Both hotels and the short-term rental market are reeling from the coronavirus-driven travel collapse, but industry reports show that the latter is weathering the health crisis more successfully due to its different nature.

"The features that differentiate short-term rentals from hotels—such as full-service amenities, living space, larger properties, and inventory in more remote destinations—have proven to be vital assets during the pandemic," according to a joint report by leading accommodation data providers.

The recent analysis by STR and AirDNA in 27 markets around the globe contrasted the performance of hotels and short-term rentals in the year preceding the outbreak, the subsequent economic downturn, and post-decline travel patterns.

It compared hotel data with two different categories of short-term rentals:

- Hotel-comparable rentals (Rentals HC), which comprise studio and 1-bedroom units; and

- 2+ Bedroom Rentals, which comprise units with 2 bedrooms or more.

Read more: Hosts Turning to Long-Term Rentals Amid COVID-19

Here are the key findings of the research, which covers the period from January 2019 through June 27, 2020.

1- Hotels historically have shown higher occupancy and room rates compared to Rentals HC.

2- The hotel industry witnessed much more severe declines than all short-term rentals as business and group-oriented travel has largely ground to a halt.

3- Regional tourism destinations have become more popular than their urban counterparts for all accommodation types.

4- Short-term rentals have maintained higher absolute occupancy levels since COVID-19.

5- The hotel sector endured the hardest hit to performance during the worst weeks of the pandemic, but it has experienced noticeable week-over-week growth since its low point.

6- The short-term rental industry is much closer to reaching the previous year's levels in revenue per available room (RevPAR), a performance measure used in the hospitality industry.

All-Time Highs

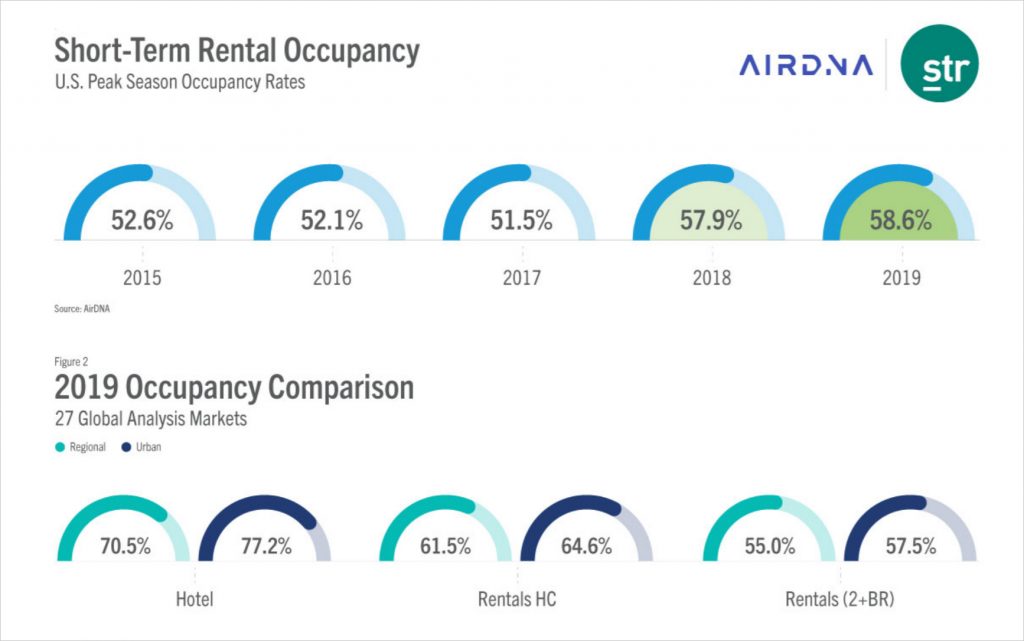

The report says the global economy and accommodation industry had grown significantly in the years and months leading up to the pandemic, with annualized global hotel occupancy exceeding 66% for a record 58th consecutive month as of February 2020.

"From October 2016 through March 2020, year-over-year global hotel supply grew 2.0% or greater for 42 straight months, peaking at +2.5% in September of 2019, while short-term rental supply grew at a record annualized pace of 174% from 2016 through 2019."

Hotel Performance Trends

According to STR and AirDNA, hotels had been mainly performing better than their short-term rental counterparts before the novel coronavirus disrupting almost everything.

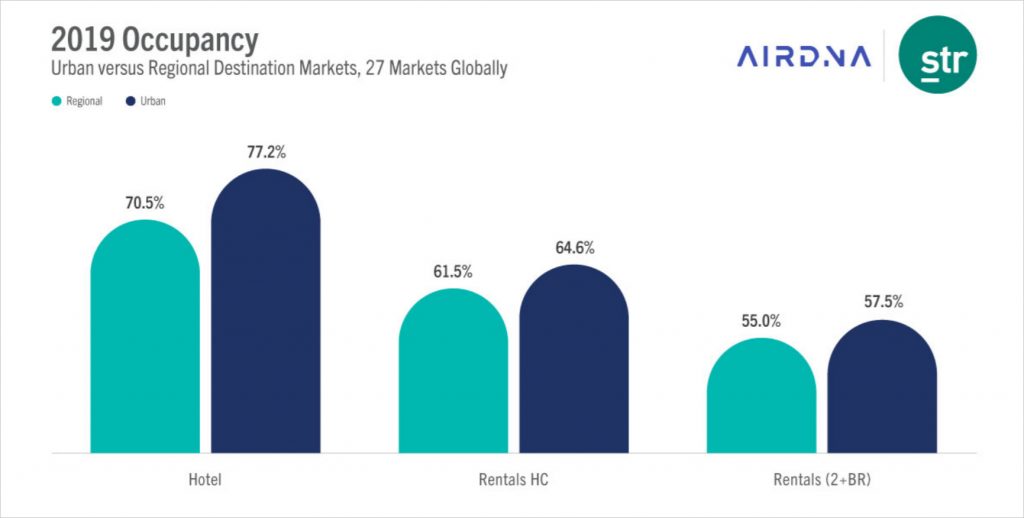

"In 2019, for instance, hotel occupancy was on average 11.4 percentage points higher (75.0%) than Rentals HC occupancy (63.6%) and nearly 20 percentage points higher when compared to 2+ Bedroom Rentals (56.3%). The same was true with an average daily rate (ADR), which was 22.7% higher for hotels ($161.39) compared with Rentals HC ($131.50)."

Driving Factors

The analysis says both the hotel and short-term rental sectors rely heavily on leisure (transient) travel demand, which represents about three-quarters of global hotel demand and a much higher percentage of short-term rental demand.

A quarter of the demand in the hotel sector is from business travelers (business transient and group), it added.

"As the economy thrived pre-COVID, business travel demand boomed, especially in urban markets. Urban markets traditionally have had an occupancy advantage over regional markets: Urban hotel occupancy held a 6.7-point edge over regional market hotel occupancy in 2019. The urban advantage for short-term rentals also was apparent last year, albeit less pronounced."

Momentum for Short-Term Rentals

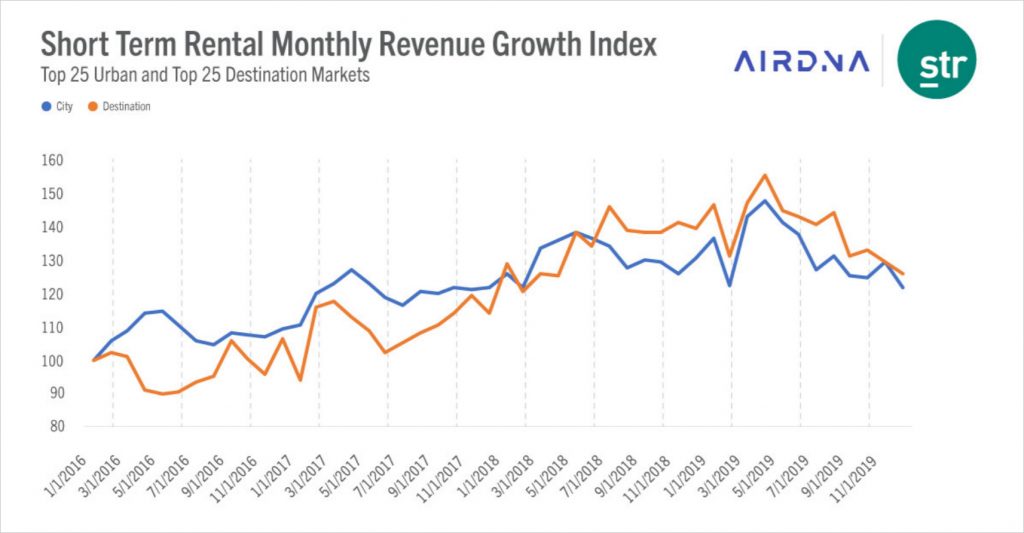

According to the report, the short-term rental sector had just registered a half-decade total growth of around 300% before the pandemic and the surge was driven by travelers who had prioritized more affordable and unique experiences.

Slowed growth and volatility marked 2019 but the industry as a whole remained considerably strong, it added.

Disappointing Performance

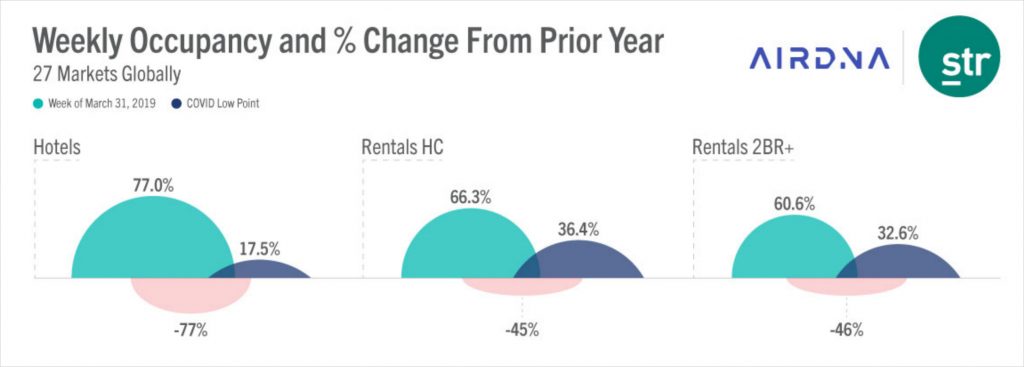

Travel restrictions and nosedives in accommodation demand took a heavy toll on both hotels and short-term rentals with hotels being hit harder during the unprecedented crisis.

In the markets covered in the analysis by STR and AirDNA, hotels bottomed out at 17.5% occupancy for the week ending March 28 while short-term rentals (Rental HC and 2+ Bedroom Rentals) reached a low of 34.3%.

"Hotel occupancy declined 77.3% and ADR fell 50.4% when comparing data for the week of March 31, 2019, to its weekly March 2020 low point. By comparison, Rentals HC and 2+ Bedroom Rentals occupancy declined 45.1% and 46.2%, respectively. ADR among these two rental types fell by a more modest 11.6% (Rentals HC) and 6.4% (2+ Bedroom Rentals)."

Hotel occupancy dropped 78.6% in regional markets and 77.6% in urban locations, the report said, adding that the occupancy rate of Rentals HC declined 46.2% in regional spots and 44.5% in urban markets.

Why Were Hotels Hit Harder?

The data provided by the research offers insights into why the outbreak had a greater negative impact on the hotel sector.

"First, as quarantine restrictions, social distancing, and economic troubles took hold, many business meetings, conferences, and other events were canceled. Given the hotel sector's reliance on demand from group and business travel, this had an unequal impact on hotel occupancy," the report reads.

The second reason identified by STR and AirDNA is that hotel travelers migrated toward midscale and economy class options as their budgets shrank, which resulted in a significant decline in hotel ADR.

Short-Term Rentals Not Immune, But Performing Better

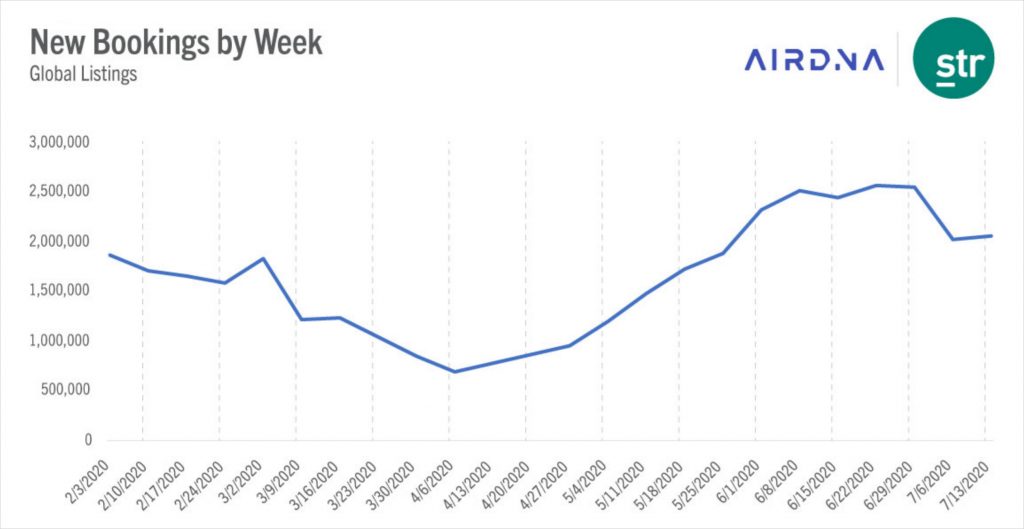

The analysis shows that Global new bookings fell 47% from more than 2.3 million in January 2020 to just 1.2 million in April, and global new bookings were down 61% year over year.

The figures look grim, but the fall of short-term rentals was not as severe as hotels, for several reasons.

"First, short-term rentals can make social distancing easier given the availability of larger units (see 2+ Bedrooms and entire homes) as well as the availability of inventory in more rural and/or remote vacation markets—locations that allowed travelers to escape more densely populated urban markets where cases were spiking."

The second reason is that most short-term rentals offer full-service amenities like kitchens and living space, which allowed for longer-term stays, the report added.

The increased popularity of such units among families seeking spaces to retreat led to a 58% increase in the average length of stay during COVID-19, STR and AirDNA wrote.

They say the accommodation sector has started to recover but it will take years to get back to pre-corona levels.

"After week-over-week losses reached their low-point in mid-to-late March, the accommodations sector began to rebound with modest, week-to-week occupancy gains beginning in April. Weekly hotel occupancy increased at an average rate of 8.8% since the COVID low point, compared to a 5.3% average weekly increase for short-term rentals."

Hotel occupancy has since increased 123.8% from its low, while Rentals HC occupancy increased 60.0%, the report said, adding that hotel ADR has increased 31.9% during the same period and Rentals HC ADR increased 23.2%.

According to the analysis, the global vacation rental industry rebounded during the stretch from early April to early July as pent-up travel demand led to a 257% increase in global bookings.

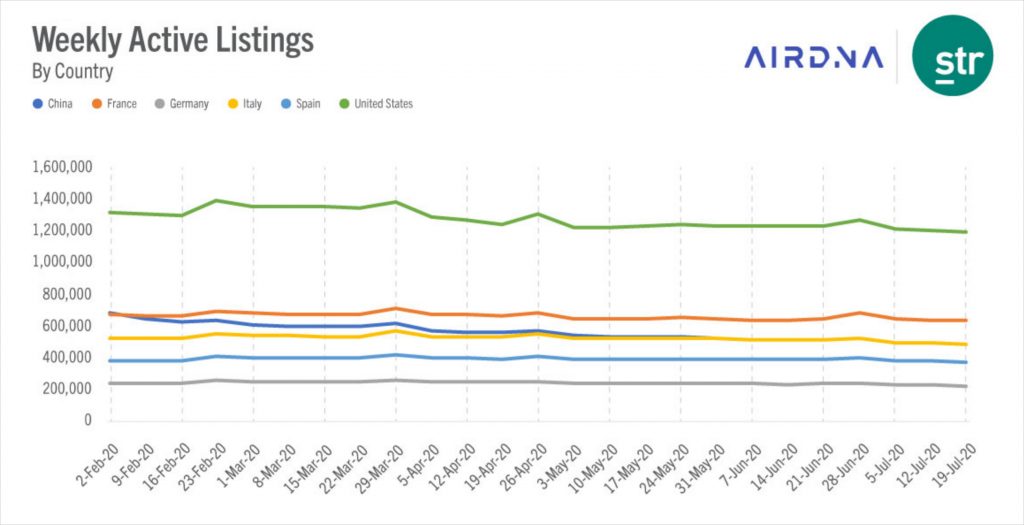

"Overall, supply has remained relatively steady as hosts are opting to keep their listings active and welcome bookings for the fall and winter months."

In terms of average daily rate, the research found that 2020's booked rates are already back on track with 2019 levels and are even higher on some short-term platforms in many countries around the world.

"These gains—combined with hotels' greater decreases has meant the short-term rental industry is now outperforming hotels."

Travel Behavior

Both urban and regional markets were affected by COVID-19, but the analysis reveals that regional markets have performed better most recently.

The average weekly occupancy increase in regional markets since the COVID low point, according to the report, has been 13.1% for hotels in comparison to 7.1% in urban markets.

"From the COVID low point through the week ending June 21, hotel occupancy in regional markets increased 210.4%, compared to 98.9% for urban hotels. For Rentals HC, the average weekly increase in urban markets was also lower at 3.4% compared to 5.7% for regional markets," STR and AirDNA added.

Skift Research

A recent analysis conducted by U.S.-based Skift also confirms that short term rentals are in a better situation than hotels during the unfolding pandemic.

"Many short-term rentals offer extra space and control over your living environment. Both attributed highly valued during this time of pandemic. Nothing's decided yet, but some early evidence suggests that short-term rentals might be doing less worse than traditional hotels peers," says Seth Borko, a senior research analyst at the travel industry media company.

Read more: Digital Nomadism to Flourish in Post-Coronavirus Era

Skift—which analyzed airbnb.com, booking.com, expedia.com, kayak.com, priceline.com, skyscanner.com, tripadvisor.com, trivago.com, vrbo.com—found that web traffic to online travel websites is down by 70 percent globally.

However, it says online booking sites focused on short-term rentals appear to be outperforming their hotel-heavy, full-service peers.

"We suspect that this reflects the recent phenomenon of families temporarily leaving their homes in dense cities, where the coronavirus outbreak is worse and where home confinement in a small apartment is more restricting, to temporarily relocate to less-crowded suburban or rural destinations," Skift analysts noted.

In the words of STR and AirDNA, it may be "too soon" to say that the lodging industry is experiencing a "rebound" but the recent improvements signal an encouraging trend to watch in an otherwise difficult year.