(VIANEWS) – A lot could go wrong with Tesla’s (TSLA) fourth quarter earnings call after the markets close on Wednesday. The market seems to be in agreement with TSLA stock down -1.3% in Wednesday’s premarket. This, however, puts it directly in line with NASDAQ futures, which are declining due to meager growth and outlook from Microsoft’s (MSFT) earnings release late Tuesday and Boeing (BA) missing its earnings consensus early Wednesday. Can CEO Elon Musk and Tesla turn this frown around?

As reported by FXStreet, with so much happening at Tesla, and with many a shareholder confused about CEO Elon Musk spending so much time with Twitter these last few months, the takeaways from the Q4 call should be fascinating. The biggest movers of Tesla stock will be guidance for 2023 deliveries and how recent price cuts will affect margins. A large number of predictions have been released of late, but one wonders how Musk’s own prediction of a recession in 2023 will affect this delivery number.

Shares of Tesla (NASDAQ: TSLA) jumped 9.78% to $158.55 at 10:42 EST on Thursday, after four consecutive sessions in a row of gains. NASDAQ is rising 0.74% to $11,396.64, after two consecutive sessions in a row of losses. This seems, up until now, a somewhat bullish trend trading session today.

Tesla’s last close was $144.43, 62.42% under its 52-week high of $384.29.

Tesla stock surges toward best 1-day performance in 6 months

Shares of Tesla Inc. charged up 8.7% in premarket trading toward a six-week high, and the best one-day performance in six months, in the wake of the electric vehicle maker’s has gained 4.9%.

Nio stock forecast: NIO shares jump 5% in premarket on Tesla earnings coattails

During the Tesla earnings call, Elon Musk hyped up Tesla’s competitors in China. , In line with Tesla stock moving 5.5% higher in the premarket, Nio is experiencing renewed exuberance for the EV sector.

Better-than-expected results for Tesla (tsla stock).

The Tesla Inc. stock is today’s instrument and it was traded on the NASDAQ under ticker TSLA.

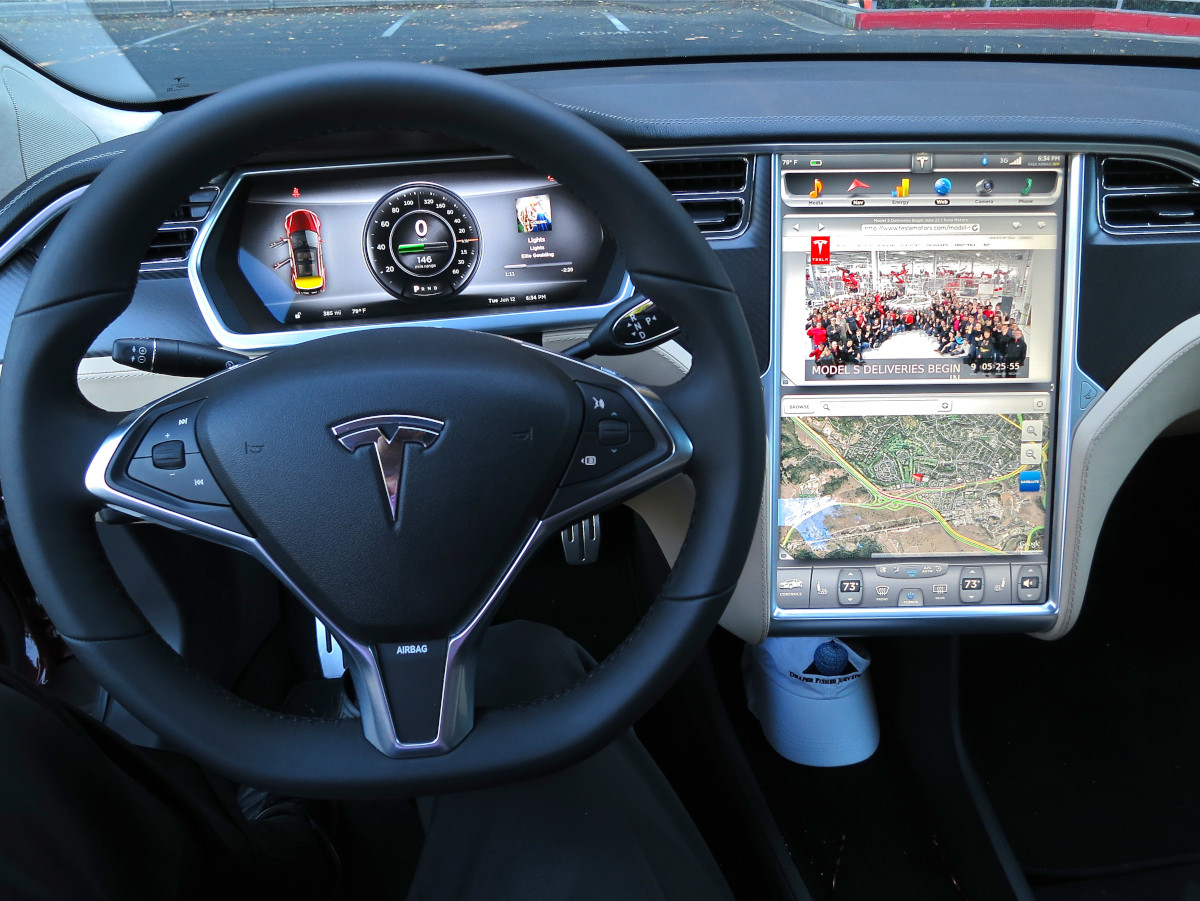

About Tesla

Tesla, Inc. develops, produces, leases, sells, and leases electric cars and other energy storage and generation systems throughout the United States, China, as well as internationally. It operates two divisions: Automotive and Energy Generation and Storage. It offers electric cars and sells regulatory credit. The segment offers sedans and sport-utility vehicles via direct and used vehicle sales. It also has a network Tesla Superchargers that can be upgraded and in-app upgrades. Purchase financing and leasing are other options. The segment also provides non-warranty aftersales services and retail merchandise. It sells products to third parties. Services for electric cars through company-owned service points and Tesla mobile technicians. There are vehicle limited warranties as well as extended service plans. Energy Generation and Storage is involved in design, manufacturing, installation, sales, and lease of solar energy generation and storage products. It also offers related services for residential, commercial and industrial customers and utility companies through its stores and galleries as well as through a number of channel partners. The segment offers repair and service to customers of its energy products, as well as financing options for its customers. The original name of the company was Tesla Motors, Inc., but it changed its name in February 2017 to Tesla, Inc. Tesla, Inc. was founded in 2003. It is located in Austin, Texas.

Earnings Per Share

As for profitability, Tesla has a trailing twelve months EPS of $1.

PE Ratio

Tesla has a trailing twelve months price to earnings ratio of 158.87. Meaning,

the purchaser of the share is investing $158.87 for every dollar of annual earnings.

The company’s return on equity, which measures the profitability of a business relative to shareholder’s equity, for the twelve trailing months is 32.24%.

Growth Estimates Quarters

For the current quarter, the company expects to grow by 47.1% and 20% respectively.

Previous days news about Tesla (TSLA)

- Tesla earnings top estimates; stock wobbles in late trading. According to MarketWatch on Wednesday, 25 January, “The Tesla team is used to challenges,” company executives said in a letter to shareholders. “

- : JPMorgan ‘hates Tesla and me,’ musk says in court. According to MarketWatch on Tuesday, 24 January, “Tesla Inc. TSLA Chief Executive Elon Musk on Tuesday shed more light onto the often-acrimonious dealings between the EV maker and JPMorgan Chase & Co. JPM Musk said in a federal trial over his “funding secured” tweets on Tuesday that the relationship between Tesla and bankers at JP Morgan is “very negative,” and that Musk decided to take away all of Tesla’s commercial-banking business from JP Morgan. “

More news about Tesla (TSLA).