The tumultuous Q2 of 2020 saw a surge in video usage and live streaming as well as an increase in ad spend in many regions and industries worldwide, according to a study by a global AI-powered social media marketing company.

"On the organic marketing side, video usage surged on Twitter and Facebook Live usage increased by 85% as marketers attempted to adapt their strategies amid remote work for users who were largely stuck at home," Socialbakers wrote in its latest social media trends report.

The company predicts that many brands will continue to leverage Facebook Live and live video overall going into Q3 and Q4 because of its consistently high engagement levels.

Read more: Is Facebook Stock Still a Buy After the Advertising Boycott?

"The message is clear: brands that aren’t investing in live video are leaving engagement on the table," says Yuval Ben-Itzhak, CEO of Socialbakers

The analysis also shows that paid advertising bounced back and CPC increased in Q2, as business started to return to normal.

"However, after largely increasing throughout the quarter, we did see a dip in ad spend in early June, most notably in the U.S., which corresponds to #BlackoutTuesday," Ben-Itzhak noted.

He added that ad spending returned to normal almost immediately as brands have no real alternative to Facebook to reach and engage with users at such scale.

"There was another dip in ad spend at the end of June, which was likely related to an ad boycott that could also affect figures in Q3 2020."

Read more: Influencer Marketing Holds Great Potential: Serial Digital Entrepreneur

Here are the key insights from the Socialbakers' report about where things stand in the middle of an eventful year that has affected nearly every industry across the globe:

Advertising

Spend rises before the ad boycott

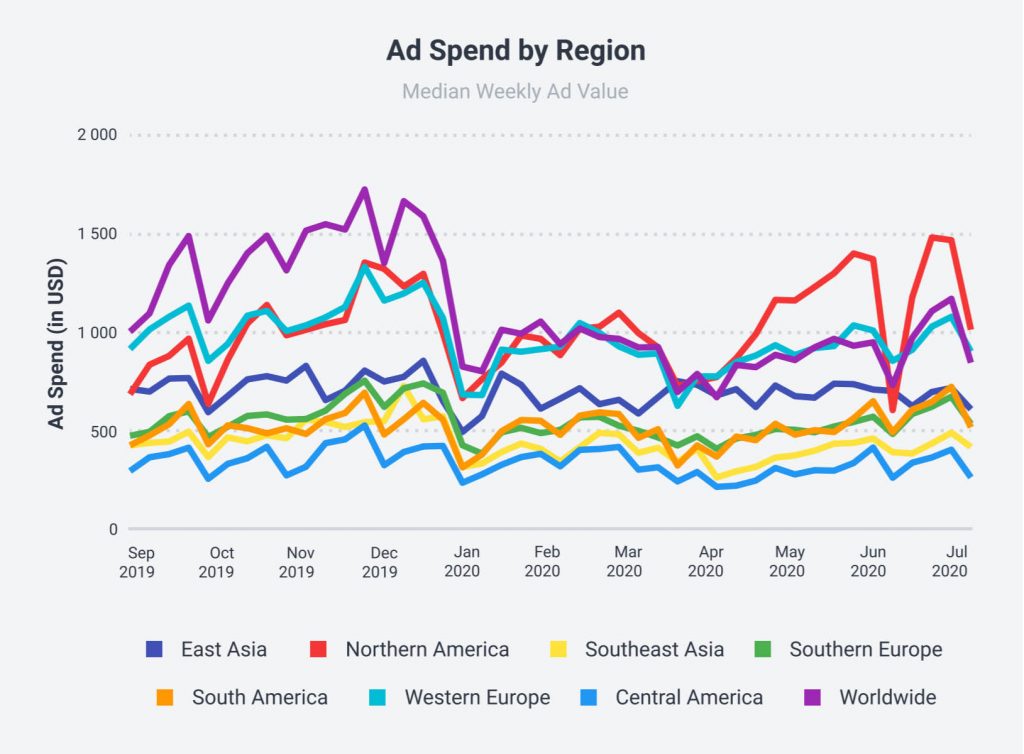

Global ad spending increased by 26.2% in Q2 compared to where it was at the end of Q1 when the coronavirus pandemic hugely impacted budgets.

The increase was great in mid-June before dropping off again at the end of the month.

That decline was likely related to #BlackoutTuesday and the Facebook ad boycott led by civil rights and activist groups.

With the boycott expected to last at least through July, spending will likely continue to decline early in Q3.

Accommodation ad spend increases 150%

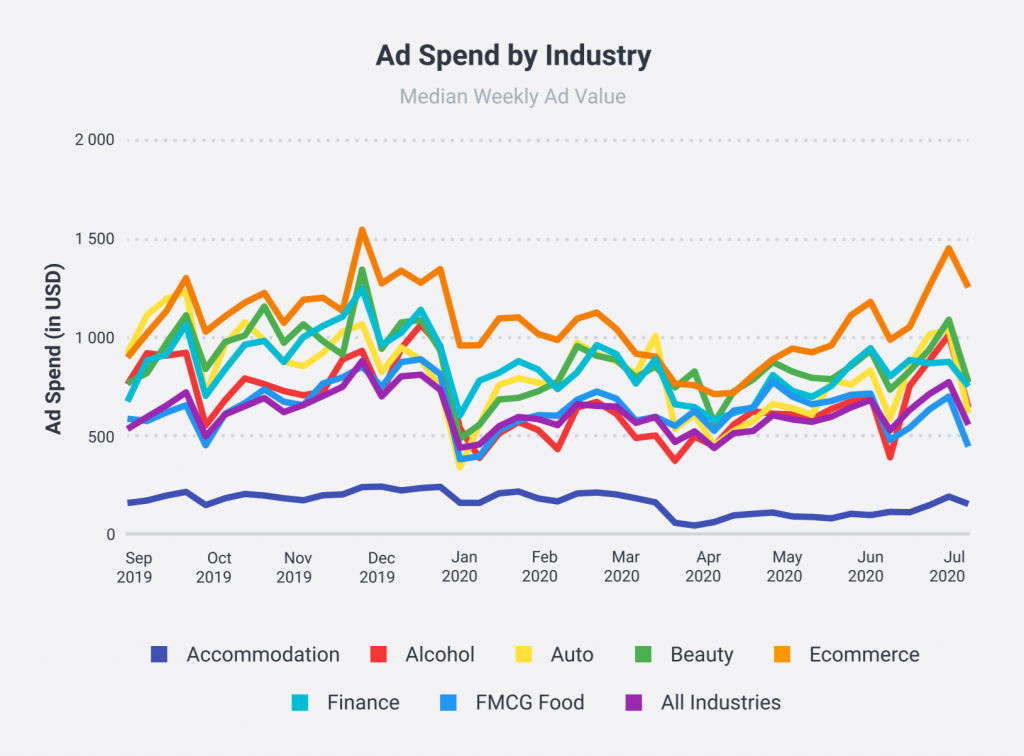

Even with the end-of-quarter decline, the spending on accommodation and e-commerce increased by 151.3% and 76.3% respectively, compared to the end of Q1 2020.

Overall, the ad spending in all industries increased by an average of 27.1%, which shows a strong return after the initial impacts of COVID-19.

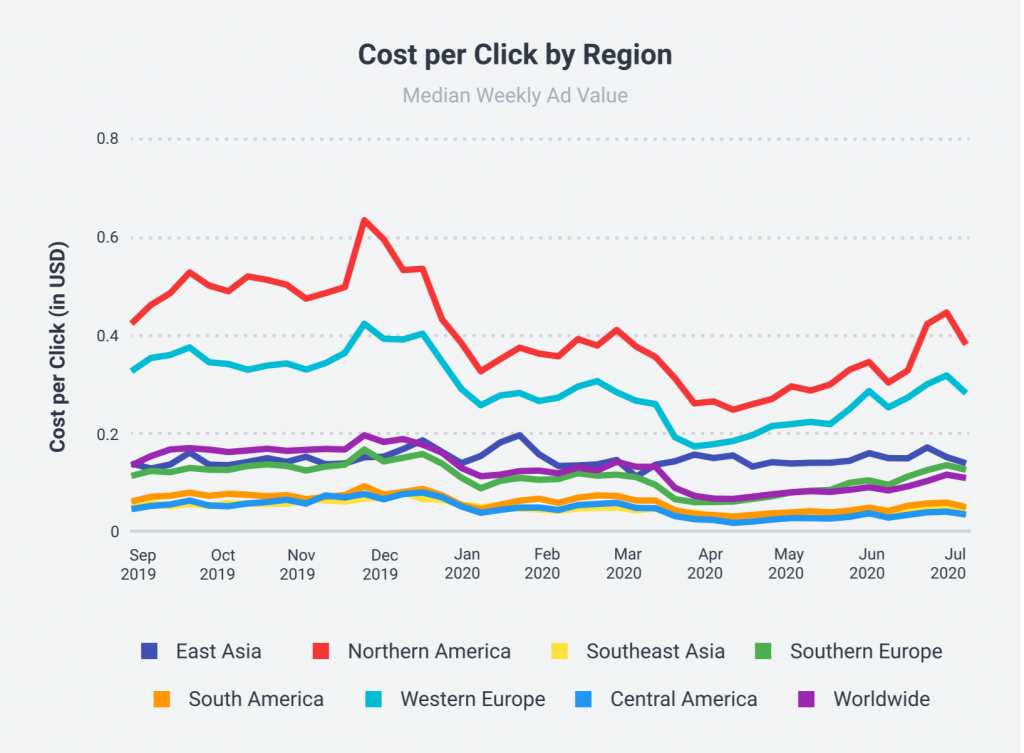

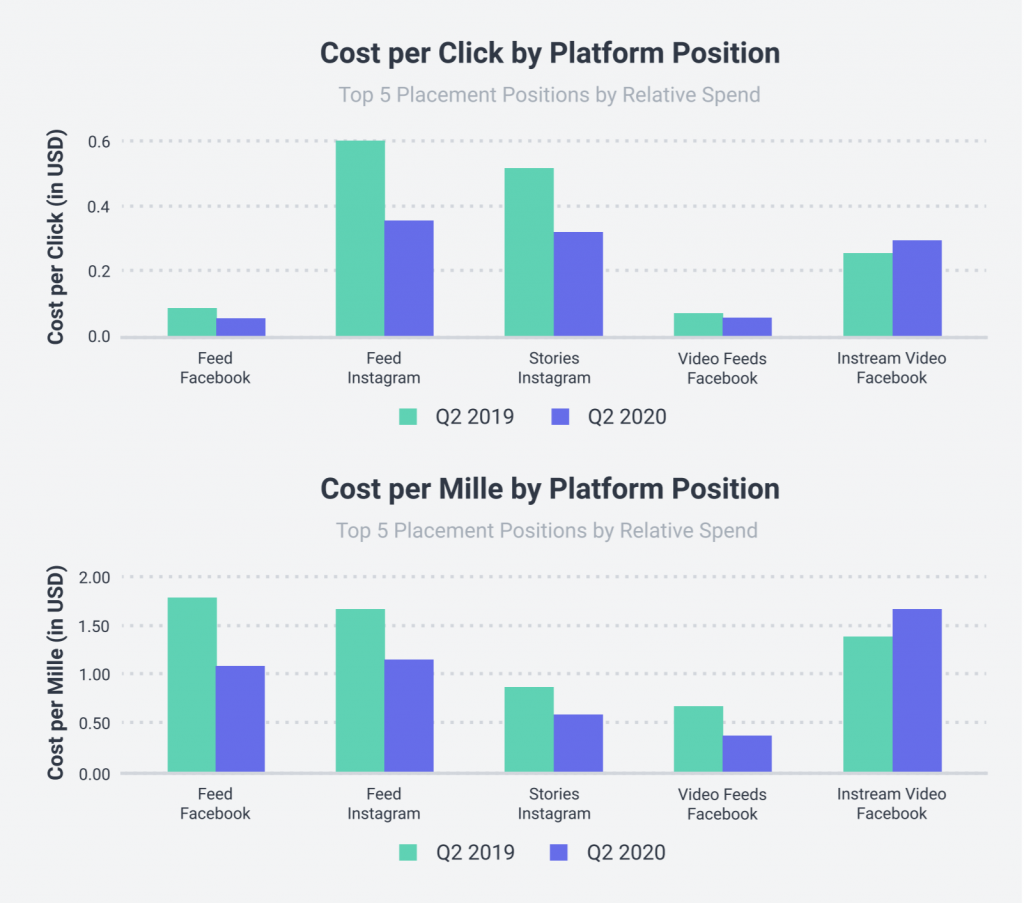

Global CPC increases by 55%

The worldwide cost per click increased by 55.3% in Q2 2020 ($0.118 vs. $0.076). It reached its highest point in early March before the pandemic began to show its effects.

The most considerable increase was seen in Southern Europe and Northern America.

Ad spend decreases on main feeds

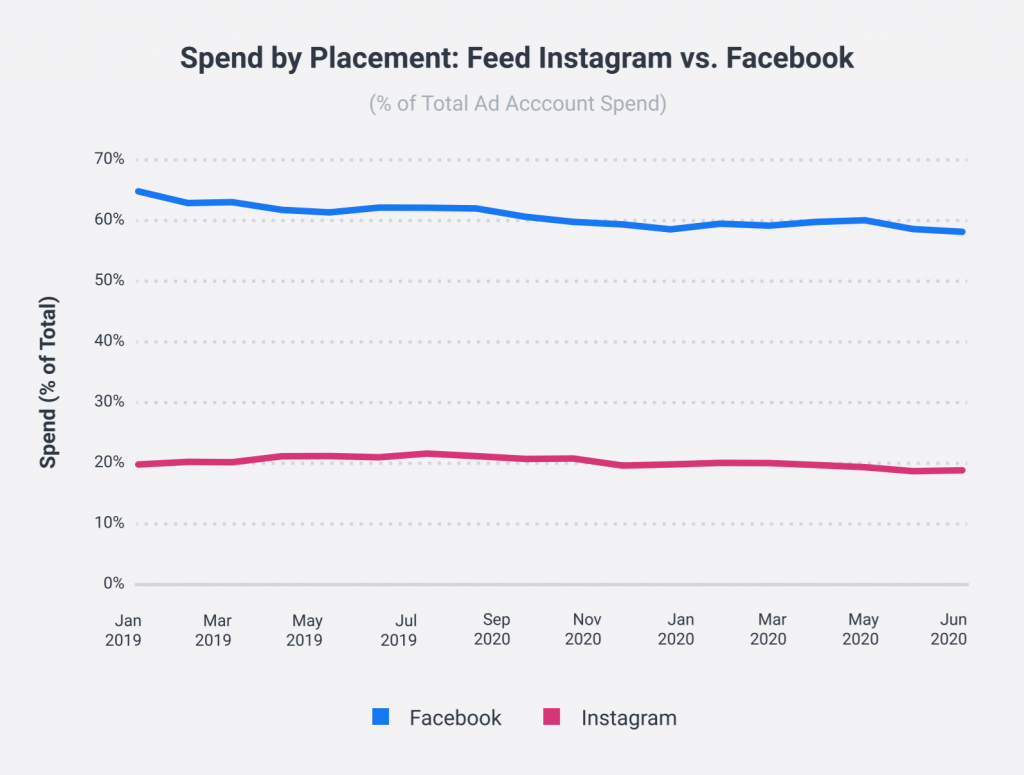

Ad spending on Facebook News Feed decreased by 2.6% in Q2 2020, while the spend on Instagram Feed decreased by 4.2%.

Since January 2019, Facebook News Feed declined from a high of 64.1% of total spend to 57.7% in June 2020.

In that same time frame, Instagram Feed fluctuated between a high of 21.4% (July 2019) and a low of 18.8% (May 2020).

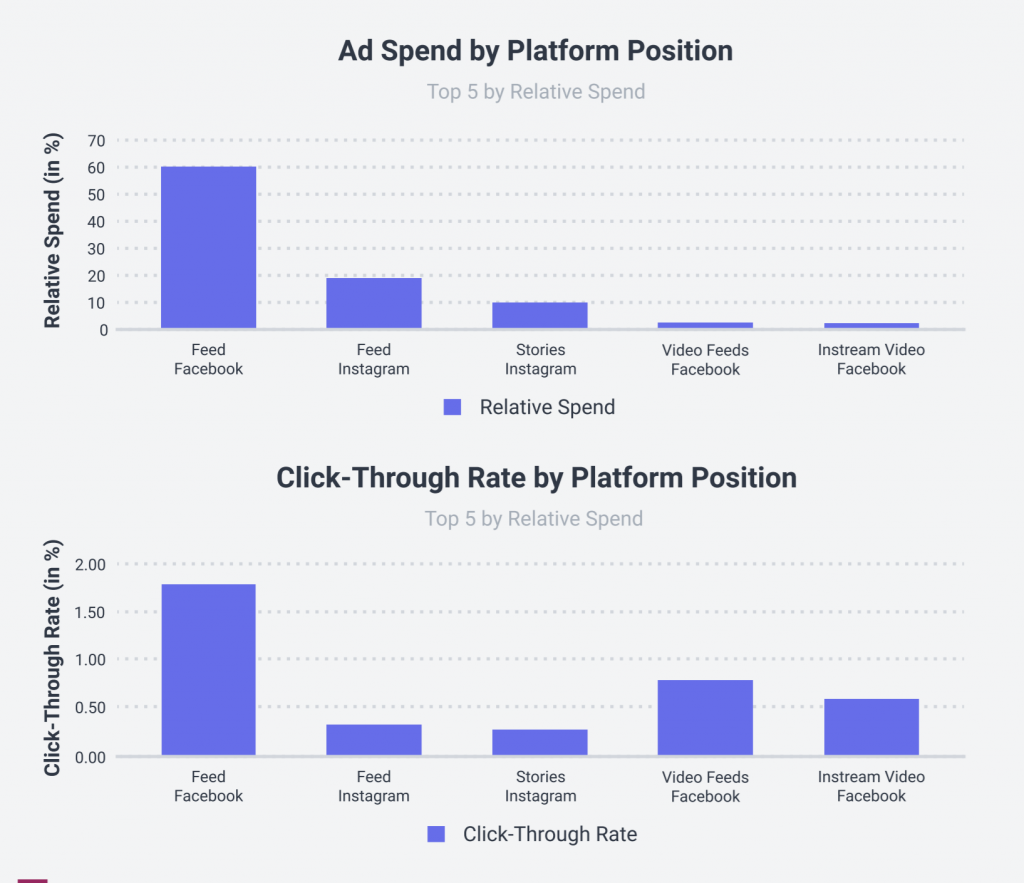

Highest converting ad placement types

In Q2 2020, Facebook News Feed received 59.7% of the relative ad spend. The next two channels were Instagram Feed and Instagram Stories, which together received 27.8% of spend.

Facebook news feed costs decrease by 35%

Compared with Q2 2019, Facebook News Feed in Q2 2020 declined by 34.6% in CPC ($0.104 vs. $0.068) and 40.6% in CPM ($1.822 vs. $1.082).

Similarly, Instagram Feed and Instagram Stories decreased by about 37% in CPC and 28% in CPM. The only placement to increase at all was Facebook Instream Video.

Organic Engagement

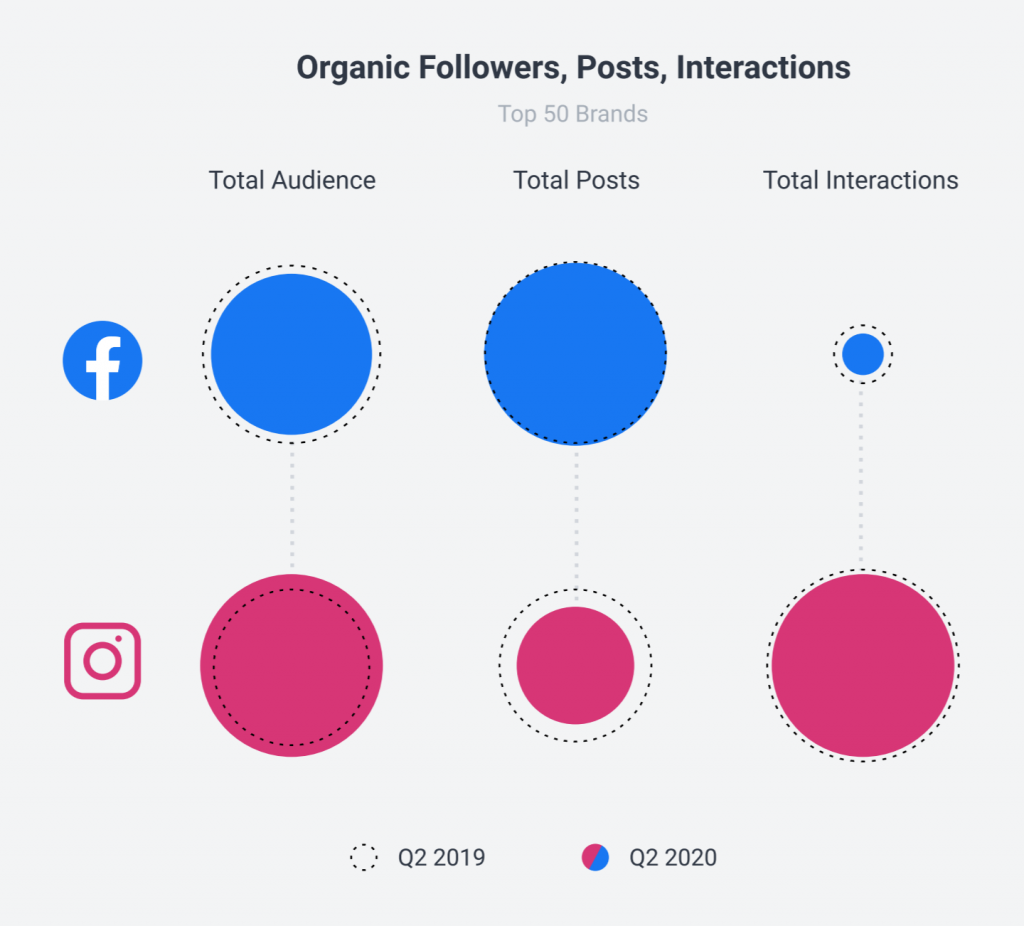

Instagram audience size 31% larger than Facebook

The total audience size of the 50 biggest brand profiles in Q2 2020 was 31.2% bigger on Instagram than Facebook.

Engagement remained considerably stronger on Instagram, which had 18.7x more interactions compared to Facebook. This is while 70.7% of all brand posts were on Facebook.

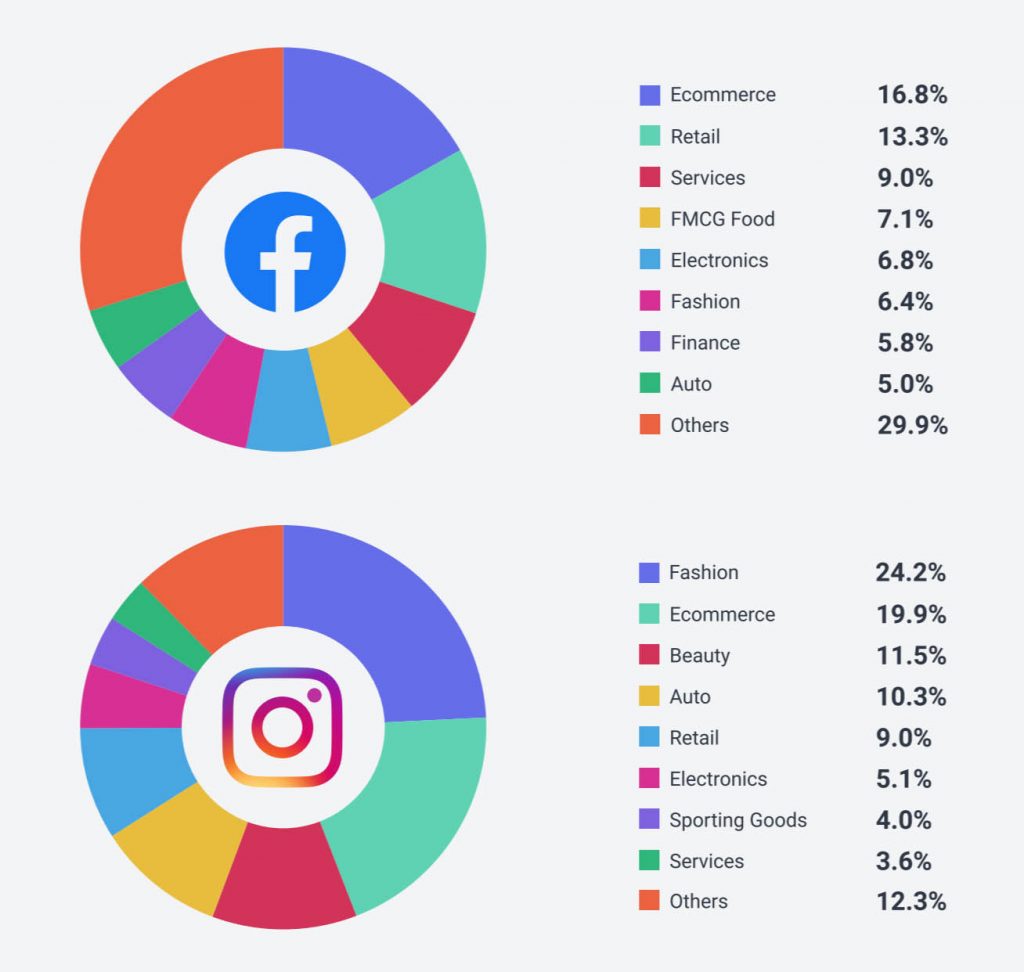

Distribution of interactions across industries

E-commerce received the highest percentage of interactions on Facebook and the second-highest number of interactions on Instagram, behind only Fashion.

Overall, the Fashion industry was less prevalent during Q2 2020. Fashion decreased by 6.6% and 21% on Instagram and Facebook, respectively.

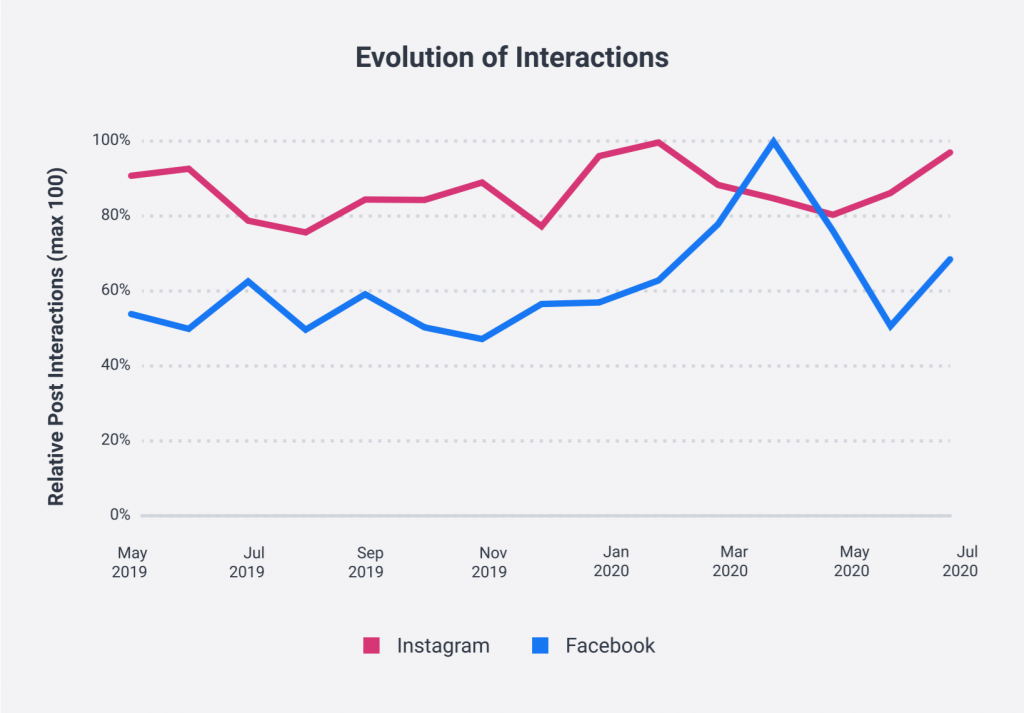

Instagram interactions near their peak

The relative post interactions for the 50 biggest Instagram brand pages showed an increase in Q2 2020 and nearly reached their peak at the end of June.

The relative post interactions on Facebook during Q2 2020 decreased substantially. It went from 100% in March to 50.8% before increasing again at the end of the quarter.

But the decrease was mostly a return to the normal level following an unusual spike in mid-March.

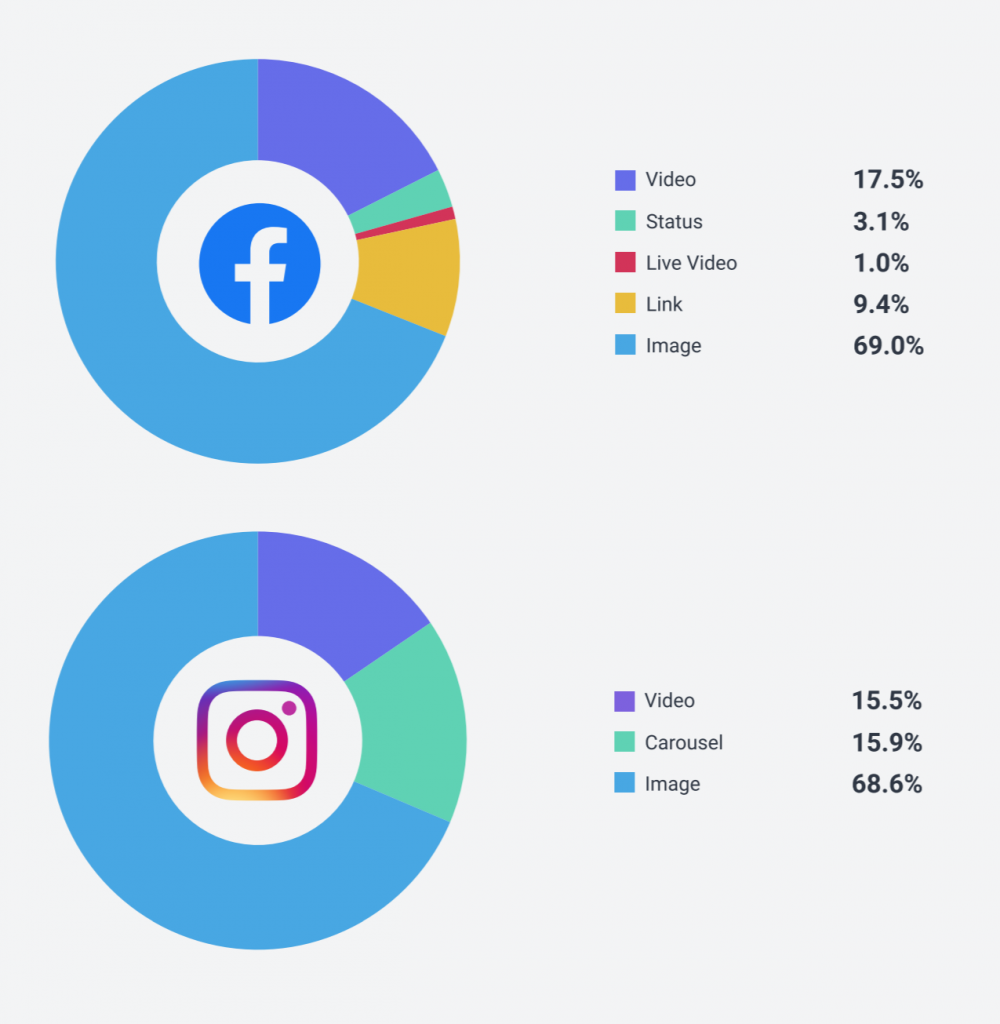

Distribution of post types on Facebook and Instagram

Images made up about 69% of all content on both Facebook and Instagram. On Facebook, video was the second most common post type (17.5%), followed by links and status updates.

The use of Facebook Live videos showed an 85.2% increase compared to Q1 2020.

In general, video grew on both platforms. However, bigger growth was seen on Facebook. In addition to the surge in Live, regular video posts increased by 10.8%.

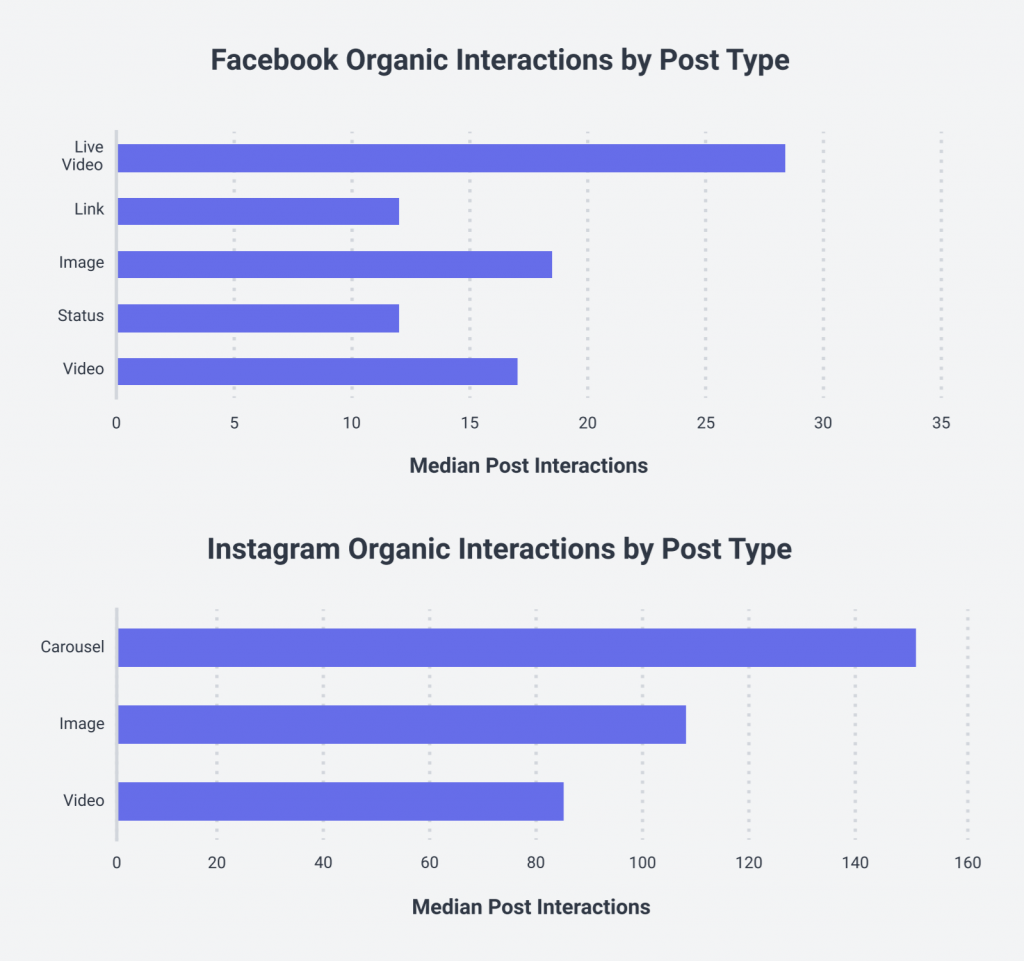

Live video delivers most interactions on Facebook

Facebook Live was by far the most engaging format on the platform in Q2 2020, with 28 median post interactions. Images (18) and regular video (17) had the next highest amount of interactions on Facebook.

On Instagram, carousel was the most engaging format with 150.5 median post interactions.

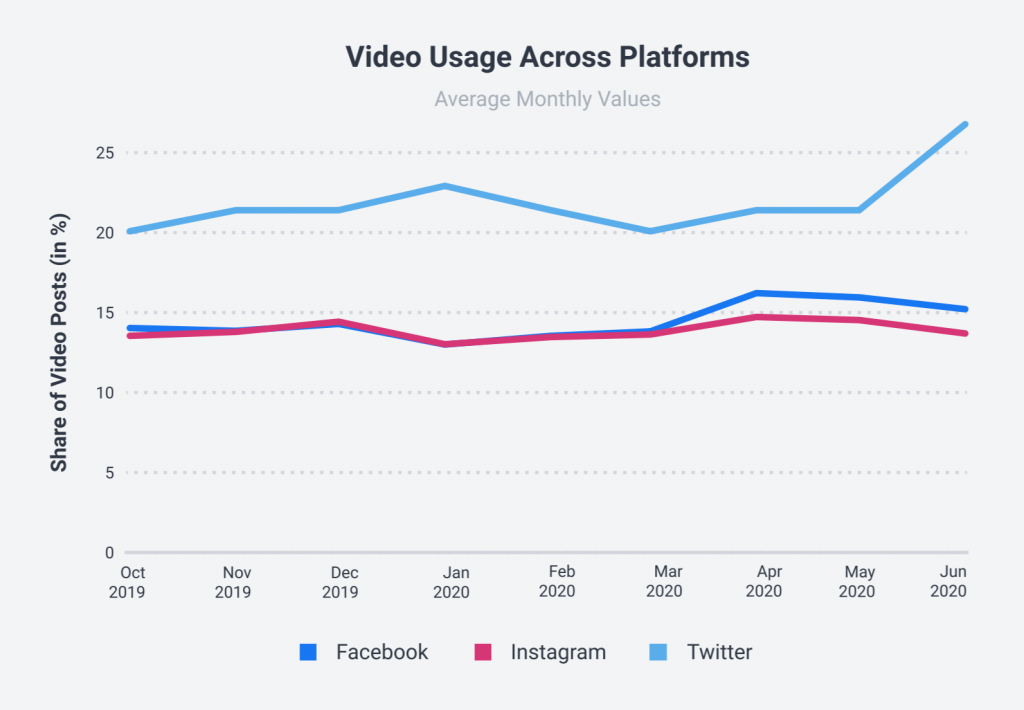

Twitter has the highest percentage of video

Compared to Facebook and Instagram, Twitter contained the highest percentage of video.

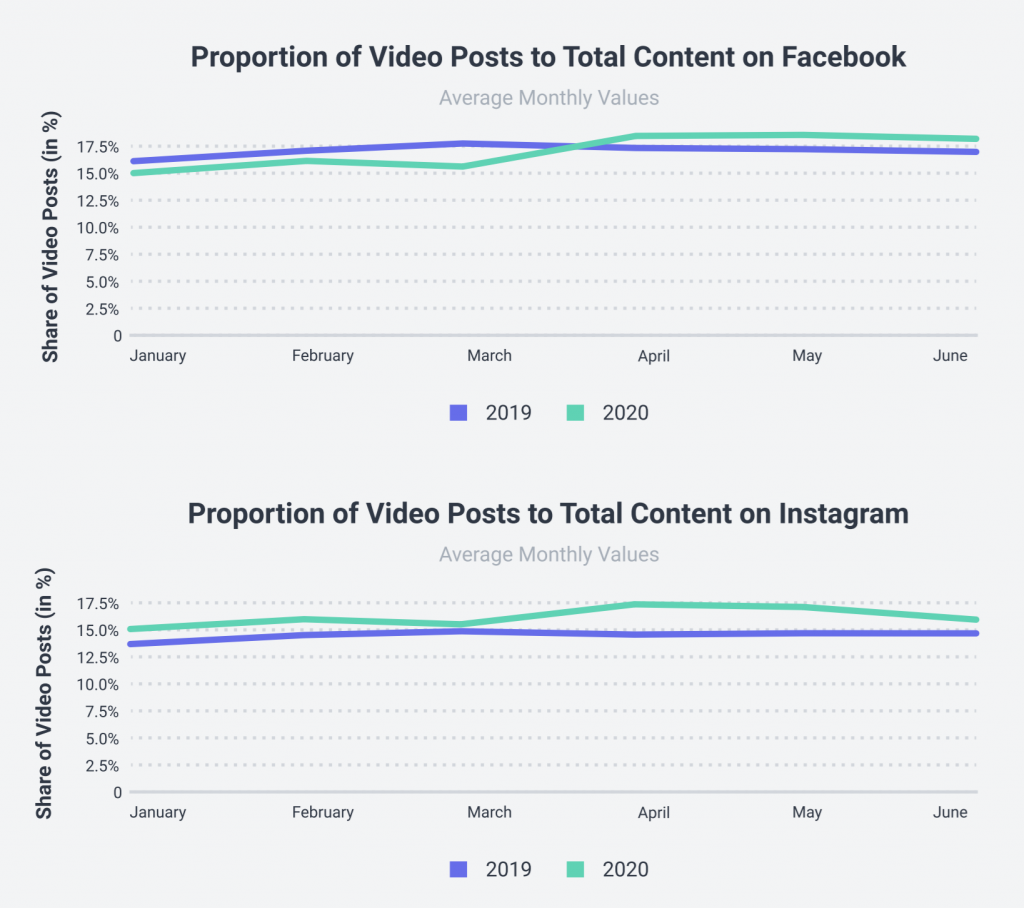

Video grows on Facebook and Instagram

In Q2 2020, the percentage of videos on both Facebook and Instagram increased when compared to Q2 2019.

Video content accounted for 17.1% of all Instagram posts in Q2 2020, an increase of 16.3% compared to Q2 2019.

On Facebook, there was a higher overall percentage of video content in Q2 2020 (18%).

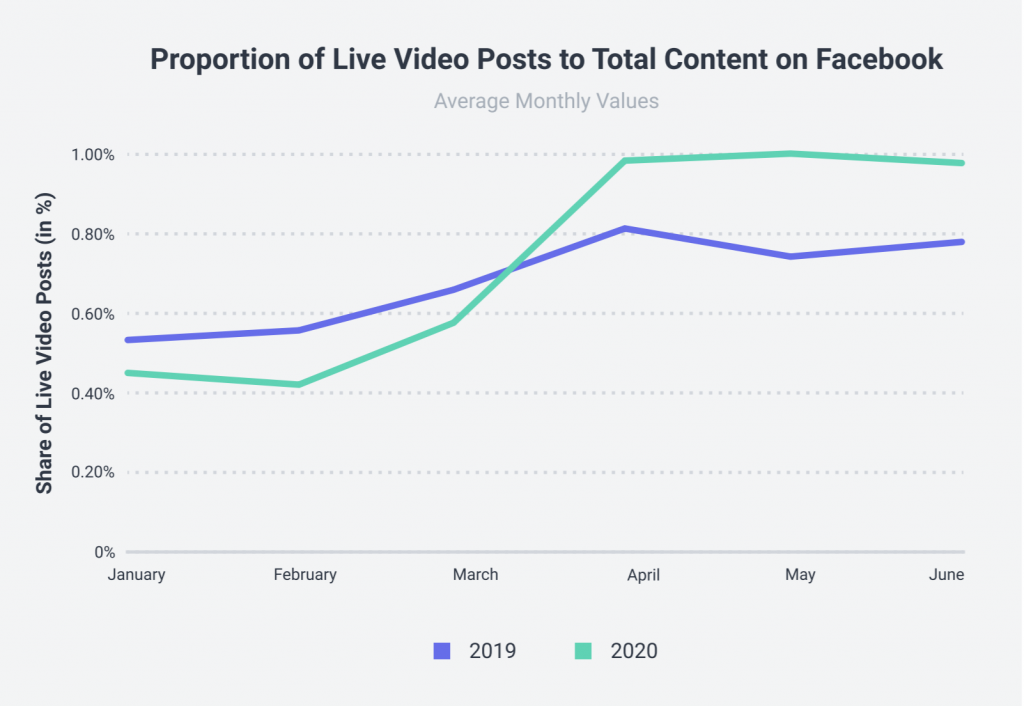

Facebook Live usage increases by 27%

Facebook Live usage began to increase during the coronavirus pandemic, and overall it made up 0.99% of all posts from Facebook brand profiles in Q2 2020.

That was a growth of 26.9% compared to Q2 2019, and it increased by 126% over the last four months.

Brands boost podcasts during the pandemic

The number of brands that mentioned podcasts on Instagram doubled during the year. It went from a low of 510 in June 2019 to a high of 1,087 in April 2020.

The increase was similar but not quite as dramatic on Facebook. 2,832 brands posted 6,189 times about podcasts in April 2020, compared to 1,512 brands making 3,193 posts in June 2019.

But the number of posts and the total brands both showed a slight decrease in May 2020.

Podcasts a common topic in the service industry

The industry that spent the most time mentioning podcasts in the last year on both Instagram and Facebook was services, which include housing, mail and shipping, transportation, wellness, agencies, and others like lawyers and hairdressers.