The coronavirus pandemic has caused a considerable decrease in cash flow for the space industry but a sustained upward trend in interest heralds strong public-private partnerships in the remainder of the year, according to a recent report on venture investment in the space sector.

Noosphere Ventures—which conducted the analysis and invests in space technology companies—calls 2020 the year of commercial space travel as new launch companies emerged and the private and public sectors began to collaborate more closely.

Read more: Global Esports Market to Generate $973.9 Million in 2020

Indeed, this year ushered in a new era and direction for crewed spaceflight as entrepreneur Elon Musk’s company SpaceX became the first commercial operator to carry astronauts into space under a public-private partnership set up by Nasa, the American space agency.

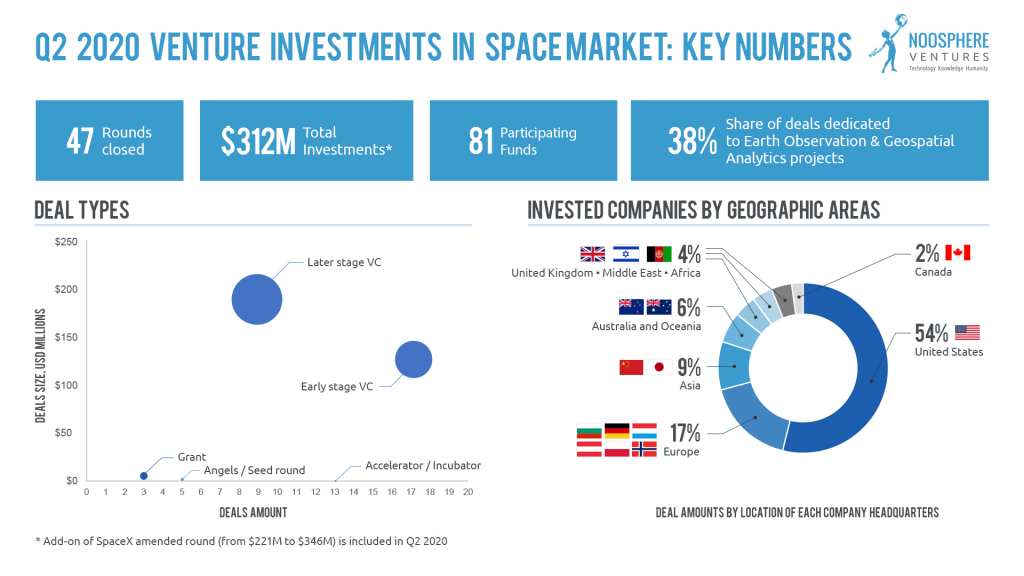

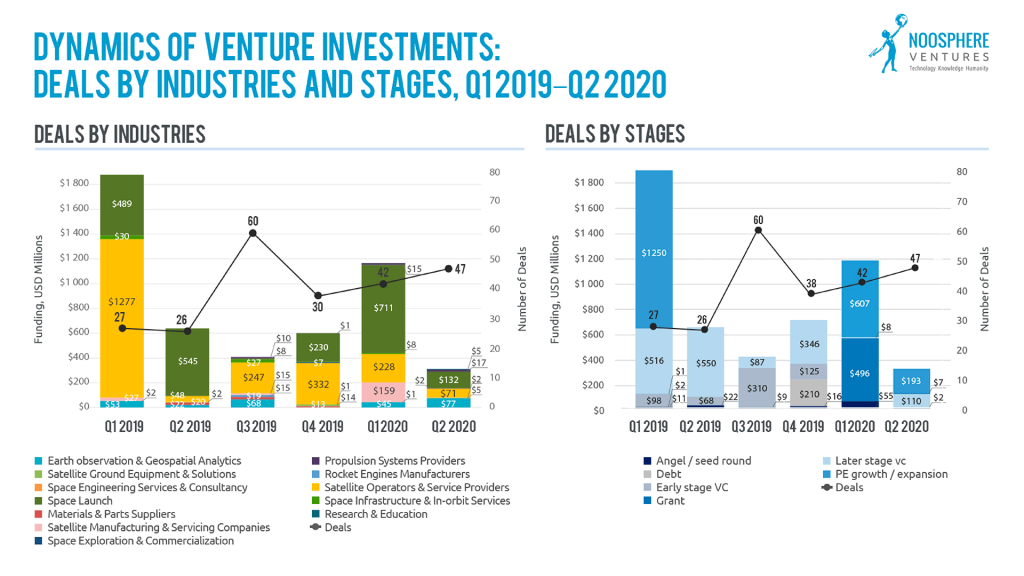

Public data collected by Noosphere Ventures shows that 47 rounds of financing were closed in Q2 2020, with a total investment of $312 million.

“Compared to Q1 2020, even with five more rounds, investments dropped 4 times. Up to 81 funds participated in the rounds. Most of the completed contracts were early-stage VC and Angel/seed funding,” the report said.

Thirty-eight percent of the share of the deals are dedicated to Earth observation and geospatial analytics projects.

According to Noosphere Ventures, half of the companies that secured investment are based in the United States. The Asian market share decreased from 17% to 9% compared to Q1 2020 numbers. This is while Australia and Oceania grew by 4%.

The top three biggest deals of Q2 2020 were:

$346 million investment in SpaceX

The investment is meant to support three programs: Crew Dragon spacecraft; Starlink, a fleet of low-flying, internet-beaming satellites; and Starship, a fully reusable super heavy-lift launch vehicle ferry.

$38 million investment in Commsat

The fundraising took place as Commsat is planning to create a satellite internet platform.

$23 million investment in Taranis

The amount raised will be used to elevate its positions in North and South America and further develop its expertise.

The second group of the largest funding deals was Myriota ($17M), Tianbing Technology ($14M), GHGSat ($14M), and Enview ($12M).

M&A Deals

Among the largest merger and acquisition deals was a $140 million purchase by Maxar for the remaining 50% share in Vricon, which gave them full ownership, Noosphere Ventures says.

Also, AE Industrial Partners created Redwire by combining several businesses.

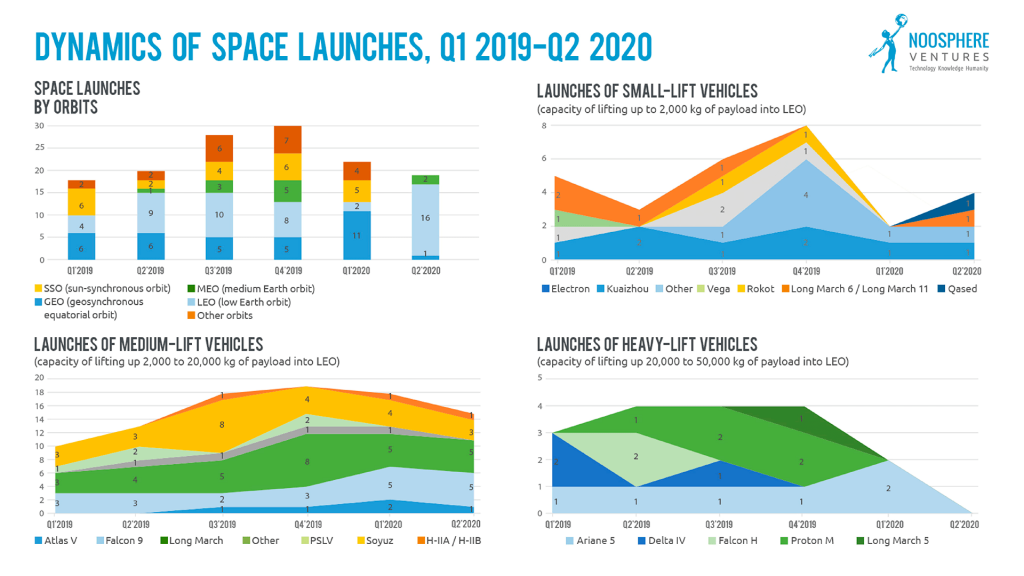

The setback caused by the coronavirus pandemic and the related economic downturn has negatively impacted the number of space launches.

The report indicates that the number of space lunches has been negatively impacted by COVID-19 and the ensuing economic downturn.

“Medium-lift vehicle launches fell from 18 to 14, none of the heavy-lift vehicles were launched in Q2 and only small-lift vehicles doubled the number of launches from 2 to 4.”

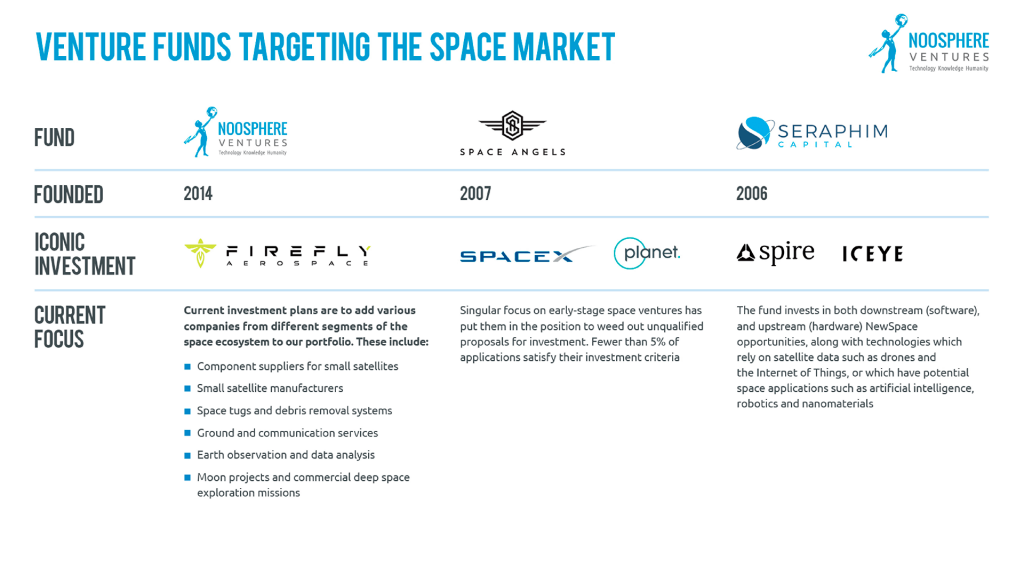

Noosphere Ventures (investments in Firefly Aerospace), Space Angels Network (investments in SpaceX and Planet), and Seraphim Capital (investments in Spire and Iceye) are highlighted in the Q2 report as top funds with successful space-tech oriented portfolios.

Read more: COVID-19: A Pivotal Moment for Future of AI