(VIANEWS) – Today, the Innrs artificial intelligence algorithm suggests a high probability of discovering the approximate price for tomorrow of Chubb Corporation CB, TJX Companies TJX and others.

Via News will regularly fact-check this AI algorithm that aims to consistently predict the next session price and next week’s trend of financial assets.

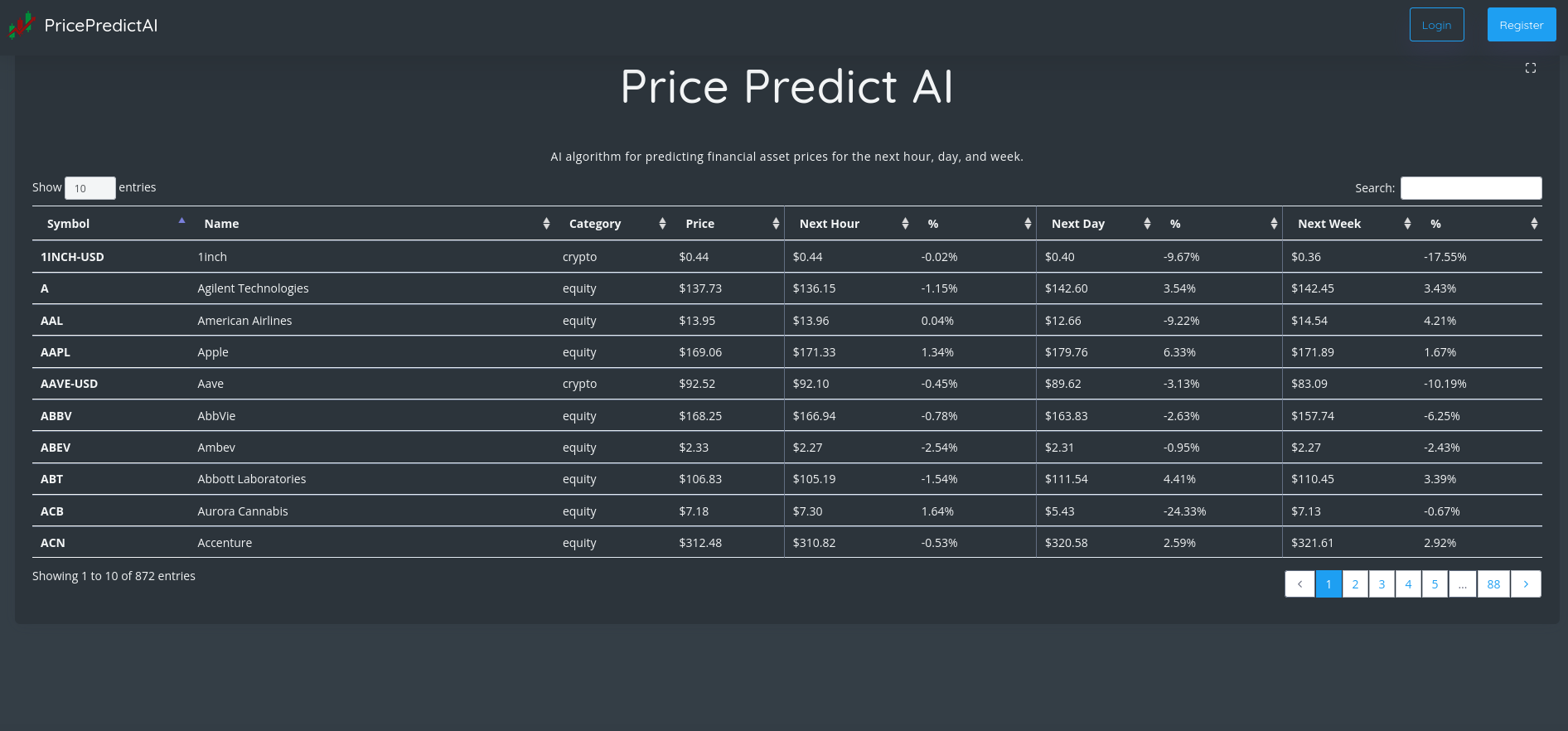

Innrs provides A.I.-based statistical tools to help investors make decisions. The table below shows the financial assets predicting price, ordered by the highest expected accuracy.

Innrs officials say this tool helps investors make better-informed decisions, supposedly used alongside other relevant financial information and the specific trader strategy.

In the next session, Via News will report the finding on the algorithm precision.

| Financial Asset | Accuracy | Close Price | Prediction |

|---|---|---|---|

| Chubb Corporation (CB) | 99.31% | $215.08 | ⇧ $219.13 |

| TJX Companies (TJX) | 98.84% | $79.96 | ⇧ $80.25 |

| Bank of New York Mellon (BK) | 97.87% | $44.81 | ⇧ $45.86 |

| Progressive Corporation (PGR) | 94.28% | $130.23 | ⇧ $133.55 |

| ONE Gas (OGS) | 94.19% | $86.58 | ⇧ $87.55 |

| General Motors (GM) | 94.14% | $39.44 | ⇧ $39.79 |

| Consolidated Edison (ED) | 94.04% | $96.33 | ⇧ $99.75 |

| Dominion Resources (D) | 94.03% | $60.64 | ⇧ $62.43 |

| MSCI (MSCI) | 93.99% | $494.18 | ⇧ $507.1 |

| Merck (MRK) | 93.71% | $108.36 | ⇧ $110.88 |

| Entergy Corporation (ETR) | 93.69% | $113.06 | ⇧ $115.68 |

| Ameren (AEE) | 93.68% | $87.75 | ⇧ $89.3 |

| First Bancorp (FBNC) | 93.63% | $48.1 | ⇧ $48.71 |

| White Mountains Insurance Group (WTM) | 93.53% | $1417.25 | ⇧ $1450.91 |

| Gilead Sciences (GILD) | 93.49% | $85.2 | ⇧ $86.92 |

| NextEra Energy (NEE) | 93.4% | $83.6 | ⇧ $85.35 |

| Bristol (BMY) | 93.31% | $79 | ⇧ $81.48 |

| American Electric Power Company (AEP) | 93.23% | $95.02 | ⇧ $97.98 |

| The Travelers Companies (TRV) | 93.16% | $186.22 | ⇧ $190.09 |

| Zoom (ZM) | 92.9% | $71.33 | ⇧ $72.52 |

| Martin Marietta Materials (MLM) | 92.69% | $358.33 | ⇧ $368.21 |

| CMS Energy (CMS) | 92.54% | $60.72 | ⇧ $63.3 |

| Aon plc (AON) | 92.52% | $305.07 | ⇧ $314.12 |

| Xcel Energy (XEL) | 92.47% | $69.31 | ⇧ $71.33 |

| Intercontinental Exchange (ICE) | 92.27% | $105.09 | ⇧ $107.66 |

| Southern Company (SO) | 92.19% | $65.67 | ⇧ $67.7 |

| Fifth Third Bancorp (FITBI) | 89.71% | $25.56 | ⇧ $25.68 |

| Liberty Media (LSXMA) | 89.54% | $43.35 | ⇧ $43.49 |

| Hartford Financial Services Group (HIG) | 89.43% | $75.04 | ⇧ $75.6 |

| Arthur J. Gallagher & Co. (AJG) | 89.35% | $196.37 | ⇧ $202.09 |

| AbbVie (ABBV) | 89.2% | $158.28 | ⇧ $161.26 |

| Cardinal Health (CAH) | 89.15% | $78.34 | ⇧ $79.11 |

| Citizens Financial Group (CFG) | 89.15% | $41.12 | ⇧ $41.6 |

| RenaissanceRe Hold (RNR) | 89.12% | $184.54 | ⇧ $187.95 |

| Allstate (ALL) | 89.03% | $132.72 | ⇧ $136.97 |

1. Chubb Corporation (CB)

Shares of Chubb Corporation dropped 0.07% in from $215.23 to $215.08 at 18:21 EST on Monday, after five consecutive sessions in a row of gains. NYSE is sliding 1.51% to $15,370.44, after three successive sessions in a row of gains.

Chubb Limited provides insurance and reinsurance products worldwide. The company's North America Commercial P&C Insurance segment offers commercial property, casualty, workers' compensation, package policies, risk management, financial lines, marine, construction, environmental, medical, cyber risk, surety, and excess casualty; and group accident and health insurance to large, middle market, and small commercial businesses. Its North America Personal P&C Insurance segment provides affluent and high net worth individuals and families with homeowners, automobile and collector cars, valuable articles, personal and excess liability, travel insurance, and recreational marine insurance and services. The company's North America Agricultural Insurance segment offers multiple peril crop and crop-hail insurance; and coverage for farm and ranch property, and commercial agriculture products. Its Overseas General Insurance segment provides coverage for traditional commercial property and casualty; specialty categories, such as financial lines, marine, energy, aviation, political risk, and construction risk; and group accident and health, and traditional and specialty personal lines for corporations, middle markets, and small customers through retail brokers, agents, and other channels. The company's Global Reinsurance segment offers traditional and specialty reinsurance under the Chubb Tempest Re brand to property and casualty companies. Its Life Insurance segment provides protection and savings products comprising whole life, endowment plans, individual term life, group term life, medical and health, personal accident, credit life, universal life, and unit linked contracts. The company markets its products primarily through insurance and reinsurance brokers. The company was formerly known as ACE Limited and changed its name to Chubb Limited in January 2016. Chubb Limited was incorporated in 1985 and is headquartered in Zurich, Switzerland.

Volatility

Chubb Corporation’s last week, last month’s, and last quarter’s current intraday variation average was 0.63%, 0.24%, and 1.29%.

Chubb Corporation’s highest amplitude of average volatility was 0.63% (last week), 0.94% (last month), and 1.29% (last quarter).

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Chubb Corporation’s stock is considered to be oversold (<=20).

Sales Growth

Chubb Corporation’s sales growth is 7.1% for the present quarter and 6.8% for the next.

More news about Chubb Corporation.

2. TJX Companies (TJX)

Shares of TJX Companies jumped by a staggering 10.95% in from $72.07 to $79.96 at 18:21 EST on Monday, after five consecutive sessions in a row of gains. NYSE is falling 1.51% to $15,370.44, after three successive sessions in a row of gains.

The TJX Companies, Inc., together with its subsidiaries, operates as an off-price apparel and home fashions retailer. It operates through four segments: Marmaxx, HomeGoods, TJX Canada, and TJX International. The company sells family apparel, including footwear and accessories; home fashions, such as home basics, furniture, rugs, lighting products, giftware, soft home products, decorative accessories, tabletop, and cookware, as well as expanded pet, kids, and gourmet food departments; jewelry and accessories; and other merchandise. As of February 23, 2022, it operated 1,284 T.J. Maxx, 1,148 Marshalls, 850 HomeGoods, 59 Sierra, and 39 Homesense stores, as well as tjmaxx.com, marshalls.com, and sierra.com in the United States; 293 Winners, 147 HomeSense, and 106 Marshalls stores in Canada; 618 T.K. Maxx and 77 Homesense stores, as well as tkmaxx.com in Europe; and 68 T.K. Maxx stores in Australia. The company was incorporated in 1962 and is headquartered in Framingham, Massachusetts.

More news about TJX Companies.

3. Bank of New York Mellon (BK)

Shares of Bank of New York Mellon rose 6.49% in from $42.08 to $44.81 at 18:21 EST on Monday, after five successive sessions in a row of gains. NYSE is dropping 1.51% to $15,370.44, after three successive sessions in a row of gains.

The Bank of New York Mellon Corporation provides a range of financial products and services in the United States and internationally. The company operates through Securities Services, Market and Wealth Services, Investment and Wealth Management, and Other segments. The Securities Services segment offers custody, trust and depositary, accounting, exchange-traded funds, middle-office solutions, transfer agency, services for private equity and real estate funds, foreign exchange, securities lending, liquidity/lending services, prime brokerage, and data analytics. This segment also provides trustee, paying agency, fiduciary, escrow and other financial, issuer, and support services for brokers and investors. The Market and Wealth Services segment offers clearing and custody, investment, wealth and retirement solutions, technology and enterprise data management, trading, and prime brokerage services; and clearance and collateral management services. This segment also provides integrated cash management solutions, including payments, foreign exchange, liquidity management, receivables processing and payables management, and trade finance and processing services. The Investment and Wealth Management segment offers investment management strategies and distribution of investment products, investment management, custody, wealth and estate planning, private banking, investment, and information management services. The Other segment engages in the provision of leasing, corporate treasury, derivative and other trading, corporate and bank-owned life insurance, renewable energy investment, and business exit services. It serves central banks and sovereigns, financial institutions, asset managers, insurance companies, corporations, local authorities and high net-worth individuals, and family offices. The company was founded in 1784 and is headquartered in New York, New York.

Yearly Top and Bottom Value

Bank of New York Mellon’s stock is valued at $44.81 at 18:21 EST, way below its 52-week high of $64.63 and way higher than its 52-week low of $36.22.

Moving Average

Bank of New York Mellon’s value is higher than its 50-day moving average of $41.47 and under its 200-day moving average of $45.34.

More news about Bank of New York Mellon.

4. Progressive Corporation (PGR)

Shares of Progressive Corporation jumped 1.09% in from $128.83 to $130.23 at 18:21 EST on Monday, after five consecutive sessions in a row of gains. NYSE is sliding 1.51% to $15,370.44, after three successive sessions in a row of gains.

The Progressive Corporation, an insurance holding company, provides personal and commercial auto, personal residential and commercial property, general liability, and other specialty property-casualty insurance products and related services in the United States. It operates in three segments: Personal Lines, Commercial Lines, and Property. The Personal Lines segment writes insurance for personal autos and recreational vehicles (RV). This segment's products include personal auto insurance; and special lines products, including insurance for motorcycles, ATVs, RVs, watercrafts, snowmobiles, and related products. The Commercial Lines segment provides auto-related primary liability and physical damage insurance, and business-related general liability and property insurance for autos, vans, pick-up trucks, and dump trucks used by small businesses; tractors, trailers, and straight trucks primarily used by regional general freight and expeditor-type businesses, and long-haul operators; dump trucks, log trucks, and garbage trucks used by dirt, sand and gravel, logging, and coal-type businesses; and tow trucks and wreckers used in towing services and gas/service station businesses; as well as non-fleet and airport taxis, and black-car services. The Property segment writes residential property insurance for homeowners, other property owners, and renters, as well as offers personal umbrella insurance, and primary and excess flood insurance. The company also offers policy issuance and claims adjusting services; and acts as an agent to homeowner general liability, workers' compensation insurance, and other products. In addition, it provides reinsurance services. The company sells its products through independent insurance agencies, as well as directly on Internet through mobile devices, and over the phone. The Progressive Corporation was founded in 1937 and is headquartered in Mayfield, Ohio.

Sales Growth

Progressive Corporation’s sales growth is 9.7% for the current quarter and 9.7% for the next.

Volatility

Progressive Corporation’s last week, last month’s, and last quarter’s current intraday variation average was 1.42%, 0.19%, and 1.35%.

Progressive Corporation’s highest amplitude of average volatility was 1.42% (last week), 1.22% (last month), and 1.35% (last quarter).

More news about Progressive Corporation.

5. ONE Gas (OGS)

Shares of ONE Gas rose by a staggering 11.33% in from $77.77 to $86.58 at 18:21 EST on Monday, after five successive sessions in a row of gains. NYSE is sliding 1.51% to $15,370.44, after three successive sessions in a row of gains.

ONE Gas, Inc., together with its subsidiaries, operates as a regulated natural gas distribution utility company in the United States. The company operates through three divisions: Oklahoma Natural Gas, Kansas Gas Service, and Texas Gas Service. It provides natural gas distribution services to 2.2 million customers in three states. It serves residential, commercial, and transportation customers. As of December 31, 2021, it operated approximately 41,600 miles of distribution mains; and 2,400 miles of transmission pipelines, as well as had 51.4 billion cubic feet of natural gas storage capacity. ONE Gas, Inc. was founded in 1906 and is headquartered in Tulsa, Oklahoma.

Moving Average

ONE Gas’s worth is way above its 50-day moving average of $76.63 and higher than its 200-day moving average of $81.63.

Sales Growth

ONE Gas’s sales growth for the next quarter is negative 26.3%.

More news about ONE Gas.

6. General Motors (GM)

Shares of General Motors rose 0.46% in from $39.26 to $39.44 at 18:21 EST on Monday, after three sequential sessions in a row of gains. NYSE is sliding 1.51% to $15,370.44, after three sequential sessions in a row of gains.

General Motors Company designs, builds, and sells trucks, crossovers, cars, and automobile parts and accessories in North America, the Asia Pacific, the Middle East, Africa, South America, the United States, and China. The company operates through GM North America, GM International, Cruise, and GM Financial segments. It markets its vehicles primarily under the Buick, Cadillac, Chevrolet, GMC, Holden, Baojun, and Wuling brand names. The company also sells trucks, crossovers, cars, and purpose-built vehicles to dealers for consumer retail sales, as well as to fleet customers, including daily rental car companies, commercial fleet customers, leasing companies, and governments. In addition, it offers safety and security services for retail and fleet customers, including automatic crash response, emergency services, roadside assistance, crisis assist, stolen vehicle assistance, and turn-by-turn navigation; and connected services comprising mobile applications for owners to remotely control their vehicles and electric vehicle owners to locate charging stations, on-demand vehicle diagnostics, smart driver, marketplace in-vehicle commerce, in-vehicle voice, voice assistant, navigation and app ecosystem, connected navigation, SiriusXM with 360L, and 4G LTE wireless connectivity, as well as develops and commercializes autonomous vehicle technology. Further, the company provides automotive financing and insurance services; and software-enabled services and subscriptions. General Motors Company was founded in 1908 and is headquartered in Detroit, Michigan.

Growth Estimates Quarters

The company’s growth estimates for the present quarter is 25.2% and a drop 26.3% for the next.

Yearly Top and Bottom Value

General Motors’s stock is valued at $39.44 at 18:21 EST, way below its 52-week high of $67.21 and way higher than its 52-week low of $30.33.

Revenue Growth

Year-on-year quarterly revenue growth grew by 56.4%, now sitting on 147.21B for the twelve trailing months.

Sales Growth

General Motors’s sales growth is 20% for the current quarter and 4.5% for the next.

More news about General Motors.

7. Consolidated Edison (ED)

Shares of Consolidated Edison rose 9.43% in from $88.03 to $96.33 at 18:21 EST on Monday, after five sequential sessions in a row of gains. NYSE is sliding 1.51% to $15,370.44, after three consecutive sessions in a row of gains.

Consolidated Edison, Inc., through its subsidiaries, engages in the regulated electric, gas, and steam delivery businesses in the United States. It offers electric services to approximately 3.5 million customers in New York City and Westchester County; gas to approximately 1.1 million customers in Manhattan, the Bronx, parts of Queens, and Westchester County; and steam to approximately 1,555 customers in parts of Manhattan. The company also supplies electricity to approximately 0.3 million customers in southeastern New York and northern New Jersey; and gas to approximately 0.1 million customers in southeastern New York. In addition, it operates 533 circuit miles of transmission lines; 15 transmission substations; 64 distribution substations; 87,564 in-service line transformers; 3,924 pole miles of overhead distribution lines; and 2,291 miles of underground distribution lines, as well as 4,350 miles of mains and 377,971 service lines for natural gas distribution. Further, the company owns, operates, and develops renewable and energy infrastructure projects; and provides energy-related products and services to wholesale and retail customers, as well as invests in electric and gas transmission projects. It primarily sells electricity to industrial, commercial, residential, and government customers. The company was founded in 1823 and is based in New York, New York.

More news about Consolidated Edison.

8. Dominion Resources (D)

Shares of Dominion Resources dropped by a staggering 15.42% in from $71.7 to $60.64 at 18:21 EST on Monday, after five sequential sessions in a row of gains. NYSE is falling 1.51% to $15,370.44, after three successive sessions in a row of gains.

Dominion Energy, Inc. produces and distributes energy in the United States. The company operates through four segments: Dominion Energy Virginia, Gas Distribution, Dominion Energy South Carolina, and Contracted Assets. The Dominion Energy Virginia segment generates, transmits, and distributes regulated electricity to approximately 2.7 million residential, commercial, industrial, and governmental customers in Virginia and North Carolina. The Gas Distribution segment is involved in the regulated natural gas sales, transportation, gathering, storage, and distribution operations in Ohio, West Virginia, North Carolina, Utah, southwestern Wyoming, and southeastern Idaho that serve approximately 3.1 million residential, commercial and industrial customers. It also has nonregulated renewable natural gas facilities in operation. The Dominion Energy South Carolina segment generates, transmits, and distributes electricity to approximately 772,000 customers in the central, southern, and southwestern portions of South Carolina; and distributes natural gas to approximately 419,000 residential, commercial, and industrial customers in South Carolina. The Contracted Assets segment is involved in the nonregulated long-term contracted renewable electric generation and solar generation facility development operations; and gas transportation, LNG import, and storage operations, as well as in the liquefaction facility. As of December 31, 2021, the company's portfolio of assets included approximately 30.2 gigawatt of electric generating capacity; 10,700 miles of electric transmission lines; 78,000 miles of electric distribution lines; and 95,700 miles of gas distribution mains and related service facilities. The company was formerly known as Dominion Resources, Inc. Dominion Energy, Inc. was incorporated in 1983 and is headquartered in Richmond, Virginia.

Volatility

Dominion Resources’s last week, last month’s, and last quarter’s current intraday variation average was a positive 1.04%, a negative 0.63%, and a positive 1.67%.

Dominion Resources’s highest amplitude of average volatility was 1.04% (last week), 1.78% (last month), and 1.67% (last quarter).

Revenue Growth

Year-on-year quarterly revenue growth grew by 18.4%, now sitting on 14.93B for the twelve trailing months.

Growth Estimates Quarters

The company’s growth estimates for the present quarter is a negative 2.7% and positive 23.3% for the next.

More news about Dominion Resources.

9. MSCI (MSCI)

Shares of MSCI jumped 4.6% in from $472.45 to $494.18 at 18:21 EST on Monday, after four consecutive sessions in a row of gains. NYSE is falling 1.51% to $15,370.44, after three successive sessions in a row of gains.

MSCI Inc., together with its subsidiaries, provides investment decision support tools for the clients to manage their investment processes worldwide. It operates through four segments: Index, Analytics, ESG and Climate, and All Other – Private Assets. The Index segment provides indexes for use in various areas of the investment process, including indexed product creation, such as ETFs, mutual funds, annuities, futures, options, structured products, over-the-counter derivatives; performance benchmarking; portfolio construction and rebalancing; and asset allocation, as well as licenses GICS and GICS Direct. The Analytics segment offers risk management, performance attribution and portfolio management content, application, and service that provides an integrated view of risk and return, and an analysis of market, credit, liquidity, and counterparty risk across asset classes; managed services, including consolidation of client portfolio data from various sources, review and reconciliation of input data and results, and customized reporting; and HedgePlatform to measure, evaluate, and monitor the risk of hedge fund investments. The ESG and Climate segment provides products and services that help institutional investors understand how ESG factors impact the long-term risk and return of their portfolio and individual security-level investments; and data, ratings, research, and tools to help investors navigate increasing regulation. The All Other – Private Assets segment includes real estate market and transaction data, benchmarks, return-analytics, climate assessments and market insights for funds, investors, and managers; business intelligence to real estate owners, managers, developers, and brokers; and offers investment decision support tools for private capital. It serves asset owners and managers, financial intermediaries, wealth managers, real estate professionals, and corporates. MSCI Inc. was incorporated in 1998 and is headquartered in New York, New York.

Volatility

MSCI’s last week, last month’s, and last quarter’s current intraday variation average was a negative 0.87%, a positive 1.38%, and a positive 2.08%.

MSCI’s highest amplitude of average volatility was 1.42% (last week), 2.66% (last month), and 2.08% (last quarter).

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

MSCI’s stock is considered to be oversold (<=20).

Moving Average

MSCI’s worth is way above its 50-day moving average of $445.85 and above its 200-day moving average of $458.96.

Growth Estimates Quarters

The company’s growth estimates for the current quarter is 8.8% and a drop 1.7% for the next.

More news about MSCI.

10. Merck (MRK)

Shares of Merck rose 7.02% in from $101.25 to $108.36 at 18:21 EST on Monday, following the last session’s upward trend. NYSE is falling 1.51% to $15,370.44, after three successive sessions in a row of gains.

Merck & Co., Inc. operates as a healthcare company worldwide. It operates through two segments, Pharmaceutical and Animal Health. The Pharmaceutical segment offers human health pharmaceutical products in the areas of oncology, hospital acute care, immunology, neuroscience, virology, cardiovascular, and diabetes, as well as vaccine products, such as preventive pediatric, adolescent, and adult vaccines. The Animal Health segment discovers, develops, manufactures, and markets veterinary pharmaceuticals, vaccines, and health management solutions and services, as well as digitally connected identification, traceability, and monitoring products. It serves drug wholesalers and retailers, hospitals, and government agencies; managed health care providers, such as health maintenance organizations, pharmacy benefit managers, and other institutions; and physicians and physician distributors, veterinarians, and animal producers. The company has collaborations with AstraZeneca PLC; Bayer AG; Eisai Co., Ltd.; Ridgeback Biotherapeutics; and Gilead Sciences, Inc. to jointly develop and commercialize long-acting treatments in HIV. Merck & Co., Inc. was founded in 1891 and is headquartered in Kenilworth, New Jersey.

Volatility

Merck’s last week, last month’s, and last quarter’s current intraday variation average was 1.53%, 0.43%, and 1.13%.

Merck’s highest amplitude of average volatility was 1.53% (last week), 1.15% (last month), and 1.13% (last quarter).

More news about Merck.

11. Entergy Corporation (ETR)

Shares of Entergy Corporation rose 5.66% in from $107 to $113.06 at 18:21 EST on Monday, after four sequential sessions in a row of gains. NYSE is sliding 1.51% to $15,370.44, after three successive sessions in a row of gains.

Entergy Corporation, together with its subsidiaries, engages in the production and retail distribution of electricity in the United States. The company operates in two segments, Utility and Entergy Wholesale Commodities. The Utility segment generates, transmits, distributes, and sells electric power in portions of Arkansas, Louisiana, Mississippi, and Texas, including the City of New Orleans; and distributes natural gas. The Entergy Wholesale Commodities segment engages in the ownership, operation, and decommissioning of nuclear power plants; and ownership of interests in non-nuclear power plants that sell electric power to wholesale customers, as well as provides services to other nuclear power plant owners. It generates electricity through gas, nuclear, coal, hydro, and solar power sources. The company sells energy to retail power providers, utilities, electric power co-operatives, power trading organizations, and other power generation companies. The company's power plants have approximately 24,000 megawatts (MW) of electric generating capacity, which include 5,000 MW of nuclear power. It delivers electricity to 3 million utility customers in Arkansas, Louisiana, Mississippi, and Texas. The company was founded in 1913 and is headquartered in New Orleans, Louisiana.

Revenue Growth

Year-on-year quarterly revenue growth grew by 1.2%, now sitting on 11.78B for the twelve trailing months.

More news about Entergy Corporation.

12. Ameren (AEE)

Shares of Ameren rose 7.66% in from $81.51 to $87.75 at 18:21 EST on Monday, after five consecutive sessions in a row of gains. NYSE is dropping 1.51% to $15,370.44, after three successive sessions in a row of gains.

Ameren Corporation, together with its subsidiaries, operates as a public utility holding company in the United States. It operates through four segments: Ameren Missouri, Ameren Illinois Electric Distribution, Ameren Illinois Natural Gas, and Ameren Transmission. The company engages in the rate-regulated electric generation, transmission, and distribution activities; and rate-regulated natural gas distribution and transmission businesses. It primarily generates electricity through coal, nuclear, and natural gas, as well as renewable sources, such as hydroelectric, wind, methane gas, and solar. The company serves residential, commercial, and industrial customers. Ameren Corporation was founded in 1881 and is headquartered in St. Louis, Missouri.

Yearly Top and Bottom Value

Ameren’s stock is valued at $87.75 at 18:21 EST, way below its 52-week high of $99.20 and way higher than its 52-week low of $73.28.

Sales Growth

Ameren’s sales growth is 3.7% for the current quarter and 3.6% for the next.

Volatility

Ameren’s last week, last month’s, and last quarter’s current intraday variation average was 1.04%, 0.49%, and 1.52%.

Ameren’s highest amplitude of average volatility was 1.65% (last week), 1.25% (last month), and 1.52% (last quarter).

Revenue Growth

Year-on-year quarterly revenue growth grew by 20.3%, now sitting on 6.42B for the twelve trailing months.

More news about Ameren.

13. First Bancorp (FBNC)

Shares of First Bancorp jumped 7.99% in from $44.54 to $48.10 at 18:21 EST on Monday, following the last session’s upward trend. NASDAQ is sliding 1.58% to $11,049.50, following the last session’s downward trend.

First Bancorp operates as the bank holding company for First Bank that provides banking products and services for individuals and small to medium-sized businesses primarily in North Carolina and northeastern South Carolina. It accepts deposit products, such as checking, savings, and money market accounts, as well as time deposits, including certificate of deposits and individual retirement accounts. The company also offers loans for a range of consumer and commercial purposes comprising loans for business, real estate, personal, home improvement, and automobiles, as well as residential mortgages and small business administration loans; and accounts receivable financing and factoring, inventory financing, and purchase order financing services. In addition, it provides credit and debit cards, letter of credits, and safe deposit box rental services, as well as electronic funds transfer services consisting of wire transfers; and internet and mobile banking, cash management, bank-by-phone services, and remote deposit capture services. Further, the company offers investment and insurance products, such as mutual funds, annuities, long-term care insurance, life insurance, and company retirement plans, as well as property and casualty insurance products; and financial planning services. As of December 31, 2021, it operated 121 branches comprising 114 branch offices located in North Carolina and seven branches in South Carolina. First Bancorp was founded in 1934 and is headquartered in Southern Pines, North Carolina.

More news about First Bancorp.

14. White Mountains Insurance Group (WTM)

Shares of White Mountains Insurance Group jumped 0.8% in from $1406 to $1,417.25 at 18:21 EST on Monday, after two consecutive sessions in a row of gains. NYSE is dropping 1.51% to $15,370.44, after three sequential sessions in a row of gains.

Yearly Top and Bottom Value

White Mountains Insurance Group’s stock is valued at $1,417.25 at 18:21 EST, higher than its 52-week high of $1,393.48.

More news about White Mountains Insurance Group.

15. Gilead Sciences (GILD)

Shares of Gilead Sciences jumped 8.62% in from $78.44 to $85.20 at 18:21 EST on Monday, after four consecutive sessions in a row of gains. NASDAQ is sliding 1.58% to $11,049.50, following the last session’s downward trend.

Gilead Sciences, Inc., a biopharmaceutical company, discovers, develops, and commercializes medicines in the areas of unmet medical need in the United States, Europe, and internationally. The company provides Biktarvy, Genvoya, Descovy, Odefsey, Truvada, Complera/ Eviplera, Stribild, and Atripla products for the treatment of HIV/AIDS; Veklury, an injection for intravenous use, for the treatment of coronavirus disease 2019; and Epclusa, Harvoni, Vosevi, Vemlidy, and Viread for the treatment of liver diseases. It also offers Yescarta, Tecartus, Trodelvy, and Zydelig products for the treatment of hematology, oncology, and cell therapy patients. In addition, the company provides Letairis, an oral formulation for the treatment of pulmonary arterial hypertension; Ranexa, an oral formulation for the treatment of chronic angina; and AmBisome, a liposomal formulation for the treatment of serious invasive fungal infections. Gilead Sciences, Inc. has collaboration agreements with Arcus Biosciences, Inc.; Pionyr Immunotherapeutics Inc.; Tizona Therapeutics, Inc.; Tango Therapeutics, Inc.; Jounce Therapeutics, Inc.; Galapagos NV; Janssen Sciences Ireland Unlimited Company; Japan Tobacco, Inc.; Gadeta B.V.; Bristol-Myers Squibb Company; Dragonfly Therapeutics, Inc.; and Merck & Co, Inc. The company was incorporated in 1987 and is headquartered in Foster City, California.

Revenue Growth

Year-on-year quarterly revenue growth grew by 0.7%, now sitting on 27.52B for the twelve trailing months.

Moving Average

Gilead Sciences’s worth is way higher than its 50-day moving average of $70.55 and way higher than its 200-day moving average of $63.98.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Gilead Sciences’s stock is considered to be oversold (<=20).

Sales Growth

Gilead Sciences’s sales growth is negative 12.4% for the present quarter and negative 5.7% for the next.

More news about Gilead Sciences.

16. NextEra Energy (NEE)

Shares of NextEra Energy jumped 7.87% in from $77.5 to $83.60 at 18:21 EST on Monday, after five sequential sessions in a row of gains. NYSE is sliding 1.51% to $15,370.44, after three successive sessions in a row of gains.

NextEra Energy, Inc., through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America. The company generates electricity through wind, solar, nuclear, coal, and natural gas facilities. It also develops, constructs, and operates long-term contracted assets that consists of clean energy solutions, such as renewable generation facilities, battery storage projects, and electric transmission facilities; sells energy commodities; and owns, develops, constructs, manages and operates electric generation facilities in wholesale energy markets. As of December 31, 2021, the company had approximately 28,564 megawatts of net generating capacity; approximately 77,000 circuit miles of transmission and distribution lines; and 696 substations. It serves approximately 11 million people through approximately 5.7 million customer accounts in the east and lower west coasts of Florida. The company was formerly known as FPL Group, Inc. and changed its name to NextEra Energy, Inc. in 2010. The company was founded in 1925 and is headquartered in Juno Beach, Florida.

Sales Growth

NextEra Energy’s sales growth is 3.9% for the current quarter and 29.3% for the next.

More news about NextEra Energy.

17. Bristol (BMY)

Shares of Bristol rose 1.92% in from $77.51 to $79.00 at 18:21 EST on Monday, after four sequential sessions in a row of gains. NYSE is falling 1.51% to $15,370.44, after three sequential sessions in a row of gains.

Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, and markets biopharmaceutical products worldwide. It offers products for hematology, oncology, cardiovascular, immunology, fibrotic, neuroscience, and covid-19 diseases. The company's products include Revlimid, an oral immunomodulatory drug for the treatment of multiple myeloma; Eliquis, an oral inhibitor for reduction in risk of stroke/systemic embolism in NVAF, and for the treatment of DVT/PE; Opdivo for anti-cancer indications; Pomalyst/Imnovid indicated for patients with multiple myeloma; and Orencia for adult patients with active RA and psoriatic arthritis. It also provides Sprycel for the treatment of Philadelphia chromosome-positive chronic myeloid leukemia; Yervoy for the treatment of patients with unresectable or metastatic melanoma; Abraxane, a protein-bound chemotherapy product; Reblozyl for the treatment of anemia in adult patients with beta thalassemia; and Empliciti for the treatment of multiple myeloma. In addition, the company offers Zeposia to treat relapsing forms of multiple sclerosis; Breyanzi, a CD19-directed genetically modified autologous T cell immunotherapy for the treatment of adult patients with relapsed or refractory large B-cell lymphoma; Inrebic, an oral kinase inhibitor indicated for the treatment of adult patients with myelofibrosis; and Onureg for the treatment of adult patients with AML. It sells products to wholesalers, distributors, pharmacies, retailers, hospitals, clinics, and government agencies. The company was formerly known as Bristol-Myers Company. The company was founded in 1887 and is headquartered in New York, New York.

Sales Growth

Bristol’s sales growth is negative 3.4% for the present quarter and negative 4.6% for the next.

Yearly Top and Bottom Value

Bristol’s stock is valued at $79.00 at 18:21 EST, under its 52-week high of $80.59 and way higher than its 52-week low of $53.22.

More news about Bristol.

18. American Electric Power Company (AEP)

Shares of American Electric Power Company rose 8.21% in from $87.81 to $95.02 at 18:21 EST on Monday, after five successive sessions in a row of gains. NYSE is sliding 1.51% to $15,370.44, after three consecutive sessions in a row of gains.

American Electric Power Company, Inc., an electric public utility holding company, engages in the generation, transmission, and distribution of electricity for sale to retail and wholesale customers in the United States. It operates through Vertically Integrated Utilities, Transmission and Distribution Utilities, AEP Transmission Holdco, and Generation & Marketing segments. The company generates electricity using coal and lignite, natural gas, nuclear, hydro, solar, wind, and other energy sources. It also supplies and markets electric power at wholesale to other electric utility companies, rural electric cooperatives, municipalities, and other market participants. American Electric Power Company, Inc. was incorporated in 1906 and is headquartered in Columbus, Ohio.

Revenue Growth

Year-on-year quarterly revenue growth grew by 21.3%, now sitting on 17.92B for the twelve trailing months.

Volatility

American Electric Power Company’s last week, last month’s, and last quarter’s current intraday variation average was 1.39%, 0.41%, and 1.66%.

American Electric Power Company’s highest amplitude of average volatility was 1.39% (last week), 1.36% (last month), and 1.66% (last quarter).

Growth Estimates Quarters

The company’s growth estimates for the current quarter and the next is 2% and 15.6%, respectively.

Sales Growth

American Electric Power Company’s sales growth is negative 3.7% for the current quarter and 1.4% for the next.

More news about American Electric Power Company.

19. The Travelers Companies (TRV)

Shares of The Travelers Companies jumped 0.9% in from $184.56 to $186.22 at 18:21 EST on Monday, after five consecutive sessions in a row of gains. NYSE is dropping 1.51% to $15,370.44, after three sequential sessions in a row of gains.

The Travelers Companies, Inc., through its subsidiaries, provides a range of commercial and personal property, and casualty insurance products and services to businesses, government units, associations, and individuals in the United states and internationally. The company operates through three segments: Business Insurance, Bond & Specialty Insurance, and Personal Insurance. The Business Insurance segment offers workers' compensation, commercial automobile and property, general liability, commercial multi-peril, employers' liability, public and product liability, professional indemnity, marine, aviation, onshore and offshore energy, construction, terrorism, personal accident, and kidnap and ransom insurance products. This segment operates through select accounts, which serve small businesses; commercial accounts that serve mid-sized businesses; national accounts, which serve large companies; and national property and other that serve large and mid-sized customers, commercial trucking industry, and agricultural businesses, as well as markets and distributes its products through brokers, wholesale agents, and program managers. The Bond & Specialty Insurance segment provides surety, fidelity, management and professional liability, and other property and casualty coverages and related risk management services through independent agencies and brokers. The Personal Insurance segment offers property and casualty insurance covering personal risks, primarily automobile and homeowners insurance to individuals through independent agencies and brokers. The Travelers Companies, Inc. was founded in 1853 and is based in New York, New York.

More news about The Travelers Companies.

20. Zoom (ZM)

Shares of Zoom dropped by a staggering 17.15% in from $86.1 to $71.33 at 18:21 EST on Monday, after five successive sessions in a row of losses. NASDAQ is dropping 1.58% to $11,049.50, following the last session’s downward trend.

Zoom Video Communications, Inc. provides unified communications platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa. The company offers Zoom Meetings that offers HD video, voice, chat, and content sharing through mobile devices, desktops, laptops, telephones, and conference room systems; Zoom Phone, an enterprise cloud phone system; and Zoom Chat enables users to share messages, images, audio files, and content in desktop, laptop, tablet, and mobile devices. It also provides Zoom Rooms, a software-based conference room system; Zoom Hardware-as-a-Service allows users to access video communication technology from third party equipment; Zoom Conference Room Connector, a gateway for SIP/H.323 endpoints to join Zoom meetings; Zoom Events, which enables users to manage and host internal and external virtual events; OnZoom, a prosumer-focused virtual event platform and marketplace for Zoom users to create, host, and monetize online events; and Zoom Webinars to provide video presentations to large audiences from many devices. In addition, the company offers Zoom Developer Platform that enables developers, platform integrators, service providers, and customers to build apps and integrations using Zoom's video-based communications solutions, as well as integrate Zoom's technology into their products and services; Zoom App Marketplace, which helps developers to publish their apps, as well as third-party integrations of Zoom; and Zoom Contact Center, an omnichannel contact center solution. It serves individuals; and education, entertainment/media, enterprise infrastructure, finance, government, healthcare, manufacturing, non-profit/not for profit and social impact, retail/consumer products, and software/Internet industries. The company was formerly known as Zoom Communications, Inc. and changed its name to Zoom Video Communications, Inc. in May 2012. The company was incorporated in 2011 and is headquartered in San Jose, California.

Growth Estimates Quarters

The company’s growth estimates for the current quarter and the next is a negative 31.6% and a negative 18.9%, respectively.

More news about Zoom.

21. Martin Marietta Materials (MLM)

Shares of Martin Marietta Materials jumped 6.55% in from $336.3 to $358.33 at 18:21 EST on Monday, after five consecutive sessions in a row of gains. NYSE is falling 1.51% to $15,370.44, after three sequential sessions in a row of gains.

Martin Marietta Materials, Inc., a natural resource-based building materials company, supplies aggregates and heavy-side building materials to the construction industry in the United States and internationally. It offers crushed stone, sand, and gravel products; ready mixed concrete and asphalt; paving products and services; and Portland and specialty cement for use in the infrastructure projects, and nonresidential and residential construction markets, as well as in the railroad, agricultural, utility, and environmental industries. The company also produces magnesia-based chemicals products that are used in industrial, agricultural, and environmental applications; and dolomitic lime primarily to customers for steel production and soil stabilization. Its chemical products are used in flame retardants, wastewater treatment, pulp and paper production, and other environmental applications. The company was founded in 1939 and is headquartered in Raleigh, North Carolina.

Revenue Growth

Year-on-year quarterly revenue growth grew by 17.6%, now sitting on 5.54B for the twelve trailing months.

Growth Estimates Quarters

The company’s growth estimates for the current quarter and the next is 17.2% and 17.8%, respectively.

More news about Martin Marietta Materials.

22. CMS Energy (CMS)

Shares of CMS Energy jumped 6.3% in from $57.12 to $60.72 at 18:21 EST on Monday, after five successive sessions in a row of gains. NYSE is sliding 1.51% to $15,370.44, after three consecutive sessions in a row of gains.

CMS Energy Corporation operates as an energy company primarily in Michigan. The company operates through three segments: Electric Utility; Gas Utility; and Enterprises. The Electric Utility segment is involved in the generation, purchase, transmission, distribution, and sale of electricity. This segment generates electricity through coal, wind, gas, renewable energy, oil, and nuclear sources. Its distribution system comprises 208 miles of high-voltage distribution overhead lines; 4 miles of high-voltage distribution underground lines; 4,428 miles of high-voltage distribution overhead lines; 19 miles of high-voltage distribution underground lines; 82,474 miles of electric distribution overhead lines; 9,395 miles of underground distribution lines; 1,093 substations; and 3 battery facilities. The Gas Utility segment engages in the purchase, transmission, storage, distribution, and sale of natural gas, which includes 2,392 miles of transmission lines; 15 gas storage fields; 28,065 miles of distribution mains; and 8 compressor stations. The Enterprises segment is involved in the independent power production and marketing, including the development and operation of renewable generation. It serves 1.9 million electric and 1.8 million gas customers, including residential, commercial, and diversified industrial customers. The company was incorporated in 1987 and is headquartered in Jackson, Michigan.

Revenue Growth

Year-on-year quarterly revenue growth grew by 17.3%, now sitting on 8.35B for the twelve trailing months.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

CMS Energy’s stock is considered to be oversold (<=20).

Sales Growth

CMS Energy’s sales growth is negative 7.1% for the ongoing quarter and 9.9% for the next.

Volatility

CMS Energy’s last week, last month’s, and last quarter’s current intraday variation average was 0.46%, 0.36%, and 1.51%.

CMS Energy’s highest amplitude of average volatility was 0.46% (last week), 1.13% (last month), and 1.51% (last quarter).

More news about CMS Energy.

23. Aon plc (AON)

Shares of Aon plc rose 8.14% in from $282.11 to $305.07 at 18:21 EST on Monday, after five successive sessions in a row of gains. NYSE is falling 1.51% to $15,370.44, after three consecutive sessions in a row of gains.

Aon plc, a professional services firm, provides advice and solutions to clients focused on risk, retirement, and health worldwide. It offers commercial risk solutions, including retail brokerage, cyber, and global risk consulting solutions, as well as acts as a captives management; and health solutions, such as health and benefits brokerages, and health care exchanges. The company also provides treaty and facultative reinsurance, as well as insurance-linked securities, capital raising, strategic advice, restructuring, and mergers and acquisitions services; and corporate finance advisory services and capital markets solutions products. In addition, it offers strategic design consulting services on their retirement programs, actuarial services, and risk management services; advice services on developing and maintaining investment programs across a range of plan types, including defined benefit plans, defined contribution plans, endowments, and foundations for public and private companies, and other institutions; and advice and solutions that help clients in risk, health, and wealth through commercial risk, reinsurance, health, and wealth solutions. Further, the company offers CoverWallet; Affinity; Aon Inpoint; CoverWallet; and ReView services. Aon plc was founded in 1919 and is headquartered in Dublin, Ireland.

Moving Average

Aon plc’s worth is higher than its 50-day moving average of $281.03 and above its 200-day moving average of $287.28.

Volatility

Aon plc’s last week, last month’s, and last quarter’s current intraday variation average was 0.32%, 0.30%, and 1.38%.

Aon plc’s highest amplitude of average volatility was 0.32% (last week), 1.31% (last month), and 1.38% (last quarter).

Growth Estimates Quarters

The company’s growth estimates for the ongoing quarter is 14.4% and a drop 0.5% for the next.

Revenue Growth

Year-on-year quarterly revenue growth grew by 3.4%, now sitting on 12.44B for the twelve trailing months.

More news about Aon plc.

24. Xcel Energy (XEL)

Shares of Xcel Energy jumped 6.35% in from $65.17 to $69.31 at 18:21 EST on Monday, after five sequential sessions in a row of gains. NASDAQ is sliding 1.58% to $11,049.50, following the last session’s downward trend.

Xcel Energy Inc., through its subsidiaries, generates, purchases, transmits, distributes, and sells electricity. It operates through Regulated Electric Utility, Regulated Natural Gas Utility, and All Other segments. The company generates electricity through coal, nuclear, natural gas, hydroelectric, solar, biomass, oil, wood/refuse, and wind energy sources. It also purchases, transports, distributes, and sells natural gas to retail customers, as well as transports customer-owned natural gas. In addition, the company develops and leases natural gas pipelines, and storage and compression facilities; and invests in rental housing projects, as well as procures equipment for the construction of renewable generation facilities. It serves residential, commercial, and industrial customers in the portions of Colorado, Michigan, Minnesota, New Mexico, North Dakota, South Dakota, Texas, and Wisconsin. The company sells electricity to approximately 3.7 million customers; and natural gas to approximately 2.1 million customers. Xcel Energy Inc. was incorporated in 1909 and is headquartered in Minneapolis, Minnesota.

More news about Xcel Energy.

25. Intercontinental Exchange (ICE)

Shares of Intercontinental Exchange rose 9.93% in from $95.6 to $105.09 at 18:21 EST on Monday, after five sequential sessions in a row of gains. NYSE is sliding 1.51% to $15,370.44, after three successive sessions in a row of gains.

Intercontinental Exchange, Inc., together with its subsidiaries, operates regulated exchanges, clearing houses, and listings venues for commodity, financial, fixed income, and equity markets in the United States, the United Kingdom, the European Union, Singapore, Israel, and Canada. It operates through three segments: Exchanges, Fixed Income and Data Services, and Mortgage Technology. The company operates marketplaces for listing, trading, and clearing an array of derivatives contracts and financial securities, such as commodities, interest rates, foreign exchange, and equities, as well as corporate and exchange-traded funds; trading venues, including 13 regulated exchanges and 6 clearing houses; and offers futures and options products for energy, agricultural and metals, financial, cash equities and equity, over-the-counter, and other markets, as well as listings and data and connectivity services. It also provides fixed income data and analytic, fixed income execution, CDS clearing, and other multi-asset class data and network services. In addition, the company offers proprietary and comprehensive mortgage origination platform, which serves residential mortgage loans; closing solutions that provides customers connectivity to the mortgage supply chain and facilitates the secure exchange of information; data and analytics services; and Data as a Service for lenders to access data and origination information. Intercontinental Exchange, Inc. was founded in 2000 and is headquartered in Atlanta, Georgia.

Volatility

Intercontinental Exchange’s last week, last month’s, and last quarter’s current intraday variation average was a negative 0.27%, a positive 0.46%, and a positive 1.38%.

Intercontinental Exchange’s highest amplitude of average volatility was 0.39% (last week), 1.37% (last month), and 1.38% (last quarter).

Sales Growth

Intercontinental Exchange’s sales growth for the next quarter is negative 0.8%.

Growth Estimates Quarters

The company’s growth estimates for the current quarter and the next is a negative 2.3% and a negative 3.7%, respectively.

Yearly Top and Bottom Value

Intercontinental Exchange’s stock is valued at $105.09 at 18:21 EST, way below its 52-week high of $138.46 and way above its 52-week low of $88.60.

More news about Intercontinental Exchange.

26. Southern Company (SO)

Shares of Southern Company rose 0.24% in from $65.51 to $65.67 at 18:21 EST on Monday, after five consecutive sessions in a row of gains. NYSE is falling 1.51% to $15,370.44, after three consecutive sessions in a row of gains.

The Southern Company, through its subsidiaries, engages in the generation, transmission, and distribution of electricity. It operates through Gas Distribution Operations, Gas Pipeline Investments, Wholesale Gas Services, and Gas Marketing Services segments. The company also develops, constructs, acquires, owns, and manages power generation assets, including renewable energy projects and sells electricity in the wholesale market; and distributes natural gas in Illinois, Georgia, Virginia, and Tennessee, as well as provides gas marketing services, wholesale gas services, and gas pipeline investments operations. In addition, it owns and/or operates 30 hydroelectric generating stations, 24 fossil fuel generating stations, three nuclear generating stations, 13 combined cycle/cogeneration stations, 45 solar facilities, 15 wind facilities, one fuel cell facility, and four battery storage facility; and constructs, operates, and maintains 76,289 miles of natural gas pipelines and 14 storage facilities with total capacity of 157 Bcf to provide natural gas to residential, commercial, and industrial customers. The company serves approximately 8.7 million electric and gas utility customers. Further, the company offers digital wireless communications and fiber optics services. The Southern Company was incorporated in 1945 and is headquartered in Atlanta, Georgia.

Growth Estimates Quarters

The company’s growth estimates for the current quarter and the next is a negative 30.6% and a negative 13.4%, respectively.

More news about Southern Company.

27. Fifth Third Bancorp (FITBI)

Shares of Fifth Third Bancorp jumped 1.19% in from $25.26 to $25.56 at 18:21 EST on Monday, following the last session’s downward trend. NASDAQ is falling 1.58% to $11,049.50, following the last session’s downward trend.

Fifth Third is a bank that's as long on innovation as it is on history. Since 1858, we've been helping individuals, families, businesses and communities grow through smart financial services that improve lives. Our list of firsts is extensive, and it's one that continues to expand as we explore the intersection of tech-driven innovation, dedicated people, and focused community impact. Fifth Third is one of the few U.S.-based banks to have been named among Ethisphere's World's Most Ethical Companies® for several years. With a commitment to taking care of our customers, employees, communities and shareholders, our goal is not only to be the nation's highest performing regional bank, but to be the bank people most value and trust. Fifth Third Bank, National Association is a federally chartered institution. Fifth Third Bancorp is the indirect parent company of Fifth Third Bank and its common stock is traded on the NASDAQ® Global Select Market under the symbol “FITB.” Investor information and press releases can be viewed at www.53.com.

Volatility

Fifth Third Bancorp’s last week, last month’s, and last quarter’s current intraday variation average was 0.16%, 0.16%, and 0.70%.

Fifth Third Bancorp’s highest amplitude of average volatility was 0.18% (last week), 0.93% (last month), and 0.70% (last quarter).

Revenue Growth

Year-on-year quarterly revenue growth declined by 2.8%, now sitting on 7.75B for the twelve trailing months.

More news about Fifth Third Bancorp.

28. Liberty Media (LSXMA)

Shares of Liberty Media rose 2.19% in from $42.42 to $43.35 at 18:21 EST on Monday, after four sequential sessions in a row of gains. NASDAQ is falling 1.58% to $11,049.50, following the last session’s downward trend.

The Liberty SiriusXM Group, through its subsidiaries, engages in the entertainment business in the United States and Canada. It features music, sports, entertainment, comedy, talk, news, traffic, weather channels, podcast, and infotainment services through proprietary satellite radio systems, as well as streamed through applications for mobile and home devices, and other consumer electronic equipment. It also offers connected vehicle services; a suite of data services that include graphical weather, fuel prices, sports schedules and scores, and movie listings; and traffic information services, which provide information as to road closings, traffic flow and incident data to consumers with compatible in-vehicle navigation systems, and real-time weather services in vehicles, boats, and planes. In addition, the company operates a music, comedy, and podcast streaming platform. Further, it offers ad-supported radio services; Pandora Plus, a radio subscription service; and Pandora Premium, an on-demand subscription service. Additionally, the company distributes satellite radios through automakers and retailers, as well as through its website. As of December 31, 2021, it served approximately 34.0 million subscribers through Sirius XM and approximately 6.4 million subscribers through Pandora. The Liberty SiriusXM Group is headquartered in Englewood, Colorado. The Liberty SiriusXM Group is a subsidiary of Liberty Media Corporation.

Moving Average

Liberty Media’s worth is higher than its 50-day moving average of $41.13 and above its 200-day moving average of $42.16.

More news about Liberty Media.

29. Hartford Financial Services Group (HIG)

Shares of Hartford Financial Services Group jumped 3.59% in from $72.44 to $75.04 at 18:21 EST on Monday, after five sequential sessions in a row of gains. NYSE is sliding 1.51% to $15,370.44, after three successive sessions in a row of gains.

The Hartford Financial Services Group, Inc. provides insurance and financial services to individual and business customers in the United States, the United Kingdom, and internationally. Its Commercial Lines segment offers workers' compensation, property, automobile, liability, umbrella, bond, marine, livestock, and reinsurance; and customized insurance products and risk management services, including professional liability, bond, surety, and specialty casualty coverages through regional offices, branches, sales and policyholder service centers, independent retail agents and brokers, wholesale agents, and reinsurance brokers. The company's Personal Lines segment provides automobile, homeowners, and personal umbrella coverages through direct-to-consumer channel and independent agents. Its Property & Casualty Other Operations segment offers coverage for asbestos and environmental exposures. The company's Group Benefits segment provides group life, disability, and other group coverages to members of employer groups, associations, and affinity groups through direct insurance policies; reinsurance to other insurance companies; employer paid and voluntary product coverages; disability underwriting, administration, and claims processing to self-funded employer plans; and a single-company leave management solution. This segment distributes its group insurance products and services through brokers, consultants, third-party administrators, trade associations, and private exchanges. Its Hartford Funds segment offers investment products for retail and retirement accounts; exchange-traded products through broker-dealer organizations, independent financial advisers, defined contribution plans, financial consultants, bank trust groups, and registered investment advisers; and investment management and administrative services, such as product design, implementation, and oversight. The company was founded in 1810 and is headquartered in Hartford, Connecticut.

Moving Average

Hartford Financial Services Group’s value is way higher than its 50-day moving average of $66.22 and higher than its 200-day moving average of $68.26.

More news about Hartford Financial Services Group.

30. Arthur J. Gallagher & Co. (AJG)

Shares of Arthur J. Gallagher & Co. jumped 4.65% in from $187.64 to $196.37 at 18:21 EST on Monday, after five successive sessions in a row of gains. NYSE is falling 1.51% to $15,370.44, after three sequential sessions in a row of gains.

Arthur J. Gallagher & Co., together with its subsidiaries, provides insurance brokerage, consulting, third-party claims settlement, and administration services in the United States, Australia, Bermuda, Canada, the Caribbean, New Zealand, India, and the United Kingdom. It operates through Brokerage and Risk Management segments. The Brokerage segment consists of retail and wholesale insurance brokerage operations; assists retail brokers and other non-affiliated brokers in the placement of specialized and hard-to-place insurance; acts as a brokerage wholesaler, managing general agent, and managing general underwriter for distributing specialized insurance coverage's to underwriting enterprises. This segment also performs activities, including marketing, underwriting, issuing policies, collecting premiums, appointing and supervising other agents, paying claims, and negotiating reinsurance; and offers brokerage and consulting services to businesses and organizations, including commercial, not-for-profit, and public entities, as well as individuals in the areas of insurance placement, risk of loss management, and management of employer sponsored benefit programs. The Risk Management segment provides contract claim settlement and administration services to enterprises and public entities; and claims management, loss control consulting, and insurance property appraisal services. The company offers its services through a network of correspondent insurance brokers and consultants. It serves commercial, industrial, public, religious, and not-for-profit entities. The company was incorporated in 1927 and is headquartered in Rolling Meadows, Illinois.

Yearly Top and Bottom Value

Arthur J. Gallagher & Co.’s stock is valued at $196.37 at 18:21 EST, higher than its 52-week high of $192.00.

More news about Arthur J. Gallagher & Co..

31. AbbVie (ABBV)

Shares of AbbVie rose 8.26% in from $146.2 to $158.28 at 18:21 EST on Monday, following the last session’s upward trend. NYSE is sliding 1.51% to $15,370.44, after three consecutive sessions in a row of gains.

AbbVie Inc. discovers, develops, manufactures, and sells pharmaceuticals in the worldwide. The company offers HUMIRA, a therapy administered as an injection for autoimmune and intestinal Behçet's diseases; SKYRIZI to treat moderate to severe plaque psoriasis in adults; RINVOQ, a JAK inhibitor for the treatment of moderate to severe active rheumatoid arthritis in adult patients; IMBRUVICA to treat adult patients with chronic lymphocytic leukemia (CLL), small lymphocytic lymphoma (SLL), and VENCLEXTA, a BCL-2 inhibitor used to treat adults with CLL or SLL; and MAVYRET to treat patients with chronic HCV genotype 1-6 infection. It also provides CREON, a pancreatic enzyme therapy for exocrine pancreatic insufficiency; Synthroid used in the treatment of hypothyroidism; Linzess/Constella to treat irritable bowel syndrome with constipation and chronic idiopathic constipation; Lupron for the palliative treatment of advanced prostate cancer, endometriosis and central precocious puberty, and patients with anemia caused by uterine fibroids; and Botox therapeutic. In addition, the company offers ORILISSA, a nonpeptide small molecule gonadotropin-releasing hormone antagonist for women with moderate to severe endometriosis pain; Duopa and Duodopa, a levodopa-carbidopa intestinal gel to treat Parkinson's disease; Lumigan/Ganfort, a bimatoprost ophthalmic solution for the reduction of elevated intraocular pressure (IOP) in patients with open angle glaucoma (OAG) or ocular hypertension; Ubrelvy to treat migraine with or without aura in adults; Alphagan/ Combigan, an alpha-adrenergic receptor agonist for the reduction of IOP in patients with OAG; and Restasis, a calcineurin inhibitor immunosuppressant to increase tear production, as well as other eye care products. AbbVie Inc. has a research collaboration with Dragonfly Therapeutics, Inc. The company was incorporated in 2012 and is headquartered in North Chicago, Illinois.

Sales Growth

AbbVie’s sales growth for the next quarter is 6%.

Moving Average

AbbVie’s value is higher than its 50-day moving average of $144.85 and above its 200-day moving average of $148.32.

More news about AbbVie.

32. Cardinal Health (CAH)

Shares of Cardinal Health rose 2.98% in from $76.07 to $78.34 at 18:21 EST on Monday, following the last session’s upward trend. NYSE is dropping 1.51% to $15,370.44, after three successive sessions in a row of gains.

Cardinal Health, Inc. operates as an integrated healthcare services and products company in the United States, Canada, Europe, Asia, and internationally. It provides customized solutions for hospitals, healthcare systems, pharmacies, ambulatory surgery centers, clinical laboratories, physician offices, and patients in the home. The company operates in two segments, Pharmaceutical and Medical. The Pharmaceutical segment distributes branded and generic pharmaceutical, specialty pharmaceutical, and over-the-counter healthcare and consumer products. The segment also provides services to pharmaceutical manufacturers and healthcare providers for specialty pharmaceutical products; operates nuclear pharmacies and radiopharmaceutical manufacturing facilities; repackages generic pharmaceuticals and over-the-counter healthcare products; and offers medication therapy management and patient outcomes services to hospitals, other healthcare providers, and payers, as well as provides pharmacy management services to hospitals. The Medical segment manufactures, sources, and distributes Cardinal Health branded medical, surgical, and laboratory products and devices that include exam and surgical gloves; needles, syringe, and sharps disposals; compressions; incontinences; nutritional delivery products; wound care products; single-use surgical drapes, gowns, and apparels; fluid suction and collection systems; urology products; operating room supply products; and electrode product lines. The segment also distributes a range of national brand products, including medical, surgical, and laboratory products; provides supply chain services and solutions to hospitals, ambulatory surgery centers, clinical laboratories, and other healthcare providers; and assembles and sells sterile, and non-sterile procedure kits. The company was incorporated in 1979 and is headquartered in Dublin, Ohio.

More news about Cardinal Health.

33. Citizens Financial Group (CFG)

Shares of Citizens Financial Group rose 0.54% in from $40.9 to $41.12 at 18:21 EST on Monday, after five consecutive sessions in a row of gains. NYSE is dropping 1.51% to $15,370.44, after three sequential sessions in a row of gains.

Citizens Financial Group, Inc. operates as the bank holding company for Citizens Bank, National Association that provides retail and commercial banking products and services to individuals, small businesses, middle-market companies, corporations, and institutions in the United States. The company operates in two segments, Consumer Banking and Commercial Banking. The Consumer Banking segment offers deposit products, mortgage and home equity lending products, credit cards, business loans, wealth management, and investment services; and auto, education, and point-of-sale finance loans, as well as digital deposit products. This segment serves its customers through telephone service centers, as well as through its online and mobile platforms. The Commercial Banking segment provides various financial products and solutions, including lending and leasing, deposit and treasury management services, foreign exchange, and interest rate and commodity risk management solutions, as well as syndicated loans, corporate finance, mergers and acquisitions, and debt and equity capital markets services. This segment serves government banking, not-for-profit, healthcare, technology, professionals, oil and gas, asset finance, franchise finance, asset-based lending, commercial real estate, private equity, and sponsor finance industries. It operates approximately 1,200 branches in 14 states and the District of Columbia; 114 retail and commercial non-branch offices in national markets; and approximately 3,300 automated teller machines. The company was formerly known as RBS Citizens Financial Group, Inc. and changed its name to Citizens Financial Group, Inc. in April 2014. Citizens Financial Group, Inc. was founded in 1828 and is headquartered in Providence, Rhode Island.

Revenue Growth

Year-on-year quarterly revenue growth grew by 5.8%, now sitting on 7.03B for the twelve trailing months.

Volatility

Citizens Financial Group’s last week, last month’s, and last quarter’s current intraday variation average was 0.04%, 0.24%, and 1.73%.

Citizens Financial Group’s highest amplitude of average volatility was 1.15% (last week), 1.45% (last month), and 1.73% (last quarter).

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Citizens Financial Group’s stock is considered to be oversold (<=20).

More news about Citizens Financial Group.

34. RenaissanceRe Hold (RNR)

Shares of RenaissanceRe Hold jumped by a staggering 19.07% in from $154.98 to $184.54 at 18:21 EST on Monday, after two sequential sessions in a row of gains. NYSE is dropping 1.51% to $15,370.44, after three consecutive sessions in a row of gains.

RenaissanceRe Holdings Ltd. provides reinsurance and insurance products in the United States and internationally. The company operates through Property, and Casualty and Specialty segments. The Property segment writes property catastrophe excess of loss reinsurance and excess of loss retrocessional reinsurance to insure insurance and reinsurance companies against natural and man-made catastrophes, including hurricanes, earthquakes, typhoons, and tsunamis, as well as claims arising from other natural and man-made catastrophes comprising winter storms, freezes, floods, fires, windstorms, tornadoes, explosions, and acts of terrorism; and other property class of products, such as proportional reinsurance, property per risk, property reinsurance, binding facilities, and regional U.S. multi-line reinsurance. The Casualty and Specialty segment writes various classes of products, such as directors and officers, medical malpractice, and professional indemnity; automobile and employer's liability, casualty clash, umbrella or excess casualty, workers' compensation, and general liability; financial and mortgage guaranty, political risk, surety, and trade credit; and accident and health, agriculture, aviation, cyber, energy, marine, satellite, and terrorism. The company distributes its products and services primarily through intermediaries. RenaissanceRe Holdings Ltd. was founded in 1993 and is headquartered in Pembroke, Bermuda.

Growth Estimates Quarters

The company’s growth estimates for the current quarter is a negative 3.4% and positive 16.6% for the next.

Yearly Top and Bottom Value

RenaissanceRe Hold’s stock is valued at $184.54 at 18:21 EST, below its 52-week high of $187.89 and way above its 52-week low of $124.18.

Revenue Growth

Year-on-year quarterly revenue growth declined by 37.7%, now sitting on 4.77B for the twelve trailing months.

More news about RenaissanceRe Hold.

35. Allstate (ALL)

Shares of Allstate rose 5.04% in from $126.35 to $132.72 at 18:21 EST on Monday, after two sequential sessions in a row of gains. NYSE is sliding 1.51% to $15,370.44, after three sequential sessions in a row of gains.

The Allstate Corporation, together with its subsidiaries, provides property and casualty, and other insurance products in the United States and Canada. The company operates through Allstate Protection; Protection Services; Allstate Health and Benefits; and Run-off Property-Liability segments. The Allstate Protection segment offers private passenger auto and homeowners insurance; specialty auto products, including motorcycle, trailer, motor home, and off-road vehicle insurance; other personal lines products, such as renter, condominium, landlord, boat, umbrella, and manufactured home and stand-alone scheduled personal property; and commercial lines products under the Allstate and Encompass brand names. The Protection Services segment provides consumer product protection plans and related technical support for mobile phones, consumer electronics, furniture, and appliances; finance and insurance products, including vehicle service contracts, guaranteed asset protection waivers, road hazard tire and wheel, and paint and fabric protection; roadside assistance; device and mobile data collection services; data and analytic solutions using automotive telematics information; and identity protection services. This segment offers its products under various brands including Allstate Protection Plans, Allstate Dealer Services, Allstate Roadside Services, Arity, and Allstate Identity Protection. The Allstate Health and Benefits provides life, accident, critical illness, short-term disability, and other health insurance products. The Run-off Property-Liability offers property and casualty insurance. It sells its products through call centers, agencies, financial specialists, independent agents, brokers, wholesale partners, and affinity groups, as well as through online and mobile applications. The Allstate Corporation was founded in 1931 and is based in Northbrook, Illinois.

More news about Allstate.