(VIANEWS) – Today, the Innrs artificial intelligence algorithm suggests a high probability of discovering the approximate price for tomorrow of AbbVie ABBV, Gilead Sciences GILD and others.

Via News will regularly fact-check this AI algorithm that aims to consistently predict the next session price and next week’s trend of financial assets.

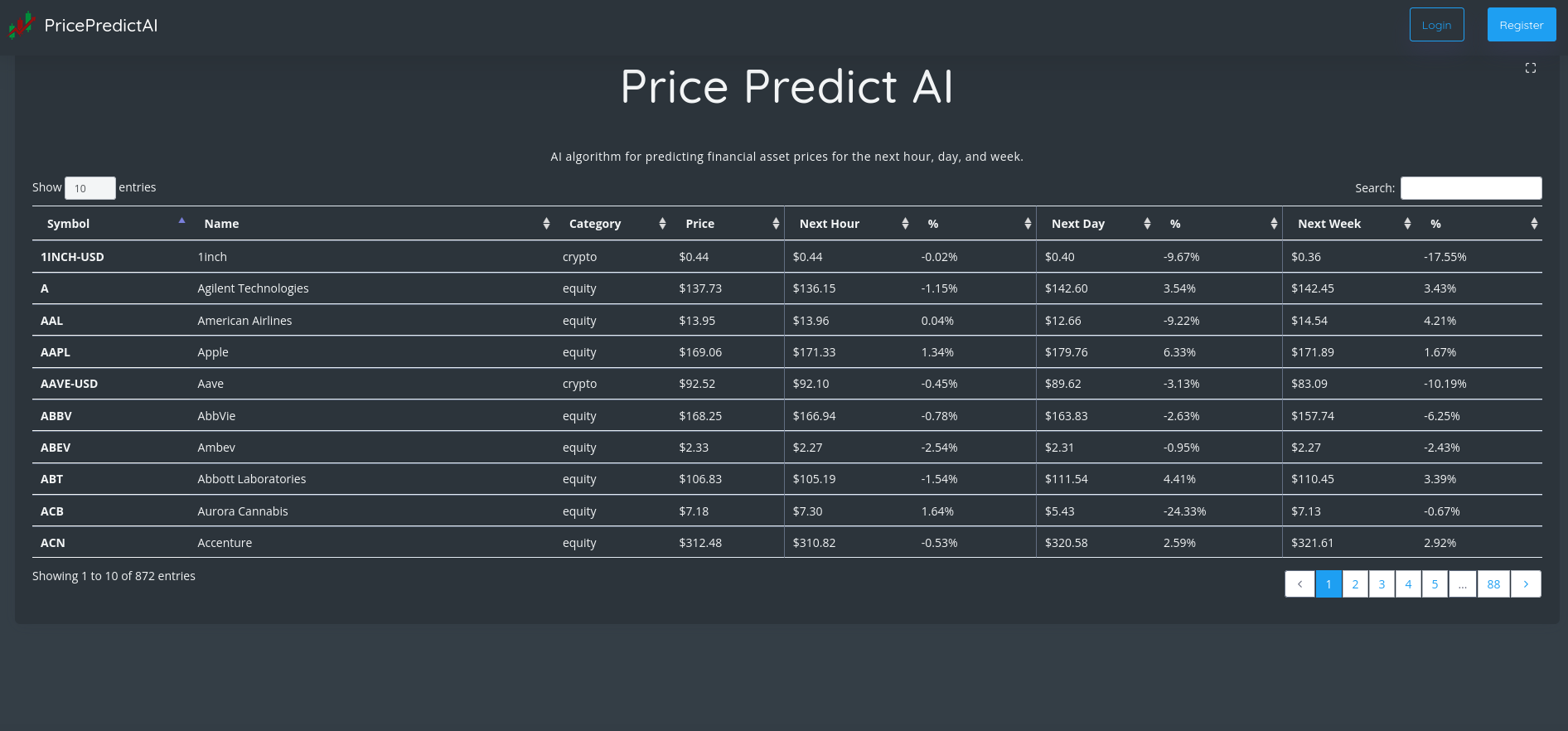

Innrs provides A.I.-based statistical tools to help investors make decisions. The table below shows the financial assets predicting price, ordered by the highest expected accuracy.

Innrs officials say this tool helps investors make better-informed decisions, supposedly used alongside other relevant financial information and the specific trader strategy.

In the next session, Via News will report the finding on the algorithm precision.

| Financial Asset | Accuracy | Close Price | Prediction |

|---|---|---|---|

| AbbVie (ABBV) | 93.99% | $151.94 | ⇧ $153.94 |

| Gilead Sciences (GILD) | 93.9% | $82.84 | ⇧ $84.93 |

| Comcast Corporation (CMCSA) | 93.49% | $33.98 | ⇧ $34.97 |

| TE Connectivity (TEL) | 93.47% | $125.77 | ⇧ $129.78 |

| Lumen Technologies (LUMN) | 93.3% | $5.87 | ⇧ $5.9 |

| MGM Resorts (MGM) | 93.24% | $37.06 | ⇧ $37.57 |

| STMicroelectronics (STM) | 92.76% | $37.97 | ⇧ $38.54 |

| Logitech (LOGI) | 92.74% | $59.42 | ⇧ $60.85 |

| MarketAxess Holdings (MKTX) | 92.51% | $262.27 | ⇧ $268.7 |

| Super Micro Computer (SMCI) | 92.5% | $82.16 | ⇧ $82.47 |

| Amkor Technology (AMKR) | 92.48% | $27.95 | ⇧ $28.98 |

| AMD (AMD) | 92.43% | $72.87 | ⇧ $75.01 |

| Moderna (MRNA) | 91.57% | $184.97 | ⇧ $188.72 |

| AT&T (T) | 89.39% | $18.93 | ⇧ $19.12 |

| Raymond James Financial (RJF) | 89.15% | $120.61 | ⇧ $121.12 |

| Rogers Communication (RCI) | 89.03% | $43.09 | ⇧ $44.12 |

| International Business Machines (IBM) | 89% | $144.71 | ⇧ $147.7 |

| Visa (V) | 88.99% | $210.74 | ⇧ $213.95 |

| SS&C Technologies Holdings (SSNC) | 88.84% | $52.52 | ⇧ $53.01 |

| Genmab (GMAB) | 88.77% | $43.62 | ⇧ $44.3 |

| Johnson & Johnson (JNJ) | 88.41% | $173.64 | ⇧ $177.54 |

| Genuine Parts Company (GPC) | 88.2% | $180.09 | ⇧ $181.63 |

| Akamai Technologies (AKAM) | 87.93% | $90.99 | ⇧ $93.23 |

| Intuitive Surgical (ISRG) | 87.83% | $263 | ⇧ $265.22 |

| NetEase (NTES) | 87.48% | $71.43 | ⇧ $73.79 |

| ON Semiconductor (ON) | 87.27% | $70.66 | ⇧ $72.35 |

| Cooper Companies (COO) | 87.22% | $310.18 | ⇧ $320.75 |

| Synopsys (SNPS) | 87.02% | $331.49 | ⇧ $339.52 |

| Align Technology (ALGN) | 86.85% | $200.97 | ⇧ $208.03 |

| Zebra Technologies (ZBRA) | 86.81% | $258.48 | ⇧ $260.22 |

| Atrion (ATRI) | 86.74% | $621.05 | ⇧ $637.74 |

| Block (SQ) | 86.2% | $69.43 | ⇧ $70.73 |

1. AbbVie (ABBV)

Shares of AbbVie rose 5.21% in from $144.42 to $151.94 at 18:21 EST on Wednesday, after four successive sessions in a row of gains. NYSE is dropping 0.75% to $15,265.25, following the last session’s upward trend.

AbbVie Inc. discovers, develops, manufactures, and sells pharmaceuticals in the worldwide. The company offers HUMIRA, a therapy administered as an injection for autoimmune and intestinal Behçet's diseases; SKYRIZI to treat moderate to severe plaque psoriasis in adults; RINVOQ, a JAK inhibitor for the treatment of moderate to severe active rheumatoid arthritis in adult patients; IMBRUVICA to treat adult patients with chronic lymphocytic leukemia (CLL), small lymphocytic lymphoma (SLL), and VENCLEXTA, a BCL-2 inhibitor used to treat adults with CLL or SLL; and MAVYRET to treat patients with chronic HCV genotype 1-6 infection. It also provides CREON, a pancreatic enzyme therapy for exocrine pancreatic insufficiency; Synthroid used in the treatment of hypothyroidism; Linzess/Constella to treat irritable bowel syndrome with constipation and chronic idiopathic constipation; Lupron for the palliative treatment of advanced prostate cancer, endometriosis and central precocious puberty, and patients with anemia caused by uterine fibroids; and Botox therapeutic. In addition, the company offers ORILISSA, a nonpeptide small molecule gonadotropin-releasing hormone antagonist for women with moderate to severe endometriosis pain; Duopa and Duodopa, a levodopa-carbidopa intestinal gel to treat Parkinson's disease; Lumigan/Ganfort, a bimatoprost ophthalmic solution for the reduction of elevated intraocular pressure (IOP) in patients with open angle glaucoma (OAG) or ocular hypertension; Ubrelvy to treat migraine with or without aura in adults; Alphagan/ Combigan, an alpha-adrenergic receptor agonist for the reduction of IOP in patients with OAG; and Restasis, a calcineurin inhibitor immunosuppressant to increase tear production, as well as other eye care products. AbbVie Inc. has a research collaboration with Dragonfly Therapeutics, Inc. The company was incorporated in 2012 and is headquartered in North Chicago, Illinois.

Revenue Growth

Year-on-year quarterly revenue growth grew by 4.5%, now sitting on 57.35B for the twelve trailing months.

Volatility

AbbVie’s last week, last month’s, and last quarter’s current intraday variation average was 0.91%, 0.25%, and 1.24%.

AbbVie’s highest amplitude of average volatility was 0.91% (last week), 1.09% (last month), and 1.24% (last quarter).

Growth Estimates Quarters

The company’s growth estimates for the present quarter and the next is 26.1% and 21.8%, respectively.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

AbbVie’s stock is considered to be oversold (<=20).

More news about AbbVie.

2. Gilead Sciences (GILD)

Shares of Gilead Sciences rose by a staggering 24.8% in from $66.38 to $82.84 at 18:21 EST on Wednesday, after two sequential sessions in a row of gains. NASDAQ is sliding 1.54% to $11,183.66, following the last session’s upward trend.

Gilead Sciences, Inc., a biopharmaceutical company, discovers, develops, and commercializes medicines in the areas of unmet medical need in the United States, Europe, and internationally. The company provides Biktarvy, Genvoya, Descovy, Odefsey, Truvada, Complera/ Eviplera, Stribild, and Atripla products for the treatment of HIV/AIDS; Veklury, an injection for intravenous use, for the treatment of coronavirus disease 2019; and Epclusa, Harvoni, Vosevi, Vemlidy, and Viread for the treatment of liver diseases. It also offers Yescarta, Tecartus, Trodelvy, and Zydelig products for the treatment of hematology, oncology, and cell therapy patients. In addition, the company provides Letairis, an oral formulation for the treatment of pulmonary arterial hypertension; Ranexa, an oral formulation for the treatment of chronic angina; and AmBisome, a liposomal formulation for the treatment of serious invasive fungal infections. Gilead Sciences, Inc. has collaboration agreements with Arcus Biosciences, Inc.; Pionyr Immunotherapeutics Inc.; Tizona Therapeutics, Inc.; Tango Therapeutics, Inc.; Jounce Therapeutics, Inc.; Galapagos NV; Janssen Sciences Ireland Unlimited Company; Japan Tobacco, Inc.; Gadeta B.V.; Bristol-Myers Squibb Company; Dragonfly Therapeutics, Inc.; and Merck & Co, Inc. The company was incorporated in 1987 and is headquartered in Foster City, California.

More news about Gilead Sciences.

3. Comcast Corporation (CMCSA)

Shares of Comcast Corporation jumped by a staggering 10.25% in from $30.82 to $33.98 at 18:21 EST on Wednesday, after four sequential sessions in a row of gains. NASDAQ is falling 1.54% to $11,183.66, following the last session’s upward trend.

Comcast Corporation operates as a media and technology company worldwide. It operates through Cable Communications, Media, Studios, Theme Parks, and Sky segments. The Cable Communications segment offers broadband, video, voice, wireless, and other services to residential and business customers under the Xfinity brand; and advertising services. The Media segment operates NBCUniversal's television and streaming platforms, including national, regional, and international cable networks, the NBC and Telemundo broadcast, and Peacock networks. The Studios segment operates NBCUniversal's film and television studio production and distribution operations. The Theme Parks segment operates Universal theme parks in Orlando, Florida; Hollywood, California; Osaka, Japan; and Beijing, China. The Sky segment offers direct-to-consumer services, such as video, broadband, voice and wireless phone services, and content business operates entertainment networks, the Sky News broadcast network, and Sky Sports networks. The company also owns the Philadelphia Flyers, as well as the Wells Fargo Center arena in Philadelphia, Pennsylvania; and provides streaming service, such as Peacock. Comcast Corporation was founded in 1963 and is headquartered in Philadelphia, Pennsylvania.

Yearly Top and Bottom Value

Comcast Corporation’s stock is valued at $33.98 at 18:21 EST, way under its 52-week high of $54.59 and way higher than its 52-week low of $28.39.

Growth Estimates Quarters

The company’s growth estimates for the current quarter and the next is 6.9% and 14.3%, respectively.

Moving Average

Comcast Corporation’s value is above its 50-day moving average of $32.23 and way below its 200-day moving average of $40.72.

More news about Comcast Corporation.

4. TE Connectivity (TEL)

Shares of TE Connectivity jumped by a staggering 12.38% in from $111.91 to $125.77 at 18:21 EST on Wednesday, after five consecutive sessions in a row of gains. NYSE is dropping 0.75% to $15,265.25, following the last session’s upward trend.

TE Connectivity Ltd., together with its subsidiaries, manufactures and sells connectivity and sensor solutions in Europe, the Middle East, Africa, the Asia–Pacific, and the Americas. The company operates through three segments: Transportation Solutions, Industrial Solutions, and Communications Solutions. The Transportation Solutions segment provides terminals and connector systems and components, sensors, relays, antennas, heat shrink tubing, and application tooling products for use in the automotive, commercial transportation, and sensor markets. The Industrial Solutions segment offers terminals and connector systems and components; and heat shrink tubing, interventional medical components, relays, and wires and cables for aerospace, defense, oil and gas, industrial equipment, medical, and energy markets. The Communications Solutions segment supplies electronic components, such as terminals and connector systems and components, relays, heat shrink tubing, and antennas for the data and devices, and appliances markets. TE Connectivity Ltd. sells its products to approximately 140 countries primarily through direct sales to manufacturers, as well as through third-party distributors. The company was formerly known as Tyco Electronics Ltd. and changed its name to TE Connectivity Ltd. in March 2011. TE Connectivity Ltd. was incorporated in 2000 and is based in Schaffhausen, Switzerland.

Revenue Growth

Year-on-year quarterly revenue growth grew by 6.6%, now sitting on 15.74B for the twelve trailing months.

Growth Estimates Quarters

The company’s growth estimates for the present quarter is 11.2% and a drop 1.7% for the next.

More news about TE Connectivity.

5. Lumen Technologies (LUMN)

Shares of Lumen Technologies slid by a staggering 17.21% in from $7.09 to $5.87 at 18:21 EST on Wednesday, after five sequential sessions in a row of losses. NYSE is sliding 0.75% to $15,265.25, following the last session’s upward trend.

Lumen Technologies, Inc., a facilities-based technology and communications company, provides various integrated products and services under the Lumen, Quantum Fiber, and CenturyLink brands to business and residential customers in the United States and internationally. The company operates in two segments, Business and Mass Markets. It offers compute and application services, such as cloud services, IT solutions, unified communication and collaboration solutions, colocation and data center services, content delivery services, and managed security services; and IP and data services, including VPN data network, Ethernet, internet protocol (IP), and voice over internet protocol. The company also provides fiber infrastructure services comprising high bandwidth optical wavelength networks; and unlit optical fiber and related professional services. In addition, it offers voice and other services, including private line services, a direct circuit or channel specifically dedicated for connecting two or more organizational sites; a portfolio of traditional time division multiplexing voice services; and synchronous optical network-based Ethernet, legacy data hosting services, and conferencing services. As of December 31, 2021, the company served approximately 4.5 million broadband subscribers. The company was formerly known as CenturyLink, Inc. and changed its name to Lumen Technologies, Inc. in September 2020. Lumen Technologies, Inc. was incorporated in 1968 and is headquartered in Monroe, Louisiana.

Volatility

Lumen Technologies’s last week, last month’s, and last quarter’s current intraday variation average was a negative 0.11%, a negative 0.37%, and a positive 2.81%.

Lumen Technologies’s highest amplitude of average volatility was 1.37% (last week), 3.12% (last month), and 2.81% (last quarter).

Yearly Top and Bottom Value

Lumen Technologies’s stock is valued at $5.87 at 18:21 EST, way under its 52-week low of $9.31.

Sales Growth

Lumen Technologies’s sales growth is negative 6.8% for the current quarter and negative 8.1% for the next.

Moving Average

Lumen Technologies’s worth is way under its 50-day moving average of $11.33 and way below its 200-day moving average of $11.96.

More news about Lumen Technologies.

6. MGM Resorts (MGM)

Shares of MGM Resorts rose by a staggering 14.91% in from $32.25 to $37.06 at 18:21 EST on Wednesday, after four consecutive sessions in a row of gains. NYSE is dropping 0.75% to $15,265.25, following the last session’s upward trend.

MGM Resorts International, through its subsidiaries, owns and operates casino, hotel, and entertainment resorts in the United States and Macau. The company operates through three segments: Las Vegas Strip Resorts, Regional Operations, and MGM China. Its casino resorts offer gaming, hotel, convention, dining, entertainment, retail, and other resort amenities. The company's casino operations include slots and table games, as well as online sports betting and iGaming through BetMGM. As of February 17, 2021, its portfolio consisted of 29 hotel and destination gaming offerings. The company also owns and operates Las Vegas Strip Resorts and Fallen Oak golf course. Its customers include premium gaming customers; leisure and wholesale travel customers; business travelers; and group customers, including conventions, trade associations, and small meetings. The company was formerly known as MGM MIRAGE and changed its name to MGM Resorts International in June 2010. MGM Resorts International was incorporated in 1986 and is based in Las Vegas, Nevada.

Growth Estimates Quarters

The company’s growth estimates for the ongoing quarter and the next is 666.7% and 8.3%, respectively.

Moving Average

MGM Resorts’s value is way above its 50-day moving average of $33.05 and above its 200-day moving average of $35.96.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

MGM Resorts’s stock is considered to be oversold (<=20).

More news about MGM Resorts.

7. STMicroelectronics (STM)

Shares of STMicroelectronics jumped by a staggering 19.55% in from $31.76 to $37.97 at 18:21 EST on Wednesday, after five sequential sessions in a row of gains. NYSE is dropping 0.75% to $15,265.25, following the last session’s upward trend.

STMicroelectronics N.V., together with its subsidiaries, designs, develops, manufactures, and sells semiconductor products in Europe, the Middle East, Africa, the Americas, and the Asia Pacific. The company operates through Automotive and Discrete Group; Analog, MEMS and Sensors Group; and Microcontrollers and Digital ICs Group segments. The Automotive and Discrete Group segment offers automotive integrated circuits (ICs); and discrete and power transistor products. The Analog, MEMS and Sensors Group segment provides industrial application-specific integrated circuits (ASICs) and application-specific standard products (ASSPs); general purpose analog products; custom analog ICs; wireless charging solutions; galvanic isolated gate drivers; low and high voltage amplifiers, comparators, and current-sense amplifiers; MasterGaN, a solution that integrates a silicon driver and GaN power transistors in a single package; wireline and wireless connectivity ICs; touch screen controllers; micro-electro-mechanical systems (MEMS) products, including sensors or actuators; and optical sensing solutions. The Microcontrollers and Digital ICs Group segment offers general purpose and secure microcontrollers; radio frequency (RF) and electrically erasable programmable read-only memories; and RF, digital, and mixed-signal ASICs. It also provides assembly and other services. The company sells its products through distributors and retailers, as well as through sales representatives. It serves automotive, industrial, personal electronics and communications equipment, and computers and peripherals markets. STMicroelectronics N.V. was incorporated in 1987 and is headquartered in Geneva, Switzerland.

Yearly Top and Bottom Value

STMicroelectronics’s stock is valued at $37.97 at 18:21 EST, way under its 52-week high of $52.15 and way above its 52-week low of $28.35.

Revenue Growth

Year-on-year quarterly revenue growth grew by 28.2%, now sitting on 14.14B for the twelve trailing months.

Volatility

STMicroelectronics’s last week, last month’s, and last quarter’s current intraday variation average was 4.09%, 0.85%, and 2.56%.

STMicroelectronics’s highest amplitude of average volatility was 4.09% (last week), 2.69% (last month), and 2.56% (last quarter).

Sales Growth

STMicroelectronics’s sales growth is 24.2% for the ongoing quarter and 15% for the next.

More news about STMicroelectronics.

8. Logitech (LOGI)

Shares of Logitech rose by a staggering 31.58% in from $45.16 to $59.42 at 18:21 EST on Wednesday, following the last session’s upward trend. NASDAQ is dropping 1.54% to $11,183.66, following the last session’s upward trend.

Logitech International S.A., through its subsidiaries, designs, manufactures, and markets products that connect people to digital and cloud experiences worldwide. The company offers pointing devices, such as wireless mouse; corded and cordless keyboards, living room keyboards, and keyboard-and-mouse combinations; PC webcams; and keyboards for tablets and smartphones, as well as other accessories for mobile devices. It also provides keyboards, mice, headsets, and simulation products, such as steering wheels and flight sticks for gamers; video conferencing products, such as ConferenceCams, which combine enterprise-quality audio and high-definition video to bring video conferencing to businesses of any size; webcams and headsets that turn desktop into collaboration space; and controller for video conferencing room solutions. In addition, the company offers portable wireless Bluetooth and Wi-Fi connected speakers, mobile speakers, PC speakers, PC headsets, microphones, in-ear headphones, and wireless audio wearables; home entertainment controllers, and home security cameras. Its channel network includes consumer electronics distributors, retailers, e-tailers, mass merchandisers, specialty stores, computer and telecommunications stores, value-added resellers, and online merchants. The company sells its products under the Logitech, Logitech G, ASTRO Gaming, Streamlabs, Blue Microphones, Ultimate Ears, and Jaybird brands. Logitech International S.A. was incorporated in 1981 and is headquartered in Lausanne, Switzerland.

Moving Average

Logitech’s worth is way above its 50-day moving average of $48.29 and under its 200-day moving average of $59.91.

More news about Logitech.

9. MarketAxess Holdings (MKTX)

Shares of MarketAxess Holdings jumped by a staggering 11.2% in from $235.85 to $262.27 at 18:21 EST on Wednesday, after two consecutive sessions in a row of losses. NASDAQ is sliding 1.54% to $11,183.66, following the last session’s upward trend.

MarketAxess Holdings Inc., together with its subsidiaries, operates an electronic trading platform for institutional investor and broker-dealer companies worldwide. It offers the access to liquidity in the U.S. investment-grade bonds, U.S. high-yield bonds, and U.S. Treasuries, as well as municipal bonds, emerging market debts, Eurobonds, and other fixed income securities. The company, through its Open Trading protocols, executes bond trades between and among institutional investor and broker-dealer clients in an all-to-all anonymous trading environment for corporate bonds. It also offers trading-related products and services, including composite+ pricing and other market data products to assist clients with trading decisions; auto-execution and other execution services for clients requiring specialized workflow solutions; connectivity solutions that facilitate straight-through processing; and technology services to optimize trading environments. In addition, the company provides various pre-and post-trade services, such as trade matching, trade publication, regulatory transaction reporting, and market and reference data across a range of fixed-income and other products. MarketAxess Holdings Inc. was incorporated in 2000 and is headquartered in New York, New York.

More news about MarketAxess Holdings.

10. Super Micro Computer (SMCI)

Shares of Super Micro Computer rose by a staggering 46.4% in from $56.12 to $82.16 at 18:21 EST on Wednesday, following the last session’s upward trend. NASDAQ is falling 1.54% to $11,183.66, following the last session’s upward trend.

Super Micro Computer, Inc., together with its subsidiaries, develops and manufactures high-performance server and storage solutions based on modular and open architecture. Its solutions range from complete server, storage, modular blade servers, blades, workstations, full racks, networking devices, server management software, and server sub-systems, as well as security software. The company also provides application-optimized server solutions, including rackmount and blade servers, storage systems, and subsystems and accessories; and server software management solutions, such as Server Management Suite, including Supermicro Server Manager, Supermicro Power Management software, Supermicro Update Manager, SuperCloud Composer, and SuperDoctor 5. In addition, it offers server subsystems and accessories comprising server boards, chassis, power supplies, and other accessories. Further, the company provides server and storage system integration, configuration, and software upgrade and update services; and technical documentation services, as well as identifies service requirements, creates and executes project plans, and conducts verification testing and training services. Additionally, it offers help desk and on-site product support services for its server and storage systems; and customer support services, including ongoing maintenance and technical support for its products. The company provides its products to enterprise data centers, cloud computing, artificial intelligence, and 5G and edge computing markets. It sells its products through direct and indirect sales force, distributors, value-added resellers, system integrators, and original equipment manufacturers. The company primarily operates in the United States, Europe, Asia, and internationally. Super Micro Computer, Inc. was incorporated in 1993 and is headquartered in San Jose, California.

Volatility

Super Micro Computer’s last week, last month’s, and last quarter’s current intraday variation average was 2.67%, 1.92%, and 3.24%.

Super Micro Computer’s highest amplitude of average volatility was 3.61% (last week), 3.33% (last month), and 3.24% (last quarter).

Yearly Top and Bottom Value

Super Micro Computer’s stock is valued at $82.16 at 18:21 EST, below its 52-week high of $86.15 and way above its 52-week low of $34.11.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Super Micro Computer’s stock is considered to be oversold (<=20).

More news about Super Micro Computer.

11. Amkor Technology (AMKR)

Shares of Amkor Technology jumped by a staggering 57.02% in from $17.8 to $27.95 at 18:21 EST on Wednesday, after four consecutive sessions in a row of gains. NASDAQ is dropping 1.54% to $11,183.66, following the last session’s upward trend.

Amkor Technology, Inc. provides outsourced semiconductor packaging and test services in the United States, Japan, Europe, the Middle East, Africa, and the rest of the Asia Pacific. It offers turnkey packaging and test services, including semiconductor wafer bump, wafer probe, wafer back-grind, package design, packaging, and test and drop shipment services. The company also provides flip chip-scale package products for use in smartphones, tablets, and other mobile consumer electronic devices; flip-chip stacked chip-scale packages that are used to stack memory on top of digital baseband, and as applications processors in mobile devices; and flip-chip ball grid array packages for various networking, storage, computing, and consumer applications. In addition, it offers wafer-level CSP packages that are used in power management, transceivers, sensors, wireless charging, codecs, radar, and specialty silicon; wafer-level fan-out packages for use in ICs; and silicon wafer integrated fan-out technology, which replaces a laminate substrate with a thinner structure. Further, the company provides lead frame packages that are used in electronic devices for low to medium pin count analog and mixed-signal applications; substrate-based wirebond packages, which are used to connect a die to a substrate; micro-electro-mechanical systems (MEMS) packages that are miniaturized mechanical and electromechanical devices; and advanced system-in-package modules, which are used in radio frequency and front end modules, basebands, connectivity, fingerprint sensors, display and touch screen drivers, sensors and MEMS, and NAND memory and solid-state drives. It primarily serves integrated device manufacturers, fabless semiconductor companies, original equipment manufacturers, and contract foundries. Amkor Technology, Inc. was founded in 1968 and is headquartered in Tempe, Arizona.

Volatility

Amkor Technology’s last week, last month’s, and last quarter’s current intraday variation average was 6.65%, 2.35%, and 2.39%.

Amkor Technology’s highest amplitude of average volatility was 6.65% (last week), 2.79% (last month), and 2.39% (last quarter).

Revenue Growth

Year-on-year quarterly revenue growth grew by 24%, now sitting on 6.91B for the twelve trailing months.

Moving Average

Amkor Technology’s value is way higher than its 50-day moving average of $19.04 and way higher than its 200-day moving average of $19.91.

More news about Amkor Technology.

12. AMD (AMD)

Shares of AMD jumped by a staggering 25.72% in from $57.96 to $72.87 at 18:21 EST on Wednesday, after four consecutive sessions in a row of gains. NASDAQ is dropping 1.54% to $11,183.66, following the last session’s upward trend.

Advanced Micro Devices, Inc. operates as a semiconductor company worldwide. The company operates in two segments, Computing and Graphics; and Enterprise, Embedded and Semi-Custom. Its products include x86 microprocessors as an accelerated processing unit, chipsets, discrete and integrated graphics processing units (GPUs), data center and professional GPUs, and development services; and server and embedded processors, and semi-custom System-on-Chip (SoC) products, development services, and technology for game consoles. The company provides processors for desktop and notebook personal computers under the AMD Ryzen, AMD Ryzen PRO, Ryzen Threadripper, Ryzen Threadripper PRO, AMD Athlon, AMD Athlon PRO, AMD FX, AMD A-Series, and AMD PRO A-Series processors brands; discrete GPUs for desktop and notebook PCs under the AMD Radeon graphics, AMD Embedded Radeon graphics brands; and professional graphics products under the AMD Radeon Pro and AMD FirePro graphics brands. It also offers Radeon Instinct, Radeon PRO V-series, and AMD Instinct accelerators for servers; chipsets under the AMD trademark; microprocessors for servers under the AMD EPYC; embedded processor solutions under the AMD Athlon, AMD Geode, AMD Ryzen, AMD EPYC, AMD R-Series, and G-Series processors brands; and customer-specific solutions based on AMD CPU, GPU, and multi-media technologies, as well as semi-custom SoC products. It serves original equipment manufacturers, public cloud service providers, original design manufacturers, system integrators, independent distributors, online retailers, and add-in-board manufacturers through its direct sales force, independent distributors, and sales representatives. The company was incorporated in 1969 and is headquartered in Santa Clara, California.

Revenue Growth

Year-on-year quarterly revenue growth grew by 29%, now sitting on 22.83B for the twelve trailing months.

Volatility

AMD’s last week, last month’s, and last quarter’s current intraday variation average was 6.36%, 1.47%, and 2.94%.

AMD’s highest amplitude of average volatility was 6.36% (last week), 3.16% (last month), and 2.94% (last quarter).

More news about AMD.

13. Moderna (MRNA)

Shares of Moderna jumped by a staggering 32.83% in from $139.25 to $184.97 at 18:21 EST on Wednesday, after four consecutive sessions in a row of gains. NASDAQ is falling 1.54% to $11,183.66, following the last session’s upward trend.

Moderna, Inc., a biotechnology company, discovers, develops, and commercializes messenger RNA therapeutics and vaccines for the treatment of infectious diseases, immuno-oncology, rare diseases, cardiovascular diseases, and auto-immune diseases in the United States, Europe, and internationally. Its respiratory vaccines include COVID-19, flu, respiratory syncytial virus, Endemic HCoV, and hMPV+PIV3 vaccines; latent vaccines comprise cytomegalovirus, epstein-barr virus, human immunodeficiency virus, herpes simplex virus, and varicella-zoster virus vaccines; and public health vaccines consists of Zika and Nipah vaccines. The company also offers systemic secreted and cell surface therapeutics; cancer vaccines, such as personalized cancer, KRAS, and checkpoint vaccines; intratumoral immuno-oncology products; localized regenerative, systemic intracellular, and inhaled pulmonary therapeutics. It has strategic alliances with AstraZeneca PLC; Merck & Co., Inc.; Vertex Pharmaceuticals Incorporated; Vertex Pharmaceuticals (Europe) Limited; Carisma Therapeutics, Inc.; Metagenomi, Inc.; the Defense Advanced Research Projects Agency; Biomedical Advanced Research and Development Authority; Institute for Life Changing Medicines; and The Bill & Melinda Gates Foundation, as well as a collaboration and license agreement with Chiesi Farmaceutici S.P.A. The company was formerly known as Moderna Therapeutics, Inc. and changed its name to Moderna, Inc. in August 2018. Moderna, Inc. was founded in 2010 and is headquartered in Cambridge, Massachusetts.

Revenue Growth

Year-on-year quarterly revenue growth grew by 9.1%, now sitting on 22.99B for the twelve trailing months.

Yearly Top and Bottom Value

Moderna’s stock is valued at $184.97 at 18:21 EST, way below its 52-week high of $376.65 and way higher than its 52-week low of $115.03.

Moving Average

Moderna’s value is way higher than its 50-day moving average of $136.10 and way higher than its 200-day moving average of $148.53.

More news about Moderna.

14. AT&T (T)

Shares of AT&T jumped by a staggering 23.64% in from $15.31 to $18.93 at 18:21 EST on Wednesday, after two sequential sessions in a row of losses. NYSE is falling 0.75% to $15,265.25, following the last session’s upward trend.

AT&T Inc. provides telecommunications, media, and technology services worldwide. Its Communications segment offers wireless voice and data communications services; and sells handsets, wireless data cards, wireless computing devices, and carrying cases and hands-free devices through its own company-owned stores, agents, and third-party retail stores. It also provides data, voice, security, cloud solutions, outsourcing, and managed and professional services, as well as customer premises equipment for multinational corporations, small and mid-sized businesses, governmental, and wholesale customers. In addition, this segment offers broadband fiber and legacy telephony voice communication services to residential customers. It markets its communications services and products under the AT&T, Cricket, AT&T PREPAID, and AT&T Fiber brand names. The company's Latin America segment provides wireless services in Mexico; and video services in Latin America. This segment markets its services and products under the AT&T and Unefon brand names. The company was formerly known as SBC Communications Inc. and changed its name to AT&T Inc. in 2005. AT&T Inc. was incorporated in 1983 and is headquartered in Dallas, Texas.

Growth Estimates Quarters

The company’s growth estimates for the current quarter and the next is a negative 26.9% and a negative 16.9%, respectively.

Revenue Growth

Year-on-year quarterly revenue growth declined by 24.7%, now sitting on 155.32B for the twelve trailing months.

More news about AT&T.

15. Raymond James Financial (RJF)

Shares of Raymond James Financial rose by a staggering 19.57% in from $100.87 to $120.61 at 18:21 EST on Wednesday, after two successive sessions in a row of gains. NYSE is sliding 0.75% to $15,265.25, following the last session’s upward trend.

Raymond James Financial, Inc., a diversified financial services company, provides private client group, capital markets, asset management, banking, and other services to individuals, corporations, and municipalities in the United States, Canada, and Europe. The Private Client Group segment offers investment services, portfolio management services, insurance and annuity products, and mutual funds; support to third-party product partners, including sales and marketing support, as well as distribution and accounting, and administrative services; margin loans; and securities borrowing and lending services. The Capital Markets segment provides investment banking services, including equity underwriting, debt underwriting, and merger and acquisition advisory services; and fixed income and equity brokerage services. The Asset Management segment offers asset management, portfolio management, and related administrative services to retail and institutional clients; and administrative support services, such as record-keeping. The Raymond James Bank segment provides insured deposit accounts; commercial and industrial, commercial real estate (CRE) and CRE construction, tax-exempt, residential, securities-based, and other loans; and loan syndication services. The Other segment engages in the private equity investments, including various direct and third-party private equity investments; and legacy private equity funds. The company was founded in 1962 and is headquartered in St. Petersburg, Florida.

Sales Growth

Raymond James Financial’s sales growth for the current quarter is 7.9%.

More news about Raymond James Financial.

16. Rogers Communication (RCI)

Shares of Rogers Communication rose by a staggering 13.16% in from $38.08 to $43.09 at 18:21 EST on Wednesday, after two successive sessions in a row of losses. NYSE is falling 0.75% to $15,265.25, following the last session’s upward trend.

Rogers Communications Inc. operates as a communications and media company in Canada. It operates through three segments: Wireless, Cable, and Media. The company offers mobile Internet access, wireless voice and enhanced voice, device and accessory financing, wireless home phone, device protection, e-mail, global voice and data roaming, bridging landline, machine-to-machine and Internet of Things solutions, and advanced wireless solutions for businesses, as well as device delivery services; and postpaid and prepaid services under the Rogers, Fido, and chatr brands to approximately 11.3 million subscribers. It also provides Internet and WiFi services; smart home monitoring services, such as monitoring, security, automation, energy efficiency, and smart control through a smartphone app. In addition, the company offers local and network TV; on-demand television; cloud-based digital video recorders; voice-activated remote controls, and integrated apps; personal video recorders; linear and time-shifted programming; digital specialty channels; 4K television programming; and televised content on smartphones, tablets, and personal computers, as well as operates Ignite TV and Ignite TV app. Further, it provides residential and small business local telephony services; calling features, such as voicemail, call waiting, and long distance; voice, data networking, Internet protocol, and Ethernet services; private networking, Internet, IP voice, and cloud solutions; optical wave and multi-protocol label switching services; IT and network technologies; and cable access network services. The company also owns Toronto Blue Jays and the Rogers Centre event venue; and operates Sportsnet ONE, Sportsnet 360, Sportsnet World, Citytv, OMNI, FX (Canada), FXX (Canada), and OLN television networks, as well as 55 AM and FM radio stations. The company was founded in 1960 and is headquartered in Toronto, Canada.

More news about Rogers Communication.

17. International Business Machines (IBM)

Shares of International Business Machines rose by a staggering 19.08% in from $121.52 to $144.71 at 18:21 EST on Wednesday, after five successive sessions in a row of gains. NYSE is dropping 0.75% to $15,265.25, following the last session’s upward trend.

International Business Machines Corporation provides integrated solutions and services worldwide. The company operates through four business segments: Software, Consulting, Infrastructure, and Financing. The Software segment offers hybrid cloud platform and software solutions, such as Red Hat, an enterprise open-source solutions; software for business automation, AIOps and management, integration, and application servers; data and artificial intelligence solutions; and security software and services for threat, data, and identity. This segment also provides transaction processing software that supports clients' mission-critical and on-premise workloads in banking, airlines, and retail industries. The Consulting segment offers business transformation services, including strategy, business process design and operations, data and analytics, and system integration services; technology consulting services; and application and cloud platform services. The Infrastructure segment provides on-premises and cloud-based server and storage solutions for its clients' mission-critical and regulated workloads; and support services and solutions for hybrid cloud infrastructure, as well as remanufacturing and remarketing services for used equipment. The Financing segment offers lease, installment payment, loan financing, and short-term working capital financing services. The company was formerly known as Computing-Tabulating-Recording Co. International Business Machines Corporation was incorporated in 1911 and is headquartered in Armonk, New York.

Growth Estimates Quarters

The company’s growth estimates for the present quarter is a negative 24.2% and positive 13.1% for the next.

Revenue Growth

Year-on-year quarterly revenue growth grew by 9.3%, now sitting on 59.68B for the twelve trailing months.

Sales Growth

International Business Machines’s sales growth is negative 23.1% for the present quarter and negative 1.1% for the next.

Moving Average

International Business Machines’s value is way higher than its 50-day moving average of $127.06 and way above its 200-day moving average of $131.49.

More news about International Business Machines.

18. Visa (V)

Shares of Visa rose by a staggering 13.76% in from $185.25 to $210.74 at 18:21 EST on Wednesday, after four sequential sessions in a row of gains. NYSE is dropping 0.75% to $15,265.25, following the last session’s upward trend.

Visa Inc. operates as a payments technology company worldwide. The company facilitates digital payments among consumers, merchants, financial institutions, businesses, strategic partners, and government entities. It operates VisaNet, a transaction processing network that enables authorization, clearing, and settlement of payment transactions. In addition, the company offers card products, platforms, and value-added services. It provides its services under the Visa, Visa Electron, Interlink, VPAY, and PLUS brands. Visa Inc. has a strategic agreement with Ooredoo to provide an enhanced payment experience for Visa cardholders and Ooredoo customers in Qatar. Visa Inc. was founded in 1958 and is headquartered in San Francisco, California.

More news about Visa.

19. SS&C Technologies Holdings (SSNC)

Shares of SS&C Technologies Holdings jumped 7.16% in from $49.01 to $52.52 at 18:21 EST on Wednesday, following the last session’s upward trend. NASDAQ is sliding 1.54% to $11,183.66, following the last session’s upward trend.

SS&C Technologies Holdings, Inc., together with its subsidiaries, provides software products and software-enabled services to financial services and healthcare industries. The company owns and operates technology stack across securities accounting; front-office functions, such as trading and modeling; middle-office functions include portfolio management and reporting; back-office functions, such as accounting, performance measurement, reconciliation, reporting, processing and clearing, and compliance and tax reporting; and healthcare solutions comprising claims adjudication, benefit management, care management, and business intelligence solutions. Its products and services allow professionals in the financial services and healthcare industries to automate complex business processes and are instrumental in helping its clients to manage information processing requirements. The company's software-enabled services include SS&C GlobeOp, Global Investor and Distribution Solutions, SS&C Retirement Solutions, Black Diamond Wealth Platform, Bluedoor, Advent Outsourcing Services, Advent Data Solutions, ALPS Advisors, and Virtual Data Rooms, as well as pharmacy, healthcare administration, and health outcomes optimization solutions. Its software products comprise portfolio/investment accounting and analytics software, portfolio management software, trading software, digital process automation product suite, and banking and lending solutions, as well as research, analytics, risk, and training solutions. The company also provides professional services, including consulting and implementation services to assist clients; and product support services. It operates in the United States; the United Kingdom; Europe, the Middle East, and Africa; the Asia Pacific and Japan; Canada; and the Americas. The company was founded in 1986 and is headquartered in Windsor, Connecticut.

Revenue Growth

Year-on-year quarterly revenue growth grew by 5.5%, now sitting on 5.18B for the twelve trailing months.

Yearly Top and Bottom Value

SS&C Technologies Holdings’s stock is valued at $52.52 at 18:21 EST, way under its 52-week high of $84.85 and way above its 52-week low of $45.25.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

SS&C Technologies Holdings’s stock is considered to be oversold (<=20).

More news about SS&C Technologies Holdings.

20. Genmab (GMAB)

Shares of Genmab jumped by a staggering 16.54% in from $37.43 to $43.62 at 18:21 EST on Wednesday, after two consecutive sessions in a row of gains. NASDAQ is falling 1.54% to $11,183.66, following the last session’s upward trend.

Genmab A/S develops antibody therapeutics for the treatment of cancer and other diseases primarily in Denmark. The company markets DARZALEX, a human monoclonal antibody for the treatment of patients with multiple myeloma (MM); teprotumumab for the treatment of thyroid eye disease; ofatumurnab, a human monoclonal antibody to treat chronic lymphocytic leukemia (CLL) and multiple sclerosis; and Amivantamab for advanced or metastatic gastric or esophageal cancer and NSCLC. Its products include daratumumab to treat MM, non-MM blood cancers, and AL amyloidosis; GEN1047; tisotumab vedotin for treating cervical, ovarian, and solid cancers; DuoBody-PD-L1x4-1BB, and DuoBody-CD40x4-1BB for treating solid tumors; Epcoritamab for relapsed/refractory diffuse large B-cell lymphoma and chronic lymphocytic leukemia; and HexaBody-CD38 and DuoHexaBody-CD37 for treating hematological malignancies. The company's also develops products, which is in Phase 2 comprise Teclistamab for vaso-occlusive crises; Camidanlumab tesirine to treat hodgkin lymphoma and solid tumors; JNJ-64007957 and JNJ-64407564 to treat MM; PRV-015 for treating celiac disease; Mim8 for treating haemophilia A; and Lu AF82422 for treating multiple system atrophy disease. In addition, it has approximately 20 active pre-clinical programs. The company has a commercial license and collaboration agreement with Seagen Inc. to co-develop tisotumab vedotin. It also has a collaboration agreement with CureVac AG for the research and development of differentiated mRNA-based antibody products; AbbVie for the development of epcoritamab; and collaborations with BioNTech, Janssen, Novo Nordisk A/S, BliNK Biomedical SAS, and Bolt Biotherapeutics, Inc. Genmab A/S was founded in 1999 and is headquartered in Copenhagen, Denmark.

Moving Average

Genmab’s value is way above its 50-day moving average of $36.56 and way higher than its 200-day moving average of $34.40.

Sales Growth

Genmab’s sales growth is 26.8% for the present quarter and 31.8% for the next.

More news about Genmab.

21. Johnson & Johnson (JNJ)

Shares of Johnson & Johnson jumped 4.23% in from $166.59 to $173.64 at 18:21 EST on Wednesday, after two successive sessions in a row of gains. NYSE is sliding 0.75% to $15,265.25, following the last session’s upward trend.

Johnson & Johnson, together with its subsidiaries, researches and develops, manufactures, and sells various products in the healthcare field worldwide. The company's Consumer Health segment offers baby care products under the JOHNSON'S and AVEENO Baby brands; oral care products under the LISTERINE brand; skin health/beauty products under the AVEENO, CLEAN & CLEAR, DR. CI:LABO, NEUTROGENA, and OGX brands; TYLENOL acetaminophen products; SUDAFED cold, flu, and allergy products; BENADRYL and ZYRTEC allergy products; MOTRIN IB ibuprofen products; NICORETTE smoking cessation products; and PEPCID acid reflux products. It also offers STAYFREE and CAREFREE sanitary pads; o.b. tampons; adhesive bandages under the BAND-AID brand; and first aid products under the NEOSPORIN brand. It serves general public, retail outlets, and distributors. The company's Pharmaceutical segment offers products for rheumatoid arthritis, psoriatic arthritis, inflammatory bowel disease, and psoriasis; HIV/AIDS and COVID-19 infectious diseases; mood disorders, neurodegenerative disorders, and schizophrenia; prostate cancer, hematologic malignancies, lung cancer, and bladder cancer; thrombosis, diabetes and macular degeneration; and pulmonary arterial hypertension. This segment serves retailers, wholesalers, distributors, hospitals, and healthcare professionals directly for prescription use. Its MedTech segment provides electrophysiology products to treat cardiovascular diseases; neurovascular care products to treat hemorrhagic and ischemic stroke; orthopaedics products in support of hips, knees, trauma, spine, sports, and other; advanced and general surgery solutions that focus on breast aesthetics, ear, nose, and throat procedures; and disposable contact lenses and ophthalmic products related to cataract and laser refractive surgery under the ACUVUE brand. This segment serves wholesalers, hospitals, and retailers. The company was founded in 1886 and is based in New Brunswick, New Jersey.

Volatility

Johnson & Johnson’s last week, last month’s, and last quarter’s current intraday variation average was a negative 0.38%, a positive 0.15%, and a positive 0.90%.

Johnson & Johnson’s highest amplitude of average volatility was 1.67% (last week), 0.89% (last month), and 0.90% (last quarter).

Sales Growth

Johnson & Johnson’s sales growth is negative 3.6% for the present quarter and 0.7% for the next.

Yearly Top and Bottom Value

Johnson & Johnson’s stock is valued at $173.64 at 18:21 EST, below its 52-week high of $186.69 and way higher than its 52-week low of $155.72.

Growth Estimates Quarters

The company’s growth estimates for the present quarter is 4.7% and a drop 3.7% for the next.

More news about Johnson & Johnson.

22. Genuine Parts Company (GPC)

Shares of Genuine Parts Company jumped by a staggering 13.81% in from $158.24 to $180.09 at 18:21 EST on Wednesday, after two successive sessions in a row of gains. NYSE is dropping 0.75% to $15,265.25, following the last session’s upward trend.

Genuine Parts Company distributes automotive replacement parts, and industrial parts and materials. It operates through Automotive Parts Group and Industrial Parts Group segments. The company distributes automotive replacement parts for hybrid and electric vehicles, trucks, SUVs, buses, motorcycles, recreational vehicles, farm vehicles, small engines, farm equipment, marine equipment, and heavy duty equipment; and accessory and supply items used by various automotive aftermarket customers, such as repair shops, service stations, fleet operators, automobile and truck dealers, leasing companies, bus and truck lines, mass merchandisers, farms, industrial concerns, and individuals. It also distributes industrial replacement parts and related supplies, such as bearings, mechanical and electrical power transmission products, industrial automation and robotics, hoses, hydraulic and pneumatic components, industrial and safety supplies, and material handling products for original equipment manufacturer, as well as maintenance, repair, and operation customers in equipment and machinery, food and beverage, forest product, primary metal, pulp and paper, mining, automotive, oil and gas, petrochemical, pharmaceutical, power generation, alternative energy, governments, transportation, ports, and other industries. In addition, the company provides various services and repairs comprising gearbox and fluid power and process pump assembly and repair, hydraulic drive shaft repair, electrical panel assembly and repair, hose and gasket manufacture and assembly, and other value-added services. It operates in the United States, Canada, France, the United Kingdom, Ireland, Germany, Poland, the Netherlands, Belgium, Australia, New Zealand, Mexico, Indonesia, and Singapore. The company was incorporated in 1928 and is headquartered in Atlanta, Georgia.

Revenue Growth

Year-on-year quarterly revenue growth grew by 17.8%, now sitting on 21.38B for the twelve trailing months.

More news about Genuine Parts Company.

23. Akamai Technologies (AKAM)

Shares of Akamai Technologies rose by a staggering 10.24% in from $82.54 to $90.99 at 18:21 EST on Wednesday, following the last session’s upward trend. NASDAQ is dropping 1.54% to $11,183.66, following the last session’s upward trend.

Akamai Technologies, Inc. provides cloud services for securing, delivering, and optimizing content and business applications over the internet in the United States and internationally. The company offers cloud solutions to keep infrastructure, websites, applications, application programming interfaces, and users safe from various cyberattacks and online threats while enhancing performance. It also provides web and mobile performance solutions to enable dynamic websites and applications; media delivery solutions, including video streaming and video player services, game and software delivery, broadcast operations, authoritative domain name system, resolution, and data and analytics; and edge compute solutions to enable developers to deploy and distribute code at the edge. In addition, the company offers carrier offerings, including cybersecurity protection, parental controls, DNS infrastructure and content delivery solutions; and an array of service and support to assist customers with integrating, configuring, optimizing, and managing its offerings. It sells its solutions through direct sales and service organizations, as well as through various channel partners. Akamai Technologies, Inc. was incorporated in 1998 and is headquartered in Cambridge, Massachusetts.

Volatility

Akamai Technologies’s last week, last month’s, and last quarter’s current intraday variation average was 0.95%, 0.67%, and 1.68%.

Akamai Technologies’s highest amplitude of average volatility was 1.95% (last week), 1.84% (last month), and 1.68% (last quarter).

Growth Estimates Quarters

The company’s growth estimates for the current quarter and the next is a negative 14.8% and a negative 3.6%, respectively.

More news about Akamai Technologies.

24. Intuitive Surgical (ISRG)

Shares of Intuitive Surgical jumped by a staggering 38.33% in from $190.13 to $263.00 at 18:21 EST on Wednesday, following the last session’s upward trend. NASDAQ is dropping 1.54% to $11,183.66, following the last session’s upward trend.

Intuitive Surgical, Inc. develops, manufactures, and markets products that enable physicians and healthcare providers to enhance the quality of and access to minimally invasive care in the United States and internationally. The company offers the da Vinci Surgical System to enable complex surgery using a minimally invasive approach; and Ion endoluminal system, which extends its commercial offerings beyond surgery into diagnostic procedures enabling minimally invasive biopsies in the lung. It also provides a suite of stapling, energy, and core instrumentation for its surgical systems; progressive learning pathways to support the use of its technology; a complement of services to its customers, including support, installation, repair, and maintenance; and integrated digital capabilities providing unified and connected offerings, streamlining performance for hospitals with program-enhancing insights. The company was incorporated in 1995 and is headquartered in Sunnyvale, California.

More news about Intuitive Surgical.

25. NetEase (NTES)

Shares of NetEase jumped 0.37% in from $71.17 to $71.43 at 18:21 EST on Wednesday, after four successive sessions in a row of gains. NASDAQ is dropping 1.54% to $11,183.66, following the last session’s upward trend.

NetEase, Inc. provides online services focusing on diverse content, community, communication, and commerce in the Peoples' Republic of China and internationally. The company operates in three segments: Online Game Services, Youdao, Cloud Music, and Innovative Businesses and Others. It develops and operates PC and mobile games, as well as offers games licensed from other game developers. The company's products and services include Youdao Dictionary, an online knowledge tool; Youdao Translation, a tool specifically designed to support translation needs of business and leisure travelers; U-Dictionary, an online dictionary and translation app; Youdao Kids' Dictionary, a smart and fun tool; smart devices, such as Youdao Dictionary Pen, Youdao Listening Pod, Youdao Smart Lamp, Youdao Pocket Translator, and Youdao Super Dictionary; online courses; interactive learning apps; enterprise services, such as Youdao Smart Learning Terminal, a device that automates paper-based homework processing and provides learning diagnosis through artificial intelligence technology at schools; and Youdao Smart Cloud, a cloud-based platform that allows third-party app developers, smart device brands and manufacturers to access advanced optical character recognition capabilities and neural machine translation engine. Its products and services also include NetEase Cloud Music, a music streaming platform; Yanxuan, an e-commerce platform, which sells private label products, including consumer electronics, food, apparel, homeware, kitchenware, and other general merchandise; NetEase Media, an internet media platform; NetEase Mail, an email service; NetEase CC Live streaming, a live streaming platform with a focus on game broadcasting; and NetEase Pay, a payment platform. The company was formerly known as NetEase.com, Inc. and changed its name to NetEase, Inc. in March 2012. NetEase, Inc. was founded in 1997 and is headquartered in Hangzhou, the People's Republic of China.

Revenue Growth

Year-on-year quarterly revenue growth grew by 12.8%, now sitting on 93.28B for the twelve trailing months.

More news about NetEase.

26. ON Semiconductor (ON)

Shares of ON Semiconductor jumped by a staggering 18.18% in from $59.79 to $70.66 at 18:21 EST on Wednesday, following the last session’s upward trend. NASDAQ is sliding 1.54% to $11,183.66, following the last session’s upward trend.

ON Semiconductor Corporation provides intelligent sensing and power solutions worldwide. Its intelligent power technologies enable the electrification of the automotive industry that allows for lighter and longer-range electric vehicles, empowers fast-charging systems, and propels sustainable energy for the solar strings, industrial power, and storage systems. The company operates through three segments the Power Solutions Group, the Advanced Solutions Group, and the Intelligent Sensing Group segments. It offers analog, discrete, module, and integrated semiconductor products that perform multiple application functions, including power switching and conversion, signal conditioning, circuit protection, signal amplification, and voltage regulation functions. The company also designs and develops analog, mixed-signal, advanced logic, application specific standard product and ASICs, radio frequency, and integrated power solutions for end-users in end-markets, as well as provides foundry and design services for government customers. In addition, it develops complementary metal oxide semiconductor image sensors, image signal processors, and single photon detectors, including silicon photomultipliers and single photon avalanche diode arrays, as well as actuator drivers for autofocus and image stabilization for a broad base of end-users in various end-markets. ON Semiconductor Corporation was incorporated in 1992 and is headquartered in Phoenix, Arizona.

Moving Average

ON Semiconductor’s worth is above its 50-day moving average of $65.36 and way higher than its 200-day moving average of $60.82.

Yearly Top and Bottom Value

ON Semiconductor’s stock is valued at $70.66 at 18:21 EST, below its 52-week high of $76.78 and way higher than its 52-week low of $44.76.

Sales Growth

ON Semiconductor’s sales growth is 12.8% for the current quarter and 2.9% for the next.

Revenue Growth

Year-on-year quarterly revenue growth grew by 24.9%, now sitting on 7.62B for the twelve trailing months.

More news about ON Semiconductor.

27. Cooper Companies (COO)

Shares of Cooper Companies rose by a staggering 19.25% in from $260.11 to $310.18 at 18:21 EST on Wednesday, following the last session’s upward trend. NYSE is dropping 0.75% to $15,265.25, following the last session’s upward trend.

The Cooper Companies, Inc., together with its subsidiaries, develops, manufactures, and markets contact lens wearers. The company operates in two segments, CooperVision and CooperSurgical. The CooperVision segment offers spherical lense, including lenses that correct near and farsightedness; and toric and multifocal lenses comprising lenses correcting vision challenges, such as astigmatism, presbyopia, myopia, ocular dryness and eye fatigues in the Americas, Europe, Middle East, Africa, and Asia Pacific. The CooperSurgical segment focuses on family and women's health care, which provides medical devices, fertility, genomics, diagnostics, and contraception to health care professionals and patients worldwide. It offers surgical and office products, including PARAGARD, uterine manipulators, retractors, closure products, point of care products, LEEP products, endosee, and illuminate and fetal pillows; fertility products and services, such as fertility consumables and equipment, and embryo options and preimplantation genetic testing. The Cooper Companies, Inc. was founded in 1958 and is headquartered in San Ramon, California.

Growth Estimates Quarters

The company’s growth estimates for the present quarter and the next is a negative 4.6% and a negative 7.4%, respectively.

Sales Growth

Cooper Companies’s sales growth for the current quarter is 10.9%.

Yearly Top and Bottom Value

Cooper Companies’s stock is valued at $310.18 at 18:21 EST, way below its 52-week high of $430.67 and way above its 52-week low of $244.22.

More news about Cooper Companies.

28. Synopsys (SNPS)

Shares of Synopsys jumped by a staggering 14.6% in from $289.26 to $331.49 at 18:21 EST on Wednesday, following the last session’s upward trend. NASDAQ is sliding 1.54% to $11,183.66, following the last session’s upward trend.

Synopsys, Inc. provides electronic design automation software products used to design and test integrated circuits. The company offers Fusion Design Platform that provides digital design implementation solutions; Verification Continuum Platform that provides virtual prototyping, static and formal verification, simulation, emulation, field programmable gate array (FPGA)-based prototyping, and debug solutions; and FPGA design products that are programmed to perform specific functions. It also provides intellectual property (IP) solutions for USB, PCI Express, DDR, Ethernet, SATA, MIPI, HDMI, and Bluetooth low energy applications; analog IP, including data converters and audio codecs; and system-on-chip (SoC) infrastructure IP, datapath and building block IP, and verification IP products, as well as mathematical and floating-point components, and Arm AMBA interconnect fabric and peripherals. In addition, the company offers logic libraries and embedded memories; configurable processor cores and application-specific instruction-set processor tools for embedded applications; IP subsystems for audio, sensor, and data fusion functionality; and security IP solutions. Further, it provides Platform Architect solutions for SoC architecture analysis and optimization; virtual prototyping solutions; and HAPS FPGA-based prototyping systems, as well as a series of tools used in the design of optical systems and photonic devices. Additionally, the company offers security testing, managed services, programs and professional services, and training that enable its customers to detect and remediate security vulnerabilities, and defects in the software development lifecycle, as well as manufacturing solutions. It serves electronics, financial services, automotive, medicine, energy, and industrial areas. The company was incorporated in 1986 and is headquartered in Mountain View, California.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Synopsys’s stock is considered to be oversold (<=20).

Sales Growth

Synopsys’s sales growth is 11.2% for the present quarter and 6.2% for the next.

Revenue Growth

Year-on-year quarterly revenue growth grew by 18%, now sitting on 4.95B for the twelve trailing months.

Moving Average

Synopsys’s worth is above its 50-day moving average of $304.78 and higher than its 200-day moving average of $313.92.

More news about Synopsys.

29. Align Technology (ALGN)

Shares of Align Technology slid 5.21% in from $212.02 to $200.97 at 18:21 EST on Wednesday, following the last session’s upward trend. NASDAQ is sliding 1.54% to $11,183.66, following the last session’s upward trend.

Align Technology, Inc., a medical device company, designs, manufactures, and markets Invisalign clear aligners and iTero intraoral scanners and services for orthodontists and general practitioner dentists, and restorative and aesthetic dentistry. It operates in two segments, Clear Aligner; and Scanners and Services. The Clear Aligner segment consists of comprehensive products, including Invisalign comprehensive treatment that addresses the orthodontic needs of teenage patients, such as mandibular advancement, compliance indicators, and compensation for tooth eruption; and Invisalign First Phase I and Invisalign First Comprehensive Phase 2 package for younger patients generally between the ages of seven and ten years, which is a mixture of primary/baby and permanent teeth. This segment's non-comprehensive products comprise Invisalign moderate, lite and express packages, and Invisalign go; and non-case products include retention products, Invisalign training fees, and sales of ancillary products, such as cleaning material, and adjusting tools used by dental professionals during the course of treatment. The Scanners and Services segment offers iTero scanner, a single hardware platform with software options for restorative or orthodontic procedures; restorative software for general practitioner dentists, prosthodontists, periodontists, and oral surgeons; and software for orthodontists for digital records storage, orthodontic diagnosis, and for the fabrication of printed models and retainers. This segment also provides computer-aided design and computer-aided manufacturing services; ancillary products, such as disposable sleeves for the wand; iTero model and dies; third party scanners and digital scans; Invisalign outcome simulator, a chair-side and cloud-based application for the iTero scanner; Invisalign progress assessment tool; and TimeLapse technology, which allows doctors or practitioners to compare a patient's historic 3D scans to the present-day scan. The company sells its products in the United States, Switzerland, China, and internationally. Align Technology, Inc. was incorporated in 1997 and is headquartered in Tempe, Arizona.

Sales Growth

Align Technology’s sales growth is negative 11.8% for the ongoing quarter and negative 8.3% for the next.

Growth Estimates Quarters

The company’s growth estimates for the current quarter and the next is a negative 44.2% and a negative 13.1%, respectively.

More news about Align Technology.

30. Zebra Technologies (ZBRA)

Shares of Zebra Technologies dropped 1.22% in from $261.67 to $258.48 at 18:21 EST on Wednesday, following the last session’s upward trend. NASDAQ is falling 1.54% to $11,183.66, following the last session’s upward trend.

Zebra Technologies Corporation, together with its subsidiaries, provides enterprise asset intelligence solutions in the automatic identification and data capture solutions industry worldwide. It operates in two segments, Asset Intelligence & Tracking and Enterprise Visibility & Mobility. The company designs, manufactures, and sells printers, which produce labels, wristbands, tickets, receipts, and plastic cards; dye-sublimination thermal card printers, which produce images which are used for personal identification, access control, and financial transactions; RFID printers that encode data into passive RFID transponders; accessories and options for our printers, including vehicle mounts and battery chargers; stock and customized thermal labels, receipts, ribbons, plastic cards, and RFID tags for printers; and temperature-monitoring labels primarily used in vaccine distribution. It also provides various maintenance, technical support, repair, and managed and professional services; real-time location systems and services; and tags, sensors, exciters, middleware software, and application software; as well as physical inventory management solutions, and rugged tablets and enterprise-grade mobile computing products and accessories. In addition, the company offers barcode scanners, image capture devices, and RFID readers; and workforce management solutions, workflow execution and task management solutions, and prescriptive analytics solutions, as well as communications and collaboration solutions. It also provides services, including maintenance, technical support, repair, managed and professional services; as well as cloud-based software subscriptions and robotics automation solutions. The company serves retail and e-commerce, manufacturing, transportation and logistics, healthcare, public sector, and other industries through direct sales force, and network of channel partners. The company was founded in 1969 and is headquartered in Lincolnshire, Illinois.

Revenue Growth

Year-on-year quarterly revenue growth grew by 6.6%, now sitting on 5.8B for the twelve trailing months.

Sales Growth

Zebra Technologies’s sales growth is 3% for the ongoing quarter and 4.7% for the next.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Zebra Technologies’s stock is considered to be oversold (<=20).

More news about Zebra Technologies.

31. Atrion (ATRI)

Shares of Atrion rose 1.31% in from $613.02 to $621.05 at 18:21 EST on Wednesday, after two sequential sessions in a row of losses. NASDAQ is sliding 1.54% to $11,183.66, following the last session’s upward trend.

Atrion Corporation, together with its subsidiaries, develops, manufactures, and sells products for fluid delivery, cardiovascular, and ophthalmology applications in the United States, Canada, Europe, and internationally. Its fluid delivery products include valves that fill, hold, and release controlled amounts of fluids or gasses for use in various intubation, intravenous, catheter, and other applications in the anesthesia and oncology fields, as well as promote infection control in hospital and home healthcare environments. The company's cardiovascular products comprise Myocardial Protection System that delivers fluids and medications and mixes critical drugs, as well as controls temperature, pressure, and other variables; cardiac surgery vacuum relief valves; silicone vessel loops for retracting and occluding vessels; and inflation devices for balloon catheter dilation, stent deployment, and fluid dispensing, as well as products for use in heart bypass surgery. Its ophthalmic products include specialized medical devices that disinfect contact lenses; and a line of balloon catheters, which are used for the treatment of nasolacrimal duct obstruction in children and adults. The company also manufactures instrumentation and associated disposables that measure the activated clotting time of blood; and products for safe needle and scalpel blade containment. In addition, it manufactures inflation systems and valves used in marine and aviation safety products; components used in inflatable survival products and structures; and one-way and two-way pressure relief valves that protect sensitive electronics and other products during transport in other medical and non-medical applications. The company sells its products to physicians, hospitals, clinics, and other treatment centers; and other equipment manufacturers through direct sales force, independent sales representatives, and distributors. Atrion Corporation was founded in 1944 and is headquartered in Allen, Texas.

Revenue Growth

Year-on-year quarterly revenue growth grew by 4.1%, now sitting on 180.94M for the twelve trailing months.

Moving Average

Atrion’s value is higher than its 50-day moving average of $602.60 and under its 200-day moving average of $645.62.

Volatility

Atrion’s last week, last month’s, and last quarter’s current intraday variation average was 0.09%, 0.21%, and 1.67%.

Atrion’s highest amplitude of average volatility was 5.46% (last week), 2.35% (last month), and 1.67% (last quarter).

Yearly Top and Bottom Value

Atrion’s stock is valued at $621.05 at 18:21 EST, way below its 52-week high of $789.99 and way higher than its 52-week low of $542.10.

More news about Atrion.

32. Block (SQ)

Shares of Block rose by a staggering 24.16% in from $55.92 to $69.43 at 18:21 EST on Wednesday, after two successive sessions in a row of gains. NYSE is falling 0.75% to $15,265.25, following the last session’s upward trend.

Block, Inc., together with its subsidiaries, creates tools that enables sellers to accept card payments and provides reporting and analytics, and next-day settlement. It provides hardware products, including Magstripe reader, which enables swiped transactions of magnetic stripe cards; Contactless and chip reader that accepts Europay, MasterCard, and Visa (EMV) chip cards and Near Field Communication payments; Square Stand, which enables an iPad to be used as a payment terminal or full point of sale solution; Square Register that combines its hardware, point-of-sale software, and payments technology; Square Terminal, a payments device and receipt printer to replace traditional keypad terminals, which accepts tap, dip, and swipe payments. The company also offers various software products, including Square Point of Sale; Square Appointments; Square for Retail; Square for Restaurants; Square Online and Square Online Checkout; Square Invoices; Square Virtual Terminal; Square Team Management; Square Contracts; Square Loyalty, Marketing, and Gift Cards; and Square Dashboard. In addition, it offers a developer platform, which includes application programming interfaces and software development kits. Further, the company provides Cash App, which enables to send, spend, and store money; and Weebly that offers customers website hosting and domain name registration solutions. It serves in the United States, Canada, Japan, Australia, Ireland, France, Spain, and the United Kingdom. The company was formerly known as Square, Inc. and changed its name to Block, Inc. in December 2021. Block, Inc. was incorporated in 2009 and is based in San Francisco, California.

Volatility

Block’s last week, last month’s, and last quarter’s current intraday variation average was 7.38%, 1.27%, and 3.98%.

Block’s highest amplitude of average volatility was 8.70% (last week), 4.52% (last month), and 3.98% (last quarter).

More news about Block.