As physical sports were grounded by the coronavirus pandemic across the globe, esports not only continued to thrive but also found new fans along the way.

Multiple industry reports have painted a fairly bright future for esports—which refers to organized, multiplayer video game competitions—saying that there are great opportunities in this sector despite widespread disruptions caused by the outbreak.

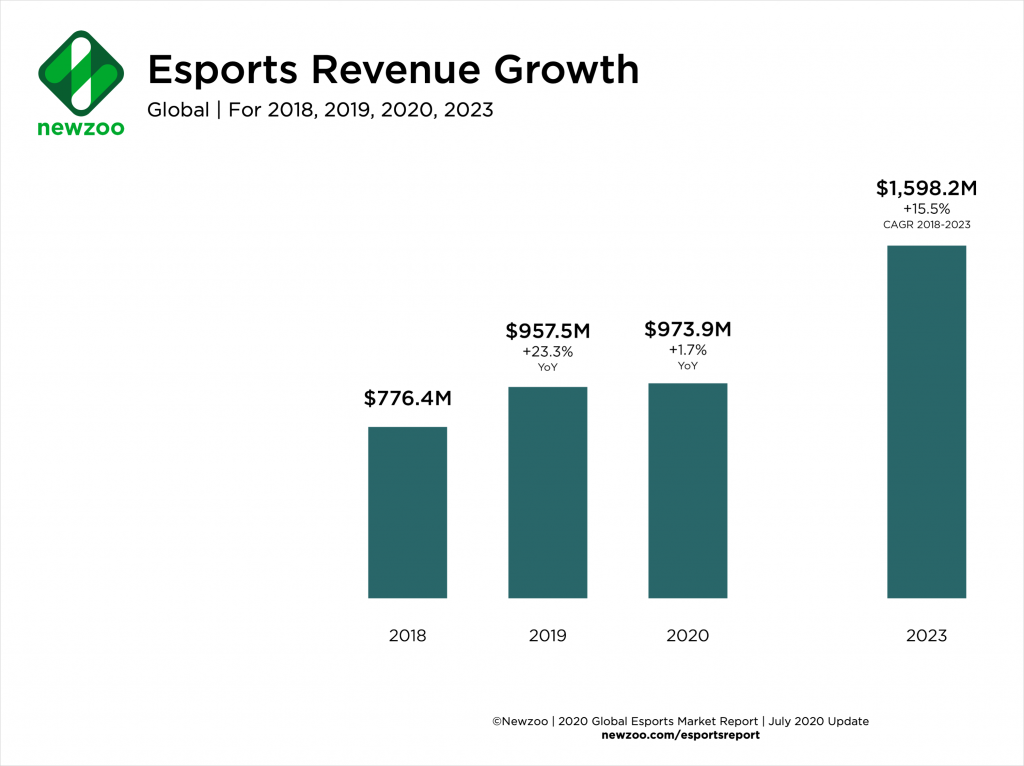

Newzoo, a leading source for games and esports analytics and market research, estimated in a recent report that the global esports market will generate $973.9 million in 2020 and $1194.8 million in 2021.

These figures are a downward revision from its prior projections earlier in the year but still pretty good nonetheless.

According to Newzoo, the sinking forecasts has nothing to do with a lack of demand for esports as the audience is not going to be smaller.

It also said the adjustment was not due to a decline in esports content offered by organizers and is happening as a result of physical events getting delayed or drying up.

Read more: Sole Focus on Gaming Eclipses VR Critical Use Cases: Virtuleap’s Co-Founder

Physical events were previously a big chunk of the industry's revenue, and a transition away from them has created some uncertainties and poses several challenges for esports.

"The 2020 and 2021 revisions alike are a result of COVID-19's ongoing impact; most notably, cancellations and postponements that have trickled into Q3 and Q4 of this year," the analytics firm noted.

Likewise, a larger number of international events have switched to alternative formats, it added. "Online events are replacing offline events, leading organizers to replace international tournaments with regional ones."

Regional vs. International Events

Newzoo suggests that esports should focus more on regional events if it wants to be successful digitally.

It argues that it is harder to coordinate among multiple parties in different time zones and factors such as varying internet connection quality could undermine the integrity of the competition.

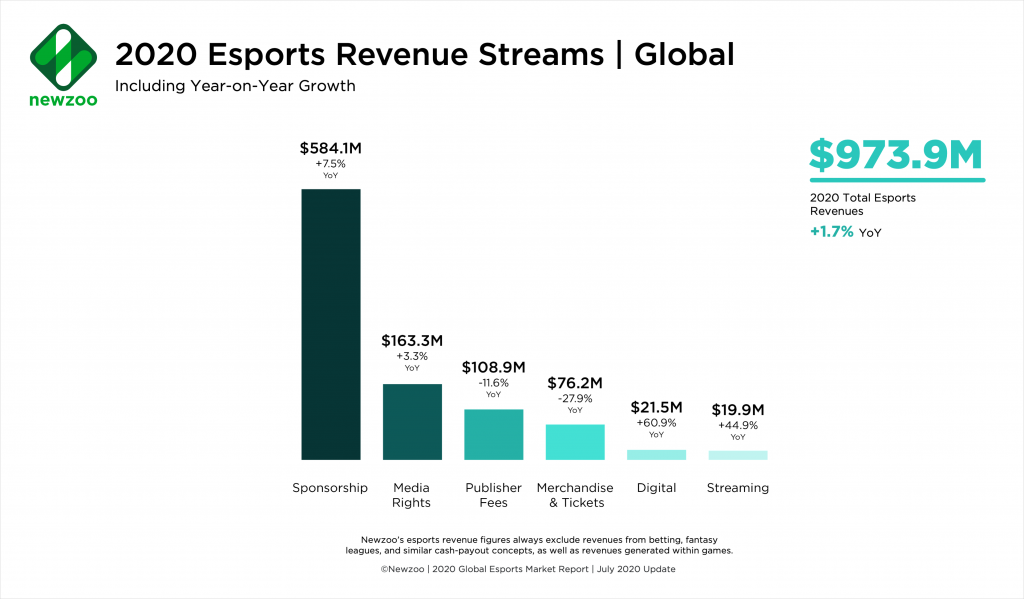

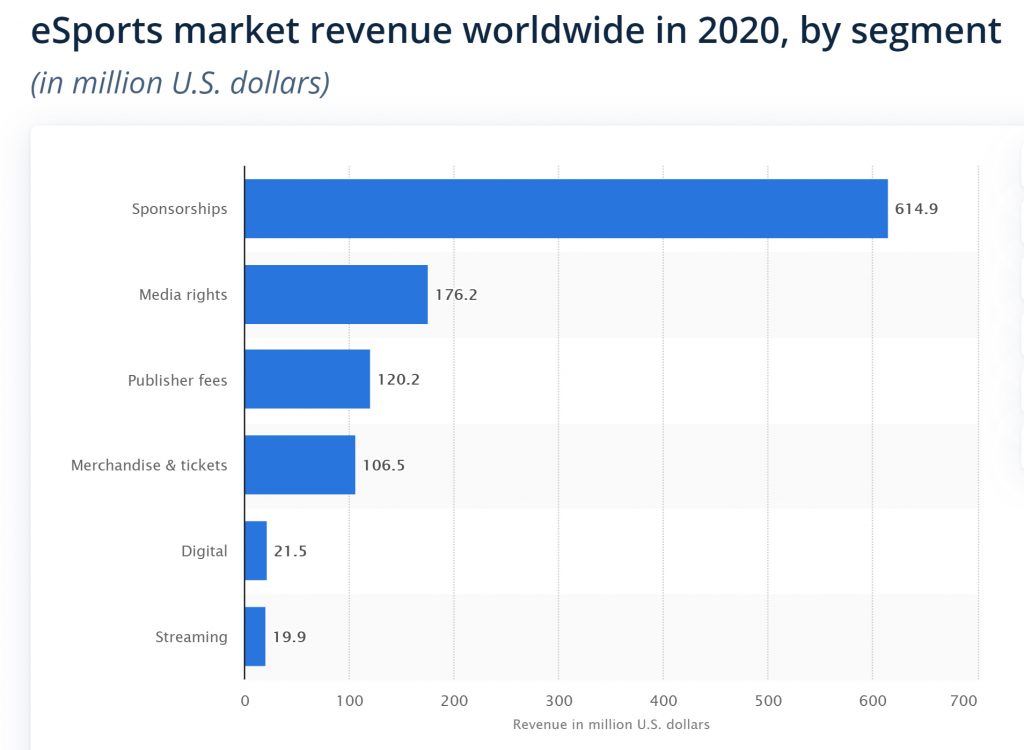

According to the report, merchandise and tickets are most impacted by the move to digital, but media rights and sponsorships are more resilient.

Merchandise, Ticket Sales

Newzoo's July figures show that esports merchandise and ticket sales will generate revenues of $76.2 million in 2020, compared to $121.7 million in February and $106.5 million in April.

Media rights and sponsorship are expected to be $163.3 million and $584.1 million in 2020, respectively.

It seems sponsors are less interested in digital events where they cannot engage a live audience.

Despite the downgrading, Marketing Dive says the esports industry is weathering the pandemic relatively well and is still an area of interest for some deep-pocketed brands.

"BMW in April signed on to sponsor five of the world's leading esports teams, a move it billed as a 'major expansion' into the category. In June, Verizon inked a three-year contract to serve as the official 5G and network services provider of Legends Championship Series," the industry publication wrote in a recent article.

It added that partnerships with prominent content creators and players are on the rise.

Growth in Prominence

The World Economic Forum says esports may be growing in prominence as a result of COVID-19.

"Sports leagues around the world have turned to the sector to find new ways of engaging with fans. Several esports competitions are being shown on live TV, as broadcasters look to fill hours of scheduled sports content that were canceled in the wake of the pandemic."

Read more: Video Game Industry Thriving While Production Faces Challenges

According to the Switzerland-based organization, the value of the sector more broadly has risen despite the decline in revenues thanks to the low-cost marketing it has benefited from during the pandemic.

Rise in Esports Betting

A Forbes article reports that the cancellation of physical esports events has drawn the attention of many fans who would normally bet on more traditional sports to esports.

"But it’s not just consumers who are focusing more on the world of esports betting. With no sports to look for, sponsors and investors are also investing more into the esports side of things during this time, looking to capitalize on the boom that is currently happening," it said.

Despite all the headwinds, the entire esports market is expected to grow over the coming years.

Statista has projected that the worldwide revenues will reach $1.79 billion in 2022.

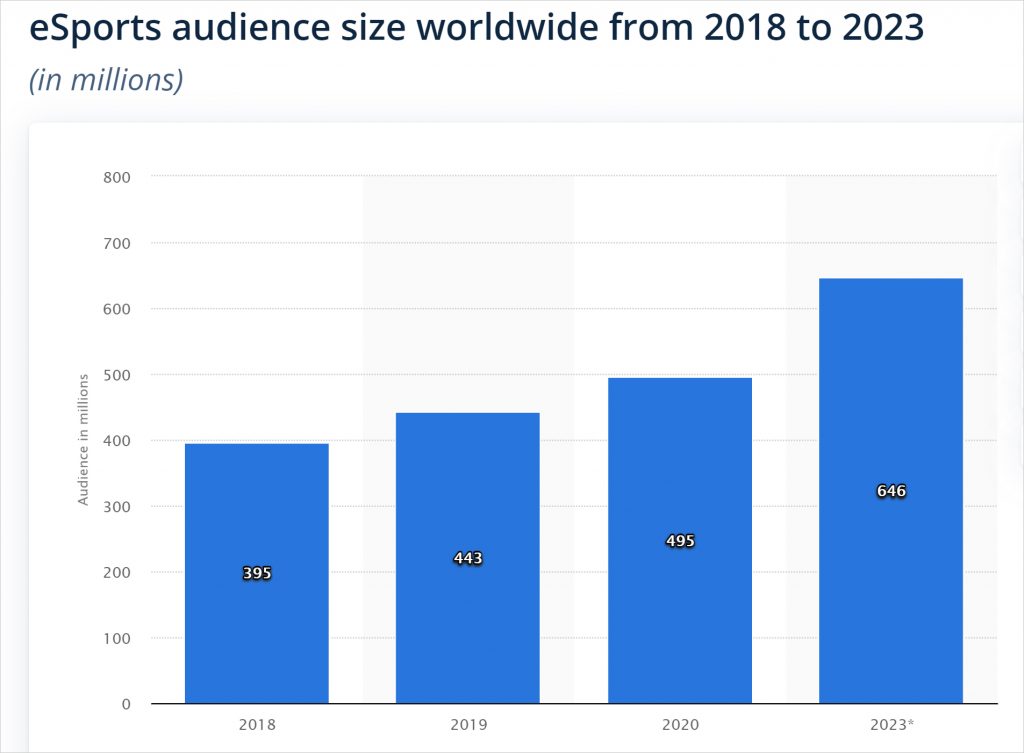

It also says there are expected to be 646 million viewers of esports worldwide, a huge increase from the 395 million in 2018.

Citing analysts, the World Economic Forum states that COVID-19 may lead to the normalization of esports as a result of the "unprecedented and accidental" adoption by broadcasters, athletes, and leagues seeking to engage fans.

"At the very least, the pandemic has reminded media companies and brands that there remains an addressable market of highly engaged consumers. Recent developments will likely inch esports towards the mainstream."