(VIANEWS) – Today, the Innrs artificial intelligence algorithm suggests a high probability of discovering the approximate price for tomorrow of LyondellBasell LYB, Verizon VZ and others.

Via News will regularly fact-check this AI algorithm that aims to consistently predict the next session price and next week’s trend of financial assets.

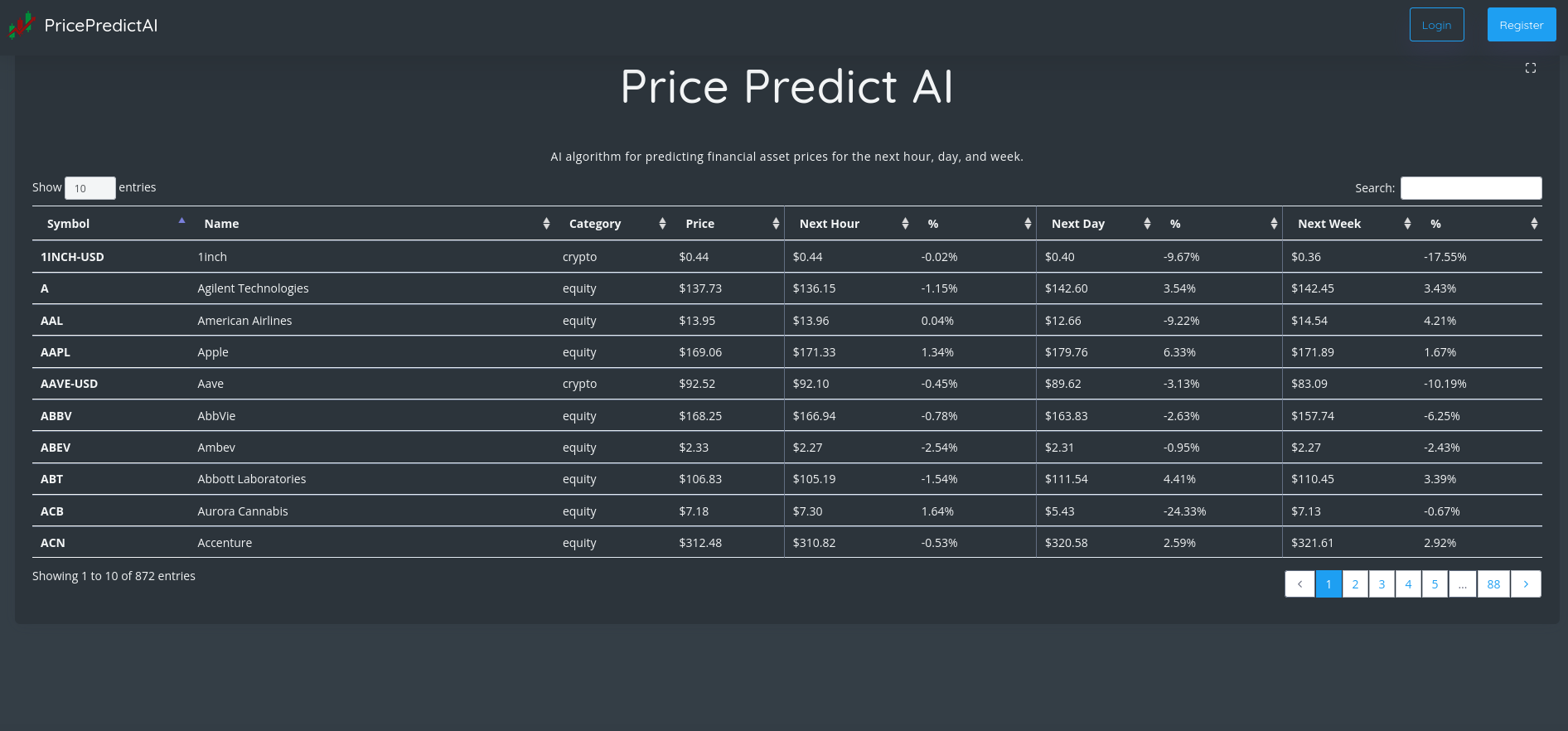

Innrs provides A.I.-based statistical tools to help investors make decisions. The table below shows the financial assets predicting price, ordered by the highest expected accuracy.

Innrs officials say this tool helps investors make better-informed decisions, supposedly used alongside other relevant financial information and the specific trader strategy.

In the next session, Via News will report the finding on the algorithm precision.

| Financial Asset | Accuracy | Close Price | Prediction |

|---|---|---|---|

| LyondellBasell (LYB) | 94.37% | $90.28 | ⇧ $90.47 |

| Verizon (VZ) | 94.19% | $42.29 | ⇧ $42.75 |

| General Motors (GM) | 94.1% | $35.9 | ⇧ $36.58 |

| Laboratory Corporation of America Holdings (LH) | 93.57% | $242.85 | ⇧ $248.79 |

| Booking Holdings (BKNG) | 93.52% | $2191.2 | ⇧ $2245.78 |

| E.I. du Pont de Nemours and Company (DD) | 93.47% | $72.49 | ⇧ $73.71 |

| JP Morgan Chase (JPM) | 93.4% | $138 | ⇧ $142.37 |

| V.F. Corporation (VFC) | 93.1% | $29.47 | ⇧ $29.75 |

| Super Micro Computer (SMCI) | 89.35% | $84.92 | ⇧ $87.72 |

| Cognizant Technology Solutions (CTSH) | 89.33% | $59.78 | ⇧ $60.95 |

| Hasbro (HAS) | 89.09% | $64.89 | ⇧ $66.67 |

| Burlington Stores (BURL) | 89.05% | $224.77 | ⇧ $226.73 |

| AT&T (T) | 89.04% | $19.58 | ⇧ $19.72 |

| Bank of America (BAC) | 89.03% | $34.38 | ⇧ $34.95 |

| Trimble (TRMB) | 88.98% | $51.42 | ⇧ $52.35 |

| Baxter International (BAX) | 88.94% | $48.59 | ⇧ $50.37 |

| Capital One Financial (COF) | 88.9% | $96.99 | ⇧ $97.69 |

| JD.com (JD) | 88.89% | $64.27 | ⇧ $64.33 |

| Logitech (LOGI) | 88.87% | $65.93 | ⇧ $67.37 |

| Magna International (MGA) | 88.84% | $61.48 | ⇧ $63.08 |

| Southern Copper (SCCO) | 88.75% | $67.6 | ⇧ $69.94 |

| Expedia Group (EXPE) | 88.56% | $94.18 | ⇧ $95.21 |

| NewMarket (NEU) | 88.55% | $335.56 | ⇧ $346.8 |

| Cisco (CSCO) | 88.5% | $48.33 | ⇧ $49.16 |

| Rogers Communication (RCI) | 88.48% | $47.56 | ⇧ $48.36 |

1. LyondellBasell (LYB)

Shares of LyondellBasell jumped by a staggering 11% in from $81.33 to $90.28 at 18:21 EST on Friday, after five sequential sessions in a row of gains. NYSE is jumping 2.06% to $15,539.74, following the last session’s downward trend.

LyondellBasell Industries N.V. is a chemical company that operates in the United States of America, Mexico, Italy Poland, France and Japan. It also has operations internationally. The company operates in six segments: Olefins and Polyolefins–Americas; Olefins and Polyolefins–Europe, Asia, International; Intermediates and Derivatives; Advanced Polymer Solutions; Refining; and Technology. The company produces and markets co-products, olefins, polyolefins, polyethylene products. These include high, medium, and low density polyethylenes, as well as linear, low density polyethylenes. It also makes polypropylene products such as copolymers and homopolymers. It also manufactures and markets propylene oxide, its derivatives, oxyfuels, and related products. The intermediate chemicals include styrene monomers and copolymers as well as acetyls and ethylene glycols. It also produces and markets solutions such as engineered plastics and masterbatches; engineered composites and colors; advanced polymers and other compounds. The company also refines crude oil from different sources to make gasoline, distillates and chemicals. It develops and licenses process technology for chemical and polyolefins; manufactures and markets polyolefin catalysts. LyondellBasell Industries N.V., which was established in 2009 is located in Houston.

Sales Growth

LyondellBasell sales growth was negative 1.5% in the current quarter, and negative 7.1% the following.

Annual Top and Bottom Value

LyondellBasell stock was valued at $90.28 as of 18:21 EST. This is lower than the 52-week high $117.22, and much higher than the 52-week low $71.46.

Growth Estimates Quarters

The company’s growth estimates for the ongoing quarter and the next is a negative 45.9% and a negative 42.1%, respectively.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

LyondellBasell’s stock is considered to be oversold (<=20).

More news about LyondellBasell.

2. Verizon (VZ)

Shares of Verizon jumped by a staggering 14.36% in from $36.98 to $42.29 at 18:21 EST on Friday, after five sequential sessions in a row of gains. NYSE is rising 2.06% to $15,539.74, following the last session’s downward trend.

Verizon Communications Inc. offers technology, entertainment, information and communications products and services worldwide through its subsidiaries. The Consumer segment offers postpaid and pre-paid service plans, internet access on laptop computers and tablets, wireless equipment including smartphones and other devices; as well as wireless-enabled devices such tablets and smart watches. The company also offers residential fixed connectivity services, including internet, voice, and video; as well as selling network access to mobile virtual networks operators. It had approximately 115,000,000 wireless retail connections and 7 million wireline broadband connections. There were also 4 million Fios videos connections. Its business segment offers network connectivity products such as private networking, private cloud connectivity and virtual and software-defined networking. The segment offers management and security services as well as domestic and international voice and data services. These include voice calling, messaging, call center solutions and private lines and access networks. It also provides customer equipment, installation, maintenance and site services. It had 477 000 wireline broadband connections, and approximately 27,000,000 wireless retail postpaid connections as of December 31, 2021. The original name of the company was Bell Atlantic Corporation. In June 2000, Verizon Communications Inc. took over its business. Verizon Communications Inc. was founded in 1983. It is located in New York, New York.

Revenue growth

The year-over-year growth in quarterly revenue was 0.1%. We now have 134.33B dollars for the 12 trailing months.

Volatility

Verizon’s intraday variation average for the week and quarter ended last week at 0.76%. It was also 0.17% and 1.21% respectively.

Verizon had the highest average volatility amplitude at 0.76%, 1.03% and 1.21% respectively in last week, quarter and month.

Annual Top and Bottom Value

Verizon stock was valued at $42.29 as of 18:21 EST. This is lower than its 52 week high of $55.51 but higher than its low 52-week of $39.11.

More news about Verizon.

3. General Motors (GM)

Shares of General Motors fell 6.43% in from $38.37 to $35.90 at 18:21 EST on Friday, after three successive sessions in a row of gains. NYSE is rising 2.06% to $15,539.74, following the last session’s downward trend.

General Motors Company designs, builds, and sells trucks, crossovers, cars, and automobile parts and accessories in North America, the Asia Pacific, the Middle East, Africa, South America, the United States, and China. The company operates through GM North America, GM International, Cruise, and GM Financial segments. It markets its vehicles primarily under the Buick, Cadillac, Chevrolet, GMC, Holden, Baojun, and Wuling brand names. The company also sells trucks, crossovers, cars, and purpose-built vehicles to dealers for consumer retail sales, as well as to fleet customers, including daily rental car companies, commercial fleet customers, leasing companies, and governments. In addition, it offers safety and security services for retail and fleet customers, including automatic crash response, emergency services, roadside assistance, crisis assist, stolen vehicle assistance, and turn-by-turn navigation; and connected services comprising mobile applications for owners to remotely control their vehicles and electric vehicle owners to locate charging stations, on-demand vehicle diagnostics, smart driver, marketplace in-vehicle commerce, in-vehicle voice, voice assistant, navigation and app ecosystem, connected navigation, SiriusXM with 360L, and 4G LTE wireless connectivity, as well as develops and commercializes autonomous vehicle technology. Further, the company provides automotive financing and insurance services; and software-enabled services and subscriptions. General Motors Company was founded in 1908 and is headquartered in Detroit, Michigan.

Volatility

General Motors’s last week, last month’s, and last quarter’s current intraday variation average was a positive 1.32%, a negative 0.85%, and a positive 1.77%.

General Motors’s highest amplitude of average volatility was 1.38% (last week), 1.75% (last month), and 1.77% (last quarter).

More news about General Motors.

4. Laboratory Corporation of America Holdings (LH)

Shares of Laboratory Corporation of America Holdings jumped 3.14% in from $235.46 to $242.85 at 18:21 EST on Friday, after five consecutive sessions in a row of gains. NYSE is rising 2.06% to $15,539.74, following the last session’s downward trend.

Laboratory Corporation of America Holdings is a worldwide life science company. It provides crucial information that helps doctors, nurses, pharmacist companies, researchers and patients to make informed decisions. Labcorp Diagnostics is (Dx), and Labcorp Drug Development(DD) are its two main segments. There are many tests it offers, including blood chemistry, blood cell counts and urinalysis, blood cell counts and thyroid testing. It also provides tests such as PAP and hemoglobin tests. Labcorp Drug Development (DD) is its two-part segment. It also offers specialty testing, which includes gene-based or esoteric tests; advanced testing targets specific diseases such as anatomic pathology/oncology and cardiovascular disease. Online and mobile apps are available to patients for checking test results. There is also an online application that can be used by managed care and accountable organizations. The company offers complete drug, medical, and companion diagnostic solutions, from the early stages of research through clinical development and access to commercial markets. Managed care companies, pharmaceutical, biotechnology and medical device, diagnostics firms, government agencies, doctors and other healthcare providers as well as hospitals and health system employers, consumers, contractors research organisations and independent clinical labs, are all served. Laboratory Corporation of America Holdings and Tigerlily Foundation have a collaborative agreement to expand the number of women of color participating in clinical trials. This company was founded in 1994, and its headquarters are in Burlington (North Carolina).

Growth Estimates Quarters

For the current quarter, the company expects a decline of 33.2% in growth and 31.4% for the next.

Moving Average

Laboratory Corporation of America Holdings is worth more than its moving average of $226.10 for 50 days and greater than its moving average of £242.52 for 200 days.

More news about Laboratory Corporation of America Holdings.

5. Booking Holdings (BKNG)

Shares of Booking Holdings rose 9.12% in from $2008.06 to $2,191.20 at 18:21 EST on Friday, after five successive sessions in a row of gains. NASDAQ is jumping 2.56% to $10,569.29, following the last session’s downward trend.

Booking Holdings Inc. offers online reservations for travel and restaurants worldwide. Booking.com offers accommodation bookings online; Rentalcars.com provides rental car services online; Priceline which allows customers to make travel reservations online for hotel, flight and rental cars. Agoda, which offers online accommodations reservation, flight, ground transport, and activity reservation services, is also available. KAYAK is an online price comparison site that lets consumers search for and compare prices on travel itineraries. This includes information about rental cars, airline tickets, hotel reservations, and accommodation. OpenTable allows customers to book online restaurants. It also offers insurance and management services for consumers and travel service providers. The original name of the company was The Priceline Group Inc., but it changed its name in February 2018 to Booking Holdings Inc. It was established in 1997. The headquarters are located in Norwalk in Connecticut.

Sales Growth

Booking Holdings has a 37.7% and 31.1% sales growth for the current quarters.

Average Moving

Booking Holdings is worth more than its $50-day average value of $1947.68, and much higher than its $200-day average of $1983.90.

More news about Booking Holdings.

6. E.I. du Pont de Nemours and Company (DD)

Shares of E.I. du Pont de Nemours and Company jumped 3.87% in from $69.79 to $72.49 at 18:21 EST on Friday, after five consecutive sessions in a row of gains. NYSE is rising 2.06% to $15,539.74, following the last session’s downward trend.

DuPont de Nemours, Inc. provides technology-based materials and solutions in the United States, Canada, the Asia Pacific, Latin America, Europe, the Middle East, and Africa. It operates through three segments: Electronics & Industrial, Mobility & Materials, and Water & Protection. The Electronics & Industrial segment supplies materials and printing systems to the advanced printing industry; and materials and solutions for the fabrication of semiconductors and integrated circuits addressing front-end and back-end of the manufacturing process. This segment also provides semiconductor and advanced packaging materials; dielectric and metallization solutions for chip packaging; and silicones for light emitting diode packaging and semiconductor applications; permanent and process chemistries for the fabrication of printed circuit boards to include laminates and substrates, electroless, and electrolytic metallization solutions, as well as patterning solutions, and materials and metallization processes for metal finishing, decorative, and industrial applications. In addition, it offers various materials to manufacture rigid and flexible displays for organic light emitting diode, and other display applications, as well as provides high performance parts, and specialty silicone elastomers, and lubricants. The Mobility & Materials segment provides engineering resins, silicone encapsulants, pastes, filaments, and advanced films to engineers and designers in the transportation, electronics, renewable energy, industrial, and consumer end-markets. The Water & Protection segment provides engineered products and integrated systems for worker safety, water purification and separation, transportation, energy, medical packaging and building materials. The company was formerly known as DowDuPont Inc. and changed its name to DuPont de Nemours, Inc. in June 2019. DuPont de Nemours, Inc. is headquartered in Wilmington, Delaware.

Revenue Growth

Year-on-year quarterly revenue growth grew by 7%, now sitting on 17.13B for the twelve trailing months.

More news about E.I. du Pont de Nemours and Company.

7. JP Morgan Chase (JPM)

Shares of JP Morgan Chase rose 4.1% in from $132.56 to $138.00 at 18:21 EST on Friday, following the last session’s downward trend. NYSE is rising 2.06% to $15,539.74, following the last session’s downward trend.

JPMorgan Chase & Co. operates as a financial services company worldwide. It operates through four segments: Consumer & Community Banking (CCB), Corporate & Investment Bank (CIB), Commercial Banking (CB), and Asset & Wealth Management (AWM). The CCB segment offers s deposit, investment and lending products, payments, and services to consumers; lending, deposit, and cash management and payment solutions to small businesses; mortgage origination and servicing activities; residential mortgages and home equity loans; and credit card, auto loan, and leasing services. The CIB segment provides investment banking products and services, including corporate strategy and structure advisory, and equity and debt markets capital-raising services, as well as loan origination and syndication; payments and cross-border financing; and cash and derivative instruments, risk management solutions, prime brokerage, and research. This segment also offers securities services, including custody, fund accounting and administration, and securities lending products for asset managers, insurance companies, and public and private investment funds. The CB segment provides financial solutions, including lending, payments, investment banking, and asset management to small business, large and midsized companies, local governments, and nonprofit clients; and commercial real estate banking services to investors, developers, and owners of multifamily, office, retail, industrial, and affordable housing properties. The AWM segment offers multi-asset investment management solutions in equities, fixed income, alternatives, and money market funds to institutional clients and retail investors; and retirement products and services, brokerage, custody, trusts and estates, loans, mortgages, deposits, and investment management products. The company also provides ATM, online and mobile, and telephone banking services. JPMorgan Chase & Co. was founded in 1799 and is headquartered in New York, New York.

More news about JP Morgan Chase.

8. V.F. Corporation (VFC)

Shares of V.F. Corporation rose 2.83% in from $28.66 to $29.47 at 18:21 EST on Friday, after two consecutive sessions in a row of losses. NYSE is rising 2.06% to $15,539.74, following the last session’s downward trend.

V.F. V.F. The company operates in three main segments, Outdoor, Active and Work. It offers outdoor, casual, merino wool, and lifestyle clothing; footwear; equipment and accessories. The company also makes protective footwear, handbags and luggage as well as lifestyle and lifestyle footwear and apparel. The company sells its products under the Timberland and Smartwool brand names. It sells products to specialty shops, department stores and national chains as well as mass merchants. V.F. Corporation was established in 1899. It is located in Denver, Colorado.

More news about V.F. Corporation.

9. Super Micro Computer (SMCI)

Shares of Super Micro Computer dropped 0.79% in from $85.6 to $84.92 at 18:21 EST on Friday, after two successive sessions in a row of losses. NASDAQ is jumping 2.56% to $10,569.29, following the last session’s downward trend.

Super Micro Computer, Inc., along with its affiliates, designs and produces high-performance storage and server solutions that are modular and open-architecture. The company’s products include complete servers and storage as well as modular blade servers, workstations as well as full racks. It also offers server management software as server sub-systems. The company also provides application-optimized server solutions, including rackmount and blade servers, storage systems, and subsystems and accessories; and server software management solutions, such as Server Management Suite, including Supermicro Server Manager, Supermicro Power Management software, Supermicro Update Manager, SuperCloud Composer, and SuperDoctor 5. It also offers accessories and subsystems for server systems, including power supplies and chassis. The company also offers server system configuration and upgrade services. It also provides technical documentation. It also offers on-site and help desk support for server and storage system; as well as customer support, which includes ongoing maintenance and technical support. It sells its products to enterprises, edge computing markets, cloud computing and artificial intelligence. The company sells products via direct sales and indirect sales, as well as distributors and value-added resellers. It primarily operates internationally, in America, Europe and Asia. Super Micro Computer, Inc., was founded in 1993. Its headquarters are in San Jose, California.

Yearly Top and Bottom Value

Super Micro Computer’s stock is valued at $84.92 at 18:22 EST, way below its 52-week high of $95.22 and way higher than its 52-week low of $34.11.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Super Micro Computer stock considered overbought (>=80).

More news about Super Micro Computer.

10. Cognizant Technology Solutions (CTSH)

Shares of Cognizant Technology Solutions jumped 0.84% in from $59.28 to $59.78 at 18:21 EST on Friday, following the last session’s downward trend. NASDAQ is rising 2.56% to $10,569.29, following the last session’s downward trend.

Cognizant Technology Solutions Corporation, a professional services company, provides consulting and technology, and outsourcing services in North America, Europe, and internationally. It operates through four segments: Financial Services; Healthcare; Products and Resources; and Communications, Media and Technology. The company offers customer experience enhancement, robotic process automation, analytics, and AI services in areas, such as digital lending, fraud detection, and next generation payments; the shift towards consumerism, outcome-based contracting, digital health, delivering integrated seamless, omni-channel, and patient-centered experience; and services that drive operational improvements in areas, such as clinical development, pharmacovigilance, and manufacturing, as well as claims processing, enrollment, membership, and billing to healthcare providers and payers, and life sciences companies, including pharmaceutical, biotech, and medical device companies. It also provides solution to manufacturers, retailers and travel and hospitality companies, as well as companies providing logistics, energy and utility services; and digital content, the creation of personalized user experience, and acceleration of digital engineering services to information, media and entertainment, and communications and technology companies. The company was founded in 1994 and is headquartered in Teaneck, New Jersey.

Sales Growth

Cognizant Technology Solutions’s sales growth is negative 0.6% for the current quarter and 1.3% for the next.

Volatility

The last week’s and quarter’s intraday variations averages for Cognizant Technology Solutions were positive 0.54% and negative 0.20% respectively.

Cognizant Technology Solutions had the highest average volatility amplitude at 0.54%, 1.09% and 1.66% respectively.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Cognizant Technology Solutions’s stock is considered to be overbought (>=80).

Moving Average

Cognizant Technology Solutions is worth more than its moving average 50 days of $58.53 but less than its moving average 200 days of $68.19.

More news about Cognizant Technology Solutions.

11. Hasbro (HAS)

Shares of Hasbro jumped 8.1% in from $60.03 to $64.89 at 18:21 EST on Friday, after five sequential sessions in a row of gains. NASDAQ is rising 2.56% to $10,569.29, following the last session’s downward trend.

Hasbro, Inc., along with its affiliates, is a play-and-entertainment company. The company’s Consumer Products division focuses on the marketing and sourcing of toys and games. The segment promotes brands by allowing third parties to out-license trademarks and characters. This is done through the sales of consumer goods such as apparels and toys. Toys and games it offers include toys and games such as action figures, crafts, creative play products and fashion, other dolls and play sets, pre-school toys, plush toys, sport action blasters, accessories, vehicles, toys-related specialty items, games and licensed products. These products can be apparels, publications, electronics and home goods, or toys. Its Wizards of the Coast segment and Digital Gaming segment promotes its brands by developing trading cards, role-playing and digital games experiences that are based on Wizards of the Coast. The Entertainment segment develops, produces, distributes, and sells world-class entertainment content. This includes film, television scripted or unscripted, family programming and digital entertainment. It sells products directly to customers through its e-commerce site Hasbro PULSE. Hasbro, Inc. was established in Pawtucket, Rhode Island in 1923.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Hasbro stock considered oversold (=20).

Moving Average

Hasbro’s worth is above its 50-day moving average of $61.06 and way below its 200-day moving average of $76.55.

Volatility

The intraday variation average for Hasbro in the last week, last year, and quarter was 1.24%. 0.24% and 1.88%, respectively.

Hasbro had the highest average volatility amplitudes: 1.24% last week, 1.63% last month and 1.88% in the quarter.

More news about Hasbro.

12. Burlington Stores (BURL)

Shares of Burlington Stores rose by a staggering 13.33% in from $198.33 to $224.77 at 18:21 EST on Friday, after five successive sessions in a row of gains. NYSE is jumping 2.06% to $15,539.74, following the last session’s downward trend.

Burlington Stores, Inc. is a US retailer for branded apparel. It offers fashion-focused merchandise such as women’s ready to wear apparel, menswear and youth apparel as well as footwear, accessories and toys. It had 837 stores operating under its Burlington Stores brand, 2 under Cohoes Fashions, 1 under the MJM Designer Shoes brand in 45 US states and Puerto Rico. Burlington Stores, Inc., was established in 1972. It is located in Burlington, New Jersey.

Growth Estimates Quarters

The company’s growth estimates for the ongoing quarter is a negative 61.8% and positive 4.3% for the next.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Burlington Stores’s stock is considered to be oversold (<=20).

Annual Top and Bottom Value

Burlington Stores stock was valued at $224.77 as of 18:22 EST. This is way below its 52 week high of $295.30, and far above its 52 week low of $106.47.

Sales Growth

Burlington Stores’s sales growth for the next quarter is negative 0.6%.

More news about Burlington Stores.

13. AT&T (T)

Shares of AT&T rose 2.78% in from $19.05 to $19.58 at 18:21 EST on Friday, after five successive sessions in a row of gains. NYSE is rising 2.06% to $15,539.74, following the last session’s downward trend.

AT&T Inc. provides telecommunications, media, and technology services worldwide. Its Communications segment offers wireless voice and data communications services; and sells handsets, wireless data cards, wireless computing devices, and carrying cases and hands-free devices through its own company-owned stores, agents, and third-party retail stores. It also provides data, voice, security, cloud solutions, outsourcing, and managed and professional services, as well as customer premises equipment for multinational corporations, small and mid-sized businesses, governmental, and wholesale customers. In addition, this segment offers broadband fiber and legacy telephony voice communication services to residential customers. It markets its communications services and products under the AT&T, Cricket, AT&T PREPAID, and AT&T Fiber brand names. The company's Latin America segment provides wireless services in Mexico; and video services in Latin America. This segment markets its services and products under the AT&T and Unefon brand names. The company was formerly known as SBC Communications Inc. and changed its name to AT&T Inc. in 2005. AT&T Inc. was incorporated in 1983 and is headquartered in Dallas, Texas.

Moving Average

AT&T’s worth is above its 50-day moving average of $18.00 and higher than its 200-day moving average of $18.59.

Sales Growth

AT&T’s sales growth is negative 23.1% for the present quarter and 2.4% for the next.

Volatility

AT&T’s last week, last month’s, and last quarter’s current intraday variation average was a negative 0.25%, a negative 0.30%, and a positive 1.31%.

AT&T’s highest amplitude of average volatility was 1.07% (last week), 1.09% (last month), and 1.31% (last quarter).

More news about AT&T.

14. Bank of America (BAC)

Shares of Bank of America jumped 6.18% in from $32.38 to $34.38 at 18:21 EST on Friday, following the last session’s downward trend. NYSE is jumping 2.06% to $15,539.74, following the last session’s downward trend.

Deutsche bank reduces JPMorgan; Bank of America will hold on to buy

Analysts reduced the Bank of America’s share price to $36 per share, down from $45/share. JPMorgan’s share price target was cut to $145/share from $155. Bank of America shares have fallen 28.7% over the last 12 months. JPMorgan stock has dropped 17%, and S&P 500 stocks are off 17.6%.

Bank of America Corporation, through its subsidiaries, provides banking and financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide. Its Consumer Banking segment offers traditional and money market savings accounts, certificates of deposit and IRAs, noninterest-and interest-bearing checking accounts, and investment accounts and products; and credit and debit cards, residential mortgages, and home equity loans, as well as direct and indirect loans, such as automotive, recreational vehicle, and consumer personal loans. The company's Global Wealth & Investment Management segment offers investment management, brokerage, banking, and trust and retirement products and services; and wealth management solutions, as well as customized solutions, including specialty asset management services. Its Global Banking segment provides lending products and services, including commercial loans, leases, commitment facilities, trade finance, and commercial real estate and asset-based lending; treasury solutions, such as treasury management, foreign exchange, and short-term investing options and merchant services; working capital management solutions; and debt and equity underwriting and distribution, and merger-related and other advisory services. The company's Global Markets segment offers market-making, financing, securities clearing, settlement, and custody services, as well as risk management products using interest rate, equity, credit, currency and commodity derivatives, foreign exchange, fixed-income, and mortgage-related products. As of December 31, 2021, it served approximately 67 million consumer and small business clients with approximately 4,200 retail financial centers; approximately 16,000 ATMs; and digital banking platforms with approximately 41 million active users. The company was founded in 1784 and is based in Charlotte, North Carolina.

More news about Bank of America.

15. Trimble (TRMB)

Shares of Trimble slid by a staggering 12.19% in from $58.56 to $51.42 at 18:21 EST on Friday, following the last session’s downward trend. NASDAQ is jumping 2.56% to $10,569.29, following the last session’s downward trend.

Trimble Inc. provides technology solutions that enable professionals and field mobile workers to enhance or transform their work processes worldwide. The company's Buildings and Infrastructure segment offers field and office software for route selection and design; systems to guide and control construction equipment; software for 3D design and data sharing; systems to monitor, track, and manage assets, equipment, and workers; software to share and communicate data; program management solutions for construction owners; 3D conceptual design and modeling software; building information modeling software; enterprise resource planning, project management, and project collaboration solutions; integrated site layout and measurement systems; cost estimating, scheduling, and project controls solutions; and applications for sub-contractors and trades. Its Geospatial segment provides surveying and geospatial products, and geographic information systems. The company's Resources and Utilities segment offers precision agriculture products and services, such as guidance and positioning systems, including autonomous steering systems, automated and variable-rate application and technology systems, and information management solutions; manual and automated navigation guidance for tractors and other farm equipment; solutions to automate application of pesticide and seeding; water solutions; and agricultural software. Its Transportation segment offers solutions for long haul trucking and freight shipper markets; mobility solutions comprising route management, safety and compliance, end-to-end vehicle management, video intelligence, and supply chain communications; and fleet and transportation management systems, analytics, routing, mapping, reporting, and predictive modeling solutions. The company was formerly known as Trimble Navigation Limited and changed its name to Trimble Inc. in October 2016. Trimble Inc. was founded in 1978 and is headquartered in Westminster, Colorado.

Moving Average

Trimble’s worth is below its 50-day moving average of $55.87 and way below its 200-day moving average of $62.06.

Yearly Top and Bottom Value

Trimble’s stock is valued at $51.42 at 18:22 EST, way under its 52-week high of $88.06 and above its 52-week low of $47.52.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Trimble’s stock is considered to be overbought (>=80).

Revenue Growth

Year-on-year quarterly revenue growth declined by 0.4%, now sitting on 3.76B for the twelve trailing months.

More news about Trimble.

16. Baxter International (BAX)

Shares of Baxter International dropped 8.17% in from $52.91 to $48.59 at 18:21 EST on Friday, after three consecutive sessions in a row of gains. NYSE is jumping 2.06% to $15,539.74, following the last session’s downward trend.

Baxter International Inc. and its subsidiaries develop and provide a range of healthcare products around the world. It offers intravenous dialysis and hemolysis as well as additional therapies and services. The company also offers connected care services, which include devices, software and communications; integrated patient monitoring, diagnostic technologies and technologies for diagnosing, treating, and managing various illnesses and diseases. These technologies include respiratory therapy, cardiac screening and vision screening; and surgical video technologies. It can provide tables, lighting, pendants and precision positioning devices as well as other accessories. The company also offers contract services to several pharmaceutical and biopharmaceutical businesses. The company’s products can be found in hospitals, dialysis centers and nursing homes as well as rehabilitation centers, doctor’s offices, clinics, private practices, and at-home patients under medical supervision. It sells products via direct sales, independent distributors and drug wholesalers. Celerity Pharmaceutical, LLC has signed an agreement to create oncolytic and acute care generic injectable premixes. Baxter International Inc., which was founded in 1931, is located in Deerfield Illinois.

Volatility

Baxter International’s last week, last month’s, and last quarter’s current intraday variation average was a positive 0.45%, a negative 0.21%, and a positive 1.53%.

Baxter International’s highest amplitude of average volatility was 0.65% (last week), 1.05% (last month), and 1.53% (last quarter).

Yearly Top and Bottom Value

Baxter International’s stock is valued at $48.59 at 18:22 EST, under its 52-week low of $49.00.

More news about Baxter International.

17. Capital One Financial (COF)

Shares of Capital One Financial jumped 3.84% in from $93.4 to $96.99 at 18:21 EST on Friday, following the last session’s downward trend. NYSE is rising 2.06% to $15,539.74, following the last session’s downward trend.

Capital One Financial Corporation operates as the financial services holding company for the Capital One Bank (USA), National Association; and Capital One, National Association, which provides various financial products and services in the United States, Canada, and the United Kingdom. It operates through three segments: Credit Card, Consumer Banking, and Commercial Banking. The company accepts checking accounts, money market deposits, negotiable order of withdrawals, savings deposits, and time deposits. Its loan products include credit card loans; auto and retail banking loans; and commercial and multifamily real estate, and commercial and industrial loans. The company also offers credit and debit card products; online direct banking services; and treasury management and depository services. It serves consumers, small businesses, and commercial clients through digital channels, branches, cafés, and other distribution channels located in New York, Louisiana, Texas, Maryland, Virginia, New Jersey, and California. Capital One Financial Corporation was founded in 1988 and is headquartered in McLean, Virginia.

Moving Average

Capital One Financial is worth less than its moving average for 50 days of $99.30, and much lower than its moving average for 200 days of $111.23.

Sales Growth

Capital One Financial’s sales growth is 8.2% for the current quarter and 5.7% for the next.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Capital One Financial stock is oversold (=20).

More news about Capital One Financial.

18. JD.com (JD)

Shares of JD.com jumped 6.48% in from $60.36 to $64.27 at 18:21 EST on Friday, following the last session’s downward trend. NASDAQ is rising 2.56% to $10,569.29, following the last session’s downward trend.

JD.com, Inc. provides supply chain-based technologies and services in the People's Republic of China. The company offers computers, communication, and consumer electronics products, as well as home appliances; and general merchandise products comprising food, beverage and fresh produce, baby and maternity products, furniture and household goods, cosmetics and other personal care items, pharmaceutical and healthcare products, books, automobile accessories, apparel and footwear, bags, and jewelry. It also provides online marketplace services for third-party merchants; marketing services; and omni-channel solutions to customers and offline retailers, as well as online healthcare services. In addition, the company develops, owns, and manages its logistics facilities and other real estate properties to support third parties; and provides asset management services for logistics property investors. Further, it provides integrated data, technology, business, and user management industry solutions to support the digitization of enterprises and institutions. The company was formerly known as 360buy Jingdong Inc. and changed its name to JD.com, Inc. in January 2014. JD.com, Inc. was incorporated in 2006 and is headquartered in Beijing, the People's Republic of China.

Revenue Growth

Year-on-year quarterly revenue growth grew by 5.4%, now sitting on 1T for the twelve trailing months.

Moving Average

JD.com is worth more than its moving average 50 days of $51.11 or its moving average 200 days of $56.09.

More news about JD.com.

19. Logitech (LOGI)

Shares of Logitech rose 9.57% in from $60.17 to $65.93 at 18:21 EST on Friday, after three sequential sessions in a row of gains. NASDAQ is jumping 2.56% to $10,569.29, following the last session’s downward trend.

Logitech International S.A. designs, produces, and markets products worldwide that enable people to connect with digital and cloud services through its subsidiaries. It offers wireless pointing devices such as a corded or cordless mouse, corded keyboards and living room keyboards as well as keyboards and accessories for smartphones and tablets. The company also offers keyboards, mice and headsets as well as simulation products such as flight sticks and steering wheels for gamers and video conferencing products such as ConferenceCams. ConferenceCams combines enterprise-quality audio with high-definition videos to provide video conferencing for businesses of all sizes; headsets and webcams that transform desktops into collaborative spaces; and controllers for video conference room solutions. The company also offers wireless Bluetooth speakers and Wi-Fi speakers as well as mobile and in-ear Bluetooth headphones and microphones. It can also provide home entertainment controllers and security cameras. The company’s channel network includes retailers, online sellers, mass merchants, wholesalers and retail outlets. Logitech G and ASTRO Gaming are the brands used by this company. Logitech International S.A. is located in Lausanne in Switzerland and was founded in 1981.

Yearly Top and Bottom Value

Logitech’s stock is valued at $65.93 at 18:23 EST, way under its 52-week high of $87.57 and way higher than its 52-week low of $41.81.

Volatility

Logitech’s last week, last month’s, and last quarter’s current intraday variation average was 0.95%, 0.33%, and 2.09%.

Logitech’s highest amplitude of average volatility was 0.95% (last week), 1.44% (last month), and 2.09% (last quarter).

Revenue Growth

Year-on-year quarterly revenue growth declined by 11.6%, now sitting on 5.33B for the twelve trailing months.

Growth Estimates Quarters

For the current quarter, the company expects a decline of 41.2% in growth and 46.5% for the next.

More news about Logitech.

20. Magna International (MGA)

Shares of Magna International jumped 5.42% in from $58.32 to $61.48 at 18:21 EST on Friday, after five successive sessions in a row of gains. NYSE is rising 2.06% to $15,539.74, following the last session’s downward trend.

Magna International Inc. is a designer, engineer, and manufacturer of components, assemblies and systems for vehicle and light truck original equipment producers. The company operates in four areas: Body Exteriors & Structures; Power & Vision; Seating Systems and Complete Vehicles. Body Exteriors & Structures provides chassis and body, as well exterior and roof systems. It also offers engineering and testing services. This includes fascia, trims, front module, liftgate module, front integration panels and liftgate modules. Active aerodynamics, engineered glasses, running boards and truck bed access products. Power & Vision offers electric and hybrid drive systems as well as motors. Inverters and onboard chargers are also available. Transmission, engine, driveline components and engine plates can be ordered. Engineering services include advanced driver assistance and sensor systems. Exterior and interior mirrors. Driver monitoring and electronics. Door handles and overhead consoles. Hinges and wire forming system hinges. Hard and soft roofs may also be offered. Seating Systems offers seat structure, hardware and trim solutions as well as foam and trim products. Complete Vehicles offers manufacturing and engineering services. It also design, engineers and produces tooling products. Magna International Inc., which was established in 1957, is located in Aurora (Canada).

Moving Average

Magna International’s market value is much higher than the 50-day average moving price of $55.75, and even more than the 200-day average moving price of $59.15.

Growth Estimates Quarters

The company’s growth estimates for the present quarter and the next is a negative 18.5% and a negative 25.8%, respectively.

Revenue Growth

Year-on-year quarterly revenue growth grew by 3.6%, now sitting on 36.03B for the twelve trailing months.

More news about Magna International.

21. Southern Copper (SCCO)

Shares of Southern Copper rose 9.94% in from $61.49 to $67.60 at 18:21 EST on Friday, after five successive sessions in a row of gains. NYSE is jumping 2.06% to $15,539.74, following the last session’s downward trend.

Southern Copper Corporation engages in mining, exploring, smelting, and refining copper and other minerals in Peru, Mexico, Argentina, Ecuador, and Chile. The company is involved in the mining, milling, and flotation of copper ore to produce copper and molybdenum concentrates; smelting of copper concentrates to produce blister and anode copper; refining of anode copper to produce copper cathodes; production of molybdenum concentrate and sulfuric acid; production of refined silver, gold, and other materials; and mining and processing of zinc and lead. It operates the Toquepala and Cuajone open-pit mines, and a smelter and refinery in Peru; and La Caridad, an open-pit copper mine, as well as a copper ore concentrator, a SX-EW plant, a smelter, refinery, and a rod plant in Mexico. The company also operates Buenavista, an open-pit copper mine, as well as two copper concentrators and two operating SX-EW plants in Mexico. In addition, it operates five underground mines that produce zinc, lead, copper, silver, and gold; a coal mine that produces coal and coke; and a zinc refinery. The company has interests in 82,134 hectares of exploration concessions in Peru; 493,533 hectares of exploration concessions in Mexico; 246,346 hectares of exploration concessions in Argentina; 29,888 hectares of exploration concessions in Chile; and 7,299 hectares of exploration concessions in Ecuador. Southern Copper Corporation was incorporated in 1952 and is based in Phoenix, Arizona. Southern Copper Corporation operates as a subsidiary of Americas Mining Corporation.

Growth Estimates Quarters

For the current quarter, the company expects a decline of 46.4% in growth and for the next quarter, a decrease of 26.9% respectively.

Average Moving

Southern Copper’s current value is much higher than its moving average 50 days of $54.51 or its moving average 200 days of $56.66.

Annual Top and Bottom Value

At 18:23 EST Southern Copper stock was valued at $67.60. This is way lower than its 52-week peak of $79.32, and far higher than its 52 week low of $42.42.

Sales Growth

Southern Copper is experiencing a negative 2.3% sales growth in the next quarter.

More news about Southern Copper.

22. Expedia Group (EXPE)

Shares of Expedia Group rose 0.86% in from $93.38 to $94.18 at 18:21 EST on Friday, after five sequential sessions in a row of gains. NASDAQ is rising 2.56% to $10,569.29, following the last session’s downward trend.

Expedia Group, Inc. is an international online travel agency that operates in the United States. It operates in three segments: Retail, B2B and Trivago. Brand Expedia is an online travel agency that offers full-service, localized services. Hotels.com and Vrbo are online platforms for finding and booking alternative lodging. Hotwire provides travel booking services. CarRentals.com allows you to book car rentals online. Classic Vacations is a specialist in luxury travel. Expedia Cruise gives advice on booking cruises. Expedia Partner Solutions is a brand for business that offers travel and non-travel services. This includes travel agencies, corporate travel management and online retail. Egencia provides corporate travel management. Trivago is a website that allows you to refer people to travel agencies and service providers via hotel websites. Expedia Group Media Solutions completes the brand portfolio. The company also offers online travel services via its Wotif.com.au and travel.com.au brands, loyalty programs, hotel accommodations, and other accommodations. The company serves corporate and leisure travelers. Before March 2018, Expedia, Inc. was the company’s name. It changed its name from Expedia Group, Inc. to Expedia Group, Inc. Expedia Group, Inc. is located in Seattle, Washington.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Expedia Group stock considered oversold (=20).

Revenue Growth

Year-on-year quarterly revenue growth grew by 50.7%, now sitting on 10.67B for the twelve trailing months.

More news about Expedia Group.

23. NewMarket (NEU)

Shares of NewMarket rose 6.18% in from $316.03 to $335.56 at 18:21 EST on Friday, after two successive sessions in a row of losses. NYSE is rising 2.06% to $15,539.74, following the last session’s downward trend.

NewMarket Corporation, through its subsidiaries, engages in the petroleum additives business. The company offers lubricant additives for use in various vehicle and industrial applications, including engine oils, transmission fluids, off-road powertrain and hydraulic systems, gear oils, hydraulic oils, turbine oils, and other applications where metal-to-metal moving parts are utilized; engine oil additives designed for passenger cars, motorcycles, on and off-road heavy duty commercial equipment, locomotives, and engines in ocean-going vessels; driveline additives designed for products, such as transmission fluids, axle fluids, and off-road powertrain fluids; and industrial additives designed for products for industrial applications consisting of hydraulic fluids, grease, industrial gear fluids, and industrial specialty applications, such as turbine oils. It also provides fuel additives that are used to enhance the oil refining process and the performance of gasoline, diesel, biofuels, and other fuels to industry, government, original equipment manufacturers, and individual customers. In addition, the company engages in the antiknock compounds business, as well as contracted manufacturing and services activities; and owns and manages a real property in Virginia. It operates in North America, Latin America, the Asia Pacific, Europe, the Middle East, Africa, and India. NewMarket Corporation was founded in 1887 and is headquartered in Richmond, Virginia.

Sales Growth

NewMarket’s sales growth for the next quarter is 2.9%.

More news about NewMarket.

24. Cisco (CSCO)

Shares of Cisco slid 1.22% in from $48.93 to $48.33 at 18:21 EST on Friday, after two consecutive sessions in a row of losses. NASDAQ is jumping 2.56% to $10,569.29, following the last session’s downward trend.

Cisco Systems, Inc. designs, manufactures, and sells Internet Protocol based networking and other products related to the communications and information technology industry in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and China. The company also offers switching portfolio encompasses campus switching as well as data center switching; enterprise routing portfolio interconnects public and private wireline and mobile networks, delivering highly secure, and reliable connectivity to campus, data center and branch networks; wireless products include wireless access points that are standalone, controller appliance-based, switch-converged, and Meraki cloud-managed offerings; and compute portfolio including the cisco unified computing system, hyperflex, and software management capabilities, which combine computing, networking, and storage infrastructure management and virtualization. In addition, it provides Internet for the future product consists of routed optical networking, 5G, silicon, and optics solutions; collaboration products, such as meetings, collaboration devices, calling, contact center, and communication platform as a service; end-to-end security product consists of network security, cloud security, security endpoints, unified threat management, and zero trust; and optimized application experiences products including full stack observability and cloud-native platform. Further, the company offers a range of service and support options for its customers, including technical support and advanced services and advisory services. It serves businesses of various sizes, public institutions, governments, and service providers. The company sells its products and services directly, as well as through systems integrators, service providers, other resellers, and distributors. Cisco Systems, Inc. has strategic alliances with other companies. Cisco Systems, Inc. was incorporated in 1984 and is headquartered in San Jose, California.

Growth Estimates Quarters

The company’s growth estimates for the current quarter and the next is 1.2% and 2.3%, respectively.

Moving Average

Cisco’s worth is higher than its 50-day moving average of $46.72 and above its 200-day moving average of $46.43.

Volatility

Cisco’s intraday variation average for the week and quarter ended last week at a negative 0.18, negative 0.54% and positive 1.18%.

Cisco had the highest average volatility amplitude at 0.96%, 0.88% and 1.18% respectively in last week and quarter.

More news about Cisco.

25. Rogers Communication (RCI)

Shares of Rogers Communication jumped 5.81% in from $44.95 to $47.56 at 18:21 EST on Friday, after two sequential sessions in a row of losses. NYSE is jumping 2.06% to $15,539.74, following the last session’s downward trend.

Rogers Communications Inc. is a Canadian communications and media company. The company operates in three areas: Wireless, Cable, and Media. It offers wireless Internet access, voice and enhanced voice, accessory and device financing, mobile Internet, wired voice, home phone and device protection, wireless device, device and global voice roaming, data roaming and bridging landline. The company also offers Internet and WiFi services and smart home monitoring services. These include monitoring, security and automation as well as energy efficiency and smart control via a smartphone application. The company also offers on-demand and local TV, cloud-based digital video recorders, voice-activated remote control, and integrated apps, personal video recorders, linear and time-shifted programming, digital specialty channels, 4K TV programming, and televised content for smartphones, tablets, or personal computers. It also operates Ignite TV, Ignite TV App, and Ignite TV. It also offers residential and small-business local telephony services. It also holds the Toronto Blue Jays team and Rogers Centre venue. The company operates Sportsnet ONE and Sportsnet 360 television networks. OLN radio stations, 55 AM and FM radio stations, and Sportsnet 360. It was established in Canada in 1960.

Yearly Top and Bottom Value

Rogers Communication’s stock is valued at $47.56 at 18:23 EST, way below its 52-week high of $64.55 and way above its 52-week low of $36.23.

More news about Rogers Communication.