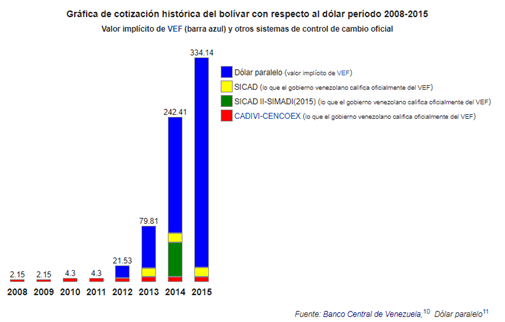

Quoted price of VEF against the USD (2008-2015). Source: Central Bank of Venezuela[/caption]

The exchange rate began to grow abruptly from 2013, and no Government economic plan has been successful until today. An increase that has become a daily fact with many of the country's businessc sectors calculating their costs from that rate. The price of products, daily services and real estate in the country are very volatile and rise as the parallel dollar rate increases. Interestingly, when the parallel dollar falls, the prices of goods, services, and real estate in Venezuela keep getting higher. This shows a total disruption of the national economy in terms of the devaluation of the “Bolívar Fuerte” (national currency, VEF) while the national economy has suffered a brutal inflation since 2013.

Apparently, there are no visible solutions. All consumption by Venezuelans has been dollarized but this is far from being an institutionalized reality because wages and salaries continue to be in VEF.

On the one hand, there is strong corruption and the government's lack of responsiveness to what they call an "economic war" being waged against the people of Venezuela. The worrying thing is that beyond the existence or absence of an "economic war", the country suffers from a real and palpable economic crisis with the government refusing to accept its apparently inefficient economic administration.

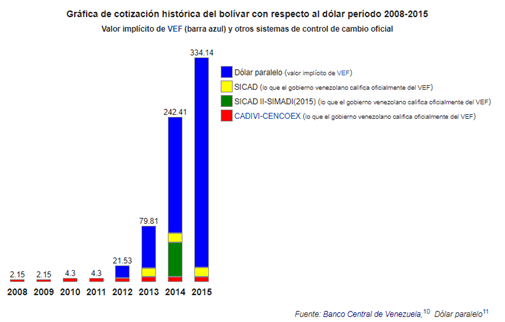

Quoted price of VEF against the USD (2008-2015). Source: Central Bank of Venezuela[/caption]

The exchange rate began to grow abruptly from 2013, and no Government economic plan has been successful until today. An increase that has become a daily fact with many of the country's businessc sectors calculating their costs from that rate. The price of products, daily services and real estate in the country are very volatile and rise as the parallel dollar rate increases. Interestingly, when the parallel dollar falls, the prices of goods, services, and real estate in Venezuela keep getting higher. This shows a total disruption of the national economy in terms of the devaluation of the “Bolívar Fuerte” (national currency, VEF) while the national economy has suffered a brutal inflation since 2013.

Apparently, there are no visible solutions. All consumption by Venezuelans has been dollarized but this is far from being an institutionalized reality because wages and salaries continue to be in VEF.

On the one hand, there is strong corruption and the government's lack of responsiveness to what they call an "economic war" being waged against the people of Venezuela. The worrying thing is that beyond the existence or absence of an "economic war", the country suffers from a real and palpable economic crisis with the government refusing to accept its apparently inefficient economic administration.

The Government or a Website: Who has More Power Over Venezuelan Economy?

Vera Sanoja Zerpa

December 4, 2017

CARACAS Venezuela (ViaNews) - The study of the influence of the dollar and its impact on the black market has been a recurring theme over the past 4 years in Venezuela.

The black market exchange rate in Venezuela is set by a web portal called "DolarToday", which operates from the United States and it defines the country's exchange rate on a daily basis. It is important to say that the dollar figure is not mathematically established, but responds to a foreign project aimed at setting the exchange rate values from outside of the Venezuelan territory.

The DolarToday team in an interview with the BBC defined itself as "a form of protest against a dictatorial regime increasingly committed to silencing and intimidating the media in Venezuela".

A controversy has arisen between national and foreign analysts over whether the Venezuelan economy is governed by the State or by the "DolarToday" portal. This controversy questions the government's feigned economic policy, in turn evidencing the clear flight of capital at the border with Colombia and which has allegedly been induced by private sectors and individuals.

This point is relevant given that the value of the dollar is associated with the prices that traders arbitrarily place at the Colombian-Venezuelan border according to the law of supply and demand. These practices define, almost in its entirety, the price of the dollar, along with variables of lesser weight such as the number of reserves and their measurement according to the gold standard, the exportation of oil, etc...

[caption id="attachment_3108" align="aligncenter" width="505"] Quoted price of VEF against the USD (2008-2015). Source: Central Bank of Venezuela[/caption]

The exchange rate began to grow abruptly from 2013, and no Government economic plan has been successful until today. An increase that has become a daily fact with many of the country's businessc sectors calculating their costs from that rate. The price of products, daily services and real estate in the country are very volatile and rise as the parallel dollar rate increases. Interestingly, when the parallel dollar falls, the prices of goods, services, and real estate in Venezuela keep getting higher. This shows a total disruption of the national economy in terms of the devaluation of the “Bolívar Fuerte” (national currency, VEF) while the national economy has suffered a brutal inflation since 2013.

Apparently, there are no visible solutions. All consumption by Venezuelans has been dollarized but this is far from being an institutionalized reality because wages and salaries continue to be in VEF.

On the one hand, there is strong corruption and the government's lack of responsiveness to what they call an "economic war" being waged against the people of Venezuela. The worrying thing is that beyond the existence or absence of an "economic war", the country suffers from a real and palpable economic crisis with the government refusing to accept its apparently inefficient economic administration.

Quoted price of VEF against the USD (2008-2015). Source: Central Bank of Venezuela[/caption]

The exchange rate began to grow abruptly from 2013, and no Government economic plan has been successful until today. An increase that has become a daily fact with many of the country's businessc sectors calculating their costs from that rate. The price of products, daily services and real estate in the country are very volatile and rise as the parallel dollar rate increases. Interestingly, when the parallel dollar falls, the prices of goods, services, and real estate in Venezuela keep getting higher. This shows a total disruption of the national economy in terms of the devaluation of the “Bolívar Fuerte” (national currency, VEF) while the national economy has suffered a brutal inflation since 2013.

Apparently, there are no visible solutions. All consumption by Venezuelans has been dollarized but this is far from being an institutionalized reality because wages and salaries continue to be in VEF.

On the one hand, there is strong corruption and the government's lack of responsiveness to what they call an "economic war" being waged against the people of Venezuela. The worrying thing is that beyond the existence or absence of an "economic war", the country suffers from a real and palpable economic crisis with the government refusing to accept its apparently inefficient economic administration.

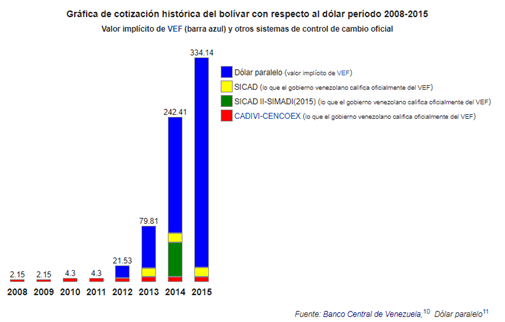

Quoted price of VEF against the USD (2008-2015). Source: Central Bank of Venezuela[/caption]

The exchange rate began to grow abruptly from 2013, and no Government economic plan has been successful until today. An increase that has become a daily fact with many of the country's businessc sectors calculating their costs from that rate. The price of products, daily services and real estate in the country are very volatile and rise as the parallel dollar rate increases. Interestingly, when the parallel dollar falls, the prices of goods, services, and real estate in Venezuela keep getting higher. This shows a total disruption of the national economy in terms of the devaluation of the “Bolívar Fuerte” (national currency, VEF) while the national economy has suffered a brutal inflation since 2013.

Apparently, there are no visible solutions. All consumption by Venezuelans has been dollarized but this is far from being an institutionalized reality because wages and salaries continue to be in VEF.

On the one hand, there is strong corruption and the government's lack of responsiveness to what they call an "economic war" being waged against the people of Venezuela. The worrying thing is that beyond the existence or absence of an "economic war", the country suffers from a real and palpable economic crisis with the government refusing to accept its apparently inefficient economic administration.

Quoted price of VEF against the USD (2008-2015). Source: Central Bank of Venezuela[/caption]

The exchange rate began to grow abruptly from 2013, and no Government economic plan has been successful until today. An increase that has become a daily fact with many of the country's businessc sectors calculating their costs from that rate. The price of products, daily services and real estate in the country are very volatile and rise as the parallel dollar rate increases. Interestingly, when the parallel dollar falls, the prices of goods, services, and real estate in Venezuela keep getting higher. This shows a total disruption of the national economy in terms of the devaluation of the “Bolívar Fuerte” (national currency, VEF) while the national economy has suffered a brutal inflation since 2013.

Apparently, there are no visible solutions. All consumption by Venezuelans has been dollarized but this is far from being an institutionalized reality because wages and salaries continue to be in VEF.

On the one hand, there is strong corruption and the government's lack of responsiveness to what they call an "economic war" being waged against the people of Venezuela. The worrying thing is that beyond the existence or absence of an "economic war", the country suffers from a real and palpable economic crisis with the government refusing to accept its apparently inefficient economic administration.