The shock wave of the coronavirus is driving technological adoption in unanticipated ways around the globe, transforming societies and economies at a pace that would have seemed unimaginable just a few years ago.

In particular, companies enabling communication and exchange of services and goods over distance have seen notable increases in adoption and usage.

Fintech is one of the sectors that has helped minimize some of the health risks and detrimental socioeconomic effects of the COVID-19 pandemic while allowing some critical aspects of day-to-day life to continue as normal.

Drawing on mobile application data from 74 countries, a report by the Swiss Finance Institute found that the spread of the virus and related government lockdowns have led to between a 24 and 32 percent increase in the relative rate of daily downloads of finance mobile applications.

Read more: 7 Consumer Behavior Trends Emerging From COVID-19

"In absolute terms, this equates to an average daily increase of roughly 5.2 to 6.3 million application downloads and an aggregate increase of about 316 million app downloads since the pandemic's outbreak," reads the research paper.

The fintech industry is now more vital than ever as robust financial services will be a lifeline for a large number of individuals and enterprises.

"Companies that provide digital financial services are better placed to take advantage of this situation. FinTech must be prepared not just to accommodate this increased demand but also to scale up their enterprise IT infrastructure while adapting to the new world, just like everyone else," FinTech Magazine says.

COVID-19 Impact on Fintech

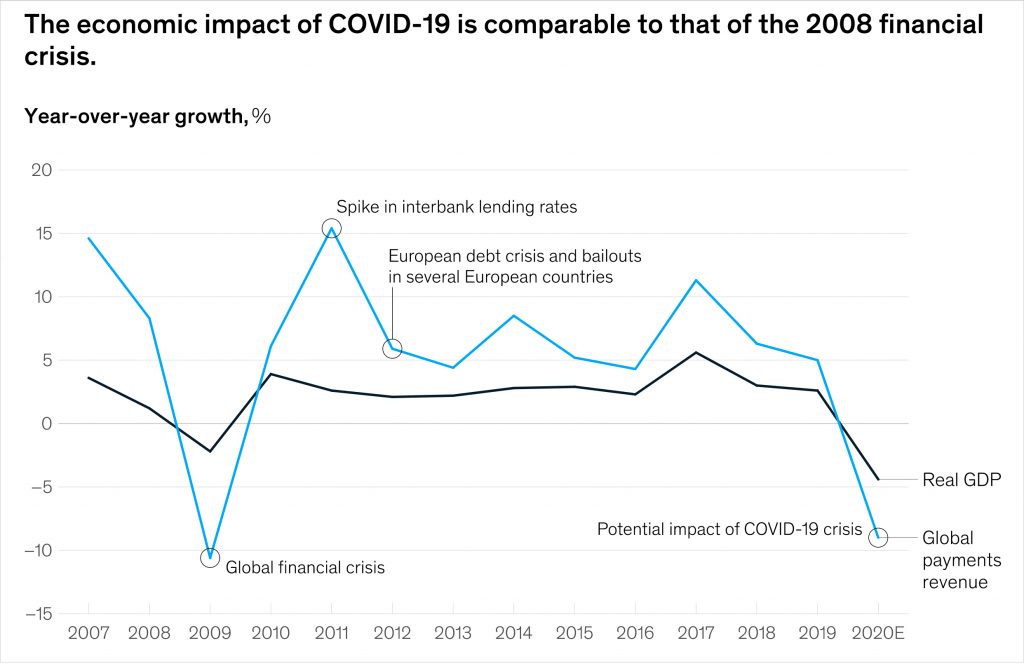

According to McKinsey, it is difficult to precisely determine the impact of the coronavirus on payments economics as much depends on "the complex interplay between economic activity, the interest-rate landscape and associated liquidity patterns, and the evolution of individual and collective behavior."

Taking these factors into consideration, the consulting firm expects revenue growth in global payments to turn negative.

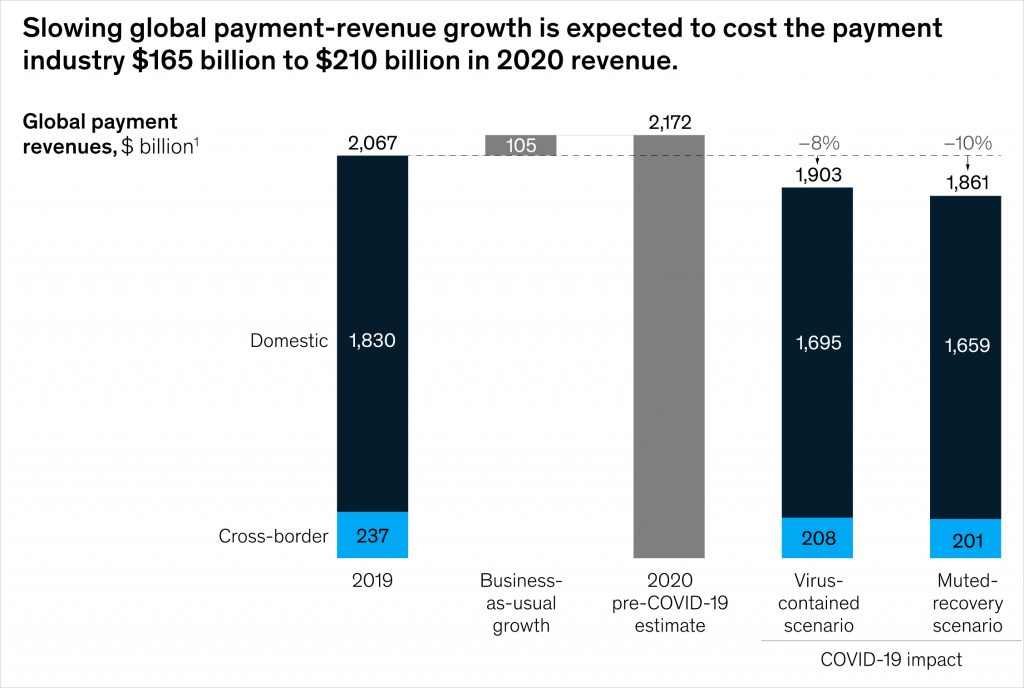

"Instead of growing by 6 percent, as projected by our 2019 global payments report, the activity could drop by as much as 8 to 10 percent of total revenues, or a reduction of $165 billion to $210 billion—comparable to the 10 to 11 percent revenue reduction in the wake of the global financial crisis in 2008–09," McKinsey wrote in a recent report.

Short and Long-Term Outlook

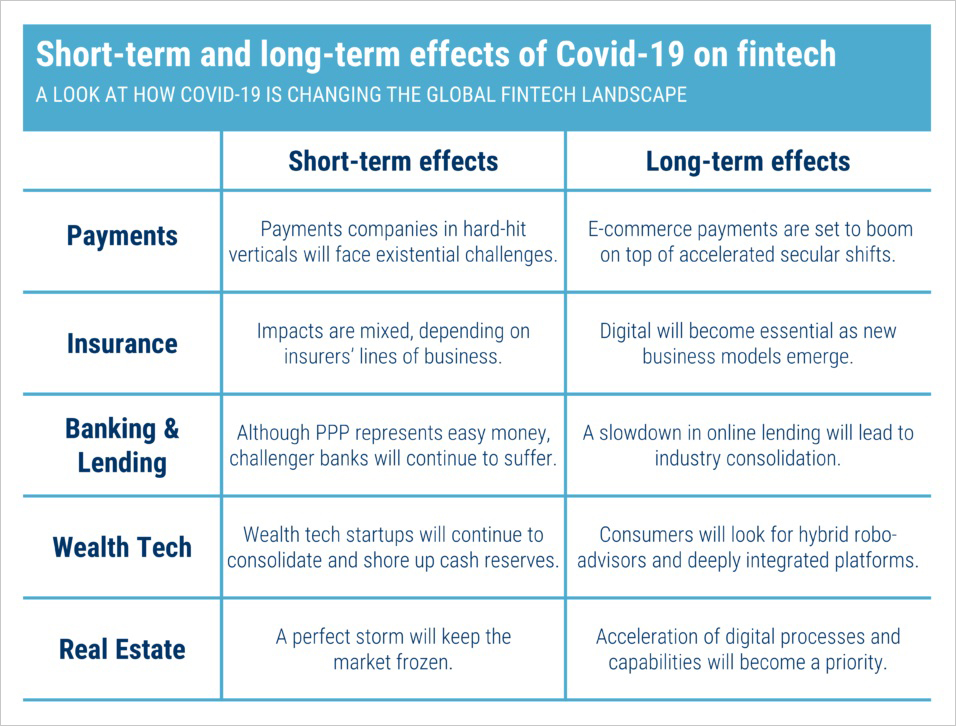

CB Insights argues that certain parts of the fintech ecosystem stand to benefit long term from the pandemic even though funding is down and certain sectors are hurting.

In a June report, the market intelligence platform explored the short-term and long-term effects of COVID-19 on five parts of the fintech ecosystem: Payments, insurance, banking and lending, wealth and capital markets, and real estate.

Here is a brief look at the findings of their research:

Payments

Short term: Some payments companies will encounter existential challenges

Payments companies targeting sectors such as travel, restaurants, and events and entertainment—which have been hit the hardest by the coronavirus—will have to find new sources of transaction volume if they want to survive.

Long term: E-commerce payments companies benefit from accelerated shifts in consumer and tech behavior

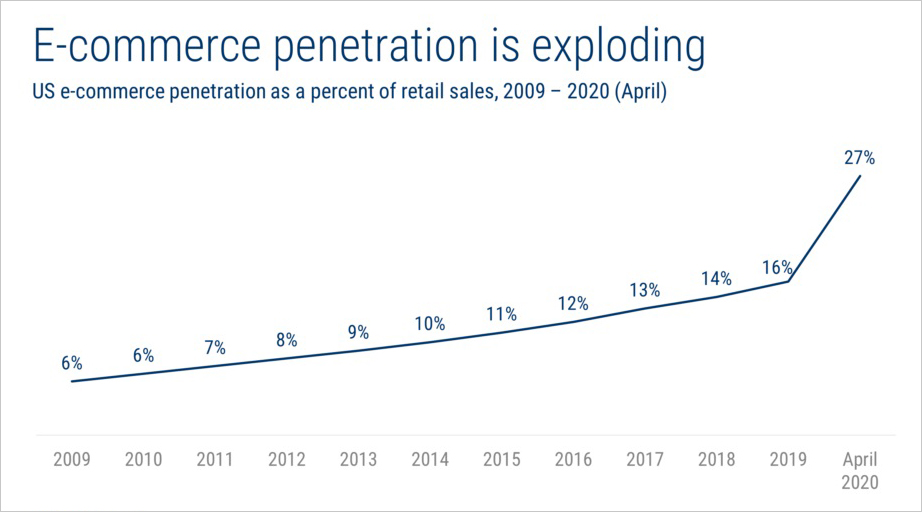

COVID-19 has wreaked havoc on certain industries but it has helped increase payments volume in other key areas.

For instance, the outbreak has led to an explosion in e-commerce at the expense of physical retail. As a result, the biggest long-term beneficiaries of the pandemic will be payments companies enabling the e-commerce sector.

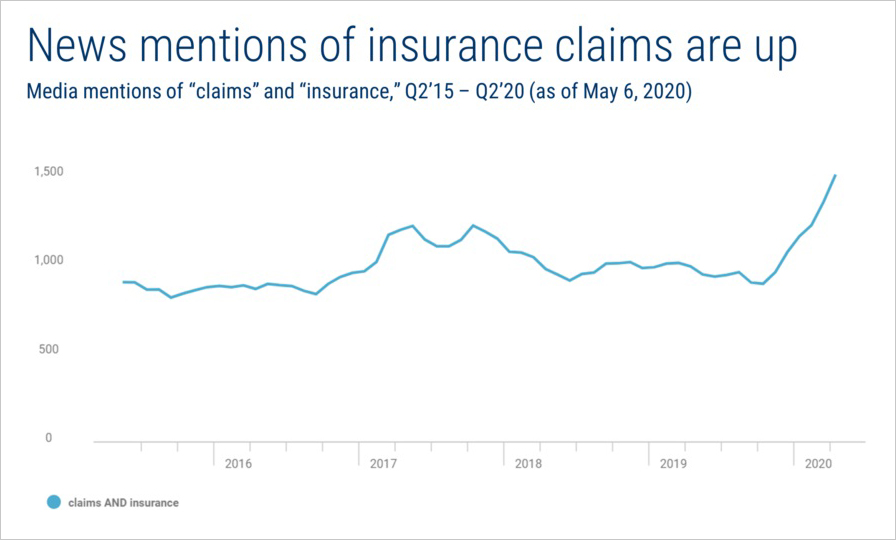

Insurance

Short term: Impact of COVID-19 depends on the business line

The P&C market will witness downward pressure on premiums for most personal and commercial lines in the near term as unemployment increases and economic activity slows down.

Fewer people driving means that auto claims will likely decrease, but insurers could face considerable losses in commercial lines as a result of workers comp and business interruption claims.

The life insurance market will likely be less negatively affected by premiums and may even see an increase.

Long term: Digital will become vital for cost-cutting and as new business models emerge

It will be essential to digitizing key value chain operations (like underwriting and claims management) as insurers look to improve operational efficiency and cut costs.

Consumers may be more attracted to more flexible and transparent products—such as parametric insurance, on-demand insurance, and usage-based insurance—may be more attractive to consumers in the aftermath of Covid-19.

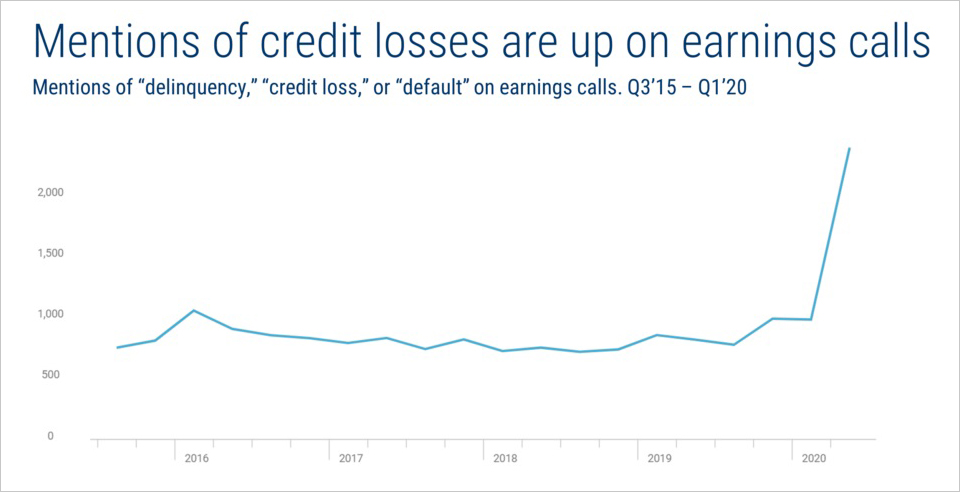

Banking and Lending

Short term: PPP represents easy money for big lenders, while online lenders and challenger banks suffer

Big retail banks will benefit from the pandemic in the short term through the Paycheck Protection Program (PPP), which generates fees for banks without credit risk.

Limited spending is expected to harm challenger banks, which generate most of their revenues from debit swipe fees. The blow could be softened by the fiscal stimulus to consumers and businesses.

Online lenders are the worst affected, as rising defaults have investors running for the exits.

Marketplaces that connect borrowers to lenders without taking on balance sheet credit risk are likely to fare well during the pandemic.

Long term: A slowdown in online consumer and business lending will probably lead to industry consolidation

In the longer term, online banks and lenders may see insolvency for some and consolidation for others.

COVID-19 is set to accelerate digital banking and lending and will serve as a filtering mechanism for transactional businesses that do not have a durable revenue model.

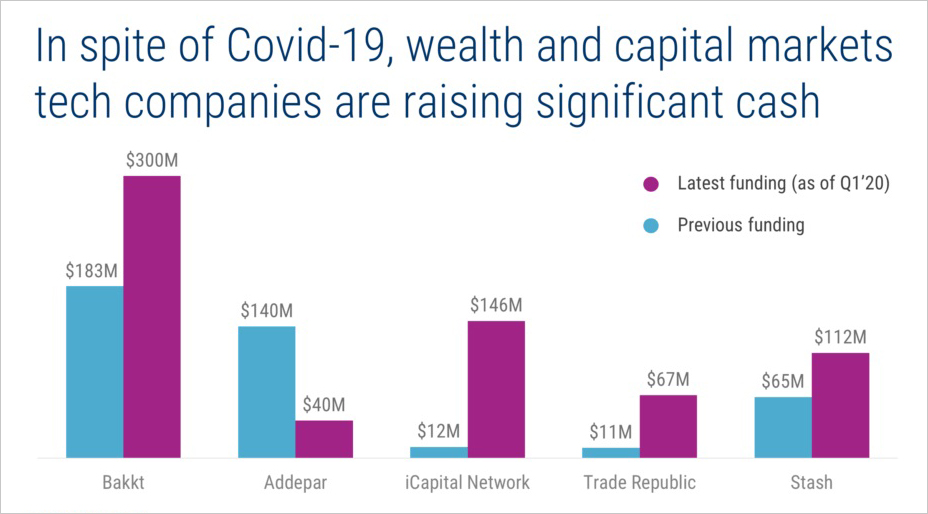

Wealth and Capital Markets

Short term: Capital markets and wealth management startups are shoring up cash balances and consolidating

In this uncertain time, capital markets players are utilizing all available cash facilities.

Consolidation is also increasing because struggling companies are being scooped up at decreased valuations.

Long term: Greater engagement with hybrid robo-advisory services and more integrated wealth tech platforms

The mainstreaming of hybrid robo-advisory services will be one of the long-term effects of COVID-19.

There is a growing need for centrally managed "autopilot" personal finance solutions. As consumers are now saving more, wealth tech firms are developing millennial-friendly platforms that offer a more holistic suite of analytics tools and services.

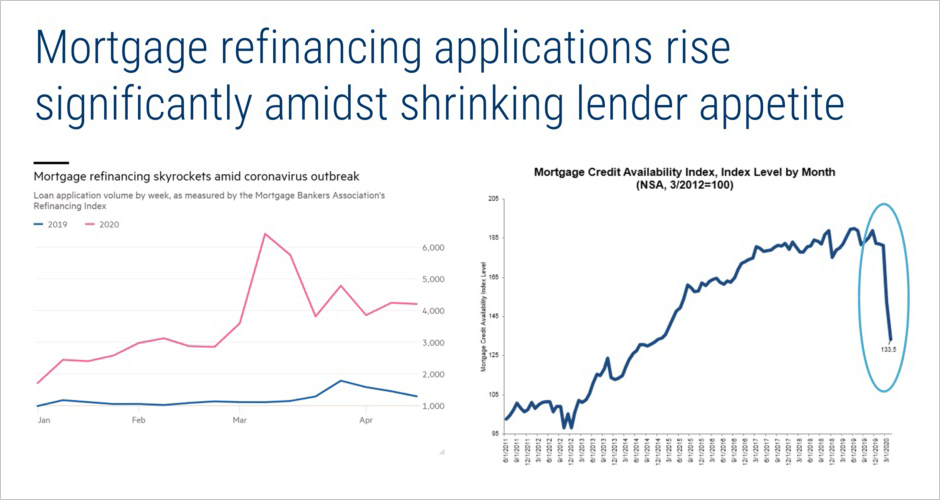

Real Estate

Short term: Uncertainty, restricted movement, and tighter lending standards are freezing the real estate market

Real estate agents have been hit hard as the coronavirus pandemic has crushed consumer demand. Online real estate portals have also seen demand drop.

Digital lenders stand to benefit from the current situation as their lean cost structures enable them to take advantage of refinancing activity.

Long term: The acceleration of digital capabilities and processes will become an urgent priority

In a post-COVID world, there will be a greater focus on virtual and online experiences. So only those businesses who adapt quickly will be able to compete successfully in the market.

Read more: Netherlands Offers Valuable Lessons for European Startup Ecosystems

Further Opportunities

The Deloitte Center for Financial Services wrote in a recent report that the pandemic can create new opportunities for some fintechs. The opportunity areas include:

Expanding partnership strategies: Fintech may continue to look for partnership opportunities with financial institutions, other fintech, bigtech, and non-financial services firms.

Advancing financial inclusion programs: According to the World Bank, there are currently 1.7 billion unbanked individuals worldwide. Fintech companies can serve people in developing and developed economies who are outside the financial system.

Accelerating economic relief efforts: Payments companies can aid in the faster disbursement of government relief funds, particularly to those without bank accounts.

Empowering gig workers: Gig economy workers—who usually have inconsistent or unpredictable income patterns and have unique financial, insurance, and tax requirements —are generally underserved by banks and are an attractive segment for fintech.

Harnessing the Internet of Things: COVID-19 is expected to accelerate the adoption of IoT-enabled payments, opening up new opportunities for fintech companies.