(VIANEWS) – Today, the Innrs artificial intelligence algorithm suggests a high probability of discovering the approximate price for tomorrow of LyondellBasell LYB, General Motors GM and others.

Via News will regularly fact-check this AI algorithm that aims to consistently predict the next session price and next week’s trend of financial assets.

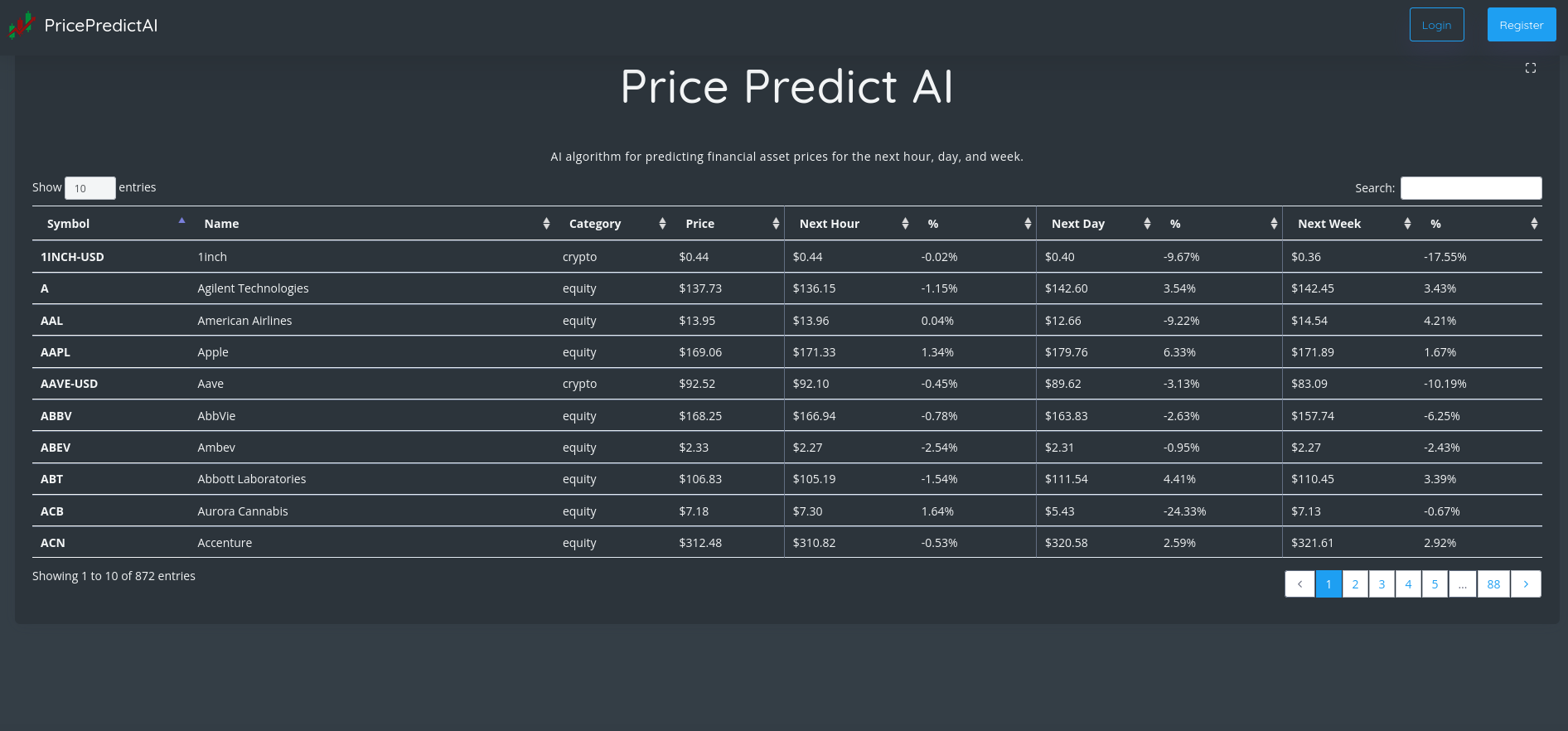

Innrs provides A.I.-based statistical tools to help investors make decisions. The table below shows the financial assets predicting price, ordered by the highest expected accuracy.

Innrs officials say this tool helps investors make better-informed decisions, supposedly used alongside other relevant financial information and the specific trader strategy.

In the next session, Via News will report the finding on the algorithm precision.

| Financial Asset | Accuracy | Close Price | Prediction |

|---|---|---|---|

| LyondellBasell (LYB) | 99.17% | $92.89 | ⇧ $93.55 |

| General Motors (GM) | 99.09% | $37.67 | ⇧ $38.19 |

| Ford (F) | 98.87% | $13.13 | ⇧ $13.44 |

| E.I. du Pont de Nemours and Company (DD) | 98.74% | $74.91 | ⇧ $77.01 |

| Booking Holdings (BKNG) | 98.58% | $2210.42 | ⇧ $2254 |

| Laboratory Corporation of America Holdings (LH) | 98.1% | $245.22 | ⇧ $254.24 |

| America Movil (AMOV) | 94.52% | $19.69 | ⇧ $19.89 |

| America Movil (AMX) | 94.48% | $20.03 | ⇧ $20.23 |

| Banco Bilbao Vizcaya Argentaria (BBVA) | 94.35% | $6.78 | ⇧ $6.93 |

| V.F. Corporation (VFC) | 94.32% | $29.98 | ⇧ $30.26 |

| Intel (INTC) | 94.07% | $29.42 | ⇧ $29.77 |

| Celanese (CE) | 94.06% | $119.02 | ⇧ $120.83 |

| Capital One Financial (COF) | 94.04% | $101.79 | ⇧ $103.22 |

| Darden Restaurants (DRI) | 94% | $149.48 | ⇧ $152.38 |

| BeiGene (BGNE) | 93.97% | $249.39 | ⇧ $253.86 |

| Cognizant Technology Solutions (CTSH) | 93.87% | $61.29 | ⇧ $62.89 |

| PT Telekomunikasi (TLK) | 93.85% | $24.43 | ⇧ $24.94 |

| MarketAxess Holdings (MKTX) | 93.83% | $320.82 | ⇧ $324.9 |

| Oracle (ORCL) | 93.79% | $88.46 | ⇧ $90.32 |

| Southern Copper (SCCO) | 93.78% | $73.22 | ⇧ $74.33 |

| Toll Brothers (TOL) | 93.78% | $55.46 | ⇧ $56.9 |

| Cisco (CSCO) | 93.77% | $48.76 | ⇧ $49.59 |

| Illumina (ILMN) | 93.76% | $194.44 | ⇧ $197.12 |

| Trimble (TRMB) | 93.66% | $52.24 | ⇧ $53.58 |

| PennyMac (PFSI) | 93.6% | $62.47 | ⇧ $63.69 |

| Flex (FLEX) | 93.6% | $23.12 | ⇧ $23.57 |

| Logitech (LOGI) | 93.49% | $67.17 | ⇧ $69.49 |

| Randgold (GOLD) | 93.38% | $19.42 | ⇧ $19.48 |

| U.S. Bancorp (USB) | 93.25% | $46.6 | ⇧ $48.35 |

| Salesforce (CRM) | 93.15% | $144.84 | ⇧ $146.08 |

| Catalyst Pharmaceuticals (CPRX) | 92.39% | $19.67 | ⇧ $19.97 |

| PNC Financial Services Group (PNC) | 92.35% | $165.03 | ⇧ $170.22 |

| Lyft (LYFT) | 92.34% | $13.37 | ⇧ $14.5 |

| NRG Energy (NRG) | 89.47% | $32.15 | ⇧ $32.66 |

| Walt Disney (DIS) | 89.35% | $96.18 | ⇧ $97.67 |

| ONE Gas (OGS) | 89.34% | $80.94 | ⇧ $81.79 |

| CDW Corporation (CDW) | 89.1% | $186.26 | ⇧ $188.73 |

| Internationa Flavors & Fragrances (IFF) | 89.07% | $114.52 | ⇧ $117.65 |

| Verizon (VZ) | 89.06% | $41.12 | ⇧ $42.09 |

| Akamai Technologies (AKAM) | 89.04% | $87.32 | ⇧ $89.12 |

1. LyondellBasell (LYB)

Shares of LyondellBasell rose by a staggering 10.18% in from $84.31 to $92.89 at 18:22 EST on Wednesday, after five consecutive sessions in a row of gains. NYSE is rising 0.9% to $15,749.09, following the last session’s upward trend.

LyondellBasell Industries N.V. is a chemical company that operates in the United States of America, Mexico, Italy Poland, France and Japan. It also has operations internationally. The company operates in six segments: Olefins and Polyolefins–Americas; Olefins and Polyolefins–Europe, Asia, International; Intermediates and Derivatives; Advanced Polymer Solutions; Refining; and Technology. The company produces and markets co-products, olefins, polyolefins, polyethylene products. These include high, medium, and low density polyethylenes, as well as linear, low density polyethylenes. It also makes polypropylene products such as copolymers and homopolymers. It also manufactures and markets propylene oxide, its derivatives, oxyfuels, and related products. The intermediate chemicals include styrene monomers and copolymers as well as acetyls and ethylene glycols. It also produces and markets solutions such as engineered plastics and masterbatches; engineered composites and colors; advanced polymers and other compounds. The company also refines crude oil from different sources to make gasoline, distillates and chemicals. It develops and licenses process technology for chemical and polyolefins; manufactures and markets polyolefin catalysts. LyondellBasell Industries N.V., which was established in 2009 is located in Houston.

Growth Estimates Quarters

For the current quarter, the company expects a decline of 45.9% in growth and for the next quarter it will be negative 42.1%.

Volatility

LyondellBasell last week’s and last month’s intraday variations averages were 2.07%, 0.677% and 1.68%, respectively.

LyondellBasell had the highest average volatility amplitude at 2.07%, 1.42% and 1.68% respectively (last week, last month, and last quarter).

More news about LyondellBasell.

2. General Motors (GM)

Shares of General Motors slid 2.84% in from $38.77 to $37.67 at 18:22 EST on Wednesday, after five successive sessions in a row of gains. NYSE is jumping 0.9% to $15,749.09, following the last session’s upward trend.

General Motors Company designs, builds, and sells trucks, crossovers, cars, and automobile parts and accessories in North America, the Asia Pacific, the Middle East, Africa, South America, the United States, and China. The company operates through GM North America, GM International, Cruise, and GM Financial segments. It markets its vehicles primarily under the Buick, Cadillac, Chevrolet, GMC, Holden, Baojun, and Wuling brand names. The company also sells trucks, crossovers, cars, and purpose-built vehicles to dealers for consumer retail sales, as well as to fleet customers, including daily rental car companies, commercial fleet customers, leasing companies, and governments. In addition, it offers safety and security services for retail and fleet customers, including automatic crash response, emergency services, roadside assistance, crisis assist, stolen vehicle assistance, and turn-by-turn navigation; and connected services comprising mobile applications for owners to remotely control their vehicles and electric vehicle owners to locate charging stations, on-demand vehicle diagnostics, smart driver, marketplace in-vehicle commerce, in-vehicle voice, voice assistant, navigation and app ecosystem, connected navigation, SiriusXM with 360L, and 4G LTE wireless connectivity, as well as develops and commercializes autonomous vehicle technology. Further, the company provides automotive financing and insurance services; and software-enabled services and subscriptions. General Motors Company was founded in 1908 and is headquartered in Detroit, Michigan.

More news about General Motors.

3. Ford (F)

Shares of Ford fell 3.35% in from $13.59 to $13.13 at 18:22 EST on Wednesday, after five consecutive sessions in a row of gains. NYSE is jumping 0.9% to $15,749.09, following the last session’s upward trend.

: ford stock Zooms to ninth straight day of gains, notches highest in nearly a monthShares of Ford Motor Co. were on track for their highest close since Dec. 14, extending their winning streak to a ninth straight session.

: ford stock Zooms to ninth straight day of gains, notches highest in nearly a month Ford Motor Co. shares were at their highest close since December 14, and extended their winning streak to nine consecutive sessions.

Ford Motor Company designs, manufactures, markets, and services a range of Ford trucks, cars, sport utility vehicles, electrified vehicles, and Lincoln luxury vehicles worldwide. It operates through three segments: Automotive, Mobility, and Ford Credit. The Automotive segment sells Ford and Lincoln vehicles, service parts, and accessories through distributors and dealers, as well as through dealerships to commercial fleet customers, daily rental car companies, and governments. The Mobility segment designs and builds mobility services; and provides self-driving systems development services. The Ford Credit segment primarily engages in vehicle-related financing and leasing activities to and through automotive dealers. It provides retail installment sale contracts for new and used vehicles; and direct financing leases for new vehicles to retail and commercial customers, such as leasing companies, government entities, daily rental companies, and fleet customers. This segment also offers wholesale loans to dealers to finance the purchase of vehicle inventory; and loans to dealers to finance working capital and enhance dealership facilities, purchase dealership real estate, and other dealer vehicle programs. The company has a strategic collaboration with ARB Corporation Limited to develop a suite of aftermarket products for the new Ford Bronco. Ford Motor Company was incorporated in 1903 and is based in Dearborn, Michigan.

Yearly Top and Bottom Value

Ford’s stock is valued at $13.13 at 18:22 EST, way under its 52-week high of $25.87 and way above its 52-week low of $10.61.

Growth Estimates Quarters

The company’s growth estimates for the present quarter and the next is 142.3% and 13.2%, respectively.

Sales Growth

Ford sales growth for the current quarter is 17.3% and 14.1% respectively.

Revenue growth

The year-over-year growth in quarterly revenue was 50.2%. We now have 148.03B to our credit for the 12 trailing months.

More news about Ford.

4. E.I. du Pont de Nemours and Company (DD)

Shares of E.I. du Pont de Nemours and Company rose 5.76% in from $70.83 to $74.91 at 18:22 EST on Wednesday, after five sequential sessions in a row of gains. NYSE is jumping 0.9% to $15,749.09, following the last session’s upward trend.

DuPont de Nemours, Inc. offers technology-based solutions and materials in America, Canada, Latin America, Latin America, Europe, Asia Pacific, Latin America, Europe, Middle East, Africa. The company operates in three main segments, Electronics & Industrial and Mobility & Materials. Water & Protection is its third segment. Electronics & Industrial supplies advanced printing materials, printing systems and other materials to this industry. It also provides materials and solutions that can be used in the production of integrated circuits for semiconductors. The segment provides advanced packaging materials, semiconductors and dielectrics; dielectrics and metallization options for chip packaging; silicones for light-emitting diode packaging, semiconductor applications, permanent and process chemicals for fabricating printed circuit boards. This includes substrates, laminates and substrates as well as patterns and metal finishing and decorative metallization. It also offers a variety of materials for rigid and flexible display, including those that emit organic light, and others, as well specialty silicone elastomers and lubricants. Mobility & Materials provides advanced films, engineering resins and silicone encapsulants to designers and engineers in electronics, transportation, manufacturing, renewable energy and industrial markets. Water & Protection provides integrated products and engineered products for worker safety, water separation, transport, energy and medical packaging, as well as systems to protect workers. In June 2019, the company, formerly DowDuPont Inc., changed its name into DuPont de Nemours, Inc. DuPont de Nemours, Inc. has its headquarters in Wilmington, Delaware.

Revenue Growth

Year-on-year quarterly revenue growth grew by 7%, now sitting on 17.13B for the twelve trailing months.

Yearly Top and Bottom Value

E.I. du Pont de Nemours and Company’s stock is valued at $74.91 at 18:22 EST, way under its 52-week high of $85.16 and way higher than its 52-week low of $49.52.

Sales Growth

E.I. du Pont de Nemours and Company’s quarter-end sales growth is negative 20%

Moving Average

E.I. du Pont de Nemours and Company’s value is way higher than its 50-day moving average of $67.61 and way above its 200-day moving average of $62.54.

More news about E.I. du Pont de Nemours and Company.

5. Booking Holdings (BKNG)

Shares of Booking Holdings rose 7.72% in from $2052.01 to $2,210.42 at 18:22 EST on Wednesday, after five sequential sessions in a row of gains. NASDAQ is rising 1.76% to $10,931.67, after three successive sessions in a row of gains.

Booking Holdings Inc. offers online reservations for travel and restaurants worldwide. Booking.com offers accommodation bookings online; Rentalcars.com provides rental car services online; Priceline which allows customers to make travel reservations online for hotel, flight and rental cars. Agoda, which offers online accommodations reservation, flight, ground transport, and activity reservation services, is also available. KAYAK is an online price comparison site that lets consumers search for and compare prices on travel itineraries. This includes information about rental cars, airline tickets, hotel reservations, and accommodation. OpenTable allows customers to book online restaurants. It also offers insurance and management services for consumers and travel service providers. The original name of the company was The Priceline Group Inc., but it changed its name in February 2018 to Booking Holdings Inc. It was established in 1997. The headquarters are located in Norwalk in Connecticut.

Volatility

Booking Holdings’s intraday variation average for the week and quarter ended last week at 1.98%. 0.35% and 1.74% respectively.

Booking Holdings had the highest average volatility amplitude at 1.98%, 1.63% and 1.74% respectively.

Revenue Growth

Year-on-year quarterly revenue growth grew by 98.8%, now sitting on 14.65B for the twelve trailing months.

More news about Booking Holdings.

6. Laboratory Corporation of America Holdings (LH)

Shares of Laboratory Corporation of America Holdings rose 5.82% in from $231.73 to $245.22 at 18:22 EST on Wednesday, after five successive sessions in a row of gains. NYSE is jumping 0.9% to $15,749.09, following the last session’s upward trend.

Laboratory Corporation of America Holdings is a worldwide life science company. It provides crucial information that helps doctors, nurses, pharmacist companies, researchers and patients to make informed decisions. Labcorp Diagnostics is (Dx), and Labcorp Drug Development(DD) are its two main segments. There are many tests it offers, including blood chemistry, blood cell counts and urinalysis, as well as thyroid and PAP testing, hemoglobin and vitamin D tests and tests for sexually transmitted disease, HIV, Hepatitis C, microbiology cultures, procedures and tests to detect alcohol abuse. It also offers specialty testing, which includes gene-based or esoteric tests; advanced testing targets specific diseases such as anatomic pathology/oncology and cardiovascular disease. Online and mobile apps are available to patients for checking test results. There is also an online application that can be used by managed care and accountable organizations. The company offers complete drug, medical, and companion diagnostic solutions, from the early stages of research through clinical development and access to commercial markets. Managed care companies, pharmaceutical, biotechnology and medical device, diagnostics firms, government agencies, doctors and other healthcare providers as well as hospitals and health system employers, consumers, contractors research organisations and independent clinical labs, are all served. Laboratory Corporation of America Holdings and Tigerlily Foundation have a collaborative agreement to expand the number of women of color participating in clinical trials. This company was founded in 1994, and its headquarters are in Burlington (North Carolina).

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Laboratory Corporation of America Holdings’s stock is considered to be oversold (<=20).

Revenue Growth

Year-on-year quarterly revenue growth declined by 3.7%, now sitting on 15.72B for the twelve trailing months.

Moving Average

Laboratory Corporation of America Holdings’s value is above its 50-day moving average of $226.10 and above its 200-day moving average of $242.52.

Sales Growth

Laboratory Corporation of America Holdings’s sales growth is negative 6.3% for the current quarter and negative 7.2% for the next.

More news about Laboratory Corporation of America Holdings.

7. America Movil (AMOV)

Shares of America Movil rose 8.72% in from $18.11 to $19.69 at 18:22 EST on Wednesday, after five consecutive sessions in a row of gains. NASDAQ is jumping 1.76% to $10,931.67, after three consecutive sessions in a row of gains.

America Movil, S.A.B. de C.V. offers telecommunications services throughout Latin America as well as internationally. It offers fixed and wireless voice services as well as network interconnection. These services include local, national, and international long distance services. The company also offers data services such as hosting, data administration and data centers to residential and business clients. It also offers value-added services including Internet access and messaging; data transmission, email, instant messaging and content streaming; wireless security services and machine-to-machine, machine-tomachine, mobile banking and virtual private network service. Video calls and personal communication services are all offered by the company. The company also offers broadband services for residential customers, IT solutions to large businesses, and subscriptions to satellite and cable pay TV. It also sells accessories and computers, as well as equipment directories and wireless security. The company offers call center services, software development, advertising and media support, as well. The company also provides audio and video content via the Internet, directly from content providers to end users. The company sells products and services under Telcel, Telmex Infinitum and A1 brand names through a network that includes retailers, service centers, corporate clients, as well as through its sales force. The company has approximately 286.5 millions wireless voice and data customers as of December 31, 2021. America Movil, S.A.B. de C.V. was established in 2000. It is located in Mexico City.

Volatility

America Movil’s last week, last month’s, and last quarter’s current intraday variation average was 1.41%, 0.26%, and 1.43%.

America Movil’s highest amplitude of average volatility was 1.41% (last week), 1.31% (last month), and 1.43% (last quarter).

Yearly Top and Bottom Value

America Movil’s stock is valued at $19.69 at 18:23 EST, way below its 52-week high of $22.57 and way above its 52-week low of $15.86.

More news about America Movil.

8. America Movil (AMX)

Shares of America Movil jumped 9.69% in from $18.26 to $20.03 at 18:22 EST on Wednesday, after five sequential sessions in a row of gains. NYSE is jumping 0.9% to $15,749.09, following the last session’s upward trend.

América Móvil, S.A.B. de C.V. provides telecommunications services in Latin America and internationally. The company offers wireless and fixed voice services, including local, domestic, and international long-distance services; and network interconnection services. It also provides data services, such as data centers, data administration, and hosting services to residential and corporate clients; value-added services, including Internet access, messaging, and other wireless entertainment and corporate services; data transmission, email services, instant messaging, content streaming, and interactive applications; and wireless security services, mobile payment solutions, machine-to-machine services, mobile banking, virtual private network services, and video calls and personal communications services. In addition, the company offers residential broadband services; IT solutions for small businesses and large corporations; and cable and satellite pay television subscriptions. Further, it sells equipment, accessories, and computers; and offers telephone directories, wireless security, call center, advertising, media, and software development services. Additionally, the company provides video, audio, and other media content through the Internet directly from the content provider to the end user. It sells its products and services under the Telcel, Telmex Infinitum, and A1 brands through a network of retailers and service centers to retail customers; and through sales force to corporate customers. As of December 31, 2021, the company had approximately 286.5 million wireless voice and data subscribers. América Móvil, S.A.B. de C.V. was incorporated in 2000 and is based in Mexico City, Mexico.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

America Movil stock considered oversold (=20).

Moving Average

America Movil’s value is above its 50-day moving average of $19.09 and above its 200-day moving average of $19.16.

Growth Estimates Quarters

The company’s growth estimates for the present quarter is 11.8% and a drop 17% for the next.

More news about America Movil.

9. Banco Bilbao Vizcaya Argentaria (BBVA)

Shares of Banco Bilbao Vizcaya Argentaria rose by a staggering 15.7% in from $5.86 to $6.78 at 18:22 EST on Wednesday, after five consecutive sessions in a row of gains. NYSE is jumping 0.9% to $15,749.09, following the last session’s upward trend.

Banco Bilbao Vizcaya Argentaria, S.A., together with its subsidiaries, provides retail banking, wholesale banking, and asset management services. It offers current accounts; and demand, savings, overnight, time, term, and subordinated deposits. The company also provides loan products; deals in securities; and manages pension and investment funds. In addition, it offers credit cards; corporate and investment banking services; insurance products and services; and real estate services. The company provides its products through online and mobile channels. As of December 31, 2021, it operated through a network of 6,083 branches and 29,148 ATMs. It operates in Spain, Mexico, South America, the United States, Turkey, Asia, and rest of Europe. Banco Bilbao Vizcaya Argentaria, S.A. was founded in 1857 and is headquartered in Bilbao, Spain.

Revenue growth

The year-on-year revenue growth was 21.1%. 20.4B is now available for the 12 trailing months.

Moving Average

Banco Bilbao Vizcaya Argentaria is worth more than its $50-day moving mean of $5.35, and much higher than its $200-day moving median of $5.02.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Banco Bilbao Vizcaya Argentaria’s stock is considered to be oversold (<=20).

Volatility

Banco Bilbao Vizcaya Argentaria’s last week, last month’s, and last quarter’s current intraday variation average was 2.38%, 0.79%, and 1.54%.

Banco Bilbao Vizcaya Argentaria’s highest amplitude of average volatility was 2.38% (last week), 1.53% (last month), and 1.54% (last quarter).

More news about Banco Bilbao Vizcaya Argentaria.

10. V.F. Corporation (VFC)

Shares of V.F. Corporation jumped 5.38% in from $28.45 to $29.98 at 18:22 EST on Wednesday, after five consecutive sessions in a row of gains. NYSE is rising 0.9% to $15,749.09, following the last session’s upward trend.

V.F. V.F. The company operates in three main segments, Outdoor, Active and Work. It offers outdoor, casual, merino wool, and lifestyle clothing; footwear; equipment and accessories. The company also makes protective footwear, handbags and luggage as well as lifestyle and lifestyle footwear and apparel. The company sells its products under the Timberland and Smartwool brand names. It sells products to specialty shops, department stores and national chains as well as mass merchants. V.F. Corporation was established in 1899. It is located in Denver, Colorado.

Moving Average

V.F. V.F.

Revenue Growth

Year-on-year quarterly revenue growth grew by 3.1%, now sitting on 11.91B for the twelve trailing months.

More news about V.F. Corporation.

11. Intel (INTC)

Shares of Intel jumped 2.4% in from $28.73 to $29.42 at 18:22 EST on Wednesday, after three successive sessions in a row of gains. NASDAQ is jumping 1.76% to $10,931.67, after three sequential sessions in a row of gains.

Intel Corporation is engaged in designing, manufacturing, and selling computer products and technology worldwide. CCG, DCG and IOTG are the company’s segments. The company offers platform products such as chipsets and central processing units, system-on chip and multichip package, and other products that are non-platform, like accelerators and boards, systems and connectivity products, graphics and memory. It also offers high-performance computing solutions to targeted verticals as well embedded applications in retail, healthcare, and industrial markets. The company also has solutions for autonomous and assisted driving that include compute platforms, active sensors, machine learning-based sensing and mapping, localization, driving policy and computer vision. It also offers cloud service providers, government agencies, communications service providers and other related products that optimize workloads. It serves original equipment and original design producers, as well as cloud service providers. Intel Corporation and MILA have a strategic partnership to jointly develop and use artificial intelligence techniques for improving the search for drugs. It was founded in 1968, and its headquarters are in Santa Clara (California).

Sales Growth

Intel’s sales growth is negative 16.7% for the ongoing quarter and negative 14.9% for the next.

Annual Top and Bottom Value

At 18:23 EST Intel stock was valued at $29.42. This is way lower than its 52 week high of $56.28 but higher than its low 52-week of $24.59.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Intel’s stock is considered to be oversold (<=20).

More news about Intel.

12. Celanese (CE)

Shares of Celanese jumped 8.87% in from $109.32 to $119.02 at 18:22 EST on Wednesday, after five successive sessions in a row of gains. NYSE is jumping 0.9% to $15,749.09, following the last session’s upward trend.

Celanese Corporation is a specialty and technology materials company that manufactures and markets high-performance engineered polymers both in the United States as well internationally. Three segments make up the company: Engineered Materials and Acetyl Chain. Engineered Materials is a segment that develops, produces and supplies special polymers for medical and automotive applications. It also makes industrial and consumer electronics. Acesulfame potassium is also available, which can be used in beverages, confections and dairy products. It also provides food protection ingredients such as potassiumsorbate or sorbic acid, for use within foods, drinks, personal care products, and beverages. Acetate Tow provides tows of acetate and flakes that can be used in the manufacture of filter products. Acetyl Chain produces and supplies various acetyl products such as acetic acid and vinyl acetate monomers and acetic anhydride. Acetyl esters are used in colorants, paints adhesives coatings, pharmaceuticals, organic solvents, intermediates for agricultural and chemical products. Vinyl acetate-based paints and coatings are also offered. These include adhesives, construction and glass fibers as well as paper and textile applications. It also stocks ethylene vinyl compounds and resins. Low-density polyethylene is available for flexible packaging, lamination films products, hot melt adhesives as well as carpeting and automotive parts. It also produces ultra-high molecularweight polyethylene. Celanese Corporation was established in 1918. It is located in Irving, Texas.

More news about Celanese.

13. Capital One Financial (COF)

Shares of Capital One Financial rose 3.11% in from $98.72 to $101.79 at 18:22 EST on Wednesday, after three sequential sessions in a row of gains. NYSE is jumping 0.9% to $15,749.09, following the last session’s upward trend.

Capital One Financial Corporation is the financial holding company of Capital One Bank (USA), National Association and Capital One National Association. This bank provides a variety of financial products and services throughout the United States and Canada. The company operates in three distinct segments, Credit Card, Consumer Banking and Commercial Banking. Checking accounts, money market deposits and negotiable orders of withdrawals are all accepted. The company offers credit cards, auto and retail bank loans, as well as commercial and multi-family real estate and loans for industrial and commercial purposes. It also provides credit and debit cards, online banking services and treasury and depository management services. The company serves small and large businesses as well as consumers through branches, cafes and digital channels. It also has other distribution channels in New York and California. Capital One Financial Corporation was established in 1988. It is located in McLean in Virginia.

More news about Capital One Financial.

14. Darden Restaurants (DRI)

Shares of Darden Restaurants rose 3.15% in from $144.92 to $149.48 at 18:22 EST on Wednesday, after five successive sessions in a row of gains. NYSE is rising 0.9% to $15,749.09, following the last session’s upward trend.

Through its subsidiaries, Darden Restaurants, Inc. owns and runs full-service restaurants throughout the United States. It owned and operated 1,867 full-service restaurants in the United States and Canada as of May 29, 2022.

Revenue Growth

Year-on-year quarterly revenue growth grew by 6.1%, now sitting on 9.77B for the twelve trailing months.

Volatility

Darden Restaurants’s intraday variation average for the week ending September 30, 2013, and quarter ended November 31, 2013 was 1.53%. 0.17% and 1.07% respectively.

Darden Restaurants had the highest average volatility amplitudes of 1.53%, 1.11% and 1.07% respectively (last week, last month, and last quarter).

More news about Darden Restaurants.

15. BeiGene (BGNE)

Shares of BeiGene jumped by a staggering 19.63% in from $208.47 to $249.39 at 18:22 EST on Wednesday, after five consecutive sessions in a row of gains. NASDAQ is rising 1.76% to $10,931.67, after three successive sessions in a row of gains.

BeiGene, Ltd., a biotechnology company, focuses on discovering, developing, manufacturing, and commercializing various medicines worldwide. Its products include BRUKINSA to treat relapsed/refractory (R/R) mantle cell lymphoma; Tislelizumab to treat R/R classical Hodgkin's lymphoma; REVLIMID to treat multiple myeloma; VIDAZA to treat myelodysplastic syndromes, chronic myelomonocyte leukemia, and acute myeloid leukemia; XGEVA to treat giant cell tumor of bone; BLINCYTO to treat acute lymphoblastic leukemia; KYPROLIS to treat R/R multiple myeloma; SYLVANT to treat idiopathic multicentric castleman disease; QARZIBA to treat neuroblastoma; Pamiparib for the treatment of various solid tumors; and Pobevcy to treat metastatic colorectal cancer, liver cancer, and non-small cell lung cancer (NSCLC). The company's clinical stage drug candidates comprise Zanubrutinib, a BTK inhibitor to treat lymphomas; Tislelizumab, an anti-PD-1 antibody to treat solid and hematological cancers; Lifirafenib and BGB-3245 to treat melanoma, NSCLC, and endometrial cancer; and Sitravatinib, a multi-kinase inhibitor to treat NSCLC, melanoma, and other solid tumors. Its clinical stage drug candidates also include BGB-A333, a PD-L1 inhibitor to treat various solid tumors; Ociperlimab, a TIGIT inhibitor to treat various solid tumors; BGB-11417, a small molecule Bcl-2 inhibitor to treat mature B-cell malignancies; BGB-A445, an OX40 agonist antibody to treat solid tumors; Zanidatamab, a bispecific HER2 inhibitor to treat breast and gastric cancer; BGB-A425, a T-cell immunoglobulin and mucin-domain containing-3 inhibitor to treat various solid tumors; and BGB-15025, a small molecule inhibitor of HPK1. The company has strategic collaborations with Shoreline Biosciences, Inc., Amgen Inc., Novartis AG, and Bristol Myers Squibb company. BeiGene, Ltd. was incorporated in 2010 and is headquartered in Cambridge, Massachusetts.

More news about BeiGene.

16. Cognizant Technology Solutions (CTSH)

Shares of Cognizant Technology Solutions jumped 3.5% in from $59.22 to $61.29 at 18:22 EST on Wednesday, after three successive sessions in a row of gains. NASDAQ is jumping 1.76% to $10,931.67, after three successive sessions in a row of gains.

Cognizant Technology Solutions Corporation, a professional services company, provides consulting and technology, and outsourcing services in North America, Europe, and internationally. It operates through four segments: Financial Services; Healthcare; Products and Resources; and Communications, Media and Technology. The company offers customer experience enhancement, robotic process automation, analytics, and AI services in areas, such as digital lending, fraud detection, and next generation payments; the shift towards consumerism, outcome-based contracting, digital health, delivering integrated seamless, omni-channel, and patient-centered experience; and services that drive operational improvements in areas, such as clinical development, pharmacovigilance, and manufacturing, as well as claims processing, enrollment, membership, and billing to healthcare providers and payers, and life sciences companies, including pharmaceutical, biotech, and medical device companies. It also provides solution to manufacturers, retailers and travel and hospitality companies, as well as companies providing logistics, energy and utility services; and digital content, the creation of personalized user experience, and acceleration of digital engineering services to information, media and entertainment, and communications and technology companies. The company was founded in 1994 and is headquartered in Teaneck, New Jersey.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Cognizant Technology Solutions’s stock is considered to be oversold (<=20).

Yearly Top and Bottom Value

Cognizant Technology Solutions’s stock is valued at $61.29 at 18:23 EST, way below its 52-week high of $93.47 and way above its 52-week low of $51.33.

More news about Cognizant Technology Solutions.

17. PT Telekomunikasi (TLK)

Shares of PT Telekomunikasi jumped 2.95% in from $23.73 to $24.43 at 18:22 EST on Wednesday, after five successive sessions in a row of gains. NYSE is rising 0.9% to $15,749.09, following the last session’s upward trend.

Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia Tbk provides telecommunications, informatics, and network services worldwide. Its Mobile segment provides mobile voice, SMS and mobile broadband services. The company also offers digital services including digital financial services and video on demand. The company’s Consumer segment offers fixed voice, broadband and IPTV services. Enterprise services include ICT and digital platform. This includes satellite, ICT services, cloud and data center services and outsourcing services. CPE trading, managed, cyber security and financial services are also available. The company’s Wholesale and International Business segments offer wholesale voice, managed SMS, A2P SMS and IP transit and connectivity. They also provide security, value added and digital service, as well as mobile network operator and mobile virtual network operator services. Other services include digital platforms, digital content and ecommerce. They also offer property management and other digital services. It also offers building management and maintenance, payment, business consulting and capital venture services, as well as health insurance administration and tourism. The company acts both as a developer and civil consultant. Leases offices are available. It had 9.1 million subscribers to fixed wirelines, which included 8.0 million broadband subscribers. 169.5 million subscribers were cellular, with 115.9 millions mobile broadband subscribers. It was established in Bandung in Indonesia in 1884.

Yearly Top and Bottom Value

PT Telekomunikasi’s stock is valued at $24.43 at 18:23 EST, under its 52-week low of $25.00.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

PT Telekomunikasi’s stock is considered to be oversold (<=20).

More news about PT Telekomunikasi.

18. MarketAxess Holdings (MKTX)

Shares of MarketAxess Holdings rose by a staggering 10.79% in from $289.57 to $320.82 at 18:22 EST on Wednesday, after five successive sessions in a row of gains. NASDAQ is rising 1.76% to $10,931.67, after three successive sessions in a row of gains.

MarketAxess Holdings Inc., together with its subsidiaries, operates an electronic trading platform for institutional investor and broker-dealer companies worldwide. It offers the access to liquidity in the U.S. investment-grade bonds, U.S. high-yield bonds, and U.S. Treasuries, as well as municipal bonds, emerging market debts, Eurobonds, and other fixed income securities. The company, through its Open Trading protocols, executes bond trades between and among institutional investor and broker-dealer clients in an all-to-all anonymous trading environment for corporate bonds. It also offers trading-related products and services, including composite+ pricing and other market data products to assist clients with trading decisions; auto-execution and other execution services for clients requiring specialized workflow solutions; connectivity solutions that facilitate straight-through processing; and technology services to optimize trading environments. In addition, the company provides various pre-and post-trade services, such as trade matching, trade publication, regulatory transaction reporting, and market and reference data across a range of fixed-income and other products. MarketAxess Holdings Inc. was incorporated in 2000 and is headquartered in New York, New York.

Sales Growth

MarketAxess Holdings saw a 7.3% increase in sales for its current quarter, and an 8.6% rise for the following.

Annual Top and Bottom Value

MarketAxess Holdings is currently valued at $320.82 (at 18:23 EST), which is way below its 52 week high of $390.13, and far above its 52 week low of $217.44.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

MarketAxess Holdings’s stock is considered to be oversold (<=20).

More news about MarketAxess Holdings.

19. Oracle (ORCL)

Shares of Oracle jumped by a staggering 10.05% in from $80.38 to $88.46 at 18:22 EST on Wednesday, after five successive sessions in a row of gains. NYSE is rising 0.9% to $15,749.09, following the last session’s upward trend.

Oracle Corporation offers products and services that address enterprise information technology environments worldwide. Its Oracle cloud software as a service offering include various cloud software applications, including Oracle Fusion cloud enterprise resource planning (ERP), Oracle Fusion cloud enterprise performance management, Oracle Fusion cloud supply chain and manufacturing management, Oracle Fusion cloud human capital management, Oracle Advertising, and NetSuite applications suite, as well as Oracle Fusion Sales, Service, and Marketing. The company also offers cloud-based industry solutions for various industries; Oracle application licenses; and Oracle license support services. In addition, it provides cloud and license business' infrastructure technologies, such as the Oracle Database, an enterprise database; Java, a software development language; and middleware, including development tools and others. The company's cloud and license business' infrastructure technologies also comprise cloud-based compute, storage, and networking capabilities; and Oracle autonomous database, MySQL HeatWave, Internet-of-Things, digital assistant, and blockchain. Further, it provides hardware products and other hardware-related software offerings, including Oracle engineered systems, enterprise servers, storage solutions, industry-specific hardware, virtualization software, operating systems, management software, and related hardware services; and consulting and customer services. The company markets and sells its cloud, license, hardware, support, and services offerings directly to businesses in various industries, government agencies, and educational institutions, as well as through indirect channels. Oracle Corporation was founded in 1977 and is headquartered in Austin, Texas.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Oracle’s stock is considered to be oversold (<=20).

Annual Top and Bottom Value

Oracle stock’s value is $88.46 as of 18:23 EST. This price is below its 52 week high of $89.52, and much higher than its low 52 week of $60.78.

Revenue Growth

Year-on-year quarterly revenue growth grew by 17.6%, now sitting on 44.16B for the twelve trailing months.

More news about Oracle.

20. Southern Copper (SCCO)

Shares of Southern Copper jumped by a staggering 19.41% in from $61.32 to $73.22 at 18:22 EST on Wednesday, after five sequential sessions in a row of gains. NYSE is jumping 0.9% to $15,749.09, following the last session’s upward trend.

Southern Copper Corporation is involved in the mining, exploration, smelting and refining of copper and other minerals in Peru and Chile. It is engaged in mining, processing, and flotation copper ore. The company operates two open-pit mines: Cuajone and Toquepala, in Peru. It also has a refinery and a refinery in Peru. La Caridad is an open-pit copper mine. Buenavista is an open-pit copper mining operation. It also owns two copper concentrators in Mexico and two SX-EW plant. It also owns five underground mines producing zinc, lead and copper; coke and coal mines; and a zinc refining plant. It holds interests in exploration concessions covering 82,134 ha in Peru, 493,533 ha in Mexico, 246,346 ha in Argentina, 298,888 ha in Chile, and 7,299 ha in Ecuador. Southern Copper Corporation was founded in 1952. It is located in Phoenix, Arizona. Southern Copper Corporation is a subsidiary to Americas Mining Corporation.

Moving Average

Southern Copper’s current value is much higher than its $50-day average moving average $58.28, and far more than its $200-day average moving average $55.89.

Growth Estimates Quarters

For the current quarter, the company expects a decline of 46.4% in growth and for the next quarter, a decrease of 26.9% respectively.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Southern Copper stock considered oversold (=20).

Annual Top and Bottom Value

At 18:23 EST Southern Copper stock was valued at $73.22, which is below the 52-week high $79.32, and well above its 52 week low $42.42.

More news about Southern Copper.

21. Toll Brothers (TOL)

Shares of Toll Brothers jumped 9.3% in from $50.74 to $55.46 at 18:22 EST on Wednesday, after five consecutive sessions in a row of gains. NYSE is jumping 0.9% to $15,749.09, following the last session’s upward trend.

Toll Brothers, Inc., together with its subsidiaries, designs, builds, markets, sells, and arranges finance for a range of detached and attached homes in luxury residential communities in the United States. The company operates in two segments, Traditional Home Building and City Living. It also designs, builds, markets, and sells condominiums through Toll Brothers City Living. In addition, the company develops, owns, and operates golf courses and country clubs; develops and sells land; and develops, operates, and rents apartments, as well as provides various interior fit-out options, such as flooring, wall tile, plumbing, cabinets, fixtures, appliances, lighting, and home-automation and security technologies. Further, it owns and operates architectural, engineering, mortgage, title, insurance, smart home technology, landscaping, lumber distribution, house component assembly, and manufacturing operations. The company serves move-up, empty-nester, active-adult, and second-home buyers. It has a strategic partnership with Equity Residential to develop new rental apartment communities in the United States markets. The company was founded in 1967 and is headquartered in Fort Washington, Pennsylvania.

More news about Toll Brothers.

22. Cisco (CSCO)

Shares of Cisco fell 1.78% in from $49.64 to $48.76 at 18:22 EST on Wednesday, after three sequential sessions in a row of gains. NASDAQ is jumping 1.76% to $10,931.67, after three consecutive sessions in a row of gains.

Cisco Systems, Inc. designs, manufactures, and sells Internet Protocol based networking and other products related to the communications and information technology industry in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and China. The company also offers switching portfolio encompasses campus switching as well as data center switching; enterprise routing portfolio interconnects public and private wireline and mobile networks, delivering highly secure, and reliable connectivity to campus, data center and branch networks; wireless products include wireless access points that are standalone, controller appliance-based, switch-converged, and Meraki cloud-managed offerings; and compute portfolio including the cisco unified computing system, hyperflex, and software management capabilities, which combine computing, networking, and storage infrastructure management and virtualization. In addition, it provides Internet for the future product consists of routed optical networking, 5G, silicon, and optics solutions; collaboration products, such as meetings, collaboration devices, calling, contact center, and communication platform as a service; end-to-end security product consists of network security, cloud security, security endpoints, unified threat management, and zero trust; and optimized application experiences products including full stack observability and cloud-native platform. Further, the company offers a range of service and support options for its customers, including technical support and advanced services and advisory services. It serves businesses of various sizes, public institutions, governments, and service providers. The company sells its products and services directly, as well as through systems integrators, service providers, other resellers, and distributors. Cisco Systems, Inc. has strategic alliances with other companies. Cisco Systems, Inc. was incorporated in 1984 and is headquartered in San Jose, California.

Annual Top and Bottom Value

Cisco stock was valued at $48.76 as of 18:24 EST. This is way below its 52 week high of $62.82 but well above its low 52-week of $38.60.

Volatility

Cisco’s intraday variation average for the last week, month, and quarter was 0.34%.

Cisco had the highest average volatility amplitude, at 1.47% last week, 0.93% last month and 1.17% in its quarter.

Growth Estimates Quarters

For the current quarter, the company expects to grow by 1.2% and 2.3% respectively.

More news about Cisco.

23. Illumina (ILMN)

Shares of Illumina dropped 8.46% in from $212.41 to $194.44 at 18:22 EST on Wednesday, following the last session’s downward trend. NASDAQ is jumping 1.76% to $10,931.67, after three consecutive sessions in a row of gains.

Illumina, Inc. provides sequencing and array-based solutions for genetic and genomic analysis. Its products and services serve customers in a range of markets enabling the adoption of genomic solutions in research and clinical settings for applications in the life sciences, oncology, reproductive health, agriculture, and other emerging segments. The company provides instruments and consumables used in genetic analysis; and genotyping and sequencing services, instrument service contracts, and development and licensing agreements, as well as cancer detection testing services. Its customers include genomic research centers, academic institutions, government laboratories, and hospitals, as well as pharmaceutical, biotechnology, commercial molecular diagnostic laboratories, and consumer genomics companies. The company markets and distributes its products directly to customers in North America, Europe, Latin America, and the Asia-Pacific region, as well as sells through life-science distributors in various markets within Europe, the Asia-Pacific region, Latin America, the Middle East, and Africa. The company was incorporated in 1998 and is based in San Diego, California.

Sales Growth

Illumina saw a 0.3% increase in sales for its current quarter, and 0.7% the following.

Volatility

Illumina’s intraday variation average for the week and quarter ended last week at 0.80%. 0.05% and 2.16% respectively.

Illumina had the highest average volatility amplitudes of 1.16%, 1.70% and 2.16% in the last week.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Illumina’s stock has been overbought by more than 80.

More news about Illumina.

24. Trimble (TRMB)

Shares of Trimble slid 5.26% in from $55.14 to $52.24 at 18:22 EST on Wednesday, after three consecutive sessions in a row of gains. NASDAQ is rising 1.76% to $10,931.67, after three successive sessions in a row of gains.

Trimble Inc. offers technology solutions to professionals and mobile workers worldwide that enhance or transform work processes. Trimble Inc.’s Buildings and Infrastructure Segment offers software that can be used to design and guide construction vehicles; 3D modeling and software to collaborate on projects; programs to track and monitor workers, assets and employees; and software to communicate and share data. It also provides software solutions to program managers. The Geospatial segment offers surveying, geospatial products and geographical information systems. Resources and Utilities offers precise agriculture products and services. These include guidance and positioning system, which includes autonomous steering systems and variable rate application and technology systems. Information management solutions, manual and automatic navigation for tractors and farm equipment, solutions to automate pesticide and seeding application, water solutions, and software. The company’s Transportation segment provides solutions for long-haul trucking, freight shipper markets, mobility solutions including route management, safety, compliance, supply chain management, video intelligence and supply chain communication; fleet and transportation management system, fleet management, logistics, routing, maps, reporting and predictive modeling. Trimble Navigation Limited was the company’s former name. In October 2016, Trimble Inc. became Trimble Inc. Trimble Inc. was established in 1978. It is located in Westminster Colorado.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Trimble stock considered oversold (=20).

Volatility

Trimble’s intraday variation average for the week and quarter ended last week was positive at 0.47% and negative at 0.63% respectively. The last quarter’s end saw a positive of 2.34%.

Trimble had the highest average volatility amplitudes of 1.15%, 1.95% and 2.34% in last week.

More news about Trimble.

25. PennyMac (PFSI)

Shares of PennyMac rose 5.92% in from $58.98 to $62.47 at 18:22 EST on Wednesday, after five consecutive sessions in a row of gains. NYSE is rising 0.9% to $15,749.09, following the last session’s upward trend.

PennyMac Financial Services, Inc., through its subsidiaries, engages in the mortgage banking and investment management activities in the United States. It operates through three segments: Production, Servicing, and Investment Management. The Production segment is involved in the origination, acquisition, and sale of loans. It sources first-lien residential conventional and government-insured or guaranteed mortgage loans. The Servicing segment engages in the servicing of newly originated loans, and execution and management of early buyout transactions and servicing of loans. It performs loan administration, collection, and default management activities, including the collection and remittance of loan payments, response to customer inquiries, accounting for principal and interest, holding custodial funds for the payment of property taxes and insurance premiums, counseling delinquent borrowers, and supervising foreclosures and property dispositions, as well as administers loss mitigation activities, such as modification and forbearance programs. The Investment Management segment is involved in sourcing, performing diligence, bidding, and closing investment asset acquisitions; managing correspondent production activities for PennyMac Mortgage Investment Trust; and managing acquired assets. PennyMac Financial Services, Inc. was founded in 2008 and is headquartered in Westlake Village, California.

Volatility

PennyMac’s last week, last month’s, and last quarter’s current intraday variation average was 0.89%, 0.02%, and 2.17%.

PennyMac’s highest amplitude of average volatility was 0.98% (last week), 1.60% (last month), and 2.17% (last quarter).

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

PennyMac’s stock is considered to be oversold (<=20).

More news about PennyMac.

26. Flex (FLEX)

Shares of Flex fell 0.13% in from $23.15 to $23.12 at 18:22 EST on Wednesday, following the last session’s downward trend. NASDAQ is rising 1.76% to $10,931.67, after three successive sessions in a row of gains.

Flex Ltd. provides design, engineering, manufacturing, and supply chain services and solutions to original equipment manufacturers in Asia, the Americas, and Europe. It operates through three segments: Flex Agility Solutions (FAS), Flex Reliability Solutions (FRS), and Nextracker. The company provides cross-industry technologies, including human-machine interface, internet of things platforms, power, sensor fusion, and smart audio. It also offers integrated solar tracker and software solutions used in utility-scale and ground-mounted distributed generation solar projects. In addition, the company provides value-added design and engineering services; and systems assembly and manufacturing services that include enclosures, testing services, and materials procurement and inventory management services. Further, it offers chargers for smartphones and tablets; adapters for notebooks and gaming systems; power supplies for the server, storage, and networking markets; and power solutions, such as switchgear, busway, power distribution, modular power systems, and monitoring solutions and services. Additionally, the company provides after-market and forward supply chain logistics services to computing, consumer digital, infrastructure, industrial, mobile, automotive, and medical industries; and reverse logistics and repair solutions, including returns management, exchange programs, complex repair, asset recovery, recycling, and e-waste management. It serves to cloud, communications, enterprise, automotive, industrial, consumer devices, lifestyle, healthcare, and energy industries. The company was formerly known as Flextronics International Ltd. and changed its name to Flex Ltd. in September 2016. Flex Ltd. was incorporated in 1990 and is based in Singapore.

More news about Flex.

27. Logitech (LOGI)

Shares of Logitech jumped 7.01% in from $62.77 to $67.17 at 18:22 EST on Wednesday, after five consecutive sessions in a row of gains. NASDAQ is jumping 1.76% to $10,931.67, after three successive sessions in a row of gains.

Logitech International S.A. designs, produces, and markets products worldwide that enable people to connect with digital and cloud services through its subsidiaries. It offers wireless pointing devices such as a corded or cordless mouse, corded keyboards and living room keyboards as well as keyboards and accessories for smartphones and tablets. The company also offers keyboards, mice and headsets as well as simulation products such as flight sticks and steering wheels for gamers and video conferencing products such as ConferenceCams. ConferenceCams combines enterprise-quality audio with high-definition videos to provide video conferencing for businesses of all sizes; headsets and webcams that transform desktops into collaborative spaces; and controllers for video conference room solutions. The company also offers wireless Bluetooth speakers and Wi-Fi speakers as well as mobile and in-ear Bluetooth headphones and microphones. It can also provide home entertainment controllers and security cameras. The company’s channel network includes retailers, online sellers, mass merchants, wholesalers and retail outlets. Logitech G and ASTRO Gaming are the brands used by this company. Logitech International S.A. is located in Lausanne in Switzerland and was founded in 1981.

Volatility

Logitech’s last week, last month’s, and last quarter’s current intraday variation average was 1.48%, 0.53%, and 2.03%.

Logitech’s highest amplitude of average volatility was 1.48% (last week), 1.66% (last month), and 2.03% (last quarter).

Annual Top and Bottom Value

At 18:24 EST Logitech stock was valued at $67.17, which is way lower than the 52-week high at $86.26 but much higher than its 52 week low at $41.81.

More news about Logitech.

28. Randgold (GOLD)

Shares of Randgold jumped by a staggering 11.29% in from $17.45 to $19.42 at 18:22 EST on Wednesday, following the last session’s upward trend. NASDAQ is rising 1.76% to $10,931.67, after three consecutive sessions in a row of gains.

Barrick Gold Corporation is involved in exploration, mining development, production and sales of copper and gold properties. The company owns interests in the production of gold mines in Argentina, Canada and Cote d’Ivoire. It also owns copper mines in Chile, Saudi Arabia and Zambia. There are many other projects throughout Africa and the Americas. Barrick Gold Corporation was established in 1983 in Toronto, Canada.

Growth Estimates Quarters

The company’s growth estimates for the ongoing quarter and the next is a negative 24.4% and a negative 5.7%, respectively.

Moving Average

Randgold’s market value has risen to $16.39 per day, and $18.02 per day for 200 days.

Revenue Growth

Year-on-year quarterly revenue growth declined by 1.2%, now sitting on 11.85B for the twelve trailing months.

More news about Randgold.

29. U.S. Bancorp (USB)

Shares of U.S. Bancorp rose 5.38% in from $44.22 to $46.60 at 18:22 EST on Wednesday, after five consecutive sessions in a row of gains. NYSE is rising 0.9% to $15,749.09, following the last session’s upward trend.

U.S. Bancorp, a financial services holding company, provides various financial services to individuals, businesses, institutional organizations, governmental entities and other financial institutions in the United States. It operates in Corporate and Commercial Banking, Consumer and Business Banking, Wealth Management and Investment Services, Payment Services, and Treasury and Corporate Support segments. The company offers depository services, including checking accounts, savings accounts, and time certificate contracts; lending services, such as traditional credit products; and credit card services, lease financing and import/export trade, asset-backed lending, agricultural finance, and other products. It also provides ancillary services comprising capital markets, treasury management, and receivable lock-box collection services to corporate and governmental entity customers; and a range of asset management and fiduciary services for individuals, estates, foundations, business corporations, and charitable organizations. In addition, the company offers investment and insurance products to its customers principally within its markets, as well as fund administration services to a range of mutual and other funds. Further, it provides corporate and purchasing card, and corporate trust services; and merchant processing services, as well as investment management, ATM processing, mortgage banking, insurance, and brokerage and leasing services. As of December 31, 2021, the company provided its products and services through a network of 2,230 banking offices principally operating in the Midwest and West regions of the United States, as well as through on-line services, over mobile devices, and other distribution channels; and operated a network of 4,059 ATMs. The company was founded in 1863 and is headquartered in Minneapolis, Minnesota.

Volatility

U.S. Bancorp last week’s and last month’s intraday variations averages were 1.52%, 0.4%, and 1.45%, respectively.

U.S. Bancorp had the highest average volatility amplitude at 1.92% last week, 1.17% last month and 1.45% in the quarter.

Sales Growth

U.S. Bancorp has experienced a 6.9% increase in sales for the current quarter, and a 20.5% growth for the next.

More news about U.S. Bancorp.

30. Salesforce (CRM)

Shares of Salesforce jumped 6.85% in from $135.55 to $144.84 at 18:22 EST on Wednesday, after three successive sessions in a row of gains. NYSE is jumping 0.9% to $15,749.09, following the last session’s upward trend.

Salesforce, Inc. offers customer relationship management technology to connect customers and companies worldwide. The company’s Customer 360 platform enables customers to collaborate to create connected experiences for customers. Its services include sales to track leads, progress and forecast, get insights through analytics, relationship intelligence and delivery of quotes, contracts and invoices. Service allows companies to provide trusted, highly personal customer support and service at scale. The company’s services include a flexible platform which allows companies from different industries, sizes and locations to create business apps that bring them closer with drag-and drop tools, an online learning platform that allows anybody to master Salesforce skills, and Slack, which is a platform for engagement. The company also offers a Marketing offering which allows companies to personalize and optimize customer marketing campaigns; and a Commerce offering which empowers brands and allows them to create unified customer experiences across all channels, including mobile, online, and social. It also offers Tableau, which is an enterprise-level analytics platform that can be used for a variety of use cases, and MuleSoft, which allows customers to integrate data from across the enterprise. It offers its services to customers across a range of industries, including manufacturing, financial services and healthcare. The company also provides professional services and offers in-person as well as online training to its partners and customers on designing, managing, deploying and maintaining its service offerings. It offers its services via direct sales, as well as through consulting firms and systems integrators. Salesforce, Inc. was founded in 1999. It is located in San Francisco, California.

Revenue Growth

Year-on-year quarterly revenue growth grew by 21.8%, now sitting on 29.32B for the twelve trailing months.

Volatility

Last week Salesforce’s intraday variation averages were 1.48%, 0.399% and 2.33% respectively.

The highest Salesforce amplitudes of average volatility were 2.67% (last Wednesday), 1.62%(last month), and 2.33 (last quarter).

More news about Salesforce.

31. Catalyst Pharmaceuticals (CPRX)

Shares of Catalyst Pharmaceuticals jumped by a staggering 10.32% in from $17.83 to $19.67 at 18:22 EST on Wednesday, following the last session’s upward trend. NASDAQ is rising 1.76% to $10,931.67, after three sequential sessions in a row of gains.

Catalyst Pharmaceuticals, Inc. is a biopharmaceutical firm at the commercial stage. It specializes in developing and marketing therapies for patients with neurological, debilitating, or chronic neuromuscular diseases. Firdapse is an amifampridine-phosphate tablet for patients suffering from lambert–eaton syndrome (LEMS) and Ruzurgi to treat pediatric LEMS patients. Firdapse is also developed by the company to treat MuSK antibody positive myasthenia Gravis and spinal muscular atrophy Type 3. It can also be used to treat hereditary nervepathy with liability for pressure palsies. Endo Ventures Limited and BioMarin Pharmaceutical Inc. have license agreements. Endo Ventures Limited has a collaboration agreement for the commercialization and development of generic Sabril tablets. Catalyst Pharmaceutical Partners, Inc. was the company’s former name. It changed its name in May 2015 to Catalyst Pharmaceuticals, Inc. Catalyst Pharmaceuticals, Inc., was established in 2002. It is located in Coral Gables, Florida.

Revenue growth

The year-on-year revenue growth was 46.1%. It now stands at 170.46M in the 12 trailing months.

Sales Growth

Catalyst Pharmaceuticals’s sales growth is 48.4% for the present quarter and 101.2% for the next.

Annual Top and Bottom Value

Catalyst Pharmaceuticals stock was valued at $19.67 as of 18:25 EST. This is below its 52 week high of $20.51, and much higher than its 52 week low of $5.24.

More news about Catalyst Pharmaceuticals.

32. PNC Financial Services Group (PNC)

Shares of PNC Financial Services Group jumped 6.89% in from $154.39 to $165.03 at 18:22 EST on Wednesday, after five consecutive sessions in a row of gains. NYSE is rising 0.9% to $15,749.09, following the last session’s upward trend.

PNC Financial Group, Inc. is a United States-based financial services firm. Retail Banking offers savings and checking accounts as well as money market and certificates of deposit. It also provides residential mortgages and home equity loans as well as lines of credit and auto loans. Credit cards are available for education, personal loans, small-business loans and credit lines. The segment also includes brokerage and insurance services, investment management and cash management. The segment provides small- and large-business customers with a variety of banking services, including ATMs, call centres, online and mobile banking, as well as a network that includes branches and ATMs. The Corporate & Institutional Banking segment offers secured and unsecured loans as well as letters of credit and equipment leasing. It also provides cash management, receivables management, money transfer services and international payment services. Access to online/mobile information and reporting is available. This segment serves large and mid-sized corporations as well as government and non-profit organizations. Asset Management Group, a segment of the company, offers customized investment management, cash and credit management solutions and trust management. It also provides administration and trust services to high-net worth people and their families. Multi-generational family planning is available for ultra wealthy individuals and their families. The company also offers outsourced chief investor, custody, fixed income, cash, and fixed-income client solutions and fiduciary retirement advisory service for institutions. There are 2,591 branches of the company and 9502 ATMs. It was established in 1852 in Pittsburgh, Pennsylvania.

More news about PNC Financial Services Group.

33. Lyft (LYFT)

Shares of Lyft rose by a staggering 14.86% in from $11.64 to $13.37 at 18:22 EST on Wednesday, after four successive sessions in a row of gains. NASDAQ is jumping 1.76% to $10,931.67, after three successive sessions in a row of gains.

Lyft, Inc. operates a peer-to-peer marketplace for on-demand ridesharing in the United States and Canada. The company operates multimodal transportation networks that offer riders personalized and on-demand access to various mobility options. It provides Ridesharing Marketplace, which connects drivers with riders; Express Drive, a flexible car rentals program for drivers; Lyft Rentals that provides vehicles for long-distance trips; and a network of shared bikes and scooters in various cities to address the needs of riders for short trips. The company also integrates third-party public transit data into the Lyft app to offer riders various transportation options. In addition, it offers access to autonomous vehicles; centralized tools and enterprise transportation solutions, such as concierge transportation solutions for organizations; Lyft Pink subscription plans; Lyft Pass commuter programs; first-mile and last-mile services; and university safe rides programs. The company was formerly known as Zimride, Inc. and changed its name to Lyft, Inc. in April 2013. Lyft, Inc. was incorporated in 2007 and is headquartered in San Francisco, California.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Lyft’s stock is considered to be oversold (<=20).

More news about Lyft.

34. NRG Energy (NRG)

Shares of NRG Energy fell 3.7% in from $33.39 to $32.15 at 18:22 EST on Wednesday, after five consecutive sessions in a row of gains. NYSE is jumping 0.9% to $15,749.09, following the last session’s upward trend.

NRG Energy, Inc., together with its subsidiaries, operates as an integrated power company in the United States. It operates through Texas, East, and West. The company is involved in the producing, selling, and delivering electricity and related products and services to approximately 6 million residential, commercial, industrial, and wholesale customers. It generates electricity using natural gas, coal, oil, solar, nuclear, and battery storage. The company also provides system power, distributed generation, renewable products, backup generation, storage and distributed solar, demand response, and energy efficiency, and advisory services, as well as carbon management and specialty services; and on-site energy solutions. In addition, it trades in electric power, natural gas, and related commodities; environmental products; weather products; and financial products, including forwards, futures, options, and swaps. Further, the company procures fuels; provides transportation services; and directly sells energy, services, and products and services to retail customers under the NRG, Reliant, Direct Energy, Green Mountain Energy, Stream, and XOOM Energy. As of December 31, 2021, it owns and leases power generation portfolio with approximately 18,000 megawatts of capacity at 25 plants. NRG Energy, Inc. was founded in 1989 and is headquartered in Houston, Texas.

Sales Growth

NRG Energy saw sales growth of 19.4% in the current quarter, and negative 14.4% the following.

More news about NRG Energy.

35. Walt Disney (DIS)

Shares of Walt Disney jumped 1.49% in from $94.77 to $96.18 at 18:22 EST on Wednesday, after three successive sessions in a row of gains. NYSE is jumping 0.9% to $15,749.09, following the last session’s upward trend.

The Walt Disney Company, together with its subsidiaries, operates as an entertainment company worldwide. It operates through two segments, Disney Media and Entertainment Distribution; and Disney Parks, Experiences and Products. The company engages in the film and episodic television content production and distribution activities, as well as operates television broadcast networks under the ABC, Disney, ESPN, Freeform, FX, Fox, National Geographic, and Star brands; and studios that produces motion pictures under the Walt Disney Pictures, Twentieth Century Studios, Marvel, Lucasfilm, Pixar, and Searchlight Pictures banners. It also offers direct-to-consumer streaming services through Disney+, Disney+ Hotstar, ESPN+, Hulu, and Star+; sale/licensing of film and television content to third-party television and subscription video-on-demand services; theatrical, home entertainment, and music distribution services; staging and licensing of live entertainment events; and post-production services by Industrial Light & Magic and Skywalker Sound. In addition, the company operates theme parks and resorts, such as Walt Disney World Resort in Florida; Disneyland Resort in California; Disneyland Paris; Hong Kong Disneyland Resort; and Shanghai Disney Resort; Disney Cruise Line, Disney Vacation Club, National Geographic Expeditions, and Adventures by Disney as well as Aulani, a Disney resort and spa in Hawaii; licenses its intellectual property to a third party for the operations of the Tokyo Disney Resort; and provides consumer products, which include licensing of trade names, characters, visual, literary, and other IP for use on merchandise, published materials, and games. Further, it sells branded merchandise through retail, online, and wholesale businesses; and develops and publishes books, comic books, and magazines. The Walt Disney Company was founded in 1923 and is based in Burbank, California.

Revenue Growth

Year-on-year quarterly revenue growth grew by 26.3%, now sitting on 81.11B for the twelve trailing months.

Volatility

Walt Disney’s last week, last month’s, and last quarter’s current intraday variation average was 1.98%, 0.03%, and 1.97%.

Walt Disney’s highest amplitude of average volatility was 2.01% (last week), 1.74% (last month), and 1.97% (last quarter).

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Walt Disney’s stock is considered to be oversold (<=20).

More news about Walt Disney.

36. ONE Gas (OGS)

Shares of ONE Gas jumped 2.96% in from $78.61 to $80.94 at 18:22 EST on Wednesday, after two consecutive sessions in a row of gains. NYSE is rising 0.9% to $15,749.09, following the last session’s upward trend.

ONE Gas, Inc., along with its subsidiaries, is a regulated natural-gas distribution utility company in America. It operates in three segments: Oklahoma Natural Gas and Kansas Gas Service. Texas Gas Service is its other division. The company provides natural gas distribution services for 2.2 million customers across three states. The company serves both residential and commercial customers as well as transportation clients. It had approximately 41,600 mile of distribution mains and 2400 miles transmission pipelines. In addition, 51.4 billion cubic feet natural gas storage capacity. ONE Gas, Inc. was established in 1906. It is based in Tulsa, Oklahoma.

Growth Estimates Quarters

The company’s growth estimates for the current quarter and the next is 13.2% and 9.8%, respectively.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

ONE Gas stock considered oversold (=20).

More news about ONE Gas.

37. CDW Corporation (CDW)

Shares of CDW Corporation dropped 4.03% in from $194.08 to $186.26 at 18:22 EST on Wednesday, after three sequential sessions in a row of gains. NASDAQ is jumping 1.76% to $10,931.67, after three sequential sessions in a row of gains.

CDW Corporation provides information technology (IT) solutions in the United States, the United Kingdom, and Canada. It operates through three segments: Corporate, Small Business, and Public. The company offers discrete hardware and software products and services, as well as integrated IT solutions, including on-premise, hybrid, and cloud capabilities across data center and networking, digital workspace, and security. Its hardware products comprise notebooks/mobile devices, network communications, desktop computers, video monitors, enterprise and data storage, and others; and software products consists of application suites, security, virtualization, operating systems, and network management. The company also provides advisory and design, software development, implementation, managed, professional, configuration, and telecom services, as well as warranties; mission critical software, systems, and network solutions; and implementation and installation, and repair services to its customers through various third-party service providers. It serves government, education, and healthcare customers; and small, medium, and large business customers. The company was founded in 1984 and is headquartered in Vernon Hills, Illinois.

Annual Top and Bottom Value

CDW Corporation stock was valued at $186.26, 18:25 EST. This is below its 52 week high of $202.78 but well above its low 52-week of $147.91.

Growth Estimates Quarters

For the current quarter, the company expects to grow by 19.7% and 8.2% respectively.

More news about CDW Corporation.

38. Internationa Flavors & Fragrances (IFF)

Shares of Internationa Flavors & Fragrances jumped 6.83% in from $107.2 to $114.52 at 18:22 EST on Wednesday, after three consecutive sessions in a row of gains. NYSE is rising 0.9% to $15,749.09, following the last session’s upward trend.