(VIANEWS) – Today, the Innrs artificial intelligence algorithm suggests a high probability of discovering the approximate price for tomorrow of Merck MRK, Orix Corp IX and others.

Via News will regularly fact-check this AI algorithm that aims to consistently predict the next session price and next week’s trend of financial assets.

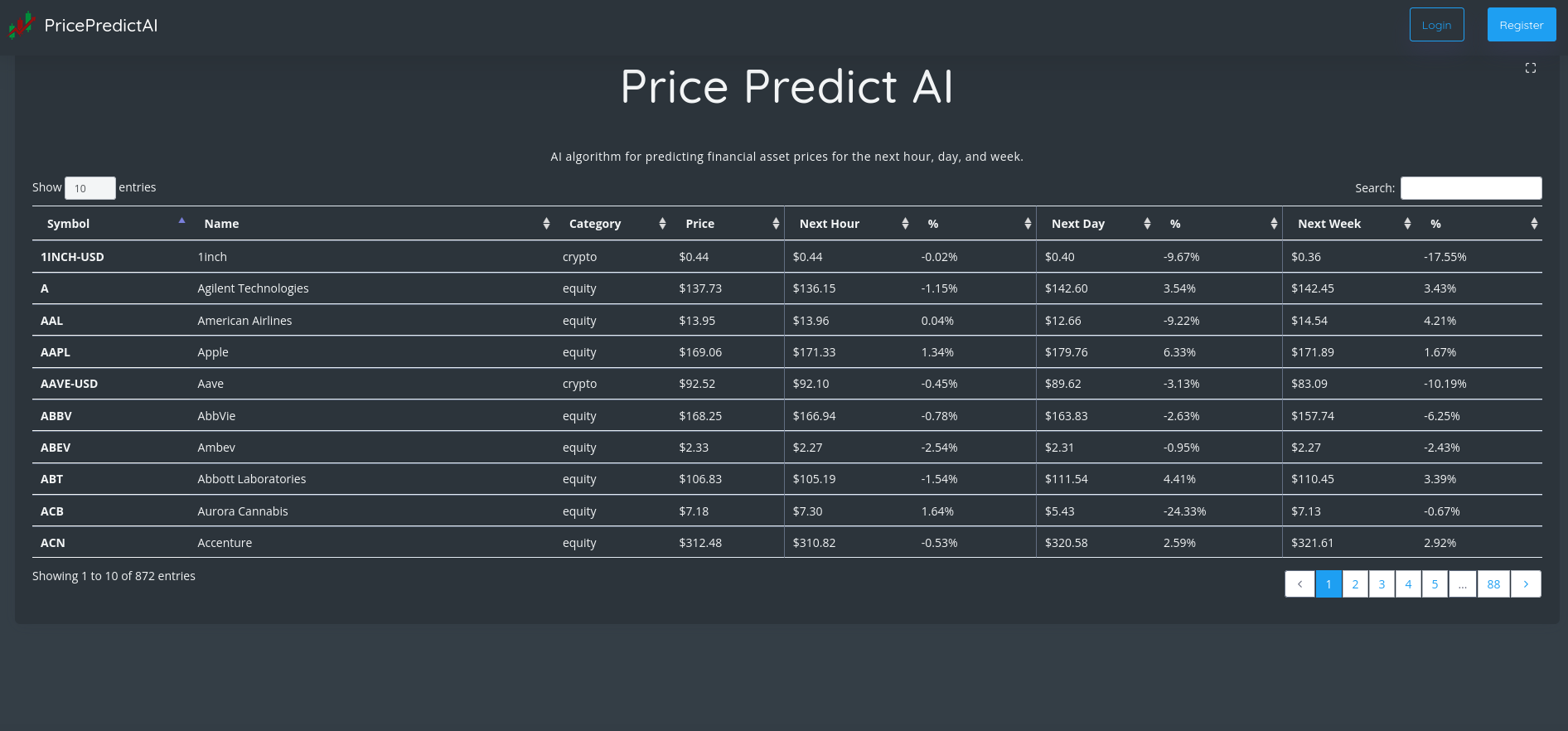

Innrs provides A.I.-based statistical tools to help investors make decisions. The table below shows the financial assets predicting price, ordered by the highest expected accuracy.

Innrs officials say this tool helps investors make better-informed decisions, supposedly used alongside other relevant financial information and the specific trader strategy.

In the next session, Via News will report the finding on the algorithm precision.

| Financial Asset | Accuracy | Close Price | Prediction |

|---|---|---|---|

| Merck (MRK) | 98.43% | $109.82 | ⇧ $112.28 |

| Orix Corp (IX) | 94.06% | $80.13 | ⇧ $80.78 |

| Astrazeneca (AZN) | 93.94% | $68.45 | ⇧ $68.52 |

| Laboratory Corporation of America Holdings (LH) | 93.76% | $240.9 | ⇧ $246.26 |

| Royal Caribbean Cruises (RCL) | 93.74% | $60.46 | ⇧ $61.34 |

| Coca-Cola (KO) | 93.66% | $64.39 | ⇧ $65.13 |

| Church & Dwight Company (CHD) | 93.29% | $83.12 | ⇧ $85.33 |

| Exelon (EXC) | 93.24% | $41.37 | ⇧ $42.42 |

| Bristol (BMY) | 93.19% | $80.86 | ⇧ $83.18 |

| White Mountains Insurance Group (WTM) | 93.17% | $1372 | ⇧ $1418.88 |

| SPS Commerce (SPSC) | 93.01% | $145.4 | ⇧ $146.71 |

| Eli Lilly and Company (LLY) | 89.32% | $374.64 | ⇧ $377.9 |

| Kellogg Company (K) | 89.28% | $73.72 | ⇧ $74.99 |

| Goldman Sachs Group (GS) | 89.16% | $379.77 | ⇧ $384.26 |

| General Motors (GM) | 89.15% | $39.9 | ⇧ $40.1 |

| Regeneron Pharmaceuticals (REGN) | 89.05% | $766.88 | ⇧ $771.61 |

| Rogers Communication (RCI) | 88.92% | $46.24 | ⇧ $47.4 |

| Ventas (VTR) | 88.75% | $46.24 | ⇧ $46.61 |

| General Mills (GIS) | 88.75% | $86.4 | ⇧ $88.26 |

| Gilead Sciences (GILD) | 88.56% | $89.05 | ⇧ $90.71 |

| Genmab (GMAB) | 88.56% | $47.08 | ⇧ $47.1 |

| Accenture (ACN) | 88.56% | $299.71 | ⇧ $310.21 |

| Ross Stores (ROST) | 88.54% | $118.86 | ⇧ $121.34 |

| Internationa Flavors & Fragrances (IFF) | 88.53% | $108 | ⇧ $109.36 |

| Ares Capital (ARCC) | 88.51% | $19.41 | ⇧ $19.74 |

| Live Nation Entertainment (LYV) | 88.5% | $73.96 | ⇧ $75.34 |

| Johnson & Johnson (JNJ) | 88.42% | $178.94 | ⇧ $182.32 |

| Booking Holdings (BKNG) | 88.37% | $2088.36 | ⇧ $2123.21 |

1. Merck (MRK)

Shares of Merck jumped by a staggering 11.2% in from $98.76 to $109.82 at 18:21 EST on Friday, following the last session’s downward trend. NYSE is jumping 0.04% to $15,767.02, following the last session’s downward trend.

Merck & Co., Inc. operates as a healthcare company worldwide. It operates through two segments, Pharmaceutical and Animal Health. The Pharmaceutical segment offers human health pharmaceutical products in the areas of oncology, hospital acute care, immunology, neuroscience, virology, cardiovascular, and diabetes, as well as vaccine products, such as preventive pediatric, adolescent, and adult vaccines. The Animal Health segment discovers, develops, manufactures, and markets veterinary pharmaceuticals, vaccines, and health management solutions and services, as well as digitally connected identification, traceability, and monitoring products. It serves drug wholesalers and retailers, hospitals, and government agencies; managed health care providers, such as health maintenance organizations, pharmacy benefit managers, and other institutions; and physicians and physician distributors, veterinarians, and animal producers. The company has collaborations with AstraZeneca PLC; Bayer AG; Eisai Co., Ltd.; Ridgeback Biotherapeutics; and Gilead Sciences, Inc. to jointly develop and commercialize long-acting treatments in HIV. Merck & Co., Inc. was founded in 1891 and is headquartered in Kenilworth, New Jersey.

Volatility

Merck’s last week, last month’s, and last quarter’s current intraday variation average was 0.77%, 0.50%, and 1.08%.

Merck’s highest amplitude of average volatility was 0.77% (last week), 1.08% (last month), and 1.08% (last quarter).

Moving Average

Merck’s worth is way higher than its 50-day moving average of $93.34 and way higher than its 200-day moving average of $88.10.

More news about Merck.

2. Orix Corp (IX)

Shares of Orix Corp rose by a staggering 10.22% in from $72.7 to $80.13 at 18:21 EST on Friday, after five consecutive sessions in a row of gains. NYSE is rising 0.04% to $15,767.02, following the last session’s downward trend.

ORIX Corporation offers a variety of financial services throughout Japan, Asia, Europe and Australasia. Corporate Financial Services and Maintenance Leasing are the company’s segments. They deal with leasing and renting automobiles and electronic measuring devices, as well as providing life and environmental insurance and products and services. The company’s Real Estate segment manages, develops, leases and rents real estate. It also manages office buildings and residential condos. Concession and PE Investment segment of the company engage in private equity (PEI) investments and concessions businesses. The company’s Environment and Energy segment offers renewable energy, ESCO and sells electricity. It also provides recycling and waste management and storage system sales. Its Insurance segment offers life insurance products via agents, banks and other financial institutions. These are available online, face-to-face, and online. The company’s Banking and Credit segment offers banking and consumer finance services. Aircraft and Ships is the company’s aircraft and ships segment. It also engages in ship-related finance and investments. The company’s ORIX USA section offers investment and finance services as well as asset management. The company’s ORIX Europe section offers equity and fixed-income asset management services. The company’s Asia-Australia segment provides finance and investment services. ORIX Corporation was formerly called Orient Leasing Co., Ltd., but it changed its name in 1989 to ORIX Corporation. ORIX Corporation was founded in Tokyo in 1950.

Volatility

Orix Corp’s last week, last month’s, and last quarter’s current intraday variation average was 0.68%, 0.38%, and 1.54%.

Orix Corp’s highest amplitude of average volatility was 1.41% (last week), 1.92% (last month), and 1.54% (last quarter).

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Orix Corp’s stock is considered to be oversold (<=20).

More news about Orix Corp.

3. Astrazeneca (AZN)

Shares of Astrazeneca rose by a staggering 14.2% in from $59.94 to $68.45 at 18:21 EST on Friday, after two sequential sessions in a row of gains. NYSE is jumping 0.04% to $15,767.02, following the last session’s downward trend.

AstraZeneca PLC, a biopharmaceutical company, focuses on the discovery, development, manufacturing, and commercialization of prescription medicines. Its marketed products include Calquence, Enhertu, Faslodex, Imfinzi, Iressa, Koselugo, Lumoxiti, Lynparza, Orpathys, Tagrisso, and Zoladex for oncology; Brilinta/Brilique, Bydureon/Byetta, BCise, Byetta, Crestor, Evrenzo, Farxiga/Forxiga, Komboglyze/Kombiglyze XR, Lokelma, Onglyza, Qtern, and Xigduo/Xigduo XR for cardiovascular, renal, and metabolism diseases; Bevespi Aerosphere, Breztri Aerosphere, Daliresp/Daxas, Duaklir Genuair, Fasenra, Pulmicort, Saphnelo, Symbicort, and Tudorza/Eklira/Bretaris for respiratory and immunology; and Andexxa/Ondexxya, Kanuma, Soliris, Strensiq, and Ultomiris for rare diseases. The company's marketed products also comprise Synagis for respiratory syncytial virus; Fluenz Tetra/FluMist Quadrivalent for Influenza; Seroquel IR/Seroquel XR for schizophrenia bipolar disease; Nexium, and Losec/Prilosec for gastroenterology; and Vaxzevria and Evusheld for covid-19. The company serves primary care and specialty care physicians through distributors and local representative offices in the United Kingdom, rest of Europe, the Americas, Asia, Africa, and Australasia. It has a collaboration agreement with Regeneron Pharmaceuticals, Inc. to research, develop, and commercialize small molecule medicines for obesity; Neurimmune AG to develop and commercialize NI006; Ionis Pharmaceuticals, Inc. to develop eplontersen, a liver-targeted antisense therapy in Phase III development for the treatment of transthyretin amyloidosis; Proteros Biostructures GmbH to jointly discover novel small molecules for the treatment of hematological cancers; Sierra Oncology, Inc. to develop and commercialize AZD5153. The company was formerly known as Zeneca Group PLC and changed its name to AstraZeneca PLC in April 1999. AstraZeneca PLC was incorporated in 1992 and is headquartered in Cambridge, the United Kingdom.

More news about Astrazeneca.

4. Laboratory Corporation of America Holdings (LH)

Shares of Laboratory Corporation of America Holdings rose 7.62% in from $223.84 to $240.90 at 18:21 EST on Friday, after five consecutive sessions in a row of gains. NYSE is rising 0.04% to $15,767.02, following the last session’s downward trend.

Laboratory Corporation of America Holdings operates as a global life sciences company that provides vital information to help doctors, hospitals, pharmaceutical companies, researchers, and patients make clear and confident decisions. It operates in two segments, Labcorp Diagnostics (Dx) and Labcorp Drug Development (DD). It offers various tests, such as blood chemistry analyses, urinalyses, blood cell counts, thyroid tests, PAP tests, hemoglobin A1C and vitamin D, prostate-specific antigens, tests for sexually transmitted diseases, hepatitis C tests, microbiology cultures and procedures, and alcohol and other substance-abuse tests. The company also provides specialty testing services comprising gene-based and esoteric testing; advanced tests target specific diseases, including anatomic pathology/oncology, cardiovascular disease, coagulation, diagnostic genetics, endocrinology, infectious disease, women's health, pharmacogenetics, and parentage and donor testing; and occupational testing services, medical drug monitoring services, chronic disease programs, and kidney stone prevention tests. It provides online and mobile applications to enable patients to check test results; and online applications for managed care organizations and accountable care organizations. It offers end-to-end drug development, medical device, and companion diagnostic development solutions from early-stage research to clinical development and commercial market access. It serves managed care organizations, pharmaceutical, biotechnology, medical device and diagnostics companies, governmental agencies, physicians and other healthcare providers, hospitals and health systems, employers, patients and consumers, contract research organizations, and independent clinical laboratories. Laboratory Corporation of America Holdings has a collaboration agreement with Tigerlily Foundation to increase clinical trial diversity for women of color. The company was incorporated in 1994 and is headquartered in Burlington, North Carolina.

More news about Laboratory Corporation of America Holdings.

5. Royal Caribbean Cruises (RCL)

Shares of Royal Caribbean Cruises jumped by a staggering 12.74% in from $53.63 to $60.46 at 18:21 EST on Friday, after two sequential sessions in a row of gains. NYSE is jumping 0.04% to $15,767.02, following the last session’s downward trend.

Royal Caribbean Cruises Ltd. operates as a cruise company worldwide. The company operates cruises under the Royal Caribbean International, Celebrity Cruises, Azamara, and Silversea Cruises brands, which comprise a range of itineraries that call on approximately 1,000 destinations. As of February 25, 2022, it operated 61 ships. The company was founded in 1968 and is headquartered in Miami, Florida.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Royal Caribbean Cruises’s stock is considered to be oversold (<=20).

More news about Royal Caribbean Cruises.

6. Coca-Cola (KO)

Shares of Coca-Cola rose 9.51% in from $58.8 to $64.39 at 18:21 EST on Friday, after two successive sessions in a row of gains. NYSE is jumping 0.04% to $15,767.02, following the last session’s downward trend.

The Coca-Cola Company, a beverage company, manufactures, markets, and sells various nonalcoholic beverages worldwide. The company provides sparkling soft drinks; flavored and enhanced water, and sports drinks; juice, dairy, and plant–based beverages; tea and coffee; and energy drinks. It also offers beverage concentrates and syrups, as well as fountain syrups to fountain retailers, such as restaurants and convenience stores. The company sells its products under the Coca-Cola, Diet Coke/Coca-Cola Light, Coca-Cola Zero Sugar, Fanta, Fresca, Schweppes, Sprite, Thums Up, Aquarius, Ciel, dogadan, Dasani, glacéau smartwater, glacéau vitaminwater, Ice Dew, I LOHAS, Powerade, Topo Chico, AdeS, Del Valle, fairlife, innocent, Minute Maid, Minute Maid Pulpy, Simply, Ayataka, BODYARMOR, Costa, FUZE TEA, Georgia, and Gold Peak brands. It operates through a network of independent bottling partners, distributors, wholesalers, and retailers, as well as through bottling and distribution operators. The company was founded in 1886 and is headquartered in Atlanta, Georgia.

More news about Coca-Cola.

7. Church & Dwight Company (CHD)

Shares of Church & Dwight Company jumped by a staggering 15.94% in from $71.69 to $83.12 at 18:21 EST on Friday, after four successive sessions in a row of gains. NYSE is rising 0.04% to $15,767.02, following the last session’s downward trend.

Church & Dwight Co., Inc. develops, manufactures, and markets household, personal care, and specialty products. It operates through three segments: Consumer Domestic, Consumer International, and Specialty Products Division. The company offers cat litters, carpet deodorizers, laundry detergents, and baking soda, as well as other baking soda based products under the ARM & HAMMER brand; condoms, lubricants, and vibrators under the TROJAN brand; stain removers, cleaning solutions, laundry detergents, and bleach alternatives under the OXICLEAN brand; battery-operated and manual toothbrushes under the SPINBRUSH brand; home pregnancy and ovulation test kits under the FIRST RESPONSE brand; depilatories under the NAIR brand; oral analgesics under the ORAJEL brand; laundry detergents under the XTRA brand; gummy dietary supplements under the L'IL CRITTERS and VITAFUSION brands; dry shampoos under the BATISTE brand; water flossers and replacement showerheads under the WATERPIK brand; FLAWLESS products; cold shortening and relief products under the ZICAM brand; and oral care products under the THERABREATH brand. Its specialty products include animal productivity products, such as MEGALAC rumen bypass fat, a supplement that enables cows to maintain energy levels during the period of high milk production; BIO-CHLOR and FERMENTEN, which are used to reduce health issues associated with calving, as well as provides needed protein; and CELMANAX refined functional carbohydrate, a yeast-based prebiotic. The company offers sodium bicarbonate; and cleaning and deodorizing products. It sells its consumer products through supermarkets, mass merchandisers, wholesale clubs, drugstores, convenience stores, home stores, dollar and other discount stores, pet and other specialty stores, and websites and other e-commerce channels; and specialty products to industrial customers and livestock producers through distributors. The company was founded in 1846 and is headquartered in Ewing, New Jersey.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Church & Dwight Company’s stock is considered to be oversold (<=20).

More news about Church & Dwight Company.

8. Exelon (EXC)

Shares of Exelon rose by a staggering 11.54% in from $37.09 to $41.37 at 18:21 EST on Friday, after two consecutive sessions in a row of gains. NASDAQ is falling 0.18% to $11,461.50, after two successive sessions in a row of gains.

Exelon Corporation, a utility services holding company, engages in the energy generation, delivery, and marketing businesses in the United States and Canada. It owns nuclear, fossil, wind, hydroelectric, biomass, and solar generating facilities. The company also sells electricity to wholesale and retail customers; and sells natural gas, renewable energy, and other energy-related products and services. Additionally, it is involved in the purchase and regulated retail sale of electricity and natural gas; and transmission and distribution of electricity, and distribution of natural gas to retail customers. Further, the company offers support services, including legal, human resources, information technology, financial, supply management, accounting, engineering, customer operations, distribution and transmission planning, asset management, system operations, and power procurement services. It serves distribution utilities, municipalities, cooperatives, and financial institutions, as well as commercial, industrial, governmental, and residential customers. Exelon Corporation was incorporated in 1999 and is headquartered in Chicago, Illinois.

Volatility

Exelon’s last week, last month’s, and last quarter’s current intraday variation average was 0.94%, 0.33%, and 1.70%.

Exelon’s highest amplitude of average volatility was 1.22% (last week), 1.49% (last month), and 1.70% (last quarter).

Yearly Top and Bottom Value

Exelon’s stock is valued at $41.37 at 18:21 EST, way below its 52-week high of $50.71 and way above its 52-week low of $35.19.

Growth Estimates Quarters

The company’s growth estimates for the ongoing quarter is a negative 50% and positive 3.1% for the next.

More news about Exelon.

9. Bristol (BMY)

Shares of Bristol rose 3.05% in from $78.47 to $80.86 at 18:21 EST on Friday, after four sequential sessions in a row of gains. NYSE is jumping 0.04% to $15,767.02, following the last session’s downward trend.

Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, and markets biopharmaceutical products worldwide. It offers products for hematology, oncology, cardiovascular, immunology, fibrotic, neuroscience, and covid-19 diseases. The company's products include Revlimid, an oral immunomodulatory drug for the treatment of multiple myeloma; Eliquis, an oral inhibitor for reduction in risk of stroke/systemic embolism in NVAF, and for the treatment of DVT/PE; Opdivo for anti-cancer indications; Pomalyst/Imnovid indicated for patients with multiple myeloma; and Orencia for adult patients with active RA and psoriatic arthritis. It also provides Sprycel for the treatment of Philadelphia chromosome-positive chronic myeloid leukemia; Yervoy for the treatment of patients with unresectable or metastatic melanoma; Abraxane, a protein-bound chemotherapy product; Reblozyl for the treatment of anemia in adult patients with beta thalassemia; and Empliciti for the treatment of multiple myeloma. In addition, the company offers Zeposia to treat relapsing forms of multiple sclerosis; Breyanzi, a CD19-directed genetically modified autologous T cell immunotherapy for the treatment of adult patients with relapsed or refractory large B-cell lymphoma; Inrebic, an oral kinase inhibitor indicated for the treatment of adult patients with myelofibrosis; and Onureg for the treatment of adult patients with AML. It sells products to wholesalers, distributors, pharmacies, retailers, hospitals, clinics, and government agencies. The company was formerly known as Bristol-Myers Company. The company was founded in 1887 and is headquartered in New York, New York.

Growth Estimates Quarters

The company’s growth estimates for the current quarter and the next is a negative 7.5% and a negative 3.8%, respectively.

Moving Average

Bristol’s value is way higher than its 50-day moving average of $71.43 and way higher than its 200-day moving average of $72.59.

More news about Bristol.

10. White Mountains Insurance Group (WTM)

Shares of White Mountains Insurance Group jumped 0.84% in from $1360.57 to $1,372.00 at 18:21 EST on Friday, after two sequential sessions in a row of gains. NYSE is jumping 0.04% to $15,767.02, following the last session’s downward trend.

More news about White Mountains Insurance Group.

11. SPS Commerce (SPSC)

Shares of SPS Commerce jumped by a staggering 20.06% in from $121.11 to $145.40 at 18:21 EST on Friday, after five successive sessions in a row of gains. NASDAQ is sliding 0.18% to $11,461.50, after two sequential sessions in a row of gains.

SPS Commerce, Inc. provides cloud-based supply chain management solutions worldwide. It offers solutions through the SPS Commerce, a cloud-based platform that enhances the way retailers, suppliers, grocers, distributors, and logistics firms manage and fulfill omnichannel orders, optimize sell-through performance, and automate new trading relationships. The company also provides Fulfillment solution that provides fulfillment automation and replaces or augments an organization's existing staff and trading partner electronic communication infrastructure by enabling easy compliance with retailers' rulebooks, automatic, and digital exchange of information among numerous trading partners through various protocols, and greater visibility into the journey of an order; and Analytics solution, which consists of data analytics applications that enables customers to enhance their visibility across supply chains through greater analytics capabilities. In addition, it offers various complimentary products, such as assortment product, which enables accurate order management and rapid fulfillment; and community product that accelerates vendor onboarding and ensures trading partner adoption of new supply chain requirements. The company was formerly known as St. Paul Software, Inc. and changed its name to SPS Commerce, Inc. in May 2001. SPS Commerce, Inc. was incorporated in 1987 and is headquartered in Minneapolis, Minnesota.

More news about SPS Commerce.

12. Eli Lilly and Company (LLY)

Shares of Eli Lilly and Company jumped 3.51% in from $361.94 to $374.64 at 18:21 EST on Friday, following the last session’s downward trend. NYSE is rising 0.04% to $15,767.02, following the last session’s downward trend.

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals worldwide. It offers Basaglar, Humalog, Humalog Mix 75/25, Humalog U-100, Humalog U-200, Humalog Mix 50/50, insulin lispro, insulin lispro protamine, insulin lispro mix 75/25, Humulin, Humulin 70/30, Humulin N, Humulin R, and Humulin U-500 for diabetes; and Jardiance, Trajenta, and Trulicity for type 2 diabetes. The company provides Alimta for non-small cell lung cancer (NSCLC) and malignant pleural mesothelioma; Cyramza for metastatic gastric cancer, gastro-esophageal junction adenocarcinoma, metastatic NSCLC, metastatic colorectal cancer, and hepatocellular carcinoma; Erbitux for colorectal cancers, and various head and neck cancers; Retevmo for metastatic NSCLC, medullary thyroid cancer, and thyroid cancer; Tyvyt for relapsed or refractory classic Hodgkin's lymph and non-squamous NSCLC; and Verzenio for HR+, HER2- metastatic breast cancer, node positive, and early breast cancer. It offers Olumiant for rheumatoid arthritis; and Taltz for plaque psoriasis, psoriatic arthritis, ankylosing spondylitis, and non-radiographic axial spondylarthritis. The company offers Cymbalta for depressive disorder, diabetic peripheral neuropathic pain, generalized anxiety disorder, fibromyalgia, and chronic musculoskeletal pain; Emgality for migraine prevention and episodic cluster headache; and Zyprexa for schizophrenia, bipolar I disorder, and bipolar maintenance. Its Bamlanivimab and etesevimab, and Bebtelovimab for COVID-19; Cialis for erectile dysfunction and benign prostatic hyperplasia; and Forteo for osteoporosis. The company has collaborations with Incyte Corporation; Boehringer Ingelheim Pharmaceuticals, Inc.; AbCellera Biologics Inc.; Junshi Biosciences; Regor Therapeutics Group; Lycia Therapeutics, Inc.; Kumquat Biosciences Inc.; Entos Pharmaceuticals Inc.; and Foghorn Therapeutics Inc. Eli Lilly and Company was founded in 1876 and is headquartered in Indianapolis, Indiana.

More news about Eli Lilly and Company.

13. Kellogg Company (K)

Shares of Kellogg Company jumped 6.09% in from $69.49 to $73.72 at 18:21 EST on Friday, after four sequential sessions in a row of gains. NYSE is rising 0.04% to $15,767.02, following the last session’s downward trend.

Kellogg Company, together with its subsidiaries, manufactures and markets snacks and convenience foods. The company operates through four segments: North America, Europe, Latin America, and Asia Middle East Africa. Its principal products include crackers, crisps, savory snacks, toaster pastries, cereal bars, granola bars and bites, ready-to-eat cereals, frozen waffles, veggie foods, and noodles. The company offers its products under the Kellogg's, Cheez-It, Pringles, Austin, Parati, RXBAR, Kashi, Bear Naked, Eggo, Morningstar Farms, Choco Krispies, Crunchy Nut, Nutri-Grain, Special K, Squares, Zucaritas, Sucrilhos, Pop-Tarts, K-Time, Sunibrite, Split Stix, Be Natural, LCMs, Coco Pops, Frosties, Rice Krispies Squares, Kashi Go, Vector, Incogmeato, Veggitizers, and Gardenburger brand names. It sells its products to retailers through direct sales forces, as well as brokers and distributors. The company was founded in 1906 and is headquartered in Battle Creek, Michigan.

More news about Kellogg Company.

14. Goldman Sachs Group (GS)

Shares of Goldman Sachs Group rose 8.91% in from $348.7 to $379.77 at 18:21 EST on Friday, after two sequential sessions in a row of losses. NYSE is rising 0.04% to $15,767.02, following the last session’s downward trend.

The Goldman Sachs Group, Inc., a financial institution, provides a range of financial services for corporations, financial institutions, governments, and individuals worldwide. It operates through four segments: Investment Banking, Global Markets, Asset Management, and Consumer & Wealth Management. The company's Investment Banking segment provides financial advisory services, including strategic advisory assignments related to mergers and acquisitions, divestitures, corporate defense activities, restructurings, and spin-offs; and middle-market lending, relationship lending, and acquisition financing, as well as transaction banking services. This segment also offers underwriting services, such as equity underwriting for common and preferred stock and convertible and exchangeable securities; and debt underwriting for various types of debt instruments, including investment-grade and high-yield debt, bank and bridge loans, and emerging-and growth-market debt, as well as originates structured securities. Its Global Markets segment is involved in client execution activities for cash and derivative instruments; credit and interest rate products; and provision of equity intermediation and equity financing, clearing, settlement, and custody services, as well as mortgages, currencies, commodities, and equities related products. The company's Asset Management segment manages assets across various classes, including equity, fixed income, hedge funds, credit funds, private equity, real estate, currencies, and commodities; and provides customized investment advisory solutions, as well as invests in corporate, real estate, and infrastructure entities. Its Consumer & Wealth Management segment offers wealth advisory and banking services, including financial planning, investment management, deposit taking, and lending; private banking; and unsecured loans, as well as accepts saving and time deposits. The company was founded in 1869 and is headquartered in New York, New York.

Volatility

Goldman Sachs Group’s last week, last month’s, and last quarter’s current intraday variation average was a negative 0.10%, a positive 0.52%, and a positive 1.48%.

Goldman Sachs Group’s highest amplitude of average volatility was 0.87% (last week), 0.95% (last month), and 1.48% (last quarter).

Revenue Growth

Year-on-year quarterly revenue growth declined by 27.7%, now sitting on 49.3B for the twelve trailing months.

More news about Goldman Sachs Group.

15. General Motors (GM)

Shares of General Motors rose 3.53% in from $38.54 to $39.90 at 18:21 EST on Friday, following the last session’s downward trend. NYSE is jumping 0.04% to $15,767.02, following the last session’s downward trend.

General Motors Company designs, builds, and sells trucks, crossovers, cars, and automobile parts and accessories in North America, the Asia Pacific, the Middle East, Africa, South America, the United States, and China. The company operates through GM North America, GM International, Cruise, and GM Financial segments. It markets its vehicles primarily under the Buick, Cadillac, Chevrolet, GMC, Holden, Baojun, and Wuling brand names. The company also sells trucks, crossovers, cars, and purpose-built vehicles to dealers for consumer retail sales, as well as to fleet customers, including daily rental car companies, commercial fleet customers, leasing companies, and governments. In addition, it offers safety and security services for retail and fleet customers, including automatic crash response, emergency services, roadside assistance, crisis assist, stolen vehicle assistance, and turn-by-turn navigation; and connected services comprising mobile applications for owners to remotely control their vehicles and electric vehicle owners to locate charging stations, on-demand vehicle diagnostics, smart driver, marketplace in-vehicle commerce, in-vehicle voice, voice assistant, navigation and app ecosystem, connected navigation, SiriusXM with 360L, and 4G LTE wireless connectivity, as well as develops and commercializes autonomous vehicle technology. Further, the company provides automotive financing and insurance services; and software-enabled services and subscriptions. General Motors Company was founded in 1908 and is headquartered in Detroit, Michigan.

Moving Average

General Motors’s worth is higher than its 50-day moving average of $36.91 and above its 200-day moving average of $38.67.

Sales Growth

General Motors’s sales growth is 20% for the ongoing quarter and 4.5% for the next.

Revenue Growth

Year-on-year quarterly revenue growth grew by 56.4%, now sitting on 147.21B for the twelve trailing months.

Volatility

General Motors’s last week, last month’s, and last quarter’s current intraday variation average was 0.28%, 0.15%, and 2.18%.

General Motors’s highest amplitude of average volatility was 1.65% (last week), 1.81% (last month), and 2.18% (last quarter).

More news about General Motors.

16. Regeneron Pharmaceuticals (REGN)

Shares of Regeneron Pharmaceuticals rose 3.68% in from $739.66 to $766.88 at 18:21 EST on Friday, after two sequential sessions in a row of gains. NASDAQ is sliding 0.18% to $11,461.50, after two sequential sessions in a row of gains.

Regeneron Pharmaceuticals, Inc. discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide. The company's products include EYLEA injection to treat wet age-related macular degeneration and diabetic macular edema; myopic choroidal neovascularization; and diabetic retinopathy, as well as macular edema following retinal vein occlusion, including macular edema following central retinal vein occlusion and macular edema following branch retinal vein occlusion. It also provides Dupixent injection to treat atopic dermatitis and asthma in adults and pediatrics; Libtayo injection to treat metastatic or locally advanced cutaneous squamous cell carcinoma;Praluent injection for heterozygous familial hypercholesterolemia or clinical atherosclerotic cardiovascular disease in adults; REGEN-COV for covid-19; and Kevzara solution for treating rheumatoid arthritis in adults. In addition, the company offers Inmazeb injection for infection caused by Zaire ebolavirus; ARCALYST injection for cryopyrin-associated periodic syndromes, including familial cold auto-inflammatory syndrome and muckle-wells syndrome; and ZALTRAP injection for intravenous infusion to treat metastatic colorectal cancer; and develops product candidates for treating patients with eye, allergic and inflammatory, cardiovascular and metabolic, infectious, and rare diseases; and cancer, pain, and hematologic conditions. It has collaboration and license agreements with Sanofi; Bayer; Teva Pharmaceutical Industries Ltd.; Mitsubishi Tanabe Pharma Corporation; Alnylam Pharmaceuticals, Inc.; Roche Pharmaceuticals; and Kiniksa Pharmaceuticals, Ltd., as well as has an agreement with the U.S. Department of Health and Human Services, as well as with Zai Lab Limited; Intellia Therapeutics, Inc.; Biomedical Advanced Research Development Authority; and AstraZeneca PLC. The company was incorporated in 1988 and is headquartered in Tarrytown, New York.

Yearly Top and Bottom Value

Regeneron Pharmaceuticals’s stock is valued at $766.88 at 18:21 EST, below its 52-week high of $769.63 and way above its 52-week low of $538.01.

Growth Estimates Quarters

The company’s growth estimates for the present quarter and the next is a negative 34% and a negative 51.6%, respectively.

More news about Regeneron Pharmaceuticals.

17. Rogers Communication (RCI)

Shares of Rogers Communication jumped by a staggering 11.93% in from $41.31 to $46.24 at 18:21 EST on Friday, after four successive sessions in a row of gains. NYSE is jumping 0.04% to $15,767.02, following the last session’s downward trend.

Rogers Communications Inc. operates as a communications and media company in Canada. It operates through three segments: Wireless, Cable, and Media. The company offers mobile Internet access, wireless voice and enhanced voice, device and accessory financing, wireless home phone, device protection, e-mail, global voice and data roaming, bridging landline, machine-to-machine and Internet of Things solutions, and advanced wireless solutions for businesses, as well as device delivery services; and postpaid and prepaid services under the Rogers, Fido, and chatr brands to approximately 11.3 million subscribers. It also provides Internet and WiFi services; smart home monitoring services, such as monitoring, security, automation, energy efficiency, and smart control through a smartphone app. In addition, the company offers local and network TV; on-demand television; cloud-based digital video recorders; voice-activated remote controls, and integrated apps; personal video recorders; linear and time-shifted programming; digital specialty channels; 4K television programming; and televised content on smartphones, tablets, and personal computers, as well as operates Ignite TV and Ignite TV app. Further, it provides residential and small business local telephony services; calling features, such as voicemail, call waiting, and long distance; voice, data networking, Internet protocol, and Ethernet services; private networking, Internet, IP voice, and cloud solutions; optical wave and multi-protocol label switching services; IT and network technologies; and cable access network services. The company also owns Toronto Blue Jays and the Rogers Centre event venue; and operates Sportsnet ONE, Sportsnet 360, Sportsnet World, Citytv, OMNI, FX (Canada), FXX (Canada), and OLN television networks, as well as 55 AM and FM radio stations. The company was founded in 1960 and is headquartered in Toronto, Canada.

Yearly Top and Bottom Value

Rogers Communication’s stock is valued at $46.24 at 18:21 EST, way below its 52-week high of $64.55 and way higher than its 52-week low of $36.23.

More news about Rogers Communication.

18. Ventas (VTR)

Shares of Ventas rose by a staggering 25.07% in from $36.97 to $46.24 at 18:21 EST on Friday, after two successive sessions in a row of losses. NYSE is rising 0.04% to $15,767.02, following the last session’s downward trend.

Ventas, an S&P 500 company, operates at the intersection of two powerful and dynamic industries – healthcare and real estate. As one of the world's foremost Real Estate Investment Trusts (REIT), we use the power of capital to unlock the value of real estate, partnering with leading care providers, developers, research and medical institutions, innovators and healthcare organizations whose success is buoyed by the demographic tailwind of an aging population. For more than twenty years, Ventas has followed a successful strategy that endures: combining a high-quality diversified portfolio of properties and capital sources to manage through cycles, working with industry leading partners, and a collaborative and experienced team focused on producing consistent growing cash flows and superior returns on a strong balance sheet, ultimately rewarding Ventas shareholders. As of September 30, 2020, Ventas owned or managed through unconsolidated joint ventures approximately 1,200 properties.

Growth Estimates Quarters

The company’s growth estimates for the present quarter and the next is a negative 95.7% and a negative 106.2%, respectively.

More news about Ventas.

19. General Mills (GIS)

Shares of General Mills rose 9.51% in from $78.9 to $86.40 at 18:21 EST on Friday, after four successive sessions in a row of gains. NYSE is rising 0.04% to $15,767.02, following the last session’s downward trend.

General Mills, Inc. manufactures and markets branded consumer foods worldwide. The company operates in five segments: North America Retail; Convenience Stores & Foodservice; Europe & Australia; Asia & Latin America; and Pet. It offers ready-to-eat cereals, refrigerated yogurt, soup, meal kits, refrigerated and frozen dough products, dessert and baking mixes, bakery flour, frozen pizza and pizza snacks, snack bars, fruit and salty snacks, ice cream, nutrition bars, wellness beverages, and savory and grain snacks, as well as various organic products, including frozen and shelf-stable vegetables. It also supplies branded and unbranded food products to the North American foodservice and commercial baking industries; and manufactures and markets pet food products, including dog and cat food. The company markets its products under the Annie's, Betty Crocker, Bisquick, Blue Buffalo, Blue Basics, Blue Freedom, Bugles, Cascadian Farm, Cheerios, Chex, Cinnamon Toast Crunch, Cocoa Puffs, Cookie Crisp, EPIC, Fiber One, Food Should Taste Good, Fruit by the Foot, Fruit Gushers, Fruit Roll-Ups, Gardetto's, Go-Gurt, Gold Medal, Golden Grahams, Häagen-Dazs, Helpers, Jus-Rol, Kitano, Kix, Lärabar, Latina, Liberté, Lucky Charms, Muir Glen, Nature Valley, Oatmeal Crisp, Old El Paso, Oui, Pillsbury, Progresso, Raisin Nut Bran, Total, Totino's, Trix, Wanchai Ferry, Wheaties, Wilderness, Yoki, and Yoplait trademarks. It sells its products directly, as well as through broker and distribution arrangements to grocery stores, mass merchandisers, membership stores, natural food chains, e-commerce retailers, commercial and noncommercial foodservice distributors and operators, restaurants, convenience stores, and pet specialty stores, as well as drug, dollar, and discount chains. The company operates 466 leased and 392 franchise ice cream parlors. General Mills, Inc. was founded in 1866 and is headquartered in Minneapolis, Minnesota.

Yearly Top and Bottom Value

General Mills’s stock is valued at $86.40 at 18:21 EST, higher than its 52-week high of $82.10.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

General Mills’s stock is considered to be oversold (<=20).

Revenue Growth

Year-on-year quarterly revenue growth grew by 8.1%, now sitting on 18.99B for the twelve trailing months.

More news about General Mills.

20. Gilead Sciences (GILD)

Shares of Gilead Sciences jumped by a staggering 12.13% in from $79.42 to $89.05 at 18:21 EST on Friday, after three consecutive sessions in a row of gains. NASDAQ is sliding 0.18% to $11,461.50, after two consecutive sessions in a row of gains.

Gilead Sciences, Inc., a biopharmaceutical company, discovers, develops, and commercializes medicines in the areas of unmet medical need in the United States, Europe, and internationally. The company provides Biktarvy, Genvoya, Descovy, Odefsey, Truvada, Complera/ Eviplera, Stribild, and Atripla products for the treatment of HIV/AIDS; Veklury, an injection for intravenous use, for the treatment of coronavirus disease 2019; and Epclusa, Harvoni, Vosevi, Vemlidy, and Viread for the treatment of liver diseases. It also offers Yescarta, Tecartus, Trodelvy, and Zydelig products for the treatment of hematology, oncology, and cell therapy patients. In addition, the company provides Letairis, an oral formulation for the treatment of pulmonary arterial hypertension; Ranexa, an oral formulation for the treatment of chronic angina; and AmBisome, a liposomal formulation for the treatment of serious invasive fungal infections. Gilead Sciences, Inc. has collaboration agreements with Arcus Biosciences, Inc.; Pionyr Immunotherapeutics Inc.; Tizona Therapeutics, Inc.; Tango Therapeutics, Inc.; Jounce Therapeutics, Inc.; Galapagos NV; Janssen Sciences Ireland Unlimited Company; Japan Tobacco, Inc.; Gadeta B.V.; Bristol-Myers Squibb Company; Dragonfly Therapeutics, Inc.; and Merck & Co, Inc. The company was incorporated in 1987 and is headquartered in Foster City, California.

Volatility

Gilead Sciences’s last week, last month’s, and last quarter’s current intraday variation average was 0.70%, 0.54%, and 1.37%.

Gilead Sciences’s highest amplitude of average volatility was 1.32% (last week), 0.98% (last month), and 1.37% (last quarter).

Moving Average

Gilead Sciences’s worth is way above its 50-day moving average of $70.55 and way above its 200-day moving average of $63.98.

More news about Gilead Sciences.

21. Genmab (GMAB)

Shares of Genmab rose by a staggering 18.74% in from $39.65 to $47.08 at 18:21 EST on Friday, following the last session’s downward trend. NASDAQ is dropping 0.18% to $11,461.50, after two consecutive sessions in a row of gains.

Genmab A/S develops antibody therapeutics for the treatment of cancer and other diseases primarily in Denmark. The company markets DARZALEX, a human monoclonal antibody for the treatment of patients with multiple myeloma (MM); teprotumumab for the treatment of thyroid eye disease; ofatumurnab, a human monoclonal antibody to treat chronic lymphocytic leukemia (CLL) and multiple sclerosis; and Amivantamab for advanced or metastatic gastric or esophageal cancer and NSCLC. Its products include daratumumab to treat MM, non-MM blood cancers, and AL amyloidosis; GEN1047; tisotumab vedotin for treating cervical, ovarian, and solid cancers; DuoBody-PD-L1x4-1BB, and DuoBody-CD40x4-1BB for treating solid tumors; Epcoritamab for relapsed/refractory diffuse large B-cell lymphoma and chronic lymphocytic leukemia; and HexaBody-CD38 and DuoHexaBody-CD37 for treating hematological malignancies. The company's also develops products, which is in Phase 2 comprise Teclistamab for vaso-occlusive crises; Camidanlumab tesirine to treat hodgkin lymphoma and solid tumors; JNJ-64007957 and JNJ-64407564 to treat MM; PRV-015 for treating celiac disease; Mim8 for treating haemophilia A; and Lu AF82422 for treating multiple system atrophy disease. In addition, it has approximately 20 active pre-clinical programs. The company has a commercial license and collaboration agreement with Seagen Inc. to co-develop tisotumab vedotin. It also has a collaboration agreement with CureVac AG for the research and development of differentiated mRNA-based antibody products; AbbVie for the development of epcoritamab; and collaborations with BioNTech, Janssen, Novo Nordisk A/S, BliNK Biomedical SAS, and Bolt Biotherapeutics, Inc. Genmab A/S was founded in 1999 and is headquartered in Copenhagen, Denmark.

Yearly Top and Bottom Value

Genmab’s stock is valued at $47.08 at 18:21 EST, higher than its 52-week high of $43.88.

Moving Average

Genmab’s worth is way above its 50-day moving average of $37.24 and way above its 200-day moving average of $34.63.

Growth Estimates Quarters

The company’s growth estimates for the ongoing quarter and the next is 492.6% and 1252.9%, respectively.

Revenue Growth

Year-on-year quarterly revenue growth grew by 60.3%, now sitting on 10.21B for the twelve trailing months.

More news about Genmab.

22. Accenture (ACN)

Shares of Accenture jumped by a staggering 16.61% in from $257.02 to $299.71 at 18:21 EST on Friday, after four consecutive sessions in a row of gains. NYSE is rising 0.04% to $15,767.02, following the last session’s downward trend.

Accenture plc, a professional services company, provides strategy and consulting, interactive, industry X, song, and technology and operation services worldwide. The company offers application services, including agile transformation, DevOps, application modernization, enterprise architecture, software and quality engineering, data management, intelligent automation comprises robotic process automation, natural language processing, and virtual agents, and application management services, as well as software engineering services; strategy and consulting services; data and analytics strategy, data discovery and augmentation, data management and beyond, data democratization, and industrialized solutions comprises turnkey analytics and artificial intelligence (AI) solutions; metaverse; and sustainability services. It also provides change management, HR transformation and delivery, organization strategy and design, talent strategy and development, and leadership and culture services; digital commerce; infrastructure services, including cloud infrastructure managed, cloud and data center, network, digital workplace, database platforms, service management, and cloud and infrastructure security services; data-enabled operating models; technology consulting and AI services; and technology consulting services. In addition, the company offers engineering and R&D digitization, smart connected products, product as-a-service enablement, capital projects, intelligent asset management, digital industrial workforce, and autonomous robotic systems; business process outsourcing; and services related to technology innovation. Further, it provides cloud, ecosystem, marketing, security, supply chain management, zero-based transformation, customer experience, finance consulting, mergers and acquisitions, and sustainability services. The company was founded in 1951 and is based in Dublin, Ireland.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Accenture’s stock is considered to be oversold (<=20).

More news about Accenture.

23. Ross Stores (ROST)

Shares of Ross Stores rose by a staggering 28.66% in from $92.38 to $118.86 at 18:21 EST on Friday, after four consecutive sessions in a row of gains. NASDAQ is sliding 0.18% to $11,461.50, after two consecutive sessions in a row of gains.

Ross Stores, Inc., together with its subsidiaries, operates off-price retail apparel and home fashion stores under the Ross Dress for Less and dd's DISCOUNTS brand names. Its stores primarily offer apparel, accessories, footwear, and home fashions. The company's Ross Dress for Less stores sell its products at department and specialty stores primarily to middle income households; and dd's DISCOUNTS stores sell its products at department and discount stores for households with moderate income. As of September 28, 2022, it operated approximately 2,000 stores under the Ross Dress for Less and dd's DISCOUNTS name in 40 states, the District of Columbia, and Guam. Ross Stores, Inc. was incorporated in 1957 and is headquartered in Dublin, California.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Ross Stores’s stock is considered to be oversold (<=20).

More news about Ross Stores.

24. Internationa Flavors & Fragrances (IFF)

Shares of Internationa Flavors & Fragrances rose by a staggering 15.83% in from $93.24 to $108.00 at 18:21 EST on Friday, after three consecutive sessions in a row of gains. NYSE is jumping 0.04% to $15,767.02, following the last session’s downward trend.

International Flavors & Fragrances Inc., together with its subsidiaries, manufactures and sells cosmetic active and natural health ingredients for use in various consumer products in Europe, Africa, the Middle East, Greater Asia, North America, and Latin America. It operates through Nourish, Scent, Health & Biosciences, and Pharma Solutions segments. The Nourish segment offers natural and plant-based specialty food ingredients, such as flavor compounds, and savory solutions and inclusions. It also provides natural food protection ingredients consist of natural antioxidants and anti-microbials as well as beverages, sweets , and dairy products. The Scent segment provides fragrance compounds, which include fine fragrances comprising perfumes and colognes, as well as consumer fragrances; fragrance ingredients comprising synthetic and natural ingredients that could be combined with other materials to create fragrance and consumer compounds; and cosmetic active ingredients consisting of active and functional ingredients, botanicals, and delivery systems to support its customers' cosmetic and personal care product lines. The Health & Biosciences segment develops and produces enzymes, food cultures, probiotics, and specialty ingredients. The Pharma Solutions segment produces and sells cellulosics and seaweed-based pharma excipients. The company sells its products primarily to manufacturers of perfumes and cosmetics, hair and other personal care products, soaps and detergents, cleaning products, dairy, meat and other processed foods, beverages, snacks and savory foods, sweet and baked goods, dietary supplements, infant and elderly nutrition, functional food, and pharmaceutical excipients and oral care products. International Flavors & Fragrances Inc. was founded in 1833 and is headquartered in New York, New York.

Sales Growth

Internationa Flavors & Fragrances’s sales growth for the next quarter is 8.3%.

More news about Internationa Flavors & Fragrances.

25. Ares Capital (ARCC)

Shares of Ares Capital jumped 0.26% in from $19.36 to $19.41 at 18:21 EST on Friday, after two consecutive sessions in a row of losses. NASDAQ is falling 0.18% to $11,461.50, after two successive sessions in a row of gains.

Ares Capital Corporation is a business development company specializing in acquisition, recapitalization, mezzanine debt, restructurings, rescue financing, and leveraged buyout transactions of middle market companies. It also makes growth capital and general refinancing. It prefers to make investments in companies engaged in the basic and growth manufacturing, business services, consumer products, health care products and services, and information technology service sectors. The fund will also consider investments in industries such as restaurants, retail, oil and gas, and technology sectors. It focuses on investments in Northeast, Mid-Atlantic, Southeast and Southwest regions from its New York office, the Midwest region, from the Chicago office, and the Western region from the Los Angeles office. The fund typically invests between $20 million and $200 million and a maximum of $400 million in companies with an EBITDA between $10 million and $250 million. It makes debt investments between $10 million and $100 million The fund invests through revolvers, first lien loans, warrants, unitranche structures, second lien loans, mezzanine debt, private high yield, junior capital, subordinated debt, and non-control preferred and common equity. The fund also selectively considers third-party-led senior and subordinated debt financings and opportunistically considers the purchase of stressed and discounted debt positions. The fund prefers to be an agent and/or lead the transactions in which it invests. The fund also seeks board representation in its portfolio companies.

Revenue Growth

Year-on-year quarterly revenue growth grew by 4.4%, now sitting on 1.89B for the twelve trailing months.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Ares Capital stock considered oversold (=20).

Volatility

Ares Capital’s last week, last month’s, and last quarter’s current intraday variation average was a negative 0.30%, a negative 0.03%, and a positive 1.45%.

Ares Capital’s highest amplitude of average volatility was 1.01% (last week), 0.90% (last month), and 1.45% (last quarter).

Growth Estimates Quarters

The company’s growth estimates for the present quarter is 2.1% and a drop 13.8% for the next.

More news about Ares Capital.

26. Live Nation Entertainment (LYV)

Shares of Live Nation Entertainment dropped 3.37% in from $76.54 to $73.96 at 18:21 EST on Friday, after four consecutive sessions in a row of gains. NYSE is rising 0.04% to $15,767.02, following the last session’s downward trend.

Live Nation Entertainment, Inc. operates as a live entertainment company. It operates through Concerts, Ticketing, and Sponsorship & Advertising segments. The Concerts segment promotes live music events in its owned or operated venues, and in rented third-party venues; operates and manages music venues; produces music festivals; creates associated content; and offers management and other services to artists. The Ticketing segment manages the ticketing operations, including the provision of ticketing software and services to clients for tickets and event information through its primary websites livenation.com and ticketmaster.com, as well as provides ticket resale services. This segment sells tickets for its events, as well as for third-party clients in various live event categories, such as arenas, stadiums, amphitheaters, music clubs, concert promoters, professional sports franchises and leagues, college sports teams, performing arts venues, museums, and theaters through websites, mobile apps, and ticket outlets. The Sponsorship & Advertising segment sells international, national, and local sponsorships and placement of advertising, including signage, promotional programs, rich media offering that comprise advertising related with live streaming and music-related content; and ads across its distribution network of venues, events, and websites. This segment also manages the development of strategic sponsorship programs, as well as develops, books, and produces custom events or programs for specific brands. As of December 31, 2021, it owned, operated, or leased 165 entertainment venues in North America and 94 entertainment venues internationally. The company was formerly known as Live Nation, Inc. and changed its name to Live Nation Entertainment, Inc. in January 2010. Live Nation Entertainment, Inc. was incorporated in 2005 and is headquartered in Beverly Hills, California.

More news about Live Nation Entertainment.

27. Johnson & Johnson (JNJ)

Shares of Johnson & Johnson rose 4.8% in from $170.74 to $178.94 at 18:21 EST on Friday, after two consecutive sessions in a row of gains. NYSE is jumping 0.04% to $15,767.02, following the last session’s downward trend.

Johnson & Johnson, together with its subsidiaries, researches and develops, manufactures, and sells various products in the healthcare field worldwide. The company's Consumer Health segment offers baby care products under the JOHNSON'S and AVEENO Baby brands; oral care products under the LISTERINE brand; skin health/beauty products under the AVEENO, CLEAN & CLEAR, DR. CI:LABO, NEUTROGENA, and OGX brands; TYLENOL acetaminophen products; SUDAFED cold, flu, and allergy products; BENADRYL and ZYRTEC allergy products; MOTRIN IB ibuprofen products; NICORETTE smoking cessation products; and PEPCID acid reflux products. It also offers STAYFREE and CAREFREE sanitary pads; o.b. tampons; adhesive bandages under the BAND-AID brand; and first aid products under the NEOSPORIN brand. It serves general public, retail outlets, and distributors. The company's Pharmaceutical segment offers products for rheumatoid arthritis, psoriatic arthritis, inflammatory bowel disease, and psoriasis; HIV/AIDS and COVID-19 infectious diseases; mood disorders, neurodegenerative disorders, and schizophrenia; prostate cancer, hematologic malignancies, lung cancer, and bladder cancer; thrombosis, diabetes and macular degeneration; and pulmonary arterial hypertension. This segment serves retailers, wholesalers, distributors, hospitals, and healthcare professionals directly for prescription use. Its MedTech segment provides electrophysiology products to treat cardiovascular diseases; neurovascular care products to treat hemorrhagic and ischemic stroke; orthopaedics products in support of hips, knees, trauma, spine, sports, and other; advanced and general surgery solutions that focus on breast aesthetics, ear, nose, and throat procedures; and disposable contact lenses and ophthalmic products related to cataract and laser refractive surgery under the ACUVUE brand. This segment serves wholesalers, hospitals, and retailers. The company was founded in 1886 and is based in New Brunswick, New Jersey.

More news about Johnson & Johnson.

28. Booking Holdings (BKNG)

Shares of Booking Holdings jumped by a staggering 13.9% in from $1833.5 to $2,088.36 at 18:21 EST on Friday, following the last session’s downward trend. NASDAQ is dropping 0.18% to $11,461.50, after two consecutive sessions in a row of gains.

Booking Holdings Inc. provides travel and restaurant online reservation and related services worldwide. The company operates Booking.com, which offers online accommodation reservations; Rentalcars.com that provides online rental car reservation services; Priceline, which offer online travel reservation services, and consumers hotel, flight, and rental car reservation services, as well as vacation packages, cruises, and hotel distribution services. It also operates Agoda that provides online accommodation reservation services, as well as flight, ground transportation and activities reservation services. In addition, the company operates KAYAK, an online price comparison service that allows consumers to search and compare travel itineraries and prices, comprising airline ticket, accommodation reservation, and rental car reservation information; and OpenTable for booking online restaurant reservations. Further, it offers travel-related insurance products, and restaurant management services to consumers, travel service providers, and restaurants. The company was formerly known as The Priceline Group Inc. and changed its name to Booking Holdings Inc. in February 2018. The company was founded in 1997 and is headquartered in Norwalk, Connecticut.

Sales Growth

Booking Holdings’s sales growth is 37.7% for the ongoing quarter and 31.1% for the next.

Moving Average

Booking Holdings’s worth is way higher than its 50-day moving average of $1,815.74 and above its 200-day moving average of $2,026.93.

Growth Estimates Quarters

The company’s growth estimates for the ongoing quarter and the next is 32.3% and 48.3%, respectively.

More news about Booking Holdings.