VIANEWS – The Innrs algorithm for artificial intelligence suggests a high likelihood of finding the estimated price of tomorrow’s Kodak KODK and Castle Biosciences CSTL.

Via News regularly facts-checks this AI algorithm, which aims to predict the session prices and trend for financial assets over time.

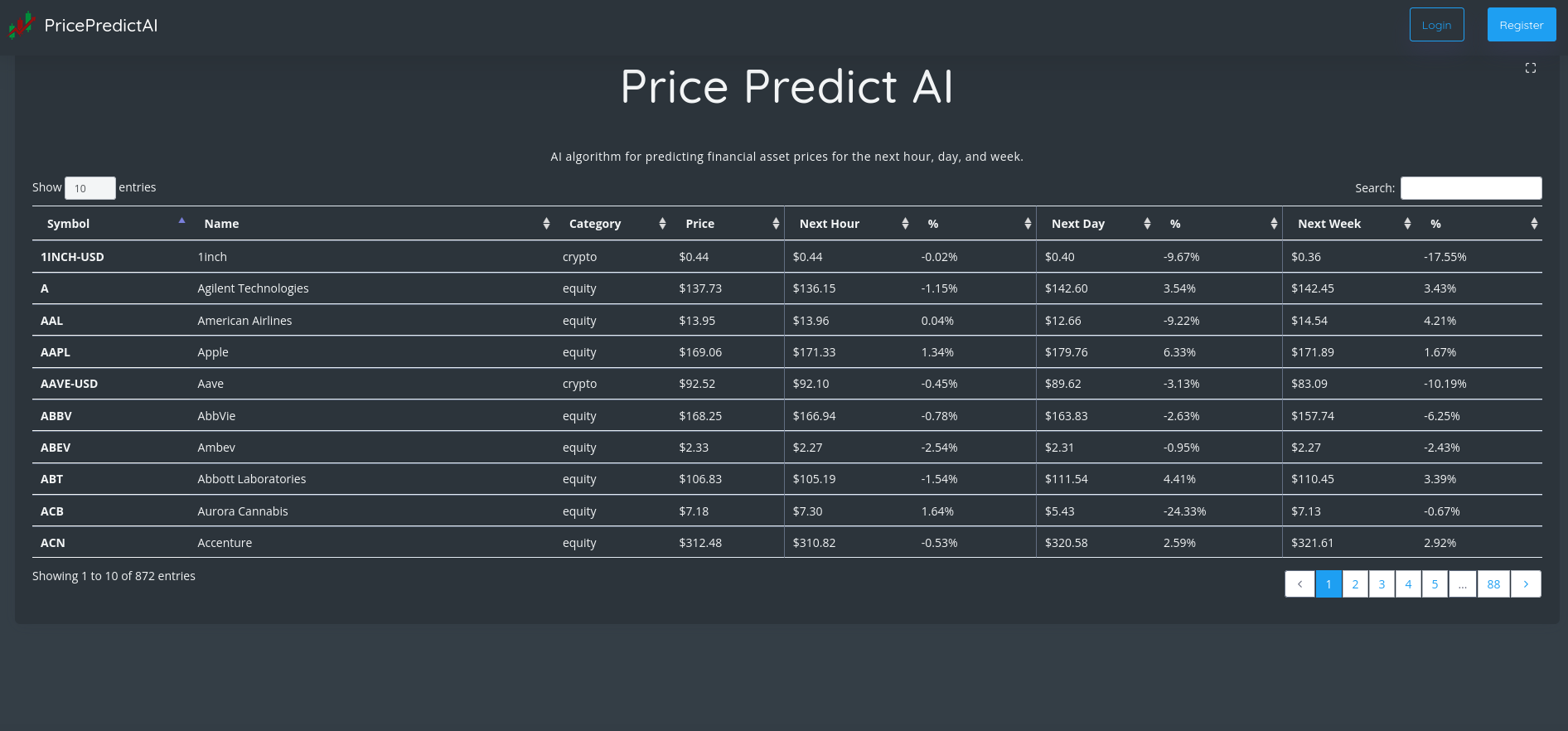

Innrs offers A.I.-based statistics tools that can be used to assist investors in making decisions. Below is a table that lists the most accurate financial assets for predicting prices, sorted by their highest predicted accuracy.

Officials at Innrs claim that this tool assists investors in making better-informed financial decisions. It is supposedly combined with other pertinent financial information, and the trader strategy.

Via News will present the results of the algorithm precision in the next session.

| Financial Asset | Accuracy | Close Price | Prediction |

|---|---|---|---|

| Kodak (KODK) | 95.08% | $3.15 | ⇩ $2.93 |

| Castle Biosciences (CSTL) | 92.32% | $23.8 | ⇧ $24.37 |

| Riot Blockchain (RIOT) | 90.49% | $3.77 | ⇩ $3.38 |

| StoneCo (STNE) | 89.01% | $8.99 | ⇩ $8.2 |

| Canaan (CAN) | 87.05% | $2.28 | ⇩ $2.17 |

| Air Products and Chemicals (APD) | 84.19% | $317.08 | ⇧ $325.61 |

| Towers Watson & Co (TW) | 84.16% | $63.91 | ⇧ $65.24 |

| Twitter (TWTR) | 84.13% | $53.7 | ⇧ $53.81 |

| Novo Nordisk A/S (NVO) | 84.02% | $133.54 | ⇧ $134.47 |

| Redfin (RDFN) | 83.78% | $4.93 | ⇧ $5.17 |

| HCA Holdings (HCA) | 83.69% | $239.3 | ⇧ $245.42 |

| Exelon (EXC) | 83.48% | $41.72 | ⇧ $42.86 |

| Sabre Corporation (SABR) | 83.33% | $6.01 | ⇩ $5.89 |

| Aware, Inc. (AWRE) | 82.71% | $1.77 | ⇩ $1.68 |

| Petroleo Brasileiro (PBR) | 82.56% | $9.44 | ⇩ $9.29 |

| ONE Gas (OGS) | 82.03% | $74.47 | ⇧ $75.89 |

1. Kodak (KODK)

Shares of Kodak fell by a staggering 44.44% in from $5.67 to $3.15 at 18:21 EST on Friday, after five sequential sessions in a row of losses. NYSE is dropping 1.08% to $15,018.17, after two consecutive sessions in a row of losses.

Eastman Kodak Company provides hardware, software, consumables, and services to customers in the commercial print, packaging, publishing, manufacturing, and entertainment markets worldwide. The company operates through Traditional Printing, Digital Printing, Advanced Materials and Chemicals, and Brand. The Traditional Printing segment offers digital offset plate and computer-to-plate imaging solutions to commercial industries, including commercial print, direct mail, book publishing, newspapers and magazines, and packaging. The Digital Printing segment provides electrophotographic printing solutions, such as The ASCEND and NEXFINITY printers; prosper products, including the PROSPER 6000 Press, PROSPER Writing Systems, PROSPER press systems, and PROSPER components; versamark products; and PRINERGY workflow production software. The Advanced Materials and Chemicals segment engages in industrial film and chemicals, motion picture, and advanced materials and functional printing businesses. This segment also comprises the Kodak Research Laboratories, which conducts research, develops new product or new business opportunities, and files patent applications for its inventions and innovations, as well as manages licensing of its intellectual property to third parties. The Brand segment engages in the licensing of Kodak brand to third parties. The company engages in the operation of Eastman Business Park, a technology center and industrial complex. It sells its products and services through direct sales, third party resellers, dealers, channel partners, and distributors. Eastman Kodak Company was founded in 1880 and is headquartered in Rochester, New York.

Moving Average

Kodak’s value is far below its moving average 50 days of $5.12, and its moving average 200 days of $5.18.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Kodak stock considered overbought (>=80).

Annual Top and Bottom Value

Kodak stock’s value is $3.15 as of 18:21 EST. This is below the 52-week low $3.46.

Volatility

Kodak’s last week, last month’s, and last quarter’s current intraday variation average was a negative 1.49%, a negative 2.23%, and a positive 2.80%.

Kodak’s highest amplitude of average volatility was 1.49% (last week), 3.47% (last month), and 2.80% (last quarter).

More news about Kodak.

2. Castle Biosciences (CSTL)

Shares of Castle Biosciences rose by a staggering 20.14% in from $19.81 to $23.80 at 18:21 EST on Friday, following the last session’s downward trend. NASDAQ is falling 0.97% to $10,705.41, after two consecutive sessions in a row of losses.

Castle Biosciences, Inc., a commercial-stage diagnostics company, focuses to provide diagnostic and prognostic testing services for dermatological cancers. Its lead product is DecisionDx-Melanoma, a multi-gene expression profile (GEP) test to identify the risk of metastasis for patients diagnosed with invasive cutaneous melanoma. The company also offers DecisionDx-UM test, a proprietary GEP test that predicts the risk of metastasis for patients with uveal melanoma, a rare eye cancer; DecisionDx-SCC, a proprietary 40-gene expression profile test that uses an individual patient's tumor biology to predict individual risk of squamous cell carcinoma metastasis for patients with one or more risk factors; and DecisionDx DiffDx-Melanoma and myPath Melanoma, a proprietary GEP test to diagnose suspicious pigmented lesions. It offers test services through physicians and their patients. The company was founded in 2007 and is headquartered in Friendswood, Texas.

Moving Average

Castle Biosciences’s worth is higher than its 50-day moving average of $23.18 and way under its 200-day moving average of $27.23.

More news about Castle Biosciences.

3. Riot Blockchain (RIOT)

Shares of Riot Blockchain dropped by a staggering 22.28% in from $4.85 to $3.77 at 18:21 EST on Friday, following the last session’s downward trend. NASDAQ is sliding 0.97% to $10,705.41, after two sequential sessions in a row of losses.

Riot Blockchain, Inc. and its affiliates focuses exclusively on Bitcoin mining in North America. It is present in three segments: Bitcoin Mining, Data Center Hosting and Electrical Products and Engineering. It had approximately 30907 active miners as of December 31, 2021. Riot Blockchain, Inc., was founded in 2000. It is located in Castle Rock, Colorado.

Sales Growth

Riot Blockchain is experiencing a negative 5.6% sales growth in the third quarter.

Annual Top and Bottom Value

Riot Blockchain stock was valued at $3.77 as of 18:21 EST at the time. This is below its 52 week low of $3.91.

Revenue growth

The year-on-year revenue growth was 112.4%. Now, the 12 trailing months are worth 308.43M.

More news about Riot Blockchain.

4. StoneCo (STNE)

Shares of StoneCo dropped by a staggering 10.12% in from $10 to $8.99 at 18:21 EST on Friday, following the last session’s downward trend. NASDAQ is falling 0.97% to $10,705.41, after two successive sessions in a row of losses.

StoneCo Ltd. provides financial technology solutions to merchants and integrated partners to conduct electronic commerce across in-store, online, and mobile channels in Brazil. It distributes its solutions, principally through proprietary Stone Hubs, which offer hyper-local sales and services; and technology and solutions to digital merchants through sales and technical personnel and software vendors, as well as sells solutions to brick-and-mortar and digital merchants through sales team. As of December 31, 2021, the company served approximately 1,766,100 clients primarily small-and-medium-sized businesses; and marketplaces, e-commerce platforms, and integrated software vendors. StoneCo Ltd. was founded in 2000 and is headquartered in George Town, the Cayman Islands. StoneCo Ltd. operates as a subsidiary of HR Holdings, LLC.

Revenue growth

The year-on-year growth in quarterly revenue was 134.2%. We now have 6.99B of revenues for the 12 trailing months.

Volatility

StoneCo’s intraday variation average for the week and quarter ended last week was negative 1.45%. It was positive 0.40% and positive 4.31%.

StoneCo had the highest average volatility amplitude at 2.81%, 4.39% and 4.31% respectively.

More news about StoneCo.

5. Canaan (CAN)

Shares of Canaan slid by a staggering 25% in from $3.04 to $2.28 at 18:21 EST on Friday, following the last session’s downward trend. NASDAQ is sliding 0.97% to $10,705.41, after two successive sessions in a row of losses.

Canaan Inc. engages in the research, design, and sale of integrated circuit (IC) final mining equipment products by integrating IC products for bitcoin mining and related components primarily in the People's Republic of China. It is also involved in the assembly and distribution of mining equipment and spare parts. The company has a strategic cooperation with Northern Data AG in the areas of artificial intelligence development, blockchain technology, and datacenter operations. Canaan Inc. was founded in 2013 and is based in Beijing, the People's Republic of China.

Yearly Top and Bottom Value

Canaan’s stock is valued at $2.28 at 18:21 EST, below its 52-week low of $2.32.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Canaan’s stock has been overbought by >=80

Moving Average

Canaan’s value is way below its 50-day moving average of $2.94 and way below its 200-day moving average of $3.72.

More news about Canaan.

6. Air Products and Chemicals (APD)

Shares of Air Products and Chemicals jumped 8.39% in from $292.54 to $317.08 at 18:21 EST on Friday, after two successive sessions in a row of losses. NYSE is dropping 1.08% to $15,018.17, after two successive sessions in a row of losses.

Air Products and Chemicals, Inc. supplies atmospheric, specialty, and process gases, as well as equipment and services around the world. It produces atmospheric gases such as oxygen, nitrogen and argon, process gases like hydrogen, carbon dioxide and carbon monoxide, and specialty gases. The company also provides equipment and services for processing gases. This includes air separation units or non-cryogenic generators. The company also produces equipment for natural gas liquefaction and air separation. Baker Hughes Company has formed a strategic partnership with Air Products and Chemicals, Inc. to create hydrogen compression systems. This company was established in 1940, and its headquarters are in Allentown in Pennsylvania.

Growth Estimates Quarters

The company’s growth estimates for the current quarter and the next is 10% and 7.5%, respectively.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Stock of Air Products and Chemicals is overbought (>=80).

More news about Air Products and Chemicals.

7. Towers Watson & Co (TW)

Shares of Towers Watson & Co jumped by a staggering 11.3% in from $57.42 to $63.91 at 18:21 EST on Friday, after four sequential sessions in a row of losses. NASDAQ is sliding 0.97% to $10,705.41, after two sequential sessions in a row of losses.

Tradeweb Markets Inc. operates and builds electronic markets in Europe, Asia Pacific and the Middle East. Its marketplaces allow traders to trade in various asset classes such as rates, credit and money markets. The company offers trade execution and processing services, pre-trade data analytics and data analytics, trade execution and trade processing as well as analytics and post-trade reporting. Flexible order and trading solutions are offered to institutional investors in 45 countries across 25 currencies. The company also provides a variety of hybrid, electronic and voice platforms for approximately 300 dealers on hybrid or electronic markets. It offers trading solutions to financial advisor firms with Tradeweb Direct platform and trading solutions that can be used by traders and financial advisers. It serves approximately 2,500 clients across the retail, wholesale and institutional client segments. Asset managers, financial advisor firms and banks are some of its customers. Tradeweb Markets Inc. is an American company that was established in New York in 1996. Tradeweb Markets Inc., a subsidiary to Refinitiv Parent Limited.

Yearly Top and Bottom Value

Towers Watson & Co’s stock is valued at $63.91 at 18:22 EST, way under its 52-week high of $102.33 and way above its 52-week low of $51.47.

More news about Towers Watson & Co.

8. Twitter (TWTR)

Shares of Twitter fell 0% in from $53.7 to $53.70 at 18:21 EST on Friday, following the last session’s downward trend. NYSE is falling 1.08% to $15,018.17, after two consecutive sessions in a row of losses.

Twitter, Inc. is a social media platform that allows people to express themselves and have real-time conversations. Twitter is the company’s main product. It allows people to create, consume, distribute and discover content. The company also offers promoted products which allow advertisers to advertise brands, products and services. The company’s promoted products include Twitter Amplify and Follower Ads as well as promoted ads. The company also offers monetization products to creators. These include Tips, which allows creators to send one-time small payments to Twitter via various payment methods including bitcoin. Super Follows is a monthly paid subscription that includes bonus content and previews. Ticketed Spaces supports creators by paying them for hosting and managing the Twitter Spaces public discussion. It also offers data partners and products to developers, including the Twitter Developer Platform. This platform allows developers to create tools for businesses and people using its public API. Partners with commercial uses of Twitter data can get paid access to Twitter data. Twitter, Inc. was established in 2006 in San Francisco, California.

Sales Growth

Twitter is forecast to grow its sales by 0.6% in the next quarter.

Growth Estimates Quarters

The company’s growth estimates for the ongoing quarter and the next is 135.2% and 24.2%, respectively.

Revenue Growth

Year-on-year quarterly revenue growth declined by 1.2%, now sitting on 5.23B for the twelve trailing months.

Moving Average

Twitter’s value is way higher than its 50-day moving average of $41.24 and way above its 200-day moving average of $40.34.

Previous days news about Twitter

- Musk says he’s taking ‘legal action’ on twitter account tracking his plane. According to MarketWatch on Thursday, 15 December, "Since taking over Twitter, Musk has vowed to make the platform more oriented to his view of "free speech." That meant a more relaxed approach to account suspensions and content takedowns than what Twitter had demonstrated during its time as a public company."

More news about Twitter.

9. Novo Nordisk A/S (NVO)

Shares of Novo Nordisk A/S jumped by a staggering 18.55% in from $112.64 to $133.54 at 18:21 EST on Friday, after two successive sessions in a row of losses. NYSE is falling 1.08% to $15,018.17, after two successive sessions in a row of losses.

Novo Nordisk A/S, a healthcare company, engages in the research, development, manufacture, and marketing of pharmaceutical products worldwide. It operates in two segments, Diabetes and Obesity care, and Biopharm. The Diabetes and Obesity care segment provides products in the areas of insulins, GLP-1 and related delivery systems, oral antidiabetic products, obesity, and other chronic diseases. The Biopharmaceuticals segment offers products in the areas of haemophilia, growth disorders, and hormone replacement therapy. The company collaboration agreements with Gilead Sciences, Inc. Novo Nordisk A/S also has a research collaboration with Lumen Bioscience, Inc. to explore strategies for delivering oral biologics for cardiometabolic disease. The company was founded in 1923 and is headquartered in Bagsvaerd, Denmark.

More news about Novo Nordisk A/S.

10. Redfin (RDFN)

Shares of Redfin slid 1.01% in from $4.98 to $4.93 at 18:21 EST on Friday, following the last session’s downward trend. NASDAQ is dropping 0.97% to $10,705.41, after two successive sessions in a row of losses.

Redfin Corporation operates as a residential real estate brokerage company in the United States and Canada. The company operates an online real estate marketplace and provides real estate services, including assisting individuals in the purchase or sell of home. It also provides title and settlement services; originates and sells mortgages; and buys and sells homes. The company was formerly known as Appliance Computing Inc. and changed its name to Redfin Corporation in May 2006. Redfin Corporation was incorporated in 2002 and is headquartered in Seattle, Washington.

Moving Average

Redfin’s value is higher than its $50-day moving median of $4.75, and much lower than its $200-day moving mean of $9.98.

Volatility

Redfin’s intraday variation average for the week and quarter ended last week was negative at 3.41% and positive at 1.89% respectively. It also stood last quarter at 4.90%.

Redfin had the highest average volatility amplitudes at 4.74%, 6.37% and 4.90% respectively.

More news about Redfin.

11. HCA Holdings (HCA)

Shares of HCA Holdings rose 5.54% in from $226.74 to $239.30 at 18:21 EST on Friday, following the last session’s downward trend. NYSE is falling 1.08% to $15,018.17, after two sequential sessions in a row of losses.

HCA Healthcare, Inc., via its subsidiaries, offers health care company services in the United States. HCA Healthcare, Inc. operates hospitals for general and acute care. It offers medical and surgical services including cardiac care, inpatient care and intensive care. Outpatient services include outpatient surgery and laboratory radiology. The company also has outpatient facilities that include freestanding ambulatory surgical centers, emergency care centers, walk-in facilities, radiology and oncology treatment centers, rehabilitation and physical therapy centres, as well as radiation and chemotherapy therapy centers. The company also operates psychiatric hospital, providing therapeutic programs that include child, adolescent, and adult psychiatric, as well as adolescent, adult, and drug abuse treatment. It operated 182 hospitals as of December 31, 2020, which included 175 acute and general care hospitals, 5 psychiatric hospital, 2 rehabilitation hospitals and 2 rehab hospitals. There were also 125 freestanding surgical centers and 21 endoscopy centres in the United States and England. HCA Holdings, Inc. was the company’s former name. HCA Healthcare, Inc. is located in Nashville, Tennessee.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

HCA Holdings’s stock is considered to be oversold (<=20).

Moving Average

HCA Holdings is worth more than its moving average for 50 days of $218.52, and much higher than its moving average for 200 days of $216.67.

Growth Estimates Quarters

The company’s growth estimates for the current quarter and the next is 7.7% and 5.3%, respectively.

More news about HCA Holdings.

12. Exelon (EXC)

Shares of Exelon rose by a staggering 11.25% in from $37.5 to $41.72 at 18:21 EST on Friday, following the last session’s downward trend. NASDAQ is sliding 0.97% to $10,705.41, after two successive sessions in a row of losses.

Exelon Corporation is a holding company for utility services. It engages in energy generation, distribution, and marketing in both the United States of America and Canada. The company owns a variety of facilities, including solar, nuclear, renewable, energy, biofuel, and hydroelectric. It also offers electricity wholesale to retail customers and natural gas and renewable energy as well as other energy-related products, services, and goods. It is also involved in the regulation and purchase of electricity and natural gases; transmission and distribution, as well distribution of natural gas retail customers. The company also offers support services such as legal, human resource, information technology and accounting. The company serves residential, commercial, industrial and governmental customers as well as distribution utilities and cooperatives. Exelon Corporation, which was founded in 1999, is located in Chicago.

More news about Exelon.

13. Sabre Corporation (SABR)

Shares of Sabre Corporation jumped by a staggering 16.7% in from $5.15 to $6.01 at 18:21 EST on Friday, after three sequential sessions in a row of losses. NASDAQ is sliding 0.97% to $10,705.41, after two consecutive sessions in a row of losses.

Sabre Corporation provides technology and software solutions to the global travel industry through Sabre Holdings Corporation. The company operates two main segments: Travel Solutions and Hospitality Solutions. It operates in two segments, Travel Solutions and Hospitality Solutions. The Travel Solutions segment is a business to-business marketplace for travel information. This includes inventory, prices and availability of a variety of suppliers including hotels, airlines, cars rental brands, railway companies and cruise lines. There are also travel buyers that include travel managers, corporate travel departments, online travel agencies and travel management firms. This segment also provides a portfolio of software technology products and solutions through software-as-a-service (SaaS) and hosted delivery models to airlines and other travel suppliers. These products include reservations systems for airlines, commercial and operation products, agency solutions and data-driven Intelligence solutions. Hospitality Solutions provides software and services to hotels through hosted delivery and SaaS. Sabre Corporation was founded in 2006, and its headquarters are in Southlake Texas.

Moving Average

Sabre Corporation is worth a lot more than its moving average for 50 days of $5.37, and much less than its moving average for 200 days of $7.47.

Revenue growth

Annual revenue growth was 56.7%. The twelve trailing months saw 2.18B in revenue.

More news about Sabre Corporation.

14. Aware, Inc. (AWRE)

Shares of Aware, Inc. jumped 1.14% in from $1.75 to $1.77 at 18:21 EST on Friday, following the last session’s downward trend. NASDAQ is dropping 0.97% to $10,705.41, after two sequential sessions in a row of losses.

Aware, Inc. provides biometrics software products and solutions in the United States, Brazil, the United Kingdom, and internationally. It offers biometrics software products, including biometric search and matching software development kits (SDKs); biometric enrollment SDKs and application programming interfaces (APIs); and imaging products for medical and advanced imaging applications, such as JPEG2000 product to compress, store, and display images, as well as software maintenance services. The company also provides Knomi mobile biometric authentication framework; AwareABIS, an automated biometric identification system; AFIX suite of products for small-scale law enforcement focused biometric identification; BioSP, a biometric services platform; WebEnroll, a browser-based biometric enrollment and data management solution; AwareID, a software-as-a-service that provides biometric face and voice analysis for liveness-verification, and document validation; and Fortress Identity Biometric Authenticator and Onboarding Authentication Platform, which offers multi-factor authentication through passive and active biometrics for multiple modalities, including voice, fingerprint, face, and behavior to enable online onboarding and identity proofing. In addition, it offers program management and software engineering services, including project planning and management; system and architecture design; software design, development, customization, configuration, and testing; and software integration and installation. The company's software portfolio enables government agencies and commercial entities to enroll, identify, authenticate, and enable using biometrics, such as fingerprints, faces, irises, and voices. The company sells its products through systems integrators, original equipment manufacturers, value added resellers, and partners, as well as directly to end user customers. Aware, Inc. was incorporated in 1986 and is headquartered in Burlington, Massachusetts.

Sales Growth

Aware, Inc.’s sales growth is negative 22.4% for the current quarter and negative 38.2% for the next.

Revenue growth

The year-on-year revenue growth fell by 27.8%. It now stands at 15.94M in the 12 trailing months.

More news about Aware, Inc..

15. Petroleo Brasileiro (PBR)

Shares of Petroleo Brasileiro dropped by a staggering 21.5% in from $12.03 to $9.44 at 18:21 EST on Friday, after two consecutive sessions in a row of gains. NYSE is sliding 1.08% to $15,018.17, after two sequential sessions in a row of losses.

Petroleo Brasileiro S.A.- Petrobras is a Brazilian company that explores, produces and markets oil and natural gas both in Brazil and abroad. Exploration and Production; Refining, Transportation and Marketing; Gas and Power; and Corporate and other Businesses are the segments of the company. The company engages in the prospecting, drilling and refining of crude oil, along with oil products and natural gas. Exploration and Production is responsible for developing, producing, and distributing crude oil and natural gas liquids. Refining, Transportation and Marketing is involved in refining, logistic, transport, and marketing crude oil and other oil products. It also exports ethanol. The segment holds interests in petrochemical and shale companies. Gas and Power is engaged in logistics and trade of natural gas and electric; transport and trading in LNG; generation and transmission of electricity via thermoelectric power stations; and holding rights in distribution and transportation of natural gas. Corporate and Other Businesses produces and distributes biodiesel and co-products and ethanol. Petroleo Brasileiro S.A. was established in 1953. It is located in Rio de Janeiro in Brazil.

Growth Estimates Quarters

The company’s growth estimates for the present quarter and the next is 196.1% and 98.5%, respectively.

Revenue Growth

Year-on-year quarterly revenue growth grew by 54.4%, now sitting on 568.39B for the twelve trailing months.

Sales Growth

Petroleo Brasileiro saw a 31.3% increase in sales for its current quarter, and 27.4% the following.

More news about Petroleo Brasileiro.

16. ONE Gas (OGS)

Shares of ONE Gas slid 9.68% in from $82.45 to $74.47 at 18:21 EST on Friday, after two successive sessions in a row of losses. NYSE is dropping 1.08% to $15,018.17, after two sequential sessions in a row of losses.

ONE Gas, Inc., together with its subsidiaries, operates as a regulated natural gas distribution utility company in the United States. The company operates through three divisions: Oklahoma Natural Gas, Kansas Gas Service, and Texas Gas Service. It provides natural gas distribution services to 2.2 million customers in three states. It serves residential, commercial, and transportation customers. As of December 31, 2021, it operated approximately 41,600 miles of distribution mains; and 2,400 miles of transmission pipelines, as well as had 51.4 billion cubic feet of natural gas storage capacity. ONE Gas, Inc. was founded in 1906 and is headquartered in Tulsa, Oklahoma.

Volatility

ONE Gas’s intraday variation average for the week and quarter ended last week was positive 1.77% and negative 0.66% respectively.

ONE Gas had the highest amplitude average volatility at 1.77%, 2.99% and 2.15% respectively (last week, last month and last quarter).

Revenue Growth

Year-on-year quarterly revenue growth grew by 35.9%, now sitting on 2.27B for the twelve trailing months.

More news about ONE Gas.