(VIANEWS) – Today, the Innrs artificial intelligence algorithm suggests a high probability of discovering the approximate price for tomorrow of Kodak KODK, Riot Blockchain RIOT and others.

Via News will regularly fact-check this AI algorithm that aims to consistently predict the next session price and next week’s trend of financial assets.

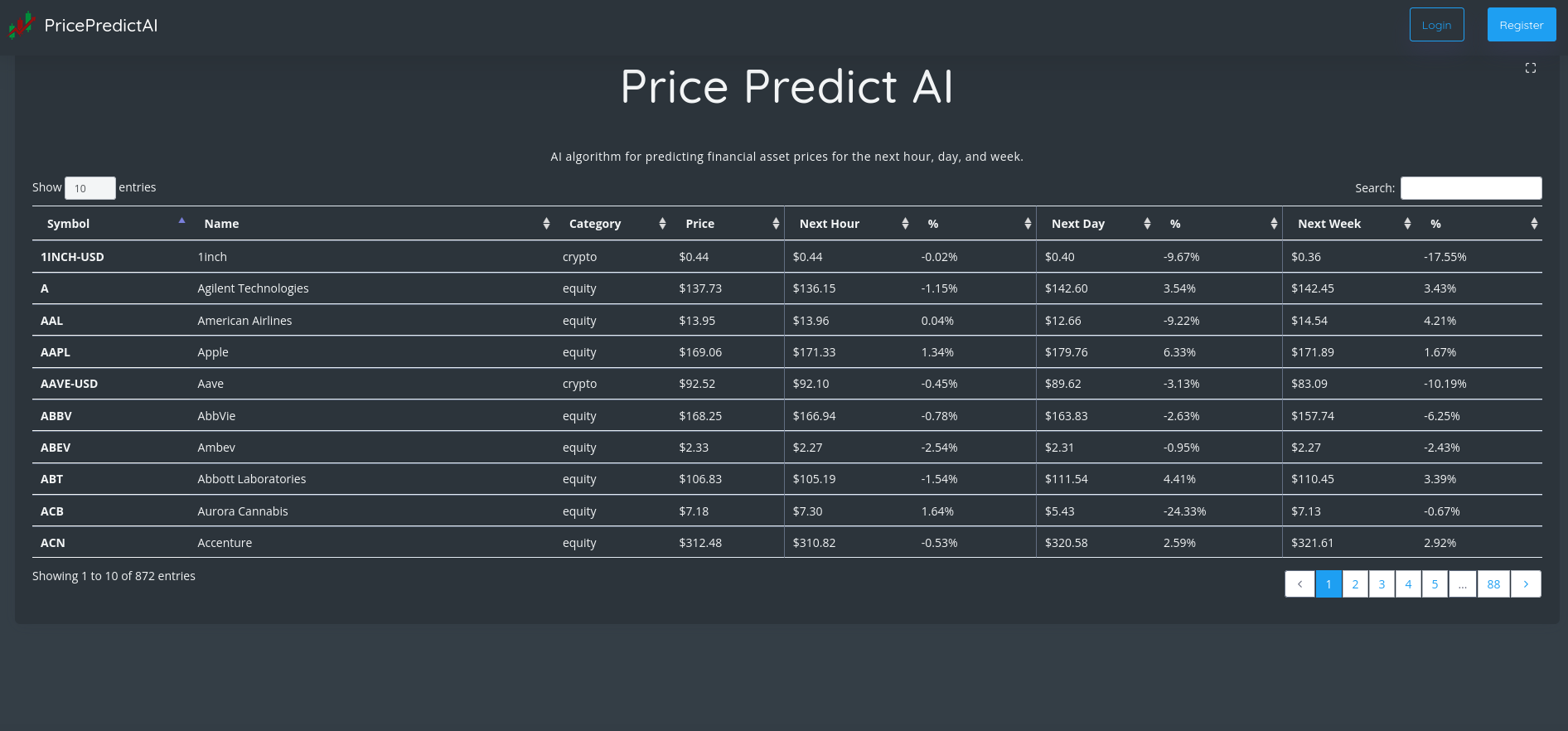

Innrs provides A.I.-based statistical tools to help investors make decisions. The table below shows the financial assets predicting price, ordered by the highest expected accuracy.

Innrs officials say this tool helps investors make better-informed decisions, supposedly used alongside other relevant financial information and the specific trader strategy.

In the next session, Via News will report the finding on the algorithm precision.

| Financial Asset | Accuracy | Close Price | Prediction |

|---|---|---|---|

| Kodak (KODK) | 90.23% | $3.09 | ⇩ $2.54 |

| Riot Blockchain (RIOT) | 90.22% | $3.77 | ⇩ $3.4 |

| StoneCo (STNE) | 88.82% | $9.27 | ⇩ $8.36 |

| Castle Biosciences (CSTL) | 87.45% | $22.74 | ⇧ $23.26 |

| Canaan (CAN) | 87.06% | $2.17 | ⇩ $2.12 |

| Twitter (TWTR) | 84.13% | $53.7 | ⇧ $54.42 |

| Air Products and Chemicals (APD) | 84.01% | $313.55 | ⇧ $318.02 |

| HCA Holdings (HCA) | 83.74% | $238.9 | ⇧ $244.16 |

| Nokia (NOK) | 83.65% | $4.6 | ⇩ $4.49 |

| Telefonica (TEF) | 83.64% | $3.41 | ⇩ $3.33 |

| Sabre Corporation (SABR) | 83.43% | $5.97 | ⇩ $5.89 |

| Celsius Holdings (CELH) | 83.43% | $105.98 | ⇧ $108.17 |

| Petroleo Brasileiro (PBR) | 82.59% | $9.65 | ⇩ $9.4 |

1. Kodak (KODK)

Shares of Kodak dropped by a staggering 40.13% in from $5.16 to $3.09 at 18:21 EST on Monday, following the last session’s upward trend. NYSE is sliding 0.53% to $14,938.03, after three consecutive sessions in a row of losses.

Eastman Kodak Company supplies hardware, software and consumables to clients in commercial printing, packaging, publishing and manufacturing markets around the world. It operates in three segments: Digital Printing and Traditional Printing. Traditional Printing offers traditional offset plates and computer-to plate imaging solutions for commercial printing, such as direct mail, commercial print, newspaper and magazine publishing and book publishing. Digital Printing offers electrophotographic printing options, such as the ASCEND, NEXFINITY and prosper printers, PROSPER Writing Systems and PROSPER press system components, versamark products and PRINERGY workflow software. Advanced Materials and Chemicals is involved in motion picture and industrial film and chemicals. It also deals with advanced materials and functional printers. The Kodak Research Laboratories is also included in this segment. This laboratory conducts research and develops new products or business opportunities. It files patent applications and manages the licensing of its intellectual properties to third parties. This segment licenses the Kodak brand name to third parties. Eastman Business Park is a complex that houses a variety of technology centers and an industrial complex. The company sells products and services via direct sales, through third-party resellers, dealers and channel partners. Eastman Kodak Company, which was established in 1880, is located in Rochester in New York.

Revenue growth

The year-over-year revenue growth was 10.3%. We now have 1.2B in the 12 trailing months.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Kodak’s stock is considered to be overbought (>=80).

More news about Kodak.

2. Riot Blockchain (RIOT)

Shares of Riot Blockchain fell 9.28% in from $4.16 to $3.77 at 18:21 EST on Monday, after three sequential sessions in a row of losses. NASDAQ is falling 1.49% to $10,546.03, after three successive sessions in a row of losses.

Riot Blockchain, Inc., together with its subsidiaries, focuses on bitcoin mining operations in North America. It operates through Bitcoin Mining, Data Center Hosting, and Electrical Products and Engineering segments. As of December 31, 2021, it operated approximately 30,907 miners. Riot Blockchain, Inc. was incorporated in 2000 and is headquartered in Castle Rock, Colorado.

Revenue Growth

Year-on-year quarterly revenue growth grew by 112.4%, now sitting on 308.43M for the twelve trailing months.

Sales Growth

Riot Blockchain’s sales growth for the next quarter is negative 5.6%.

More news about Riot Blockchain.

3. StoneCo (STNE)

Shares of StoneCo dropped by a staggering 21.57% in from $11.82 to $9.27 at 18:21 EST on Monday, after three successive sessions in a row of losses. NASDAQ is sliding 1.49% to $10,546.03, after three consecutive sessions in a row of losses.

StoneCo Ltd. offers financial technology solutions for merchants and partners. It allows them to do electronic commerce in Brazil via in-store and online channels. StoneCo Ltd. distributes their solutions through its proprietary Stone Hubs. These hubs offer local sales and services, and technology and solutions for digital merchants via sales personnel, technical vendors and sales staff. It also sells brick-and mortar and digital merchants with the help of a sales team. As of December 31, 2021, the company served approximately 1,766,100 clients primarily small-and-medium-sized businesses; and marketplaces, e-commerce platforms, and integrated software vendors. StoneCo Ltd. was established in 2000. It is located in George Town in the Cayman Islands. StoneCo Ltd. is a subsidiary to HR Holdings, LLC.

Moving Average

StoneCo’s worth is under its 50-day moving average of $10.04 and way under its 200-day moving average of $10.36.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

StoneCo stock is overbought (>=80).

Volatility

StoneCo’s intraday variation average for the week and quarter ended last week was negative 1.45%. It was positive 0.40% and positive 4.31%.

StoneCo had the highest average volatility amplitude at 2.81%, 4.39% and 4.31% respectively.

Revenue Growth

Year-on-year quarterly revenue growth grew by 134.2%, now sitting on 6.99B for the twelve trailing months.

More news about StoneCo.

4. Castle Biosciences (CSTL)

Shares of Castle Biosciences rose 9.27% in from $20.81 to $22.74 at 18:21 EST on Monday, after three sequential sessions in a row of losses. NASDAQ is falling 1.49% to $10,546.03, after three consecutive sessions in a row of losses.

Castle Biosciences, Inc. is a diagnostics company in the commercial stage. It focuses on providing diagnostic and prognostic services to dermatological cancers. DecisionDx-Melanoma is the company’s flagship product. This multi-gene expression profil (GEP test) identifies patients with invasive skin melanoma at risk for metastasis. DecisionDx UM, a proprietary GEP testing that determines the likelihood of metastasis in patients suffering from uveal melanoma (a rare form of eye cancer), DecisionDx SCC (a 40-gene expression profil test that analyzes a patient’s tumor biology and predicts individual risk for squamous cells carcinoma metastasis) and DecisionDx DiffDx -Melanoma. The company offers testing services to physicians as well as their patients. It was established in Texas in 2007.

Sales Growth

Castle Biosciences is forecasting a 43.1% increase in sales for the next quarter.

More news about Castle Biosciences.

5. Canaan (CAN)

Shares of Canaan dropped by a staggering 17.97% in from $2.65 to $2.17 at 18:21 EST on Monday, after three consecutive sessions in a row of losses. NASDAQ is sliding 1.49% to $10,546.03, after three successive sessions in a row of losses.

Canaan Inc. is involved in research, development, and sales of integrated circuits (ICs) final mining equipment products. It integrates IC products for Bitcoin mining and other related components primarily from the People’s Republic of China. The company is involved in manufacturing and distributing mining equipment spare parts. Northern Data AG is the company’s strategic partner in artificial intelligence, blockchain technology and datacenter operation. Canaan Inc. is located in Beijing in the People’s Republic of China.

Moving Average

Canaan’s worth is way under its 50-day moving average of $2.85 and way below its 200-day moving average of $3.64.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Canaan’s stock has been overbought by >=80

More news about Canaan.

6. Twitter (TWTR)

Shares of Twitter fell 0% in from $53.7 to $53.70 at 18:21 EST on Monday, following the last session’s downward trend. NYSE is falling 0.53% to $14,938.03, after three consecutive sessions in a row of losses.

Elon Musk poised to step down as twitter CEO as deciding poll concludes: A 'major positive' for Tesla stock? Musk leaving Twitter as CEO would mean that Tesla shares would benefit if someone (preferably with a social media background) was appointed to the position. This would reduce Twitter’s overhang, which would clearly be beneficial for Tesla shares.

Elon Musk asks if he should resign as twitter ceo: most people say…Poll results will dictate if Musks stays officially CEO of Twitter….a big moment for this Twitter situation, While clearly unconventional the Musk CEO poll is a sign that the noise is growing louder and louder given the spider web of Twitter and Tesla weakness.

Tesla stock rises 4.7% as 57.5% of twitter users vote against Elon Musk as CEO Musk has run Twitter for 53 days. During that time, he’s fired a lot of employees and been criticised for suspending four journalist accounts. Musk asked users on Twitter to vote for him to continue running the company during that issue.

As Tesla shares increase, Twitter votes favor Elon Musk’s resignation.

The latest controversy revolved around whether Twitter would ban accounts that post links or usernames for certain prohibited third-party social media platforms. , During that issue, Musk then asked Twitter users to vote on whether he should continue to run the company.

Twitter, Inc. operates as a platform for public self-expression and conversation in real-time. The company's primary product is Twitter, a platform that allows users to consume, create, distribute, and discover content. It also provides promoted products that enable advertisers to promote brands, products, and services, as well as enable advertisers to target an audience based on various factors, including who an account follows and actions taken on its platform, such as Tweets created and engagement with Tweets. Its promoted products consist of promoted ads and Twitter Amplify, Follower Ads, and Twitter takeover. In addition, the company offers monetization products for creators, including Tips to directly send small one-time payments on Twitter using various payment methods, including bitcoin; Super Follows, a paid monthly subscription, which includes bonus content, exclusive previews, and perks as a way to support and connect with creators on Twitter; and Ticketed Spaces to support creators on Twitter for their time and effort in hosting, speaking, and moderating the public conversation on Twitter Spaces. Further, it offers products for developers and data partners comprising Twitter Developer Platform, a platform that enables developers to build tools for people and businesses using its public application programming interface; and paid access to Twitter data for partners with commercial use cases. Twitter, Inc. was founded in 2006 and is based in San Francisco, California.

Growth Estimates Quarters

For the current quarter, the company expects to grow by 135.2% and 24.2 % respectively.

Yearly Top and Bottom Value

Twitter’s stock is valued at $53.70 at 18:21 EST, way below its 52-week high of $68.41 and way above its 52-week low of $31.30.

Sales Growth

Twitter is forecast to grow its sales by 0.6% in the next quarter.

Revenue Growth

Year-on-year quarterly revenue growth declined by 1.2%, now sitting on 5.23B for the twelve trailing months.

More news about Twitter.

7. Air Products and Chemicals (APD)

Shares of Air Products and Chemicals rose 5.67% in from $296.73 to $313.55 at 18:21 EST on Monday, following the last session’s upward trend. NYSE is dropping 0.53% to $14,938.03, after three successive sessions in a row of losses.

Air Products and Chemicals, Inc. provides atmospheric gases, process and specialty gases, equipment, and services worldwide. The company produces atmospheric gases, including oxygen, nitrogen, and argon; process gases, such as hydrogen, helium, carbon dioxide, carbon monoxide, syngas; specialty gases; and equipment for the production or processing of gases comprising air separation units and non-cryogenic generators for customers in various industries, including refining, chemical, gasification, metals, manufacturing, food and beverage, electronics, magnetic resonance imaging, energy production and refining, and metals. It also designs and manufactures equipment for air separation, hydrocarbon recovery and purification, natural gas liquefaction, and liquid helium and liquid hydrogen transport and storage. Air Products and Chemicals, Inc. has a strategic collaboration with Baker Hughes Company to develop hydrogen compression systems. The company was founded in 1940 and is headquartered in Allentown, Pennsylvania.

Volatility

Air Products and Chemicals had an intraday variation of 0.41% in the last week, last months, and last quarter. The averages were 0.50% and 1.57%, respectively.

Air Products and Chemicals had the highest average volatility amplitudes of 1.30%, 1.23% and 1.57% respectively (both last week and quarter).

Sales Growth

Air Products and Chemicals’s sales growth for the current quarter is 13.5%.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Air Products and Chemicals’s stock is considered to be overbought (>=80).

Growth Estimates Quarters

For the current quarter, the company expects to grow by 10% and 7.5% respectively.

More news about Air Products and Chemicals.

8. HCA Holdings (HCA)

Shares of HCA Holdings rose 4.33% in from $228.98 to $238.90 at 18:21 EST on Monday, after two successive sessions in a row of losses. NYSE is dropping 0.53% to $14,938.03, after three sequential sessions in a row of losses.

HCA Healthcare, Inc., via its subsidiaries, offers health care company services in the United States. HCA Healthcare, Inc. operates hospitals for general and acute care. It offers medical and surgical services including cardiac care, inpatient care and intensive care. Outpatient services include outpatient surgery and laboratory radiology. The company also has outpatient facilities that include freestanding ambulatory surgical centers, emergency care centers, urgent care centers, walk-in clinics and diagnostic and imaging centers. It also owns rehabilitation and physical therapy centres, oncology and radiation therapy centers and physician practices. The company also operates psychiatric hospital, providing therapeutic programs that include child, adolescent, and adult psychiatric, as well as adolescent, adult, and drug abuse treatment. It operated 182 hospitals as of December 31, 2020, which included 175 acute and general care hospitals, 5 psychiatric hospital, 2 rehabilitation hospitals and 2 rehab hospitals. There were also 125 freestanding surgical centers and 21 endoscopy centres in the United States and England. HCA Holdings, Inc. was the company’s former name. HCA Healthcare, Inc. is located in Nashville, Tennessee.

More news about HCA Holdings.

9. Nokia (NOK)

Shares of Nokia slid 2.61% in from $4.72 to $4.60 at 18:21 EST on Monday, after five successive sessions in a row of losses. NYSE is falling 0.53% to $14,938.03, after three successive sessions in a row of losses.

Nokia Oyj offers global mobile, fixed and cloud network solutions. It operates in four business segments, including Mobile Networks and Network Infrastructure as well as Cloud and Network Services and Nokia Technologies. The company offers services and products for radio access networks, including technologies such as 2G and 5G. It also provides microwave radio links to transport networks. The company provides fixed networking solutions, such as fiber and copper-based access infrastructure, and cloud and virtualization services, as well as wi-fi portfolio, including mesh solutions and cloud-based controllers; IP routing solutions for IP aggregation, and edge and core applications for residential, business, mobile, and industrial services; a portfolio of optical networks comprising portfolio coherent optical transponders, optical transport network switchers, wavelength-division multiplexers, reconfigurable optical add-drop multiplexer solutions, and optical line systems for metro access and aggregation, data center interconnect, regional, and long-haul/ultra-long-haul applications; and submarine networks. It also offers core network software, cloud- and cognitive services, business software and enterprise solutions. The company also offers hardware, software and services. It also licenses intellectual property including patents and technologies. The company serves communication service providers, government, cyberscalers and hyperscalers as well as digital industries. Nokia Oyj was established in Estonia in 1865. It is located in Espoo in Finland.

Volatility

Nokia’s last week, last month’s, and last quarter’s current intraday variation average was a negative 0.42%, a positive 0.55%, and a positive 1.92%.

Nokia’s highest amplitude of average volatility was 1.42% (last week), 1.63% (last month), and 1.92% (last quarter).

Annual Top and Bottom Value

Nokia stock was valued at $4.60 as of 18:22 EST. This is way lower than its 52 week high of $6.40, and much higher than its 52-week low at $4.08.

Sales Growth

Nokia sales growth was negative 0.2% in the current quarter, and negative 4.9% the following quarter.

Revenue growth

The year-on-year revenue growth was 15.6%. Now, the figure is 23.88B.

More news about Nokia.

10. Telefonica (TEF)

Shares of Telefonica fell 8.21% in from $3.72 to $3.41 at 18:21 EST on Monday, after four consecutive sessions in a row of losses. NYSE is falling 0.53% to $14,938.03, after three sequential sessions in a row of losses.

Telefonica, S.A., along with its subsidiaries, offers telecommunications services throughout Europe and Latin America. Its services include mobile voice, value-added, mobile data, Internet, wholesale, corporate roaming, fixed wireless, trunking, and paging. Fixed telecommunications services offered by the company include ISDN accesses, PSTN lines, public phone services, local, national, and international fixed-tomobile communications, corporate communications, supplementary value-added service, video telephony, intelligent network, and handset leasing and sales. It also offers broadband multimedia services, including Internet service provider, portal, network, wholesale broadband access and narrowband switched access. High-speed Internet via fibre to home is available as well as voice over Internet protocol. It also offers web hosting, application outsourcing, consultancy, system integration, professional services, as well as leased lines, virtual private networks, fiber optics and web hosting. The company also offers wholesale services to telecommunications operators. These include domestic interconnection, international wholesale services and leased lines, for other operators. It also provides local loop leasing and bit stream services. Wholesale line rental accesses and leased conduits for fiber deployment by other operators. It also offers video/TV services and smart connectivity, as well as consumer IoT products, financial and security services. The company also provides online telemedicine and home insurance as well as music streaming, consumer loans, and financial services. It was founded in Madrid, Spain in 1924.

Revenue growth

The year-over-year revenue growth fell by 0.8%. We now have 39.16B in the 12 trailing months.

Volatility

Telefonica’s last week, last month’s, and last quarter’s current intraday variation average was a negative 0.90%, a negative 0.13%, and a positive 1.66%.

Telefonica’s highest amplitude of average volatility was 1.08% (last week), 1.18% (last month), and 1.66% (last quarter).

Annual Top and Bottom Value

Telefonica stock was valued at $3.41 as of 18:22 EST. This is way lower than its 52-week peak of $5.39, and much higher than its 52 week low of $3.10.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Telefonica’s stock is considered to be overbought (>=80).

More news about Telefonica.

11. Sabre Corporation (SABR)

Shares of Sabre Corporation rose by a staggering 22.09% in from $4.89 to $5.97 at 18:21 EST on Monday, after four sequential sessions in a row of losses. NASDAQ is sliding 1.49% to $10,546.03, after three sequential sessions in a row of losses.

Sabre Corporation provides technology and software solutions to the global travel industry through Sabre Holdings Corporation. The company operates two main segments: Travel Solutions and Hospitality Solutions. It operates in two segments, Travel Solutions and Hospitality Solutions. The Travel Solutions segment is a business to-business marketplace for travel information. This includes inventory, prices and availability of a variety of suppliers including hotels, airlines, cars rental brands, railway companies and cruise lines. There are also travel buyers that include travel managers, corporate travel departments, online travel agencies and travel management firms. This segment also provides a portfolio of software technology products and solutions through software-as-a-service (SaaS) and hosted delivery models to airlines and other travel suppliers. These products include reservations systems for airlines, commercial and operation products, agency solutions and data-driven Intelligence solutions. Hospitality Solutions provides software and services to hotels through hosted delivery and SaaS. Sabre Corporation was founded in 2006, and its headquarters are in Southlake Texas.

Yearly Top and Bottom Value

Sabre Corporation’s stock is valued at $5.97 at 18:22 EST, way under its 52-week high of $12.08 and way higher than its 52-week low of $4.46.

Sales Growth

Sabre Corporation saw a 59.2% increase in sales for its current quarter, and a 44.5% rise for the next.

Volatility

Sabre Corporation’s last week, last month’s, and last quarter’s current intraday variation average was 0.40%, 0.45%, and 4.07%.

Sabre Corporation’s highest amplitude of average volatility was 2.81% (last week), 3.63% (last month), and 4.07% (last quarter).

Revenue Growth

Year-on-year quarterly revenue growth grew by 56.7%, now sitting on 2.18B for the twelve trailing months.

More news about Sabre Corporation.

12. Celsius Holdings (CELH)

Shares of Celsius Holdings rose 9.79% in from $96.53 to $105.98 at 18:21 EST on Monday, after two sequential sessions in a row of gains. NASDAQ is sliding 1.49% to $10,546.03, after three consecutive sessions in a row of losses.

Celsius Holdings, Inc. produces, markets, distributes, sells and services liquid supplements and functional drinks in North America, Europe, Asia, the Middle East, and beyond. Under the CELSIUS Originals brand, it offers a variety of carbonated and uncarbonated functional energy beverages; dietary supplements in carbonated flavours, such as apple jack’d and orangesicle; tangerine grapefruit and jackfruit; and functional energy drink with branched chain amino acids that aids in muscle recovery, under the CELSIUS BCCA+ENERGY trademark. CELSIUS ON-the-GO, which is a powdered version of active ingredients found in functional energy beverages, can be purchased in On-The-Go containers and individual packets. There are also sparkling grapefruit, cucumber lime and orange pomegranate as well as non-carbonated functional drinks such as CELSIUS sweetened, pineapple coconut and watermelon. Direct-to-store distribution distributors distribute its products. In January 2007, Celsius Holdings, Inc. was established. Celsius Holdings, Inc., was established in 2004. It is located in Boca Raton, Florida.

Growth Estimates Quarters

For the current quarter, the company expects to grow by 233.3% and 13.3% respectively.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Celsius Holdings is overbought (>=80).

More news about Celsius Holdings.

13. Petroleo Brasileiro (PBR)

Shares of Petroleo Brasileiro fell by a staggering 17.93% in from $11.76 to $9.65 at 18:21 EST on Monday, after two sequential sessions in a row of losses. NYSE is falling 0.53% to $14,938.03, after three successive sessions in a row of losses.

Petroleo Brasileiro S.A.- Petrobras is a Brazilian company that explores, produces and markets oil and natural gas both in Brazil and abroad. Exploration and Production; Refining, Transportation and Marketing; Gas and Power; and Corporate and other Businesses are the segments of the company. The company engages in the prospecting, drilling and refining of crude oil, along with oil products and natural gas. The Exploration and Production section explores and develops crude oil and natural gas liquids. This natural gas is primarily used to supply domestic refineries. Refining, Transportation and Marketing is involved in refining, logistic, transport, and marketing crude oil and other oil products. It also exports ethanol. The segment holds interests in petrochemical and shale companies. Gas and Power is engaged in logistics and trade of natural gas and electric; transport and trading in LNG; generation and transmission of electricity via thermoelectric power stations; and holding rights in distribution and transportation of natural gas. Corporate and Other Businesses produces and distributes biodiesel and co-products and ethanol. Petroleo Brasileiro S.A. was established in 1953. It is located in Rio de Janeiro in Brazil.

More news about Petroleo Brasileiro.