Petrochemical industry leaders and financial investors need to update their strategic agendas and focus on recovery scenarios, regionalized supply chains, and capital productivity. That is, if they want to minimize the negative impact of the coronavirus pandemic on the industry, according to McKinsey & Company.

In a recent analysis, the global consulting firm wrote that slowing demand growth, growing surplus, and a shrinking value pool had posed a challenge to the sector even before the outbreak.

In addition to these pronounced effects, the industry is facing structural disruption from the transition to renewable energy resources and a regenerative, or circular, economy, it noted.

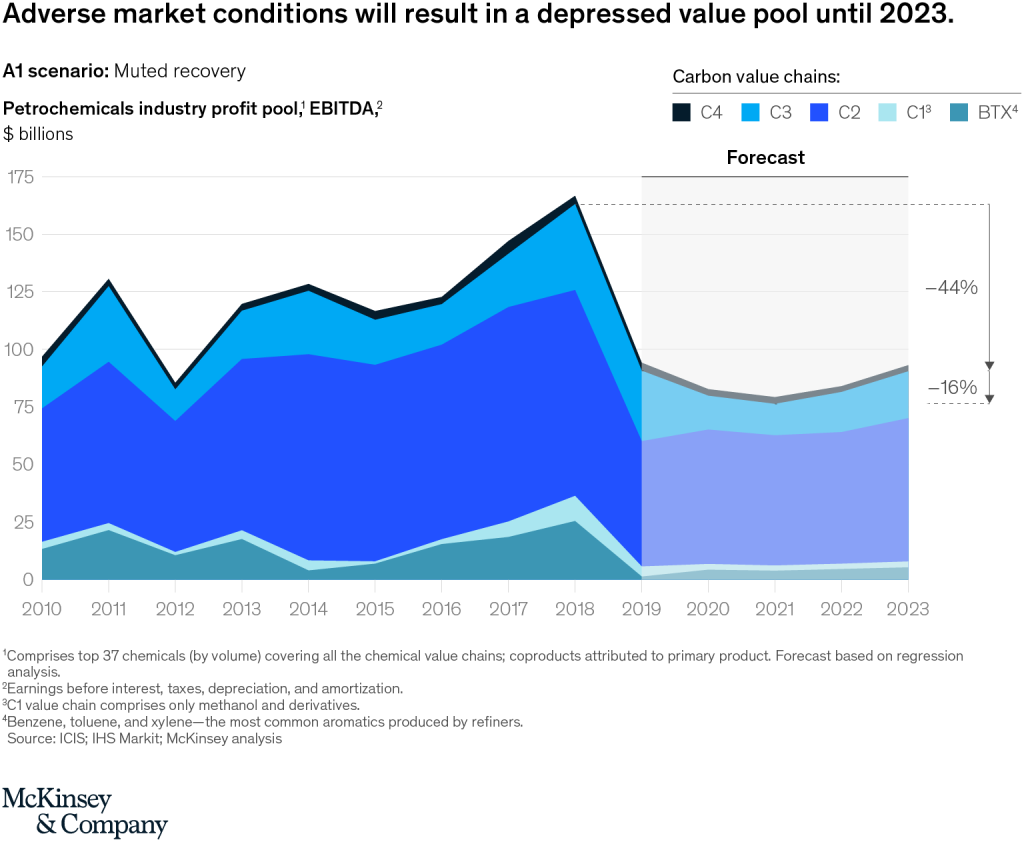

McKinsey says the sector saw prolonged, considerable growth from 2010 to 2018 after the financial crisis of 2008. During the mentioned period, the value pool grew by 8 percent per annum.

“High utilization levels and favorable feedstock dynamics eventually led to a so-called supercycle (a time when petrochemical margins are higher than usual) from 2016 to 2018.”

According to McKinsey analysts, significant capacity additions and slowing demand growth caused a decline in the industry value pool last year.

“This decline was further accelerated in 2020 by the COVID-19 pandemic. The impact of the coronavirus on petrochemical demand was irregular across value chains, with automotive and construction applications seeing particularly steep declines, and packaging demand (especially in food, sanitary products, and medical applications) remaining robust,” the report reads.

The firm cites stockpiling, a surge in delivery services, and increased healthcare-focused activity—all in response to the unfolding health emergency—as some of the reasons for the latter.

Although a few plants have shut down in select geographies, in McKinsey’s view, industry actors have coped well with the short-term impact and are now making plans for the medium term.

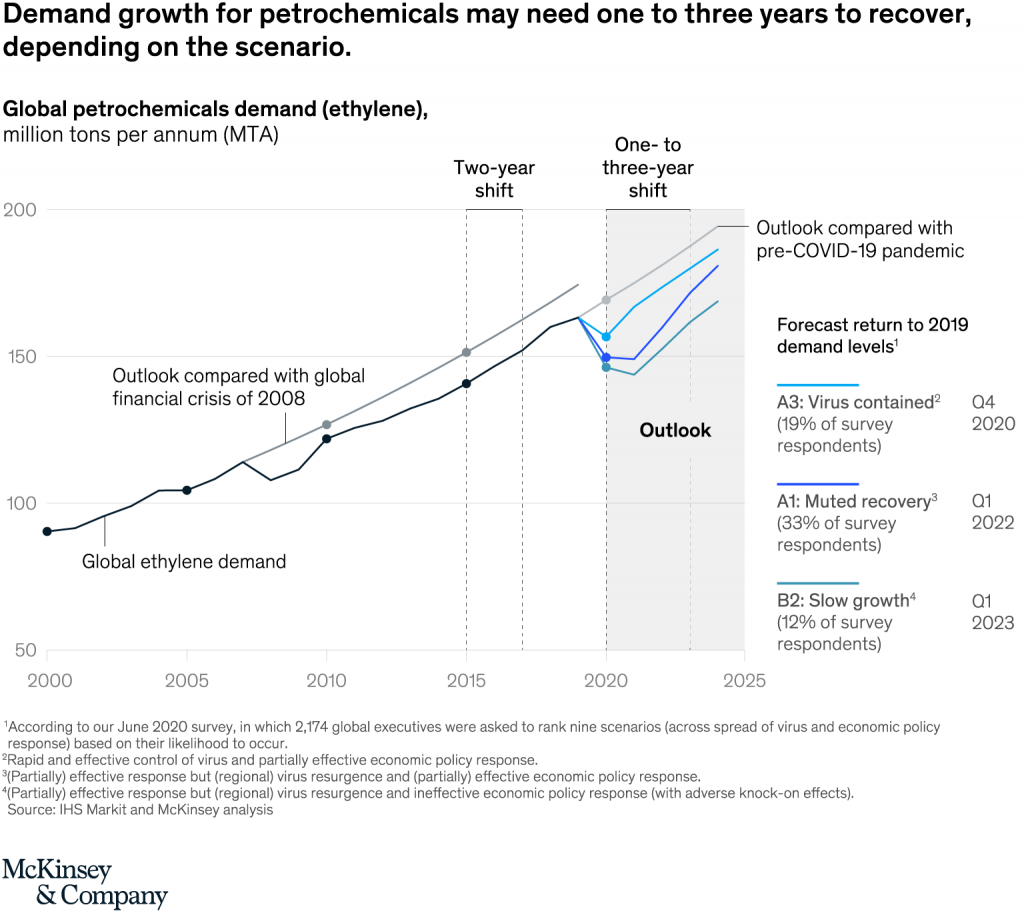

The analysis suggests that petrochemical demand recovery will vary by value chain and geography and depend on macro-economic and epidemiological impacts.

“The decline in oil prices has flattened cost curves, particularly in methanol and ethylene, eroding value pools, especially for players with access to advantageous feedstocks,” McKinsey wrote, adding that several industry forecasts see a “low for longer” scenario despite considerable uncertainty regarding oil prices.

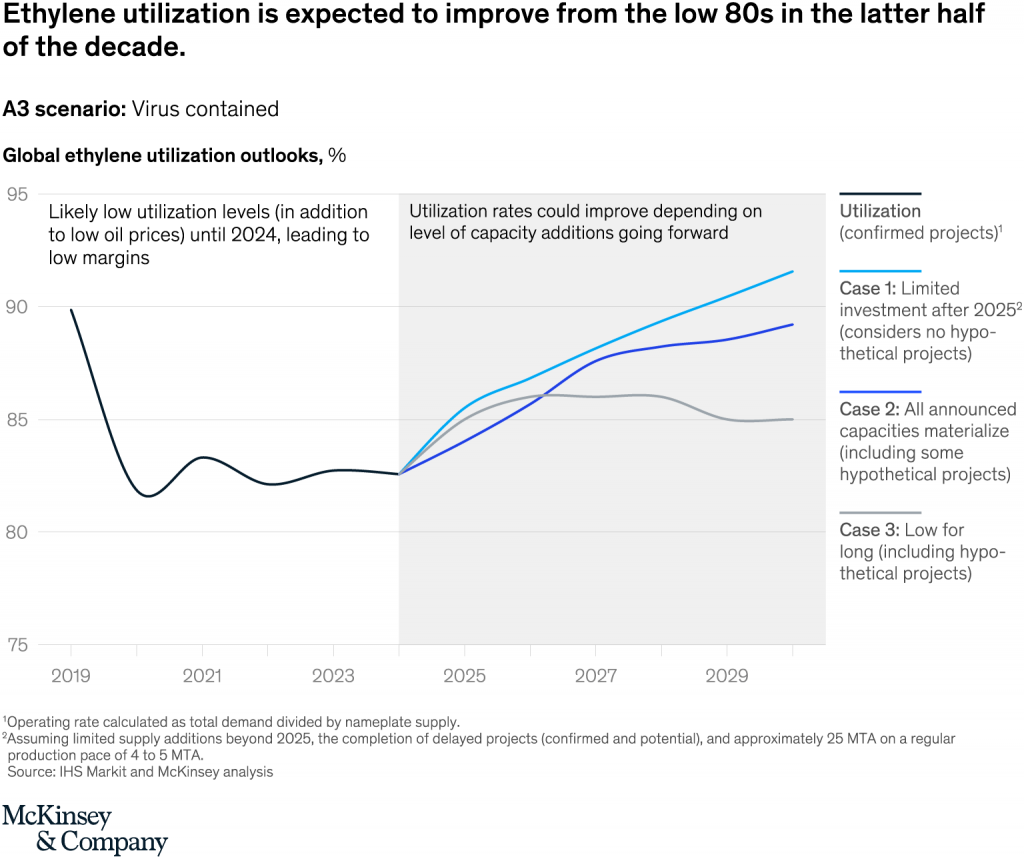

The consulting company believes that industry executives have only a few options to address utilization, which includes delaying capacity additions and restructuring current capacity.

“Heading into the crisis, ethylene utilization was expected to be about 85 percent between 2020 and 2025 (versus 89 percent in 2019). Several recent scenarios, however, suggest that utilization levels will likely remain below 85 percent, even with large reductions in capacity.”

A scenario of muted recovery is indicative of an average industry utilization of around 81 percent until 2025, it said, while highlighting that the resulting impact on the value pool shows a decline of about 16 percent and will not go back to 2019 levels until 2023.

“In the longer term, ethylene utilization rates may improve in the second half of this decade, though the extent will depend on overall industry conduct. In the event of limited investments, utilization may rebound to 2017–18 levels by 2030, or it could remain below 2019 levels if significant capacity is added,” the research says.

McKinsey recommends that industry leaders and investors change their perspectives and management agendas and embrace the following shifts:

Use scenarios to manage the recovery. Companies are advised to build scenario-based market outlooks, which are “tailored to specific value chains and geographic footprints”.

Prepare for increasingly regionalized supply chains. According to a recent McKinsey Global Institute report, up to 35 percent of the chemical industry’s annual EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) could be at risk because of supply-chain disruptions.

Raise capital productivity. Companies need to revisit their capital-investment pipelines in light of overcapacity and lower operational cash flows looming until 2025. It is suggested that they concentrate on improving productivity for well-advanced and under-construction projects, for instance, by adjusting project completion times or re-negotiating prices.

Scale digital and analytics in commercial and operations. Profit margins can be improved with the help of end-to-end digital transformations. Advanced analytics should be taken advantage of to reduce procurement costs, improve yields and throughput, lower energy consumption, and optimize product pricing.

Continue the transition to a circular economy. Low oil prices, lower overall demand, and higher consumer concerns of health and safety amid the coronavirus pandemic may slow the pace of transition to a circular economy.

But a recent McKinsey survey found that 87 percent of recyclers expect consumers to continue opting for sustainable or recycled products, regardless of the crisis or an economic downturn.

The road to recovery for the petrochemical sector is riddled with a diverse set of challenges but companies can emerge from the crisis stronger than before if they learn from the past few months and make several management shifts based on informed and realistic outlooks, McKinsey says.