Aside from delaying personal trips and vacations, the sudden halt of global travel during the coronavirus pandemic has had a major impact on companies whose workforces used to travel frequently as well as airlines and hotels that depend heavily on revenue from corporate travel.

At times of uncertainty like now, it is difficult to predict when exactly each industry will return to normal on a global level. McKinsey & Company says the rebound of travel-industry players from the unfolding crisis may take several years.

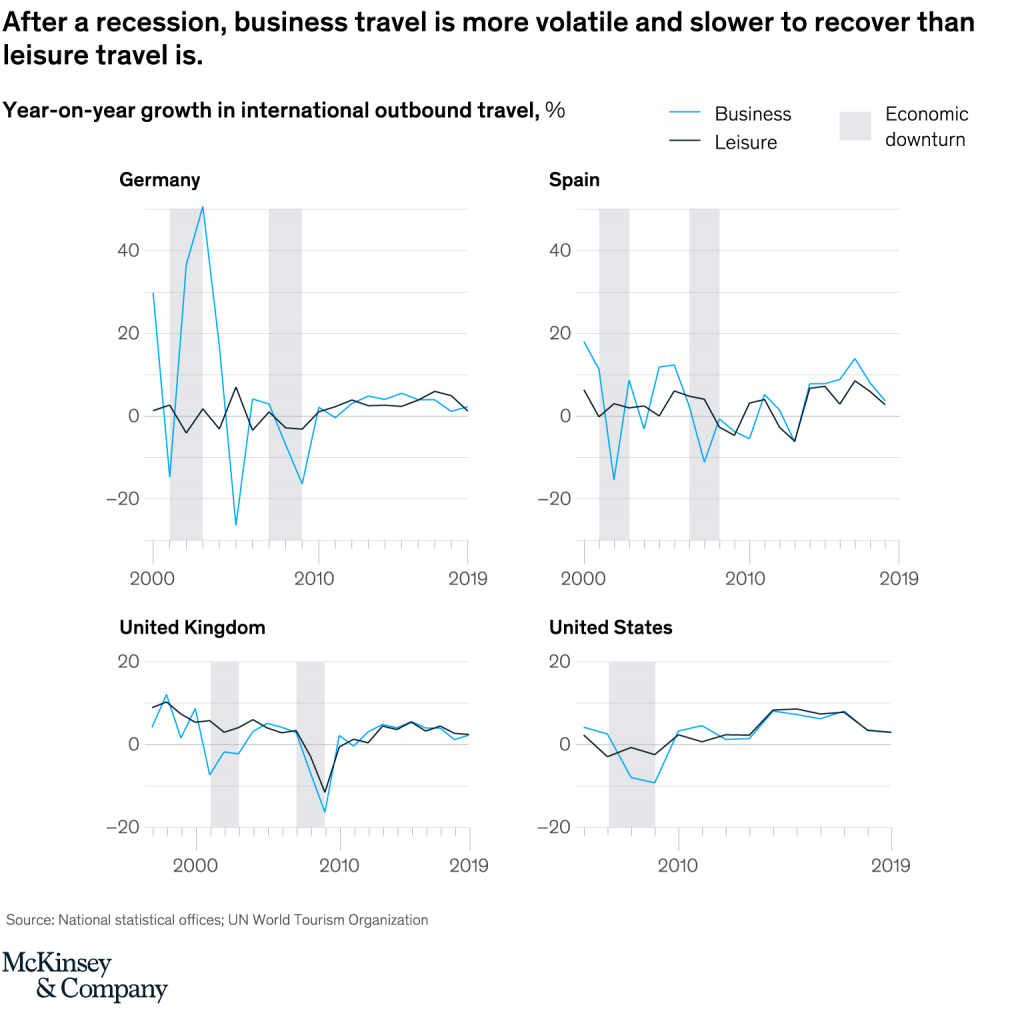

“Historically, business travel has been more volatile and slower to recover than leisure travel after economic downturns and other disruptions to travel patterns,” reads an August report by the global consulting firm.

Read more: What Will Web Summit 2020 Look Like?

It says international business travel from the United States decreased more than 8 percent during the 2008–09 global recession. This is while international leisure travel from the country saw just a 2 percent decline.

“And although international leisure travel fully recovered in just two years, international business travel didn’t fully rebound to pre-recession levels for five years.”

Corporate travel is very significant for airlines and hotels in terms of both traffic and profitability. According to a 2020 report by the World Travel & Tourism Council cited by McKinsey, business-travel spending exceeded $1.4 trillion in 2018 and accounted for 21.4 percent of the global travel and hospitality sector.

“Because corporate travelers are more willing to purchase higher class or refundable fares, they can drive between 55 and 75 percent of profit for top airlines but account for as few as 10 percent of passengers,” the consulting firm noted, quoting analysts interviewed by the New York Times.

McKinsey says China and the U.S. are the two economies where more than half of business travel—which encompasses transient travel and travel for meetings, incentives, conferences, and events (MICE)—is concentrated.

Recovery in Phases

McKinsey’s analysis says U.S. airline capacity declined about 70 percent by April 2020 from that in 2019 as a result of coronavirus-related travel restrictions.

It adds that the decline is around four times greater than seen after the September 11, 2001 attacks and six times greater than the one after the 2008–09 financial crisis.

The findings of the research indicate that companies and their employees will return in phases to the use of airports and hotels.

Global travel managers and directors told McKinsey that they are keeping a close eye on and will make decisions based on local indicators of public health and government regulations, vendors’ health and safety policies, and employees’ willingness to travel.

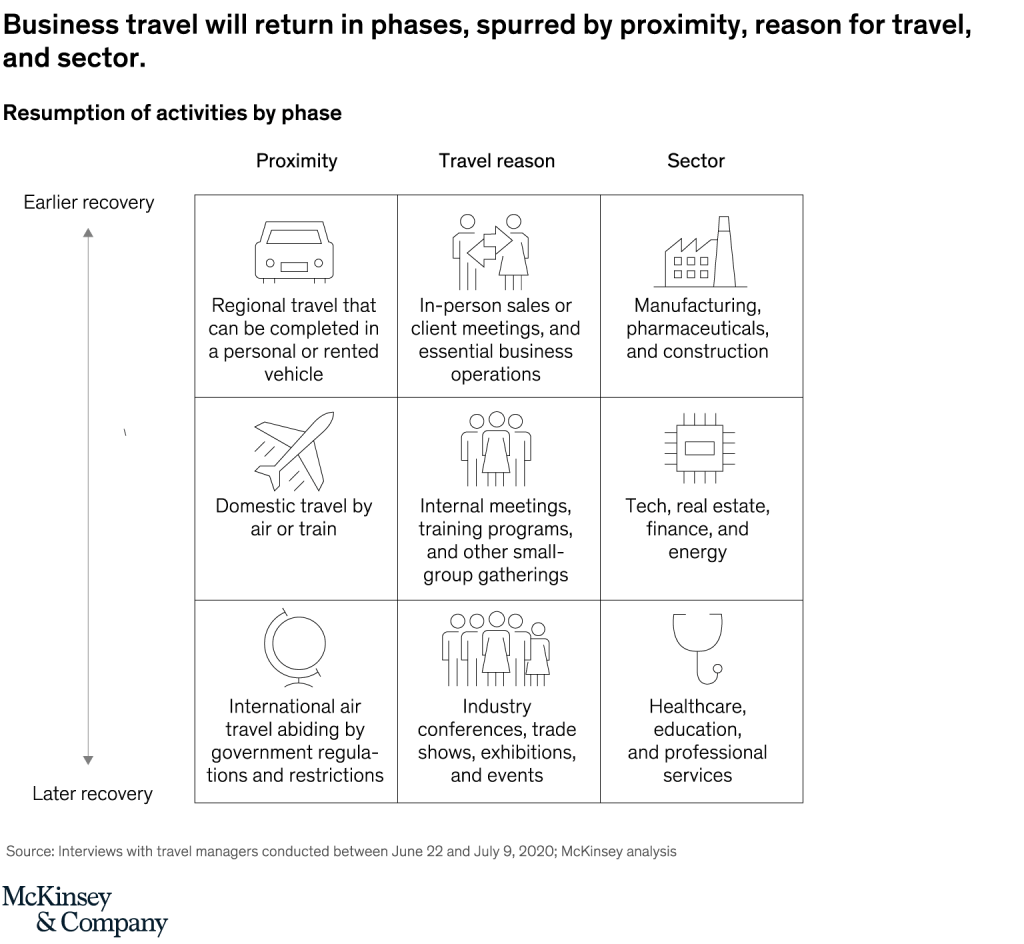

The segments of business travel that are likely to return first are determined by the length and purpose of a trip and the sector in which travelers work, the report said.

“Importantly, even those travel segments likely to return first are on a slow, long timeline for recovery, subject to geographical considerations (such as stabilization of COVID-19 outbreaks and governments’ readiness to open up travel).”

Regional, Domestic Business Travel

According to McKinsey, international travel will take longer than regional and domestic trips to rebound because of the “complexity of government regulations, mandatory quarantines, and the high risk of fast-changing policies”.

Citing a survey by the Global Business Travel Association, the report states that companies are twice as likely to have halted international travel as of July 2020 as have halted domestic travel.

In the area of domestic travel, short regional flights may be replaced by trips that can happen in personal or rental vehicles, it added.

“In Asia, to help facilitate economic development, some governments (such as Malaysia and Singapore) are exploring the creation of business-travel corridors under strict protocols that allow exceptions to quarantine measures.”

In-Person Sales, Client Meetings

Putting aside travel for mission-critical use cases such as supply-chain-related travel, McKinsey’s research forecast that travel for sales and client-related meetings is most likely to be among the first to return as travel restrictions are eased.

“The timeline for travel for internal in-person meetings to resume is longer, with higher levels of scrutiny on what is considered business-critical and can’t be accommodated with technology. Travel to interact with physical assets—data centers and IT infrastructure—will take priority.”

The study also predicts travel for internal MICE and other off-site gatherings will probably return in late 2021 or later and that some travel for internal purposes will be permanently replaced by virtual collaboration and meetings.

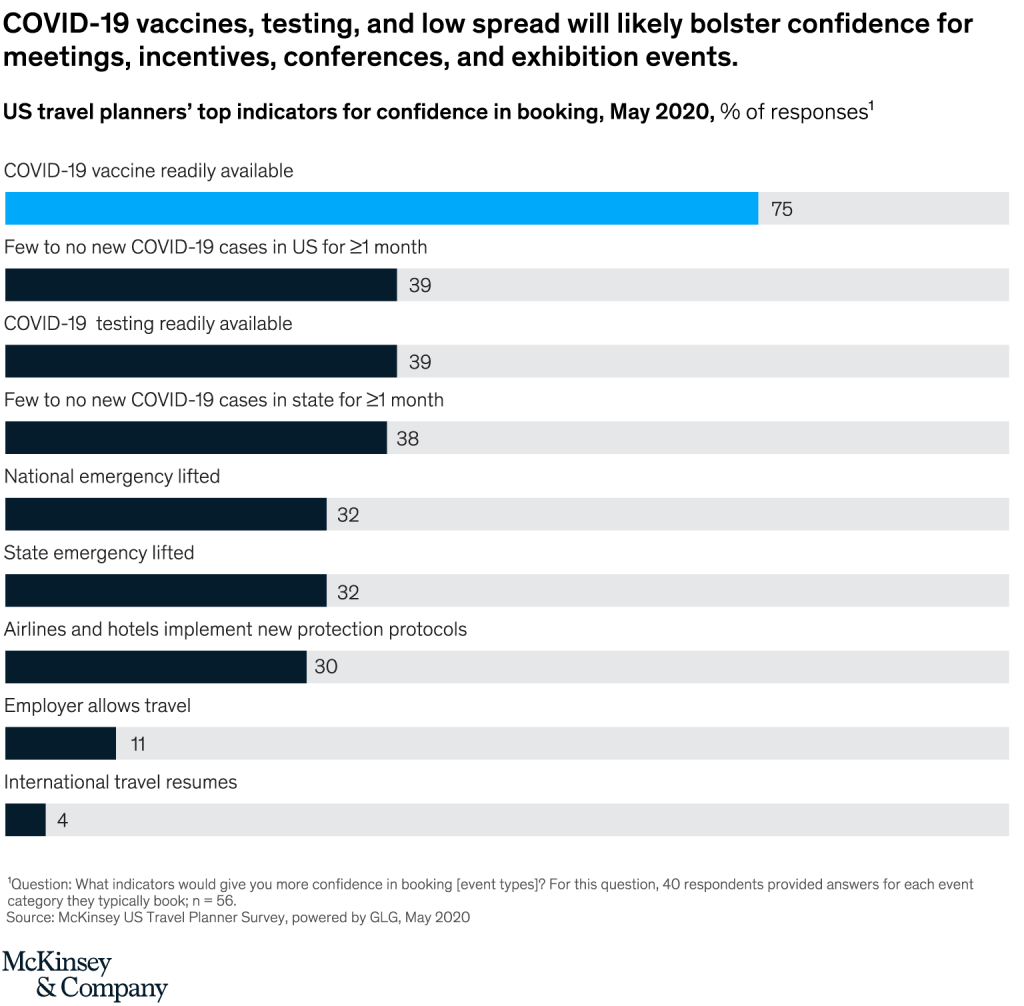

When surveyed by McKinsey about what measures will most increase confidence in business-travel bookings for major MICE, U.S. travel planners ranked the availability of a COVID-19 vaccine highest, above stable-public-health indicators and lifted government restrictions.

The global consulting firm says events will look different when they resume, with sales-oriented conferences and trade-show exhibitions expected to be the first to return to in-person formats.

“But many events will offer virtual, hybrid, or multilocal models with abbreviated in-person schedules, and they will move from destination cities to regional industry hubs. Venues will need to be modified to allow physical distancing.”

Sectoral Factors

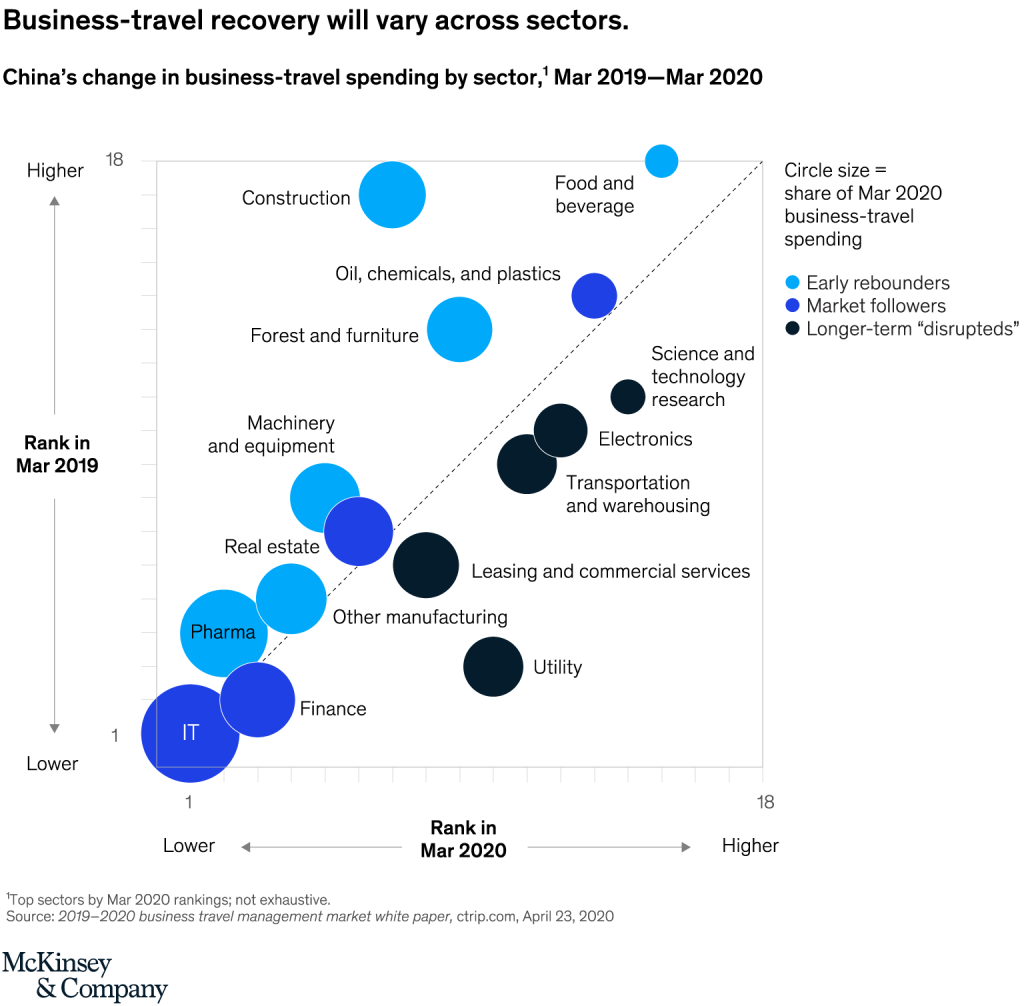

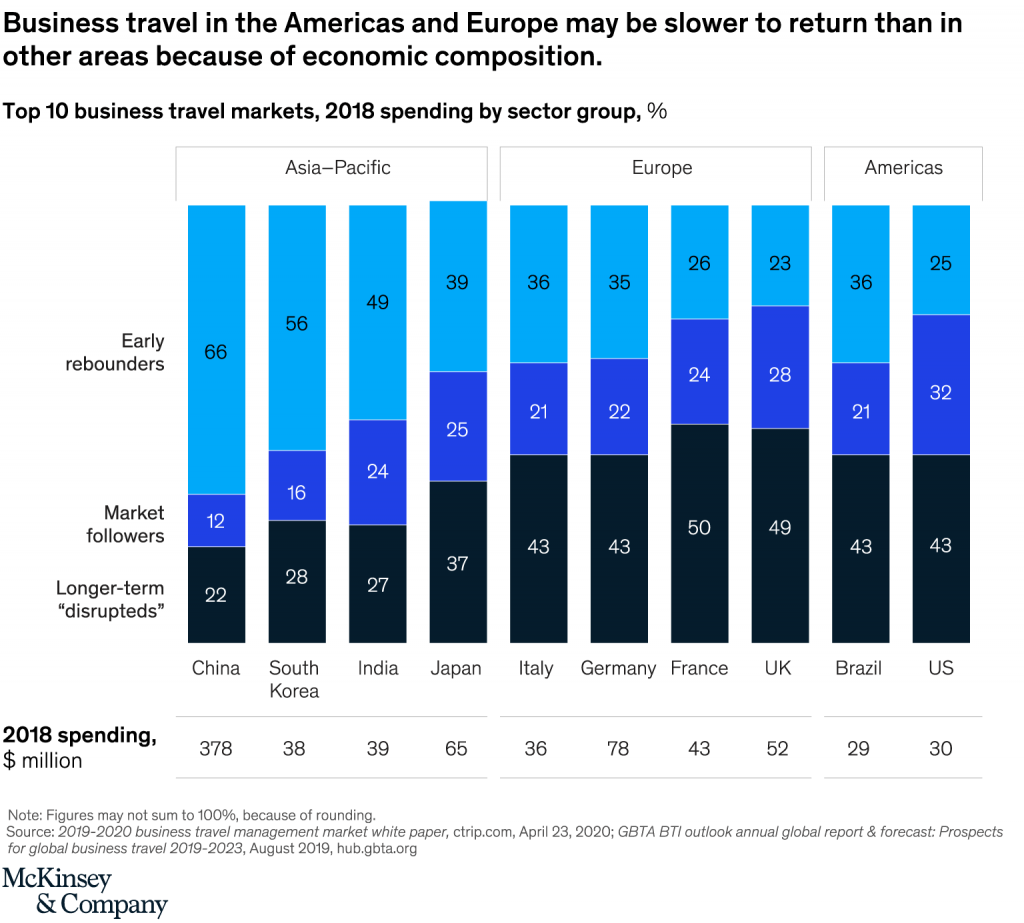

According to McKinsey, the sector will also play an important role in determining the trajectory of the return of business travel.

The hardest-hit sectors will be the last to resume corporate travel as they may face more budget constraints, it noted.

The analysis shows that industrial and production-oriented sectors such as pharmaceuticals, construction, real estate, and machinery and equipment makers may lead in the return to corporate travel.

“Comparing business-travel dynamics by industry in China before the COVID-19 pandemic and during the early travel rebound shows that those sectors rebounded sooner than the rest of the market did. Meanwhile, service and knowledge sectors (such as science and technology research) in China lagged in returning to business travel but indicated more ability to replace travel with technology.”

The report also states that business travel in the Americas and Europe may be slower to return than in other areas because they have a higher proportion of business travel spend concentrated in professional and service sectors and less in the industrial sectors that are showing early resilience in China, the origin of the outbreak.

How Travel Providers Can Prepare

McKinsey believes that travel players should act quickly if they want to stay in the competition. It says the first step is to achieve a “painstakingly granular, data-backed, flexible” perspective on how travel will return across key customers and use cases.

It recommends that industry leaders “connect directly with their top customers’ relevant decision-makers rather than engage through the procurement channels in which they may have stronger relationships today.”

The justification is that decision-makers hold critical information and can offer deeper insights into customers’ future needs.

Another step that McKinsey says business travel players should take is to evaluate the economics and pivot where needed.

“Airlines, for example, may choose to shift their business-class pricing and marketing to appeal to high-end leisure customers. Hotel operators may choose not to operate all their facilities or amenities or perhaps keep entire properties closed until demand returns.”

It added that trade associations and event planners should invest in technology to create high-quality virtual experiences to bring in revenue.

Industry players may also realize that they have to find new revenue streams to survive. “For instance, hospitality companies may choose to repurpose event and meeting spaces as shared-workspace options for companies that have reduced capacity at their office sites.”

Other Recommendations

Here is a look at McKinsey’s additional recommendations for providers in the business travel sector:

– Providers must modify policies and operations to address new customer needs. They should invest heavily to ensure complete compliance with health and safety measures and seek global accreditations.

– Hotels and airlines must innovate the customer experience, particularly for the business traveler.

– Airlines should evaluate loyalty-program benefits (for instance, business travelers might prefer upgrades to empty rows over upgrades to premium seats in the future). Hotels can re-evaluate amenity offerings through establishing partnerships with digital players in the food-service and fitness spaces.

Read more: Portugal Should Top Your Bucket List This Summer: SeaBookings’s Co-Founder

– Business travel players should shift their commercial models to accommodate disruption. They should ensure lean, efficient models in the short term without sacrificing long-term capabilities. They also need to identify opportunities for cross-industry collaboration to minimize losses through resource sharing when possible.

– Maintaining frontline sellers to stimulate long-term demand may be necessary for hotel chains and event spaces but they need to share or centralize resources across properties and adjust incentives and targets.

According to McKinsey, one thing that is certain in this volatile situation is that players that are “agile” and “keep a pulse on customer needs” will not only weather the storm but will emerge as leaders in the post-crisis recovery in the world of business travel.