VIANEWS – The Innrs algorithm for artificial intelligence suggests that there is a good chance of discovering tomorrow’s approximate price of SK Telecom SKM and Rogers Communication RCI.

Via News regularly facts-checks this AI algorithm, which aims to predict the session prices and trend for financial assets over time.

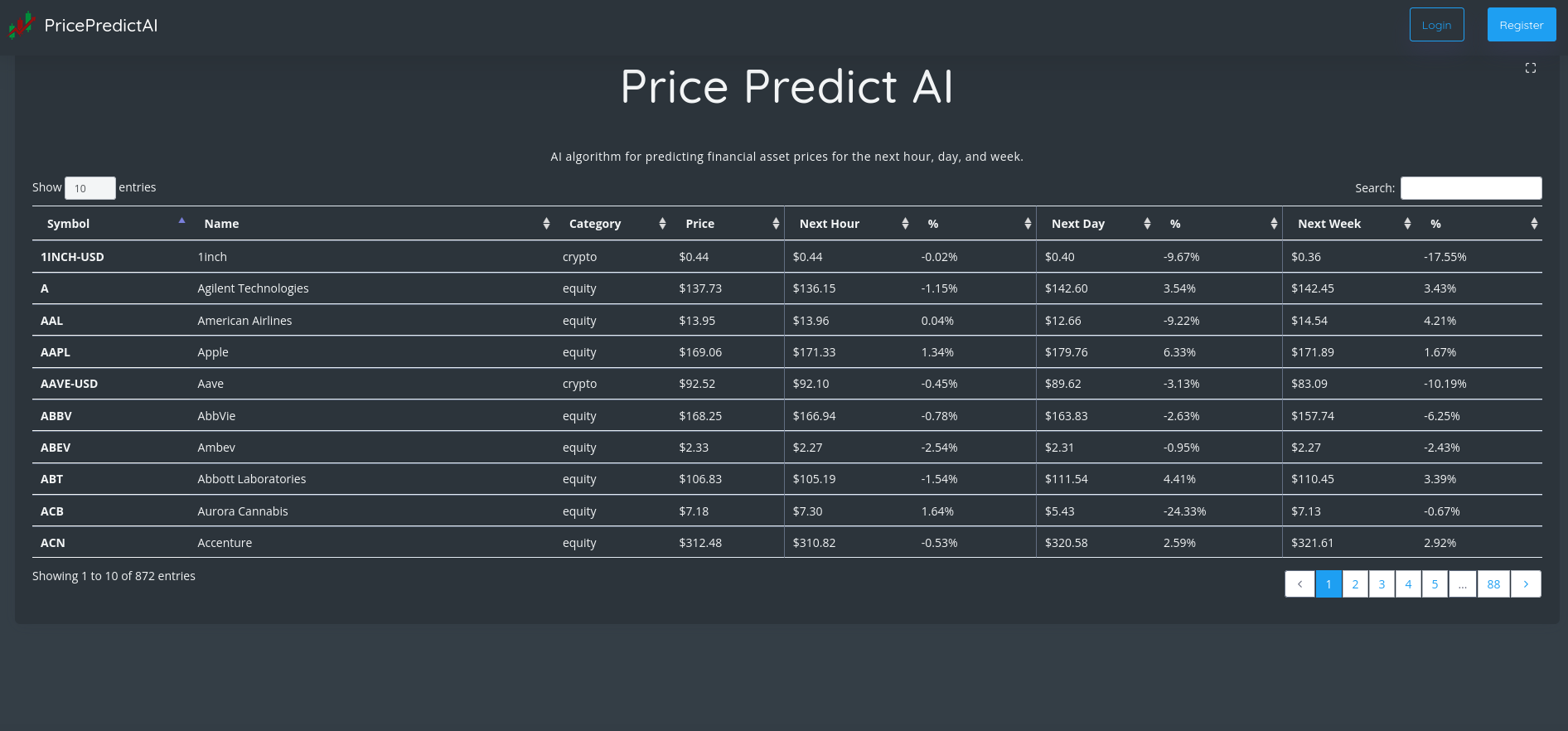

Innrs offers A.I.-based statistics tools that can be used to assist investors in making decisions. Below is a table that lists the most accurate financial assets for predicting prices, sorted by their highest predicted accuracy.

Officials at Innrs claim that this tool assists investors in making better-informed financial decisions. It is alleged to be used along with other pertinent financial information, and according to the trader strategy.

Via News will present the results of the algorithm precision in the next session.

| Financial Asset | Accuracy | Close Price | Prediction |

|---|---|---|---|

| SK Telecom (SKM) | 99.14% | $20.59 | ⇧ $20.68 |

| Rogers Communication (RCI) | 93.76% | $46.84 | ⇧ $47.59 |

| JP Morgan Chase (JPM) | 93.33% | $134.1 | ⇧ $137.73 |

| Charles Schwab (SCHW) | 93.22% | $83.26 | ⇧ $85.23 |

| Boston Scientific (BSX) | 89.66% | $46.27 | ⇧ $46.92 |

| AT&T (T) | 89.42% | $18.41 | ⇧ $18.47 |

| Box (BOX) | 89.38% | $31.13 | ⇧ $31.22 |

| Tyson Foods (TSN) | 89.24% | $62.25 | ⇧ $63.17 |

| LyondellBasell (LYB) | 89.21% | $83.03 | ⇧ $83.6 |

| Verizon (VZ) | 89.15% | $39.4 | ⇧ $39.98 |

| Dropbox (DBX) | 89.09% | $22.38 | ⇧ $22.55 |

| Cognizant Technology Solutions (CTSH) | 89.08% | $57.19 | ⇧ $57.99 |

| Novartis AG (NVS) | 89.03% | $90.72 | ⇧ $91.78 |

| Capital One Financial (COF) | 89.03% | $92.96 | ⇧ $93.49 |

| Bank of America (BAC) | 88.99% | $33.12 | ⇧ $33.7 |

| MGM Resorts (MGM) | 88.96% | $33.53 | ⇧ $33.94 |

| Chunghwa Telecom Co. (CHT) | 88.82% | $36.59 | ⇧ $37.18 |

| VALE (VALE) | 88.73% | $16.97 | ⇧ $17.4 |

| Mettler (MTD) | 88.63% | $1445.45 | ⇧ $1505.26 |

| NewMarket (NEU) | 88.54% | $311.11 | ⇧ $320.03 |

| Booking Holdings (BKNG) | 88.53% | $2015.28 | ⇧ $2062.83 |

| Duke Energy (DUK) | 88.44% | $102.99 | ⇧ $105.21 |

| Exelon (EXC) | 88.42% | $43.23 | ⇧ $44.45 |

| Rio Tinto (RIO) | 88.3% | $71.2 | ⇧ $73.21 |

1. SK Telecom (SKM)

Shares of SK Telecom dropped 3.73% in from $21.44 to $20.64 at 18:21 EST on Tuesday, after five consecutive sessions in a row of losses. NYSE is falling 0.2% to $15,154.45, following the last session’s downward trend.

SK Telecom Co., Ltd. offers wireless telecommunications services in South Korea. Cellular Services, Fixed-Line Telecommunications Services and Other Businesses are the three main segments of the company. Cellular Services offers voice and data wireless transmissions, Internet of Things solutions platform cloud smart factory solutions subscription, metaverse platform-based service and also sells wireless devices. Fixed-Line Telecommunications Services provides fixed-line phone services and broadband Internet services. It also offers media platform services such as cable TV, Internet protocol TV, and business communication services. In addition to portal and television shopping, the Other Businesses segment provides services for other businesses under T-commerce. It also provides services such as call center management and base station maintenance, information gathering, consulting, software supply and development, digital contents sourcing, quant information and communications, content and mastering sound albums sales, product manufacturing and sale, and trading in anti-theft devices and surveillance equipment. The company has 3.6 million subscribers to fixed lines and 31.9million wireless subscribers as of December 31, 2021. SK Telecom Company Limited, based in Seoul in South Korea was founded in 1984.

More news about SK Telecom.

2. Rogers Communication (RCI)

Shares of Rogers Communication jumped 0.9% in from $46.5 to $46.92 at 18:21 EST on Tuesday, after four sequential sessions in a row of gains. NYSE is dropping 0.2% to $15,154.45, following the last session’s downward trend.

Rogers Communications Inc. is a Canadian communications and media company. The company operates in three areas: Wireless, Cable, and Media. It offers wireless Internet access, voice and enhanced voice, accessory and device financing, mobile Internet, wired voice and wireless voice, home phone and device protection, wireless device, personal and business wireless solutions. The company also offers Internet and WiFi services and smart home monitoring services. These include monitoring, security and automation as well as energy efficiency and smart control via a smartphone application. The company also offers on-demand and local TV, cloud-based digital video recorders, voice-activated remote control, and integrated apps, personal video recorders, linear and time-shifted programming, digital specialty channels, 4K TV programming, and televised content for smartphones, tablets, or personal computers. It also operates Ignite TV, Ignite TV App, and Ignite TV. It also offers residential and small-business local telephony services. It also holds the Toronto Blue Jays team and Rogers Centre venue. The company operates Sportsnet ONE and Sportsnet 360 television networks. OLN radio stations, 55 AM and FM radio stations, and Sportsnet 360. It was established in Canada in 1960.

More news about Rogers Communication.

3. JP Morgan Chase (JPM)

Shares of JP Morgan Chase rose 2.74% in from $131.49 to $135.09 at 18:21 EST on Tuesday, after five consecutive sessions in a row of gains. NYSE is falling 0.2% to $15,154.45, following the last session’s downward trend.

JPMorgan Chase & Co. is a global financial services firm. There are four main segments to it: Consumer & Community Banking, Corporate & Investment Banks (CIB), Commercial Banking and Asset & Wealth Management. The CCB section offers a variety of deposit, investment, lending and payments products and services. It also lends, deposits, and cash management solutions and payment solutions for small businesses. Mortgage origination and servicing activities, residential mortgages, home equity loans, credit cards, auto loans, and leasing services. The CIB segment offers investment banking services including strategy and structure advice, equity and debt market capital-raising, loan origination, syndication, payments, cross-border financing, cash and derivatives, risk management, prime brokerage and research. The segment offers services such as custody, fund accounting, administration and securities lending products to asset managers, insurers, public and private funds, as well as securities management solutions. CB provides financial services, such as lending, payments and investment banking. It also offers asset management for small and medium-sized businesses, government agencies, nonprofit clients, and commercial real property banking services to developers and investors. AWM offers multi-asset solutions for institutional investors and clients with fixed income and alternative investments. It also provides retirement products and services such as brokerage, custody and trusts. It also offers ATM, mobile and phone banking services. JPMorgan Chase & Co. is a New York-based company that was established in 1799.

Annual Top and Bottom Value

JP Morgan Chase stock was valued at $135.09 as of 18:22 EST. This is way lower than the 52-week high $169.81, and much higher than the 52-week low $101.28.

More news about JP Morgan Chase.

4. Charles Schwab (SCHW)

Shares of Charles Schwab jumped 1.43% in from $80.84 to $82.00 at 18:21 EST on Tuesday, after five consecutive sessions in a row of gains. NYSE is dropping 0.2% to $15,154.45, following the last session’s downward trend.

Charles Schwab Corporation and its affiliates provide wealth management, brokerage, banking services, custody services, financial advice, and asset management. There are two main segments to the company: Advisor Services and Investor Services. Investor Services provides brokerage, investment advisory and banking and trust services. It also offers full-service recordkeeping to equity compensation plan sponsors for stock options, restricted stock and performance shares. The segment also includes retail investor services and clearing services. Advisor Services offers support, custodial and trading services, as well as retirement and business services. The segment offers brokerage accounts that include equity, fixed income, margin lending and options. It also provides cash management capabilities, including third-party certificates, proprietary mutual funds, mutual fund trading, clearing services, mutual fund trading, and ETF trading. You can also get advice from this segment, including managed portfolios of third-party and proprietary mutual funds, ETFs and separately managed accounts. This includes personalized advice to tailor portfolios and specialized planning. This segment also offers banking products and services such as checking and savings, home equity loans and mortgages, pledged assets lines, and trust services that include trust custody, trust reporting, trust trustee, and personal trust reporting. The Company has approximately 400 branches in the 48 US states, District of Columbia and Hong Kong. Charles Schwab Corporation was established in 1971. Its headquarters are in Westlake Texas.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Charles Schwab’s stock is considered to be oversold (<=20).

Annual Top and Bottom Value

Charles Schwab stock was valued at $82.00 as of 18:22 EST. This is way lower than the 52-week high at $96.24 but much higher than its 52 week low at $59.35.

Moving Average

Charles Schwab’s worth is higher than its 50-day moving average of $77.12 and way higher than its 200-day moving average of $72.96.

Sales Growth

Charles Schwab saw a 17.5% increase in sales for the current quarter, and an 18.1% rise for the next.

More news about Charles Schwab.

5. Boston Scientific (BSX)

Shares of Boston Scientific jumped 1.14% in from $45.44 to $45.96 at 18:21 EST on Tuesday, following the last session’s downward trend. NYSE is dropping 0.2% to $15,154.45, following the last session’s downward trend.

Boston Scientific Corporation designs, produces, and markets medical products for various medical specialty areas. The company operates in three distinct segments, MedSurg (Rhythm and Neuro), Cardiovascular, and Cardiovascular. It offers products to diagnose and treat digestive and pulmonary problems; various urological, pelvic and other conditions; an implantable cardioverter; an implantable cardiac defibrillator; pacemakers; and remote patient monitoring systems. The company also offers medical technology to treat rhythm and rate disorders in the heart. This includes 3-D cardiac mapping, navigation solutions, ablation, diagnostic catheters and mapping catheters. Delivery sheaths and other accessories. It also sells spinal cord stimulator systems that manage chronic pain. Indirect decompression systems and deep brain stimulation. The company also offers interventions in cardiology, such as drug-eluting cardiac stents for the treatment of coronary heart disease, percutaneous coronary intervention products to treat atherosclerosis, intravascular catheter directed ultrasound imaging catheters and fractional flow reserve devices. It also provides structural heart therapies. It also offers stents and balloon catheters as well as wires and atherectomy system to treat arterial disease. Marlborough is the headquarters of this company, which was founded in 1979.

Growth Estimates Quarters

For the current quarter, the company expects to grow by 4.4% and 12.8% respectively.

Moving Average

Boston Scientific is worth more than its $50-day moving mean of $44.07, and much higher than its $200-day moving median of $41.51.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Boston Scientific’s stock is considered to be oversold (<=20).

More news about Boston Scientific.

6. AT&T (T)

Shares of AT&T jumped 0.27% in from $18.73 to $18.78 at 18:21 EST on Tuesday, after two sequential sessions in a row of losses. NYSE is sliding 0.2% to $15,154.45, following the last session’s downward trend.

AT&T Inc. offers telecommunications and media services around the world. The Communications segment provides wireless voice and data communication services. It also sells wireless devices and accessories through third-party retailers, agent stores and company stores. The company also offers managed and professional services and data, voice and security solutions. This segment also offers voice communications services via legacy telephony and broadband fiber to residential customers. The company markets its communication services and products under AT&T’s Cricket, AT&T PREPAID and AT&T Fiber brands. Latin America is the company’s segment that provides services for wireless in Mexico and video in Latin America. The Unefon and AT&T brands are used to market the services and products of this segment. In 2005, the company changed its name from SBC Communications Inc. to AT&T Inc. AT&T Inc. was founded in 1983. It is located in Dallas, Texas.

Moving Average

AT&T’s value is above its 50-day moving average of $18.00 and higher than its 200-day moving average of $18.59.

More news about AT&T.

7. Box (BOX)

Shares of Box rose by a staggering 11.09% in from $28.22 to $31.35 at 18:21 EST on Tuesday, after two successive sessions in a row of losses. NYSE is dropping 0.2% to $15,154.45, following the last session’s downward trend.

Box, Inc. offers a cloud-based content management platform which allows organizations of all sizes to share and manage their content anywhere, on any device. The company’s Software-as-a-Service platform enables users to collaborate on content internally and with external parties, automate content-driven business processes, develop custom applications, and implement data protection, security, and compliance features to comply with legal and regulatory requirements, internal policies, and industry standards and regulations. The company offers cloud content management software for desktop, mobile and web. It also provides a platform to develop custom apps, industry-specific capabilities, and other services. The company was home to approximately 100,000 organizations and offered its solutions in 25 languages as of the 31st January 2022. The company serves the legal, financial, and health services sectors in America and abroad. Box.net, Inc. was the company’s previous name. Box, Inc. changed its name in November 2011 to Box, Inc. Box, Inc. was founded in 2005. It is located in San Francisco Bay Area, California.

More news about Box.

8. Tyson Foods (TSN)

Shares of Tyson Foods slid 1.87% in from $64.77 to $63.56 at 18:21 EST on Tuesday, after four sequential sessions in a row of gains. NYSE is dropping 0.2% to $15,154.45, following the last session’s downward trend.

Tyson Foods, Inc., along with its affiliates, is a global food company. The company operates in four main segments, including Beef, Chicken and Pork. It processes live-fed cattle as well as live market hogs. The company also makes prepared meats from pork and beef carcasses, including prime and sub-primal cuts. The company also produces and markets refrigerated and frozen food products. These include ready-to-eat sandwiches and flame-grilled steaks as well as Philly steaks. Tyson and Ibp also offer their products. The company sells products to supermarket retailers, wholesalers of meat, warehouse clubs stores, military commissaries and industrial food processing firms. It also has a sales team that serves chain restaurants, their distributors and live markets. Domestic distributors are those who supply restaurants, food service operation, foodservice operations such as convenience stores, schools, hospitals and plant cafeterias. It was established in 1935 in Springdale, Arkansas.

Revenue Growth

Year-on-year quarterly revenue growth grew by 16.1%, now sitting on 51.34B for the twelve trailing months.

More news about Tyson Foods.

9. LyondellBasell (LYB)

Shares of LyondellBasell jumped 0.43% in from $83.48 to $83.84 at 18:21 EST on Tuesday, after two consecutive sessions in a row of gains. NYSE is dropping 0.2% to $15,154.45, following the last session’s downward trend.

LyondellBasell Industries N.V. is a chemical company that operates in the United States of America, Mexico, Italy Poland, France and Japan. It also has operations internationally. The company operates in six segments: Olefins and Polyolefins–Americas; Olefins and Polyolefins–Europe, Asia, International; Intermediates and Derivatives; Advanced Polymer Solutions; Refining; and Technology. The company produces and markets co-products, olefins, polyolefins, polyethylene products. These include high, medium, and low density polyethylenes, as well as linear, low density polyethylenes. It also makes polypropylene products such as copolymers and homopolymers. It also manufactures and markets propylene oxide, its derivatives, oxyfuels, and related products. The intermediate chemicals include styrene monomers and copolymers as well as acetyls and ethylene glycols. It also produces and markets solutions such as engineered plastics and masterbatches; engineered composites and colors; advanced polymers and other compounds. The company also refines crude oil from different sources to make gasoline, distillates and chemicals. It develops and licenses process technology for chemical and polyolefins; manufactures and markets polyolefin catalysts. LyondellBasell Industries N.V., which was established in 2009 is located in Houston.

Volatility

LyondellBasell last week’s and last month’s intraday variations averages were negative 0.299% and positive 0.03% respectively. They also had a positive 1.65%.

LyondellBasell had the highest average volatility amplitude at 1.05%, 1.15% and 1.65% for last week.

Moving Average

LyondellBasell is worth more than its moving average over 50 days of $82.34 or its moving average over 200 days of $91.28.

More news about LyondellBasell.

10. Verizon (VZ)

Shares of Verizon jumped 7.94% in from $37.15 to $40.10 at 18:21 EST on Tuesday, after four consecutive sessions in a row of gains. NYSE is dropping 0.2% to $15,154.45, following the last session’s downward trend.

Verizon Communications Inc., through its subsidiaries, offers communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide. Its Consumer segment provides postpaid and prepaid service plans; internet access on notebook computers and tablets; wireless equipment, including smartphones and other handsets; and wireless-enabled internet devices, such as tablets, and other wireless-enabled connected devices comprising smart watches. It also provides residential fixed connectivity solutions, such as internet, video, and voice services; and sells network access to mobile virtual network operators. As of December 31, 2021, it had approximately 115 million wireless retail connections, 7 million wireline broadband connections, and 4 million Fios video connections. The company's Business segment provides network connectivity products, including private networking, private cloud connectivity, virtual and software defined networking, and internet access services; and internet protocol-based voice and video services, unified communications and collaboration tools, and customer contact center solutions. This segment also offers a suite of management and data security services; domestic and global voice and data solutions, such as voice calling, messaging services, conferencing, contact center solutions, and private line and data access networks; customer premises equipment; installation, maintenance, and site services; and Internet of Things products and services. As of December 31, 2021, it had approximately 27 million wireless retail postpaid connections and 477 thousand wireline broadband connections. The company was formerly known as Bell Atlantic Corporation and changed its name to Verizon Communications Inc. in June 2000. Verizon Communications Inc. was incorporated in 1983 and is headquartered in New York, New York.

Sales Growth

Verizon’s sales growth is 3.2% for the ongoing quarter and 2.4% for the next.

Yearly Top and Bottom Value

Verizon’s stock is valued at $40.10 at 18:22 EST, way below its 52-week high of $55.51 and higher than its 52-week low of $39.11.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

Verizon’s stock is considered to be oversold (<=20).

Revenue Growth

Year-on-year quarterly revenue growth grew by 0.1%, now sitting on 134.33B for the twelve trailing months.

More news about Verizon.

11. Dropbox (DBX)

Shares of Dropbox jumped 1.11% in from $22.44 to $22.69 at 18:21 EST on Tuesday, after two consecutive sessions in a row of gains. NASDAQ is dropping 0.76% to $10,386.98, following the last session’s downward trend.

Dropbox, Inc. offers a global content collaboration platform. The platform allows people, families, groups, and organisations to work together. Users can sign up free of charge through the app or website, and then upgrade to premium features with a subscription. The company has approximately 700 million users as of December 31, 2021. The company serves clients in media, tech, education, professional services and technology. The former name of the company was Evenflow, Inc., but it changed its name in October 2009 to Dropbox, Inc. Dropbox, Inc. was founded in 2007, and has its headquarters in San Francisco, California.

Volatility

Dropbox’s intraday variation average for the week and quarter ended last week was positive by 0.26% and negative by 0.22% respectively.

Dropbox had the highest average volatility amplitude at 0.98%, 1.53% and 1.63% respectively (last week, last month, and last quarter).

Revenue growth

The year-on-year revenue growth was 7.9%. It now stands at 2.25B in the 12 trailing months.

Annual Top and Bottom Value

Dropbox stock was valued at $22.69 as of 18:23 EST at 18.23 EST. This is way lower than the 52-week high at $25.81, and much higher than its 52 week low at $19.07.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Dropbox stock considered oversold (=20).

More news about Dropbox.

12. Cognizant Technology Solutions (CTSH)

Shares of Cognizant Technology Solutions slid 5.05% in from $60.52 to $57.46 at 18:21 EST on Tuesday, after two successive sessions in a row of gains. NASDAQ is falling 0.76% to $10,386.98, following the last session’s downward trend.

Cognizant Technology Solutions Corporation, a professional services company, provides consulting and technology, and outsourcing services in North America, Europe, and internationally. It operates through four segments: Financial Services; Healthcare; Products and Resources; and Communications, Media and Technology. The company offers customer experience enhancement, robotic process automation, analytics, and AI services in areas, such as digital lending, fraud detection, and next generation payments; the shift towards consumerism, outcome-based contracting, digital health, delivering integrated seamless, omni-channel, and patient-centered experience; and services that drive operational improvements in areas, such as clinical development, pharmacovigilance, and manufacturing, as well as claims processing, enrollment, membership, and billing to healthcare providers and payers, and life sciences companies, including pharmaceutical, biotech, and medical device companies. It also provides solution to manufacturers, retailers and travel and hospitality companies, as well as companies providing logistics, energy and utility services; and digital content, the creation of personalized user experience, and acceleration of digital engineering services to information, media and entertainment, and communications and technology companies. The company was founded in 1994 and is headquartered in Teaneck, New Jersey.

Volatility

The last week’s and quarter’s intraday variations averages for Cognizant Technology Solutions were positive 0.43% and negative 0.46% respectively.

Cognizant Technology Solutions had the highest average volatility amplitudes of 1.51%, 1.24% and 1.68% in last week.

Yearly Top and Bottom Value

Cognizant Technology Solutions’s stock is valued at $57.46 at 18:23 EST, way below its 52-week high of $93.47 and way higher than its 52-week low of $51.33.

Revenue Growth

Year-on-year quarterly revenue growth grew by 2.4%, now sitting on 19.37B for the twelve trailing months.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Cognizant Technology Solutions stock is oversold (=20).

More news about Cognizant Technology Solutions.

13. Novartis AG (NVS)

Shares of Novartis AG jumped 1.54% in from $90.86 to $92.26 at 18:21 EST on Tuesday, after two successive sessions in a row of losses. NYSE is sliding 0.2% to $15,154.45, following the last session’s downward trend.

Novartis AG develops and manufactures healthcare products around the world. Two segments of the company are Innovative Medicines (Sandoz) and Healthcare Products. Innovative Medicines offers prescription medications for both patients and health care providers. The company also offers ophthalmology and neuroscience as well as immunology, dermatology, neurology, immunology, hepatology and metabolic medicine products. Sandoz produces, markets, and manufactures finished dosage form medications; active ingredients, as well as finished dosage forms, of small-molecule pharmaceuticals for third parties. It also sells generics and antiinfectives. The company also supplies active pharmaceutical ingredients, intermediates, primarily antibiotics, protein- and other biotechnology-based product and services. Novartis AG holds a collaboration and license agreement with Alnylam Pharmaceuticals for the development, manufacturing, and marketing of inclisiran. Kura Oncology, Inc. has been contracted to conduct clinical trials to assess the combined effect of Tipifarnib/Alpelisib on patients suffering from head and neck carcinoma. Basel is the headquarters of this company, which was founded in 1996.

Moving Average

Novartis AG’s value is above its 50-day moving average of $85.11 and higher than its 200-day moving average of $84.88.

Annual Top and Bottom Value

Novartis AG stock was valued at $92.26 as of 18:23 EST. This is below the 52-week high at $94.26, and much higher than the 52-week low at $74.09.

More news about Novartis AG.

14. Capital One Financial (COF)

Shares of Capital One Financial fell 1.86% in from $94.8 to $93.04 at 18:21 EST on Tuesday, after two consecutive sessions in a row of gains. NYSE is sliding 0.2% to $15,154.45, following the last session’s downward trend.

Capital One Financial Corporation is the financial holding company of Capital One Bank (USA), National Association and Capital One National Association. This bank provides a variety of financial products and services throughout the United States and Canada. The company operates in three distinct segments, Credit Card, Consumer Banking and Commercial Banking. Checking accounts, money market deposits and negotiable orders of withdrawals are all accepted. The company offers credit cards, auto and retail bank loans; commercial and multifamily real property loans and commercial- and industrial loans. It also provides credit and debit cards, online banking services and treasury and depository management services. The company serves small and large businesses as well as consumers through branches, cafes and digital channels. It also has other distribution channels in New York and California. Capital One Financial Corporation was established in 1988. It is located in McLean in Virginia.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Capital One Financial stock is oversold (=20).

More news about Capital One Financial.

15. Bank of America (BAC)

Shares of Bank of America slid 2.51% in from $34.37 to $33.51 at 18:21 EST on Tuesday, following the last session’s downward trend. NYSE is sliding 0.2% to $15,154.45, following the last session’s downward trend.

Through its subsidiaries, Bank of America Corporation provides financial services and banking products for individuals, small- and medium-sized businesses, institutions investors, governments, large corporations and government worldwide. The bank’s Consumer Banking segment provides traditional and money-market savings accounts as well as certificates of deposit, IRAs and noninterest-and-interest bearing checking accounts. It also offers investment accounts and products, credit and debit cards and residential mortgages. Global Wealth & Investment Management offers investment management and brokerage services, trust, retirement and banking products, wealth management and solutions as well as custom solutions including special asset management. The company’s Global Banking segment offers lending products and services including loans and leases as well as commitment and trade facilities for commercial and real estate. It also provides treasury services such as foreign exchange management and working capital management. Global Markets offers services such as market-making and settlement. It served approximately 67,000,000 consumer and small-business clients, with nearly 4,200 retail financial centres; 16,000 ATMs; as well as digital banking platforms that have approximately 41 million users. It was established in Charlotte, North Carolina in 1784.

Volatility

Bank of America’s last week, last month’s, and last quarter’s current intraday variation average was a positive 0.60%, a negative 0.46%, and a positive 1.47%.

Bank of America’s highest amplitude of average volatility was 0.64% (last week), 1.15% (last month), and 1.47% (last quarter).

Revenue Growth

Year-on-year quarterly revenue growth grew by 0.9%, now sitting on 91.52B for the twelve trailing months.

More news about Bank of America.

16. MGM Resorts (MGM)

Shares of MGM Resorts fell by a staggering 13.17% in from $38.39 to $33.33 at 18:21 EST on Tuesday, after two successive sessions in a row of gains. NYSE is falling 0.2% to $15,154.45, following the last session’s downward trend.

MGM Resorts International owns and manages casino, hotel and entertainment resorts throughout the United States. It operates in three segments, Las Vegas Strip Resorts Resorts, Regional Operations and MGM China. The company’s casinos resorts provide gaming, restaurant, conference, dining and entertainment as well as retail. Its casino operations offer table and slot games as well as online betting through BetMGM and iGaming. Its portfolio included 29 destination and hotel gaming options as of February 17th, 2021. It also operates Las Vegas Strip Resorts, Fallen Oak Golf Course and Las Vegas Strip Resorts. The company’s clients include leisure and wholesale travelers, premium gamers, business travellers, small meeting planners and groups. MGM Resorts International was previously known as MGM MIRAGE. It changed its name in June 2010 to MGM Resorts International. MGM Resorts International, a Nevada-based company was founded in 1986.

Annual Top and Bottom Value

MGM Resorts’ stock was valued at $33.33 as of 18:23 EST. This is way below its 52-week peak of $49.00, and far above its 52 week low of $26.41.

Revenue Growth

Year-on-year quarterly revenue growth grew by 48.4%, now sitting on 11.77B for the twelve trailing months.

Sales Growth

MGM Resorts saw a 30.7% increase in sales for its current quarter, and 6.7% the following.

Moving Average

MGM Resorts is worth less than its moving average for 50 days of $35.24, and lower than its moving average for 200 days of $34.90.

More news about MGM Resorts.

17. Chunghwa Telecom Co. (CHT)

Shares of Chunghwa Telecom Co. rose 2.11% in from $36.54 to $37.31 at 18:21 EST on Tuesday, after two sequential sessions in a row of losses. NYSE is sliding 0.2% to $15,154.45, following the last session’s downward trend.

Together with its subsidiaries, Chunghwa Telecom Co., Ltd. provides telecom services both in Taiwanese and international. The company operates in the following segments: Domestic Fixed Communications Business; Mobile Communications Business; Internet Business; International Fixed Communications Business; and Other. It offers long distance telephone services, including broadband access and local calls, as well as information and technology services and VAS. The company also provides interconnections with fixed-line networks to connect with other fixed and mobile operators. The company also offers mobile, HiNet Internet, cloud, data communication and Internet data center services, as well as international long-distance and data service. The company also distributes and markets mobile phones, data cards and other electronic products. It designs, develops printed circuit boards and semiconductor components. It also offers property development, property management, system, network and communications integration, intelligent buildings, energy network, digital information supply, and advertisement, property and liability insurance agency, family education, computing equipment installation, management consultancy, data processing, telecommunication engineering, Internet identification, and information and solution services. The company also offers software design and Internet content production and play services. It also provides motion picture production, distribution, energy savings solutions, management consultancy, data processing, telecommunication engineering, international circuits and services for electronic parts or machine processed products. Taipei City is the headquarters of this company, which was founded in 1996.

Yearly Top and Bottom Value

Chunghwa Telecom Co.’s stock is valued at $37.31 at 18:23 EST, way below its 52-week high of $45.87 and way higher than its 52-week low of $32.90.

Moving Average

Chunghwa Telecom Co.’s value is higher than its 50-day moving average of $34.74 and below its 200-day moving average of $39.88.

Revenue Growth

Year-on-year quarterly revenue growth grew by 5.7%, now sitting on 214.51B for the twelve trailing months.

Volatility

Chunghwa Telecom Co. had a negative 0.2%, positive 0.03% and positive 0.81% intraday variation for the week and quarter ended December 31, 2013.

Chunghwa Telecom Co. had the highest average volatility amplitudes of 0.58%, 0.43% and 0.81% respectively (last week, last month, and last quarter).

More news about Chunghwa Telecom Co..

18. VALE (VALE)

Shares of VALE slid 0.61% in from $16.43 to $16.33 at 18:21 EST on Tuesday, after two consecutive sessions in a row of gains. NYSE is sliding 0.2% to $15,154.45, following the last session’s downward trend.

Vale S.A., together with its subsidiaries, produces and sells iron ore and iron ore pellets for use as raw materials in steelmaking in Brazil and internationally. The company operates through Ferrous Minerals and Base Metals segments. The Ferrous Minerals segment produces and extracts iron ore and pellets, manganese, ferroalloys, and other ferrous products; and provides related logistic services. The Base Metals segment produces and extracts nickel and its by-products, such as gold, silver, cobalt, precious metals, and others, as well as copper. The company was formerly known as Companhia Vale do Rio Doce and changed its name to Vale S.A. in May 2009. Vale S.A. was founded in 1942 and is headquartered in Rio de Janeiro, Brazil.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

VALE’s stock is considered to be oversold (<=20).

More news about VALE.

19. Mettler (MTD)

Shares of Mettler rose 0.55% in from $1450.76 to $1,458.74 at 18:21 EST on Tuesday, after two successive sessions in a row of losses. NYSE is dropping 0.2% to $15,154.45, following the last session’s downward trend.

Mettler-Toledo International Inc. is engaged in manufacturing and supplying precision instruments and related services around the world. The company operates five divisions: U.S. Operations and Swiss Operations. It also has Western European Operations, Chinese Operations, Western European Operations and Other. Laboratory instruments of the company include liquid pipetting solutions and laboratory balances. The company’s industrial instruments include industrial weighing equipment and associated terminals, automated dimensional measurement, data capture solutions and vehicle scale systems. It also offers industrial software that can be used to manage and analyze the data generated by its instruments. Retail weighing solutions include networked and standalone scales as well as software and automatic packaging and labeling systems for fresh goods. The company serves life sciences industry, testing laboratories, food manufacturers, food retailers, chemical, specialty chemicals, and cosmetics businesses; as well as the transportation, logistics, metals and electronics industries. It also provides indirect distribution and direct sales to academic communities. It was founded in 1991 in Columbus, Ohio.

Revenue Growth

Year-on-year quarterly revenue growth grew by 5.8%, now sitting on 3.87B for the twelve trailing months.

Sales Growth

Mettler’s sales growth is 5.3% for the present quarter and 1.8% for the next.

Annual Top and Bottom Value

Mettler stock was valued at $1.458.74 as of 18:24 EST. This is way lower than the 52-week high at $1.714.75, and much higher than the 52-week low at $1.065.55.

More news about Mettler.

20. NewMarket (NEU)

Shares of NewMarket rose 1% in from $320.03 to $323.23 at 18:21 EST on Tuesday, after three sequential sessions in a row of gains. NYSE is sliding 0.2% to $15,154.45, following the last session’s downward trend.

Through its subsidiaries, NewMarket Corporation is involved in the business of petroleum additives. It offers various lubricant products that can be used in vehicle and industrial applications. These include transmission fluids and hydraulic system fluids as well as gear oils and hydraulic oils. The company also offers fuel additives which are used in oil refinement and to improve the performance of petrol, diesel, biofuels and other fuels for industry, government and original equipment producers, as well as individual customers. The company also engages in antiknock compound business and contracts manufacturing and service activities. It owns and maintains real estate in Virginia. The company operates across North America, Latin America and the Asia Pacific. It also has operations in Europe, Asia Pacific, Europe Middle East, Africa, India, and Latin America. NewMarket Corporation was established in 1887. It is located in Richmond, Virginia.

Yearly Top and Bottom Value

NewMarket’s stock is valued at $323.23 at 18:24 EST, way under its 52-week high of $360.77 and way higher than its 52-week low of $280.28.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

NewMarket stock considered oversold (=20).

Revenue growth

The year-on-year revenue growth was 11.9%. We now have 2.66B in the 12 trailing months.

More news about NewMarket.

21. Booking Holdings (BKNG)

Shares of Booking Holdings dropped 0.98% in from $2053.27 to $2,033.15 at 18:21 EST on Tuesday, after two consecutive sessions in a row of gains. NASDAQ is falling 0.76% to $10,386.98, following the last session’s downward trend.

Booking Holdings Inc. offers online reservations for travel and restaurants worldwide. Booking.com offers accommodation bookings online; Rentalcars.com provides rental car services online; Priceline which allows customers to make travel reservations online for hotel, flight and rental cars. Agoda, which offers online accommodations reservation, flight, ground transport, and activity reservation services, is also available. KAYAK is an online price comparison site that lets consumers search for and compare prices on travel itineraries. This includes information about rental cars, airline tickets, hotel reservations, and accommodation. OpenTable allows customers to book online restaurants. It also offers insurance and management services for consumers and travel service providers. The original name of the company was The Priceline Group Inc., but it changed its name in February 2018 to Booking Holdings Inc. It was established in 1997. The headquarters are located in Norwalk in Connecticut.

More news about Booking Holdings.

22. Duke Energy (DUK)

Shares of Duke Energy jumped 4.47% in from $99.28 to $103.72 at 18:21 EST on Tuesday, after two sequential sessions in a row of losses. NYSE is falling 0.2% to $15,154.45, following the last session’s downward trend.

Duke Energy Corporation, together with its subsidiaries, operates as an energy company in the United States. It operates through three segments: Electric Utilities and Infrastructure, Gas Utilities and Infrastructure, and Commercial Renewables. The Electric Utilities and Infrastructure segment generates, transmits, distributes, and sells electricity in the Carolinas, Florida, and the Midwest; and uses coal, hydroelectric, natural gas, oil, renewable generation, and nuclear fuel to generate electricity. It also engages in the wholesale of electricity to municipalities, electric cooperative utilities, and load-serving entities. This segment serves approximately 8.2 million customers in 6 states in the Southeast and Midwest regions of the United States covering a service territory of approximately 91,000 square miles; and owns approximately 50,259 megawatts (MW) of generation capacity. The Gas Utilities and Infrastructure segment distributes natural gas to residential, commercial, industrial, and power generation natural gas customers; and owns, operates, and invests in pipeline transmission and natural gas storage facilities. It has approximately 1.6 million customers, including 1.1 million customers in North Carolina, South Carolina, and Tennessee, as well as 550,000 customers in southwestern Ohio and northern Kentucky. The Commercial Renewables segment acquires, owns, develops, builds, and operates wind and solar renewable generation projects, including nonregulated renewable energy and energy storage services to utilities, electric cooperatives, municipalities, and corporate customers. It has 23 wind, 178 solar, and 2 battery storage facilities, as well as 71 fuel cell locations with a capacity of 3,554 MW across 22 states. The company was formerly known as Duke Energy Holding Corp. and changed its name to Duke Energy Corporation in April 2005. The company was founded in 1904 and is headquartered in Charlotte, North Carolina.

Sales Growth

Duke Energy’s sales growth is 6.3% for the current quarter and negative 7.8% for the next.

Moving Average

Duke Energy’s value exceeds its $50-day moving median of $94.99, and is below its $200-day moving mean of $104.82.

Volatility

Duke Energy’s last week, last month’s, and last quarter’s current intraday variation average was a negative 0.22%, a positive 0.18%, and a positive 1.25%.

Duke Energy’s highest amplitude of average volatility was 0.83% (last week), 0.82% (last month), and 1.25% (last quarter).

Yearly Top and Bottom Value

Duke Energy’s stock is valued at $103.72 at 18:24 EST, way below its 52-week high of $116.33 and way above its 52-week low of $83.76.

More news about Duke Energy.

23. Exelon (EXC)

Shares of Exelon jumped 3.35% in from $41.75 to $43.15 at 18:21 EST on Tuesday, after two consecutive sessions in a row of gains. NASDAQ is falling 0.76% to $10,386.98, following the last session’s downward trend.

Exelon Corporation is a holding company for utility services. It engages in energy generation, distribution, and marketing in both the United States of America and Canada. The company owns a variety of facilities, including solar, nuclear, renewable, energy, biofuel, and hydroelectric. It also offers electricity wholesale to retail customers and natural gas and renewable energy as well as other energy-related products, services, and goods. It is also involved in the regulation and purchase of electricity and natural gases; transmission and distribution, as well distribution of natural gas retail customers. The company also offers support services such as legal, human resource, information technology and accounting. The company serves residential, commercial, industrial and governmental customers as well as distribution utilities and cooperatives. Exelon Corporation, which was founded in 1999, is located in Chicago.

Sales Growth

Exelon’s quarterly sales growth was negative 55.9% in the current quarter, and negative 5.3% the following quarter.

Moving Average

Exelon’s value is above its 50-day moving average of $40.01 and under its 200-day moving average of $43.65.

Annual Top and Bottom Value

Exelon stock was valued at $43.15 as of 18:24 EST. This is way lower than the 52-week peak of $50.71, and much higher than its 52 week low of $35.19.

Volatility

Exelon’s last week, last month’s, and last quarter’s current intraday variation average was 0.06%, 0.22%, and 1.48%.

Exelon’s highest amplitude of average volatility was 0.39% (last week), 0.93% (last month), and 1.48% (last quarter).

More news about Exelon.

24. Rio Tinto (RIO)

Shares of Rio Tinto jumped 2.1% in from $69.5 to $70.96 at 18:21 EST on Tuesday, after four successive sessions in a row of gains. NYSE is sliding 0.2% to $15,154.45, following the last session’s downward trend.

Rio Tinto Group is involved in the exploration, mining and processing of mineral resources around the world. It offers an assortment of aluminum, copper and diamonds as well as gold, borates. titanium dioxide, salt. iron ore, lithium, and other metals. The company also has open-pit and underground mines as well as smelters and power stations. It also operates research and service centers. Rio Tinto Group, which was established in 1873, is located in London.

Volatility

Rio Tinto’s last week, last month’s, and last quarter’s current intraday variation average was 0.56%, 0.79%, and 2.20%.

Rio Tinto’s highest amplitude of average volatility was 0.91% (last week), 1.56% (last month), and 2.20% (last quarter).

Yearly Top and Bottom Value

Rio Tinto’s stock is valued at $70.96 at 18:24 EST, way under its 52-week high of $84.69 and way higher than its 52-week low of $50.92.

Moving Average

Rio Tinto is worth more than its $50.49 moving average and its $200 moving average $65.19.

Classification of Stock Prices

The stochastic oscillator is a helpful indicator for overbought or oversold situations.

Rio Tinto stock considered oversold (=20).

More news about Rio Tinto.