VIANEWS – The Innrs algorithm for artificial intelligence suggests that there is a good chance of determining the price of tomorrow’s Merck MRK, Kodak KODK or other brands.

Via News regularly facts-checks this AI algorithm, which aims to predict the session prices and trend for financial assets over time.

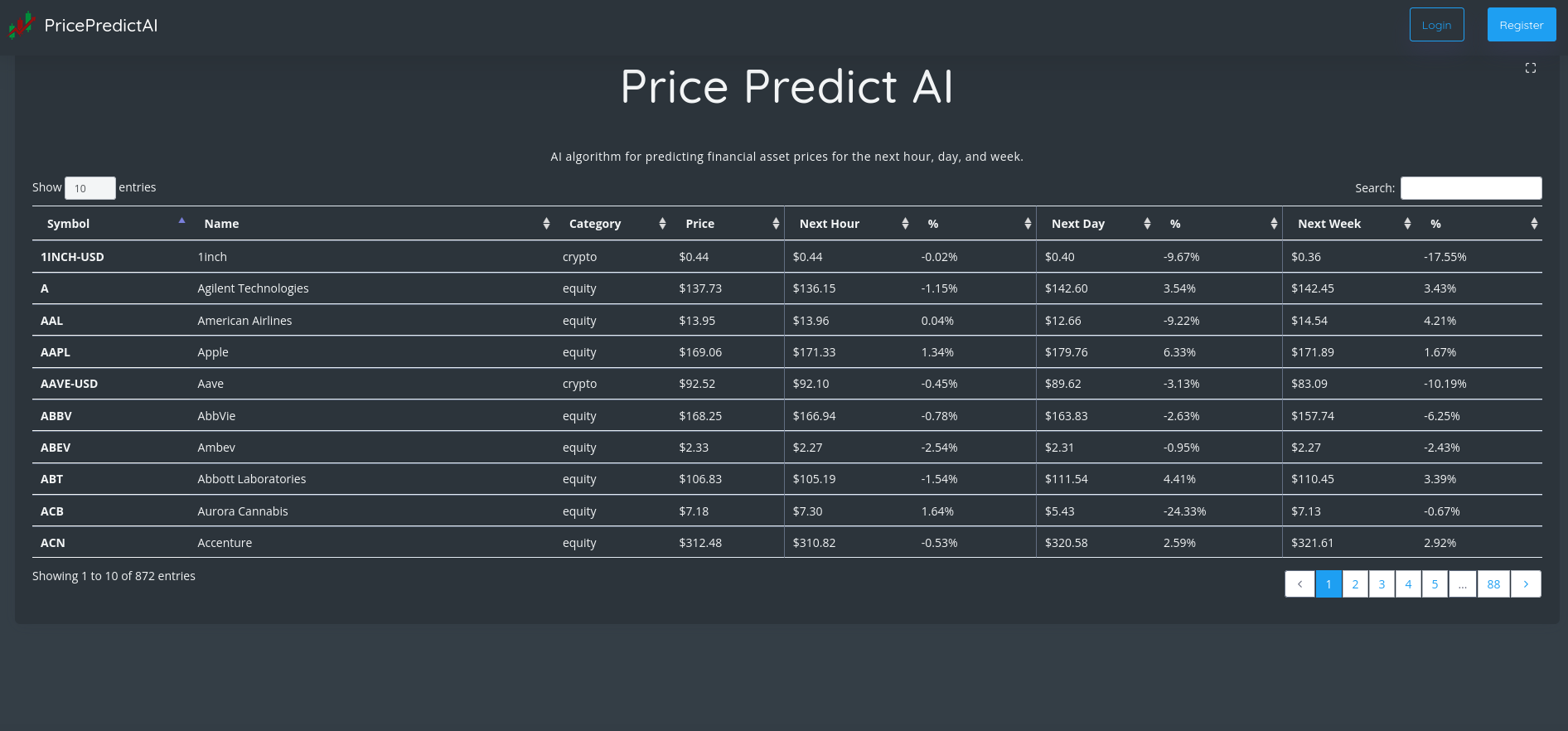

Innrs offers A.I.-based statistics tools that can be used to assist investors in making decisions. Below is a table that lists the most accurate financial assets for predicting prices, sorted by their highest predicted accuracy.

Officials at Innrs claim that this tool assists investors in making better-informed financial decisions. It is supposedly combined with other pertinent financial information, and the trader strategy.

Via News will present the results of the algorithm precision in the next session.

| Financial Asset | Accuracy | Close Price | Prediction |

|---|---|---|---|

| Merck (MRK) | 93.31% | $109.09 | ⇧ $111.38 |

| Kodak (KODK) | 90.22% | $3.84 | ⇩ $3.5 |

| Ulta Beauty (ULTA) | 88.87% | $473.52 | ⇧ $478.26 |

| JD.com (JD) | 87.81% | $58.38 | ⇧ $59.43 |

| Cigna (CI) | 87.77% | $333.23 | ⇧ $341.72 |

| 3D Systems (DDD) | 87.29% | $9.27 | ⇧ $9.33 |

| Air Products and Chemicals (APD) | 84.15% | $313.89 | ⇧ $315.04 |

| Twitter (TWTR) | 84.13% | $53.7 | ⇧ $54.1 |

| Incyte Corporation (INCY) | 84.03% | $82.36 | ⇧ $84.09 |

| Liberty Broadband (LBRDA) | 83.85% | $87.58 | ⇧ $87.62 |

| Astrazeneca (AZN) | 83.65% | $69.57 | ⇧ $71.47 |

| Invesco (IVZ) | 83.62% | $18.35 | ⇧ $18.45 |

| Live Nation Entertainment (LYV) | 83.52% | $71.74 | ⇧ $73.25 |

| Exelon (EXC) | 83.51% | $41.48 | ⇧ $42.67 |

| Dropbox (DBX) | 83.44% | $22.45 | ⇧ $22.69 |

| NextEra Energy (NEE) | 83.42% | $84.61 | ⇧ $86.73 |

| VALE (VALE) | 83.42% | $16.95 | ⇧ $17.39 |

| Koninklijke Philips (PHG) | 83.38% | $14.2 | ⇧ $14.22 |

| Pinterest (PINS) | 83.33% | $23.12 | ⇧ $23.19 |

| Altair Engineering (ALTR) | 83.29% | $47.46 | ⇧ $48.01 |

| Caesars Entertainment (CZR) | 83.18% | $49.42 | ⇧ $49.61 |

| Southern Company (SO) | 82.84% | $68.43 | ⇧ $70.61 |

| Church & Dwight Company (CHD) | 82.8% | $80.17 | ⇧ $82.56 |

| Tesla (TSLA) | 82.01% | $178.76 | ⇧ $199.44 |

1. Merck (MRK)

Shares of Merck jumped 7.03% in from $101.92 to $109.09 at 18:21 EST on Friday, after three successive sessions in a row of gains. NYSE is dropping 0.71% to $15,291.05, following the last session’s upward trend.

Merck & Co., Inc. is a global healthcare provider. The company operates in two areas: Pharmaceutical and Animal Health. It offers pharmaceutical products for human health in areas such as oncology and hospital acute care. Animal Health develops and manufactures veterinary vaccines and other health products. It also offers digitally connected traceability and identification solutions. The company serves pharmacies, government agencies, drug retailers, hospitals, as well as managed healthcare providers such is health maintenance organizations and pharmacy benefit managers. It also assists veterinarians, physicians, distributors of physician, and animal producers. AstraZeneca PLC, Bayer AG, Eisai Co., Ltd., Ridgeback Biotherapeutics, and Gilead Sciences, Inc. collaborate with the company to develop long-acting HIV treatments. Merck & Co., Inc. is a New Jersey-based company that was established in 1891.

Revenue Growth

Year-on-year quarterly revenue growth grew by 28%, now sitting on 57.17B for the twelve trailing months.

Yearly Top and Bottom Value

Merck’s stock is valued at $109.09 at 18:21 EST, below its 52-week high of $110.98 and way higher than its 52-week low of $71.50.

More news about Merck.

2. Kodak (KODK)

Shares of Kodak slid by a staggering 14.32% in from $4.48 to $3.84 at 18:21 EST on Friday, following the last session’s upward trend. NYSE is falling 0.71% to $15,291.05, following the last session’s upward trend.

Eastman Kodak Company provides hardware, software, consumables, and services to customers in the commercial print, packaging, publishing, manufacturing, and entertainment markets worldwide. The company operates through Traditional Printing, Digital Printing, Advanced Materials and Chemicals, and Brand. The Traditional Printing segment offers digital offset plate and computer-to-plate imaging solutions to commercial industries, including commercial print, direct mail, book publishing, newspapers and magazines, and packaging. The Digital Printing segment provides electrophotographic printing solutions, such as The ASCEND and NEXFINITY printers; prosper products, including the PROSPER 6000 Press, PROSPER Writing Systems, PROSPER press systems, and PROSPER components; versamark products; and PRINERGY workflow production software. The Advanced Materials and Chemicals segment engages in industrial film and chemicals, motion picture, and advanced materials and functional printing businesses. This segment also comprises the Kodak Research Laboratories, which conducts research, develops new product or new business opportunities, and files patent applications for its inventions and innovations, as well as manages licensing of its intellectual property to third parties. The Brand segment engages in the licensing of Kodak brand to third parties. The company engages in the operation of Eastman Business Park, a technology center and industrial complex. It sells its products and services through direct sales, third party resellers, dealers, channel partners, and distributors. Eastman Kodak Company was founded in 1880 and is headquartered in Rochester, New York.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Kodak stock considered overbought (>=80).

Annual Top and Bottom Value

Kodak stock was valued at $3.84 as of 18:21 EST. This is way below its 52 week high of $7.50, and way higher than its 52-week low at $3.46.

Revenue Growth

Year-on-year quarterly revenue growth grew by 9.4%, now sitting on 1.18B for the twelve trailing months.

Moving Average

Kodak’s market value is significantly below its moving average for 50 days of $5.12, and its moving average for 200 days of $5.18.

More news about Kodak.

3. Ulta Beauty (ULTA)

Shares of Ulta Beauty rose by a staggering 12.3% in from $421.66 to $473.52 at 18:21 EST on Friday, after two consecutive sessions in a row of gains. NASDAQ is sliding 0.7% to $11,004.62, following the last session’s upward trend.

Ulta Beauty, Inc. is a US-based retailer of beauty products. It sells cosmetics, haircare, shampoo and body products as well as professional salon products. The company also offers its own private label products such as Ulta Beauty Collection cosmetics, skin care, bath products and gifts; as well as Ulta Beauty brand products. The company had 1,308 stores in 50 states as of March 10, 2022. The company also sells products via its website ulta.com and through mobile apps. Ulta Beauty, Inc. was formerly Ulta Salon, Cosmetics & Fragrance, Inc. Ulta Beauty, Inc., was founded in 1990. It is located in Bolingbrook, Illinois.

Sales Growth

Ulta Beauty is expecting 6.6% sales growth in the next quarter.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Ulta Beauty stock considered oversold (=20).

Growth Estimates Quarters

The company’s growth estimates for the present quarter is 3.8% and a drop 3.9% for the next.

More news about Ulta Beauty.

4. JD.com (JD)

Shares of JD.com rose by a staggering 26.86% in from $46.02 to $58.38 at 18:21 EST on Friday, following the last session’s upward trend. NASDAQ is sliding 0.7% to $11,004.62, following the last session’s upward trend.

JD.com, Inc. offers supply chain-based technology and services to the People’s Republic of China. It offers communication and electronics products as well as consumer products. The company also offers online marketplace services to third-party sellers; marketing services, and omnichannel solutions for customers and retailers. It also offers online healthcare services. The company also develops and owns logistics properties and real estate properties for third-party support; it provides asset management services to logistics property investors. It also provides industry-specific data, technology and business solutions that support digitization in enterprises and institutions. 360buy Jingdong Inc. was the company’s previous name. JD.com, Inc. took over its operations in January 2014. JD.com, Inc. is an online company that was founded in 2006. Its headquarters are in Beijing, China.

Sales Growth

JD.com sales growth was negative 0.3% in the current quarter, and 4.1% the following.

Annual Top and Bottom Value

JD.com stock was valued at $58.38 as of 18:22 EST. This is way lower than the 52-week high $81.24 but much higher than its low 52-week of $33.17.

More news about JD.com.

5. Cigna (CI)

Shares of Cigna rose 3.04% in from $323.4 to $333.23 at 18:21 EST on Friday, after five sequential sessions in a row of gains. NYSE is falling 0.71% to $15,291.05, following the last session’s upward trend.

Cigna Corporation offers insurance products and related services in the United States. The company’s Evernorth division provides coordinated, point-solution health services. This includes pharmacy, benefits management and care delivery and management. It also offers intelligence solutions for employers and providers of health care. Cigna Healthcare, the company’s healthcare segment, offers medical, prescription, behavioral, vision, and other services to insured customers. It also provides Medicare Advantage, Medicare Supplement and Medicare Part D plans, for both seniors and individuals. The Cigna Healthcare segment also has individual and group health plans that can be taken on or off public exchanges. Permanent insurance contracts can be sold to companies to cover certain employees’ lives and help finance future benefits obligations. The company distributes products and services via insurance brokers and consultants, directly to employers and unions, as well as individuals, and through private and public exchanges. It was established in Bloomfield Connecticut in 1792.

More news about Cigna.

6. 3D Systems (DDD)

Shares of 3D Systems jumped 0.32% in from $9.24 to $9.27 at 18:21 EST on Friday, following the last session’s upward trend. NYSE is dropping 0.71% to $15,291.05, following the last session’s upward trend.

3D Systems Corporation provides 3D printing services through its subsidiaries in Asia Pacific, Europe, Africa, Middle East and Africa. 3D printing services offered by the company include stereolithography and selective laser sintering. Multi-jet printing and color jet printing are also available. Extrusion and SLA-based bioprinting transforms digital data from 3D software or computer-aided design (CAD), software into printed parts. The company also creates, blends and markets a variety of print materials such as nylon, plastic, metal, composite and elastomeric. The company also offers digital design tools such as software, scanners and haptic device, along with solutions for product design and simulation. It also offers 3D Sprint, 3DXpert and Bioprint Pro software solutions that allow researchers to create repeatable bioprint experiments and to optimize CAD data. The company also offers maintenance, training and manufacturing services. It also provides software and precision health services. The company serves small and medium-sized businesses, including those in the medical, dental and aerospace industries. 3D Systems Corporation was established in 1986. It is located in Rock Hill in South Carolina.

More news about 3D Systems.

7. Air Products and Chemicals (APD)

Shares of Air Products and Chemicals rose 8.43% in from $289.49 to $313.89 at 18:21 EST on Friday, after two consecutive sessions in a row of gains. NYSE is dropping 0.71% to $15,291.05, following the last session’s upward trend.

Air Products and Chemicals, Inc. provides atmospheric gases, process and specialty gases, equipment, and services worldwide. The company produces atmospheric gases, including oxygen, nitrogen, and argon; process gases, such as hydrogen, helium, carbon dioxide, carbon monoxide, syngas; specialty gases; and equipment for the production or processing of gases comprising air separation units and non-cryogenic generators for customers in various industries, including refining, chemical, gasification, metals, manufacturing, food and beverage, electronics, magnetic resonance imaging, energy production and refining, and metals. It also designs and manufactures equipment for air separation, hydrocarbon recovery and purification, natural gas liquefaction, and liquid helium and liquid hydrogen transport and storage. Air Products and Chemicals, Inc. has a strategic collaboration with Baker Hughes Company to develop hydrogen compression systems. The company was founded in 1940 and is headquartered in Allentown, Pennsylvania.

Volatility

Air Products and Chemicals had an intraday variation of 0.12% in the last week, 0.62% and 1.62% respectively.

Air Products and Chemicals had the highest average volatility amplitudes of 1.13%, 1.23% and 1.62% respectively (last week, last month and last quarter).

Revenue Growth

Year-on-year quarterly revenue growth grew by 22.4%, now sitting on 11.97B for the twelve trailing months.

Growth Estimates Quarters

For the current quarter, the company expects to grow by 10% and 7.5% respectively.

More news about Air Products and Chemicals.

8. Twitter (TWTR)

Shares of Twitter dropped 0% in from $53.7 to $53.70 at 18:21 EST on Friday, following the last session’s downward trend. NYSE is dropping 0.71% to $15,291.05, following the last session’s upward trend.

Twitter reinstates suspended accounts

False, hate speech impressions are actually down by 1/3 for Twitter now vs prior to acquisition @CommunityNotes

Twitter, Inc. is a social media platform that allows people to express themselves and have real-time conversations. Twitter is the company’s main product. It allows people to create, consume, distribute and discover content. The company also offers promoted products which allow advertisers to advertise brands, products and services. The company’s promoted products include Twitter Amplify and Follower Ads as well as promoted ads. The company also offers monetization products to creators. These include Tips, which allows creators to send one-time small payments to Twitter via various payment methods including bitcoin. Super Follows is a monthly paid subscription that includes bonus content and previews. Ticketed Spaces supports creators by paying them for hosting and managing the Twitter Spaces public discussion. It also offers data partners and products to developers, including the Twitter Developer Platform. This platform allows developers to create tools for businesses and people using its public API. Partners with commercial uses of Twitter data can get paid access to Twitter data. Twitter, Inc. was established in 2006 in San Francisco, California.

Previous days news about Twitter

- Exclusive: s.f. city attorney looking into loss of twitter janitors’ jobs. According to MarketWatch on Wednesday, 7 December, "Also Tuesday, Ted Goldberg, a senior editor at KQED, San Francisco’s public radio station, tweeted that the San Francisco Department of Building Inspection is launching an investigation into news reported by Forbes that Twitter has set up bedrooms for employees at its headquarters.", "Miranda said 48 janitors in total are affected, 30 of whom were waiting to go back to work because many Twitter employees had been working from home and not as many janitors were needed."

- Elon Musk fires twitter lawyer allegedly involved in censoring hunter biden laptop story. According to Benzinga on Wednesday, 7 December, "In light of concerns about Baker’s possible role in suppression of information important to the public dialogue, he was exited from Twitter today", "On Tuesday, Twitter Deputy General Counsel (and former FBI General Counsel) Jim Baker was fired. "

- Tesla bear michael burry deletes twitter account yet again after professing trust in Elon Musk. According to Benzinga on Thursday, 8 December, "Breaking: Michael Burry has once again deleted his Twitter Account pic.twitter.com/2qvGedWMNB"

More news about Twitter.

9. Incyte Corporation (INCY)

Shares of Incyte Corporation rose 5.66% in from $77.95 to $82.36 at 18:21 EST on Friday, after two successive sessions in a row of gains. NASDAQ is sliding 0.7% to $11,004.62, following the last session’s upward trend.

Incyte Corporation, a biopharmaceutical company, focuses on the discovery, development, and commercialization of proprietary therapeutics in the United States and internationally. The company offers JAKAFI, a drug for the treatment of myelofibrosis and polycythemia vera; PEMAZYRE, a fibroblast growth factor receptor kinase inhibitor that act as oncogenic drivers in various liquid and solid tumor types; and ICLUSIG, a kinase inhibitor to treat chronic myeloid leukemia and philadelphia-chromosome positive acute lymphoblastic leukemia. Its clinical stage products include ruxolitinib, a steroid-refractory chronic graft-versus-host-diseases (GVHD); itacitinib, which is in Phase II/III clinical trial to treat naïve chronic GVHD; and pemigatinib for treating bladder cancer, cholangiocarcinoma, myeloproliferative syndrome, and tumor agnostic. In addition, the company engages in developing Parsaclisib, which is in Phase II clinical trial for follicular lymphoma, marginal zone lymphoma, and mantel cell lymphoma. Additionally, it develops Retifanlimab that is in Phase II clinical trials for MSI-high endometrial cancer, merkel cell carcinoma, and anal cancer, as well as in Phase II clinical trials for patients with non-small cell lung cancer. It has collaboration agreements with Novartis International Pharmaceutical Ltd.; Eli Lilly and Company; Agenus Inc.; Calithera Biosciences, Inc; MacroGenics, Inc.; Merus N.V.; Syros Pharmaceuticals, Inc.; Innovent Biologics, Inc.; Zai Lab Limited; Cellenkos, Inc.; and Nimble Therapeutics, as well as clinical collaborations with MorphoSys AG and Xencor, Inc. to investigate the combination of tafasitamab, plamotamab, and lenalidomide in patients with relapsed or refractory diffuse large B-cell lymphoma, and relapsed or refractory follicular lymphoma. The company was incorporated in 1991 and is headquartered in Wilmington, Delaware.

Sales Growth

Incyte Corporation’s sales growth is 1.7% for the present quarter and 12.7% for the next.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Incyte Corporation stock considered oversold (=20).

More news about Incyte Corporation.

10. Liberty Broadband (LBRDA)

Shares of Liberty Broadband jumped 1.6% in from $86.2 to $87.58 at 18:21 EST on Friday, following the last session’s downward trend. NASDAQ is falling 0.7% to $11,004.62, following the last session’s upward trend.

Liberty Broadband Corporation is involved in communications business. GCI Holdings, Charter and Charter are its segments. GCI Holdings provides wireless, data and voice services for residential customers and businesses. It also offers managed services for educational and medical institutions. Subscription-based video services are offered by the Charter segment. These services include video on demand and high-definition TV, digital video recorder, local and long distance calling, voicemail and call waiting. Spectrum TV also offers voice services. The company also offers internet services. This includes an in-home WiFi product, which provides customers high-performance Wi-Fi routers and managed WiFi services. Advanced community Wi-Fi and mobile internet are just a few of the many options. It also has a security suite to protect against spyware and computer viruses. This segment also offers data networking and internet access to cellular towers, office buildings and video entertainment; business telephone services; digital outlet advertising; regional sports networks; and provides internet connectivity. Liberty Broadband Corporation, which was founded in 2014 is located in Englewood in Colorado.

Sales Growth

Liberty Broadband sales growth was negative 1.8% in the current quarter, and 0.9% the following.

Moving Average

Liberty Broadband’s value is above its 50-day moving average of $82.12 and way below its 200-day moving average of $109.07.

More news about Liberty Broadband.

11. Astrazeneca (AZN)

Shares of Astrazeneca jumped 6.92% in from $65.07 to $69.57 at 18:21 EST on Friday, after three sequential sessions in a row of gains. NYSE is sliding 0.71% to $15,291.05, following the last session’s upward trend.

AstraZeneca PLC is a biopharmaceutical firm that focuses on developing, manufacturing and marketing prescription drugs. Its marketed products include Calquence, Enhertu, Faslodex, Imfinzi, Iressa, Koselugo, Lumoxiti, Lynparza, Orpathys, Tagrisso, and Zoladex for oncology; Brilinta/Brilique, Bydureon/Byetta, BCise, Byetta, Crestor, Evrenzo, Farxiga/Forxiga, Komboglyze/Kombiglyze XR, Lokelma, Onglyza, Qtern, and Xigduo/Xigduo XR for cardiovascular, renal, and metabolism diseases; Bevespi Aerosphere, Breztri Aerosphere, Daliresp/Daxas, Duaklir Genuair, Fasenra, Pulmicort, Saphnelo, Symbicort, and Tudorza/Eklira/Bretaris for respiratory and immunology; and Andexxa/Ondexxya, Kanuma, Soliris, Strensiq, and Ultomiris for rare diseases. Synagis is a respiratory syncytialvirus treatment; Fluenz Tetra/FluMist quadrivalent for Influenza; Serocort IR/Seroquel XR to treat schizophrenia bipolar disorder; Nexium and Losec/Prilosec are gastroenterology treatments; Vaxzevria, Soliris and Strensiq are covid-19 medications. Through distributors and representative offices located in Europe, Americas, Asia and Africa, the company provides primary and specialty care doctors with services. The company has a partnership agreement with Regeneron Pharmaceuticals, Inc. for research, development, and marketing small molecule medications for obesity. Neurimmune AG will develop and market NI006 and Ionis Pharmaceuticals, Inc. for eplontersen, a liver targeted antisense treatment in Phase III for treatment of transthyretin. Proteros Biostructures GmbH and Sierra Oncology, Inc. will jointly develop and market AZD5153. The company used to be known as Zeneca Group PLC. In April 1999, it changed its name from AstraZeneca PLC. AstraZeneca Plc was founded in 1992. It is located in Cambridge, United Kingdom.

Moving Average

Astrazeneca’s value is way above its 50-day moving average of $59.47 and way higher than its 200-day moving average of $63.16.

Revenue growth

The year-on-year revenue growth was 31%. We now have 44.04B in the 12 trailing months.

Yearly Top and Bottom Value

Astrazeneca’s stock is valued at $69.57 at 18:22 EST, below its 52-week high of $71.70 and way above its 52-week low of $52.65.

More news about Astrazeneca.

12. Invesco (IVZ)

Shares of Invesco dropped 2.18% in from $18.76 to $18.35 at 18:21 EST on Friday, following the last session’s upward trend. NYSE is dropping 0.71% to $15,291.05, following the last session’s upward trend.

Invesco Ltd., a public investment manager is owned by the company. It provides services for retail clients as well as institutional clients and high-net-worth clients. The firm manages client-specific equity and fixed income portfolios. It also offers equity, fixed income and commodity mutual funds to its clients. The firm launches fixed income, equity and multi-asset funds as well as balanced exchange-traded funds. It also manages and launches private funds. The firm invests in fixed and public equity markets around the world. It also invests in other markets such as currencies and commodities. It invests in large-cap, small-cap and mid-cap growth stocks. The firm also invests in fixed income, including convertibles, government bonds and municipal bonds. The firm also invests short-term and intermediate-term bonds, high-yield bonds, tax-free and taxable bonds, senior secured loans and structured securities like asset-backed security, commercial mortgage-backed Securities, and mortgage-backed Securities. It employs long and short strategies, as well as absolute return, macro global, and other types of strategy. To make investments, it uses quantitative analysis. Formerly known as Invesco plc., AMVESCAP plc., Amvesco plc., Invesco PLC., Invesco MIIM and H. Lotery & Co. Ltd., Invesco Ltd. is based out of Atlanta, Georgia and has an additional office located in Hamilton, Bermuda.

Moving Average

Invesco’s value is way above its 50-day moving average of $16.26 and above its 200-day moving average of $18.06.

Yearly Top and Bottom Value

Invesco’s stock is valued at $18.35 at 18:22 EST, way below its 52-week high of $25.33 and way above its 52-week low of $13.20.

Revenue Growth

Year-on-year quarterly revenue growth declined by 17.4%, now sitting on 6.37B for the twelve trailing months.

More news about Invesco.

13. Live Nation Entertainment (LYV)

Shares of Live Nation Entertainment fell 6.4% in from $76.65 to $71.74 at 18:21 EST on Friday, after three consecutive sessions in a row of gains. NYSE is dropping 0.71% to $15,291.05, following the last session’s upward trend.

Live Nation Entertainment, Inc. is a live entertainment business. The company operates in three segments: Concerts, Sponsorship, and Ticketing. It promotes live music in venues it owns or manages, as well as in rented venues. The segment also operates and manages venues for music and creates related content. The ticketing segment is responsible for managing the ticketing operation. This includes providing ticketing software, services and information to customers through livenation.com or ticketmaster.com. It also provides ticket resale and other services. The segment also sells tickets to its own events as well as third-party customers in various event categories such as amphitheaters. concert promoters. professional sports teams. college sports teams. performing arts venues. museums. theaters via websites, mobile apps and ticket outlets. This segment is responsible for placing advertising and sponsorships, both local and international. It also sells signage and promotional programs. The segment develops and books custom programs or events for brands, and also helps with the creation of sponsorship programs. It owned, operated or leased 165 entertainment venues across North America, and 94 internationally. The original name of the company was Live Nation, Inc., but it changed its name in January 2010 to Live Nation Entertainment, Inc. Live Nation Entertainment, Inc. was founded in 2005. It is located in Beverly Hills, California.

More news about Live Nation Entertainment.

14. Exelon (EXC)

Shares of Exelon jumped 6.33% in from $39.01 to $41.48 at 18:21 EST on Friday, after two consecutive sessions in a row of losses. NASDAQ is sliding 0.7% to $11,004.62, following the last session’s upward trend.

Exelon Corporation is a holding company for utility services. It engages in energy generation, distribution, and marketing in both the United States of America and Canada. The company owns a variety of facilities, including solar, nuclear, renewable, energy, biofuel, wind and hydroelectric. It also offers electricity wholesale to retail customers and natural gas and renewable energy as well as other energy-related products, services, and goods. It is also involved in the regulation and purchase of electricity and natural gases; transmission and distribution, as well distribution of natural gas retail customers. The company also offers support services such as legal, human resource, information technology and accounting. The company serves residential, commercial, industrial and governmental customers as well as distribution utilities and cooperatives. Exelon Corporation, which was founded in 1999, is located in Chicago.

Revenue Growth

Year-on-year quarterly revenue growth grew by 5.4%, now sitting on 37.26B for the twelve trailing months.

Yearly Top and Bottom Value

Exelon’s stock is valued at $41.48 at 18:23 EST, way under its 52-week high of $50.71 and way above its 52-week low of $35.19.

More news about Exelon.

15. Dropbox (DBX)

Shares of Dropbox rose 0.22% in from $22.4 to $22.45 at 18:21 EST on Friday, following the last session’s upward trend. NASDAQ is sliding 0.7% to $11,004.62, following the last session’s upward trend.

Dropbox, Inc. provides a content collaboration platform worldwide. Its platform allows individuals, families, teams, and organizations to collaborate and sign up for free through its website or app, as well as upgrade to a paid subscription plan for premium features. As of December 31, 2021, the company had approximately 700 million registered users. It serves customers in professional services, technology, media, education, industrial, consumer and retail, and financial services industries. The company was formerly known as Evenflow, Inc. and changed its name to Dropbox, Inc. in October 2009. Dropbox, Inc. was incorporated in 2007 and is headquartered in San Francisco, California.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Dropbox stock considered oversold (=20).

More news about Dropbox.

16. NextEra Energy (NEE)

Shares of NextEra Energy rose 1.68% in from $83.21 to $84.61 at 18:21 EST on Friday, after five successive sessions in a row of gains. NYSE is sliding 0.71% to $15,291.05, following the last session’s upward trend.

NextEra Energy, Inc., through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America. The company generates electricity through wind, solar, nuclear, coal, and natural gas facilities. It also develops, constructs, and operates long-term contracted assets that consists of clean energy solutions, such as renewable generation facilities, battery storage projects, and electric transmission facilities; sells energy commodities; and owns, develops, constructs, manages and operates electric generation facilities in wholesale energy markets. As of December 31, 2021, the company had approximately 28,564 megawatts of net generating capacity; approximately 77,000 circuit miles of transmission and distribution lines; and 696 substations. It serves approximately 11 million people through approximately 5.7 million customer accounts in the east and lower west coasts of Florida. The company was formerly known as FPL Group, Inc. and changed its name to NextEra Energy, Inc. in 2010. The company was founded in 1925 and is headquartered in Juno Beach, Florida.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

NextEra Energy’s stock is considered to be oversold (<=20).

Annual Top and Bottom Value

NextEra Energy stock was valued at $84.61 as of 18:23 EST. This is below its 52 week high of $93.73 but well above its low 52-week of $67.22.

Volatility

NextEra Energy’s last week, last month’s, and last quarter’s current intraday variation average was 0.14%, 0.45%, and 1.63%.

NextEra Energy’s highest amplitude of average volatility was 0.18% (last week), 1.29% (last month), and 1.63% (last quarter).

More news about NextEra Energy.

17. VALE (VALE)

Shares of VALE jumped by a staggering 22.65% in from $13.82 to $16.95 at 18:21 EST on Friday, after two sequential sessions in a row of gains. NYSE is sliding 0.71% to $15,291.05, following the last session’s upward trend.

Together with its subsidiaries Vale S.A. produces and sells ironore pellets and iron ore for steelmaking both in Brazil and abroad. Ferrous Minerals, and Base Metals are the segments that make up the company. Ferrous Minerals produces ferrous minerals, such as iron ore pellets and ferroalloys. It also provides logistical services. Base Metals produces and extracts nickel, along with its byproducts such as cobalt and precious metals. The former name of the company was Companhia Vale Do Rio Doce. In May 2009, Vale S.A. took over. Vale S.A. was established in 1942. It is located in Rio de Janeiro in Brazil.

Moving Average

VALE’s value is way above its 50-day moving average of $13.10 and above its 200-day moving average of $15.72.

Volatility

VALE’s intraday variation average for the week and quarter ended last week at 0.24%. Last month’s was 2.80%.

VALE had the highest average volatility amplitude at 1.29%, 2.26% and 2.80% respectively in last week.

Revenue growth

The year-on-year revenue growth fell by 36.8%. We now have 249.43B in the 12 trailing months.

More news about VALE.

18. Koninklijke Philips (PHG)

Shares of Koninklijke Philips jumped 1% in from $14.06 to $14.20 at 18:21 EST on Friday, after five consecutive sessions in a row of losses. NYSE is sliding 0.71% to $15,291.05, following the last session’s upward trend.

Koninklijke Philips N.V. operates as a health technology company in North America and internationally. It operates through Diagnosis & Treatment Businesses, Connected Care Businesses, and Personal Health Businesses segments. The company provides diagnostic imaging solutions, includes magnetic resonance imaging, computed tomography (CT) systems, X-ray systems, and detector-based spectral CT solutions, as well as molecular and hybrid imaging solutions for nuclear medicine; integrated interventional systems; echography solutions focused on diagnosis, treatment planning and guidance for cardiology, general imaging, obstetrics/gynecology, and point-of-care applications; proprietary software to enable diagnostics and intervention; and enterprise diagnostic informatics products and services. It also offers acute patient management solutions; emergency care solutions; sleep and respiratory care solutions; and electronic medical record and care management solutions. In addition, the company provides power toothbrushes, brush heads, and interdental cleaning and teeth whitening products; infant feeding and digital parental solutions; and male grooming and beauty products and solutions. It has a strategic collaboration with Ibex Medical Analytics Ltd. to jointly promote the digital pathology and AI solutions to hospitals, health networks, and pathology laboratories worldwide, as well as a strategic partnership agreement with NICO.LAB. The company was formerly known as Koninklijke Philips Electronics N.V. and changed its name to Koninklijke Philips N.V. in May 2013. Koninklijke Philips N.V. was founded in 1891 and is headquartered in Amsterdam, the Netherlands.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Koninklijke Philips’s stock is considered to be overbought (>=80).

Moving Average

Koninklijke Philips is worth more than its $50-day moving mean of $14.15, and much less than its $200-day moving median of $21.84.

More news about Koninklijke Philips.

19. Pinterest (PINS)

Shares of Pinterest fell 0.56% in from $23.25 to $23.12 at 18:21 EST on Friday, after five successive sessions in a row of losses. NYSE is falling 0.71% to $15,291.05, following the last session’s upward trend.

Pinterest, Inc. operates as a visual discovery engine in the United States and internationally. The company's engine allows people to find inspiration for their lives, including recipes, style and home inspiration, DIY, and others; and provides video, product, and idea pins. It shows visual machine learning recommendations based on pinners taste and interests. The company was formerly known as Cold Brew Labs Inc. and changed its name to Pinterest, Inc. in April 2012. Pinterest, Inc. was incorporated in 2008 and is headquartered in San Francisco, California.

Revenue growth

The year-on-year revenue growth was 18.5%. We now have 2.67B in the 12 trailing months.

More news about Pinterest.

20. Altair Engineering (ALTR)

Shares of Altair Engineering slid 1.05% in from $47.96 to $47.46 at 18:21 EST on Friday, after two successive sessions in a row of gains. NASDAQ is sliding 0.7% to $11,004.62, following the last session’s upward trend.

Altair Engineering Inc. and its subsidiaries provide software and cloud solutions worldwide in the fields of simulation, high performance computing, data analysis, artificial intelligence, and other areas. Software and Client Engineering Services are the two main segments of Altair Engineering Inc. The software segment covers solvers, optimization technology products and high-performance computing applications as well as modeling and visualization tools. It also includes data analysis and products and tools for the Internet of Things. Support and complementary products are available. Software technologies are also offered in areas such as computational fluid dynamics, fatigue, manufacturing process simplification, cost estimation, for applications in marine and aerospace industries. This section also provides software-related services like consulting, implementation and training that focus on product design, development expertise, analysis, from component level to the final product engineering stage. Client engineering services are provided by the Client Engineering Services segment. The company also develops and sells solid state lighting technology. It also provides communication and control protocols that are based on intellectual property. This allows for direct replacement of fluorescent tubes by LED lamps. The company’s software integrates with other disciplines to optimize design performance, such as structures, motions, fluids and thermal management. Customers include banks, insurance companies, weather forecast agencies, electronics design firms and universities. Altair Engineering Inc. is located in Troy, Michigan.

More news about Altair Engineering.

21. Caesars Entertainment (CZR)

Shares of Caesars Entertainment dropped 2.93% in from $50.91 to $49.42 at 18:21 EST on Friday, after two consecutive sessions in a row of gains. NASDAQ is sliding 0.7% to $11,004.62, following the last session’s upward trend.

Caesars Entertainment, Inc. operates as a gaming and hospitality company in the United States. The company operates casinos comprising poker, keno, and race and online sportsbooks; dining venues, bars, nightclubs, and lounges; hotels; and entertainment venues. It also provides staffing and management services; accessories, souvenirs, and decorative items through retail stores; and online sports betting and iGaming services. As of December 31,2021, the company owned, leased, and managed 52 domestic properties in 16 states, consisting of approximately 55,700 slot machines, video lottery terminals, and e-tables; 2,900 table games; and 47,700 hotel rooms. Caesars Entertainment, Inc. was founded in 1937 and is based in Reno, Nevada.

Sales Growth

Caesars Entertainment’s sales growth is 7.9% for the current quarter and 20.2% for the next.

Revenue growth

The year-on-year revenue growth was 12.7%. It now stands at 10.39B in the 12 trailing months.

Volatility

Caesars Entertainment had a negative 0.85% and positive 3.41% intraday variations for the last week and quarter.

Caesars Entertainment had the highest average volatility amplitude at 2.14%, 3.00% and 3.41% respectively in last week.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Caesars Entertainment’s stock is considered to be oversold (<=20).

More news about Caesars Entertainment.

22. Southern Company (SO)

Shares of Southern Company jumped 4.35% in from $65.58 to $68.43 at 18:21 EST on Friday, after five successive sessions in a row of gains. NYSE is sliding 0.71% to $15,291.05, following the last session’s upward trend.

Through its subsidiaries, the Southern Company engages in generation, transmission and distribution of electric power. The company operates via Gas Distribution Operations and Gas Pipeline Investments segments. It also builds, purchases, manages and owns power generation assets. The company sells wholesale electricity to customers in Tennessee, Georgia, Virginia and Georgia. It also owns or operates 30 hydroelectric stations and 24 fossil fuel/cogeneration stations. 13 nuclear generating station, 3 nuclear generating sites, 1 fuel cell facility and 4 battery storage facility. The company constructs, maintains and operates 76,289 mile of natural gas pipelines. 14 storage facilities have a total capacity of 157 billion cubic feet. This allows it to supply natural gas to industrial, residential and commercial customers. It serves 8.7 million customers in the electric and gas utilities sector. The company also offers fiber optics and digital wireless communications services. Southern Company was founded in 1945. It is located in Atlanta, Georgia.

Volatility

Southern Company’s last week, last month’s, and last quarter’s current intraday variation average was 0.38%, 0.32%, and 1.38%.

Southern Company’s highest amplitude of average volatility was 0.75% (last week), 1.00% (last month), and 1.38% (last quarter).

Revenue Growth

Year-on-year quarterly revenue growth grew by 38.6%, now sitting on 25.86B for the twelve trailing months.

Growth Estimates Quarters

For the current quarter, the company expects to grow by a negative 30% and negative 13.4% respectively.

Sales Growth

Southern Company has a negative 13% quarter-over-quarter sales growth and a negative 1.2% next quarter.

More news about Southern Company.

23. Church & Dwight Company (CHD)

Shares of Church & Dwight Company rose 6.91% in from $74.99 to $80.17 at 18:21 EST on Friday, after five sequential sessions in a row of gains. NYSE is falling 0.71% to $15,291.05, following the last session’s upward trend.

Church & Dwight Co., Inc. develops, manufactures, and markets household, personal care, and specialty products. It operates through three segments: Consumer Domestic, Consumer International, and Specialty Products Division. The company offers cat litters, carpet deodorizers, laundry detergents, and baking soda, as well as other baking soda based products under the ARM & HAMMER brand; condoms, lubricants, and vibrators under the TROJAN brand; stain removers, cleaning solutions, laundry detergents, and bleach alternatives under the OXICLEAN brand; battery-operated and manual toothbrushes under the SPINBRUSH brand; home pregnancy and ovulation test kits under the FIRST RESPONSE brand; depilatories under the NAIR brand; oral analgesics under the ORAJEL brand; laundry detergents under the XTRA brand; gummy dietary supplements under the L'IL CRITTERS and VITAFUSION brands; dry shampoos under the BATISTE brand; water flossers and replacement showerheads under the WATERPIK brand; FLAWLESS products; cold shortening and relief products under the ZICAM brand; and oral care products under the THERABREATH brand. Its specialty products include animal productivity products, such as MEGALAC rumen bypass fat, a supplement that enables cows to maintain energy levels during the period of high milk production; BIO-CHLOR and FERMENTEN, which are used to reduce health issues associated with calving, as well as provides needed protein; and CELMANAX refined functional carbohydrate, a yeast-based prebiotic. The company offers sodium bicarbonate; and cleaning and deodorizing products. It sells its consumer products through supermarkets, mass merchandisers, wholesale clubs, drugstores, convenience stores, home stores, dollar and other discount stores, pet and other specialty stores, and websites and other e-commerce channels; and specialty products to industrial customers and livestock producers through distributors. The company was founded in 1846 and is headquartered in Ewing, New Jersey.

Moving Average

Church & Dwight Company is worth more than its $50.98 moving average and much less than its $200.25 moving average.

More news about Church & Dwight Company.

24. Tesla (TSLA)

Shares of Tesla slid 6.09% in from $190.35 to $178.76 at 18:21 EST on Friday, after four successive sessions in a row of losses. NASDAQ is falling 0.7% to $11,004.62, following the last session’s upward trend.

Elliott wave view: Tesla (tsla) downside looks incomplete The short termElliott Wave Viewin Tesla suggests that a cycle starting at 11.1.2022 is underway as a 5 waves impulse Elliott Wave structure.

Tesla, Inc. designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally. The company operates in two segments, Automotive, and Energy Generation and Storage. The Automotive segment offers electric vehicles, as well as sells automotive regulatory credits. It provides sedans and sport utility vehicles through direct and used vehicle sales, a network of Tesla Superchargers, and in-app upgrades; and purchase financing and leasing services. This segment is also involved in the provision of non-warranty after-sales vehicle services, sale of used vehicles, retail merchandise, and vehicle insurance, as well as sale of products to third party customers; services for electric vehicles through its company-owned service locations, and Tesla mobile service technicians; and vehicle limited warranties and extended service plans. The Energy Generation and Storage segment engages in the design, manufacture, installation, sale, and leasing of solar energy generation and energy storage products, and related services to residential, commercial, and industrial customers and utilities through its website, stores, and galleries, as well as through a network of channel partners. This segment also offers service and repairs to its energy product customers, including under warranty; and various financing options to its solar customers. The company was formerly known as Tesla Motors, Inc. and changed its name to Tesla, Inc. in February 2017. Tesla, Inc. was incorporated in 2003 and is headquartered in Austin, Texas.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Tesla stock considered overbought (>=80).

Annual Top and Bottom Value

Tesla stock’s value is $178.76 as of 18:24 EST. This price is way lower than its 52 week high of $402.67, and higher than its 52 week low of $166.19.

Moving Average

Tesla’s value is far below its moving average 50 days of $215.23, and much below its moving average 200 days of $264.23.

More news about Tesla.