According to Gartner Glossary, digitalization is the case where a business adopts technology to deliver its products and services to its customers. Telehealth is a perfect example of digitalization, where healthcare providers are embracing digital business models to deliver better services faster. Being a new sector, where is telehealth now? Where is it headed? This article attempts to provide the answers.

The telehealth services industry is a part of the digital health industry. Digital health refers to the use of telecommunications and computational technologies to deliver healthcare. By shifting the delivery of healthcare towards the application of technology, companies can address new challenges and opportunities in the healthcare market worldwide.

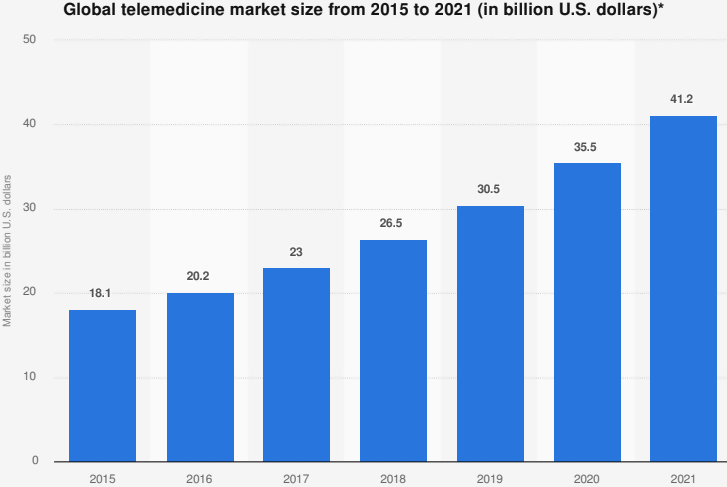

Globally, the digital health industry comprises four primary sectors, including mobile health, wireless health, telehealth, and EMR/EHR. According to Statista, Telehealth is the third largest sector in the digital health industry. Interestingly, mobile health (or mHealth) and wireless health (or eHealth) might be ahead of telehealth, but the sector is making huge strides in terms of market size. In 2015, the global telehealth market was worth approximately $18.1 billion. Three years later, in 2018, the market had expanded to about $26.5 billion, and it is projected to hit $30.5 billion by the end of 2019.

Which countries are aggressively pursuing telehealth?

Telehealth is prominent in the US. The US has one of the most expensive healthcare systems in the world. As such, patients are continually looking for cheaper alternatives. Also, the adoption of telehealth enables patients to cut down the number of hospital visits to free up more funds for healthcare costs. On the other hand, telehealth companies like CareClix offer innovative solutions that make telehealth sound better than actual hospital visits. Interestingly, CareClix enables patients to perform many of the activities they would engage during actual hospital visits. In particular, patients can schedule online visits and even track claims online.

As such, the US and North America, in general, lead in the size of the telehealth market. The telehealth market in the US and Canada combined was worth about $14.6 billion, close 44.9% of the global telehealth market. Further, the region is populated with some of the largest and most innovative telehealth companies like CareClix, Doctor On Demand, iCliniq, and MyTelemedicine, among many others.

China is another major player in the telehealth industry. The country has a large population where a significant percentage does not have access to healthcare services. Therefore, there is a massive potential for telehealth services. By 2017, the telehealth services market was worth about 15.5 billion yuan ($2.2 billion). With a compound annual growth rate of over 23%, China is poised to overtake the US as the largest telehealth market in less than a decade ahead.

What are the sectors where the application of telehealth services is most today?

Femtech is the area where telehealth services are used the most. Additionally, the digital therapeutics sector is a significant user of telehealth services. Other industries that use telehealth services include medical diagnostics, disease management, rehabilitation and monitoring, and so on.

Notably, Aerotel Medical Systems is a significant player in the telehealth services industry. The company produces telehealth services devices as well as software applications. One of these devices is HeartLineTM, used for remote ECG monitoring.

Industry outlook

One of the biggest drivers of telehealth services is its potential to facilitate proper management of chronic illnesses. Particularly, telehealth services enable healthcare providers to improve care management. On the part of patients, the industry allows them to cut healthcare spending by reducing the number of hospital visits and other related costs.

In light of this, Statista projects that the telehealth services industry will grow by 15% CAGR up to 2020. Additionally, Frost & Sullivan noted in a recent report titled “Global Digital Health Outlook, 2020” that the broad digital healthcare market will be worth approximately $234.5 billion in 2023.