VIANEWS – The Innrs algorithm for artificial intelligence suggests a high likelihood of finding the estimated price of tomorrow’s Air Products and Chemicals APD and Castle Biosciences CSTL.

Via News regularly facts-checks this AI algorithm, which aims to predict the session prices and trend for financial assets over time.

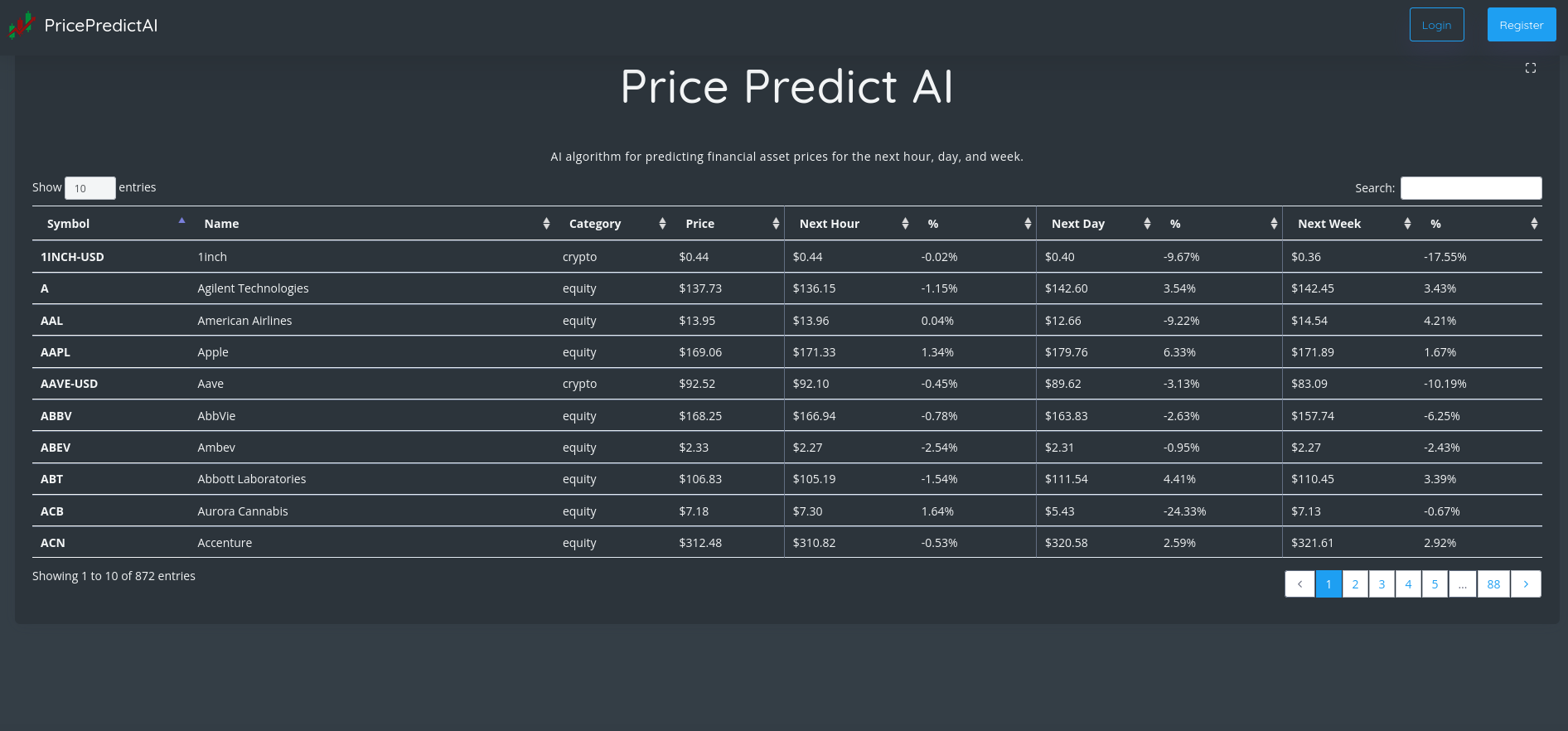

Innrs offers A.I.-based statistics tools that can be used to assist investors in making decisions. Below is a table that lists the most accurate financial assets for predicting prices, sorted by their highest predicted accuracy.

Officials at Innrs claim that this tool assists investors in making better-informed financial decisions. It is supposedly combined with other pertinent financial information, and the trader strategy.

Via News will present the results of the algorithm precision in the next session.

| Financial Asset | Accuracy | Close Price | Prediction |

|---|---|---|---|

| Air Products and Chemicals (APD) | 94.31% | $325.82 | ⇧ $330.09 |

| Castle Biosciences (CSTL) | 91.66% | $23.96 | ⇧ $24.73 |

| Kodak (KODK) | 89.82% | $3.63 | ⇩ $3.36 |

| AbbVie (ABBV) | 89.19% | $165.32 | ⇧ $165.96 |

| NextEra Energy (NEE) | 88.71% | $87.32 | ⇧ $88.61 |

| Procter & Gamble (PG) | 88.43% | $152.38 | ⇧ $155.46 |

| Altair Engineering (ALTR) | 88.32% | $48.99 | ⇧ $49.81 |

| Caesars Entertainment (CZR) | 88.31% | $52.62 | ⇧ $52.67 |

| Southern Company (SO) | 88.27% | $71.31 | ⇧ $72.85 |

| Cigna (CI) | 88.08% | $331.07 | ⇧ $344.3 |

| Palantir (PLTR) | 87.54% | $7.52 | ⇧ $7.68 |

| ONE Gas (OGS) | 85.62% | $78.61 | ⇧ $79.63 |

| Twitter (TWTR) | 84.13% | $53.7 | ⇧ $53.81 |

| Workday (WDAY) | 83.96% | $288.07 | ⇧ $290.84 |

| CME Group (CME) | 83.82% | $178.38 | ⇧ $180.97 |

| Exelon (EXC) | 83.78% | $42.67 | ⇧ $43.93 |

| Live Nation Entertainment (LYV) | 83.74% | $74.19 | ⇧ $75.95 |

| Illumina (ILMN) | 83.62% | $210.88 | ⇧ $212.79 |

| Teradyne (TER) | 83.38% | $96.45 | ⇧ $98.75 |

| Activision Blizzard (ATVI) | 83.38% | $76.86 | ⇧ $79.02 |

| Aon plc (AON) | 83.3% | $310.9 | ⇧ $314.03 |

| Wix.com (WIX) | 83.08% | $85.91 | ⇧ $86.73 |

| Abbott Laboratories (ABT) | 83.07% | $111.62 | ⇧ $114.69 |

| Monolithic Power Systems (MPWR) | 83.04% | $403.56 | ⇧ $412.26 |

| CMS Energy (CMS) | 83% | $64.11 | ⇧ $65.43 |

1. Air Products and Chemicals (APD)

Shares of Air Products and Chemicals rose by a staggering 10.34% in from $295.29 to $325.82 at 18:21 EST on Tuesday, following the last session’s upward trend. NYSE is rising 0.61% to $15,562.54, following the last session’s upward trend.

Air Products and Chemicals, Inc. provides atmospheric gases, process and specialty gases, equipment, and services worldwide. The company produces atmospheric gases, including oxygen, nitrogen, and argon; process gases, such as hydrogen, helium, carbon dioxide, carbon monoxide, syngas; specialty gases; and equipment for the production or processing of gases comprising air separation units and non-cryogenic generators for customers in various industries, including refining, chemical, gasification, metals, manufacturing, food and beverage, electronics, magnetic resonance imaging, energy production and refining, and metals. It also designs and manufactures equipment for air separation, hydrocarbon recovery and purification, natural gas liquefaction, and liquid helium and liquid hydrogen transport and storage. Air Products and Chemicals, Inc. has a strategic collaboration with Baker Hughes Company to develop hydrogen compression systems. The company was founded in 1940 and is headquartered in Allentown, Pennsylvania.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Air Products and Chemicals’s stock is considered to be oversold (<=20).

Growth Estimates Quarters

For the current quarter, the company expects to grow by 10% and 7.5% respectively.

Revenue growth

The year-on-year revenue growth was 22.4%. It now stands at 11.97 billion for the 12 trailing months.

More news about Air Products and Chemicals.

2. Castle Biosciences (CSTL)

Shares of Castle Biosciences rose 1.65% in from $23.57 to $23.96 at 18:21 EST on Tuesday, following the last session’s upward trend. NASDAQ is jumping 1.01% to $11,256.81, following the last session’s upward trend.

Castle Biosciences, Inc. is a diagnostics company in the commercial stage. It specializes in providing diagnostic and prognostic services for dermatological carcinomas. DecisionDx-Melanoma is the company’s flagship product. This multi-gene expression profil (GEP test) identifies patients with invasive skin melanoma at risk for metastasis. DecisionDx UM, a proprietary GEP testing that determines whether patients will develop metastasis from uveal melanoma; DecisionDx SCC, a 40-gene expression profil test that analyzes a patient’s tumor biology and predicts individual risks of squamous cells carcinoma metastasis. DecisionDx DiffDx -Melanoma; myPath Melanoma is a GEP proprietary test for diagnosing suspicious pigmentes. The company offers testing services to physicians as well as their patients. It was established in Texas in 2007.

Annual Top and Bottom Value

Castle Biosciences stock was valued at $23.96 as of 18:21 EST. This is way lower than the 52-week high at $48.40, and much higher than its 52 week low at $15.58.

More news about Castle Biosciences.

3. Kodak (KODK)

Shares of Kodak fell by a staggering 27.82% in from $5.03 to $3.63 at 18:21 EST on Tuesday, after two sequential sessions in a row of losses. NYSE is rising 0.61% to $15,562.54, following the last session’s upward trend.

Eastman Kodak Company supplies hardware, software and consumables to clients in commercial printing, packaging, publishing and manufacturing markets around the world. It operates in three segments: Digital Printing and Traditional Printing. Traditional Printing offers traditional offset plates and computer-to plate imaging solutions for commercial printing, such as direct mail, commercial print, newspaper and magazine publishing and book publishing. Digital Printing offers electrophotographic printing options, such as the ASCEND, NEXFINITY and prosper printers, PROSPER Writing Systems and PROSPER press system components, versamark products and PRINERGY workflow software. Advanced Materials and Chemicals is involved in motion picture and industrial film and chemicals. It also deals with advanced materials and functional printers. The Kodak Research Laboratories is also included in this segment. This laboratory conducts research and develops new products or business opportunities. It files patent applications and manages the licensing of its intellectual properties to third parties. This segment licenses the Kodak brand name to third parties. Eastman Business Park is a complex that houses a variety of technology centers and an industrial complex. The company sells products and services via direct sales, through third-party resellers, dealers and channel partners. Eastman Kodak Company, which was established in 1880, is located in Rochester in New York.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Kodak’s stock is considered to be overbought (>=80).

More news about Kodak.

4. AbbVie (ABBV)

Shares of AbbVie jumped 8.71% in from $152.07 to $165.32 at 18:21 EST on Tuesday, following the last session’s upward trend. NYSE is rising 0.61% to $15,562.54, following the last session’s upward trend.

AbbVie Inc. develops, produces, and markets pharmaceuticals worldwide. HUMIRA is an injectable therapy for autoimmune Behcet’s disease; SKYRIZI for moderate to severe plaque psoriasis; RINVOQ to treat mild to moderately severe active rheumatoidarthritis in adults; IMBRUVICA for adults with chronic lymphocyticleukemia (CLL) or small lymphocytic lioma (SLL); and VENCLEXTA to treat chronic HCV genotype 1-6 patients. The company also offers CREON, an exocrine-pancreatic enzyme therapy to treat hypothyroidism. Linzess/Constella is used for irritable bowel syndrome and chronic idiopathic constipation. Lupron can be used for palliative care of advanced prostate cancer and endometriosis. Botox Therapeutic will treat patients with chronic HCV genotype 1-6 infection. In addition, the company offers ORILISSA, a nonpeptide small molecule gonadotropin-releasing hormone antagonist for women with moderate to severe endometriosis pain; Duopa and Duodopa, a levodopa-carbidopa intestinal gel to treat Parkinson’s disease; Lumigan/Ganfort, a bimatoprost ophthalmic solution for the reduction of elevated intraocular pressure (IOP) in patients with open angle glaucoma (OAG) or ocular hypertension; Ubrelvy to treat migraine with or without aura in adults; Alphagan/ Combigan, an alpha-adrenergic receptor agonist for the reduction of IOP in patients with OAG; and Restasis, a calcineurin inhibitor immunosuppressant to increase tear production, as well as other eye care products. AbbVie Inc. collaborates with Dragonfly Therapeutics, Inc. It was founded in 2012, and its headquarters are in North Chicago (Illinois).

Growth Estimates Quarters

For the current quarter, the company expects to grow by 26.1% and 21.8% respectively.

More news about AbbVie.

5. NextEra Energy (NEE)

Shares of NextEra Energy jumped 6.77% in from $81.78 to $87.32 at 18:21 EST on Tuesday, after two consecutive sessions in a row of gains. NYSE is jumping 0.61% to $15,562.54, following the last session’s upward trend.

NextEra Energy, Inc., through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America. The company generates electricity through wind, solar, nuclear, coal, and natural gas facilities. It also develops, constructs, and operates long-term contracted assets that consists of clean energy solutions, such as renewable generation facilities, battery storage projects, and electric transmission facilities; sells energy commodities; and owns, develops, constructs, manages and operates electric generation facilities in wholesale energy markets. As of December 31, 2021, the company had approximately 28,564 megawatts of net generating capacity; approximately 77,000 circuit miles of transmission and distribution lines; and 696 substations. It serves approximately 11 million people through approximately 5.7 million customer accounts in the east and lower west coasts of Florida. The company was formerly known as FPL Group, Inc. and changed its name to NextEra Energy, Inc. in 2010. The company was founded in 1925 and is headquartered in Juno Beach, Florida.

More news about NextEra Energy.

6. Procter & Gamble (PG)

Shares of Procter & Gamble jumped 7.42% in from $141.85 to $152.38 at 18:21 EST on Tuesday, after two sequential sessions in a row of gains. NYSE is rising 0.61% to $15,562.54, following the last session’s upward trend.

The Procter & Gamble Company provides branded consumer packaged goods worldwide. It operates through five segments: Beauty; Grooming; Health Care; Fabric & Home Care; and Baby, Feminine & Family Care. The Beauty segment offers conditioners, shampoos, styling aids, and treatments under the Head & Shoulders, Herbal Essences, Pantene, and Rejoice brands; and antiperspirants and deodorants, personal cleansing, and skin care products under the Olay, Old Spice, Safeguard, Secret, and SK-II brands. The Grooming segment provides shave care products and appliances under the Braun, Gillette, and Venus brand names. The Health Care segment offers toothbrushes, toothpastes, and other oral care products under the Crest and Oral-B brand names; and gastrointestinal, rapid diagnostics, respiratory, vitamins/minerals/supplements, pain relief, and other personal health care products under the Metamucil, Neurobion, Pepto-Bismol, and Vicks brands. The Fabric & Home Care segment provides fabric enhancers, laundry additives, and laundry detergents under the Ariel, Downy, Gain, and Tide brands; and air care, dish care, P&G professional, and surface care products under the Cascade, Dawn, Fairy, Febreze, Mr. Clean, and Swiffer brands. The Baby, Feminine & Family Care segment offers baby wipes, taped diapers, and pants under the Luvs and Pampers brands; adult incontinence and feminine care products under the Always, Always Discreet, and Tampax brands; and paper towels, tissues, and toilet papers under the Bounty, Charmin, and Puffs brands. The company sells its products primarily through mass merchandisers, e-commerce, grocery stores, membership club stores, drug stores, department stores, distributors, wholesalers, specialty beauty stores, high-frequency stores, pharmacies, electronics stores, and professional channels, as well as directly to consumers. The Procter & Gamble Company was founded in 1837 and is headquartered in Cincinnati, Ohio.

Annual Top and Bottom Value

Procter & Gamble stock was valued at $152.38 as of 18:22 EST. This is below its 52 week high of $165.35, and well above its 52 week low of $122.18.

More news about Procter & Gamble.

7. Altair Engineering (ALTR)

Shares of Altair Engineering jumped 0.23% in from $48.88 to $48.99 at 18:21 EST on Tuesday, following the last session’s upward trend. NASDAQ is jumping 1.01% to $11,256.81, following the last session’s upward trend.

Altair Engineering Inc., together with its subsidiaries, provides software and cloud solutions in the areas of simulation, high-performance computing, data analytics, and artificial intelligence worldwide. The company operates in two segments, Software and Client Engineering Services. The Software segment includes solvers and optimization technology products, high-performance computing software applications and hardware products, modeling and visualization tools, data analytics and analysis products, and Internet of Things platform and analytics tools, as well as support and the complementary software products. This segment also offers software technologies in the areas of computational fluid dynamics and fatigue, manufacturing process simulation, and cost estimation for the applications in marine, motorcycle, aerospace, chemical, and architecture industries; and software-related services, such as consulting, implementation, and training services that focuses on the product design and development expertise and analysis from the component level up to complete product engineering at various stage of the lifecycle. The Client Engineering Services segment provides client engineering services. In addition, the company is involved in the development and sale of solid state lighting technology along with communication and control protocols based on its intellectual property for the direct replacement of fluorescent light tubes with LED lamps. Its integrated suite of software optimizes design performance across various disciplines, including structures, motion, fluids, thermal management, electromagnetics, system modeling, and embedded systems. The company's customers include universities, government agencies, manufacturers, pharmaceutical firms, banking, financial services, and insurance, weather prediction agencies, and electronics design companies. Altair Engineering Inc. was incorporated in 1985 and is headquartered in Troy, Michigan.

Volatility

Altair Engineering’s last week, last month’s, and last quarter’s current intraday variation average was a positive 0.03%, a negative 0.13%, and a positive 1.80%.

Altair Engineering’s highest amplitude of average volatility was 0.64% (last week), 1.64% (last month), and 1.80% (last quarter).

More news about Altair Engineering.

8. Caesars Entertainment (CZR)

Shares of Caesars Entertainment rose 1.7% in from $51.74 to $52.62 at 18:21 EST on Tuesday, following the last session’s upward trend. NASDAQ is rising 1.01% to $11,256.81, following the last session’s upward trend.

Caesars Entertainment, Inc. is a US-based gaming and hospitality business. It operates casinos that offer poker, keno and other online games; restaurants, bars and nightclubs as well as hotels and entertainment venues. The company also offers staffing, management, accessories, souvenirs and decorative items via retail shops; as well as online sports betting, iGaming, and other services. The company managed, owned and leased 52 properties across 16 US states. These included approximately 55,700 slots, video lottery terminals and e-tables. There were also 2,900 table games and 47,700 hotel rooms. Caesars Entertainment, Inc., was established in Reno, Nevada in 1937.

Moving Average

Caesars Entertainment’s value is way higher than its 50-day moving average of $44.08 and higher than its 200-day moving average of $51.85.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Caesars Entertainment’s stock is considered to be oversold (<=20).

Sales Growth

Caesars Entertainment’s sales growth is 7.9% for the present quarter and 20.2% for the next.

Revenue Growth

Year-on-year quarterly revenue growth grew by 12.7%, now sitting on 10.39B for the twelve trailing months.

More news about Caesars Entertainment.

9. Southern Company (SO)

Shares of Southern Company rose by a staggering 10.17% in from $64.73 to $71.31 at 18:21 EST on Tuesday, after two sequential sessions in a row of gains. NYSE is jumping 0.61% to $15,562.54, following the last session’s upward trend.

Through its subsidiaries, the Southern Company engages in generation, transmission and distribution of electric power. The company operates via Gas Distribution Operations and Gas Pipeline Investments segments. It also builds, purchases, manages and owns power generation assets. The company sells wholesale electricity to customers in Tennessee, Georgia, Virginia and Georgia. It also owns or operates 30 hydroelectric stations and 24 fossil fuel/cogeneration stations. 13 nuclear generating station, 3 nuclear generating sites, 1 fuel cell facility and 4 battery storage facility. The company constructs, maintains, and operates 76,289 mile of natural gas pipelines. 14 storage facilities have a total capacity of 157 billion cubic feet. This allows it to supply natural gas to industrial, residential and commercial customers. It serves 8.7 million customers in the electric and gas utilities sector. The company also offers fiber optics and digital wireless communications services. Southern Company was founded in 1945. It is located in Atlanta, Georgia.

Growth Estimates Quarters

For the current quarter, the company expects to grow by a negative 30% and negative 13.4% respectively.

Sales Growth

Southern Company’s sales growth is negative 13% for the present quarter and negative 1.2% for the next.

Yearly Top and Bottom Value

Southern Company’s stock is valued at $71.31 at 18:22 EST, way below its 52-week high of $80.57 and way higher than its 52-week low of $60.71.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Southern Company’s stock is considered to be overbought (>=80).

More news about Southern Company.

10. Cigna (CI)

Shares of Cigna rose 7.38% in from $308.32 to $331.07 at 18:21 EST on Tuesday, after two sequential sessions in a row of gains. NYSE is rising 0.61% to $15,562.54, following the last session’s upward trend.

Cigna Corporation offers insurance products and services throughout the United States. The company’s Evernorth division provides coordinated, point-solution health services. This includes pharmacy, benefits management and care delivery and management. It also offers intelligence solutions for employers and providers of health care. Cigna Healthcare, the company’s healthcare segment, offers medical, prescription, behavioral, vision, and other services to insured customers. It also provides Medicare Advantage, Medicare Supplement and Medicare Part D plans, for both seniors and individuals. The Cigna Healthcare segment also has individual and group health plans that can be taken on or off public exchanges. Permanent insurance contracts can be sold to companies to cover certain employees’ lives and help finance future benefits obligations. The company distributes products and services via insurance brokers and consultants, directly to employers and unions, as well as individuals, and through private and public exchanges. It was established in Bloomfield Connecticut in 1792.

Revenue Growth

Year-on-year quarterly revenue growth grew by 5.1%, now sitting on 179.18B for the twelve trailing months.

Yearly Top and Bottom Value

Cigna’s stock is valued at $331.07 at 18:22 EST, under its 52-week high of $336.31 and way higher than its 52-week low of $212.86.

Moving Average

Cigna’s worth is higher than its 50-day moving average of $311.21 and way higher than its 200-day moving average of $276.07.

Volatility

Cigna’s last week, last month’s, and last quarter’s current intraday variation average was a positive 0.64%, a negative 0.02%, and a positive 1.23%.

Cigna’s highest amplitude of average volatility was 0.64% (last week), 1.40% (last month), and 1.23% (last quarter).

More news about Cigna.

11. Palantir (PLTR)

Shares of Palantir slid 8.24% in from $8.2 to $7.52 at 18:21 EST on Tuesday, after two sequential sessions in a row of gains. NYSE is rising 0.61% to $15,562.54, following the last session’s upward trend.

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community in the United States to assist in counterterrorism investigations and operations. The company provides palantir gotham, a software platform which enables users to identify patterns hidden deep within datasets, ranging from signals intelligence sources to reports from confidential informants, as well as facilitates the handoff between analysts and operational users, helping operators plan and execute real-world responses to threats that have been identified within the platform. It also offers palantir foundry, a platform that transforms the ways organizations operate by creating a central operating system for their data; and allows individual users to integrate and analyze the data they need in one place. In addition, it provides apollo, a software that enables customers to deploy their own software virtually in any environment. Palantir Technologies Inc. was incorporated in 2003 and is based in Denver, Colorado.

More news about Palantir.

12. ONE Gas (OGS)

Shares of ONE Gas slid 3.97% in from $81.86 to $78.61 at 18:21 EST on Tuesday, after five consecutive sessions in a row of gains. NYSE is jumping 0.61% to $15,562.54, following the last session’s upward trend.

ONE Gas, Inc., along with its subsidiaries, is a regulated natural-gas distribution utility company in America. It operates in three segments: Oklahoma Natural Gas and Kansas Gas Service. Texas Gas Service is its other division. The company provides natural gas distribution services for 2.2 million customers across three states. The company serves both residential and commercial customers as well as transportation clients. It had approximately 41,600 mile of distribution mains and 2400 miles transmission pipelines. In addition, 51.4 billion cubic feet natural gas storage capacity. ONE Gas, Inc. was established in 1906. It is based in Tulsa, Oklahoma.

Volatility

ONE Gas’s intraday variation average for the week and quarter ended last week was positive 1.77% and negative 0.66% respectively.

ONE Gas had the highest amplitude average volatility at 1.77%, 2.99% and 2.15% respectively (last week, last month and last quarter).

Revenue growth

The year-on-year revenue growth was 35.9%. We now have 2.27B in the 12 trailing months.

Growth Estimates Quarters

For the current quarter, the company expects to grow by 13.2% and 9.8% respectively.

Yearly Top and Bottom Value

ONE Gas’s stock is valued at $78.61 at 18:22 EST, way below its 52-week high of $92.26 and way above its 52-week low of $67.64.

More news about ONE Gas.

13. Twitter (TWTR)

Shares of Twitter slid 0% in from $53.7 to $53.70 at 18:21 EST on Tuesday, following the last session’s downward trend. NYSE is rising 0.61% to $15,562.54, following the last session’s upward trend.

Bitcoin enthusiasts plead with Elon Musk for a spare account of this scientist from mass cleaning-up

Meanwhile, a petition has also been started by Twitter users which reads: ‘Keep Hal Finney’s Twitter through the dormant account deletion’. , The petition signed by 250 members said Finney’s Twitter should be left during this purge to: preserve the thoughts he so proudly shared with the world and prevent anyone else from abusing the username @halfin.

Twitter, Inc. operates as a platform for public self-expression and conversation in real-time. The company's primary product is Twitter, a platform that allows users to consume, create, distribute, and discover content. It also provides promoted products that enable advertisers to promote brands, products, and services, as well as enable advertisers to target an audience based on various factors, including who an account follows and actions taken on its platform, such as Tweets created and engagement with Tweets. Its promoted products consist of promoted ads and Twitter Amplify, Follower Ads, and Twitter takeover. In addition, the company offers monetization products for creators, including Tips to directly send small one-time payments on Twitter using various payment methods, including bitcoin; Super Follows, a paid monthly subscription, which includes bonus content, exclusive previews, and perks as a way to support and connect with creators on Twitter; and Ticketed Spaces to support creators on Twitter for their time and effort in hosting, speaking, and moderating the public conversation on Twitter Spaces. Further, it offers products for developers and data partners comprising Twitter Developer Platform, a platform that enables developers to build tools for people and businesses using its public application programming interface; and paid access to Twitter data for partners with commercial use cases. Twitter, Inc. was founded in 2006 and is based in San Francisco, California.

Sales Growth

Twitter’s sales growth for the next quarter is 0.6%.

Annual Top and Bottom Value

Twitter stock was valued at $53.70 as of 18:22 EST at 18.22 EST. This is way lower than the 52-week high at $68.41, and much higher than its 52 week low at $31.30.

Moving Average

Twitter’s value is much higher than the $41.24 50-day average and far more than its $40.34 200-day average.

Previous days news about Twitter

- Twitter to relaunch twitter blue, Apple users will pay more; policy on handling hate speech unveiled. According to Benzinga on Sunday, 11 December, "We’ve added a review step before applying a blue checkmark to an account as one of our new steps to combat impersonation (which is against the Twitter Rules)."

More news about Twitter.

14. Workday (WDAY)

Shares of Workday rose by a staggering 15.36% in from $153.87 to $177.51 at 18:21 EST on Tuesday, after four sequential sessions in a row of gains. NASDAQ is rising 1.01% to $11,256.81, following the last session’s upward trend.

Workday, Inc. provides enterprise cloud applications in the United States and internationally. The company's applications help its customers to plan, execute, analyze, and extend to other applications and environments, and to manage their business and operations. It offers a suite of financial management applications, which enable chief financial officers to maintain accounting information in the general ledger; manage financial processes; identify real-time financial, operational, and management insights; enhance financial consolidation; reduce time-to-close; promote internal control and auditability; and achieve consistency across finance operations. The company also provides cloud spend management solutions that helps organizations to streamline supplier selection and contracts, manage indirect spend, and build and execute sourcing events, such as requests for proposals; Human Capital Management (HCM) solution, a suite of human capital management applications that allows organizations to manage the entire employee lifecycle from recruitment to retirement, and enables HR teams to hire, onboard, pay, develop, reskill, and provide employee experiences; Workday applications for planning; and applications for analytics and reporting, including augmented analytics to surface insights to the line of business in simple-to-understand stories, machine learning to drive efficiency and automation, and benchmarks to compare performance against other companies. It serves professional and business services, financial services, healthcare, education, government, technology, media, retail, and hospitality industries. The company was formerly known as North Tahoe Power Tools, Inc. and changed its name to Workday, Inc. in July 2005. Workday, Inc. was incorporated in 2005 and is headquartered in Pleasanton, California.

Moving Average

Workday’s worth is way higher than its 50-day moving average of $151.87 and higher than its 200-day moving average of $173.04.

Growth Estimates Quarters

The company’s growth estimates for the present quarter is a negative 24.5% and positive 14.1% for the next.

Sales Growth

The next quarter’s Workday sales growth is at 19.8%

More news about Workday.

15. CME Group (CME)

Shares of CME Group jumped 2.36% in from $174.27 to $178.38 at 18:21 EST on Tuesday, after three consecutive sessions in a row of gains. NASDAQ is rising 1.01% to $11,256.81, following the last session’s upward trend.

CME Group Inc., together with its subsidiaries, operates contract markets for the trading of futures and options on futures contracts worldwide. It offers futures and options products based on interest rates, equity indexes, foreign exchange, agricultural commodities, energy, and metals, as well as fixed income products. The company also provides clearing house services, including clearing, settling, and guaranteeing futures and options contracts, and cleared swaps products traded through its exchanges; and trade processing and risk mitigation services. In addition, the company offers a range of market data services, including real-time and historical data services. It serves professional traders, financial institutions, institutional and individual investors, corporations, manufacturers, producers, governments, and central banks. The company was formerly known as Chicago Mercantile Exchange Holdings Inc. and changed its name to CME Group Inc. in July 2007. CME Group Inc. was founded in 1898 and is headquartered in Chicago, Illinois.

Yearly Top and Bottom Value

CME Group’s stock is valued at $178.38 at 18:23 EST, way under its 52-week high of $256.94 and higher than its 52-week low of $166.58.

More news about CME Group.

16. Exelon (EXC)

Shares of Exelon jumped by a staggering 11.76% in from $38.18 to $42.67 at 18:21 EST on Tuesday, following the last session’s upward trend. NASDAQ is jumping 1.01% to $11,256.81, following the last session’s upward trend.

Exelon Corporation, a utility services holding company, engages in the energy generation, delivery, and marketing businesses in the United States and Canada. It owns nuclear, fossil, wind, hydroelectric, biomass, and solar generating facilities. The company also sells electricity to wholesale and retail customers; and sells natural gas, renewable energy, and other energy-related products and services. Additionally, it is involved in the purchase and regulated retail sale of electricity and natural gas; and transmission and distribution of electricity, and distribution of natural gas to retail customers. Further, the company offers support services, including legal, human resources, information technology, financial, supply management, accounting, engineering, customer operations, distribution and transmission planning, asset management, system operations, and power procurement services. It serves distribution utilities, municipalities, cooperatives, and financial institutions, as well as commercial, industrial, governmental, and residential customers. Exelon Corporation was incorporated in 1999 and is headquartered in Chicago, Illinois.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Exelon’s stock is considered to be oversold (<=20).

More news about Exelon.

17. Live Nation Entertainment (LYV)

Shares of Live Nation Entertainment rose 0.79% in from $73.61 to $74.19 at 18:21 EST on Tuesday, after five sequential sessions in a row of gains. NYSE is rising 0.61% to $15,562.54, following the last session’s upward trend.

Live Nation Entertainment, Inc. is a live entertainment business. The company operates in three segments: Concerts, Sponsorship, and Ticketing. It promotes live music in venues it owns or manages, as well as in rented venues. The segment also operates and manages venues for music and creates related content. The ticketing segment is responsible for managing the ticketing operation. This includes providing ticketing software, services and information to customers through livenation.com or ticketmaster.com. It also provides ticket resale and other services. The segment also sells tickets to its own events as well as third-party customers in different live event categories such as amphitheaters. concert promoters. professional sports leagues. college sports teams. performing arts venues. museums. theaters via websites, mobile apps and ticket outlets. This segment is responsible for placing advertising and sponsorships, both local and international. It also sells signage and promotional programs. The segment develops and books custom programs or events for brands, as well manages strategic sponsorship programs. It owned, operated or leased 165 entertainment venues across North America, and 94 internationally. The original name of the company was Live Nation, Inc., but it changed its name in January 2010 to Live Nation Entertainment, Inc. Live Nation Entertainment, Inc. was founded in 2005. It is located in Beverly Hills, California.

More news about Live Nation Entertainment.

18. Illumina (ILMN)

Shares of Illumina slid by a staggering 11.44% in from $238.12 to $210.88 at 18:21 EST on Tuesday, following the last session’s upward trend. NASDAQ is jumping 1.01% to $11,256.81, following the last session’s upward trend.

Illumina, Inc. provides sequencing and array-based solutions for genetic and genomic analysis. Its products and services serve customers in a range of markets enabling the adoption of genomic solutions in research and clinical settings for applications in the life sciences, oncology, reproductive health, agriculture, and other emerging segments. The company provides instruments and consumables used in genetic analysis; and genotyping and sequencing services, instrument service contracts, and development and licensing agreements, as well as cancer detection testing services. Its customers include genomic research centers, academic institutions, government laboratories, and hospitals, as well as pharmaceutical, biotechnology, commercial molecular diagnostic laboratories, and consumer genomics companies. The company markets and distributes its products directly to customers in North America, Europe, Latin America, and the Asia-Pacific region, as well as sells through life-science distributors in various markets within Europe, the Asia-Pacific region, Latin America, the Middle East, and Africa. The company was incorporated in 1998 and is based in San Diego, California.

Growth Estimates Quarters

The company’s growth estimates for the ongoing quarter is a negative 79.3% and positive 10.7% for the next.

More news about Illumina.

19. Teradyne (TER)

Shares of Teradyne rose 1.93% in from $94.62 to $96.45 at 18:21 EST on Tuesday, after two successive sessions in a row of gains. NASDAQ is jumping 1.01% to $11,256.81, following the last session’s upward trend.

Teradyne, Inc. develops, produces, markets, supports, and maintains automatic test equipment around the world. It operates in four segments: Semiconductor Test and System Test; Industrial Automation; Wireless Test. Semiconductor test offers services and products for device level and package testing in automobile, automotive, communications, consumer smartphones, cloud computing, electronic games, and other markets. FLEX platform systems, J750 and Magnum platforms to test volume semiconductor devices. The ETS platform is for semiconductor manufacturers and subcontractors. This segment serves integrated device makers that incorporate the manufacture of silicon wafers in their businesses; fabless firms that outsource silicon wafer manufacturing; foundries and semiconductor assembly/test providers. System Test offers storage and test system, defense/aerospace instrumentation and systems and circuit board test and inspection. Industrial Automation provides robotic arm collaboration, mobile autonomous robots and robotic control software to support manufacturing and logistics. Wireless Test provides testing solutions to be used in the design and manufacturing of mobile devices, modules, smartphones and tablets as well as notebooks and laptops. The segment offers IQxel Wi-Fi products and IQxstream solutions for testing GSM and CDMA2000. Teradyne, Inc., was founded in 1960. It is located in North Reading, Massachusetts.

More news about Teradyne.

20. Activision Blizzard (ATVI)

Shares of Activision Blizzard jumped 3.77% in from $74.07 to $76.86 at 18:21 EST on Tuesday, after two consecutive sessions in a row of gains. NASDAQ is jumping 1.01% to $11,256.81, following the last session’s upward trend.

Activision Blizzard, Inc., along with its affiliates, creates and publishes interactive entertainment and related services throughout the Americas, Europe, Middle East, Africa, Asia Pacific, and Africa. It operates in three distinct segments, Activision Blizzard and King. The company develops and distributes video games consoles, mobile devices and related services, such as subscriptions, full-game and in-game sales. It also licenses software to third-party and related companies that sell Activision or Blizzard products. Battle.net, a company-owned online gaming platform, facilitates the digital distribution and social networking, as well as user-generated content creation. It also operates esports leagues, offers digital advertising content, and provides logistics and warehousing services for third-party publishers of interactive software and manufacturers of interactive hardware. Call of Duty and World of Warcraft are the company’s most important product brands. Through third-party distribution agreements and licensing, it serves both retailers and distributors. Santa Monica is the headquarters of this company.

Revenue growth

The year-on-year revenue growth for quarters fell by 13.9%. We now have 7.36B in the 12 trailing months.

Yearly Top and Bottom Value

Activision Blizzard’s stock is valued at $76.86 at 18:23 EST, way under its 52-week high of $86.90 and way above its 52-week low of $58.02.

Growth Estimates Quarters

The company’s growth estimates for the present quarter and the next is 20% and 84.2%, respectively.

Moving Average

Activision Blizzard’s value is above its 50-day moving average of $73.69 and under its 200-day moving average of $77.25.

More news about Activision Blizzard.

21. Aon plc (AON)

Shares of Aon plc jumped 6.24% in from $292.64 to $310.90 at 18:21 EST on Tuesday, following the last session’s upward trend. NYSE is jumping 0.61% to $15,562.54, following the last session’s upward trend.

Aon plc, a professional services firm, provides advice and solutions to clients focused on risk, retirement, and health worldwide. It offers commercial risk solutions, including retail brokerage, cyber, and global risk consulting solutions, as well as acts as a captives management; and health solutions, such as health and benefits brokerages, and health care exchanges. The company also provides treaty and facultative reinsurance, as well as insurance-linked securities, capital raising, strategic advice, restructuring, and mergers and acquisitions services; and corporate finance advisory services and capital markets solutions products. In addition, it offers strategic design consulting services on their retirement programs, actuarial services, and risk management services; advice services on developing and maintaining investment programs across a range of plan types, including defined benefit plans, defined contribution plans, endowments, and foundations for public and private companies, and other institutions; and advice and solutions that help clients in risk, health, and wealth through commercial risk, reinsurance, health, and wealth solutions. Further, the company offers CoverWallet; Affinity; Aon Inpoint; CoverWallet; and ReView services. Aon plc was founded in 1919 and is headquartered in Dublin, Ireland.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Stocks of Aon plc are considered oversold (=20).

Volatility

Aon plc’s intraday variation average for the week and quarter ended last week was negative 0.25 percent, positive 0.22% and positive 1.37%, respectively.

Aon plc had the highest average volatility amplitude at 0.65% last week, 0.81% last month and 1.37% in its final quarter.

Sales Growth

Aon plc’s quarter-to-quarter sales growth is 3.6%

Revenue Growth

Year-on-year quarterly revenue growth grew by 3.4%, now sitting on 12.44B for the twelve trailing months.

More news about Aon plc.

22. Wix.com (WIX)

Shares of Wix.com dropped 1.58% in from $87.29 to $85.91 at 18:21 EST on Tuesday, following the last session’s upward trend. NASDAQ is rising 1.01% to $11,256.81, following the last session’s upward trend.

Wix.com Ltd. and its subsidiaries develop and market a cloud-based platform which allows anyone to build a website, or web app in North America and Europe. Wix Editor is a drag and drop visual development platform and website editor. Wix ADI allows users to build websites that meet their needs. Corvid by Wix can be used to make web apps and websites. Ascend by Wix is also available, giving users access to approximately 20 products and features that will allow them to communicate with customers and automate their work. Wix Logo Maker allows users to create a logo by using artificial intelligence. Wix Answers provides support infrastructure, allowing users to assist their users via various channels. Wix Payments lets users get payments through Wix. The company also offers a variety of vertically-specific apps that allow business owners to manage various parts of their online business. It also offers a variety of complimentary services such as App Market, where registered users can install and uninstall various paid and free web apps; Wix Arena which brings together users looking for help creating and managing websites with Web experts; Wix App native mobile app, which allows users to manage and update their Wix operating system and Websites. The company has approximately 6 million premium subscribers and 222 million users as of December 31, 2021. Wixpress Ltd. used to be the company’s name. Wix.com Ltd. was established in 2006. It is located in Tel Aviv in Israel.

Yearly Top and Bottom Value

Wix.com’s stock is valued at $85.91 at 18:23 EST, way below its 52-week high of $164.10 and way above its 52-week low of $53.12.

Moving Average

Wix.com’s worth is higher than its 50-day moving average of $81.17 and way above its 200-day moving average of $75.60.

Growth Estimates Quarters

The company’s growth estimates for the present quarter and the next is 52.4% and 97.3%, respectively.

Volatility

Wix.com’s last week, last month’s, and last quarter’s current intraday variation average was a negative 1.64%, a positive 1.04%, and a positive 3.50%.

Wix.com’s highest amplitude of average volatility was 3.87% (last week), 3.47% (last month), and 3.50% (last quarter).

More news about Wix.com.

23. Abbott Laboratories (ABT)

Shares of Abbott Laboratories rose 8.72% in from $102.67 to $111.62 at 18:21 EST on Tuesday, after five sequential sessions in a row of gains. NYSE is jumping 0.61% to $15,562.54, following the last session’s upward trend.

Abbott Laboratories and its affiliates discover, develop, produce, market, and distribute health care products around the world. There are four main segments to the company: Established Pharmaceutical Products and Diagnostic Products; Nutritional Products; Medical Devices. It offers generic drugs for treating pancreatic exocrine dysfunction, irritable stool syndrome, or biliary spasms, intrahepatic cholesterol or depressive symptoms and hormone replacement therapy. Diagnostic Products offers lab systems for immunoassay and clinical chemistry. It also provides molecular diagnostics products that can automate the preparation, extraction and analysis of DNA from patients. Nutritional products are available for both children and adults. Medical Devices offers rhythm management, electrophysiology and heart failure treatment; as well as diabetes care products and neuromodulation devices to manage chronic pain and move disorders. Abbott Laboratories, which was established in North Chicago in Illinois in 1888, is still in business.

Revenue growth

The year-on-year revenue growth for quarterly declined 4.7%. We now have 45.03B in the 12 trailing months.

More news about Abbott Laboratories.

24. Monolithic Power Systems (MPWR)

Shares of Monolithic Power Systems rose 3.74% in from $389.01 to $403.56 at 18:21 EST on Tuesday, after four successive sessions in a row of gains. NASDAQ is jumping 1.01% to $11,256.81, following the last session’s upward trend.

Monolithic Power Systems, Inc. is engaged in designing, developing, marketing, selling and servicing semiconductor-based power electronic solutions for computing, storage, automotive, industrial, communication, and consumer markets. Direct current (DC), to DC integrated circuits are (ICs) used to control and convert voltages in various electronic systems such as laptops and portable devices, wireless access points, computer and notebooks and infotainment apps, medical equipment, informationtainment, audio and video, etc. The company also sells lighting control ICs that enable backlighting. These ICs are used to light up LCD panels on notebooks and monitors. It sells products via third-party distributors as well as value-added resellers. Monolithic Power Systems, Inc., was established in 1997. It is located in Kirkland, Washington.

Revenue Growth

Year-on-year quarterly revenue growth grew by 57.2%, now sitting on 1.5B for the twelve trailing months.

More news about Monolithic Power Systems.

25. CMS Energy (CMS)

Shares of CMS Energy rose by a staggering 10.71% in from $57.91 to $64.11 at 18:21 EST on Tuesday, after five sequential sessions in a row of gains. NYSE is rising 0.61% to $15,562.54, following the last session’s upward trend.

CMS Energy Corporation operates as an energy company primarily in Michigan. The company operates through three segments: Electric Utility; Gas Utility; and Enterprises. The Electric Utility segment is involved in the generation, purchase, transmission, distribution, and sale of electricity. This segment generates electricity through coal, wind, gas, renewable energy, oil, and nuclear sources. Its distribution system comprises 208 miles of high-voltage distribution overhead lines; 4 miles of high-voltage distribution underground lines; 4,428 miles of high-voltage distribution overhead lines; 19 miles of high-voltage distribution underground lines; 82,474 miles of electric distribution overhead lines; 9,395 miles of underground distribution lines; 1,093 substations; and 3 battery facilities. The Gas Utility segment engages in the purchase, transmission, storage, distribution, and sale of natural gas, which includes 2,392 miles of transmission lines; 15 gas storage fields; 28,065 miles of distribution mains; and 8 compressor stations. The Enterprises segment is involved in the independent power production and marketing, including the development and operation of renewable generation. It serves 1.9 million electric and 1.8 million gas customers, including residential, commercial, and diversified industrial customers. The company was incorporated in 1987 and is headquartered in Jackson, Michigan.

Revenue Growth

Year-on-year quarterly revenue growth grew by 17.3%, now sitting on 8.35B for the twelve trailing months.

Moving Average

CMS Energy’s value has risen to $57.97 per day, and $65.47 in 200 days.

Volatility

CMS Energy’s last week, last month’s, and last quarter’s current intraday variation average was a negative 0.20%, a positive 0.31%, and a positive 1.49%.

CMS Energy’s highest amplitude of average volatility was 1.43% (last week), 1.29% (last month), and 1.49% (last quarter).

Yearly Top and Bottom Value

CMS Energy’s stock is valued at $64.11 at 18:24 EST, way below its 52-week high of $73.76 and way above its 52-week low of $52.41.

More news about CMS Energy.