its base case scenario despite of heavy monetary and fiscal stimulus.

In a research note cited by Business Insider, the Swiss bank said that the continent's economy could contract by as much as 4.5% similar to the 2008 global financial crisis.

"A European recession appears inevitable—the question is how deep and long it will be," UBS economists Reinhard Cluse, Felix Huefner, Anna Titareva, and Jennifer Aslin said while projecting that Italy and Germany would be the hardest-hit economies.

Swiss Investment Bank UBS says a steep recession in Europe is now its base case scenario.

The bank's base-case scenario suggests that "the shutdown lasts until mid-May, followed by a recovery. But despite heavy stimulus from monetary and fiscal policy, negative secondary effects cannot be avoided, unemployment and bankruptcies will rise over the coming weeks, weighing on household consumption and fixed investment even after the shutdown is over."

'Extraordinary Measures'

The ECB has pumped €750 billion into the European economy in a bid to keep the region's financial system functioning and support countries that have been adversely affected by coronavirus, according to the New York Times.

"Extraordinary times require extraordinary action," ECB President Christine Lagarde said on Twitter as she announced plans to counteract the serious risks to the eurozone caused by the coronavirus pandemic.

"There are no limits to our commitment to the euro," she added.

The length of the shutdown in Europe would dictate the gravity of the situation. The deeper the recession is, the greater the impact on the strength of a potential bounceback will be.

"It seems pretty difficult to avoid a recession in the first half of the year," Ángel Talavera, head of European economics at Oxford Economics in London, was recently quoted as saying by the New York Times. "The spread of the disease in Europe is a game-changer. The question is how deep it will be, and how long it will last."

European Pledges

According to CNN, European countries have pledged to commit at least $1.5 trillion in spending and loan guarantees to shield businesses, workers, and families from the fallout of the still-unfolding situation, which has turned the world upside down in a matter of weeks. That figure already seems set to grow.

Germany has unleashed its biggest post-war economic help package worth at least €550 billion to shore up its companies, Guardian says. The UK has promised £350 billion to support businesses and France €345 billion.

The fact that Germany, one of the largest economies in Europe, is heading for rocky times translates into a deep-rooted impact on the entire European economy.

Bundesbank, the German central bank, warned on Monday that a pronounced recession in Germany is unavoidable, Business Insider wrote.

"Sliding into a pronounced recession cannot be prevented. Economic recovery will only start when the pandemic risk is effectively contained," Bundesbank said in its March monthly report.

European countries have pledged to commit at least $1.5 trillion in spending and loan guarantees to counter the impact of the coronavirus outbreak.

What's Next?

As coronavirus rampages through the world, it offers a glimmer of hope that seven of the world's leading economies are coming together to help vulnerable countries and rescue the global economy.

A statement issued by G7 finance ministers and central bankers on Tuesday said the group will do "whatever is necessary" to restore economic confidence and protect businesses and jobs during the COVID-19 pandemic, AP reported.

The finance officials also said they will endeavor to "promote global trade and investment" and "coordinate on a weekly basis" as they implement these measures and take "further timely and effective actions".